|

市場調查報告書

商品編碼

1616888

即用型醫藥品包裝市場:各容器類型,各封口裝置類型,各製造材料,各主要地區:到2035年前的產業趨勢與全球預測Ready to Use Pharmaceutical Packaging Market by Type of Container, Type of Closure, Material of Fabrication and Key Geographical Regions : Industry Trends and Global Forecasts, Till 2035 |

||||||

預計到 2035 年,全球無菌/即用型藥品包裝市場規模將從目前的 95 億美元增長到 251 億美元,到 2035 年的預測期內複合年增長率為 9.2%。

在製藥業,滅菌是維護產品安全和嚴格品質標準的關鍵步驟。需要強調的是,初級包裝在確保藥品和疫苗的完整性和安全性方面發揮關鍵作用。多年來,即用型藥品內包裝已發展成為傳統內包裝的有前途的替代品。這為簡化藥品填充/精加工操作提供了顯著的附加價值。此外,即用型組件消除了整個填充/表面處理製造過程中的多個步驟,從而提高了營運效率,符合現有的監管標準。此外,對病人安全的日益重視促使了無菌封閉件和容器的引入。即用型容器和封閉件透過減少滅菌設備的需求和相關成整體提高成本和時間效率。因此,無菌小瓶和注射器等即用型組件因其在各種應用中的便利性和可靠性而變得越來越受歡迎。

無菌藥品包裝市場由多種因素驅動,包括藥品的無菌和完整性以及藥品和疫苗包裝的嚴格監管指南。隨著 ATMP 等醫藥產品變得越來越複雜,對適合細胞和基因療法的無菌填充和精加工的初級容器的需求不斷增加。無菌包裝在製藥業的整合可以透過優化的價值鏈加快產品上市速度。

本報告提供全球即用型醫藥品包裝市場相關調查,提供市場概要,以及各容器類型,各封口裝置類型,各製造材料,各地區的趨勢,及加入此市場的主要企業簡介等資訊。

目錄

第1章 序文

第2章 調查手法

第3章 經濟以及其他的計劃特有的考慮事項

第4章 摘要整理

第5章 簡介

第6章 殺菌完畢/即用型容器:市場形勢

第7章 殺菌完畢/即用型瓶蓋:市場形勢

第8章 重要的洞察

第9章 產品競爭力分析:殺菌完畢/即用型容器

第10章 產品競爭力分析:殺菌完畢/即用型瓶蓋

第11章 企業簡介

- 章概要

- APG Pharma Packaging

- Aptar

- Daikyo Seiko

- Datwyler

- DWK Life Sciences

- Ningbo Zhengli Pharmaceutical Packaging

- SCHOTT

- Stevanato

- West Pharmaceutical Services

第12章 夥伴關係和合作

第13章 市場進入的決策架構

第14章 需求分析

第15章 對市場的影響分析:促進因素,阻礙因素,機會,課題

第16章 全球殺菌完畢/即用型醫藥品包裝市場

第17章 殺菌完畢/即用型醫藥品包裝市場,各容器類型

第18章 殺菌完畢/即用型醫藥品包裝市場,各封口裝置類型

第19章 殺菌完畢/即用型醫藥品包裝市場,各製造材料

第20章 殺菌完畢/即用型醫藥品包裝市場,各主要地區

第21章 醫藥品包裝的新的趨勢

第22章 案例研究:醫藥品包裝的機器人技術

第23章 結論

第24章 執行洞察

第25章 附錄1:表格形式的資料

第26章 附錄2:企業及組織一覽

READY TO USE PHARMACEUTICAL PACKAGING MARKET: OVERVIEW

As per Roots Analysis, the global pre-sterilized / ready to use pharmaceutical packaging market is estimated to grow from USD 9.5 billion in the current year to USD 25.1 billion by 2035, at a CAGR of 9.2% during the forecast period, till 2035.

The market sizing and opportunity analysis has been segmented across the following parameters:

Type of Container

- Sterile Cartridges

- Sterile Syringes

- Sterile Vials

Type of Closure

- Caps, Plungers

- Seals

- Stoppers

- Tip Caps / Needle Shields

Material of Fabrication

- Aluminum

- Glass

- Plastic

- Rubber

Key Geographical Regions

- North America

- Europe

- Asia

- Middle East and North Africa

- Latin America

READY TO USE PHARMACEUTICAL PACKAGING MARKET: GROWTH AND TRENDS

In the pharmaceutical industry, sterilization is a critical step in maintaining product safety and upholding stringent quality standards. It is important to highlight that primary packaging plays an important role in ensuring the integrity and safety of drugs and vaccines. Over the years, the ready to use of pharmaceutical primary packaging has evolved as a promising alternative to conventional primary packaging. It adds significant value to streamline the pharmaceutical fill / finish operations. Moreover, ready-to-use components remove multiple steps in the overall fill / finish manufacturing which improve operational efficiencies in compliance with the existing regulatory standards. Further, the growing emphasis on patient safety has led to the emergence of pre-sterilized closures and containers. The ready to use containers and closures improve cost and time efficiency by reducing the need for sterilization equipment and associated expenses. As a result, ready to use components, such as sterile vials and syringes have become increasingly popular due to their convenience and reliability in a range of applications.

The pre-sterilized pharmaceutical packaging market is driven by multiple factors, such as sterility and integrity of pharmaceutical products, and stringent regulatory guidelines for packaging drugs / vaccines. The growing complexities of drug products, such as ATMPs, has led to a rise in demand for primary containers that are suitable for aseptic fill and finish of cell and gene therapies. The integration of pre-sterilized packaging containers within the pharmaceutical industry enables swift product launch through an optimized value chain.

READY TO USE PHARMACEUTICAL PACKAGING MARKET: KEY INSIGHTS

The report delves into the current state of the pre-sterilized / ready to use pharmaceutical packaging market and identifies potential growth opportunities within the industry. Some key findings from the report include:

1. Presently, over 95 pre-sterilized / ready to use containers are available or being developed by close to 50 manufacturers; a relatively larger proportion of these players were established before 2000.

2. Nearly 45% of the ready-to-use containers are being offered as vials; the majority of these products are sterilized using ethylene oxide (EtO).

