|

市場調查報告書

商品編碼

1690693

歐洲 PCB:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Europe PCB - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

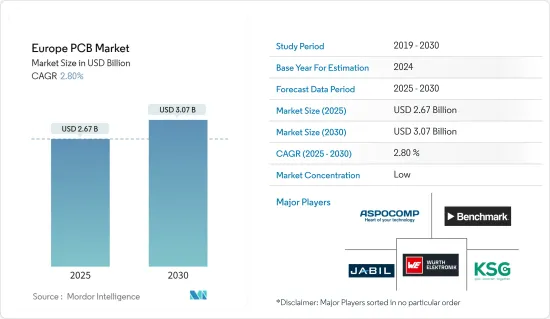

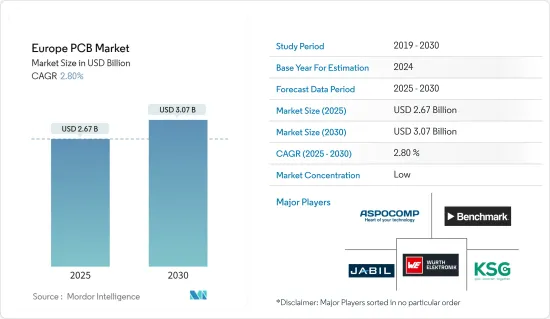

預計2025年歐洲 PCB 市場規模為 26.7 億美元,到 2030 年將達到 30.7 億美元,預測期內(2025-2030 年)的複合年成長率為 2.8%。

主要亮點

- 聯網汽車中 PCB 的採用正在加速市場的發展。這些車輛配備了有線和無線技術,方便與智慧型手機等運算設備的連接。這種技術可以讓駕駛者解鎖汽車、遠端啟動氣候控制系統、檢查電動車的電池狀態,甚至使用智慧型手機追蹤汽車。

- 電子元件的小型化使得可以製造隨身攜帶的小型可攜式和手持式計算設備成為可能。因此,市場上出現了更小、更輕且處理能力更強大的設備。電子元件變得越來越適合穿戴,因為它們可以輕鬆嵌入(例如在衣服或包包中)並且可以長時間攜帶。

- 近年來,歐洲PCB製造業在技術進步和產能擴張方面的投資不斷增加。例如,2022 年 9 月,總部位於格爾德恩的 Unimicron Germany 公司投資 1,200 萬歐元(1,289 萬美元)用於新工廠和先進的高科技 PCB 製造流程。新建築毗鄰內層製造工廠,該工廠於 2018 年竣工,是歐洲最現代化的工廠之一。該公司表示,此項投資將有助於加強其在印刷基板技術和永續性的技術領先地位。

- 電子設備的小型化意味著將更多的電晶體節點封裝到更小的積體電路中。然後將 IC 與所需的系統或設備連接,組裝後,系統就能夠執行其所需的功能。尺寸、重量和功率 (SWaP) 最佳化是電子製造領域的最新技術。無論是在航太、醫療、國防、 IT 和通訊或消費市場,當務之急是在不影響運算能力和效率的情況下實現產品小型化。

- 新冠肺炎疫情對該地區的經濟產生了重大影響。包括電子製造業在內的許多終端用戶產業都感到擔憂。然而,在疫情過後,由於許多地區政府正在推動半導體產業的發展,市場將見證成長。

歐洲 PCB 市場趨勢

軟性和剛撓性 PCB 的日益普及推動了市場

- 軟性和剛撓性 PCB(用於穿戴式電子產品、軟性顯示器和醫療應用)的日益普及預計將推動歐洲 PCB 市場的發展。

- 在歐洲,由於對穿戴式裝置的需求不斷增加以及健身活動的活性化,已經推出了多種產品。法國政府也為每個公民推出了國家數位平台,例如電子病人環境(ENS),以便醫療保健使用者和提供者能夠安全、輕鬆地存取數位服務和資訊。

