|

市場調查報告書

商品編碼

1469330

家庭能源管理:發電、消耗、需求回應Home Energy Management: Generation, Consumption, Demand Response |

||||||

對能源成本上升和電網可靠性的擔憂促使消費者希望更好地管理能源消耗。 公用事業和能源提供者正在加強實施需求響應計劃,並探索為家庭服務的新機會。

本報告研究了家庭能源管理市場,並解釋了智慧家庭和智慧能源設備如何成為主流,以及這一趨勢對製造商、能源提供者和其他參與者意味著什麼。 還包括採用趨勢、購買意願以及不斷變化的消費者對能源監控解決方案、家用太陽能、電池儲存和需求響應計劃的看法。

目錄

調查方法/定義

重要術語和定義

引進能源監控

執行摘要

能源成本與消耗

智慧恆溫器:引入狀態、引入目的和預計節省費用

能源服務與需求響應計畫:知識與參與

能源監控:偏好與概念

家庭供電:電動車、太陽能發電、智慧電板

太陽能發電及蓄電池銷售

SYNOPSIS:

Rising energy costs and concerns about grid reliability prompt consumer interest in better managing their energy consumption. Utilities and energy providers seek to ramp up engagement in demand response programs and look for new opportunities to provide services to the home. This research examines how smart home and smart energy devices are moving into the mainstream and the opportunities that move opens for manufacturers, energy providers, and other industry players. It includes trending adoption, purchase intention, and shifting consumer perspectives on energy monitoring solutions, home solar, battery storage, and demand response programs.

SAMPLE VIEW

Key questions addressed:

- 1. To what extent are internet households impacted by rising energy costs?

- 2. Has familiarity with energy programs and energy devices increased?

- 3. What is the current adoption of energy devices, including smart thermostats, home solar, home battery storage, and electric vehicles?

- 4. How are consumer perceptions of utility programs changing? Has participation in demand response grown?

- 5. What is the interest in next-gen solutions, such as whole-home monitoring and solar/storage systems?

- 6. Are smart thermostats and solar systems meeting consumer expectations?

"In this push-pull environment, the most immediate opportunity lies in helping consumers make small, accessible changes that can help them save on their energy costs. Smart thermostats and demand response programs fit the bill." - Jennifer Kent, VP, Research, Parks Associates.

ABOUT THE AUTHORS:

Yilan Jiang, Senior Director of Consumer Analytics.

Yilan leads Parks Associates' Consumer Analytics team and manages numerous primary research and custom research across all areas of the consumer IoT, including consumer electronics, entertainment services, voice assistants, and connected home solutions. Yilan conducts consumer behavior analysis to understand market trends, predict consumer demand, and provide quantified market intelligence that guides strategic business decisions. Yilan leads research that provides rich insight into consumer preference and deep analysis of competitive strategies and business models.

Yilan earned her MA in economics from University of Texas at Arlington and BA in economics in Nankai University, P.R. China.

Jennifer Kent, Vice President, Research.

INDUSTRY EXPERTISE: Connected Health, Connected Home Technologies and Services, Connected Entertainment Products and Services

Jennifer manages the research department and Parks Associates' process for producing high-quality, relevant, and meaningful research. Jennifer also leads and advises on syndicated and custom research projects across all connected consumer verticals and guides questionnaire development for Parks Associates' extensive consumer analytics survey program. Jennifer is a certified focus group moderator, with training from the Burke Institute.

Jennifer earned her PhD in religion, politics, and society and an MA in church-state studies from Baylor University. She earned her BA in politics from the Catholic University of America in Washington, DC.

Sharon Jiang, Consumer Insights Manager.

Sharon Jiang is a member of the Consumer Analytics team. She analyzes different kinds of consumer data to extract critical findings of market trending and consumer behavior. She also contributes to the visualization of information to construct consumer reports. In addition, she leads the communication process with venders to provide cost estimates for custom surveys.

Sharon is currently pursuing her Dbl. BSAN MS and MBA degrees at the University of Texas at Dallas. She also earned a master's degree in Accounting at Syracuse University.

Table of Contents

Survey Methodology and Definitions

Key Terms and Definitions

Introducing Energy Monitoring

Executive Summary

- Avg. Monthly Electricity Expenditure

- "I actively work to reduce my energy consumption at home."

