|

市場調查報告書

商品編碼

1616878

灌裝-完成藥品合約製造市場:Fill Finish Pharmaceutical Contract Manufacturing Market by Type of Fill Finish Service Offered, Type of FDF, API Potency, Type of Primary Packaging Container, Regions and Leading Players: Industry Trends and Global Forecasts, Till 2035 |

||||||

全球灌裝藥品合約製造市場規模預計將從目前的 72 億美元成長到 2035 年的 120 億美元,到 2035 年的預測期間複合年增長率為 4.8%。

目前,小分子藥物佔目前治療管線的近90%。此外,預計每年核准的新藥中約60%將是小分子藥物。這是由於該領域技術創新的快速步伐,以及對有效和個人化藥理學干預措施日益偏好的推動。然而,小分子具有多種複雜性,包括此類分子的無菌填充和精加工所涉及的挑戰。

無菌填充和精加工過程是藥品生產最重要的步驟之一。在製造過程(例如填充和精加工)過程中保持無菌至關重要,不僅對於確保患者安全,而且對於維持產品品質和藥理功效也至關重要。此外,新的小分子配方需要專門的設備和專業知識,導致製造成本增加。這迫使一些藥物開發公司將灌裝和包裝作業的各個方面外包給合約服務提供者。此外,機器人和人工智慧等先進技術的整合正在推動該領域的進步。在對專業知識和簡化生產工作流程的需求以及管道技術不斷進步的推動下,灌裝藥品合約製造市場可能會在不久的將來出現顯著增長。

該報告調查了全球灌裝完成藥品合約製造市場,並提供了市場概況,以及按提供的灌裝服務類型、FDF 類型、原料藥藥理活性、初級包裝容器類型、按它提供了按規模、地區和進入市場的公司概況劃分的趨勢。

目錄

第1章 前言

第2章 研究方法

第3章市場動態

第4章. 經濟和其他專案特定考慮因素

第5章 執行摘要

第6章 簡介

第7章 市場狀況

第8章 公司簡介:北美服務供應商

第9章 公司簡介:歐洲服務供應商

第10章公司簡介:亞太地區服務提供商

第11章 公司簡介:其他地區服務商

第12章企業競爭力分析

第13章能力分析

第 14 章案例研究:灌裝/精加工操作中的機器人系統

第 15 章案例研究:用於無菌填充/精加工的即用型包裝組件

第16章 市場影響分析:推動因素、阻礙因素、機會、挑戰

第17章 全球灌裝-完成藥品合約製造市場

第18章 Fill-Finish 藥品合約製造市場(依提供的 Fill-Finish 服務類型劃分)

第19章 Fill-Finish 藥品合約製造市場(依 FDF 類型)

第20章依原料藥藥理活性劃分的灌裝-完成藥品合約製造市場

第21章依初級包裝容器類型劃分的灌裝-完成藥品合約製造市場

第22章依業務規模劃分的填充成品藥品合約製造市場

第 23 章按公司規模劃分的 Fill-Finish 藥品合約製造市場

第24章按地區劃分的Fill-Finish藥品合約製造市場

第25章:填充和完成藥品合約製造市場,主要公司

第26章 結論

第27章 高階主管洞察

第28章附錄一:表格數據

第29章 附錄二:公司與組織名單

FILL FINISH PHARMACEUTICAL CONTRACT MANUFACTURING MARKET: OVERVIEW

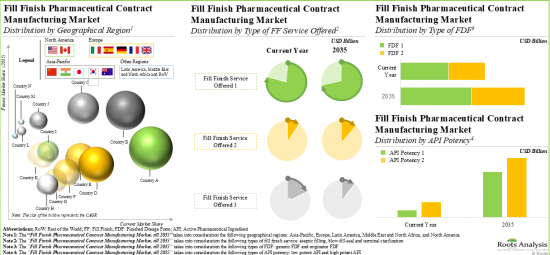

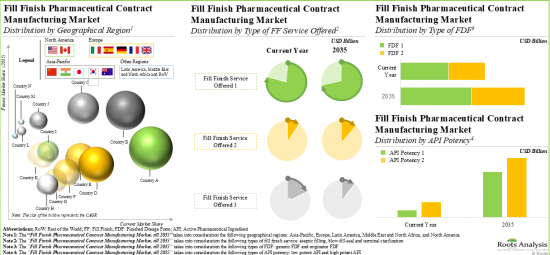

As per Roots Analysis, the global fill finish pharmaceutical contract manufacturing market is estimated to grow from USD 7.2 billion in the current year to USD 12 billion by 2035, at a CAGR of 4.8% during the forecast period, till 2035.

The market sizing and opportunity analysis has been segmented across the following parameters:

Type of Fill Finish Service Offered

- Aseptic Filling

- Blow-Fill-Seal

- Terminal Sterilization

Type of FDF

- Generic FDF

- Originator FDF

API Potency

- Low Potent API

- High Potent API

Type of Primary Packaging Container

- Ampoules

- Cartridges

- Prefilled Syringe

- Vials

- Other Containers

Scale of Operation

- Clinical

- Commercial

Company Size

- Small and Mid-sized Companies

- Large / Very Large Companies

Key Geographical Regions

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and North Africa

FILL FINISH PHARMACEUTICAL CONTRACT MANUFACTURING MARKET: GROWTH AND TRENDS

Currently, small molecule drugs represent nearly 90% of the current therapeutics pipeline. Further, estimates suggest that approximately 60% of the new drugs approved each year are small molecules. This can be attributed to the rapid pace of innovation in this segment, driven by the growing preference for effective and personalized pharmacological interventions. However, small molecules are associated with several complexities, including the challenges involved in the sterile fill finish of such molecules.

The sterile fill-finish process is one of the most important steps in pharmaceutical manufacturing. Maintenance of aseptic conditions during production process (such as fill finish) is not only critical for ensuring the safety of the patients but also for preserving product quality and pharmacological efficacy. Moreover, novel small molecules-based formulations require specialized equipment and expertise, leading to increased production costs. This has compelled several drug developers to outsource various aspects of fill finish operations to contract service providers. Further, the integration of advanced technologies, such as robotics and artificial intelligence, is driving the advancement in this domain. Driven by the need for specialized expertise and streamlined production workflows, growing pipeline technological advancement, the fill finish pharmaceutical contract manufacturing market is likely to witness substantial growth in the near future.

FILL FINISH PHARMACEUTICAL CONTRACT MANUFACTURING MARKET: KEY INSIGHTS

The report delves into the current state of the fill finish pharmaceutical contract manufacturing market and identifies potential growth opportunities within the industry. Some key findings from the report include:

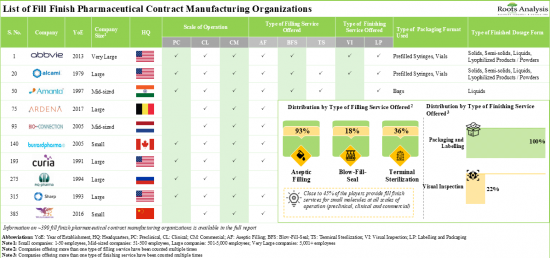

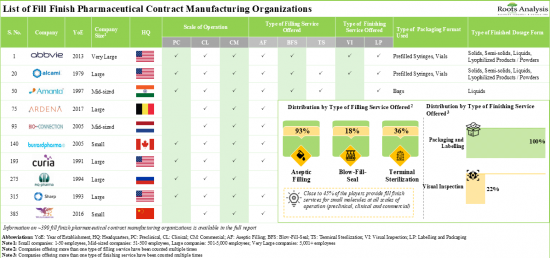

1. Presently, close to 390 organizations offer fill finish pharmaceutical contract manufacturing services; of these, majority of the contract manufacturing organizations offer aseptic filling services.

2. Vials (63%) have emerged as the most adopted primary packaging container format; close to 85% of the players have the required capabilities to fill finish liquid formulations as the finished dosage form.

3. The current market landscape of fill finish pharmaceutical CMOs is highly fragmented, featuring the presence of both new entrants and established players across key geographical regions.

4. In pursuit of obtaining a competitive edge, industry stakeholders are actively upgrading their existing capabilities and adding new competencies in order to enhance their respective product portfolios.

5. The global pharmaceutical fill finish capacity is well distributed across different facilities worldwide; notably, large and very large players account for 80% of the total capacity.

6. The fill finish pharmaceutical contract manufacturing market is anticipated to grow at a steady rate, till 2035; terminal sterilization is expected to capture the majority share (over 40%) of the market in foreseeable future.

7. In the long term, ampoules and vials packaging formats are likely to drive the growth of fill finish pharmaceutical contract manufacturing market; vials segment is expected to capture the majority share (~50%) by 2035.

