|

市場調查報告書

商品編碼

1690194

車載充電器:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Automotive On-board Charger - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

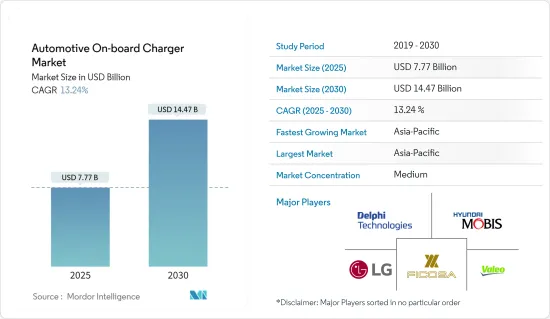

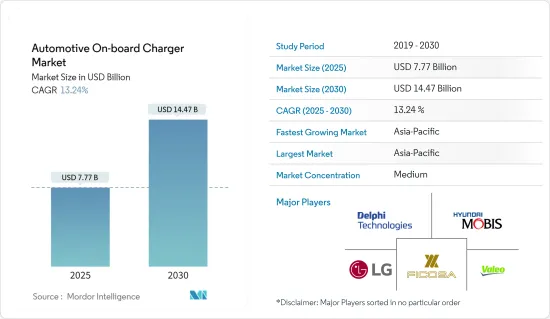

預計 2025 年汽車車載充電器市場規模為 77.7 億美元,到 2030 年將達到 144.7 億美元,預測期內(2025-2030 年)的複合年成長率為 13.24%。

從長遠來看,電動車的快速銷售、電池技術的進步、充電基礎設施的改善以及嚴格的排放法規預計將推動車載充電器的需求。電動車在已開發國家越來越受歡迎。電動車行業領導者和新興企業計劃在未來幾年推出新的電動車車型。

根據國際能源總署(IEA)的數據,2022 年全球電池式電動車銷量將達到 730 萬輛,而 2021 年為 460 萬輛,2022與前一年同期比較增 30.3%。

美國政府承諾在2030年將溫室氣體排放在2005年的基礎上減少50-52%。政府已宣佈2050年實現淨零經濟的目標。

隨著高功率商用車投入市場,適合整合到這些車輛中的先進車載充電器的需求激增。因此,一些製造商採用了加入雙車載充電器的策略來提高這些車輛的效率並有助於降低車載充電器的成本。隨著電動車推進技術日益普及,全球對車載充電器的需求預計將會增加。

然而,車載充電器成本較高,對市場參與者構成了重大挑戰。為了解決高成本的問題,市場上的各種參與者正在開發先進的技術來降低這些充電器的成本。為了滿足電動車買家的大量需求,一些OEM正在推出配備快速充電技術的汽車以縮短充電時間,預計這將在預測期內對車載充電器的需求產生積極影響。未來幾年,由於都市化進程加快、人均可支配收入增加以及消費者偏好轉向新能源汽車,預計亞太地區將呈現快速成長。

汽車車用充電器市場趨勢

乘用車領域引領車用充電器市場

在政府積極推動交通運輸業脫碳以及消費者對新能源汽車偏好轉變的推動下,電動乘用車的普及近年來迅速成長。隨著越來越多的消費者傾向於使用乘用車,對整合到乘用車中以提高其充電效率的組件(例如先進的車載充電器)的需求將顯著增加。

根據印度電動車製造商協會 (SMEV) 的數據,印度 2024 會計年度的電動四輪車銷量預計將達到 88,114 輛,而 2023 會計年度為 47,499與前一年同期比較,2023 會計年度和 2024 會計年度的年成長率為 85.5%。

2023 年第一季度,美國電池式電動車銷量為 258,800 輛,而 2022 年第一季為 226,700 輛,與 2022 年第四季相比,2023 年第一季環比成長 14.1%。

在全球範圍內,對開發電動車充電基礎設施的投資不斷增加,以幫助促進從汽油/柴油汽車到電動車的平穩過渡。消費者需要大量的公共電動車充電站,以確保他們的旅行不會因汽車電量不足而受到影響。因此,世界各國政府都在投資建造電動車充電網路,這將有助於未來幾年乘用車車載充電器的快速成長。

美國政府於 2024 年 1 月宣布計劃投資 6.23 億美元,加速在全國推出一系列電動車充電站,以補充交通運輸部門的脫碳努力。該政府表示,將透過向全國 22 個州提供津貼金的方式,改善充電基礎設施,包括在奧勒岡州部署快速充電器,在德克薩斯州為貨運卡車部署氫燃料充電器。

