|

市場調查報告書

商品編碼

1689774

損壞感測型智慧標籤:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Spoil Detection-based Smart Labels - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

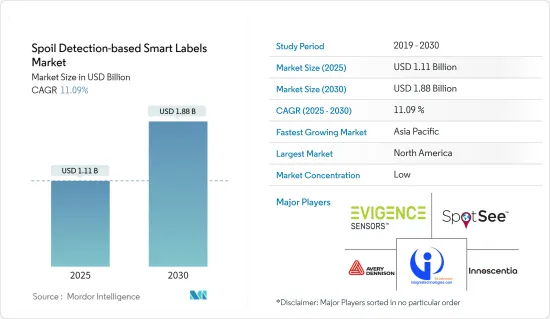

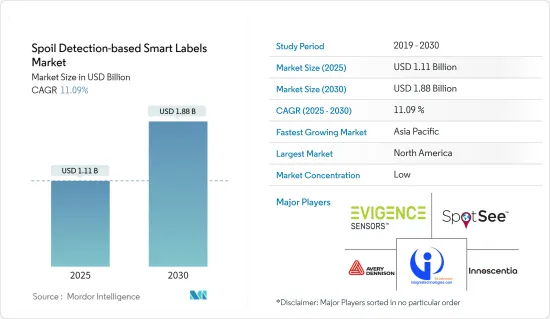

損壞感測型智慧標籤市場規模預計在 2025 年為 11.1 億美元,預計到 2030 年將達到 18.8 億美元,預測期內(2025-2030 年)的複合年成長率為 11.09%。

智慧標籤正在成為製藥、食品和化妝品行業最廣泛的技術之一。它被視為實現更高效率和盈利同時提供物品真實性和可追溯性的理想手段。

主要亮點

- 智慧標籤可在幾秒鐘內提供有關單一物品的詳細資訊,提供即時資訊。它還確保了真實性和供應鏈的完整性,同時為品牌與客戶互動創造了新的機會。預計在預測期內,消費者對衛生食品成分的偏好和快速檢測新鮮度的能力將推動基於腐敗檢測的智慧標籤市場的需求。

- 近年來,食品和藥品召回事件的增多,提高了全球對在某些「低溫運輸」產品的製造、處理和管理過程中維持安全的產品溫度範圍的真正挑戰的認知。 2020年1月,FUSION IV Pharmaceuticals Inc.AXIA Pharmaceutical因無法保證無菌性,自願將所有未使用的在有效期內的無菌藥品召回至用戶層面。

- 此外,由於新冠疫情的出現,人們在電子商務平台上對安全和可追溯食品的傾向增加,從而增加了明顯的行為變化,並提高了人們的整體健康和安全意識。

- 根據 IBM 的一項調查 (2020 年),約 71% 的消費者願意為提供產品完全透明度和可追溯性的公司支付平均約 37% 的額外溢價。在這種背景下,供應鏈內的端到端可視性已成為企業尋求與消費者建立信任的首要任務之一,而區塊鏈和物聯網預計將產生重大影響。

- 製藥、醫療保健和食品行業對產品品質的追蹤和維護需求日益成長,推動了智慧標籤的應用。一些智慧標籤還具有檢測損壞的能力,尤其是在運輸過程中。這些標籤包含多種類型的感測器,包括光學、超音波和主動感測器。這些感測器經久耐用,可提供有關濕度、溫度、運動、位置和許多其他因素的資訊。

- 部署此類感測器的公司可以使用它們來檢查產品狀況,以防止變質並檢驗新鮮度。他們還可以檢查儲存設施的溫度,以防止變質。

腐敗感測型智慧標籤的市場趨勢

RFID 領域預計將佔據主要市場佔有率

- 將類似RFID的感測器整合到腐敗感測型智慧標籤中的趨勢可能會在未來幾年被各行各業所採用。 RFID 的有限成本和最低限度的維護使其對製造業、物流業、醫療保健業、農業和食品業等許多應用領域都具有吸引力。

- 智慧標籤開發是RFID的一個創新應用。典型的 RFID 系統由兩個主要組件組成:閱讀器和標籤。智慧標籤由 RFID 系統和圖形使用者介面 (GUI) 組成。

- 本質上,RFID 系統涉及的兩個主要組件是應答器(貼在天線上的標籤)和詢問器(RFID讀取器)。借助 RFID 標籤,腐敗感測型智慧標籤可以透過改變食品成分的質地和顏色並將其傳達給系統來傳達其準確的新鮮度水平。