FILL FINISH PHARMACEUTICAL CONTRACT MANUFACTURING MARKET: KEY SEGMENTS

Currently, Terminal Sterilization Segment Occupies the Largest Share of the Fill Finish Pharmaceutical Contract Manufacturing Market

Based on the type of fill finish service offered, the market is segmented into aseptic filling, blow-fill-seal and terminal sterilization. It is worth highlighting that the terminal sterilization segment is likely to dominate the market in the coming decade. This can be attributed to the fact that terminal sterilization offers the highest level of sterility assurance, making it both more reliable and cost-effective.

Generic FDF Segment Holds Maximum Share of the Fill Finish Pharmaceutical Contract Manufacturing Market

Based on the type of FDF, the market is segmented into generic FDF and originator FDF. It is worth highlighting that the generic FDF segment is likely to dominate the market in the coming decade. This can be attributed to competitive pricing, cost effectiveness and quality standards maintained by generic contract manufacturers.

Currently, Low Potent API Segment Occupies the Largest Share of the Fill Finish Pharmaceutical Contract Manufacturing Market

Based on the type of API by potency, the market is segmented into low potent API and high potent API. Owing to their higher demand, less complex manufacturing requirements and lower overall production costs, the current fill finish pharmaceutical contract manufacturing market is dominated by low potent API.

Prefilled Syringes Segment is the Fastest Growing Segment within the Fill Finish Pharmaceutical Contract Manufacturing Market During the Forecast Period

Based on the type of primary packaging container, the market is segmented into ampoules, cartridges, prefilled syringe, vials and other containers. It is worth highlighting that, at present, the ampoules segment holds the larger share of the fill finish pharmaceutical contract manufacturing market. However, prefilled syringes segment is likely to grow at a higher CAGR.

By Scale of Operation, Commercial Scale is Likely to Dominate the Fill Finish Pharmaceutical Contract Manufacturing Market During the Forecast Period

Based on the scale of operation, the market is segmented into clinical and commercial scale. It is worth highlighting that, at present, revenues generated from commercial scale small molecules fill finish services hold maximum share in the fill finish pharmaceutical contract manufacturing market.

Large / Very Large Service Providers Accounts for the Largest Share for the Fill Finish Pharmaceutical Contract Manufacturing Market

Based on the company size, the market is segmented into small and mid-sized companies and large / very large companies. It is worth highlighting that large / very large service providers are likely to dominate the fill finish pharmaceutical contract manufacturing market in the coming decade. This can be attributed to the fact that these companies have dedicated and skilled personnel, innovative fill / finish facilities and robust regulatory capabilities.

Europe Accounts for the Largest Share of the Market

Based on key geographical regions, the market is segmented into North America, Europe, Asia-Pacific, Latin America, Middle East and North Africa, and Rest of the World. Majority share is expected to be captured by contract manufacturers based in Europe. It is worth highlighting that, over the years, the market of rest of the world is expected to grow at a higher CAGR.

Example Players in the Fill Finish Pharmaceutical Contract Manufacturing Market

- Alcami

- Amanta Healthcare

- Aurigene Pharmaceutical Services

- Batterjee Pharma

- Burrard Pharmaceuticals

- Curida

- Eriochem

- Fresenius Kabi

- GlaxoSmithKline

- Nextar Chempharma Solutions

- Pfizer CentreOne

- Plastikon Healthcare

- Procaps

- Recipharm

- ROMMELAG CMO

- Sharp

- Sypharma

- Teva Pharmaceuticals

- WuXi AppTec

FILL FINISH PHARMACEUTICAL CONTRACT MANUFACTURING MARKET: RESEARCH COVERAGE

- Market Sizing and Opportunity Analysis: The report features a detailed market size estimation for fill finish pharmaceutical contract manufacturing market (for small molecules), focusing on key market segments, including [A] type of fill finish service offered, [B] type of FDF, [C] API potency, [D] type of primary packaging container, [E] scale of operation, [F] company size and [G] geographical regions.

- Market Landscape: The report presents comprehensive evaluation of companies involved in fill finish pharmaceutical contract manufacturing, considering various parameters, such as [A] year of establishment, [B] company size (based on number of employees), [C] location of headquarters, [D] location of manufacturing facility, [E] scale of operation, [F] type of fill finish service offered, [G] type of finishing service offered [H] type of packaging format, [I] type of finished dosage form, [J] degree of automation.

- Company Competitiveness Analysis: The report highlights a detailed competitive analysis of fill finish pharmaceutical contract manufacturers (for small molecules), examining factors, such as company strength, portfolio strength and portfolio diversity.

- Company Profiles: The report features and in-depth profiles of key fill finish pharmaceutical contract manufacturers based in North America, Europe, Asia-Pacific and rest of the world focusing on [A] company overviews, [B] financial information (if available), [C] service portfolio, [D] recent developments and [E] an informed future outlook.

- Capacity Analysis: The report provides an estimation of global annual small molecules fill finish capacity. The available capacity for various packaging containers used (ampoules, cartridges, syringes and vials) has been segmented across [A] company size and [B] key geographical regions.

- Case Study 1: The report includes a case study discussing the advantages of using robotic / automated equipment for aseptic fill finish processes. In addition, it includes a list of equipment manufacturers providing robots suitable for pharmaceutical operations.

- Case Study 2: The report contains a case study featuring the role of ready-to-use packaging containers in aseptic fill finish operations. In addition, it provides a list of suppliers providing the ready-to-use components.

- Growth Drivers and Restraints: The report analyzes various factors such as drivers, restraints, opportunities, and challenges affecting market growth.

KEY QUESTIONS ANSWERED IN THIS REPORT

- How many companies are currently engaged in this market?

- Which are the leading CMOs in this market?

- What factors are likely to influence the evolution of this market?

- What is the current and future market size?

- What is the CAGR of this market?

- How is the current and future market opportunity likely to be distributed across key market segments?

REASONS TO BUY THIS REPORT

- The report provides a comprehensive market analysis, offering detailed revenue projections of the overall market and its specific sub-segments. This information is valuable to both established market leaders and emerging entrants.

- Stakeholders can leverage the report to gain a deeper understanding of the competitive dynamics within the market. By analyzing the competitive landscape, businesses can make informed decisions to optimize their market positioning and develop effective go-to-market strategies.

- The report offers stakeholders a comprehensive overview of the market, including key drivers, barriers, opportunities, and challenges. This information empowers stakeholders to stay abreast of market trends and make data-driven decisions to capitalize on growth prospects.

ADDITIONAL BENEFITS

- Complimentary PPT Insights Packs

- Complimentary Excel Data Packs for all Analytical Modules in the Report

- 10% Free Content Customization

- Detailed Report Walkthrough Session with Research Team

- Free Updated report if the report is 6-12 months old or older

TABLE OF CONTENTS

1. PREFACE

- 1.1. Introduction

- 1.2. Market Share Insights

- 1.3. Key Market Insights

- 1.4. Report Coverage

- 1.5. Key Questions Answered

- 1.6. Chapter Outlines

2. RESEARCH METHODOLOGY

- 2.1. Chapter Overview

- 2.2. Research Assumptions

- 2.2.1. Market Landscape and Market Trends

- 2.2.2. Market Forecast and Opportunity Analysis

- 2.2.3. Comparative Analysis

- 2.3. Database Building

- 2.3.1. Data Collection

- 2.3.2. Data Validation

- 2.3.3. Data Analysis

- 2.4. Project Methodology

- 2.4.1. Secondary Research

- 2.4.1.1. Annual Reports

- 2.4.1.2. Academic Research Papers

- 2.4.1.3. Company Websites

- 2.4.1.4. Investor Presentations

- 2.4.1.5. Regulatory Filings

- 2.4.1.6. White Papers

- 2.4.1.7. Industry Publications

- 2.4.1.8. Conferences and Seminars

- 2.4.1.9. Government Portals

- 2.4.1.10. Media and Press Releases

- 2.4.1.11. Newsletters

- 2.4.1.12. Industry Databases

- 2.4.1.13. Roots Proprietary Databases

- 2.4.1.14. Paid Databases and Sources

- 2.4.1.15. Social Media Portals

- 2.4.1.16. Other Secondary Sources

- 2.4.2. Primary Research

- 2.4.2.1. Types of Primary Research

- 2.4.2.1.1. Qualitative Research

- 2.4.2.1.2. Quantitative Research

- 2.4.2.1.3. Hybrid Approach

- 2.4.2.2. Advantages of Primary Research

- 2.4.2.3. Techniques for Primary Research

- 2.4.2.3.1. Interviews

- 2.4.2.3.2. Surveys

- 2.4.2.3.3. Focus Groups

- 2.4.2.3.4. Observational Research

- 2.4.2.3.5. Social Media Interactions

- 2.4.2.4. Key Opinion Leaders Considered in Primary Research

- 2.4.2.4.1. Company Executives (CXOs)