例如,英國計劃在2040年之前禁止銷售所有汽油和柴油汽車。印度政府計劃在2027年之前考慮在所有城市禁止柴油汽車。挪威等其他歐洲國家已經建立了框架,到2025年只銷售零燃燒汽車。各國政府正在製定全面的策略來推動二氧化碳排放,這將導致電動乘用車銷量增加,對車載充電器市場的需求產生正面影響。

亞太地區可望引領汽車車用充電器市場

亞太地區是電動車產業的中心,由於原料低成本,預計將引領車載充電器市場。

電動車製造商數量眾多,人口不斷成長,政府也參與其中。因此,隨著中國、印度和日本等國家的電動乘用車和商用車產業的擴張,預計未來幾年亞太地區的車載充電器市場將快速成長。

根據中國工業協會(CAAM)的數據,2023 年 7 月商用純電動車(BEV)月銷量達到 38,000 輛,而 2023 年 6 月為 33,000 輛,6 月至 7 月環比成長 15.1%。

根據日本汽車檢查登記資訊協會的數據,2023 年日本投入使用的純電動車數量將達到 162,390 輛,而 2022 年為 138,330 輛, 與前一年同期比較同比成長 17.3%。

該地區有多家汽車製造商提供相容的電動車,例如比亞迪和塔塔汽車,這也有助於擴大電動車市場並推動車載充電器的需求。該地區的商業車隊營運商,例如物流和最後一哩配送服務公司,越來越傾向於在其車隊中部署電動貨車和卡車,以配合政府減少碳排放的努力。預計未來幾年將部署大量卡車和貨車,這可能會增加亞太地區對車載充電器的需求。

由於電動車持有的不斷增加和建立電動車製造中心的優惠政策,中國有望主導亞太車載充電器市場。該國可選的電動車充電基礎設施也有望促進電動車的普及,這將對未來幾年車載充電器的需求產生積極影響。

汽車車用充電器產業概況

由於生態系統中存在多家國際製造商,車載充電器市場分散且競爭激烈。主要參與者包括德爾福科技 (BorgWarner Inc)、現代摩比斯、LG 公司、意法半導體、Ficosa International SA、法雷奧 SE、豐田自動織機公司和 Bel Fuse Inc. 隨著各種新型電動車型進入市場,車載充電器製造商正在透過與其他參與者建立戰略聯盟並推出新的車載充電器來擴大其影響力。

2023 年 11 月,博格華納宣布與目標商標產品製造商 (OEM) 建立合作夥伴關係,為該OEM生產的乘用車型供應雙向 800V 車載充電器 (OBC)。該公司表示,其車用充電器採用碳化矽電源開關,以提高車輛效率並改善電源轉換和安全合規性。

2023 年 6 月,雷諾和 Mobilize 宣布合作,為雷諾生產的 Model 5 車款配備 R5 雙向車用充電器。 Mobilize 表示,其雙向充電器、雙向充電站和 V2G 服務將幫助客戶降低充電成本,因為該技術有助於將電力送回電網。

車載充電器市場預計將見證大量研發投入,以整合先進技術,提高電動車的效率並縮短電動乘用車和商用車的充電時間。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場促進因素

- 政府大力推廣電動車,推動市場成長

- 市場限制

- 車載充電器高成本阻礙因素市場成長

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 購買者/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章 市場區隔

- 按車型

- 搭乘用車

- 商用車

- 按動力傳動系統

- 純電動車 (BEV)

- 插電式混合動力汽車(PHEV)

- 按額定輸出

- 小於 3.3 千瓦

- 3.3~11 kW

- 11kW 或以上

- 按銷售管道

- 目的地設備製造商(OEM)

- 售後市場

- 按地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 其他歐洲國家

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 世界其他地區

- 巴西

- 墨西哥

- 阿拉伯聯合大公國

- 其他國家

- 北美洲

第6章 競爭格局

- 供應商市場佔有率

- 公司簡介

- Delphi Technologies(BorgWarner Inc.)

- Hyundai Mobis

- LG Corporation

- STMicroelectronics

- Ficosa International SA

- Valeo SE

- Delta Energy Systems AG

- Toyota Industries Corporation

- Brusa Elektronik AG

- VisIC Technologies Ltd

- Bel Fuse Inc.