- 根據糧農組織的資料,全球約有33%的食物在供應鏈中被浪費。根據歐盟委員會統計,這一數字佔食品進入零售市場前的 40% 以上。供應鏈中食品浪費的主要原因是多種多樣的,包括生產、加工、包裝、主要是美觀原因、HORECA採購管理、分銷和零售。作為改進計劃的一部分,許多配銷中心和倉庫正在投資提高其流程的效率。這些投資預計將推動基於 RFID 的智慧標籤的成長。

- RFID 技術正在創造對印表機的需求,該印表機可以讀取、編程和檢驗嵌入在標籤中的 RF 標籤,並同時在標籤表面列印文字、條碼和圖形。在產生圖形、條碼和人類可讀的文字時,智慧標籤印表機可作為傳統印表機的功能。它還具有內建的 RFID 編碼器和閱讀器。

- RFID 系統可以實現每件產品的獨特可追溯性,而無需直接視線來讀取資料。這種獨特的自動化技術提供了供應鏈和物流流程的可視性,簡化和減少庫存管理和採購預測,同時最大限度地減少錯誤、未知損失和缺貨。

預計北美將佔最大佔有率

- 北美是世界上最大的腐敗感測型智慧標籤市場之一,其中美國佔大部分。該國巨大的需求歸因於大型和小型零售店的大量存在。在美國,沃爾瑪等零售巨頭正在推動研究活動的活性化,為該國研究市場的成長做出了重大貢獻。

- 根據美國農業部估計,美國每年有30-40%的食物供應被廢棄物。食物浪費導致該國出現嚴重的糧食不安全狀況。預計光是 2022 年,該國就有 5,000 萬人面臨糧食短缺問題。糧食安全的大幅提高可能會刺激人們大力減少糧食腐敗,進而推動市場成長。為了解決各零售店貨架上令人震驚的食物浪費問題,供應商正在引入基於智慧標籤的新型腐敗檢測技術,以最大限度地減少這種浪費。

- 隨著研究市場中技術的普及,智慧標籤可以預測新鮮度並幫助消費者和經銷商了解哪些食物已經變質。研究和開發有助於開發包裝上的指示器標籤,以顯示番石榴的新鮮度,而不會改變水果的品質。

- 此外,美國和食品藥物管理局於 2019 年宣布了一項關於對細胞肉類和其他食品進行標籤的框架協議。預計這將進一步擴大該國的市場規模。該國的供應商正在投資技術以提高整個供應鏈的可追溯性,區塊鏈的使用與腐敗感測型智慧標籤一起增加。

- 除了國家不斷增加的醫療保健支出外,RFID 技術還有望推動醫療保健和醫療領域的損壞感測型智慧標籤市場的發展。預計支出的增加將為腐敗感測型智慧標籤的部署開闢新的途徑。總體而言,預計預測期內該國市場將會顯著成熟。

損壞感測型智慧標籤產業概況

由於 Evigence Sensors、Insignia Technologies 等主要企業的存在,損壞感測型智慧標籤市場的競爭態勢十分激烈。產業參與者透過建立策略夥伴關係關係,透過持續研發成功開發出產品,進而推動市場成長。

- 2022 年 3 月-艾利丹尼森公司收購了總部位於英國約克郡的英國公司 Catchpoint Ltd 開發的無底紙標籤技術。此次收購涵蓋 Catchpoint 的專利、品牌、商業機密和專有技術。

- 2022 年 1 月 - SpotSee 是狀態指示解決方案的全球領導者,致力於保護生命科學產品免受損害並確保供應鏈的完整性,該公司收購了 Biosynergy, Inc.,後者是一家主要監測紅血球核心溫度的醫療設備製造商。

- 2022 年 1 月 - CCL Industries, Inc. 是全球領先的專業標籤、安全和包裝解決方案供應商,為全球企業、政府機構、中小型企業和消費者提供服務,該公司已收購兩家美國軟體標籤卡企業,即 International Master Products Corporation 和 Lodging Access Systems, Inc.

