|

市場調查報告書

商品編碼

1690946

美國老年生活:市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)United States Senior Living - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

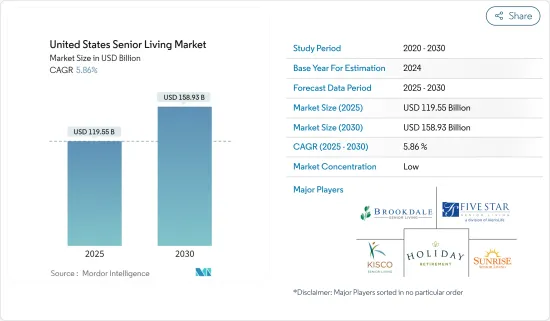

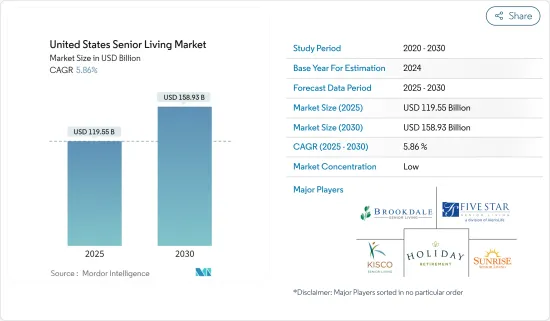

美國老年生活市場規模預計在 2025 年為 1,195.5 億美元,預計到 2030 年將達到 1,589.3 億美元,預測期內(2025-2030 年)的複合年成長率為 5.86%。

主要亮點

- 從 2024 年起,老年生活社區預計將把重點從照護轉向健康,這一趨勢將會持續下去。以健康為重點的社區為居民提供健身設施、營養計劃、心理健康服務和各種社交活動。這種全面的老年生活方式有望提高老年人的整體生活品質。

- 隨著嬰兒潮世代超過退休年齡,美國老化速度預計將在未來十年超過任何其他年齡層。在美國,每天有超過 1 萬人年滿 65 歲。

- 尤其是美國80歲以上人口,預計未來10年將成長近50%,從1,390萬增至2,080萬。這凸顯了老年生活和照護的巨大需求。相較之下,美國總人口預計在同一時期將僅成長 4.7%。

- 生活協助和獨立生活的入住率均顯著成長,分別達到80%以上和70%以上。其他入住率最高的城市包括聖荷西(83.7%)、波特蘭(83.4%)和舊金山(83.4%)。此外,休士頓(73.0%)、亞特蘭大(74.8%)和拉斯維加斯(74.9%)的入住率較低。

- 美國擁有最多的老年生活設施,有 3,706 個,其次是西部(3,436 個)、東北部(3,320 個)、中北地區(3,303 個)和中南部地區(2,244 個)。東南部包括北卡羅來納州、南卡羅來納州、田納西州、喬治亞、佛羅裡達州、阿拉巴馬州、密西西比州、阿肯色州、路易斯安那州和德克薩斯州。

- 東北地區包括緬因州、新罕布夏州、佛蒙特州、麻薩諸塞州、羅德島州、康乃狄克州、紐約州、紐澤西州和賓州。西部地區包括蒙大拿州、愛達荷州、懷俄明州、科羅拉多、新墨西哥州、亞利桑那州、猶他州、內華達州、加州、奧勒岡、華盛頓州、阿拉斯加州和夏威夷州。

美國老年生活市場趨勢

老年生活需求不斷成長

- 根據國家老年人投資中心的資料,老年住宅和護理領域的入住率達到了歷史最高水準。截至2023年8月,入住率為82.1%,是所有護理類別中付費輔助生活設施季度增幅最高的。在老年生活領域,入住率為 85.2%,包括輔助和獨立生活住宿設施以及記憶護理。

- 根據生活協助的最新資料,美國約有 32,820 個生活協助社區。全美各地的輔助生活中心註冊了約 128 萬張床位。預計到 2060 年,65 歲以上人口將幾乎加倍,養老院需求也預計將增加。

- 美國國家輔助生活中心 (NCAL) 的數據顯示,雖然絕大多數輔助生活設施(超過 80%)都是營利性的,但非營利社群的表現仍然優於國家品牌社群。非營利社區往往規模較小,入住率較高,但便利設施較少。根據 NCAL 的數據,截至 2023 年 1 月,生活部門約有 48 萬名全職員工。

- 這包括所有員工,包括經理、負責人、護理助理、廚師、清潔工和維修工人。在這 4.8 億人中,約有 3 億人是全職醫療保健和人類服務僱員。

快速成長的護理群

- 在美國,由於嬰兒潮世代(即二戰前出生的人)的數量不斷增加,對照護的需求正在大幅增加。這個高齡化社會需要更多的健康支持和更多的老年生活社區。此外,老年人的嚴重健康狀況需要熟練護理人員的監測,如慢性心臟疾病、阿茲海默症和失智症、關節炎和高血壓,正在推動輔助生活社區領域的發展。

