|

市場調查報告書

商品編碼

1689953

磷酸:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Phosphoric Acid - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

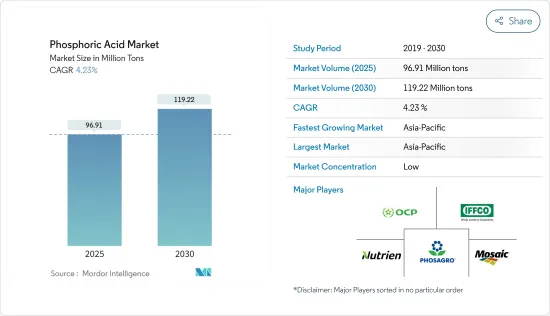

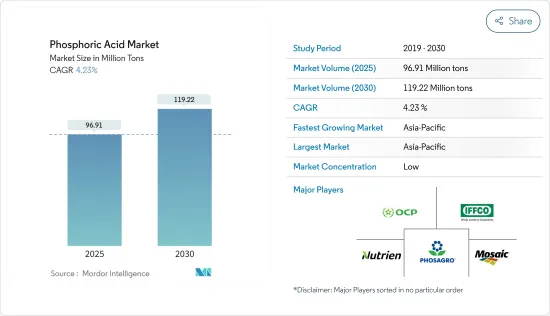

預計 2025 年磷酸市場規模為 9,691 萬噸,到 2030 年將達到 1.1922 億噸,預測期內(2025-2030 年)的複合年成長率為 4.23%。

由於主要供應和生產線中斷,市場受到 COVID-19 疫情的負面影響,導致嚴重的供不應求。磷酸的主要用途是生產肥料。疫情也導致作物減產,並引發民眾食物和其他必需品短缺。疫情過後,隨著重點產業復工,市場加速發展,需求成長。

主要亮點

- 由於大部分磷酸被用作肥料的原料,預計肥料行業的需求增加以及食品和飲料行業用量的增加將推動市場需求。

- 磷酸鹽造成的健康危害和化肥價格上漲預計會阻礙市場成長。

- 然而,從磷酸中回收稀土元素以及手性磷酸作為催化劑的商業化預計將為市場帶來豐厚的機會。

- 亞太地區貢獻了最大的市場佔有率,並可能在預測期內佔據市場主導地位。

磷酸市場趨勢

肥料產業佔據市場主導地位

- 磷酸鹽本質上是生產肥料的中間體。磷酸一銨(MAP)、磷酸二銨(DAP)、磷酸三鈉(TSP)等肥料都是由磷酸生產的。

- 磷酸鹽是一種多功能劑,可用於植物營養、調節 pH 值以及清除灌溉系統中的石灰沉積物,是許多肥料的主要成分。磷酸鹽是植物的豐富磷來源。

- 磷肥對植物非常重要,而且比有機肥料效果更好。磷促進植物成熟並有助於根部發育。這在乾旱地區尤其重要。

- 根據基本化學工業統計,全世界每年生產超過 4,300 萬噸磷酸鹽,其中約 90% 用於製造肥料。

- 根據美國農業部對外農業服務局的數據,中國、俄羅斯、美國、印度和加拿大共生產了全球 60% 以上的肥料養分。俄羅斯和美國的化肥產量均佔全球總量的不到 10%,而中國的化肥產量則約為 25%。

- 2022年9月,美國政府宣布了一項5億美元的計劃,以促進國內化肥產量,並敦促歐盟採取類似措施。加拿大已經是世界上最大的鉀肥供應國,該國於2022年11月宣布,將每年增加20%的化肥出口量,以填補其他國家停止出口留下的缺口。

- 根據國際肥料協會(IFA)統計,中國是最大的化肥使用國,消耗了全球近四分之一的化肥供應。 2022年,中國總合生產NPK肥料5,570萬噸。這高於 2021 年的 5,544 萬噸和 2020 年的 5,496 萬噸。

- 因此,考慮到世界各個地區化肥的成長趨勢和產量,化肥產業可能會主導市場,導致預測期內磷酸鹽的需求增加。

亞太地區佔市場主導地位

- 2022 年,亞太地區在磷酸市場上佔據主導地位,佔有相當大的佔有率,預計在預測期內仍將保持主導地位。

- 這是因為中國是世界上最大的化肥生產國和消費國。中國、印度和東南亞等國家對磷酸的需求持續增加。

- 中國約佔世界農業面積的7%,但卻養活了全球22%的人口。該國是多種農作物的最大生產國,其產品包括米、棉花、馬鈴薯等。因此,由於該國大規模的農業活動,對肥料中使用的磷酸鹽的需求正在迅速成長。

- 磷酸也廣泛用於磷酸鋰鐵鋰電池的生產,而中國是該領域的主導國家。到2022年,中國銷售的所有電動車中44%將使用LFP電池,其次是歐洲的6%和美國和加拿大的3%。