- 新《護理法》使得 ENS 的發展成為可能,它使公民能夠存取所有護理資訊和服務(安全通訊、遠端諮詢、預約系統、連網穿戴設備等)。預計這將成為市場成長的驅動力。

- 整個歐洲對多層軟性 PCB 的需求正在增加。這些電路基板通常由單面和雙面電路混合製成。本產品具有組裝密度高、靈活性強、連接線束需求減少、尺寸緊湊、易於結合電阻控制功能等優點。此外,多層軟性PCB有望在包括航太工業在內的各個工業領域中廣泛應用。許多公司正在積極採用新技術,以獲得相對於競爭對手的競爭優勢。

- 醫療應用不斷尋找改善功能的方法。多層電路基板可以處理這種情況所需的所有控制功能。但此類應用程式需要更高的靈活性和便攜性。設備變得越來越小,但越來越複雜。血糖值監測儀、心臟監測儀和靜脈治療輸液幫浦等設備的各種包裝標準會限制設備內可用於容納必要電路的空間。

- 軟硬複合PCB 是具有剛性和軟性部分的印刷電路基板,適用於各種應用。軟硬複合板 (PCB) 因其高應力吸收能力和節省空間而已在汽車行業中得到應用。這些 PCB 比標準剛性 PCB 的使用壽命更長,並且在惡劣環境下更可靠。 PCB 常見於控制模組、液晶螢幕、娛樂和控制系統以及其他應用。

德國佔據主要市場佔有率

- 德國是汽車工業最突出的地區之一。半導體公司和汽車製造商正在積極投資新興自動駕駛汽車的創新。政府的有利舉措是投資進一步推動市場的主要動力。

- 區域參與者也是國際參與者的主要供應商,從而增強了該地區的市場。例如,在疫情爆發之前,總部位於德國的歐洲科技公司Aixtron SE就收到了日本住友電工設備創新公司(SEDI)的訂單,要求其訂單8x6吋晶圓配置的AIX G5+工具,以擴大GaN-on-SiC(氮化鎵-碳化矽)射頻(RF)裝置的生產能力。這些應用是無線的,包括雷達、衛星通訊和快速擴展的5G行動網路的基地台。

- 據KBA稱,近年來,德國新電動車註冊數量急劇增加。 2022年1月至11月,新註冊電動車366,234輛。 2022年3月,電動車公司特斯拉在德國柏林附近的格蘭海德開設了第一家歐洲工廠。該工廠的總產能為每年 50 萬台,初始生產率為第 6 週每週 1,000 台,計劃到 2022年終增加到每週 5,000 台。此類發展預計將進一步提振對 PCB 的需求,而 PCB 是電動車不可或缺的零件。

- 由於許多大型電力計劃被擱置,國家電網需要幫助來適應可再生能源和分散式能源的崛起。同時,各國政府正努力使電網適應新的需求。四家國家電網營運商為提高輸電能力所採取的措施總額達 500 億歐元(536.9 億美元)。因此,利用PLC累積資料並採取適當措施的用途可能會擴大,從而振興PLC市場。

- 市場上有許多供應商提供專為 PCB 製造商設計的乾膜圖形化和阻焊成像靈活平台。例如,為 PCB 製造及相關市場提供直接成像 (DI) 系統的 Limata 推出了 X1000,這是一個靈活、經濟高效的系統平台,用於乾膜圖形化和阻焊成像,專為具有短期生產配置的 PCB 製造商而設計。

歐洲 PCB 產業概況

歐洲印刷基板市場高度分散,主要參與者包括 Jabil Inc.、Aspocomp Group PLC、KSG GmbH、Benchmark Electronics Inc. 和 Wurth Elektronik Group(伍爾特集團)。該市場的競爭對手正在採取聯盟、合併、投資和收購等策略來加強其產品供應並獲得永續的競爭優勢。

