|

市場調查報告書

商品編碼

1630406

中東和非洲電池能源儲存系統市場:市場佔有率分析、產業趨勢、成長預測(2025-2030)Middle-East and Africa Battery Energy Storage System - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

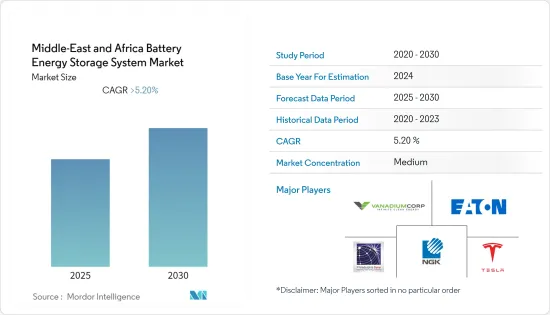

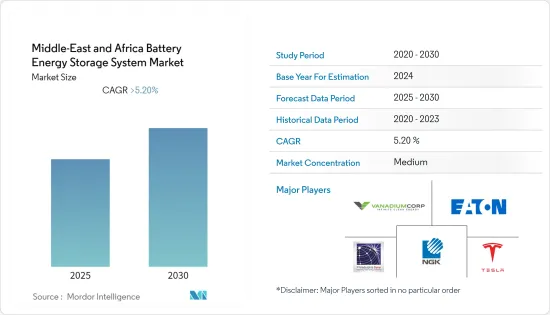

中東和非洲電池能源儲存系統市場預計在預測期內複合年成長率將超過5.2%。

COVID-19 對 2020 年市場產生了中等影響。目前市場已達到疫情前的水準。

主要亮點

- 在中東和非洲,作為首選能源儲存解決方案的電池的需求正在增加,這主要得益於技術創新和電池成本的降低。推動市場的關鍵因素是可再生能源滲透率的提高、對可靠不間斷電力供應的需求以及老化的電網基礎設施。

- 然而,安裝電池能源儲存系統所需的高額初始投資預計將阻礙所研究市場的成長。

- 物聯網 (IoT) 和機器學習等數位技術正在推動創新軟體平台的創建,以提高電池儲存的技術能力、經濟性和可融資性。

- 在預測期內,阿拉伯聯合大公國在中東和非洲的電池能源儲存系統市場將顯著成長。

中東和非洲電池能源儲存系統系統市場趨勢

鋰離子電池領域佔市場主導地位

- 在技術方面,中東和非洲先進的能源儲存市場對鋰離子電池的需求量很大。這些電池也用於該地區儲存來自太陽能和風能等再生能源來源的能源儲存。

- 最近電池開發的大部分重點都集中在鋰離子電池上,因為電力應用與電動車和家用電子電器產品之間存在強大的協同效應。

- 鋰離子電池的發展受到汽車產業使用量增加和電池成本下降等因素的推動。

- 鋰離子系統為電網應用提供了許多優勢,包括高能量密度、快速反應、非常高的效率和靈活的操作。這些特性使得鋰離子電池原則上可用於大多數應用。

- 在中東和非洲最不開發中國家,需求成長可以忽略不計。在中東地區,大多數國家都依賴原油生產。

- 在非洲,鋰離子電池的採用正在增加。由於鋰離子市場可以為電動車提供更長的續航里程,因此成本在過去十年中大幅下降,事實證明,其利潤可能是儲能市場的 10 倍。

- 鋰離子電池是一種已經使用了十年的商業性技術,因此其性能具有一定的確定性。

預計阿拉伯聯合大公國市場將顯著成長

- 阿拉伯聯合大公國是可再生能源領域的新興市場。阿拉伯聯合大公國是可再生能源領域的新興市場,預計將舉辦多個可再生能源計劃。

- 阿拉伯聯合大公國的關鍵驅動力之一是對清潔和可再生能源的依賴,導致該國大力投資開發可再生儲存系統。 2050年,可再生能源發電計劃預計發電量將超過70GW,投資額達7,000億美元。

- 到2021年,該國可再生能源裝置容量將達到2,706兆瓦,杜拜舉措基金將斥資272億美元支持沙姆斯杜拜計劃,該計畫旨在加速屋頂太陽能板的安裝,諸如此類的投資正在大力推動可再生的引進。

- 此外,阿拉伯聯合大公國2050年能源戰略的目標是到2050年將清潔能源在國家能源結構中的佔有率提高到50%,從而在預測期內刺激對能源儲存系統的需求。

- 在中東國家中,阿拉伯聯合大公國擁有最有利的能源儲存環境,阿拉伯國家中能源儲存計劃正在進行中,未來採用的意願也很高。

中東和非洲電池能源儲存系統系統產業概況

中東和非洲電池能源儲存系統系統市場已整合。市場主要企業包括(排名不分先後)Philadelphia Solar LTD、NGK INSULATORS, LTD.、Eaton Corporation PLC、Tesla Inc. 和 Vanadiumcorp Resource Inc.。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第 2 章執行摘要

第3章調查方法

第4章市場概況

- 介紹

- 至2028年市場規模及需求預測(單位:十億美元)

- 最新趨勢和發展

- 政府法規和措施

- 市場動態

- 促進因素

- 抑制因素

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第5章市場區隔

- 技術部分

- 鋰離子電池

- 鉛酸電池

- 其他

- 目的

- 住宅

- 商業/工業

- 公共產業

- 地區

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

- 埃及

- 其他中東/非洲

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 主要企業策略

- 公司簡介

- NGK INSULATORS, LTD.