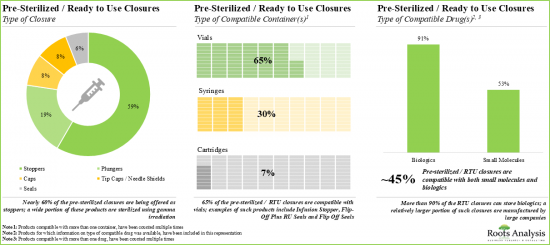

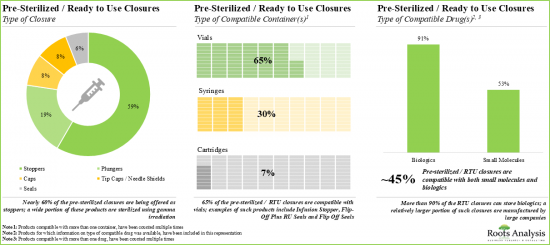

3. Around 85 pre-sterilized / RTU closures are being manufactured by players across the globe; ~60% of these firms are headquartered in Asia.

4. A wide range of RTU closures are compatible with different types of containers, including vials, syringes and cartridges, providing optimal packaging solutions for biologics and small molecules.

5. In pursuit of gaining a competitive edge, companies engaged in the manufacturing of RTU containers and closures are presently focusing on the integration of advanced features into their respective product offerings.

6. Close to 40 companies claim to offer robotic machinery, with different degrees of freedom, to enhance the productivity and flexibility of various pharmaceutical operations.

7. The rising interest in the RTU containers and closures domain is also evident from the partnership activity; in fact, the maximum number of collaborations were inked in the recent past.

8. Identifying drivers and barriers in the industry provides valuable insights to improve strategic planning, resulting in more effective and efficient operations that are better equipped to adapt to the evolving business landscape.

9. Vials are expected to account for close to 55% of the demand for pre-sterilized / ready to use containers in the foreseen future.

10. The RTU primary packaging market is anticipated to grow at a CAGR of 9.2% over the next few years, primarily driven by the revenues generated from pre-sterilized / ready to use containers.

11. Several growth opportunities exist in the industry owing to the increasing demand for advanced packaging materials and technologies that can accommodate the requirements of complex drug products.

READY TO USE PHARMACEUTICAL PACKAGING MARKET: KEY SEGMENTS

Pre-Sterilized / Ready to Use Syringes Segment is Likely to Dominate the Ready to Use Pharmaceutical Packaging Market During the Forecast Period

Based on the type of container, the market is segmented into sterile cartridges, sterile syringes and sterile vials. It is worth highlighting that majority of the current ready to use pharmaceutical packaging market is captured by sterile syringes. This can be attributed to the fact that sterile syringes are more efficient and convenient, and eliminate the need for manual filling, reducing the risk of contamination and improving the accuracy of dosing.

Currently, Pre-Sterilized / Ready to Use Plungers Segment Occupies the Largest Share of the Ready to Use Pharmaceutical Packaging Market

Based on the type of closure, the market is segmented into caps, plungers, seals, stoppers, tip caps / needle shields. It is worth highlighting that the ready to use pharmaceutical packaging market for pre-sterilized / ready to use caps is likely to grow at a relatively higher CAGR, during the forecast period.

Aluminum Containers and Closures is the Fastest Growing Segment of the Ready to Use Pharmaceutical Packaging Market

Based on the material of fabrication, the market is segmented into aluminum, glass, plastic and rubber. It is worth highlighting that, at present, the market is dominated by plastic-based pre-sterilized / ready to use containers and closures. This can be attributed to the fact that plastic syringes are more commonly used due to their durability and cost-effectiveness. In addition, these syringes are free from heavy metals and do not undergo siliconization, making them a safer option for drug administration.

Asia Accounts for the Largest Share of the Market

Based on key geographical regions, the market is segmented into North America, Europe, Asia, Latin America, Middle East and North Africa, and Rest of the World. It is worth highlighting that in the coming years, the market in Asia-Pacific is expected to grow at a higher CAGR. This increase can be attributed to the expanding population of the region, thereby increasing the demand for healthcare products. Moreover, favorable government initiatives and investments in the pharmaceutical sector are likely to drive the growth opportunities in this region, in the long term.

Example Players in the Pre-Sterilized / Ready to Use Pharmaceutical Packaging Market

- APG Pharma

- Aptar

- Daikyo Seiko

- Datwyler

- DWK Life Sciences

- Ningbo Zhengli Pharmaceutical Packaging

- SCHOTT

- Stevanto

- West Pharmaceutical Services

Primary Research Overview

The opinions and insights presented in this study were influenced by discussions conducted with multiple stakeholders. The research report features detailed transcripts of interviews held with the following industry stakeholders:

- Business Development Specialist, Jinan Youlyy Industrial

- Founder and Managing Director, Sagar Rubber

- Business Development and Technology Director, Aseptic Technologies

- Former Facilitator, BioPhorum

- Former Project Manager of Business Development, PYRAMID Laboratories

PRE-STERILIZED / READY TO USE PHARMACEUTICAL PACKAGING MARKET: RESEARCH COVERAGE

- The report features an in-depth analysis of the pre-sterilized / ready to use pharmaceutical packaging market, focusing on key market segments, including type of container, type of closure, material of fabrication and key geographical regions.

- The report analyzes various factors such as drivers, restraints, opportunities, and challenges affecting market growth.

- A detailed assessment of the overall market landscape of pre-sterilized / ready to use containers, based on several relevant parameters, including type of container (sterile vials, sterile syringes, sterile bags and sterile cartridges), material(s) of fabrication (glass and plastic), container color (clear and amber), type of compatible drug(s) (biologics and small molecules), scale of operation (preclinical, clinical and commercial), packaging format(s) (nest and tub, and tray), sterilization technique(s) used (ethylene oxide sterilization, steam sterilization, gamma sterilization and others), quality certification(s) obtained (ISO compliant, cGMP compliant, USP compliant, EP compliant, JP compliant, FDA compliant and others), target market (domestic and international and, domestic), availability of additional coating and RTU kits. It also provides an assessment of the pre-sterilized / ready to use container manufacturers based on their year of establishment, company size (in terms of number of employees) and location of headquarters.

- A comprehensive evaluation of pre-sterilized / ready to use closures, based on several relevant parameters, including type of closure (stoppers, plungers, caps, tip caps / needle shields and seals), material(s) of fabrication (rubber, plastic and aluminum), type of compatible container(s) (vials, syringes and cartridges), type of compatible drug(s) (biologics and small molecules), sterilization technique(s) used (gamma sterilization, steam sterilization and others), available finish format(s) (bags, nest and tub and single-vented), quality certification(s) obtained (ISO compliant, cGMP compliant, USP compliant, EP compliant, JP compliant and others), target market (domestic and international and, domestic) and availability of additional coating. It also provides an assessment of the pre-sterilized / ready to use closure manufacturers based on their year of establishment, company size (in terms of number of employees) and location of headquarters.