- 2022 年 8 月 - Wurth Elektronik ICS 透過成立 Wurth Elektronik ICS Italia Srl 擴大在義大利的業務。但由於義大利的需求不斷成長以及眾多移動機械和商用車製造商的存在,該公司決定進一步擴大在歐洲的業務。

- 2022 年 6 月 - KSG 設計了一種創新的真空蝕刻模組,可最大限度地減少蝕刻過程中水坑的影響,從而盡可能提高效率。運輸輥的最佳化放置也改善了製程化學品的流動特性。此外,採用單獨噴嘴控制的間歇蝕刻可改善銅蝕刻,使基板頂部和底部的蝕刻圖案更加均勻。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

- 產業價值鏈分析

- 典型的 PCB 製造工作流程

- COVID-19 市場影響評估

第5章 市場動態

- 市場促進因素

- 技術小型化需求不斷成長,PCB 種類和密度不斷增加

- 歐洲加大對 PCB 製造的研發與投資

- 軟性和剛柔結合 PCB 的採用日益增多(穿戴式電子產品、軟性顯示器、醫療應用)

- 市場限制

- 組件小型化導致複雜性增加

- 嚴格的監理合規要求

第6章 市場細分

- 按類別

- 標準多層 PCB

- 剛性 1-2 面 PCB

- HDI/微孔/積層

- 軟性 PCB

- 軟硬複合板

- 其他類別

- 按行業

- 工業電子

- 航太和國防

- 消費性電子產品

- 通訊

- 車

- 醫療

- 其他行業

- 按國家

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 其他歐洲國家

第7章 競爭格局

- 公司簡介

- Jabil Inc.

- Aspocomp Group PLC

- KSG GmbH

- Benchmark Electronics Inc.

- Wurth Elektronik Group(Wurth Group)

- LeitOn GmbH

- MicroCirtec Micro Circuit Technology GmbH

- Becker & Muller Schaltungsdruck GmbH

- AT&S Austria Technologies & Systemtechnik AG

- MEKTEC Europe GmbH(Nippon Mektron Ltd)

- Unimicron Technology Corporation

- Sumitomo Electric Industries Ltd(Sumitomo Corporation)

- ICAPE Group

- Elvia PCB Group

- Fujikura Ltd

- Multek Corporation

- NCAB Group

- Exception PCB Limited

- Lab Circuits

- Eurocircuits

- TTM Technologies Inc.

第8章 市場展望

The Europe PCB Market size is estimated at USD 2.67 billion in 2025, and is expected to reach USD 3.07 billion by 2030, at a CAGR of 2.8% during the forecast period (2025-2030).

Key Highlights

- PCBs adoption in connected vehicles accelerated the market. These vehicles have been fully equipped with both wired and wireless technologies, making it easy for them to connect to computing devices like smartphones. With such technology, drivers can unlock their vehicles, start climate control systems remotely, check their electric car's battery status, and track their vehicles using smartphones.

- Electronic components miniaturization made it possible to build small portable and handheld computing devices that can be carried anywhere. As a result, smaller and lighter devices having high processing capacity are available on the market. They are becoming more wearable since components can be easily embedded (for example: in clothing and bags) and carried for long periods.

- In recent years, the European PCB manufacturing sector is witnessing robust investments in technological advancements and capacity expansions. For instance, in September 2022, Unimicron Germany, headquartered in Geldern, committed EUR 12 million (USD 12.89 million) to a new facility and advanced high-tech PCB production processes. The new structure is adjacent to the inner layer manufacturing, which was completed in 2018 and is one of the most modern in Europe. According to the company, the investment will help it enhance its technological leadership in printed circuit board technology and sustainability.

- Miniaturization in electronic devices comprises fitting more transistor nodes on a smaller integrated circuit. The IC is then interfaced within its intended system or device so that, once assembled, the system can perform the desired function. Optimizing size, weight, and power (SWaP) is the latest technology in electronics manufacturing. Be it aerospace, medical, defense, telecommunications, or the consumer market, the need of the hour is a miniaturized product without compromising computing capability and efficiency.