- Eaton Corporation PLC

- Philadelphia Solar LTD

- Tesla Inc

- Vanadiumcorp Resource Inc

- Eskom Holdings SOC Ltd

- Sumitomo Corporation

第7章 市場機會及未來趨勢

The Middle-East and Africa Battery Energy Storage System Market is expected to register a CAGR of greater than 5.2% during the forecast period.

COVID-19 moderately impacted the market in 2020. Currently. The market has reached pre-pandemic levels.

Key Highlights

- In the Middle East and African region, the demand for batteries has increased in the Middle East as a preferred energy storage solution primarily due to technological innovation and the reduction of battery costs. Major factors driving the market are the increasing levels of renewable energy penetration, demand for reliable and uninterrupted power supply, and aging grid infrastructure.

- However, the high initial investment required for the installation of the battery energy storage system is expected to hinder the growth of the market studied.

- Digital technologies, such as the Internet of Things (IoT) and machine learning, have engendered the creation of innovative software platforms that advance the technical capabilities and economic viability, and bankability of battery storage, which in turn, is likely to provide an opportunity in the market.

- The United Arab Emirates is to witness significant growth in the Middle East and Africa battery energy storage system market across the region during the forecast period.

MEA Battery Energy Storage System Market Trends

Lithium-ion Battery Segment to Dominate the Market

- In terms of technology, lithium-ion batteries are in huge demand in the Middle East and Africa Advance Energy Storage Market. These batteries are also being used for the storage of energy from renewable energy sources such as solar and wind in the region.

- Due to strong synergies between power applications and both electric vehicles and consumer electronics, much of the recent focus of battery development has been on lithium-ion batteries.

- Lithium-ion battery storage is driven by the factors such as increased usage in the automotive industry and the declining costs of batteries.

- Lithium-ion systems have a number of advantages for grid applications, including high energy density, rapid response, very high efficiencies, and flexible operation. These features enable lithium-ion batteries to be used for most applications in principle.

- The demand has been growing at a negligible rate in the less developed nations of the Middle East & Africa. In the Middle Eastern region, most of the countries are dependent on crude oil production.

- In Africa, lithium-ion battery deployment is on the rise. The cost has dropped considerably in the past decade, primarily as the Li-ion market can provide longer ranges to electric cars, which is showing to be probably ten times more lucrative than the storage market.

- It's a commercially available technology with a decade of deployment that provides some certainty of performance.

United Arab Emirates is Expected to Witness Significant Growth in the Market

- United Arab Emirates is an emerging market in the renewable energy sector. It is expected to undertake several renewable energy projects that are likely to foster the increase in demand for battery storage systems.

- One of the main drivers in the country is the steps taken in reliance on clean and renewable energy, which is leading the country to invest significantly in the development of renewable storage systems. Renewable energy projects will generate more than 70 GW of power by 2050, witnessing an investment of USD 700 billion.

- The country's renewable energy installed capacity reached 2706 MW in 2021, and the strong push for the adoption of renewable energy led by investments such as the USD 27.2 billion Dubai Green Fund to support the Shams Dubai initiative, a program aimed at promoting the installation of rooftop solar panels.

- Additionally, The 'UAE Energy Strategy 2050' aims to increase the contribution of clean energy to the country's overall national energy mix, to 50%, by 2050, thereby creating demand for energy storage systems in the forecast period.

- Among the Middle-Eastern countries, UAE has the most favorable environments for energy storage and is one of the Arab countries with ongoing energy storage projects with serious future adoption ambitions.

MEA Battery Energy Storage System Industry Overview

The Middle East and Africa Battery Energy Storage System Market is consolidated. Some of the key players in the market (not in a particular order) include Philadelphia Solar LTD, NGK INSULATORS, LTD., Eaton Corporation PLC, Tesla Inc, and Vanadiumcorp Resource Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Force Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Technology

- 5.1.1 Li-Ion Battery

- 5.1.2 Lead Acid Battery

- 5.1.3 Others

- 5.2 Application

- 5.2.1 Residential

- 5.2.2 Commercial and Industrial

- 5.2.3 Utility

- 5.3 Geography

- 5.3.1 United Arab Emirates

- 5.3.2 Saudi Arabia

- 5.3.3 South Africa

- 5.3.4 Egypt

- 5.3.5 Rest of Middle-East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 NGK INSULATORS, LTD.

- 6.3.2 Eaton Corporation PLC

- 6.3.3 Philadelphia Solar LTD

- 6.3.4 Tesla Inc

- 6.3.5 Vanadiumcorp Resource Inc

- 6.3.6 Eskom Holdings SOC Ltd

- 6.3.7 Sumitomo Corporation