- 另一個肥料生產大國印度是第二大肥料用戶。印度的大部分化肥使用資金都來自印度政府的巨額補貼。 22會計年度,印度生產了超過4,200萬噸化肥。印度的化肥產量在20會計年度達到峰值,超過4,600萬噸。近年來,政府推出了一系列優惠政策,鼓勵公共、合作和私營部門進行投資。

- 磷酸也用於食品和飲料工業,使各種可樂和果醬等食品和飲料變酸並產生濃郁或酸味。根據美國農業部(USDA)的數據,印度食品產業排名世界第三。過去幾年,該行業一直穩步成長,印度有望成為世界上最大的食品生產國。預計到 2025 年,該國食品和雜貨 (F&G) 零售市場銷售額將超過 8,500 億美元。

- 因此,上述原因可能會推動預測期內亞太磷酸市場的成長。

磷酸鹽產業概況

磷酸市場部分一體化,有多家公司在全球和區域層面開展業務。市場的主要企業(不分先後順序)包括 OCP Group、Mosaic、PhosAgro Group of Companies、Nutrien Ltd 和 IFFCO。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場促進因素

- 肥料業需求旺盛

- 在食品和飲料行業的使用日益廣泛

- 市場限制

- 磷酸的健康危害

- 價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 磷酸價格走勢分析(2018-2023年)

- 技術簡介

第5章 市場區隔

- 按最終用戶產業

- 肥料

- 飲食

- 化學品

- 藥品

- 冶金

- 其他最終用戶產業

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 墨西哥

- 加拿大

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭格局

- 併購、合資、合作、協議

- 市場排名分析

- 主要企業策略

- 公司簡介

- Aditya Birla Chemicals

- Agropolychim

- EuroChem Group

- ICL

- IFFCO

- Innophos

- JR Simplot Company

- Mosaic

- Nutrien Ltd

- Phosagro

- Sterlite Copper(A Unit of Vedanta Limited)

第7章 市場機會與未來趨勢

- 從磷酸回收稀土元素

- 手性磷酸催化劑的商業化

The Phosphoric Acid Market size is estimated at 96.91 million tons in 2025, and is expected to reach 119.22 million tons by 2030, at a CAGR of 4.23% during the forecast period (2025-2030).

The market was negatively impacted by the COVID-19 pandemic as it disrupted the main supply and manufacturing lines, leading to acute shortages. The main use of phosphoric acid is for producing fertilizers. The pandemic also led to a decrease in crop production, accompanied by a shortage of food and other essentials among people. After the pandemic, the market picked up speed, and the demand grew as major industries got back to work.

Key Highlights

- Since most phosphoric acid is used to make fertilizer, the rising demand from the fertilizer industry and increasing usage in the food and beverage industry are expected to drive market demand.

- Health hazards caused by phosphoric acid and the high price of fertilizers are expected to hinder the market's growth.

- Nevertheless, the recovery of rare earth elements from phosphoric acid and the commercialization of chiral phosphoric acid as a catalyst are expected to offer lucrative opportunities to the market.

- Asia-Pacific accounted for the highest market share, and the region is likely to dominate the market during the forecast period.

Phosphoric Acid Market Trends

Fertilizer Industry to Dominate the Market

- Phosphoric acid is basically an intermediate used to produce fertilizers. Fertilizers like monoammonium phosphate (MAP), diammonium phosphate (DAP), and trisodium phosphate (TSP) are produced from phosphoric acid.

- Phosphoric acid forms a key component for many fertilizers as it is a multi-function agent used for plant nutrition, pH adjustment, and cleansing irrigation equipment from lime precipitation. It is a rich source of phosphorus for plants.

- Phosphorus fertilizers are extremely important for the plant and provide better activities than organic fertilizers. Phosphorus accelerates the maturation of the plant and also provides the development of the roots. This is particularly important for dry areas.

- According to the Essential Chemical Industry, annually, more than 43 million metric tons of phosphoric acid are produced worldwide, of which about 90% are used to make fertilizers.

- According to the USDA Foreign Agricultural Service, China, Russia, the United States, India, and Canada produce more than 60% of the world's fertilizer nutrients combined. Russia and the United States each produce less than 10% of global fertilizers, while China produces approximately 25%.

- In September 2022, the US government announced programs worth USD 500 million to boost domestic fertilizer production, and the European Union is being urged to take similar action. Canada, already the world's largest supplier of potash fertilizers, announced in November 2022 that it will boost its fertilizer exports by 20% annually, filling a gap left by blocked shipments from other countries.

- According to the International Fertilizer Association (IFA), China is the largest user of fertilizer, consuming nearly one-quarter of global fertilizer supplies. In 2022, a total of 55.7 million tons of NPK fertilizer was produced in China. This was 55.44 million tons in 2021 and 54.96 million tons in 2020.

