|

市場調查報告書

商品編碼

1690935

碳化矽 (SiC) 晶片:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Silicon Carbide (SiC) Wafer - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

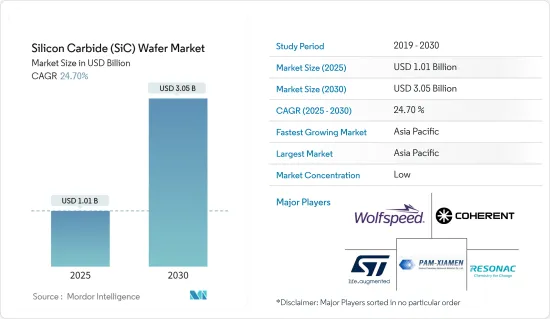

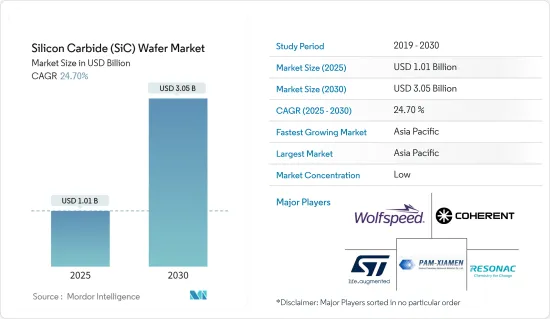

碳化矽 (SiC) 晶圓市場規模預計在 2025 年為 10.1 億美元,預計到 2030 年將達到 30.5 億美元,預測期內(2025-2030 年)的複合年成長率為 24.7%。

SiC晶片是一種以其優異的性能而聞名的特殊半導體材料。這些晶片由矽和碳組成,與傳統矽晶片相比具有顯著的優勢,在各種高性能應用中具有重要價值。

主要亮點

- 丹麥奧爾堡大學最近發布的報告預測,到2030年,功率半導體裝置的年收益將增加一倍以上。這一預期成長源於這些先進的電子元件在邁向節能社會的道路上至關重要,特別是在應對脫碳數位化的關鍵挑戰方面。與半導體積體電路(IC)在計算、資料儲存和通訊的重要作用類似,功率半導體對於現代電力電子至關重要。應用包括可再生能源發電和輸電、電動車、自動化工廠、節能資料中心、智慧城市和智慧家庭。

- 作為高壓、低損耗、高速開關功率元件的有前途的材料,WBG 半導體正受到越來越多的關注。在WBG半導體中,SiC、GaN、Ga2O3、氮化鋁(AIN)和鑽石被認為是下一代功率半導體的潛在材料。近年來,材料品質的顯著提高、裝置設計的創新以及工藝能力的提升推動了 SiC 的進步,從而導致市場上出現了各種各樣的技術演示和商業產品。

- 全球汽車產業正在經歷重大變革時期,這對能源產業也產生了影響,因為預計到 2030 年電氣化將減少每天 500 萬桶石油的需求。主要汽車市場的市場趨勢和政策努力支持電動車銷售的積極前景。根據國際能源總署的戰略情境(STEPS),基於現有政策和強力的目標,到 2030 年,電動車銷售的全球佔有率預計將從先前預測的不到 25% 增加到 35%。

- 在生產流程中,專用的SiC晶片和基板在晶圓廠開發和加工,以生產SiC基功率半導體。許多 SiC 功率半導體用於電力電子,用於轉換和控制系統內的電力。

- 晶圓尺寸越大意味著單位面積上的晶粒越多。製造更多晶粒的額外空間使得半導體代工廠或 OSAT(外包半導體組裝和測試)能夠在給定的時間內製造、測試或組裝更多晶粒。這提高了製造或組裝新產品的速度。從某種程度上來說,晶圓尺寸的提升也將對供應鏈帶來正面影響。

碳化矽(SiC)晶圓市場趨勢

最大的終端用戶是汽車和電動車(EV)產業

- SiC 具有比矽更好的熱導率,無需複雜的冷卻控制即可實現高溫功能。它們還具有明顯更高的臨界電場強度,這意味著它們可以承受快速充電所需的高電壓。這些特性使得SiC晶片在汽車工業中得到廣泛的應用。