- Thorough analysis of contemporary market trends in the pre-sterilized / ready to use containers and closures domain, based on relevant parameters, such as (type of container and scale of operation), (type of container and packaging format(s)), (type of container and material(s) of fabrication), (type of container and container color), (type of container and sterilization technique(s) used), (type of container and type of compatible drug(s)), (material(s) of fabrication and sterilization technique(s) used), (type of closure and material(s) of fabrication), (type of closure and sterilization technique(s) used), (type of closure and available finish format(s)) and (type of closure and type of compatible drug(s)).

- A comprehensive competitive analysis of various types of pre-sterilized / ready to use containers, based on the company strength and product competitiveness.

- A detailed product competitiveness analysis of various types of pre-sterilized / ready to use closures, based on company strength and product competitiveness.

- In-depth profiles of key players offering pre-sterilized / ready to use containers and closures, focusing on company overviews, financial information (if available), product portfolio, recent developments and an informed future outlook.

- An analysis of partnerships established in this sector, since 2015, based on several relevant parameters, such as year of partnership, type of partnership, type of partner, focus area, type of packaging system, type of packaging material, most active players (in terms of number of partnerships) and geography.

- Informed estimates of the current and future demand for pre-sterilized / ready to use containers and closures, based on various relevant parameters, such as type of primary packaging system, material of fabrication used, across different geographical regions.

- A detailed assessment of various emerging trends, including the advent of personalized therapies, shift towards more flexible packaging and advancements in robotic packaging solutions that are likely to impact the future adoption of RTU packaging systems.

- A case study on the use of robotic machinery in pharmaceutical manufacturing and fill / finish operations, highlighting the advantages of employing automation / automated technologies in such processes. Further, it presents the profiles of industry players providing such equipment for aseptic processing of pharmaceuticals.

KEY QUESTIONS ANSWERED IN THIS REPORT

- How many companies are currently engaged in this market?

- Which are the leading companies in this market?

- What kind of partnership models are commonly adopted by industry stakeholders?

- What are the factors that are likely to influence the evolution of this market?

- What is the current and future market size?

- What is the CAGR of this market?

- How is the current and future market opportunity likely to be distributed across key market segments?

REASONS TO BUY THIS REPORT

- The report provides a comprehensive market analysis, offering detailed revenue projections of the overall market and its specific sub-segments. This information is valuable to both established market leaders and emerging entrants.

- Stakeholders can leverage the report to gain a deeper understanding of the competitive dynamics within the market. By analyzing the competitive landscape, businesses can make informed decisions to optimize their market positioning and develop effective go-to-market strategies.

- The report offers stakeholders a comprehensive overview of the market, including key drivers, barriers, opportunities, and challenges. This information empowers stakeholders to stay abreast of market trends and make data-driven decisions to capitalize on growth prospects.

ADDITIONAL BENEFITS

- Complimentary PPT Insights Packs

- Complimentary Excel Data Packs for all Analytical Modules in the Report

- 10% Free Content Customization

- Detailed Report Walkthrough Session with Research Team

- Free Updated report if the report is 6-12 months old or older

TABLE OF CONTENTS

1. PREFACE

- 1.1. Introduction

- 1.2. Key Market Insights

- 1.3. Project Objectives

- 1.4. Scope of the Report

- 1.5. Inclusions and Exclusions

- 1.6. Key Questions Answered

- 1.7. Chapter Outlines

2. RESEARCH METHODOLOGY

- 2.1. Chapter Overview

- 2.2. Research Assumptions

- 2.3. Project Methodology

- 2.4. Forecast Methodology

- 2.5. Robust Quality Control

- 2.7. Key Considerations

- 2.7.1. Demographics

- 2.7.2. Economic Factors

- 2.7.3. Government Regulations

- 2.7.4. Supply Chain

- 2.7.5. COVID Impact / Related Factors

- 2.7.6. Market Access

- 2.7.7. Healthcare Policies

- 2.7.8. Industry Consolidation

- 2.7. Key Market Segmentations

3. ECONOMIC AND OTHER PROJECT SPECIFIC CONSIDERATIONS

- 3.1. Chapter Overview

- 3.2. Market Dynamics

- 3.2.1. Time Period

- 3.2.1.1. Historical Trends

- 3.2.1.2. Current and Future Estimates

- 3.2.2. Currency Coverage

- 3.2.2.1. Overview of Major Currencies Affecting the Market

- 3.2.2.2. Impact of Currency Fluctuations on the Industry

- 3.2.3. Foreign Exchange Impact

- 3.2.3.1. Evaluation of Foreign Exchange Rates and Their Impact on Market

- 3.2.3.2. Strategies for Mitigating Foreign Exchange Risk

- 3.2.4. Recession

- 3.2.4.1. Historical Analysis of Past Recessions and Lessons Learnt

- 3.2.4.2. Assessment of Current Economic Conditions and Potential Impact on the Market

- 3.2.5. Inflation

- 3.2.5.1. Measurement and Analysis of Inflationary Pressures in the Economy

- 3.2.5.2. Potential Impact of Inflation on the Market Evolution

- 3.2.1. Time Period

4. EXECUTIVE SUMMARY

- 4.1 Chapter Overview

5. INTRODUCTION

- 5.1. Chapter Overview

- 5.2. Pharmaceutical Packaging and Filling

- 5.2.1. Need for Pharmaceutical Packaging

- 5.2.2. Types of Pharmaceutical Packaging

- 5.2.3. Limitations of Traditional Primary Packaging

- 5.2.4. Innovation in Pharmaceutical Packaging

- 5.3. Ready to Use Primary Packaging

- 5.3.1. Sterilization Techniques used in Primary Packaging

- 5.3.2. Advantages of Ready to Use Primary Packaging

- 5.3.3. Cost Saving Opportunities in Ready to Use Primary Packaging

- 5.3.4. Current Demand for Ready to Use Primary Packaging

- 5.4. Concluding Remarks

6. PRE-STERILIZED / READY TO USE CONTAINERS: MARKET LANDSCAPE

- 6.1. Chapter Overview

- 6.2. Pre-Sterilized / Ready to Use Containers: Overall Market Landscape

- 6.2.1. Analysis by Type of Container

- 6.2.2. Analysis by Material(s) of Fabrication

- 6.2.3. Analysis by Container Color

- 6.2.4. Analysis by Type of Compatible Drug(s)

- 6.2.5. Analysis by Scale of Operation

- 6.2.6. Analysis by Packaging Format(s)