第7章 市場機會與未來趨勢

- 車載充電器技術的快速改進推動市場需求

第8章 供應商資訊

The Automotive On-board Charger Market size is estimated at USD 7.77 billion in 2025, and is expected to reach USD 14.47 billion by 2030, at a CAGR of 13.24% during the forecast period (2025-2030).

Over the long term, rapid sales of electric vehicles, advancements in battery technology, improving charging infrastructure, and stringent emission regulations are expected to fuel the demand for automotive on board chargers. The market has been witnessing the adaptation of electric passenger vehicles in developed countries. Major players and new start-ups in the EV industry plan to introduce new electric models in the coming years.

As per the International Energy Agency (IEA), battery electric vehicle sales worldwide touched 7.3 million units in 2022 compared to 4.6 million units in 2021, representing a Y-o-Y growth of 30.3% between 2021 and 2022.

The US government committed to reducing greenhouse gas emissions 50-52% below 2005 levels in 2030. The government announced its target to achieve a net-zero economy by 2050.

With the introduction of high-power commercial vehicles in the market, there is a massive demand for advanced on board chargers suitable for integration into these vehicles. Thus, several manufacturers are strategizing to incorporate dual on board chargers that improve the efficiency of these vehicles and help reduce the cost of the on board chargers. With the growing electric vehicle propulsion technology penetration in the coming years, the demand for on board chargers worldwide will increase.

However, the high cost of on board chargers imposes a significant challenge for players in the market. To tackle the issue of high costs, various players in the market are developing advanced technologies to reduce the cost of these chargers. To keep up with the high demand from buyers for electric vehicles, several OEMs are introducing cars with fast charging technologies to reduce the charging time, which will positively impact the demand for on board chargers during the forecast period. In the coming years, Asia-Pacific is expected to showcase surging growth owing to the rapid urbanization rate, increasing per capita disposable income, and the consumer preference shifting toward the adoption of new-energy vehicles.

Automotive On-board Charger Market Trends

The Passenger Cars Segment is Leading the On Board Charger Market

The penetration of electric passenger cars rapidly increased in recent years, owing to the government's aggressive push toward decarbonizing the transportation sector and consumers' shifting preference toward the adoption of new-energy vehicles. As more consumers are inclined to adopting passenger cars, the demand for components integrated into these cars, such as advanced on board chargers, to improve the charging efficiency of these cars will significantly increase.

As per the Society of Manufacturers of Electric Vehicles (SMEV), the electric four-wheeler sales in India touched 88,114 units in FY 2024 compared to 47,499 units in FY 2023, representing a Y-o-Y growth of 85.5% between FY 2023 and FY 2024.

The battery electric vehicle sales in the United States touched 258.8 thousand units in Q1 2023 compared to 226.7 thousand units in Q4 2022, recording a Q-o-Q growth of 14.1% between Q4 2022 and Q1 2023.

The rising investments in developing EV charging infrastructure globally are assisting the smooth transition from gasoline/diesel cars to electric cars. Consumers need to deploy many public EV charging stations so that their travel is not impacted due to the lack of charge in their vehicles. Hence, governments worldwide are investing in funding to develop the EV charging network, which, in turn, will contribute to the surging growth of on board chargers for passenger cars in the coming years.

In January 2024, the US government announced its plan to invest USD 623 million to foster the deployment of various electric vehicle charging points across the country, complementing its effort to decarbonize the transportation sector. The government stated that this funding will be disbursed through grants to 22 states nationwide to improve charging infrastructure, such as the deployment of rapid chargers in Oregon and hydrogen fuel chargers for freight trucks in Texas.

Globally, governments of many countries plan to promote green mobility by banning diesel vehicles and providing incentives to EV buyers; for instance, the United Kingdom plans to ban sales of all types of gasoline and diesel engine cars by 2040. The Government of India plans to consider a proposal to ban diesel vehicles from all Indian cities by 2027. Other European countries, such as Norway, are already establishing a framework to sell only zero-combustion cars by 2025. The comprehensive strategies being established by the governments to promote the reduction of carbon emissions are leading to increasing sales of electric passenger cars, which, in turn, is positively contributing to the demand for on board chargers in the market.

Asia-Pacific Is Expected to Lead the Automotive On Board Charger Market

Asia-Pacific is expected to lead the automotive on board charger market as it is the hub of the electric vehicle industry owing to the availability of lower-priced raw materials,

numerous electric vehicle manufacturers, growing population, and government participation. Therefore, with the expanding electric passenger cars and commercial vehicles industry in countries such as China, India, and Japan, the market for on board chargers is expected to showcase a rapid surge in the coming years across the Asia-Pacific.

