|

市場調查報告書

商品編碼

1644281

南美洲電池能源儲存系統系統:市場佔有率分析、行業趨勢和成長預測(2025-2030 年)South America Battery Energy Storage System - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

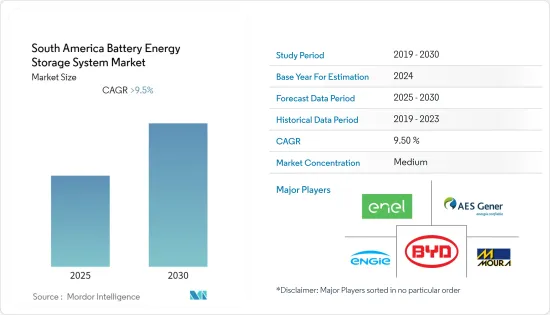

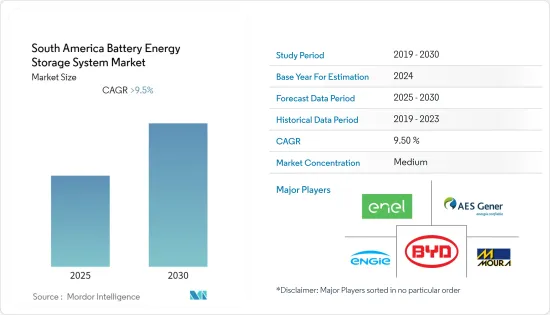

預測期內,南美洲電池能源儲存系統市場預計將以超過 9.5% 的複合年成長率成長。

2020 年,新冠疫情對市場產生了負面影響。現在,市場可能會達到疫情前的水準。

關鍵亮點

- 從長遠來看,預計在預測期內,增加可再生能源的滲透率以減少對石化燃料的依賴等因素將推動市場發展。

- 另一方面,高昂的初始資本投入是市場成長的限制因素。

- 日益靈活的電網營運和電池能源儲存系統的現代技術發展預計將為電池能源儲存的部署創造重大機會。

- 預計預測期內智利將主導整個南美洲的電池能源儲存系統市場。

南美洲電池能源儲存系統系統市場趨勢

鋰離子電池佔市場主導地位

- 南美洲擁有世界上最大的鋰蘊藏量之一。南美洲鋰三角區由智利、阿根廷和玻利維亞組成。據估計,這些地區蘊藏著全球近一半的鋰蘊藏量。

- 2021年,智利和阿根廷的鋰產量佔全球需求的近30%,分別約為2.6萬噸和6000噸。在這些地區,儘管開採鋰蘊藏量所需的前期投資和時間相對較高,但後續生產成本卻比該技術低。

- 鋰離子電池儲能系統在南美洲電池能源儲存市場需求量很大,因為它們是該地區儲存再生能源來源的先進且廣泛可用的解決方案。

- 例如,2022年5月,全球能源儲存集團NHOA(前身為Engie EPS)獲得在秘魯開發30MWh電池能源儲存系統(BESS)的訂單。該電池儲能系統將安裝在秘魯 800 兆瓦的奇爾卡火電廠,為該國電網提供一次頻率調節服務。

- 此外,鋰離子電池比其他電池技術更安全,所有電池製造商都制定了安全措施和標準,以在電池故障時保護消費者。

- 因此,鑑於上述情況,預計鋰離子電池將主導南美洲電池能源儲存系統市場。

智利佔據市場主導地位

- 智利已成為鋰離子電池能源儲存系統系統的地區領導者,以更有效地管理其可再生能源儲備。該國鋰蘊藏量豐富,大部分位於該國北部的阿塔卡馬沙漠。

- 2021年智利可再生能源裝置容量達1489萬千瓦。近年來,智利將能源安全放在首位,盡量減少對傳統能源來源的依賴,可再生能源計劃增加。

- 由於太陽能和風能等可再生能源發電具有間歇性,且發電量不盡相同,因此儲存能源以備尖峰時段使用十分重要。因此,電池能源儲存系統(BESS)正成為可再生能源計劃的重要組成部分。可再生能源產業的快速成長預計將成為智利發展最強勁的驅動力之一。

- 例如,2022年9月,阿特斯太陽能公司宣布,在2022年7月由智利國家能源委員會(CNE)舉行的智利公開競標CNE 2022/01中贏得了253 MWp太陽能光電+1,000 MWh電池能源儲存計劃。

- 太陽能市場的發展以及更有效率的電池儲存系統的引入,使智利成為該領域的地區領導者。

南美洲電池能源儲存系統系統產業概況

南美洲電池能源儲存系統系統市場需要變得更有凝聚力。市場的主要主要企業(不分先後順序)包括 Enel SpA、AES Gener SA、BYD、Engie SA 和 Acumuladores Moura SA。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究範圍

- 市場定義

- 調查前提

第 2 章執行摘要

第3章調查方法

第4章 市場概況

- 介紹

- 2027 年市場規模及需求預測(十億美元)

- 最新趨勢和發展

- 政府法規和政策

- 市場動態

- 驅動程式

- 限制因素

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章市場區隔與分析

- 技術板塊

- 鋰離子電池

- 鉛酸電池

- 其他

- 應用

- 住宅

- 商業/工業

- 公共產業

- 地區

- 巴西

- 阿根廷

- 智利

- 南美洲其他地區

第6章 競爭格局

- 併購、合資、合作與協議

- 主要企業策略

- 公司簡介

- Enel SpA

- AES Gener SA

- BYD Co Ltd

- Engie SA

- Acumuladores Moura SA

- LG Chem Brazil, Ltd.