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

- 產業價值鏈分析

- 評估新冠肺炎疫情對產業的影響

第5章 市場動態

- 市場促進因素

- 產品新鮮度測定的需求日益增加

- 消費者對衛生食品成分的偏好日益增加

- 對安全性和追蹤解決方案的需求不斷增加

- 市場挑戰

- 缺乏普遍標準和安全隱患

第6章 市場細分

- 技術(定性趨勢分析)

- RFID

- 感應標籤

- NFC

- 最終用戶產業

- 藥品

- 飲食

- 後勤

- 化妝品

- 其他最終用戶產業

- 地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 其他亞太地區

- 拉丁美洲

- 中東和非洲

- 北美洲

第7章 競爭格局

- 公司簡介

- Evigence Sensors

- Insignia Technologies

- Avery Dennison Corporation

- Innoscentia

- SpotSee

- SATO Holding AG

- Scanbuy Inc.

- Zebra Technologies Corporation

- Ensurge Micropower ASA

- CCL Industries Inc.

第8章投資分析

第9章:市場的未來

The Spoil Detection-based Smart Labels Market size is estimated at USD 1.11 billion in 2025, and is expected to reach USD 1.88 billion by 2030, at a CAGR of 11.09% during the forecast period (2025-2030).

Smart labels are becoming one of the most popular technologies across the pharmaceutical, food, and cosmetics industries. They are viewed as an ideal means to achieve greater efficiencies and profitability while providing the authenticity of an item and its traceability.

Key Highlights

- Smart labels provide detailed information about individual items in less time and offer real-time information. They also ensure authenticity and supply chain integrity while creating new opportunities for brands to engage with customers. The rising customer preference for hygienic food materials and the ability to quickly detect the degree of freshness is expected to drive the demand in the spoil detection-based smart labels market over the forecast period.

- The increased food and pharmaceutical recalls in recent years have raised global awareness about the genuine challenges of maintaining safe product temperature ranges during the production, handling, and administration of specific 'cold chain' goods. In January 2020, FUSION IV Pharmaceuticals Inc. dba. AXIA Pharmaceutical voluntarily recalled all unused sterile drug products within expiry, to the user level, due to a lack of assurance of sterility.

- Further, the emergence of the COVID-19 pandemic has led to an increase in visible behavioral changes due to a higher inclination toward safe and traceable food on e-commerce platforms and raised public consciousness about health and safety in general.

- According to an IBM study (2020), approximately 71% of consumers were willing to pay an additional average premium of around 37% for companies providing full transparency and traceability of their products. Under such conditions, end-to-end visibility within the supply chain has become one of the top priorities for businesses seeking to build trust with their consumers, where blockchain and IoT are expected to make a significant impact.

- Smart labels in the pharmaceutical, healthcare, and food industries are buoyed by the increasing need to track and maintain the quality of the products in these industries. Some smart labels are also equipped to detect spoilage, especially during transit. Many kinds of sensors are integrated into these labels, such as optical, ultrasonic, and active sensors. They are durable and provide information about moisture, temperature, movement, location, and many other factors.

- Companies deploying such sensors can use them to check the products' condition to prevent spoilage and validate their freshness. Companies may also check the temperature of storage facilities to avoid spoilage.

Spoil Detection Based Smart Labels Market Trends

The RFID Segment is Expected to Hold a Major Market Share

- The trend of integrating sensors such as RFID with spoil detection-based smart labels is likely to be introduced across various industry verticals in the next few years. RFIDs have a limited cost and negligible maintenance, which make them appealing for numerous applicative scenarios such as manufacturing, logistics, healthcare, agriculture, and food.

- Smart label development is an innovative application of RFID. Typical RFID systems comprise two major components: the reader and the label. The smart label consists of an RFID system and a graphical user interface (GUI).

- Principally, the two main components involved in the RFID system are the transponder (the label attached to the antenna) and the interrogator (RFID reader). Spoil detection-based smart labels convey the exact degree of freshness of the food material by changing its texture and color or communicating to the system with the help of RFID tags.

- According to FAO data, on a global level, about 33% of food is wasted in the supply chain. As per the European Commission, this figure amounts to over 40% of food products before reaching the retail market. The key reasons for this food waste in the supply chain range from their production origin, transformation, and packaging, largely for their aesthetic reason, HORECA purchasing management, distribution, and retail. Many distribution centers and warehouses have been investing in improving process efficiency to increase the efficiency of the processes as a part of improvement programs. Such investments are expected to drive growth for RFID-based smart labels.

- RFID technology has generated demand for a printer capable of concurrently printing text, bar codes, and graphics on the label's surface in addition to reading, programming, and verifying the RF tag embedded in the label. Smart label printers function as traditional printers when creating graphics, bar codes, and human-readable text. They also have RFID encoders and readers embedded inside.