- 2.4.2.4.2. Board of Directors

- 2.4.2.4.3. Company Presidents and Vice Presidents

- 2.4.2.4.4. Research and Development Heads

- 2.4.2.4.5. Technical Experts

- 2.4.2.4.6. Subject Matter Experts

- 2.4.2.4.7. Scientists

- 2.4.2.4.8. Doctors and Other Healthcare Providers

- 2.4.2.5. Ethics and Integrity

- 2.4.2.5.1. Research Ethics

- 2.4.2.5.2. Data Integrity

- 2.4.2.1. Types of Primary Research

- 2.4.3. Analytical Tools and Databases

- 2.4.1. Secondary Research

3. MARKET DYNAMICS

- 3.1. Chapter Overview

- 3.2. Forecast Methodology

- 3.2.1. Top-down Approach

- 3.2.2. Bottom-up Approach

- 3.2.3. Hybrid Approach

- 3.3. Market Assessment Framework

- 3.3.1. Total Addressable Market (TAM)

- 3.3.2. Serviceable Addressable Market (SAM)

- 3.3.3. Serviceable Obtainable Market (SOM)

- 3.3.4. Currently Acquired Market (CAM)

- 3.4. Forecasting Tools and Techniques

- 3.4.1. Qualitative Forecasting

- 3.4.2. Correlation

- 3.4.3. Regression

- 3.4.4. Extrapolation

- 3.4.5. Convergence

- 3.4.6. Sensitivity Analysis

- 3.4.7. Scenario Planning

- 3.4.8. Data Visualization

- 3.4.9. Time Series Analysis

- 3.4.10. Forecast Error Analysis

- 3.5. Key Considerations

- 3.5.1. Demographics

- 3.5.2. Government Regulations

- 3.5.3. Reimbursement Scenarios

- 3.5.4. Market Access

- 3.5.5. Supply Chain

- 3.5.6. Industry Consolidation

- 3.5.7. Pandemic / Unforeseen Disruptions Impact

- 3.6. Key Market Segmentation

- 3.7. Robust Quality Control

- 3.8. Limitations

4. ECONOMIC AND OTHER PROJECT SPECIFIC CONSIDERATIONS

- 4.1. Chapter Overview

- 4.2. Market Dynamics

- 4.2.1. Time Period

- 4.2.1.1. Historical Trends

- 4.2.1.2. Current and Forecasted Estimates

- 4.2.2. Currency Coverage

- 4.2.2.1. Overview of Major Currencies Affecting the Market

- 4.2.2.2. Impact of Currency Fluctuations on the Industry

- 4.2.3. Foreign Exchange Impact

- 4.2.3.1. Evaluation of Foreign Exchange Rates and Their Impact on Market

- 4.2.3.2. Strategies for Mitigating Foreign Exchange Risk

- 4.2.4. Recession

- 4.2.4.1. Historical Analysis of Past Recessions and Lessons Learnt

- 4.2.4.2. Assessment of Current Economic Conditions and Potential Impact on the Market

- 4.2.5. Inflation

- 4.2.5.1. Measurement and Analysis of Inflationary Pressures in the Economy

- 4.2.5.2. Potential Impact of Inflation on the Market Evolution

- 4.2.1. Time Period

5. EXECUTIVE SUMMARY

6. INTRODUCTION

- 6.1. Chapter Overview

- 6.2. Introduction to Fill / Finish Services for Small Molecules

- 6.2.1. Aseptic Filling

- 6.2.2. Terminal Sterilization

- 6.2.3. Blow-Fill-Seal Technology

- 6.3. Need for Outsourcing Small Molecules-related Operations

- 6.4. Role of Contract Manufacturers in the Small Molecules Industry

- 6.5. Key Considerations while selecting a Fill / Finish Service Provider

- 6.6. Advantages of Outsourcing Fill / Finish Services

- 6.7. Risks and Challenges of Outsourcing Fill / Finish Operations

- 6.8. Future Perspectives

7. MARKET LANDSCAPE

- 7.1. Chapter Overview

- 7.2. Small Molecules Fill / Finish Service Providers: Overall Market Landscape

- 7.2.1. Analysis by Year of Establishment

- 7.2.2. Analysis by Company Size

- 7.2.3. Analysis by Location of Headquarters

- 7.2.4. Analysis by Location of Fill / Finish Facilities

- 7.2.5. Analysis by Scale of Operation

- 7.2.6. Analysis by Type of Filling Service Offered

- 7.2.7. Analysis by Type of Finishing Service Offered

- 7.2.8. Analysis by Type of Packaging Format Used

- 7.2.9. Analysis by Type of Finished Dosage Form

- 7.2.10. Analysis by Degree of Automation

8. COMPANY PROFILES: SERVICE PROVIDERS IN NORTH AMERICA

- 8.1. Chapter Overview

- 8.2. Leading Small Molecules Fill / Finish Service Providers based in North America

- 8.2.1. Alcami

- 8.2.1.1. Company Overview

- 8.2.1.2. Small Molecules Fill / Finish Service Portfolio

- 8.2.1.3. Recent Developments and Future Outlook

- 8.2.2. Pfizer CentreOne

- 8.2.2.1. Company Overview

- 8.2.2.2. Small Molecules Fill / Finish Service Portfolio

- 8.2.2.3. Recent Developments and Future Outlook

- 8.2.3. Sharp Services

- 8.2.3.1. Company Overview

- 8.2.3.2. Small Molecules Fill / Finish Service Portfolio

- 8.2.3.3. Recent Developments and Future Outlook

- 8.2.1. Alcami

- 8.3. Other Leading Small Molecules Fill / Finish Service Providers based in North America

- 8.3.1. Burrard Pharmaceuticals

- 8.3.1.1. Company Overview

- 8.3.1.2. Small Molecules Fill / Finish Service Portfolio

- 8.3.2. Plastikon Healthcare

- 8.3.2.1. Company Overview

- 8.3.2.2. Small Molecules Fill / Finish Service Portfolio

- 8.3.1. Burrard Pharmaceuticals

9. COMPANY PROFILES: SERVICE PROVIDERS IN EUROPE

- 9.1. Chapter Overview

- 9.2. Leading Small Molecules Fill / Finish Service Providers based in Europe

- 9.2.1. Fresenius Kabi

- 9.2.1.1. Company Overview

- 9.2.1.2. Financial Information

- 9.2.1.3. Small Molecules Fill / Finish Service Portfolio

- 9.2.1.4. Recent Developments and Future Outlook

- 9.2.2. GlaxoSmithKline

- 9.2.2.1. Company Overview

- 9.2.2.2. Financial Information

- 9.2.2.3. Small Molecules Fill / Finish Service Portfolio

- 9.2.2.4. Recent Developments and Future Outlook

- 9.2.3. Recipharm

- 9.2.3.1. Company Overview

- 9.2.3.2. Small Molecules Fill / Finish Service Portfolio

- 9.2.3.3. Recent Developments and Future Outlook

- 9.2.1. Fresenius Kabi

- 9.3. Other Leading Small Molecules Fill / Finish Service Providers based in Europe

- 9.3.1. Curida

- 9.3.1.1. Company Overview

- 9.3.1.2. Small Molecules Fill / Finish Service Portfolio

- 9.3.2. ROMMELAG CMO

- 9.3.2.1. Company Overview

- 9.3.2.2. Small Molecules Fill / Finish Service Portfolio

- 9.3.1. Curida

10. COMPANY PROFILES: SERVICE PROVIDERS IN ASIA-PACIFIC

- 10.1. Chapter Overview

- 10.2. Leading Small Molecules Fill / Finish Service Providers based in Asia-Pacific

- 10.2.1. Aurigene Pharmaceutical Services

- 10.2.1.1. Company Overview

- 10.2.1.2. Small Molecules Fill / Finish Service Portfolio

- 10.2.1.3. Recent Developments and Future Outlook

- 10.2.2. Sypharma

- 10.2.2.1. Company Overview

- 10.2.2.2. Small Molecules Fill / Finish Service Portfolio

- 10.2.2.3. Recent Developments and Future Outlook

- 10.2.3. WuXi AppTec

- 10.2.3.1. Company Overview

- 10.2.3.2. Small Molecules Fill / Finish Service Portfolio

- 10.2.3.3. Recent Developments and Future Outlook

- 10.2.1. Aurigene Pharmaceutical Services

- 10.3. Other Small Molecules Fill / Finish Service Providers based in Asia-Pacific

