|

市場調查報告書

商品編碼

1690949

北美收縮和拉伸膜:市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)North America Shrink And Stretch Film - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

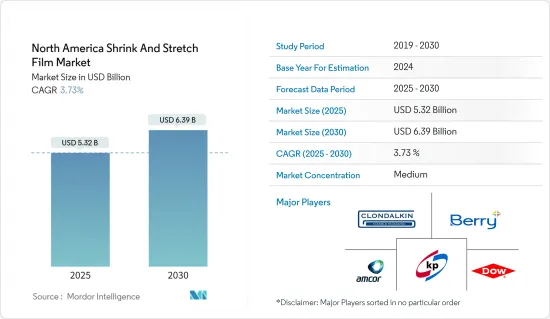

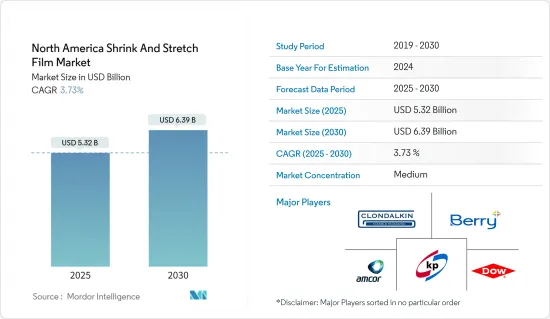

北美收縮和拉伸薄膜市場規模預計在 2025 年為 53.2 億美元,預計到 2030 年將達到 63.9 億美元,預測期內(2025-2030 年)的複合年成長率為 3.73%。

主要亮點

- 收縮拉伸膜是採用先進製程生產的聚苯乙烯薄膜。這些薄膜用於包裝應用,具有獨特的化學性質,使其在柔韌性和拉伸性方面有所區別。拉伸膜是一種柔韌、可拉伸的薄聚乙烯薄膜,用於包裹托盤貨物,而收縮膜是一種包裹單一產品或物品的薄膜,需要加熱進行包裝。這些薄膜可以防止因空氣和濕氣造成的腐敗,從而提高包裝商品的品質。

- 收縮套筒標籤是 360 度列印的標籤,通常會加熱以符合要貼標產品的形狀。收縮套筒標籤印刷在塑膠或聚酯薄膜材料的兩面上。收縮套標的耐用性使其成為暴露在潮濕和磨損中的產品的理想選擇。

- 隨著品牌越來越關注 2025 年永續性目標,探索更多永續性選擇對於實現這些承諾變得越來越重要。許多寶特瓶飲料製造商選擇可回收的聚乙烯 (PE) 收縮膜而不是硬紙板或紙板。

- Amcor 表示,PE 收縮膜是美國回收率最高的塑膠薄膜之一,透過北美 18,000 個商店回收點進行收集。透過利用消費後回收 (PCR) 內容擴大您的循環經濟努力,您可以獲得額外的永續性效益,同時提供與標準 PE 收縮膜相同的多功能性和性能。

- 除了功能優勢外,拉伸和收縮膜還具有物流優勢。使用這些薄膜可以更容易處理和存放散裝產品,大大提高倉庫效率。同時,收縮包裝的捆包緊湊且易於堆放,從而最佳化了儲存設施和車輛的空間利用率。因此,公司可以節省成本並提高其供應鏈的整體業務效率。

北美收縮和拉伸膜市場趨勢

食品飲料產業市場顯著成長

- 拉伸膜主要由線型低密度聚乙烯(LLDPE) 製成,是北美食品和飲料行業的主要產品。它是堆疊的理想選擇,可確保產品在運輸過程中的安全,並防止因錯位造成的潛在損壞。該薄膜以其良好的拉伸性和韌性而聞名,能夠完美地適應各種形狀和尺寸的產品,提供穩定性並隔絕灰塵和濕氣等外部因素。

- 另一方面,收縮膜通常由聚烯或聚氯乙烯(PVC) 製成,具有不同但同樣重要的用途。當施加熱量時,收縮包裝會收縮並緊密包裹產品,形成緊密的密封。這項特性使它們非常適合捆綁瓶子、罐子和盒子等物品,以便於處理和運輸。此外,其防篡改密封對於維護產品完整性和增強消費者對食品和飲料行業的信心至關重要。

- 拉伸膜和收縮膜對於延長食品和飲料產品的保存期限都至關重要。這些薄膜可作為抵禦灰塵、濕氣和微生物等污染物的保護屏障,有助於維持產品的新鮮度和品質。這些因素對於生鮮食品尤其重要,因為它們在儲存和運輸過程中需要嚴格的衛生和溫度控制。透過延長保存期限,這些薄膜不僅可以減少食物浪費,還可以確保消費者收到最佳狀態的產品。