- 6.2.7. Analysis by Sterilization Technique(s) Used

- 6.2.8. Analysis by Quality Certification(s) Obtained

- 6.2.9. Analysis by Target Market

- 6.2.10. Analysis by Availability of Additional Coating

- 6.2.11. Analysis by Availability of RTU Kits

- 6.3. Pre-Sterilized / Ready to Use Containers: Manufacturer Landscape

- 6.3.1. Analysis by Year of Establishment

- 6.3.2. Analysis by Company Size

- 6.3.3. Analysis by Location of Headquarters

- 6.3.4. Leading Manufacturers: Analysis by Number of Products

7. PRE-STERILIZED / READY TO USE CLOSURES: MARKET LANDSCAPE

- 7.1. Chapter Overview

- 7.2. Pre-Sterilized / Ready to Use Closures: Overall Market Landscape

- 7.2.1. Analysis by Type of Closure

- 7.2.2. Analysis by Material(s) of Fabrication

- 7.2.3. Analysis by Type of Compatible Container(s)

- 7.2.4. Analysis by Type of Compatible Drug(s)

- 7.2.5. Analysis by Sterilization Technique(s) Used

- 7.2.6. Analysis by Available Finish Format(s)

- 7.2.7. Analysis by Quality Certification(s) Obtained

- 7.2.8. Analysis by Target Market

- 7.2.9. Analysis by Availability of Additional Coating

- 7.3. Pre-Sterilized / Ready to Use Closures: Manufacturer Landscape

- 7.3.1. Analysis by Year of Establishment

- 7.3.2. Analysis by Company Size

- 7.3.3. Analysis by Location of Headquarters

- 7.3.4. Leading Manufacturers: Analysis by Number of Products

8. KEY INSIGHTS

- 8.1. Chapter Overview

- 8.2. Pre-Sterilized / Ready to Use Containers: Key Insights

- 8.2.1. Analysis by Type of Container and Scale of Operation

- 8.2.2. Analysis by Type of Container and Packaging Format(s)

- 8.2.3. Analysis by Type of Container and Material(s) of Fabrication

- 8.2.4. Analysis by Type of Container and Container Color

- 8.2.5. Analysis by Type of Container and Sterilization Technique(s) Used

- 8.2.6. Analysis by Type of Container and Type of Compatible Drug(s)

- 8.2.7. Analysis by Material(s) of Fabrication and Sterilization Technique(s) Used

- 8.3. Pre-Sterilized / Ready to Use Closures: Key Insights

- 8.3.1. Analysis by Type of Closure and Material(s) of Fabrication

- 8.3.2. Analysis by Type of Closure and Sterilization Technique(s) Used

- 8.3.3. Analysis by Type of Closure and Available Finish Format(s)

- 8.3.4. Analysis by Type of Closure and Type of Compatible Drug(s)

9. PRODUCT COMPETITIVENESS ANALYSIS: PRE-STERILIZED / READY TO USE CONTAINERS

- 9.1. Chapter Overview

- 9.2. Pre-Sterilized / Ready to Use Containers: Product Competitiveness Analysis

- 9.2.1. Assumptions and Key Parameters

- 9.2.2. Methodology

- 9.2.3. Product Competitiveness Analysis: Vials

- 9.2.4. Product Competitiveness Analysis: Syringes

- 9.2.5. Product Competitiveness Analysis: Bags

- 9.2.6. Product Competitiveness Analysis: Cartridges

10. PRODUCT COMPETITIVENESS ANALYSIS: PRE-STERILIZED / READY TO USE CLOSURES

- 10.1. Chapter Overview

- 10.2. Pre-Sterilized / Ready to Use Closures: Product Competitiveness Analysis

- 10.2.1. Assumptions and Key Parameters

- 10.2.2. Methodology

- 10.2.3. Product Competitiveness Analysis: Stoppers

- 10.2.4. Product Competitiveness Analysis: Plungers

- 10.2.5. Product Competitiveness Analysis: Caps

- 10.2.6. Product Competitiveness Analysis: Tip Caps / Needle Shields

- 10.2.7. Product Competitiveness Analysis: Seals

11. COMPANY PROFILES

- 11.1. Chapter Overview

- 11.2. APG Pharma Packaging

- 11.2.1. Company Overview

- 11.2.2. Product Portfolio

- 11.2.2.1. Ready to Use Closures

- 11.2.3. Recent Developments and Future Outlook

- 11.3. Aptar

- 11.3.1. Company Overview

- 11.3.2. Financial Information

- 11.3.3. Product Portfolio

- 11.3.3.1. Ready to Use Closures

- 11.3.4. Recent Developments and Future Outlook

- 11.4. Daikyo Seiko

- 11.4.1. Company Overview

- 11.4.2. Product Portfolio

- 11.4.2.1. Ready to Use Containers

- 11.4.2.2. Ready to Use Closures

- 11.4.3. Recent Developments and Future Outlook

- 11.5. Datwyler

- 11.5.1. Company Overview

- 11.5.2. Financial Information

- 11.5.3. Product Portfolio

- 11.5.3.1. Ready to Use Closures

- 11.5.4. Recent Developments and Future Outlook

- 11.6. DWK Life Sciences

- 11.6.1. Company Overview

- 11.6.2. Product Portfolio

- 11.6.2.1. Ready to Use Containers

- 11.6.2.2. Ready to Use Closures

- 11.6.3. Recent Developments and Future Outlook

- 11.7. Ningbo Zhengli Pharmaceutical Packaging

- 11.7.1. Company Overview

- 11.7.2. Product Portfolio

- 11.7.2.1. Ready to Use Containers

- 11.7.3. Recent Developments and Future Outlook

- 11.8. SCHOTT

- 11.8.1. Company Overview

- 11.8.2. Financial Information

- 11.8.3. Product Portfolio

- 11.8.3.1. Ready to Use Containers

- 11.8.3.2. Ready to Use Closures

- 11.8.4. Recent Developments and Future Outlook

- 11.9. Stevanato

- 11.9.1. Company Overview

- 11.9.2. Product Portfolio

- 11.9.2.1. Ready to Use Containers

- 11.9.2.2. Ready to Use Closures

- 11.9.3. Recent Developments and Future Outlook

- 11.10. West Pharmaceutical Services

- 11.10.1. Company Overview

- 11.10.2. Financial Information

- 11.10.3. Product Portfolio

- 11.10.3.1. Ready to Use Containers

- 11.10.3.2. Ready to Use Closures

- 11.10.4. Recent Developments and Future Outlook

12. PARTNERSHIPS AND COLLABORATIONS

- 12.1. Chapter Overview

- 12.2. Partnership Models

- 12.3. Pre-Sterilized / Ready to Use Pharmaceutical Packaging: Partnerships and Collaborations