As per the China Association of Automobile Manufacturers (CAAM), the monthly sales of commercial battery electric vehicles (BEVs) touched 38.000 in July 2023 compared to 33,000 units in June 2023, representing an M-o-M growth of 15.1% between June and July 2023.

According to the Japanese Automobile Inspection & Registration Information Association, the number of battery electric cars in use in Japan stood at 162.39 thousand units in 2023 compared to 138.33 thousand units in 2022, recording a Y-o-Y growth of 17.3% between 2022 and 2023.

The presence of several auto manufacturers in the region, such as BYD and Tata Motors, among others, involved in offering compatible electric vehicles is also leading in expanding the EV market, thereby fuelling the demand for on board chargers. Commercial fleet operators in the region, such as logistics and last-mile delivery service companies, are increasingly preferring to deploy electric vans and trucks in their fleet to complement the government's effort in reducing carbon emissions. With the deployment of a large number of trucks and vans expected in the coming years, the demand for on board chargers across the Asia-Pacific will increase during the forest period.

China is expected to dominate the on board chargers market in Asia-Pacific, owing to its growing electric vehicle parc and favorable policies toward establishing an EV manufacturing hub. The country's optional EV charging infrastructure is also expected to contribute to a greater adoption of EVs, which, in turn, will positively impact the demand for on board chargers in the coming years.

Automotive On-board Charger Industry Overview

The on board charger market is fragmented and highly competitive due to the presence of various international manufacturers operating in the ecosystem. Some of the major players include Delphi Technologies (BorgWarner Inc.), Hyundai Mobis, LG Corporation, STMicroelectronics, Ficosa International S.A., Valeo SE, Toyota Industries Corporation, and Bel Fuse Inc., among others. With the entry of various new electric models in the market, on board charger companies are expanding their presence by forming strategic alliances with other players and launching new automotive on board chargers.

In November 2023, BorgWarner announced its partnership with a North American-based original equipment manufacturer (OEM) to supply its bi-directional 800V Onboard Charger (OBC) for the passenger vehicle models manufactured by the OEM. The company stated that its on board chargers are equipped with silicon carbide power switches to enhance the efficiency of the vehicle and improve power conversion and safety compliance.

In June 2023, Renault and Mobilize announced its partnership to incorporate the R5's bi-directional onboard chargers into the model 5 manufactured by Renault. Mobilize stated that its bi-directional chargers, bidirectional charging station, and V2G service will assist customers reduce their charging costs since this technology helps send back electricity to the power grid.

The on board charger market is anticipated to witness massive investments in research and development to integrate advanced technology to improve the efficiency of electric vehicles and reduce the time to charge electric passenger cars or commercial vehicles.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Aggressive Government Focus to Promote the Adoption of Electric Vehicles Fosters the Growth of the Market

- 4.2 Market Restraints

- 4.2.1 High Cost of On Board Chargers Hampers the Growth of the Market

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in Value - USD and Volume - Units)

- 5.1 By Vehicle Type

- 5.1.1 Passenger Cars

- 5.1.2 Commercial Vehicles

- 5.2 By Powertrain Type

- 5.2.1 Battery Electric Vehicles (BEVs)

- 5.2.2 Plug-In Hybrid Electric Vehicles (PHEVs)

- 5.3 By Power Rating

- 5.3.1 Less than 3.3 kW

- 5.3.2 3.3-11 kW

- 5.3.3 More than 11 kW

- 5.4 By Sales Channel

- 5.4.1 Original Equipment Manufacturer (OEM)

- 5.4.2 Aftermarket

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 South Korea

- 5.5.3.5 Rest of Asia-Pacific

- 5.5.4 Rest of the World

- 5.5.4.1 Brazil

- 5.5.4.2 Mexico

- 5.5.4.3 United Arab Emirates

- 5.5.4.4 Other Countries

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Delphi Technologies (BorgWarner Inc.)

- 6.2.2 Hyundai Mobis

- 6.2.3 LG Corporation

- 6.2.4 STMicroelectronics

- 6.2.5 Ficosa International S.A.

- 6.2.6 Valeo SE

- 6.2.7 Delta Energy Systems AG

- 6.2.8 Toyota Industries Corporation

- 6.2.9 Brusa Elektronik AG

- 6.2.10 VisIC Technologies Ltd

- 6.2.11 Bel Fuse Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Rapid Enhancement in On Board Charger Technology to Fuel the Market Demand