- 拉伸膜和收縮膜的另一個優點是它們可以增加產品的可見度,使其在貨架上展示時更具吸引力。透明、有光澤的收縮膜可使包裝的產品看起來更美觀,這使得它在零售環境中特別受歡迎,因為視覺吸引力是消費者選擇的主要驅動力。此外,製造商可以將品牌名稱和產品詳細資訊直接列印在薄膜上,從而減少了對額外標籤和包裝材料的需求,並簡化了包裝流程。

- 根據美國人口普查局2023年12月的資料,美國食品和飲料機構的每月零售額達到約903億美元,較上月增加7.4%。零售額的成長凸顯了包裝薄膜的需求不斷成長,尤其是蔬菜、水果、魚和肉的包裝薄膜。

預計美國將主導市場

- 美國對收縮膜和拉伸膜的需求不斷成長,主要是由於對倉儲和配送過程中貨物有效包裝、捆綁和保護的需求不斷成長。此外,該地區每年都會舉辦一項活動,強調消費產業對這些薄膜的強勁需求。

- 美國加工食品的消費量正在大幅增加,從而推動了對拉伸和收縮薄膜的需求。隨著消費者擴大轉向簡便食品,高效的包裝解決方案變得越來越重要。收縮膜的需求量特別大,因為它有助於黏合和保護冷凍食品、零食包裝、已烹調產品等。

- 收縮膜以其密封和防篡改的特性而聞名,在加工食品領域尤其受到青睞,因為它可以確保食品的新鮮度和安全性。此外,其清晰、光滑的表面不僅提高了產品的可見度,還增加了貨架吸引力,這在競爭激烈的零售業中是一個至關重要的優勢。這種視覺吸引力,加上收縮膜的保護性能,使食品公司能夠吸引消費者並確保產品的完整性。

- 飲料瓶的高消費量也推動了收縮膜和拉伸膜的需求。收縮膜特別適用於多瓶裝飲料,例如六瓶或十二瓶裝。它能夠與瓶子的形狀緊密貼合,確保包裝美觀、穩定,並方便消費者使用。此外,收縮膜提供的防篡改密封進一步增加了消費者對產品安全性的信心。隨著美國瓶裝飲料消費量的增加,對拉伸和收縮膜等包裝解決方案的需求也持續成長。

- 該地區的市場參與者正在積極創新和推出新產品,以鞏固其市場地位並擴大客戶群。

- 根據飲料業出版物,截至 2023 年 5 月 21 日的 52 週內,美國自有品牌飲用水銷售額超過 53 億美元。由於消費者對健康補水的興趣日益濃厚,瓶裝水銷量激增,預計將對收縮膜和拉伸膜的消費產生重大影響,進一步推動對這些材料的需求。

北美收縮和拉伸膜行業概況

隨著許多公司進入包裝產業,北美收縮和拉伸薄膜市場比較分散。此外,技術創新和參與者的發展也加劇了市場競爭。

- 2023 年 8 月包裝解決方案提供商 Group O 被選為北美獨家經銷商,提供重新定義包裝永續性的新產品。該公司提供的產品是首款採用 30% 消費後回收 (PCR) 材料製成的機器製造的拉伸膜。該產品標誌著包裝領域的重大飛躍,尖端性能與永續性性相結合,塑造負責任商業的未來。

- 2023 年 4 月 Holden Industries Inc. 的子公司 Nosco Inc. 宣布推出其專有的 EcoClear 薄膜,用於 StretchPak 和其他卡片包裝應用。這款不含 PVC 的薄膜是經過精心設計的,旨在滿足主要零售商的永續性需求。它提供了高度透明的顯示,以增強您的產品的外觀。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 以循環經濟為重點的工業生態系分析

- 法律規範

- 收縮膜和拉伸膜價格分析

第5章 市場動態

- 市場促進因素

- 工業部門需求增加

- 物料輸送中防篡改的必要性

- 市場挑戰

- 回收挑戰

第6章 市場細分

- 產品類型

- 食物

- 裹

- 套筒標籤

- 材料

- 低密度聚乙烯 (LDPE) 和線型低密度聚乙烯(LLDPE)

- 聚氯乙烯(PVC)

- 聚對苯二甲酸乙二醇酯(PET)

- 其他材料

- 最終用途產業

- 飲食

- 消費品

- 藥品

- 工業的

- 其他最終用途產業

- 地區

- 美國

- 加拿大

第7章 競爭格局

- 公司簡介

- Berry Global Inc.