- 隨著碳化矽(SiC)晶圓在各種汽車晶片中的使用越來越多,大多數晶片製造商現在都到了關鍵時刻,認知到SiC晶圓是一項相當安全的投資。 SiC 在許多汽車應用中顯示出巨大的潛力,尤其是電池電動車。與矽相比,SiC 可以提高每次充電的行駛里程,減少電池充電時間,並以更低的電池容量和重量實現相同的行駛里程,從而對整體效率做出重大貢獻。

- SiC 已成為一種新興技術,在許多應用中被用來取代矽。將 SiC 晶片引入電動車可提高效率、擴大行駛里程、減輕重量並降低車輛整體成本,從而提高控制電子設備的功率密度。為了提高電動車(EV)的效率和續航里程,我們一直努力降低車輛的總重量和成本。因此,在電動車中使用 SiC 的概念應運而生,這與控制電子設備功率密度的不斷增加相吻合。

- SiC 的主要應用之一是在電動車 (EV) 中,它被用作主逆變器。該逆變器在將電池的高直流電壓轉換為驅動牽引馬達所需的交流電壓方面起著至關重要的作用。與基於相同結構的IGBT技術的逆變器相比,SiC實現了6~10%的效率提升。主逆變器極大地受益於 SiC 的低傳導損耗,尤其是在部分負載條件下運作時。效率的提高意味著更長的續航里程和更小的電池,從而節省空間和成本。

- 電動車需求的不斷成長以及銷量和投資的增加將使該市場受益匪淺。國際能源總署(IEA)強調,全球汽車產業正經歷重大變革時期,對能源產業有重大影響。

- 電動車在市場上越來越受歡迎,其行駛里程也越來越長。根據國際能源總署的數據,電動車市場將呈指數級成長,2023 年全球將註冊近 1,400 萬輛新電動車,使道路上的電動車總數達到 4,000 萬輛。 2023年電動車銷量將比2022年增加350萬輛,與前一年同期比較成長35%。 2023 年,電動車將佔所有汽車銷量的約 18%,高於 2022 年的 14%。這些趨勢表明,隨著電動車市場的成熟,成長仍將保持強勁。至2023年,電池式電動車將佔電動車保有量的70%。

亞太地區將經歷強勁成長

- 亞太地區是全球領先的碳化矽(SiC)晶片市場,並且由於其在全球半導體市場的主導地位,也受到政府政策的推動。台灣、印度、中國、日本和韓國引領該地區的半導體產業,佔據全球半導體市場的相當一部分。相較之下,泰國、越南、新加坡和馬來西亞等其他地區也為該地區的主導地位做出了重大貢獻。

- 市場顯著成長的原因是,包括中國在內的多個國家對節能混合動力電動車的需求不斷增加,以減輕日益嚴重的環境污染的影響。此外,中國汽車年銷量和產量均位居世界第一,並繼續保持全球主要汽車市場之一的地位。 2025年將迎來國產汽車產量3,500萬輛的里程碑。

- 例如,中國汽車產業發展迅速,在全球汽車工業中發揮越來越重要的作用。中國是全球推廣電動車最多的國家之一,電動車正變得越來越受歡迎。 2023年8月中國新能源車銷量達84.6萬輛,其中搭乘用電動車80.8萬輛,商用電動車3.9萬輛。其中,純電動車(BEV)乘用車銷量55.9萬輛,插電式混合動力車(PHEV)乘用車銷量24.8萬輛。

- 根據國際能源總署預測,2023年中國新電動車註冊量將達810萬輛,與前一年同期比較成長35%。汽車電池管理系統通常用於電動車和卡車等電動車。電池平衡 IC 等半導體可確保此類應用中的關鍵安全性和功能性。

- 中國不僅是亞洲,也是世界上最大的半導體市場。它還吸引了許多主要晶片製造商的大量投資,用於建立新工廠和擴大晶片生產。中國公司的全球晶片銷售額正在上升,這主要歸因於美國和中國之間的緊張關係加劇,以及全國範圍內發展中國晶片行業的努力,包括政府補貼、購買優惠和其他激勵措施。

碳化矽(SiC)晶圓市場概覽

預測期內,市場競爭仍高度分散。所研究的市場由幾家全球和地區參與者組成,他們在相當激烈的競爭中爭奪市場關注。市場現有企業透過專注於市場擴張、技術創新和收購來繼續擴大規模。現有企業包括 Wolfspeed Inc.、II-VI Incorporated、SK Siltron 和 Showa Denko K.K.對整體市場產生重大影響。這些公司透過注重市場擴張和收購來不斷擴大業務規模。