- 12.3.1. Analysis by Year of Partnership

- 12.3.2. Analysis by Type of Partnership

- 12.3.3. Analysis by Year and Type of Partnership

- 12.3.4. Analysis by Type of Partner

- 12.3.5. Analysis by Year of Partnership and Type of Partner

- 12.3.6. Analysis by Type of Partnership and Type of Partner

- 12.3.7. Analysis by Purpose of Partnership

- 12.3.8. Analysis by Type of Packaging System

- 12.3.9. Analysis by Type of Packaging Material

- 12.3.10. Most Active Players: Analysis by Number of Partnerships

- 12.3.11. Analysis by Geography

- 12.3.11.1. Intercontinental and Intracontinental Deals

13. MARKET ENTRY DECISION MAKING FRAMEWORK

- 13.1. Chapter Overview

- 13.2. Key Assumptions and Methodology

- 13.3. Key Parameters Impacting Market Entry Decision Making

- 13.3.1. Product Reach

- 13.3.2. Product Differentiation

- 13.3.3. Market Activity

- 13.3.4. Product Competitiveness

- 13.3.5. Manufacturing Complexity

- 13.4. Concluding Remarks

14. DEMAND ANALYSIS

- 14.1. Chapter Overview

- 14.2. Scope and Methodology

- 14.3. Global Demand for Pre-Sterilized / Ready to Use Pharmaceutical Packaging, Current Year and 2035: Distribution by Type of Container

- 14.3.1. Pre-Sterilized / Ready to Use Vials, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 14.3.2. Pre-Sterilized / Ready to Use Syringes, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 14.3.3. Pre-Sterilized / Ready to Use Cartridges, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 14.4. Global Demand for Pre-Sterilized / Ready to Use Pharmaceutical Packaging, Current Year and 2035: Distribution by Type of Closure

- 14.4.1. Pre-Sterilized / Ready to Use Caps, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 14.4.2. Pre-Sterilized / Ready to Use Plungers, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 14.4.3. Pre-Sterilized / Ready to Use Seals, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 14.4.4. Pre-Sterilized / Ready to Use Stoppers, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 14.4.5. Pre-Sterilized / Ready to Use Tip Caps / Needle Shields, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 14.5. Global Demand for Pre-Sterilized / Ready to Use Pharmaceutical Packaging, Current Year and 2035: Distribution by Material of Fabrication

- 14.5.1. Pre-Sterilized / Ready to Use Aluminum Containers and Closures, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 14.5.2. Pre-Sterilized / Ready to Use Glass Containers and Closures, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 14.5.3. Pre-Sterilized / Ready to Use Plastic Containers and Closures, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 14.5.4. Pre-Sterilized / Ready to Use Rubber Containers and Closures, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 14.6. Global Demand for Pre-Sterilized / Ready to Use Pharmaceutical Packaging, Current Year and 2035: Distribution by Key Geographical Region

- 14.6.1. Pre-Sterilized / Ready to Use Pharmaceutical Packaging in North America, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 14.6.2. Pre-Sterilized / Ready to Use Pharmaceutical Packaging in Europe, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 14.6.3. Pre-Sterilized / Ready to Use Pharmaceutical Packaging in Asia, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 14.6.4. Pre-Sterilized / Ready to Use Pharmaceutical Packaging in Latin America, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 14.6.5. Pre-Sterilized / Ready to Use Pharmaceutical Packaging in Middle East and North Africa, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 14.6.6. Pre-Sterilized / Ready to Use Pharmaceutical Packaging in Rest of the World, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

15. MARKET IMPACT ANALYSIS: DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES

- 15.1. Chapter Overview

- 15.2. Market Drivers

- 15.3. Market Restraints

- 15.4. Market Opportunities

- 15.5. Market Challenges

- 15.6. Conclusion

16. GLOBAL PRE-STERILIZED / READY TO USE PHARMACEUTICAL PACKAGING MARKET

- 16.1. Chapter Overview

- 16.2. Assumptions and Methodology

- 16.3. Global Pre-Sterilized / Ready to Use Pharmaceutical Packaging Market, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 16.3.1. Scenario Analysis

- 16.3.1.1. Conservative Scenario

- 16.3.1.2. Optimistic Scenario

- 16.3.1. Scenario Analysis

- 16.4. Key Market Segmentations

- 16.5. Dynamic Dashboard

17. PRE-STERILIZED / READY TO USE PHARMACEUTICAL PACKAGING MARKET, BY TYPE OF CONTAINER

- 17.1. Chapter Overview

- 17.2. Key Assumptions and Methodology

- 17.3. Pre-Sterilized / Ready to use Pharmaceutical Packaging Market: Distribution by Type of Container, 2018, Current Year and 2035

- 17.3.1. Vials: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 17.3.2. Syringes: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 17.3.3. Cartridges: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 17.4. Data Triangulation and Validation

18. PRE-STERILIZED / READY TO USE PHARMACEUTICAL PACKAGING MARKET, BY TYPE OF CLOSURE

- 18.1. Chapter Overview

- 18.2. Key Assumptions and Methodology

- 18.3. Pre-Sterilized / Ready to Use Pharmaceutical Packaging Market: Distribution by Type of Closure, 2018, Current Year and 2035

- 18.3.1. Caps: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 18.3.2 Plungers: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 18.3.3. Seals: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 18.3.4. Stoppers: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 18.3.5. Tip Caps / Needle Shields: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 18.4. Data Triangulation and Validation

19. PRE-STERILIZED / READY TO USE PHARMACEUTICAL PACKAGING MARKET, BY MATERIAL OF FABRICATION

- 19.1. Chapter Overview

- 19.2. Key Assumptions and Methodology

- 19.3. Aluminum Containers and Closures: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 19.4. Glass Containers and Closures: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 19.5. Plastic Containers and Closures: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 19.6. Rubber Containers and Closures: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 19.7. Data Triangulation and Validation

20. PRE-STERILIZED / READY TO USE PHARMACEUTICAL PACKAGING MARKET, BY KEY GEOGRAPHICAL REGION

- 20.1. Chapter Overview

- 20.2. Key Assumptions and Methodology

- 20.3. North America: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 20.3.1. Pre-Sterilized / Ready to Use Pharmaceutical Packaging Market for Containers

- 20.3.2. Pre-Sterilized / Ready to Use Pharmaceutical Packaging Market for Closures

- 20.4. Europe: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 20.4.1. Pre-Sterilized / Ready to Use Pharmaceutical Packaging Market for Containers

- 20.4.2. Pre-Sterilized / Ready to Use Pharmaceutical Packaging Market for Closures

- 20.5. Asia: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 20.5.1. Pre-Sterilized / Ready to Use Pharmaceutical Packaging Market for Containers

- 20.5.2. Pre-Sterilized / Ready to Use Pharmaceutical Packaging Market for Closures