- 10.3.1. Amanta Healthcare

- 10.3.1.1. Company Overview

- 10.3.1.2. Small Molecules Fill / Finish Service Portfolio

- 10.3.1. Amanta Healthcare

11. COMPANY PROFILES: SERVICE PROVIDERS IN REST OF THE WORLD

- 11.1. Chapter Overview

- 11.2. Leading Small Molecules Fill / Finish Service Providers based in Rest of the World

- 11.2.1. Eriochem

- 11.2.1.1. Company Overview

- 11.2.1.2. Small Molecules Fill / Finish Service Portfolio

- 11.2.1.3. Recent Developments and Future Outlook

- 11.2.2. Teva Pharmaceutical Industries

- 11.2.2.1. Company Overview

- 11.2.2.2. Small Molecules Fill / Finish Service Portfolio

- 11.2.2.3. Recent Developments and Future Outlook

- 11.2.1. Eriochem

- 11.3. Other Small Molecules Fill / Finish Service Providers based in Rest of the World

- 11.3.1. Batterjee Pharma

- 11.3.1.1. Company Overview

- 11.3.1.2. Small Molecules Fill / Finish Service Portfolio

- 11.3.2. Procaps

- 11.3.2.1. Company Overview

- 11.3.2.2. Small Molecules Fill / Finish Service Portfolio

- 11.3.1. Batterjee Pharma

12. COMPANY COMPETITIVENESS ANALYSIS

- 12.1. Chapter Overview

- 12.2. Assumptions and Key Parameters

- 12.3. Methodology

- 12.4. Small Molecules Fill / Finish Service Providers based in North America

- 12.5. Small Molecules Fill / Finish Service Providers based in Europe

- 12.6. Small Molecules Fill / Finish Service Providers based in Asia-Pacific and Rest of the World

13. CAPACITY ANALYSIS

- 13.1. Chapter Overview

- 13.2. Global Annual Small Molecules Fill / Finish Capacity for Ampoules (Number of Units)

- 13.2.1. Key Assumptions and Methodology

- 13.2.2. Analysis by Company Size

- 13.2.3. Analysis by Geography

- 13.2.3.1. Analysis of Small Molecules Fill / Finish Capacity for Ampoules in North America

- 13.2.3.2. Analysis of Small Molecules Fill / Finish Capacity for Ampoules in Europe

- 13.2.3.3. Analysis of Small Molecules Fill / Finish Capacity for Ampoules in Asia-Pacific and Rest of the World

- 13.3. Global Annual Small Molecules Fill / Finish Capacity for Cartridges (Number of Units)

- 13.3.1. Key Assumptions and Methodology

- 13.3.2. Analysis by Company Size

- 13.3.3. Analysis by Geography

- 13.3.3.1. Analysis of Small Molecules Fill / Finish Capacity for Cartridges in North America

- 13.3.3.2. Analysis of Small Molecules Fill / Finish Capacity for Cartridges in Europe

- 13.3.3.3. Analysis of Small Molecules Fill / Finish Capacity for Cartridges in Asia-Pacific and Rest of the World

- 13.4. Global Annual Small Molecules Fill / Finish Capacity for Prefilled Syringes (Number of Units)

- 13.4.1. Key Assumptions and Methodology

- 13.4.2. Analysis by Company Size

- 13.4.3. Analysis by Geography

- 13.4.3.1. Analysis of Small Molecules Fill / Finish Capacity for Prefilled Syringes in North America

- 13.4.3.2. Analysis of Small Molecules Fill / Finish Capacity for Prefilled Syringes in Europe

- 13.4.3.3. Analysis of Small Molecules Fill / Finish Capacity for Prefilled Syringes in Asia-Pacific and Rest of the World

- 13.5. Global Annual Small Molecules Fill / Finish Capacity for Vials (Number of Units)

- 13.5.1. Key Assumptions and Methodology

- 13.5.2. Analysis by Company Size

- 13.5.3. Analysis by Geography

- 13.5.3.1. Analysis of Small Molecules Fill / Finish Capacity for Vials in North America

- 13.5.3.2. Analysis of Small Molecules Fill / Finish Capacity for Vials in Europe

- 13.5.3.3. Analysis of Small Molecules Fill / Finish Capacity for Vials in Asia-Pacific and Rest of the World

14. CASE STUDY: ROBOTIC SYSTEMS IN FILL / FINISH OPERATIONS

- 14.1. Chapter Overview

- 14.2. Role of Robotic Systems in Fill / Finish Operations

- 14.2.1. Types of Robots Used

- 14.2.2. Key Considerations for Selecting Robotic Systems

- 14.3. Companies Providing Robots for use in the Pharmaceutical Industry

- 14.4. Companies Providing Isolator- based Aseptic Filling Systems

- 14.5. Small Molecules Fill / Finish Service Providers: List of Equipment Used

- 14.6. Concluding Remarks

15. CASE STUDY: READY-TO-USE PACKAGING COMPONENTS FOR ASEPTIC FILL / FINISH

- 15.1. Chapter Overview

- 15.2. Role of Ready-to-Use Packaging Components in Aseptic Fill / Finish Operations

- 15.2.1. Advantages of Ready-to-Use Packaging Components

- 15.2.2. Disadvantages of Ready-to-Use Packaging Components

- 15.3. Companies Providing Ready-to-Use Packaging Components

- 15.4. Concluding Remarks

16. MARKET IMPACT ANALYSIS: DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES

- 16.1. Chapter Overview

- 16.2. Market Drivers

- 16.3. Market Restraints

- 16.4. Market Opportunities

- 16.5. Market Challenges

- 16.6. Conclusion

17. GLOBAL PHARMACEUTICAL FILL / FINISH MANUFACTURING MARKET

- 17.1. Chapter Overview

- 17.2. Assumptions and Methodology

- 17.3. Global Pharmaceutical Fill / Finish Manufacturing Market, till 2035

- 17.3.1. Scenario Analysis

- 17.3.1.1. Conservative Scenario

- 17.3.1.2. Optimistic Scenario

- 17.3.1. Scenario Analysis

- 17.4. Key Market Segmentations

18. PHARMACEUTICAL FILL / FINISH MANUFACTURING MARKET, BY TYPE OF FILL / FINISH SERVICE OFFERED

- 18.1. Chapter Overview

- 18.2. Assumptions and Methodology

- 18.3. Pharmaceutical Fill / Finish Manufacturing Market: Distribution by Type of Fill / Finish Service Offered, 2019, Current Year and 2035

- 18.3.1. Pharmaceutical Fill / Finish Manufacturing Market for Terminal Sterilization, till 2035

- 18.3.2. Pharmaceutical Fill / Finish Manufacturing Market for Aseptic Filling, till 2035

- 18.3.3. Pharmaceutical Fill / Finish Manufacturing Market for Blow-Fill-Seal, till 2035

- 18.4. Pharmaceutical Fill / Finish Manufacturing Market, by Type of Fill / Finish Services Offered: Market Dynamics Assessment

- 18.4.1. Penetration-Growth (P-G) Matrix

- 18.4.2. Data Triangulation and Validation

19. PHARMACEUTICAL FILL / FINISH MANUFACTURING MARKET, BY TYPE OF FDF

- 19.1. Chapter Overview

- 19.2. Assumptions and Methodology

- 19.3. Pharmaceutical Fill / Finish Manufacturing Market: Distribution by Type of FDF, 2019, Current Year and 2035

- 19.3.1. Pharmaceutical Fill / Finish Manufacturing Market for Generic FDF, till 2035

- 19.3.2. Pharmaceutical Fill / Finish Manufacturing Market for Originator FDF, till 2035

- 19.4. Pharmaceutical Fill / Finish Manufacturing Market, by Type of FDF: Market Dynamics Assessment

- 19.4.1. Penetration-Growth (P-G) Matrix

- 19.4.2. Data Triangulation and Validation

20. PHARMACEUTICAL FILL / FINISH MANUFACTURING MARKET, BY API POTENCY

- 20.1. Chapter Overview

- 20.2. Assumptions and Methodology

- 20.3. Pharmaceutical Fill / Finish Manufacturing Market: Distribution by API Potency, 2019, Current Year and 2035

- 20.3.1. Pharmaceutical Fill / Finish Manufacturing Market for Low Potent API, till 2035

- 20.3.2. Pharmaceutical Fill / Finish Manufacturing Market for High Potent API, till 2035

- 20.4. Pharmaceutical Fill / Finish Manufacturing Market, by API Potency: Market Dynamics Assessment

- 20.4.1. Penetration-Growth (P-G) Matrix

- 20.4.2. Data Triangulation and Validation

21. PHARMACEUTICAL FILL / FINISH MANUFACTURING MARKET, BY TYPE OF PRIMARY PACKAGING CONTAINER

- 21.1. Chapter Overview

- 21.2. Assumptions and Methodology

- 21.3. Pharmaceutical Fill / Finish Manufacturing Market: Distribution by Type of Primary Packaging Container, 2019, Current Year and 2035