- 2024 年 1 月 - 電源系統和物聯網半導體領域的全球領導者英飛凌科技股份公司與以碳化矽技術專業知識而聞名的 WaferSpeed, Inc. 宣布延長和擴展其針對 150 毫米碳化矽 (SiC) 晶片的長期協議。該協議最初於 2018 年 2 月簽署,現已加強多年產能預留。此次擴大合作將增強英飛凌供應鏈的穩定性,以滿足汽車、太陽能和電動車應用、能源儲存系統等領域對碳化矽半導體產品快速成長的需求。

- 2024 年 1 月-英飛凌科技股份公司與碳化矽 (SiC) 供應商 SK Siltron CSS 簽署協議。透過該協議,SK Siltron CSS 將向英飛凌提供最高品質、價格具有競爭力的 150 毫米 SiC 晶圓,以提高其 SiC 半導體產量。展望未來,SK Siltron CSS 將在支援英飛凌過渡到 200 毫米晶圓直徑方面發揮作用。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 技術見解

- COVID-19 和其他宏觀經濟因素的副作用將如何影響市場

第5章 市場動態

- 市場促進因素

- 電動車普及率上升和 800V 高壓電動車架構趨勢將推動對 SIC 晶圓的需求

- 高熱導率推動電力電子開關和 LED 照明設備對 SiC 晶片的需求

- 市場限制

- 可擴展性、散熱和封裝限制對晶粒和基板供應造成壓力

第6章 市場細分

- 按晶圓尺寸

- 2 英寸、3 英寸、4 英寸

- 6吋

- 8吋、12吋

- 按應用

- 力量

- 射頻 (RF)

- 其他用途

- 按最終用戶產業

- 電訊

- 汽車和電動車 (EV)

- 太陽能發電/供電/能源儲存

- 工業(UPS、馬達驅動器等)

- 其他最終用戶產業

- 按地區

- 北美洲

- 歐洲

- 亞洲

- 澳洲和紐西蘭

- 拉丁美洲

- 中東和非洲

第7章 競爭格局

- 公司簡介

- Wolfspeed Inc.

- Coherent Corp.(II-VI Incorporated)

- Xiamen Powerway Advanced Material Co.

- STMicroelectronics(Norstel AB)

- Resonac Holdings Corporation

- Atecom Technology Co. Ltd

- SK Siltron Co. Ltd

- SiCrystal GmbH

- TankeBlue Co. Ltd

- Semiconductor Wafer Inc.

第8章市場佔有率分析

第9章投資分析

第10章:市場的未來

The Silicon Carbide Wafer Market size is estimated at USD 1.01 billion in 2025, and is expected to reach USD 3.05 billion by 2030, at a CAGR of 24.7% during the forecast period (2025-2030).

SiC wafers are specialized semiconductor materials known for their exceptional properties. Composed of silicon and carbon, these wafers offer significant advantages over traditional silicon wafers, making them invaluable for a range of high-performance applications.

Key Highlights

- A recent report from Aalborg University in Denmark forecasts that annual revenues from power semiconductor devices will more than double by 2030. This growth is expected, as these advanced electronic components are crucial in addressing significant challenges on the path to an energy-efficient society, particularly decarbonization and digitization. Similar to the essential role of semiconductor integrated circuits (ICs) in computers, data storage, and communication, power semiconductors are integral to modern power electronics. Their applications include renewable power generation and transmission, electromobility, automated factories, energy-efficient data centers, smart cities, smart homes, and more.

- WBG semiconductors have received increasing attention as promising materials for high-voltage, low-loss, and fast-switching power devices. Among the WBG semiconductors, SiC, GaN, Ga2O3, aluminum nitride (AIN), and diamond are considered to be potential materials for the next generations of power semiconductors. In recent years, significant advancements in material quality, innovative device designs, and improved process capabilities have driven the progress of SiCs, resulting in a broad range of technology demonstrators and commercial products now available in the market.