- Smart Thermostat Ownership

- Demand Response Participation

- Consumer Demand for Better Energy Insights

- Top 4 Valuable Tools of Home Energy Consumption Management

- Monitoring Home Energy Usage Through Other Applications

- Ownership of Major Home Energy Equipment

- Vehicle Purchase Intentions: 12 Month Outlook

- Type of Vehicle Intenders

- Incentive for Solar Purchasing

- Solar Purchase Intentions

- Battery Storage Adoption

Energy Costs and Consumption

- Average Monthly Expenditure

- Average Electricity Price to Residential Customers

- Consumer Perception of Monthly Electricity Bill

- Consumer Perception of Monthly Electricity Bill by Income

- Consumer Perception of Monthly Electricity Bill by Family Size

- Consumers' Perception Regarding Electricity Bill by Home Size

- Attitudes Towards Home Energy Consumption

- Not Enough Time/Info to Reduce Energy By Households with Kids

- Current Integration of Multiple Smart Home Devices Work Together

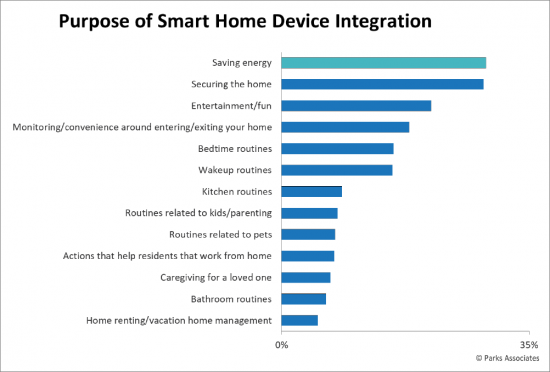

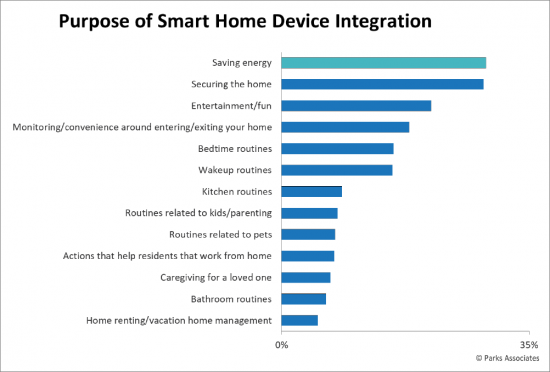

- Purpose of Smart Home Device Integration

Smart Thermostats: Adoption, Intentions, Estimated Savings

- Smart Thermostat Adoption and Recent Purchases

- Overall Smart Thermostat Purchase Intention

- Overall Smart Thermostat Purchase Intention among Those Likely to Move in the next 6 Months

- Overall Smart Thermostat Purchase Intention among Those Likely to Start a Home Renovation in the Next 6 Months

- Net Promoter Score: Smart Energy Devices

- Smart Thermostat NPS, Trending

Energy Services and Demand Response Programs: Familiarity and Engagement

- High Familiarity with Energy Programs Offered

- Adoption of Energy Programs

- Energy Program Use

- Energy Program Use Details

- Demand Response Program Use Details

- Top Motivation to Participant in Demand Response Program

- Incentive to Participate in Demand Response Program

- Estimated Number of Demand Response Events Called in Past 12 Months

- Duration of Demand Response Event

- Demand Response Event Experience

- Reasons for not Participating in Demand Response Program

- Barriers to Demand Response Participation by Gender

- Barriers to Demand Response Participation by Age

- Reasons for Churning Demand Response Program

- Products Consumers are Willing to Adjust Themselves During Peaks

- Products Consumers Will Allow Manufacturer or Utility to Adjust During Peaks

- Willingness to Adjust Products During Peaks, Among Smart Product Owners

- Likelihood of Allowing Electricity Provider to Adjust Thermostat with Incentives

- Interest in DR program incentives by Age and Households Income

Energy Monitoring: Preferences and Concepts

- Receive Electricity Consumption Breakdown from Energy Provider

- Frequency of Reviewing Consumption Breakdown

- Electricity Consumption Breakdown Review Methods

- Information Reviewed by Methods of Reviewing Energy Breakdown

- Monitoring Home Energy Usage Through Other Applications among All US Internet Households

- Monitoring Home Energy Usage Through Other Applications among Owners of Specified Devices

- Valuable Tools of Home Energy Consumption Management

- Interest in Energy Management Tools, by Current Use of Provided Consumption Breakdowns

- Interest in Energy Management Tools, by Smart Home Device Adoption

- Interest in Energy Monitors

- Preferred Energy Consumption Solutions

- Preferred Energy Consumption Solutions by Demographic

- Likelihood of Purchasing Pro-Install Retail-Time Energy Monitor

Power at Home: EVs, Solar, Smart Electric Panels

- High Familiarity with Major Home Energy Equipment

- Ownership of Major Home Energy Equipment

- High Intention of Purchasing Major Home Energy Equipment

- Vehicle Purchase Intentions: 12 Month Outlook

- Type of Vehicle Intenders

Selling Solar and Storage

- Solar Panel Purchase Motivation

- Purchase Drivers of Solar Panels

- Solar Panel Acquisition Method

- Satisfaction Level with Solar Purchase and Performance

- Reasons for Not Purchasing Solar Power Products

- Incentive for Solar Purchasing

- Solar Ownership Among EV and Smart Thermostat Owners

- Solar Purchase Intentions Among EV and Smart Thermostat Owners

- Adoption of Battery Storage Among Solar PV Owners

- Frequency of Using Home Battery to Power Home

- Home Battery Purchase Timing