- 此外,他們還提供護理、24小時監護、一日三餐和日常生活協助等典型服務。這些中心提供物理治療、職業治療、語言治療和其他復健服務。同時,床位價格上漲了22%,平均每張床位的照護費用達到3,320美元。

- 此外,用於護理的服務小組和床位數量非常高,超過46%,擁有約43,725張配備熟練護理人員的床位。此外,他們還提供護理、24小時監護、一日三餐和日常活動協助等典型服務。這些中心提供物理治療、職業治療、語言治療和其他復健服務。

- 同時,床位價格上漲了22%,平均每張床位的照護費用達到3,320美元。此外,超過46%的服務小組和床位用於護理,約43,725張床位配備了熟練的護理人員。

美國老年產業概況

美國老年生活市場比較分散。此外,市場主要由本地和小型開發商主導。分散參與者之間的競爭正在加劇。

此外,參與者還透過合併、收購、策略聯盟和推出新計畫來擴大業務,以滿足客戶需求。市場的主要參與者包括 Brookdale Senior Living Inc.、Five Star Senior Living、Sunrise Senior Living、Holiday Retirement 和 LCS。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查結果

- 研究範圍

第2章調查方法

第3章執行摘要

第 4 章 市場考量與動態

- 市場概況

- 市場動態

- 市場促進因素

- 老齡人口增加推動市場

- 醫療保健和長期照護需求推動市場

- 市場限制

- 難以負擔的醫療費用和高昂的照護費用影響市場

- 影響市場的人才和勞動挑戰

- 市場機會

- 市場領先的創新

- 市場促進因素

- 洞察養老領域技術創新

- 政府法規和舉措

- 供應鏈/價值鏈分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 購買者/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

- COVID-19 對市場的影響

第5章 市場區隔

- 按房產類型

- 生活協助

- 獨立生活

- 記憶護理

- 護理

- 其他類型

- 按主要州

- 紐約

- 伊利諾州

- 加州

- 北卡羅來納州

- 華盛頓

- 美國其他地區

第6章 競爭格局

- 公司簡介

- Brookdale Senior Living Inc.

- Five Star Senior Living

- Sunrise Senior Living

- Holiday Retirement

- Kisco Senior Living Company

- LCS

- Erickson Senior Living

- Atria Senior Living Inc.

- Senior Lifestyle

- Sonida Senior Living

- Ventas

- Watermark Retirement Communities

- Ensign Group Inc.*

- 其他公司

第7章:市場的未來

第 8 章 附錄

The United States Senior Living Market size is estimated at USD 119.55 billion in 2025, and is expected to reach USD 158.93 billion by 2030, at a CAGR of 5.86% during the forecast period (2025-2030).

Key Highlights

- In 2024 and beyond, senior living communities are expected to shift their emphasis from caregiving to wellness, a trend that is expected to continue. Wellness-focused communities offer residents access to fitness facilities, nutrition programs, mental health services, and various social activities. This holistic approach to senior living is expected to enhance senior adults' overall quality of life.

- The U.S. population is projected to age faster than any other age group in the country over the next decade as baby boomers age beyond retirement. In the U.S., over 10,000 people reach the age of 65 every day.

- In particular, the population of people over 80 in the United States is projected to increase by almost 50% over the next ten years, rising from 13.9 million to 20.8 million. This highlights the huge demand for additional senior housing and nursing care. By comparison, the overall population growth in the United States is projected to be a modest 4.7% over the same period.

- Assisted living and independent living properties both experienced significant growth in occupancy rates, accounting for more than 80% and 70%, respectively. In addition, the market experienced the highest occupancy rates in San Jose (83.7%), Portland (83.4%), San Francisco (83.4%), etc. Also, low occupancy rates were noted in Houston (73.0%), Atlanta (74.8%), Las Vegas (74.9%), etc.

- Most of the senior housing communities are present in the Southeast region of the United States, with 3,706 communities, followed by West (3,436), Northeast (3,320), North Central (3,303), and South Central (2,244). The Southeast region includes North Carolina, South Carolina, Tennessee, Georgia, Florida, Alabama, Mississippi, Arkansas, Louisiana, and Texas.

- The Northeast region includes Maine, New Hampshire, Vermont, Massachusetts, Rhode Island, Connecticut, New York, New Jersey, and Pennsylvania. The West region comprises Montana, Idaho, Wyoming, Colorado, New Mexico, Arizona, Utah, Nevada, California, Oregon, Washington, Alaska, and Hawaii.