- The COVID-19 pandemic had a significant impact on the region's economy. Many end-user industries were concerned, including those in electronics manufacturing. However, in the post-pandemic scenario, the market is witnessing growth due to many regional governments pushing the semiconductor industry.

Europe PCB Market Trends

Increasing Adoption of Flexible and Flex-Rigid PCBs to Drive the Market

- Increasing adoption of flexible and flex-rigid PCBs (wearable electronics, flexible displays, and medical applications) is expected to drive the European PCB market.

- Europe is undergoing multiple product launches due to the augmented demand for wearables and growing fitness activities. In addition, the Government of France is implementing national digital platforms, such as Electronic Patient Environment (ENS), for every citizen to facilitate safe and easy access to digital services and information for healthcare users and providers.

- ENS development was made possible with the new Care Act, where citizens can access all their care information and services (secure messaging, teleconsulting, the appointment system, and connected wearables, among others). It is expected to drive market growth.

- The need for multilayer flexible PCBs is increasing throughout Europe. These circuit boards are usually created by mixing single and double-sided circuits. The product includes several advantages: higher assembly density, increased flexibility, less requirement for the connecting wiring harness, smaller size, and more straightforward incorporation of impedance-controlled features. Further, as a result, multilayer flexible PCBs are expected to gain widespread adoption in various industrial sectors, including the aerospace industry. Multiple companies have been working tirelessly to introduce new technologies, giving competitors a competitive advantage.

- Medical applications are continuously looking for ways to improve their functionality. A multilayer circuit board can handle all of the necessary control functions in these cases. However, these applications require greater flexibility and portability. Devices are becoming smaller while becoming more complicated. The various packaging criteria for blood glucose monitors, heart monitors, and intravenous treatment infusion pumps can limit the space amount within the device for the essential circuitry.

- Rigid-flex PCBs have printed circuit boards with rigid and flexible parts, making them suitable for various applications. Because of their high stress-absorbing capability and space-saving properties, Rigid-Flex PCBs have been used by the automotive industry. These PCBs have a longer life than standard rigid PCBs and are more reliable even under harsh environments. PCBs are often found in control modules, LCD screens, entertainment and control systems, and other applications.

Germany Holds Major Market Share

- Germany is one of the prominent regions in the automotive industry. The semiconductor companies are actively investing in innovations for emerging autonomous vehicles in the country along with the automotive manufacturers. The favorable government initiatives majorly trigger the investments which further drive the market.

- The regional players are also key suppliers to foreign players, strengthening the region's market. For instance, before the pandemic, Aixtron SE, a German-based European technology company, received an order from the Japanese group Sumitomo Electric Device Innovations, Inc. (SEDI) for an AIX G5+ tool with an 8x6-inch wafer configuration to expand the production capacity of GaN-on-SiC (gallium nitride-on-silicon carbide) radio frequency (RF) devices. It is for wireless applications such as radars, satellite communication, and base stations for the rapidly expanding 5G mobile networks.

- According to KBA, the number of new electric vehicles registered in Germany increased dramatically in recent years. From January to November of 2022, 366,234 new electric cars were registered. In March 2022, the electric vehicle company Tesla opened its first European factory in Grunheide, near Berlin, Germany. At total capacity, the plant is expected to produce 500,000 cars annually, with initial plans to build 1,000 vehicles per week at the six-week mark, increasing to 5,000 per week by the end of 2022. Such developments will further propel the demand for PCBs as they form an essential component of Electric Vehicles.

- The electricity grid in the country needs help to cope with the extent of renewable and distributed energy in the country, and many major power projects are on hold. At the same time, the government endeavors to adapt the grid to the new demands placed upon it. The measures by the four national grid operators to boost power transmission capacity sufficiently add up to a cost of EUR 50 billion (USD 53.69 billion). It is likely to escalate the usage of PLC to accumulate data and further take successive measures, thereby fueling the PLC market.