- Klockner Pentaplast Group

- Amcor Group GmbH

- Clondalkin Group Holdings BV

- Dow Inc.

- Taghleef Industries LLC

- Sealed Air Corporation

- Intertape Polymer Group Inc.

- Emsur Macdonell SA

- Transcontinental Inc.

- Heat Map Analysis

- Competitor Analysis-Emerging Vs. Established Players

第8章投資分析

第9章:市場的未來

簡介目錄

Product Code: 72593

The North America Shrink And Stretch Film Market size is estimated at USD 5.32 billion in 2025, and is expected to reach USD 6.39 billion by 2030, at a CAGR of 3.73% during the forecast period (2025-2030).

Key Highlights

- Stretch and shrink films are polythene films made with advanced engineering. These films are used for packing items and have unique chemical properties that differentiate them in terms of flexibility and stretchability. Stretch films are thin polythene films that are flexible and elastic and are used to wrap around pallet loads, whereas shrink films are thin films wrapped around a single product or commodity and require heat to pack. These films help keep items from spoiling due to air and moisture, improving the quality of packed goods.

- Shrink sleeve labels refer to 360-degree printed labels that typically use heat in the application process to conform to the product's shape to which the label is applied. Shrink sleeve labels are printed on either side of the plastic or polyester film materials. The durability of the shrink sleeves makes them ideal for products that encounter moisture or friction.

- With various brands increasing their focus on sustainability goals for 2025, exploring more sustainability options is becoming increasingly central to meeting their pledges. Many bottled beverage producers are choosing recycle-ready polyethylene (PE) shrink film over corrugate and paperboard because it uses less energy and lowers greenhouse emissions in the distribution channel without compromising run speeds and machinability.

- Amcor stated that PE shrink is one of the most recycled types of plastic films in the United States, collected through the 18,000 in-store drop-off locations in North America. Expanding efforts to close the loop on a circular economy with post-consumer recycled (PCR) content can achieve additional sustainability benefits while providing the same versatility and performance as standard PE shrink films.

- In addition to their functional benefits, stretch and shrink films offer logistical advantages. The use of these films can significantly improve warehouse efficiency by enabling easier handling and storage of bulk products. Shrink-wrapped bundles, on the other hand, are compact and easier to stack, optimizing space utilization in storage facilities and vehicles. As a result, companies can achieve cost savings and improve overall operational efficiency in their supply chains.

North America Shrink and Stretch Film Market Trends

The Food and Beverage Industry is Witnessing Significant Market Growth

- Stretch film, primarily crafted from linear low-density polyethylene (LLDPE), is a cornerstone in the North American food and beverage industry. It is the go-to choice for palletizing, ensuring products remain secure during transit, thus averting potential damages from shifting. Renowned for its elasticity and robustness, this film adeptly conforms to products of varied shapes and sizes, providing stability and shielding against external elements like dust and moisture.

- On the other hand, shrink film, often fashioned from polyolefin or polyvinyl chloride (PVC), serves a distinct yet equally vital role. When subjected to heat, it contracts, snugly enveloping the goods and creating a secure seal. This feature makes it perfect for bundling items like bottles, cans, and boxes, simplifying handling and transportation. Furthermore, its tamper-evident seal is pivotal in upholding product integrity and bolstering consumer trust in the food and beverage domain.

- Both stretch and shrink films are pivotal in prolonging the shelf life of food and beverage items. Acting as a protective shield against contaminants such as dust, moisture, and microbes, these films are instrumental in preserving product freshness and quality. These factors are especially crucial for perishables, demanding stringent hygiene and temperature controls during storage and transit. By extending shelf life, these films not only combat food wastage but also ensure consumers receive products in prime condition.

- Enhancing product visibility and shelf appeal is another forte of stretch and shrink films. Shrink film, with its clear, glossy finish, elegantly showcases packaged products, a feature particularly prized in retail settings where visual allure can sway consumer choices significantly. Furthermore, manufacturers can directly print branding and product details on the film, reducing the need for additional labels and packaging materials, thereby streamlining the packaging process.

- According to data from the US Census Bureau for December 2023, monthly retail sales from US food and beverage stores hit around USD 90.3 billion, marking a notable 7.4% surge from the preceding month. This uptick in retail sales underscores the heightened demand for films, especially for packaging items like vegetables, fruits, fish, and meat.