- The global auto industry is undergoing a sea change, with implications for the energy sector, as electrification is set to avoid the need for 5 million barrels of oil a day by 2030. Market trends and policy efforts in major car markets support a bright outlook for EV sales. Under the IEA Stated Policies Scenario (STEPS), the global outlook for the share of electric car sales based on existing policies and firm objectives has increased to 35% in 2030, up from less than 25% in the previous outlook.

- In the production flow, specialized SiC wafers and substrates are developed and processed in a fab, resulting in SiC-based power semiconductors. Many SiC-based power semiconductors are used in power electronics, where the devices convert and control the electricity in systems.

- A larger wafer size offers more dies per unit area. The extra space to fabricate more dies enables semiconductor fabrication plants and OSATs (outsourced semiconductor assembly and test) to manufacture, test, or assemble more dies in a specific time. This increases the rate at which new products can be fabricated or assembled. To some extent, increasing wafer size also impacts the supply chain positively.

Silicon Carbide (SiC) Wafer Market Trends

Automotive and Electric Vehicles (EVs) Industry to be the Largest End User

- SiC possesses superior thermal conductivity to silicon, facilitating high-temperature functionality with uncomplicated cooling regulation. It exhibits a significantly higher critical electric field strength, enabling it to endure the elevated voltages required for rapid battery charging. These attributes have paved the way for extensive utilization of SiC wafers within the Automotive industry.

- The increasing utilization of silicon carbide (SiC) wafers in various automotive chips has reached a critical juncture where most chipmakers now perceive it as a reasonably secure investment. SiC exhibits immense potential for numerous automotive applications, especially in battery electric vehicles. It can enhance the driving range per charge compared to silicon, decrease the battery charging time, and significantly contribute to the overall efficiency equation by delivering the same range with reduced battery capacity and weight.

- SiC has become an advanced technology that is employed as a substitute for silicon in numerous applications. Integrating SiC wafers in electric vehicles has enhanced efficiency, extended range, reduced weight, and lowered costs for the entire vehicle, consequently amplifying the power density of control electronics. Endeavors were undertaken to boost the efficiency and range of electric cars (EVs) by minimizing the weight and cost of the overall vehicle. As a result, the concept of utilizing SiC for EVs emerged, aligning with the escalating power density of control electronics.

- SiC finds one of its primary uses in electric vehicles (EVs) as the main inverter. This inverter plays a crucial role in converting the high DC voltage from the batteries into the necessary AC voltage to drive the traction electric motor. Compared to inverters based on IGBT technology and having the same structure, SiC provides an efficiency enhancement ranging from 6-10%. The main inverter benefits significantly from SiC's lower conduction losses, mainly when operating under partial load conditions. This increased effectiveness results in extended range or reduced battery size, saving space and cost.

- The market is set to benefit significantly from the rising demand for battery electric vehicles, as well as the increasing sales and investments. The global automotive industry is undergoing a significant transformation, as highlighted by the International Energy Agency (IEA), with profound implications for the energy sector.

- EVs are gaining traction in the market, which has also increased the range. According to IEA, electric car markets are seeing exponential growth as almost 14 million new electric cars were registered globally in 2023, bringing their total number on the roads to 40 million. Electric car sales in 2023 were 3.5 million higher than in 2022, a 35% year-on-year increase. Electric cars accounted for around 18% of all cars sold in 2023, up from 14% in 2022. These trends indicate that growth remains robust as electric car markets mature. Battery electric cars accounted for 70% of the electric car stock in 2023.

Asia Pacific to Register Major Growth

- The Asia-Pacific is a major market for silicon carbide wafers worldwide, which government policies have also helped because of its dominating position in the global semiconductor market. Taiwan, India, China, Japan, and South Korea have driven the region's semiconductor industry, which comprises a considerable share of the global semiconductor market. In contrast, other regions such as Thailand, Vietnam, Singapore, and Malaysia have also contributed significantly to its dominance.

- Significant market growth can be attributed to the rising demand for energy-efficient hybrid electric vehicles in several nations, including China, to reduce the effects of rising environmental pollution. In addition, China retains its status as the leading vehicle market globally, boasting the highest annual sales and manufacturing output. By 2025, the nation is poised to reach a milestone, producing an estimated 35 million vehicles domestically.