- Many vendors in the market have flexible platforms for dry-film patterning and solder mask imaging designed for PCB manufacturers. For instance, Limata, a provider of Direct Imaging (DI) systems for PCB manufacturing and adjacent markets, introduced the X1000, a flexible, cost-efficient system platform for dry-film patterning and solder mask imaging designed for PCB manufacturers with quick turnaround production configurations.

Europe PCB Industry Overview

Europe's Printed Circuit Board Market is highly fragmented, with significant players like Jabil Inc., Aspocomp Group PLC, KSG GmbH, Benchmark Electronics Inc., and Wurth Elektronik Group (Wurth Group), among others. Players in the market are adopting strategies such as partnerships, mergers, investments, and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- August 2022 - Wurth Elektronik ICS expanded its operations in Italy by establishing Wurth Elektronik ICS Italia Srl. However, the company decided to expand its presence further in Europe due to rising demand and many mobile machinery and commercial vehicle manufacturers in Italy.

- June 2022 - KSG designed an innovative vacuum etching module that minimizes the puddling effect during the etching process to make it as efficient as possible. The transport rollers' optimal placement also ensures improved run-off characteristics for the process chemistry. Furthermore, intermittent etching with individual nozzle control improves copper etching, resulting in a more uniform etching pattern on the top and bottom sides of the printed circuit board.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products and Services

- 4.2.5 Degree of Competition

- 4.3 Industry Value Chain Analysis

- 4.3.1 Typical PCB Manufacturing Workflow

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising demand for miniaturization of technology and growth in diversity and density of PCBs

- 5.1.2 Increasing R&D and investments in PCB manufacturing in Europe

- 5.1.3 Increasing adoption of flexible and flex-rigid PCBs (Wearable electronics, Flexible displays and Medical applications)

- 5.2 Market Restraints

- 5.2.1 Increasing complexity due to miniaturization of components

- 5.2.2 Strict requirements to comply with legislations

6 MARKET SEGMENTATION

- 6.1 By Category

- 6.1.1 Standard Multilayer PCBs

- 6.1.2 Rigid 1-2-sided PCBs

- 6.1.3 HDI/Micro-via/Build-up

- 6.1.4 Flexible PCBs

- 6.1.5 Rigid Flex PCBs

- 6.1.6 Other Categories

- 6.2 By End-user Vertical

- 6.2.1 Industrial Electronics

- 6.2.2 Aerospace and Defense

- 6.2.3 Consumer Electronics

- 6.2.4 Communications

- 6.2.5 Automotive

- 6.2.6 Medical

- 6.2.7 Other End-user Verticals

- 6.3 By Country

- 6.3.1 United Kingdom

- 6.3.2 Germany

- 6.3.3 France

- 6.3.4 Italy

- 6.3.5 Spain

- 6.3.6 Rest of Europe

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Jabil Inc.

- 7.1.2 Aspocomp Group PLC

- 7.1.3 KSG GmbH

- 7.1.4 Benchmark Electronics Inc.

- 7.1.5 Wurth Elektronik Group (Wurth Group)

- 7.1.6 LeitOn GmbH

- 7.1.7 MicroCirtec Micro Circuit Technology GmbH

- 7.1.8 Becker & Muller Schaltungsdruck GmbH

- 7.1.9 AT&S Austria Technologies & Systemtechnik AG

- 7.1.10 MEKTEC Europe GmbH (Nippon Mektron Ltd)

- 7.1.11 Unimicron Technology Corporation

- 7.1.12 Sumitomo Electric Industries Ltd (Sumitomo Corporation)

- 7.1.13 ICAPE Group

- 7.1.14 Elvia PCB Group

- 7.1.15 Fujikura Ltd

- 7.1.16 Multek Corporation

- 7.1.17 NCAB Group

- 7.1.18 Exception PCB Limited

- 7.1.19 Lab Circuits

- 7.1.20 Eurocircuits

- 7.1.21 TTM Technologies Inc.