|

市場調查報告書

商品編碼

1636264

印度固定電池能源儲存系統(BESS) 市場:市場佔有率分析、產業趨勢、成長預測(2025-2030)India Stationary Battery Energy Storage System - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

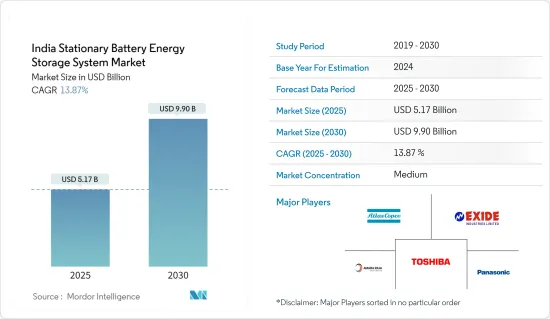

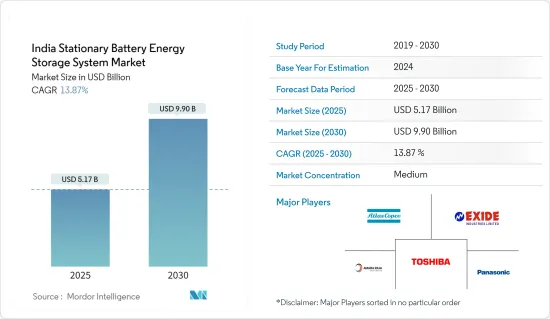

印度固定式電池能源儲存系統(BESS)市場規模預計2025年為51.7億美元,2030年將達到99億美元,預測期內(2025-2030年)複合年成長率為13.87%。

主要亮點

- 從中期來看,太陽能部署的增加和鋰離子電池成本的下降預計將推動市場發展。

- 另一方面,替代能源儲存系統的存在預計將在預測期內阻礙市場。

- 然而,鋰電池技術的進步預計將在未來創造巨大的市場機會。

印度固定電池能源儲存系統(BESS)市場趨勢

鋰離子電池預計將大幅成長

- 在印度,與其他國家相比,固定式工業鋰離子電池在過去十年中佔據了主導地位。與各種類型的電池相比,這些電池具有更多優勢。鋰離子 (Li-ion) 電池的充電和放電效率接近 100%,允許插入和取出相同的安培小時數。與鉛酸電池等其他技術相比,這些電池具有多種技術優勢。可充電鋰離子電池平均可循環超過 5,000 次。

- 鋰離子電池可以多次充電,更穩定。此外,它們往往比其他二次電池具有更高的能量密度、電壓容量和自放電率。這使得單一電池比不同類型的電池保持電荷的時間更長,從而提高了電源效率。

- 此外,隨著鋰離子電池價格的下降,電池製造商的注意力也轉移到這種電池類型。 2023年,鋰離子電池組的價格將與前一年同期比較%至139美元/kWh。除了這些好處之外,研究和開發工作正在進行中,以生產用於固定電池能源儲存系統(BESS)的更有效和高效的鋰電池材料。

- 例如,2024 年 8 月,著名固定電源解決方案公司 Best Power Equipments (BPE) 在印度北方邦大諾伊達推出了一座 20,000 平方英尺的工廠。該工廠擁有先進的自動化系統,能夠批量生產鋰離子電池和固定式BESS。這些舉措將進一步支持市場成長。

- 未來,國內製造更有效率的鋰離子電池技術預計將進一步推動該領域的發展。例如,許多本土公司正在投資鋰離子電池技術。 2024年5月,大宇針對印度市場推出了最新創新產品-免維護鋰逆變器。這種鋰離子電池技術重新定義了可靠性並注重便利性,確保無縫運作並具有環保優勢。

- 因此,由於價格下降和技術發展,該行業預計在預測期內將大幅成長。

預計併併網連接將佔據主要佔有率

- 併網固定電池能源儲存系統(BESS)旨在儲存和管理連接到電網的能源。它可以從電網獲取電力並向電網提供儲存的能量。當產量超過需求時,這些系統用於儲存多餘的能源(通常來自太陽能和風能等再生能源來源)。在電力需求尖峰時段或可再生能源發電較低時,能量會回到電網。

- 印度太陽能發電能力持續成長。根據電力部統計,太陽能發電在可再生能源中佔比最高,截至2023年5月佔38.9%。這一成長是由政府舉措、優惠政策、太陽能發電裝置成本下降以及對可再生能源的承諾所推動的。

- 印度政府實施了多項政策來促進能源儲存。例如,2023年9月,聯邦內閣核准了一項生存能力缺口資助(VGF)計劃,以建立強大的儲能系統來管理過剩的風能和太陽能發電。根據該計劃,到2031年將開發4,000MWh電池儲能系統(BESS)計劃。該計劃的初始撥款為 940 億盧比,其中包括 376 億盧比的預算支持。