- For instance, China's automotive sector is proliferating, and the region plays a more significant role in the global auto industry. China is one of the top countries that have adopted electric vehicles, which are becoming increasingly popular. In August 2023, China's new energy vehicle sales reached 846,000 units, with passenger electric vehicles accounting for 808,000 units and commercial electric vehicles for 39,000 units. Specifically, sales figures for passenger battery electric vehicles (BEVs) stood at 559,000 units, while passenger plug-in hybrid electric vehicles (PHEVs) saw sales of 248,000 units.

- According to the IEA, new electric car registrations in China hit 8.1 million in 2023, marking a 35% increase from the previous year as consumers switched from gas-guzzler models due to government subsidies and high oil prices. Automotive battery management systems are commonly used in electric vehicles, including electric cars, trucks, etc. Semiconductors, such as battery-balancing ICs, are crucial safety and functionality enablers in such applications.

- China is the largest semiconductor market, not just in Asia but also in the world. The country is also attracting large investments from many major chip manufacturers to expand chip production by setting up new factories. Chinese companies' global chip sales are rising, largely due to rising US-China tensions and nationwide efforts to develop China's chip sector, including government subsidies, purchasing preferences, and other preferential measures.

Silicon Carbide (SiC) Wafer Market Overview

The degree of competition in the market studied is highly fragmented over the forecast period. The market studied comprises several global and regional players vying for attention in a fairly contested market space. Market incumbents have been continuously expanding their scales of operation by focusing on market expansions, innovations, and acquisitions. Market incumbents, such as Wolfspeed Inc., II-VI Incorporated, SK Siltron Co. Ltd, and Showa Denko KK, considerably influence the overall market. These firms have been continuously expanding their scales of operation by focusing on market expansions and acquisitions.

- January 2024 - Infineon Technologies AG, a global leader in power systems and IoT semiconductors, and Wolfspeed Inc., renowned for its expertise in silicon carbide technology, announced an extension and expansion of their long-term agreement for 150 mm silicon carbide wafers. Initially inked in February 2018, this agreement has now been bolstered with a multi-year capacity reservation. This enhanced collaboration fortifies Infineon's supply chain stability and addresses the surging demand for silicon carbide semiconductor products across automotive, solar, EV applications, and energy storage systems.

- January 2024 - Infineon Technologies AG inked a deal with silicon carbide (SiC) supplier SK Siltron CSS. As per the terms, SK Siltron CSS will supply Infineon with top-notch, competitively-priced 150-millimeter SiC wafers, bolstering the production of SiC semiconductors. Moving forward, SK Siltron CSS is set to be instrumental in aiding Infineon's shift to a 200-millimeter wafer diameter.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Technology Insights

- 4.4 Impact of COVID-19 Aftereffects and Other Macroeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Penetration of EV and the Inclination Toward High-voltage 800V EV Architectures Propelling the Demand for SIC Wafers

- 5.1.2 Increasing Demand for SiC Wafers in Power Electronic Switches and LED Lighting Devices due to its High Thermal Conductivity

- 5.2 Market Restraints

- 5.2.1 Limiting Constraints Such as Scalability, Heat Dissipation, and Packaging-related Pressure on the Die and Substrate Supply

6 MARKET SEGMENTATION

- 6.1 By Wafer Size

- 6.1.1 2-, 3-, and 4-inch

- 6.1.2 6-inch

- 6.1.3 8- and 12-inch

- 6.2 By Application

- 6.2.1 Power

- 6.2.2 Radio Frequency (RF)

- 6.2.3 Other Applications

- 6.3 By End-user Industry

- 6.3.1 Telecom and Communications

- 6.3.2 Automotive and Electric Vehicles (EVs)

- 6.3.3 Photovoltaic/Power Supply/Energy Storage

- 6.3.4 Industrial (UPS and Motor Drives, etc.)

- 6.3.5 Other End-user Industries

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia

- 6.4.4 Australia and New Zealand

- 6.4.5 Latin America

- 6.4.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Wolfspeed Inc.

- 7.1.2 Coherent Corp. (II-VI Incorporated)

- 7.1.3 Xiamen Powerway Advanced Material Co.

- 7.1.4 STMicroelectronics (Norstel AB)

- 7.1.5 Resonac Holdings Corporation

- 7.1.6 Atecom Technology Co. Ltd

- 7.1.7 SK Siltron Co. Ltd

- 7.1.8 SiCrystal GmbH

- 7.1.9 TankeBlue Co. Ltd

- 7.1.10 Semiconductor Wafer Inc.