- Therefore, considering the growth trends and production of fertilizers in different regions worldwide, the fertilizer industry is likely to dominate the market, which, in turn, is expected to enhance the demand for phosphoric acid during the forecast period.

Asia-Pacific Region to Dominate the Market

- The Asia-Pacific region dominated the phosphoric acid market in 2022 with a considerable volume share, and it is expected to maintain its dominance during the forecast period.

- This is due to China being the world's largest producer and consumer of fertilizer. In countries like China, India, and Southeast Asian nations, the demand for phosphoric acid has been increasing continuously.

- China accounts for approximately 7% of the overall agricultural acreage globally, thus feeding 22% of the world's population. The country is the largest producer of various crops, including rice, cotton, potatoes, and others. Hence, the demand for phosphoric acid, which is used in fertilizers, is rapidly increasing owing to the large-scale agricultural activities in the country.

- Phosphoric acid is also used extensively in the production of lithium-iron-phosphate batteries, and China is the dominant country in this field. In 2022, 44% of the total electric vehicles sold in China used LFP batteries, followed by 6% in Europe and 3% in the United States and Canada.

- India, another large fertilizer producer, is the second largest user. Much of India's usage is fueled by the Indian government's heavy subsidization of fertilizers. In the financial year 2022, over 42 million metric tons of fertilizers were produced in India. Fertilizer production in India peaked in the financial year 2020 at over 46 million metric tons. During the last few years, there has been a favorable policy facilitating investments in the public, cooperative, and private sectors.

- Phosphoric acid is also used in the food and beverage industries to acidify foods and beverages, such as various colas and jams, providing a tangy or sour taste. According to the US Department of Agriculture (USDA), the Indian food industry ranks as the third-largest food industry globally. The industry has been experiencing steady growth over the past several years, with India anticipated to become the largest food producer in the world. The country's food and grocery (F&G) retail market is projected to surpass USD 850 billion in sales by 2025.

- Hence, the reasons mentioned above are likely to fuel the growth of the phosphoric acid market in Asia-Pacific over the forecast period.

Phosphoric Acid Industry Overview

The phosphoric acid market is partially consolidated, with several companies operating on both global and regional levels. Some of the major players in the market (not in any particular order) include OCP Group, Mosaic, PhosAgro Group of Companies, Nutrien Ltd, and IFFCO, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions

- 1.2 Scope of Study

2 Research Methodology

3 Executive Summary

4 Market Dynamics

- 4.1 Market Drivers

- 4.1.1 High Demand for Fertilizer Industry

- 4.1.2 Increasing Usage in the Food and Beverage Industry

- 4.2 Market Restraints

- 4.2.1 Health Hazards Caused by Phosphoric Acid

- 4.3 Industry Value Chain Analysis

- 4.4 Industry Attractiveness - Porters Five Forces Analysis

- 4.4.1 Bargaining Power of Supplier

- 4.4.2 Bargaining Power of Buyer

- 4.4.3 Threat of New Entrant

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Intensity of Competitive Rivalry

- 4.5 Price Trend Analysis of Phosphoric Acid (2018-2023)

- 4.6 Technological Snapshot

5 Market Segmentation (Market Size in Volume)

- 5.1 By End-user Industry

- 5.1.1 Fertilizer

- 5.1.2 Food and Beverages

- 5.1.3 Chemicals

- 5.1.4 Medicine

- 5.1.5 Metallurgy

- 5.1.6 Other End-user Industries

- 5.2 By Geography

- 5.2.1 Asia-Pacific

- 5.2.1.1 China

- 5.2.1.2 India

- 5.2.1.3 Japan

- 5.2.1.4 South Korea

- 5.2.1.5 Rest of Asia-Pacific

- 5.2.2 North America

- 5.2.2.1 United States

- 5.2.2.2 Mexico

- 5.2.2.3 Canada

- 5.2.3 Europe

- 5.2.3.1 Germany

- 5.2.3.2 United Kingdom

- 5.2.3.3 Italy

- 5.2.3.4 France

- 5.2.3.5 Rest of Europe

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Rest of South America

- 5.2.5 Middle East and Africa

- 5.2.5.1 Saudi Arabia

- 5.2.5.2 South Africa

- 5.2.5.3 Rest of Middle East and Africa

- 5.2.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Merger and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Aditya Birla Chemicals

- 6.4.2 Agropolychim

- 6.4.3 EuroChem Group

- 6.4.4 ICL

- 6.4.5 IFFCO

- 6.4.6 Innophos

- 6.4.7 J.R. Simplot Company

- 6.4.8 Mosaic

- 6.4.9 Nutrien Ltd

- 6.4.10 Phosagro

- 6.4.11 Sterlite Copper (A Unit of Vedanta Limited)

7 Market Opportunities and Future Trends

- 7.1 Recovery of Rare Earth Elements from Phosphoric Acid

- 7.2 Commercialization of Chiral Phosporic Acid as a Catalyst