- 這些激勵措施將鼓勵對併網 BESS 的投資,並使其對開發商和消費者更具吸引力。例如,2023年4月,印度電網信託公司宣布已開始在馬哈拉斯特拉邦的Dhule變電站試運行其第一個與太陽能電池板整合的電池儲能系統(BESS)計劃。根據公司聲明,該計劃旨在滿足變電站的輔助消耗需求。

- 此外,印度也進行了多項太陽能能源儲存系統(BESS)計劃競標,反映出人們對支持該國可再生能源目標的能源儲存解決方案的興趣和投資不斷成長。

- 此外,政府機構、私人公司和國際組織之間的合作正在促進電網 BESS計劃的發展。這種夥伴關係增強了市場上的資金籌措機會和技術專長。

- 例如,2024年3月,JSW Neo Energy完全子公司JSW Renew Energy Five與印度太陽能公司(SECI)簽署了兩套250MW/500MWh電池能源儲存系統(BESS)初期階段計劃)專案已簽訂購電協議( PPA)。根據協議,JSW Renew Five的母公司JSW Energy Limited將在12年內收到計劃總容量(150MW/300MWh)60%的付款,每月固定費用為108,400印度盧比(約合1,310美元) )每兆瓦支付容量費用。

- 這些因素結合起來,為預測期內印度固定電池能源儲存系統(BESS)市場併網部分的成長創造了有利的環境。

印度固定式電池能源儲存系統(BESS)產業概況

印度的固定電池能源儲存系統(BESS)市場處於半脫節狀態。市場的主要企業包括(排名不分先後)東芝公司、Amara Raja Energy & Mobility Limited、Exide Industries Ltd、Atlas Copco AB 和 Panasonic Holdings Corporation。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第 2 章執行摘要

第3章調查方法

第4章市場概況

- 介紹

- 2029年之前的市場規模與需求預測(單位:美元)

- 最新趨勢和發展

- 政府法規政策

- 市場動態

- 促進因素

- 增加太陽能的採用

- 鋰離子電池成本更低

- 抑制因素

- 替代能源儲存系統的存在

- 促進因素

- 供應鏈分析

- PESTLE分析

- 投資分析

第5章市場區隔

- 按下電池技術

- 鋰離子電池

- 鉛酸電池

- 其他電池技術

- 按連線類型

- 在併網

- 離網

- 按最終用戶

- 住宅

- 商業/工業

- 公共事業

- 按用途

- 逆變器

- 不斷電系統(UPS)

- 太陽能能源儲存應用

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 主要參與者採取的策略和 SWOT

- 公司簡介

- Fluence Energy Inc.

- Exide Industries Limited

- Delta Electronics Inc.

- Toshiba Corporation

- Amara Raja Energy and Mobility Ltd

- Panasonic Holdings Corporation

- HBL Power Systems Limited

- Tata Power Solar Systems Limited

- Inverted Energy Pvt. Ltd

- Atlas Copco AB

- 其他知名企業名單

- 市場排名分析

第7章 市場機會及未來趨勢

- 鋰電池技術的進步

The India Stationary Battery Energy Storage System Market size is estimated at USD 5.17 billion in 2025, and is expected to reach USD 9.90 billion by 2030, at a CAGR of 13.87% during the forecast period (2025-2030).

Key Highlights

- Over the medium period, the increasing adoption of solar energy and the declining cost of lithium-ion batteries are expected to drive the market.

- On the other hand, the presence of alternative energy storage systems is expected to hamper the market during the forecast period.

- Nevertheless, advancements in lithium battery technology are expected to create significant market opportunities in the future.

India Stationary Battery Energy Storage System Market Trends

Lithium-ion Battery Expected to Grow Significantly

- In India, lithium-ion batteries for stationary industries have gained prominence during the last decade compared to other countries. In comparison to different battery types, these batteries provide more advantages. Lithium-ion (Li-ion) batteries are nearly 100% efficient in charge and discharge, allowing the same ampere-hours in and out. These batteries offer various technical advantages over other technologies, such as lead-acid batteries. Rechargeable Li-ion batteries, on average, offer cycles more than 5,000 times, compared to lead-acid batteries that last around 400 to 500 times.

- Lithium-ion batteries can be recharged numerous times and are more stable. Furthermore, they tend to have a higher energy density, voltage capacity, and lower self-discharge rate than other rechargeable batteries. This improves power efficiency as a single cell has longer charge retention than different battery types.

- Further, the decreasing price of lithium-ion batteries has shifted the battery manufacturers' attention toward this battery type. In 2023, the price of lithium-ion battery packs decreased by 14% compared to the previous year to USD139/kWh. In addition to these advantages, research and development are being conducted to manufacture more effective and efficient lithium battery materials for stationary battery energy storage systems.