- 21.3.1. Pharmaceutical Fill / Finish Manufacturing Market for Vials, till 2035

- 21.3.2. Pharmaceutical Fill / Finish Manufacturing Market for Ampoules, till 2035

- 21.3.3. Pharmaceutical Fill / Finish Manufacturing Market for Prefilled Syringes, till 2035

- 21.3.4. Pharmaceutical Fill / Finish Manufacturing Market for Cartridges, till 2035

- 21.3.5. Pharmaceutical Fill / Finish Manufacturing Market for Other Containers, till 2035

- 21.4. Pharmaceutical Fill / Finish Manufacturing Market, by Type of Primary Packaging Container: Market Dynamics Assessment

- 21.4.1. Penetration-Growth (P-G) Matrix

- 21.4.2. Data Triangulation and Validation

22. PHARMACEUTICAL FILL / FINISH MANUFACTURING MARKET, BY SCALE OF OPERATION

- 22.1. Chapter Overview

- 22.2. Assumptions and Methodology

- 22.3. Pharmaceutical Fill / Finish Manufacturing Market: Distribution by Scale of Operation, 2019, Current Year and 2035

- 22.3.1. Pharmaceutical Fill / Finish Manufacturing Market for Clinical Scale, till 2035

- 22.3.2. Pharmaceutical Fill / Finish Manufacturing Market for Commercial Scale, till 2035

- 22.4. Pharmaceutical Fill / Finish Manufacturing Market, by Scale of Operation: Market Dynamics Assessment

- 22.4.1. Penetration-Growth (P-G) Matrix

- 22.4.2. Data Triangulation and Validation

23. PHARMACEUTICAL FILL / FINISH MANUFACTURING MARKET, BY COMPANY SIZE

- 23.1. Chapter Overview

- 23.2. Assumptions and Methodology

- 23.3. Pharmaceutical Fill / Finish Manufacturing Market: Distribution by Company Size, 2019, Current Year and 2035

- 23.3.1. Pharmaceutical Fill / Finish Manufacturing Market for Small and Mid-sized Companies, till 2035

- 23.3.2. Pharmaceutical Fill / Finish Manufacturing Market for Large / Very Large Companies, till 2035

- 23.4. Pharmaceutical Fill / Finish Manufacturing Market, by Company Size: Market Dynamics Assessment

- 23.4.1. Penetration-Growth (P-G) Matrix

- 23.4.2. Data Triangulation and Validation

24. PHARMACEUTICAL FILL / FINISH MANUFACTURING MARKET, BY GEOGRAPHICAL REGIONS

- 24.1. Chapter Overview

- 24.2. Assumptions and Methodology

- 24.3. Pharmaceutical Fill / Finish Manufacturing Market: Distribution by Geographical Regions, 2019, Current Year and 2035

- 24.3.1. Pharmaceutical Fill / Finish Manufacturing Market in North America, till 2035

- 24.3.1.1. Pharmaceutical Fill / Finish Manufacturing Market in the US, till 2035

- 24.3.1.2. Pharmaceutical Fill / Finish Manufacturing Market in Canada, till 2035

- 24.3.1.3. Pharmaceutical Fill / Finish Manufacturing Market in Mexico, till 2035

- 24.3.1.4. Pharmaceutical Fill / Finish Manufacturing Market in Puerto Rico, till 2035

- 24.3.2. Pharmaceutical Fill / Finish Manufacturing Market in Europe, till 2035

- 24.3.2.1. Pharmaceutical Fill / Finish Manufacturing Market in France, till 2035

- 24.3.2.2. Pharmaceutical Fill / Finish Manufacturing Market in Germany, till 2035

- 24.3.2.3. Pharmaceutical Fill / Finish Manufacturing Market in Italy, till 2035

- 24.3.2.4. Pharmaceutical Fill / Finish Manufacturing Market in the UK, till 2035

- 24.3.2.5. Pharmaceutical Fill / Finish Manufacturing Market in Spain, till 2035

- 24.3.2.6. Pharmaceutical Fill / Finish Manufacturing Market in Rest of Europe, till 2035

- 24.3.3. Pharmaceutical Fill / Finish Manufacturing Market in Asia-Pacific, till 2035

- 24.3.3.1. Pharmaceutical Fill / Finish Manufacturing Market in India, till 2035

- 24.3.3.2. Pharmaceutical Fill / Finish Manufacturing Market in Japan, till 2035

- 24.3.3.3. Pharmaceutical Fill / Finish Manufacturing Market in China, till 2035

- 24.3.3.4. Pharmaceutical Fill / Finish Manufacturing Market in Rest of Asia-Pacific, till 2035

- 24.3.4. Pharmaceutical Fill / Finish Manufacturing Market in Middle East and North Africa, till 2035

- 24.3.5. Pharmaceutical Fill / Finish Manufacturing Market in Latin America, till 2035

- 24.3.6. Pharmaceutical Fill / Finish Manufacturing Market in Rest of the World, till 2035

- 24.3.1. Pharmaceutical Fill / Finish Manufacturing Market in North America, till 2035

- 24.4. Pharmaceutical Fill / Finish Manufacturing Market, by Geographical Regions: Market Dynamics Assessment

- 24.4.1. Penetration-Growth (P-G) Matrix

- 24.4.2. Data Triangulation and Validation

25. PHARMACEUTICAL FILL / FINISH MANUFACTURING MARKET, BY LEADING PLAYERS

- 25.1. Chapter Overview

- 25.2. Leading Industry Players

26. CONCLUSION

27. EXECUTIVE INSIGHT

- 27.1. Chapter Overview

- 27.2. Bushu Pharmaceuticals

- 27.2.1. Company Snapshot

- 27.2.2. Interview Transcript: Tomoya Sato, Senior Executive Director, Global Sales and Marketing

28. APPENDIX I: TABULATED DATA

29. APPENDIX II: LIST OF COMPANIES AND ORGANIZATIONS

List of Tables

- Table 7.1 Small Molecules Fill / Finish Service Providers: List of Companies

- Table 7.2 Small Molecules Fill / Finish Service Providers: Information on Scale of Operation, Type of Filling Service Offered and Type of Finishing Service Offered

- Table 7.3 Small Molecules Fill / Finish Service Providers: Information on Type of Packaging Format Used, Type of Finished Dosage Form and Degree of Automation

- Table 8.1 Small Molecules Fill / Finish Service Providers in North America: List of Companies Profiled

- Table 8.2 Alcami: Company Overview

- Table 8.3 Alcami: Small Molecules Fill / Finish Service Portfolio

- Table 8.4 Alcami: Recent Developments and Future Outlook

- Table 8.5 Pfizer CentreOne: Company Overview

- Table 8.6 Pfizer CentreOne: Small Molecules Fill / Finish Service Portfolio

- Table 8.7 Sharp Services: Company Overview

- Table 8.8 Sharp Services: Small Molecules Fill / Finish Service Portfolio

- Table 8.9 Sharp Services: Recent Developments and Future Outlook

- Table 8.10 Burrard Pharmaceuticals: Company Overview

- Table 8.11 Burrard Pharmaceuticals: Small Molecules Fill / Finish Service Portfolio

- Table 8.12 Plastikon Healthcare: Company Overview

- Table 8.13 Plastikon Healthcare: Small Molecules Fill / Finish Service Portfolio

- Table 9.1 Small Molecules Fill / Finish Service Providers: List of Companies Profiled

- Table 9.2 Fresenius Kabi: Company Overview

- Table 9.3 Fresenius Kabi: Small Molecules Fill / Finish Service Portfolio

- Table 9.4 Fresenius Kabi: Recent Developments and Future Outlook

- Table 9.5 GlaxoSmithKline: Company Overview

- Table 9.6 GlaxoSmithKline: Small Molecules Fill / Finish Service Portfolio

- Table 9.7 GlaxoSmithKline: Recent Developments and Future Outlook

- Table 9.8 Recipharm: Company Overview

- Table 9.9 Recipharm: Small Molecules Fill / Finish Service Portfolio

- Table 9.10 Recipharm: Recent Developments and Future Outlook

- Table 9.11 Curida: Company Overview

- Table 9.12 Curida: Small Molecules Fill / Finish Service Portfolio

- Table 9.13 ROMMELAG CMO: Company Overview

- Table 9.14 ROMMELAG CMO: Small Molecules Fill / Finish Service Portfolio

- Table 10.1 Small Molecules Fill / Finish Service Providers: List of Companies Profiled

- Table 10.2 Aurigene Pharmaceutical Services: Company Overview

- Table 10.3 Aurigene Pharmaceutical Services: Small Molecules Fill / Finish Service Portfolio