- 20.6. Latin America: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 20.6.1. Pre-Sterilized / Ready to Use Pharmaceutical Packaging Market for Containers

- 20.6.2. Pre-Sterilized / Ready to Use Pharmaceutical Packaging Market for Closures

- 20.7. Middle East and North Africa: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 20.7.1. Pre-Sterilized / Ready to Use Pharmaceutical Packaging Market for Containers

- 20.7.2. Pre-Sterilized / Ready to Use Pharmaceutical Packaging Market for Closures

- 20.8. Rest of the World: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 20.7.1. Pre-Sterilized / Ready to Use Pharmaceutical Packaging Market for Containers

- 20.7.2. Pre-Sterilized / Ready to Use Pharmaceutical Packaging Market for Closures

- 20.9. Data Triangulation and Validation

21. EMERGING TRENDS IN PHARMACEUTICAL PACKAGING

- 21.1. Chapter Overview

- 21.2. Emerging Trends

- 21.2.1. Preference for Self-Medication of Drugs, Through the Use of Modern Drug Delivery Devices

- 21.2.2. Development of Improved Packaging Components and Efforts to Optimize Manufacturing Costs

- 21.2.3. Availability of Modular Facilities

- 21.2.4. Growing Demand and Preference for Personalized Therapies

- 21.2.5. Rise in Provisions for Automating Fill / Finish Operations

- 21.2.6. Surge in Partnership Activity

- 21.2.7. Increase in Initiatives Undertaken by Industry Stakeholders in Developing Regions

- 21.3. Concluding Remarks

22. CASE STUDY: ROBOTICS IN PHARMACEUTICAL PACKAGING

- 22.1. Chapter Overview

- 22.2. Role of Robotics in Pharmaceutical Industry

- 22.2.1. Key Considerations for Selecting a Robotic System

- 22.2.2. Advantages of Robotic Systems

- 22.2.3. Disadvantages of Robotic Systems

- 22.3. Companies Providing Robots for Use in Pharmaceutical Industry

- 22.4. Companies Providing Equipment Integrated Robotic Systems in Pharmaceutical Packaging

- 22.4.1. Aseptic Technologies

- 22.4.1.1. Crystal L1 Robot Line

- 22.4.1.2. Crystal SL1 Robot Line

- 22.4.2. AST

- 22.4.2.1. ASEPTiCELL

- 22.4.2.2. GENiSYS R

- 22.3.2.3. GENiSYS C

- 22.3.2.4. GENiSYS Lab

- 22.4.3. Bosch Packaging Technology

- 22.4.3.1. ATO

- 22.4.4. Dara Pharma

- 22.4.4.1. SYX-E Cartridge + RABS

- 22.4.5. Fedegari

- 22.4.5.1. Fedegari Isolator

- 22.4.6. IMA

- 22.4.6.1. INJECTA

- 22.4.6.2. STERI LIF3

- 22.4.7. Steriline

- 22.4.7.1. Robotic Nest Filling Machine (RNFM)

- 22.4.7.2. Robotic Vial Filling Machine (RVFM)

- 22.4.7.3. Robotic Vial Capping Machine (RVCM)

- 22.4.8. Vanrx Pharmasystems

- 22.4.8.1. Microcell Vial Filler

- 22.4.8.2. SA25 Aseptic Filling Workcell

- 22.4.1. Aseptic Technologies

- 22.5. Concluding Remarks

23. CONCLUSION

- 23.1. Chapter Overview

24. EXECUTIVE INSIGHTS

- 24.1. Chapter Overview

- 24.2. Jinan Youlyy Industrial

- 24.2.1. Company Snapshot

- 24.2.2. Interview Transcript: Cara Qiu, Business Development Specialist

- 24.3. Sagar Rubber

- 24.3.1. Company Snapshot

- 24.3.2. Interview Transcript: Daxesh Shah, Founder and Managing Director

- 24.4. Aseptic Technologies

- 24.4.1. Company Snapshot

- 24.4.2. Interview Transcript: Julien Marechal, Business Development and Technology Director

- 24.5. BioPhorum Operations

- 24.5.1. Company Snapshot

- 24.5.2. Interview Transcript: Malcolm Gilmore, Former Facilitator

- 24.6. PYRAMID Laboratories

- 24.6.1. Company Snapshot

- 24.6.2. Interview Transcript: Konstantin Kazarian, Former Project Manager of Business Development

25. APPENDIX 1: TABULATED DATA

26. APPENDIX 2: LIST OF COMPANIES AND ORGANIZATION

List of Tables

- Table 5.1 Compatibility of Polymers with Ethylene Oxide Sterilization

- Table 5.2 Advantages and Disadvantages of Different Sterilization Techniques

- Table 6.1 Pre-Sterilized / Ready to Use Containers: Information on Type of Container, Material(s) of Fabrication, Container Color and Type of Compatible Drug(s)

- Table 6.2 Pre-Sterilized / Ready to Use Containers: Information on Scale of Operation, Packaging Format(s) and Sterilization Technique(s) Used

- Table 6.3 Pre-Sterilized / Ready to Use Containers: Information on Quality Certification(s) Obtained and Target Market

- Table 6.4 Pre-Sterilized / Ready to Use Containers: Information on Availability of Additional Coating and RTU Kits

- Table 6.5 Pre-Sterilized / Ready to Use Containers: List of Manufacturers

- Table 7.1 Pre-Sterilized / Ready to Use Closures: Information on Type of Closure, Material(s) of Fabrication, Type of Compatible Container(s), Type of Compatible Drug(s) and Sterilization Technique(s) Used

- Table 7.2 Pre-Sterilized / Ready to Use Closures: Information on Available Finish Format(s), Quality Certification(s) Obtained and Target Market

- Table 7.3 Pre-Sterilized / Ready to Use Closures: Information on Availability of Additional Coating

- Table 7.4 Pre-Sterilized / Ready to Use Closures: List of Manufacturers

- Table 11.1 Leading Ready to Use Container and Closure Manufacturers

- Table 11.2 APG Pharma Packaging: Company Snapshot

- Table 11.3 APG Pharma Packaging: Ready to Use Closures

- Table 11.4 Aptar: Company Snapshot

- Table 11.5 Aptar: Ready to Use Closures

- Table 11.6 Aptar: Recent Developments and Future Outlook

- Table 11.7 Daikyo Seiko: Company Snapshot

- Table 11.8 Daikyo Seiko: Ready to Use Containers

- Table 11.9 Daikyo Seiko: Ready to Use Closures

- Table 11.10 Datwyler: Company Snapshot

- Table 11.11 Datwyler: Ready to Use Closures

- Table 11.12 Datwyler: Recent Developments and Future Outlook

- Table 11.13 DWK Life Sciences: Company Snapshot

- Table 11.14 DWK Life Sciences: Ready to Use Containers

- Table 11.15 DWK Life Sciences: Ready to Use Closures

- Table 11.16 DWK Life Sciences: Recent Developments and Future Outlook

- Table 11.17 Ningbo Zhengli Pharmaceutical Packaging: Company Snapshot

- Table 11.18 Ningbo Zhengli Pharmaceutical Packaging: Ready to Use Containers

- Table 11.19 Ningbo Zhengli Pharmaceutical Packaging: Recent Developments and Future Outlook