- For instance, in August 2024, Best Power Equipments (BPE), a prominent player in stationary power solutions, launched a 20,000-square-foot factory in Greater Noida, Uttar Pradesh, India. The fully operational facility boasts advanced automated systems tailored for large-scale manufacturing of lithium-ion batteries and stationary BESS. Such initiatives further boost the market's growth.

- In the future, the domestic manufacturing of more efficient lithium-ion battery technology is expected to drive the segment further. For instance, many regional companies are investing in lithium-ion battery technology. In May 2024, DAEWOO unveiled its latest innovation: the Maintenance-Free Lithium Inverter for Indian markets. This lithium-ion battery technology redefines reliability and emphasizes convenience, ensuring seamless operation alongside eco-friendly advantages.

- Thus, owing to the decreasing prices and technological development, the segment is expected to grow significantly during the forecast period.

On-grid Connection Expected to Record Major Share

- An on-grid stationary battery energy storage system is designed to store and manage energy connected to the electrical grid. It can draw power from the grid and supply stored energy back to it. These systems are used to store excess energy (often from renewable sources like solar or wind) when production exceeds demand. They release energy back to the grid during peak demand periods or when renewable generation is low.

- India has witnessed consistent growth in its solar energy capacity. According to the Ministry of Power, solar power contributed the highest share in the renewable energy mix, accounting for 38.9% as of May 2023. This growth was driven by government initiatives, favorable policies, decreasing solar equipment costs, and a commitment to renewable energy sources.

- The Indian government has implemented various policies to promote energy storage. For instance, in September 2023, the Union Cabinet approved a viability gap funding (VGF) scheme to establish a robust storage system for managing excess wind and solar power. Under this scheme, 4,000 MWh of battery energy storage system (BESS) projects are set to be developed by FY2031. The scheme has an initial allocation of INR 94 billion, which includes INR 37.60 billion in budgetary support.

- These incentives encourage investments in on-grid BESS, making it more attractive for developers and consumers. For instance, in April 2023, India Grid Trust announced the commissioning of its first battery energy storage system (BESS) project, integrated with solar panels at the Dhule substation in Maharashtra. According to a company statement, this project is designed to fulfill the substation's auxiliary consumption needs.

- Further, several tenders have been issued in India for solar battery energy storage system (BESS) projects, reflecting the growing interest and investment in energy storage solutions to support the country's renewable energy goals.

- Additionally, collaborations between government entities, private companies, and international organizations are facilitating the development of on-grid BESS projects. These partnerships enhance funding opportunities and technological expertise in the market.

- For instance, in March 2024, JSW Renew Energy Five, a fully owned subsidiary of JSW Neo Energy, entered a power purchase agreement (PPA) with Solar Energy Corporation of India Limited (SECI) for the initial phase of two 250 MW/500 MWh battery energy storage system (BESS) projects. Under this agreement, JSW Energy Limited, the parent company of JSW Renew Five, will receive payment for 60% of the project's total capacity (150 MW/300 MWh) over 12 years, with a fixed monthly capacity charge of INR 108,400 (approximately USD 1,310) per MW.

- Together, these factors create a favorable environment for the growth of the on-grid segment of the Indian stationary battery energy storage system market during the forecast period.

India Stationary Battery Energy Storage System Industry Overview

The Indian stationary battery energy storage system market is semi-fragmented. Some of the major players in the market (in no particular order) include Toshiba Corporation, Amara Raja Energy & Mobility Limited, Exide Industries Ltd, Atlas Copco AB, and Panasonic Holdings Corporation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumption

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increasing Adoption of Solar Energy

- 4.5.1.2 Declining Cost of Lithium-Ion Batteries

- 4.5.2 Restraints

- 4.5.2.1 The Presence of Alternative Energy Storage Systems

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 PESTLE ANALYSIS

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 By Battery Technology

- 5.1.1 Lithium-ion Batteries

- 5.1.2 Lead-acid Batteries

- 5.1.3 Other Battery Technologies

- 5.2 By Connection Type

- 5.2.1 On-grid

- 5.2.2 Off-grid

- 5.3 By End User

- 5.3.1 Residential

- 5.3.2 Commercial and Industrial

- 5.3.3 Utility

- 5.4 By Application

- 5.4.1 Inverter

- 5.4.2 Uninterruptible Power Supply (UPS)

- 5.4.3 Solar Energy Storage Applications

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies and SWOT Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Fluence Energy Inc.

- 6.3.2 Exide Industries Limited

- 6.3.3 Delta Electronics Inc.

- 6.3.4 Toshiba Corporation

- 6.3.5 Amara Raja Energy and Mobility Ltd

- 6.3.6 Panasonic Holdings Corporation

- 6.3.7 HBL Power Systems Limited

- 6.3.8 Tata Power Solar Systems Limited

- 6.3.9 Inverted Energy Pvt. Ltd

- 6.3.10 Atlas Copco AB

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Advancements in Lithium Battery Technology