United States Senior Living Market Trends

Senior Housing Witnessing Increased Demand

- According to data from the National Investment Centre for Older Persons, occupancy rates are at an all-time high in the elderly housing and care sector. With an occupancy rate of 82.1% as of August 2023, assisted living had the highest quarterly increase in all categories of care. The occupancy rate is 85.2% in the area of senior living, which covers both assisted and independently lived accommodation and memory care.

- There are approximately 32,820 assisted living communities in the United States, according to the most recent data from the National Center for Assisted Living. Almost 1.28 million assisted living beds are registered with the National Centre for Active Living. As the population of people over 65 is expected to almost double by 2060, care facilities are also expected to grow similarly.

- Most assisted living communities (over 80%) are for-profit, but according to the National Center for Assisted Living (NCAL), nonprofit communities continue to outpace their national-brand counterparts. Nonprofit communities tend to be smaller, with higher occupancy rates but potentially fewer amenities. According to NCAL, the living sector employed nearly 480,500 full-time employees as of January 2023.

- All staff, such as managers, sales representatives, care assistants, cooks, janitors, and maintenance workers, are included. Approximately 300 million of the 480 million workers are full-time healthcare and social services employees.

Nursing Care Communities Experiencing Significant Growth

- The demand for nursing care is increasing significantly due to the increase in the baby boomer generation, born before World War 2, in the United States. This aging population requires higher health support and more senior living communities. Furthermore, the nursing community sector is driven by severe health conditions of senior citizens, such as chronic heart diseases, Alzheimer's and dementia, arthritis, and high blood pressure, which need to be monitored by skilled nursing staff.

- In addition, they provide typical services, including nursing care, 24-hour supervision, three meals a day, and assistance with everyday activities. These centers offer physical, occupational, speech therapy, and other rehabilitation services. On the other hand, the prices of the beds increased by 22%, with expenses averaging USD 3,320 per bed for nursing care.

- In addition, a significant number of service units or beds are contributed to nursing care, amounting to more than 46%, which accounts for approximately 43,725 beds with skilled nursing staff. In addition, they provide typical services, including nursing care, 24-hour supervision, three meals a day, and assistance with everyday activities. These centers offer physical, occupational, speech therapy, and other rehabilitation services.

- On the other hand, the prices of the beds increased by 22%, with expenses averaging USD 3,320 per bed for nursing care. In addition, a significant number of service units or beds are contributed to nursing care, amounting to more than 46%, which accounts for approximately 43,725 beds with skilled nursing staff.

United States Senior Living Industry Overview

The senior living market in the United States is fragmented. Furthermore, the market is majorly dominated by local and small developers. Higher competition exists among the fragmented players.

In addition, players are expanding their businesses through mergers, acquisitions, strategic partnerships, and new project launches to meet customer needs. Some of the major players in the market include Brookdale Senior Living Inc., Five Star Senior Living, Sunrise Senior Living, Holiday Retirement, and LCS.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS AND DYNAMICS

- 4.1 Market Overview

- 4.2 Market Dynamics

- 4.2.1 Market Drivers

- 4.2.1.1 Increase in Aging Population Driving the Market

- 4.2.1.2 Healthcare and Long-term Care Needs Driving the Market

- 4.2.2 Market Restraints

- 4.2.2.1 High Affordability and Cost of Care Affecting the Market

- 4.2.2.2 Staffing and Workforce Challenges Affecting the Market

- 4.2.3 Market Opportunities

- 4.2.3.1 Technological Innovations Driving the Market

- 4.2.1 Market Drivers

- 4.3 Insights into Technological Innovation in the Senior Living Sector

- 4.4 Government Regulations and Initiatives

- 4.5 Supply Chain/Value Chain Analysis

- 4.6 Industry Attractiveness - Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Property Type

- 5.1.1 Assisted Living

- 5.1.2 Independent Living

- 5.1.3 Memory Care

- 5.1.4 Nursing Care

- 5.1.5 Other Property Types

- 5.2 By Key States

- 5.2.1 New York

- 5.2.2 Illinois

- 5.2.3 California

- 5.2.4 North Carolina

- 5.2.5 Washington

- 5.2.6 Rest of United States

6 COMPETITIVE LANDSCAPE

- 6.1 Overview (Market Concentration and Major Players)

- 6.2 Company Profiles

- 6.2.1 Brookdale Senior Living Inc.

- 6.2.2 Five Star Senior Living

- 6.2.3 Sunrise Senior Living

- 6.2.4 Holiday Retirement

- 6.2.5 Kisco Senior Living Company

- 6.2.6 LCS

- 6.2.7 Erickson Senior Living

- 6.2.8 Atria Senior Living Inc.

- 6.2.9 Senior Lifestyle

- 6.2.10 Sonida Senior Living

- 6.2.11 Ventas

- 6.2.12 Watermark Retirement Communities

- 6.2.13 Ensign Group Inc.*

- 6.3 Other Companies