- Table 10.4 Aurigene Pharmaceutical Services: Recent Developments and Future Outlook

- Table 10.5 Sypharma: Company Overview

- Table 10.6 Sypharma: Small Molecules Fill / Finish Service Portfolio

- Table 10.7 Sypharma: Recent Developments and Future Outlook

- Table 10.8 WuXi AppTec: Company Overview

- Table 10.9 WuXi AppTec: Small Molecules Fill / Finish Service Portfolio

- Table 10.10 WuXi AppTec: Recent Developments and Future Outlook

- Table 10.11 Amanta Healthcare: Company Overview

- Table 10.12 Amanta Healthcare: Small Molecules Fill / Finish Service Portfolio

- Table 11.1 Small Molecules Fill / Finish Service Providers: List of Companies Profiled

- Table 11.2 Eriochem: Company Overview

- Table 11.3 Eriochem: Small Molecules Fill / Finish Service Portfolio

- Table 11.4 Teva Pharmaceutical Industries: Company Overview

- Table 11.5 Teva Pharmaceutical Industries: Small Molecules Fill / Finish Service Portfolio

- Table 11.6 Teva Pharmaceutical Industries: Recent Developments and Future Outlook

- Table 11.7 Batterjee Pharma: Company Overview

- Table 11.8 Batterjee Pharma: Small Molecules Fill / Finish Service Portfolio

- Table 11.9 Nextar Chempharma Solutions: Company Overview

- Table 11.10 Nextar Chempharma Solutions: Small Molecules Fill / Finish Service Portfolio

- Table 11.11 Procaps: Company Overview

- Table 11.12 Procaps: Small Molecules Fill / Finish Service Portfolio

- Table 13.1 Small Molecules Fill / Finish Service Providers: Information on Total Capacity for Ampoules (Sample Data Set)

- Table 13.2 Small Molecules Fill / Finish Service Providers: Average Capacity per Facility for Ampoules, by Company Size (Sample Dataset)

- Table 13.3 Global Annual Small Molecules Fill / Finish Capacity for Ampoules, by Company Size (in terms of units)

- Table 13.4 Small Molecules Fill / Finish Service Providers: Information on Total Capacity for Cartridges (Sample Data Set)

- Table 13.5 Small Molecules Fill / Finish Service Providers: Average Capacity per Facility for Cartridges, by Company Size (Sample Dataset)

- Table 13.6 Global Annual Small Molecules Fill / Finish Capacity for Cartridges, by Company Size (in terms of units)

- Table 13.7 Small Molecules Fill / Finish Service Providers: Information on Total Capacity for Prefilled Syringes (Sample Data Set)

- Table 13.8 Small Molecules Fill / Finish Service Providers: Average Capacity per Facility for Prefilled Syringes, by Company Size (Sample Dataset)

- Table 13.9 Global Annual Small Molecules Fill / Finish Capacity for Prefilled Syringes, by Company Size (in terms of units)

- Table 13.10 Small Molecules Fill / Finish Service Providers: Information on Total Capacity for Vials (Sample Data Set)

- Table 13.11 Small Molecules Fill / Finish Service Providers: Average Capacity for Vials, by Company Size (Sample Dataset)

- Table 13.12 Global Annual Small Molecules Fill / Finish Capacity for Vials: Total Capacity by Company Size (in terms of units)

- Table 14.1 List of Companies Providing Robots for Use in Pharmaceutical Industry

- Table 14.2 Isolator-based Aseptic Filling Systems: Information on Compatible Primary Container

- Table 14.3 Small Molecules Fill / Finish Service Providers: Information on Fill / Finish Equipment Used

- Table 15.1 List of Companies Providing Ready-to-Use Packaging Components

- Table 25.1 Leading Industry Players: Based on the Annual Capacity Installed

- Table 27.1 Bushu Pharmaceuticals: Company Overview

- Table 28.1 Small Molecules Fill / Finish Service Providers: Distribution by Year of Establishment

- Table 28.2 Small Molecules Fill / Finish Service Providers: Distribution by Company Size

- Table 28.3 Small Molecules Fill / Finish Service Providers: Distribution by Location of Headquarters

- Table 28.4 Small Molecules Fill / Finish Service Providers: Distribution by Location of Fill / Finish Facilities

- Table 28.5 Small Molecules Fill / Finish Service Providers: Distribution by Scale of Operation

- Table 28.6 Small Molecules Fill / Finish Service Providers: Distribution by Type of Filling Service Offered

- Table 28.7 Small Molecules Fill / Finish Service Providers: Distribution by Type of Finishing Service Offered

- Table 28.8 Small Molecules Fill / Finish Service Providers: Distribution by Type of Packaging Format Used

- Table 28.9 Small Molecules Fill / Finish Service Providers: Distribution by Type of Finished Dosage Form

- Table 28.10 Small Molecules Fill / Finish Service Providers: Distribution by Degree of Automation

- Table 28.11 Pfizer (parent company of Pfizer CentreOne): Business Segment-wise Revenues and Consolidated Financial Details (USD Billion)

- Table 28.12 Fresenius Kabi: Business Segment-wise Revenues and Consolidated Financial Details (EUR Billion)

- Table 28.13 GlaxoSmithKline: Business Segment-wise Revenues and Consolidated Financial Details (EUR Billion)

- Table 28.14 WuXi AppTec: Business Segment-wise Revenues and Consolidated Financial Details (RMB Billion)

- Table 28.15 Global Annual Small Molecules Fill / Finish Capacity for Ampoules: Distribution by Company Size

- Table 28.16 Global Annual Small Molecules Fill / Finish Capacity for Ampoules: Distribution by Location of Fill / Finish Facility

- Table 28.17 Small Molecules Fill / Finish Capacity for Ampoules in North America

- Table 28.18 Small Molecules Fill / Finish Capacity for Ampoules in Europe

- Table 28.19 Small Molecules Fill / Finish Capacity for Ampoules in Asia-Pacific and Rest of the World

- Table 28.20 Global Annual Small Molecules Fill / Finish Capacity for Cartridges: Distribution by Company Size

- Table 28.21 Global Annual Small Molecules Fill / Finish Capacity for Cartridges: Distribution by Location of Fill / Finish Facility

- Table 28.22 Small Molecules Fill / Finish Capacity for Cartridges in North America

- Table 28.23 Small Molecules Fill / Finish Capacity for Cartridges in Europe

- Table 28.24 Small Molecules Fill / Finish Capacity for Cartridges in Asia-Pacific and Rest of the World

- Table 28.25 Global Annual Small Molecules Fill / Finish Capacity for Prefilled Syringes: Distribution by Company Size

- Table 28.26 Global Annual Small Molecules Fill / Finish Capacity for Prefilled Syringes: Distribution by Location of Fill / Finish Facility

- Table 28.27 Small Molecules Fill / Finish Capacity for Prefilled Syringes in North America

- Table 28.28 Small Molecules Fill / Finish Capacity for Prefilled Syringes in Europe

- Table 28.29 Small Molecules Fill / Finish Capacity for Prefilled Syringes in Asia-Pacific and Rest of the World

- Table 28.30 Global Annual Small Molecules Fill / Finish Capacity for Vials: Distribution by Company Size

- Table 28.31 Global Annual Small Molecules Fill / Finish Capacity for Vials: Distribution by Location of Fill / Finish Facility

- Table 28.32 Small Molecules Fill / Finish Capacity for Vials in North America

- Table 28.33 Small Molecules Fill / Finish Capacity for Vials in Europe

- Table 28.34 Small Molecules Fill / Finish Capacity for Vials in Asia-Pacific and Rest of the World

- Table 28.35 Global Pharmaceutical Fill / Finish Manufacturing Market: Conservative, Base, Optimistic Scenario, till 2035 (USD Billion)

- Table 28.36 Pharmaceutical Fill / Finish Manufacturing Market: Distribution by Type of Fill / Finish Service Offered, 2019, Current Year and 2035 (USD Billion)

- Table 28.37 Pharmaceutical Fill / Finish Manufacturing Market for Terminal Sterilization, till 2035 (USD Billion)

- Table 28.38 Pharmaceutical Fill / Finish Manufacturing Market for Aseptic Filling, till 2035 (USD Billion)

- Table 25.39 Pharmaceutical Fill / Finish Manufacturing Market for Blow-Fill-Seal, till 2035 (USD Billion)

- Table 28.40 Pharmaceutical Fill / Finish Manufacturing Market: Distribution by Type of FDF, 2019, Current Year and 2035 (USD Billion)

- Table 28.41 Pharmaceutical Fill / Finish Manufacturing Market for Originator FDF, till 2035 (USD Billion)

- Table 28.42 Pharmaceutical Fill / Finish Manufacturing Market for Generic FDF, till 2035 (USD Billion)