- EnerSys

- Saft Groupe SA

第7章 市場機會與未來趨勢

簡介目錄

Product Code: 70578

The South America Battery Energy Storage System Market is expected to register a CAGR of greater than 9.5% during the forecast period.

COVID-19 negatively impacted the market in 2020. Currently, the market is likely to reach pre-pandemic levels.

Key Highlights

- Over the long term, factors like increased penetration of renewable energy to reduce dependence on fossil fuels are expected to drive the market during the forecasted period.

- On the other hand, high initial capital investments are a major restraint hindering the market growth.

- Nevertheless, the increasingly flexible grid operations and the latest technological developments in battery energy storage systems are expected to create enormous opportunities for Battery Energy Storage deployment.

- Chile is expected to dominate the South America battery energy storage system market across the region during the forecast period.

South America Battery Energy Storage System Market Trends

Lithium-ion Segment to Dominate the Market

- South America has some of the world's greatest lithium reserves. The lithium triangle in South America consists of Chile, Argentina, and Bolivia. These regions are estimated to have almost half of the world's lithium reserves.

- In 2021, Chile and Argentina produced almost 30% of the global lithium demand, which was about 26 thousand tons and 6 thousand tons, respectively. Even though the initial investments and time for extraction of lithium reserves are relatively high in these regions, thereafter production is cheaper than techniques.

- Lithium-ion battery storage systems are in high demand in the South America battery energy storage market because they are advanced and widely available solutions for storing energy from renewable energy sources in the region.

- For instance, in May 2022, Global energy storage group NHOA, formerly Engie EPS, was awarded a 30MWh Battery Energy Storage System (BESS) to be developed in Peru. This BESS is expected to be installed at the 800MW Chilca thermal power plant in Peru, where it will deliver primary frequency regulation services for the country's grid.

- Moreover, Lithium-ion batteries are safer than other battery technologies, and all the battery manufacturers ensure safety measures and standards to protect consumers in case of a battery failure.

- Therefore, owing to the abovementioned points, the Lithium-ion segment is expected to dominate the South America Battery Energy Storage System Market.

Chile to Dominate in the Market

- Chile has become a regional leader in lithium-ion battery energy storage systems to manage its renewable energy reserves more efficiently. The country is home to a huge amount of lithium reserves, most of which are found in the Atacama Desert in the northern part of the country.

- Chile's renewable energy installed capacity reached 14.89 GW in 2021. In recent years renewable energy projects have increased in Chile due to increasing priority on energy security and minimizing the reliance on conventional energy sources.

- Since renewable resources such as solar and wind generate power intermittently and at different levels, storing this energy during peak demand is critical. As a result, battery energy storage systems (BESS) are becoming essential to renewable energy projects. The rapid growth of the renewable energy sector is expected to be one of the most potent drivers in Chile.

- For instance, in September 2022, Canadian Solar Inc announced that it was awarded a 253 MWp solar plus 1,000 MWh battery energy storage project in Chile's public tender CNE 2022/01 held by Chile's Energy National Commission (CNE) in July 2022.

- Developments in the photovoltaic market, alongside implementing more efficient battery energy storage systems, are positioning Chile as a regional leader in this field.

South America Battery Energy Storage System Industry Overview

The South America Battery Energy Storage System Market needs to be more cohesive. Some of the major key players in the market (not in particular order) include Enel S.p.A., AES Gener S.A., BYD Co Ltd, Engie SA, and Acumuladores Moura S. A.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2027

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Force Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION & ANALYSIS

- 5.1 Technology

- 5.1.1 Li-Ion Battery

- 5.1.2 Lead Acid Battery

- 5.1.3 Others

- 5.2 Application

- 5.2.1 Residential

- 5.2.2 Commercial and Industrial

- 5.2.3 Utility

- 5.3 Geography

- 5.3.1 Brazil

- 5.3.2 Argentina

- 5.3.3 Chile

- 5.3.4 Rest of South America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Enel S.p.A.

- 6.3.2 AES Gener S.A.

- 6.3.3 BYD Co Ltd

- 6.3.4 Engie SA

- 6.3.5 Acumuladores Moura S. A.

- 6.3.6 LG Chem Brazil, Ltd.

- 6.3.7 EnerSys

- 6.3.8 Saft Groupe SA

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219