The United States is Expected to Hold the Majority Share in the Market

- The rising demand for shrink and stretch films in the United States is primarily fueled by the growing need for effective packaging, bundling, and safeguarding of goods during warehousing and distribution. Additionally, the region hosts annual programs highlighting the robust demand for these films from consumer industries.

- With a notable surge in processed food consumption, the United States has witnessed a corresponding uptick in the need for stretch and shrink films. As consumers increasingly favor convenience foods, the importance of efficient packaging solutions has escalated. Shrink films, in particular, are in high demand, given their role in bundling and safeguarding items like frozen meals, snack packs, and ready-to-eat products.

- Shrink films, known for their ability to create a tight, tamper-evident seal, are especially prized in the realm of processed foods, ensuring both freshness and security. Furthermore, their clear, glossy finish not only enhances product visibility but also boosts shelf appeal, a crucial advantage in the fiercely competitive retail landscape. This visual allure, coupled with the protective attributes of shrink films, aids food companies in attracting consumers and ensuring product integrity.

- The significant consumption of beverage bottles is yet another driver for the demand for stretch and shrink films. Shrink films, in particular, are favored for crafting multi-packs of beverage bottles, such as six or twelve-packs. Their ability to snugly conform to bottle shapes ensures an appealing and stable package and makes them easier for consumers to handle. Moreover, the tamper-evident seal provided by shrink films further bolsters consumer confidence in product safety. Given the escalating consumption of bottled beverages in the United States, the demand for packaging solutions like stretch and shrink films is poised for a corresponding rise.

- Market players in the region have been actively innovating their products and launching new offerings to bolster their market standing and expand their customer base.

- According to the Beverage Industry Magazine, sales of private-label bottled still water in the United States surpassed USD 5.3 billion for 52 weeks ending May 21, 2023. This surge in bottled still water sales, driven by heightened consumer interest in healthy hydration, is poised to significantly impact the consumption of shrink and stretch films, further propelling demand for these materials.

North America Shrink and Stretch Film Industry Overview

The North American shrink and stretch film market is fragmented due to many players entering the packaging industry. Moreover, innovations and developments by players are making the market competitive.

- August 2023: Packaging solutions provider Group O was selected as one of the only distributors in North America to offer a new product that redefines sustainability in packaging. The product offered by the company is a first-ever machine-grade stretch film with 30% post-consumer recycled (PCR) content. This product marks a significant leap in the realm of packaging, where cutting-edge performance meets sustainability, shaping the future of responsible commerce.

- April 2023: Nosco Inc., a subsidiary of Holden Industries Inc., announced the launch of its exclusive EcoClear Film for StretchPak and other carded packaging applications. This PVC-free film was strategically developed to meet the sustainability demands of major retailers. It offers a crystal-clear display for enhanced product appearance.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Ecosystem Analysis with an Emphasis on Circular Economy

- 4.4 Regulatory Framework

- 4.5 Shrink and Stretch Film Pricing Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Demand From Industrial Sector

- 5.1.2 The Need for Tamper-evident Protection in Material Handling

- 5.2 Market Challenges

- 5.2.1 Recycling Challenges

6 MARKET SEGMENTATION

- 6.1 Product Type

- 6.1.1 Hoods

- 6.1.2 Wraps

- 6.1.3 Sleeve Labels

- 6.2 Material

- 6.2.1 Low-density Polyethylene (LDPE) and Linear Low-density Polyethylene (LLDPE)

- 6.2.2 Polyvinyl chloride (PVC)

- 6.2.3 Polyethylene terephthalate (PET)

- 6.2.4 Other Materials

- 6.3 End-use Industry

- 6.3.1 Food and Beverage

- 6.3.2 Consumer Goods

- 6.3.3 Pharmaceutical

- 6.3.4 Industrial

- 6.3.5 Other End-use Industries

- 6.4 Geography

- 6.4.1 United States

- 6.4.2 Canada

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Berry Global Inc.

- 7.1.2 Klockner Pentaplast Group

- 7.1.3 Amcor Group GmbH

- 7.1.4 Clondalkin Group Holdings BV

- 7.1.5 Dow Inc.

- 7.1.6 Taghleef Industries LLC

- 7.1.7 Sealed Air Corporation

- 7.1.8 Intertape Polymer Group Inc.

- 7.1.9 Emsur Macdonell SA

- 7.1.10 Transcontinental Inc.

- 7.2 Heat Map Analysis

- 7.3 Competitor Analysis - Emerging Vs. Established Players

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219