- An RFID system enables unique traceability per product without requiring a direct line of sight for data reading. This exclusive automation results in the visibility of supply chain and logistics processes, which reduces errors, unknown losses, and out-of-stock to a minimum while simplifying and lowering inventory management and purchasing forecasting.

North America is Expected to Hold the Largest Share

- North America is one of the largest markets for spoil detection-based smart labels globally, with the United States accounting for a significant share in the region. The country's huge demand can be attributed to the vast presence of small and big retail stores. The United States is led by retail giants, such as Walmart and others, driving the upsurge in activity, largely contributing to the country's growth of the studied market.

- According to the US Department of Agriculture, food waste is estimated at 30-40% of the food supply annually in the United States. Food waste has led to huge food insecurity in the country. The country is expected to witness 50 million people suffering from food insecurity in 2022 alone. This staggering increase in food security will likely fuel large-scale initiatives to reduce food spoilage, driving the market growth. To address the alarming food wastage on the shelves of various retail stores, vendors are introducing new spoil detection based on smart labels to minimize such wastage.

- Technology proliferation in the studied market has allowed smart labels to predict freshness and help consumers and distributors understand spoiled ones. Research studies have helped develop indicator labels that can indicate on-package freshness for guavas without altering the quality of the fruit.

- Also, USDA and FDA (Food and Drug Administration) announced a framework agreement to label cell-based meats and potentially other food products in 2019. This is expected to augment the market size in the country further. Vendors in the country invest in technologies that drive greater traceability throughout their supply chains, with blockchain increasingly used along with spoil detection-based smart labels.

- Besides the rise in healthcare expenditure in the country, RFID technology is expected to propel the spoil detection-based smart label market in the healthcare and medical sectors. The increased spending is anticipated to create new deployment avenues for spoil detection-based smart labels. Overall, the market is expected to mature significantly in the country over the forecast period.

Spoil Detection Based Smart Labels Industry Overview

The competitive rivalry in the spoil detection-based smart labels market is high due to the presence of some key players such as Evigence Sensors, Insignia Technologies, and many more. The players in the industry have been able to successfully come up with product developments through continuous research and development by entering strategic partnerships that have enabled them to boost the market growth.

- March 2022 - Avery Dennison Corporation acquired the linerless label technology developed by Catchpoint Ltd, a UK company based in Yorkshire, England. The purchase covers Catchpoint's patents, brand, trade secrets, and know-how.

- January 2022 - SpotSee, one of the global leaders in condition-indicating solutions that protect life sciences products against damage and ensure supply chain integrity, acquired Biosynergy, Inc., a manufacturer of medical devices primarily used to monitor the core temperature of red blood cells.

- January 2022 - CCL Industries Inc., one of the world leaders in specialty label, security, and packaging solutions for global corporations, government institutions, small businesses, and consumers, acquired two U.S. headquartered, software-powered tag and card businesses - International Master Products Corporation, and Lodging Access Systems, LLC for its Avery unit.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of Impact of the COVID-19 Pandemic on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Need to Determine the Freshness of Products

- 5.1.2 Rising Consumer Preference for Hygienic Food Materials

- 5.1.3 Increasing Demand for Security and Tracking Solutions

- 5.2 Market Challenges

- 5.2.1 Lack of Ubiquitous Standards and Safety Concerns

6 MARKET SEGMENTATION

- 6.1 Technology (Qualitative Trend Analysis)

- 6.1.1 RFID

- 6.1.2 Sensing Label

- 6.1.3 NFC

- 6.2 End-user Industry

- 6.2.1 Pharmaceutical

- 6.2.2 Food and Beverage

- 6.2.3 Logistics

- 6.2.4 Cosmetics

- 6.2.5 Other End-user Industries

- 6.3 Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 Germany

- 6.3.2.2 United Kingdom

- 6.3.2.3 France

- 6.3.2.4 Rest of Europe

- 6.3.3 Asia-Pacific

- 6.3.3.1 China

- 6.3.3.2 Japan

- 6.3.3.3 India

- 6.3.3.4 Rest of Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle-East and Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Evigence Sensors

- 7.1.2 Insignia Technologies

- 7.1.3 Avery Dennison Corporation

- 7.1.4 Innoscentia

- 7.1.5 SpotSee

- 7.1.6 SATO Holding AG

- 7.1.7 Scanbuy Inc.

- 7.1.8 Zebra Technologies Corporation

- 7.1.9 Ensurge Micropower ASA

- 7.1.10 CCL Industries Inc.