- Table 11.20 SCHOTT: Company Snapshot

- Table 11.21 SCHOTT: Ready to Use Containers

- Table 11.22 SCHOTT: Ready to Use Closures

- Table 11.23 SCHOTT: Recent Developments and Future Outlook

- Table 11.24 Stevanato: Company Snapshot

- Table 11.25 Stevanato: Ready to Use Containers

- Table 11.26 Stevanato: Ready to Use Closures

- Table 11.27 Stevanato: Recent Developments and Future Outlook

- Table 11.28 West Pharmaceutical Services: Company Snapshot

- Table 11.29 West Pharmaceutical Services: Ready to Use Containers

- Table 11.30 West Pharmaceutical Services: Ready to Use Closures

- Table 11.31 West Pharmaceutical Services: Recent Developments and Future Outlook

- Table 12.1 Pre-Sterilized / Ready to Use Containers and Closures: List of Partnerships and Collaborations, since 2015

- Table 14.1 Global Demand for Pre-Sterilized / Ready to Use Pharmaceutical Packaging, Current Year and 2035: Distribution by Type of Container

- Table 14.2 Global Demand for Pre-Sterilized / Ready to Use Pharmaceutical Packaging, Current Year and 2035: Distribution by Type of Closure

- Table 14.3 Global Demand for Pre-Sterilized / Ready to Use Pharmaceutical Packaging, Current Year and 2035: Distribution by Material of Fabrication

- Table 14.4 Global Demand for Pre-Sterilized / Ready to Use Pharmaceutical Packaging, Current Year and 2035: Distribution by Key Geographical Regions

- Table 16.1 Tiered Pricing Structure for Pre-Sterilized / RTU Pharmaceutical Packaging across Different Geographies

- Table 22.1 List of Pharmaceutical Robotics Manufacturers

- Table 22.2 Aseptic Technologies: Company Overview

- Table 22.3 Aseptic Technologies: Key Specifications of Crystal L1 Robot Line

- Table 22.4 Aseptic Technologies: Key Specifications of Crystal SL1 Robot Line

- Table 22.5 AST: Company Overview

- Table 22.6 AST: Key Specifications of ASEPTiCell

- Table 22.7 AST: Key Specifications of GENiSYS R

- Table 22.8 AST: Key Specifications of GENiSYS C

- Table 22.9 AST: Key Specifications of GENiSYS Lab

- Table 22.10 Bosch Packaging Technology: Company Overview

- Table 22.11 Bosch Packaging Technology: Key Specifications of ATO

- Table 22.12 Dara Pharma: Company Overview

- Table 22.13 Dara Pharma: Key Specifications of SYX-E Cartridge + RABS

- Table 22.14 Fedegari: Company Overview

- Table 22.15 Fedegari: Key Specifications of Fedegari Isolator

- Table 22.16 IMA: Company Overview

- Table 22.17 IMA: Key Specifications of INJECTA

- Table 22.18 IMA: Key Specifications of STERI LIF3

- Table 22.19 Steriline: Company Overview

- Table 22.20 Steriline: Key Specifications of Robotic Nest Filling Machine

- Table 22.21 Steriline: Key Specifications of Robotic Vial Filling Machine

- Table 22.22 Steriline: Key Specifications of Robotic Vial Capping Machine)

- Table 22.23 Vanrx Pharmasystems: Company Overview

- Table 22.24 Vanrx Pharmasystems: Key Specifications of Microcell Vial Filler

- Table 22.25 Key Specifications of SA25 Aseptic Filling Workcell

- Table 24.1 Jinan Youlyy Industrial: Company Snapshot

- Table 24.2 Sagar Rubber: Company Snapshot

- Table 24.3 Aseptic Technologies: Company Snapshot

- Table 24.4 BioPhorum Operations: Company Snapshot

- Table 24.5 PYRAMID Laboratories: Company Snapshot

- Table 25.1 Pre-Sterilized / Ready to Use Containers: Distribution by Type of Container

- Table 25.2 Pre-Sterilized / Ready to Use Containers: Distribution by Material(s) of Fabrication

- Table 25.3 Pre-Sterilized / Ready to Use Containers: Distribution by Container Color

- Table 25.4 Pre-Sterilized / Ready to Use Containers: Distribution by Type of Compatible Drug(s)

- Table 25.5 Pre-Sterilized / Ready to Use Containers: Distribution by Scale of Operation

- Table 25.6 Pre-Sterilized / Ready to Use Containers: Distribution by Packaging Format(s)

- Table 25.7 Pre-Sterilized / Ready to Use Containers: Distribution by Sterilization Technique(s) Used

- Table 25.8 Pre-Sterilized / Ready to Use Containers: Distribution by Quality Certification(s) Obtained

- Table 25.9 Pre-Sterilized / Ready to Use Containers: Distribution by Target Market

- Table 25.10 Pre-Sterilized / Ready to Use Containers: Distribution by Availability of Additional Coating

- Table 25.11 Pre-Sterilized / Ready to Use Containers: Distribution by Availability of RTU Kits

- Table 25.12 Pre-Sterilized / Ready to Use Container Manufacturers: Distribution by Year of Establishment

- Table 25.13 Pre-Sterilized / Ready to Use Container Manufacturers: Distribution by Company Size

- Table 25.14 Pre-Sterilized / Ready to Use Container Manufacturers: Distribution by Location of Headquarters (Region-wise)

- Table 25.15 Pre-Sterilized / Ready to Use Container Manufacturers: Distribution by Location of Headquarters (Country-wise)

- Table 25.16 Leading Manufacturers: Distribution by Number of Products

- Table 25.17 Pre-Sterilized / Ready to Use Closures: Distribution by Type of Closure

- Table 25.18 Pre-Sterilized / Ready to Use Closures: Distribution by Material(s) of Fabrication

- Table 25.19 Pre-Sterilized / Ready to Use Closures: Distribution by Type of Compatible Container(s)

- Table 25.20 Pre-Sterilized / Ready to Use Closures: Distribution by Type of Compatible Drug(s)

- Table 25.21 Pre-Sterilized / Ready to Use Closures: Distribution by Sterilization Technique(s) Used