- Table 28.43 Pharmaceutical Fill / Finish Manufacturing Market: Distribution by API Potency, 2019, Current Year and 2035 (USD Billion)

- Table 28.44 Pharmaceutical Fill / Finish Manufacturing Market for Low Potent API, till 2035 (USD Billion)

- Table 28.45 Pharmaceutical Fill / Finish Manufacturing Market for High Potent API, till 2035 (USD Billion)

- Table 28.46 Pharmaceutical Fill / Finish Manufacturing Market: Distribution by Type of Primary Packaging Container, 2019, Current Year and 2035 (USD Billion)

- Table 28.47 Pharmaceutical Fill / Finish Manufacturing Market for Vials, till 2035 (USD Billion)

- Table 28.48 Pharmaceutical Fill / Finish Manufacturing Market for Prefilled Syringes, till 2035 (USD Billion)

- Table 28.49 Pharmaceutical Fill / Finish Manufacturing Market for Ampoules, till 2035 (USD Billion)

- Table 28.50 Pharmaceutical Fill / Finish Manufacturing Market for Cartridges, till 2035 (USD Billion)

- Table 28.51 Pharmaceutical Fill / Finish Manufacturing Market for Other Containers, till 2035 (USD Billion)

- Table 28.52 Pharmaceutical Fill / Finish Manufacturing Market: Distribution by Scale of Operation, 2019, Current Year and 2035 (USD Billion)

- Table 28.53 Pharmaceutical Fill / Finish Manufacturing Market for Clinical Scale, till 2035 (USD Billion)

- Table 28.54 Pharmaceutical Fill / Finish Manufacturing Market for Commercial Scale, till 2035 (USD Billion)

- Table 28.55 Pharmaceutical Fill / Finish Manufacturing Market: Distribution by Company Size, 2019, Current Year and 2035 (USD Billion)

- Table 28.56 Pharmaceutical Fill / Finish Manufacturing Market for Small and Mid-sized Companies, till 2035 (USD Billion)

- Table 28.57 Pharmaceutical Fill / Finish Manufacturing Market for Large / Very Large Companies, till 2035 (USD Billion)

- Table 28.58 Pharmaceutical Fill / Finish Manufacturing Market: Distribution by Geographical Regions 2019, Current Year and 2035 (USD Billion)

- Table 28.59 Pharmaceutical Fill / Finish Manufacturing Market in North America, till 2035 (USD Billion)

- Table 28.60 Pharmaceutical Fill / Finish Manufacturing Market in the US, till 2035 (USD Billion)

- Table 28.61 Pharmaceutical Fill / Finish Manufacturing Market in Canada, till 2035 (USD Billion)

- Table 28.62 Pharmaceutical Fill / Finish Manufacturing Market in Mexico, till 2035 (USD Billion)

- Table 28.63 Pharmaceutical Fill / Finish Manufacturing Market in Puerto Rico, till 2035 (USD Billion)

- Table 28.64 Pharmaceutical Fill / Finish Manufacturing Market in Europe, till 2035 (USD Billion)

- Table 28.65 Pharmaceutical Fill / Finish Manufacturing Market in France, till 2035 (USD Billion)

- Table 28.66 Pharmaceutical Fill / Finish Manufacturing Market in Germany, till 2035 (USD Billion)

- Table 28.67 Pharmaceutical Fill / Finish Manufacturing Market in Italy, till 2035 (USD Billion)

- Table 28.68 Pharmaceutical Fill / Finish Manufacturing Market in the UK, till 2035 (USD Billion)

- Table 28.69 Pharmaceutical Fill / Finish Manufacturing Market in Spain, till 2035 (USD Billion)

- Table 28.70 Pharmaceutical Fill / Finish Manufacturing Market in Rest of Europe, till 2035 (USD Billion)

- Table 28.71 Pharmaceutical Fill / Finish Manufacturing Market in Asia-Pacific, till 2035 (USD Billion)

- Table 28.72 Pharmaceutical Fill / Finish Manufacturing Market in India, till 2035 (USD Billion)

- Table 28.73 Pharmaceutical Fill / Finish Manufacturing Market in Japan, till 2035 (USD Billion)

- Table 28.74 Pharmaceutical Fill / Finish Manufacturing Market in China, till 2035 (USD Billion)

- Table 28.75 Pharmaceutical Fill / Finish Manufacturing Market in Rest of Asia-Pacific, till 2035 (USD Billion)

- Table 28.76 Pharmaceutical Fill / Finish Manufacturing Market in Middle East and North Africa, till 2035 (USD Billion)

- Table 28.77 Pharmaceutical Fill / Finish Manufacturing Market in Latin America, till 2035 (USD Billion)

- Table 28.78 Pharmaceutical Fill / Finish Manufacturing Market in Rest of the World, till 2035 (USD Billion)

List of Figures

- Figure 2.1 Research Methodology: Project Methodology

- Figure 2.2 Research Methodology: Data Sources for Secondary Research

- Figure 3.1 Market Dynamics: Forecast Methodology

- Figure 3.2 Market Dynamics: Key Market Segmentation

- Figure 3.3 Market Dynamics: Robust Quality Control

- Figure 4.1 Lessons Learnt from Past Recessions

- Figure 5.1 Executive Summary: Market Landscape

- Figure 5.2 Executive Summary: Market Forecast and Opportunity Analysis

- Figure 6.1 Steps involved in Fill / Finish of Small Molecules

- Figure 6.2 Blow-Fill-Seal Process

- Figure 6.3 Key Considerations for Selecting a CMO Partner

- Figure 6.4 Risks and Challenges of Outsourcing Fill / Finish Operations

- Figure 7.1 Small Molecules Fill / Finish Service Providers: Distribution by Year of Establishment

- Figure 7.2 Small Molecules Fill / Finish Service Providers: Distribution by Company Size

- Figure 7.3 Small Molecules Fill / Finish Service Providers: Distribution by Location of Headquarters

- Figure 7.4 Small Molecules Fill / Finish Service Providers: Distribution by Location of Fill / Finish Facilities

- Figure 7.5 Small Molecules Fill / Finish Service Providers: Distribution by Scale of Operation

- Figure 7.6 Small Molecules Fill / Finish Service Providers: Distribution by Type of Filling Service Offered

- Figure 7.7 Small Molecules Fill / Finish Service Providers: Distribution by Type of Finishing Service Offered

- Figure 7.8 Small Molecules Fill / Finish Service Providers: Analysis by Type of Packaging Format Used

- Figure 7.9 Small Molecules Fill / Finish Service Providers: Distribution by Type of Finished Dosage Form

- Figure 7.10 Small Molecules Fill / Finish Service Providers: Distribution by Degree of Automation

- Figure 8.1 Pfizer (parent company of Pfizer CentreOne): Business Segment-wise Revenues and Consolidated Financial Details (USD Billion)

- Figure 9.1 Fresenius: Business Segment-wise Revenues and Consolidated Financial Details (EUR Billion)

- Figure 9.2 GlaxoSmithKline: Business Segment-wise Revenues and Consolidated Financial Details (EUR Billion)

- Figure 10.1 WuXi AppTec: Business Segment-wise Revenues and Consolidated Financial Details (RMB Billion)

- Figure 12.1 Company Competitiveness Analysis: Small Molecules Fill / Finish Service Providers based in North America

- Figure 12.2 Company Competitiveness Analysis: Small Molecules Fill / Finish Service Providers based in Europe

- Figure 12.3 Company Competitiveness Analysis: Small Molecules Fill / Finish Service Providers based in Asia-Pacific and Rest of the World

- Figure 13.1 Global Annual Small Molecules Fill / Finish Capacity for Ampoules: Distribution by Company Size

- Figure 13.2 Global Annual Small Molecules Fill / Finish Capacity for Ampoules: Distribution by Location of Fill / Finish Facility

- Figure 13.3 Small Molecules Fill / Finish Capacity for Ampoules in North America

- Figure 13.4 Small Molecules Fill / Finish Capacity for Ampoules in Europe

- Figure 13.5 Small Molecules Fill / Finish Capacity for Ampoules in Asia-Pacific and Rest of the World

- Figure 13.6 Global Annual Small Molecules Fill / Finish Capacity for Cartridges: Distribution by Company Size

- Figure 13.7 Global Annual Small Molecules Fill / Finish Capacity for Cartridges: Distribution by Location of Fill / Finish Facility

- Figure 13.8 Small Molecules Fill / Finish Capacity for Cartridges in North America

- Figure 13.9 Small Molecules Fill / Finish Capacity for Cartridges in Europe

- Figure 13.10 Small Molecules Fill / Finish Capacity for Cartridges in Asia-Pacific and Rest of the World

- Figure 13.11 Global Annual Small Molecules Fill / Finish Capacity for Prefilled Syringes: Distribution by Company Size

- Figure 13.12 Global Annual Small Molecules Fill / Finish Capacity for Prefilled Syringes: Distribution by Location of Fill / Finish Facility

- Figure 13.13 Small Molecules Fill / Finish Capacity for Prefilled Syringes in North America

- Figure 13.14 Small Molecules Fill / Finish Capacity for Prefilled Syringes in Europe

- Figure 13.15 Small Molecules Fill / Finish Capacity for Prefilled Syringes in Asia-Pacific and Rest of the World

- Figure 13.16 Global Annual Small Molecules Fill / Finish Capacity for Vials: Distribution by Company Size

- Figure 13.17 Global Annual Small Molecules Fill / Finish Capacity for Vials: Distribution by Location of Fill / Finish Facility

- Figure 13.18 Small Molecules Fill / Finish Capacity for Vials in North America

- Figure 13.19 Small Molecules Fill / Finish Capacity for Vials in Europe

- Figure 13.20 Small Molecules Fill / Finish Capacity for Vials in Asia-Pacific and Rest of the World

- Figure 14.1 Key Considerations for Selecting a Robotic Systems

- Figure 14.2 Advantages of Using Robotic Systems

- Figure 15.1 Key Drivers of Ready-to- Use Components

- Figure 16.1 Pharmaceutical Fill / Finish Manufacturing: Market Drivers

- Figure 16.2 Pharmaceutical Fill / Finish Manufacturing: Market Restraints

- Figure 16.3 Pharmaceutical Fill / Finish Manufacturing: Market Opportunities

- Figure 16.4 Pharmaceutical Fill / Finish Manufacturing: Market Challenges

- Figure 17.1 Global Pharmaceutical Fill / Finish Manufacturing Market, till 2035 (USD Billion)

- Figure 17.2 Global Pharmaceutical Fill / Finish Manufacturing Market, till 2035: Conservative Scenario (USD Billion)

- Figure 17.3 Global Pharmaceutical Fill / Finish Manufacturing Market, till 2035: Optimistic Scenario (USD Billion)

- Figure 18.1 Pharmaceutical Fill / Finish Manufacturing Market: Distribution by Type of Fill / Finish Service Offered, 2019, Current Year and 2035

- Figure 18.2 Pharmaceutical Fill / Finish Manufacturing Market for Terminal Sterilization, till 2035 (USD Billion)

- Figure 18.3 Pharmaceutical Fill / Finish Manufacturing Market for Aseptic Filling, till 2035 (USD Billion)

- Figure 18.4 Pharmaceutical Fill / Finish Manufacturing Market for Blow-Fill-Seal, till 2035 (USD Billion)

- Figure 18.5 Penetration-Growth (P-G) Matrix: Type of Fill / Finish Service Offered

- Figure 19.1 Pharmaceutical Fill / Finish Manufacturing Market: Distribution by Type of FDF, 2019, Current Year and 2035

- Figure 19.2 Pharmaceutical Fill / Finish Manufacturing Market for Originator FDF, till 2035 (USD Billion)

- Figure 19.3 Pharmaceutical Fill / Finish Manufacturing Market for Generic FDF, till 2035 (USD Billion)

- Figure 19.4 Penetration-Growth (P-G) Matrix: Type of FDF

- Figure 20.1 Pharmaceutical Fill / Finish Manufacturing Market: Distribution by API Potency, 2019, Current Year and 2035

- Figure 20.2 Pharmaceutical Fill / Finish Manufacturing Market for Low Potent API, till 2035 (USD Billion)

- Figure 20.3 Pharmaceutical Fill / Finish Manufacturing Market for High Potent API, till 2035 (USD Billion)

- Figure 20.4 Penetration-Growth (P-G) Matrix: API Potency

- Figure 21.1 Pharmaceutical Fill / Finish Manufacturing Market: Distribution by Type of Primary Packaging Container, 2019, Current Year and 2035

- Figure 21.2 Pharmaceutical Fill / Finish Manufacturing Market for Vials, till 2035 (USD Billion)

- Figure 21.3 Pharmaceutical Fill / Finish Manufacturing Market for Prefilled Syringes, till 2035 (USD Billion)

- Figure 21.4 Pharmaceutical Fill / Finish Manufacturing Market for Ampoules, till 2035 (USD Billion)

- Figure 21.5 Pharmaceutical Fill / Finish Manufacturing Market for Cartridges, till 2035 (USD Billion)

- Figure 21.6 Pharmaceutical Fill / Finish Manufacturing Market for Other Containers, till 2035 (USD Billion)

- Figure 21.7 Penetration-Growth (P-G) Matrix: Type of Primary Packaging Container

- Figure 22.1 Pharmaceutical Fill / Finish Manufacturing Market: Distribution by Scale of Operation, 2019, Current Year and 2035

- Figure 22.2 Pharmaceutical Fill / Finish Manufacturing Market for Clinical Scale, till 2035 (USD Billion)

- Figure 22.3 Pharmaceutical Fill / Finish Manufacturing Market for Commercial Scale, till 2035 (USD Billion)

- Figure 22.4 Penetration-Growth (P-G) Matrix: Scale of Operation

- Figure 23.1 Pharmaceutical Fill / Finish Manufacturing Market: Distribution by Company Size, 2019, Current Year and 2035

- Figure 23.2 Pharmaceutical Fill / Finish Manufacturing Market for Small and Mid-sized Companies, till 2035 (USD Billion)

- Figure 23.3 Pharmaceutical Fill / Finish Manufacturing Market for Large / Very Large Companies, till 2035 (USD Billion)

- Figure 23.4 Penetration-Growth (P-G) Matrix: Company Size

- Figure 24.1 Pharmaceutical Fill / Finish Manufacturing Market: Distribution by Geographical Regions 2019, Current Year and 2035

- Figure 24.2 Pharmaceutical Fill / Finish Manufacturing Market in North America, till 2035 (USD Billion)

- Figure 24.3 Pharmaceutical Fill / Finish Manufacturing Market in the US, till 2035 (USD Billion)

- Figure 24.4 Pharmaceutical Fill / Finish Manufacturing Market in Canada, till 2035 (USD Billion)

- Figure 24.5 Pharmaceutical Fill / Finish Manufacturing Market in Mexico, till 2035 (USD Billion)

- Figure 24.6 Pharmaceutical Fill / Finish Manufacturing Market in Puerto Rico, till 2035 (USD Billion)

- Figure 24.7 Pharmaceutical Fill / Finish Manufacturing Market in Europe, till 2035 (USD Billion)

- Figure 24.8 Pharmaceutical Fill / Finish Manufacturing Market in France, till 2035 (USD Billion)

- Figure 24.9 Pharmaceutical Fill / Finish Manufacturing Market in Germany, till 2035 (USD Billion)

- Figure 24.10 Pharmaceutical Fill / Finish Manufacturing Market in Italy, till 2035 (USD Billion)

- Figure 24.11 Pharmaceutical Fill / Finish Manufacturing Market in the UK, till 2035 (USD Billion)

- Figure 24.12 Pharmaceutical Fill / Finish Manufacturing Market in Spain, till 2035 (USD Billion)

- Figure 24.13 Pharmaceutical Fill / Finish Manufacturing Market in Rest of Europe, till 2035 (USD Billion)

- Figure 24.14 Pharmaceutical Fill / Finish Manufacturing Market in Asia-Pacific, till 2035 (USD Billion)

- Figure 24.15 Pharmaceutical Fill / Finish Manufacturing Market in India, till 2035 (USD Billion)

- Figure 24.16 Pharmaceutical Fill / Finish Manufacturing Market in Japan, till 2035 (USD Billion)

- Figure 24.17 Pharmaceutical Fill / Finish Manufacturing Market in China, till 2035 (USD Billion)

- Figure 24.18 Pharmaceutical Fill / Finish Manufacturing Market in Rest of Asia-Pacific, till 2035 (USD Billion)

- Figure 24.19 Pharmaceutical Fill / Finish Manufacturing Market in Middle East and North Africa, till 2035 (USD Billion)

- Figure 24.20 Pharmaceutical Fill / Finish Manufacturing Market in Latin America, till 2035 (USD Billion)

- Figure 24.21 Pharmaceutical Fill / Finish Manufacturing Market in Rest of the World, till 2035 (USD Billion)

- Figure 24.22 Penetration-Growth (P-G) Matrix: Geographical Regions

- Figure 26.1 Conclusion: Small Molecules Fill / Finish Service Providers Landscape

- Figure 26.2 Conclusion: Capacity Analysis

- Figure 26.3 Conclusion: Market Forecast and Opportunity Analysis (I/II)

- Figure 26.4 Conclusion: Market Forecast and Opportunity Analysis (II/II)