- Table 25.22 Pre-Sterilized / Ready to Use Closures: Distribution by Available Finish Format(s)

- Table 25.23 Pre-Sterilized / Ready to Use Closures: Distribution by Quality Certification(s) Obtained

- Table 25.24 Pre-Sterilized / Ready to Use Closures: Distribution by Target Market

- Table 25.25 Pre-Sterilized / Ready to Use Closures: Distribution by Availability of Additional Coating

- Table 25.26 Pre-Sterilized / Ready to Use Closure Manufacturers: Distribution by Year of Establishment

- Table 25.27 Pre-Sterilized / Ready to Use Closure Manufacturers: Distribution by Company Size

- Table 25.28 Pre-Sterilized / Ready to Use Closure Manufacturers: Distribution by Location of Headquarters (Region-wise)

- Table 25.29 Pre-Sterilized / Ready to Use Closure Manufacturers: Distribution by Location of Headquarters (Country-wise)

- Table 25.30 Leading Manufacturers: Distribution by Number of Products

- Table 25.31 Key Insights: Distribution by Type of Container and Scale of Operation

- Table 25.32 Key Insights: Distribution by Type of Container and Packaging Format(s)

- Table 25.33 Key Insights: Distribution by Type of Container and Material(s) of Fabrication

- Table 25.34 Key Insights: Distribution by Type of Container and Container Color

- Table 25.35 Key Insights: Distribution by Type of Container and Sterilization Technique(s) Used

- Table 25.36 Key Insights: Distribution by Type of Container and Type of Compatible Drug(s)

- Table 25.37 Key Insights: Distribution by Material(s) of Fabrication and Sterilization Technique(s) Used

- Table 25.38 Key Insights: Distribution by Type of Closure and Material(s) of Fabrication

- Table 25.39 Key Insights: Distribution by Type of Closure and Sterilization Technique(s) Used

- Table 25.40 Key Insights: Distribution by Type of Closure and Available Finish Format(s)

- Table 25.41 Key Insights: Distribution by Type of Closure and Type of Compatible Drug(s)

- Table 25.42 Aptar: Annual Revenues, FY 2016 Onwards (USD Billion)

- Table 25.43 Datwyler: Annual Revenues, FY 2016 Onwards (CHF Billion)

- Table 25.44 SCHOTT: Annual Revenues, FY 2019 Onwards (EUR Billion)

- Table 25.45 West Pharmaceutical Services: Annual Revenues, FY 2018 Onwards (USD Billion)

- Table 25.46 Partnerships and Collaborations: Cumulative Year-wise Trend, since 2015

- Table 25.47 Partnerships and Collaborations: Distribution by Type of Partnership

- Table 25.48 Partnerships and Collaborations: Distribution by Year of Partnership and Type of Partnership

- Table 25.49 Partnerships and Collaborations: Distribution by Type of Partner

- Table 25.50 Partnerships and Collaborations: Distribution by Year of Partnership and Type of Partner, since 2015

- Table 25.51 Partnerships and Collaborations: Distribution by Type of Partnership and Type of Partner

- Table 25.52 Partnerships and Collaborations: Distribution by Purpose(s) of Partnership

- Table 25.53 Partnerships and Collaborations: Distribution by Type of Packaging System

- Table 25.54 Partnerships and Collaborations: Distribution by Type of Packaging Material

- Table 25.55 Most Active Players: Distribution by Number of Partnerships

- Table 25.56 Partnerships and Collaborations: Local and International Agreements

- Table 25.57 Partnerships and Collaborations: Intercontinental and Intracontinental Agreements

- Table 25.58 Global Demand for Pre-Sterilized / Ready to Use Pharmaceutical Packaging, till 2035: Distribution by Type of Container

- Table 25.59 Demand for Pre-Sterilized / Ready to Use Vials, till 2035

- Table 25.60 Demand for Pre-Sterilized / Ready to Use Syringes, till 2035

- Table 25.61 Demand for Pre-Sterilized / Ready to Use Cartridges, till 2035

- Table 25.62 Demand for Pre-Sterilized / Ready to Use Pharmaceutical Packaging, till 2035: Distribution by Type of Closure

- Table 25.63 Demand for Pre-Sterilized / Ready to Use Caps, till 2035

- Table 25.64 Demand for Pre-Sterilized / Ready to Use Plungers, till 2035

- Table 25.65 Demand for Pre-Sterilized / Ready to Use Seals, till 2035

- Table 25.66 Demand for Pre-Sterilized / Ready to Use Stoppers, till 2035

- Table 25.67 Demand for Pre-Sterilized / Ready to Use Tip Caps / Needle Shields, till 2035

- Table 25.68 Global Demand for Pre-Sterilized / Ready to Use Pharmaceutical Packaging, till 2035: Distribution by Material of Fabrication

- Table 25.69 Demand for Pre-Sterilized / Ready to Use Pharmaceutical Packaging for Aluminum Containers and Closures, till 2035

- Table 25.70 Demand for Pre-Sterilized / Ready to Use Pharmaceutical Packaging for Glass Containers and Closures, till 2035

- Table 25.71 Demand for Pre-Sterilized / Ready to Use Pharmaceutical Packaging for Plastic Containers and Closures, till 2035

- Table 25.72 Demand for Pre-Sterilized / Ready to Use Pharmaceutical Packaging for Rubber Containers and Closures, till 2035

- Table 25.73 Global Demand for Pre-Sterilized / Ready to Use Pharmaceutical Packaging, till 2035: Distribution by Geography

- Table 25.74 Demand for Pre-Sterilized / Ready to Use Pharmaceutical Packaging in North America, till 2035

- Table 25.75 Demand for Pre-Sterilized / Ready to Use Pharmaceutical Packaging in Europe, till 2035

- Table 25.76 Demand for Pre-Sterilized / Ready to Use Pharmaceutical Packaging in Asia, till 2035

- Table 25.77 Demand for Pre-Sterilized / Ready to Use Pharmaceutical Packaging in Latin America, till 2035

- Table 25.78 Demand for Pre-Sterilized / Ready to Use Pharmaceutical Packaging in Middle East and North Africa, till 2035

- Table 25.79 Demand for Pre-Sterilized / Ready to Use Pharmaceutical Packaging in Rest of the World, till 2035

- Table 25.80 Global Pre-Sterilized / Ready to Use Pharmaceutical Packaging Market, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- Table 25.81 Global Pre-Sterilized / Ready to Use Pharmaceutical Packaging Market, till 2035: Optimistic Scenario

- Table 25.82 Global Pre-Sterilized / Ready to Use Pharmaceutical Packaging Market, till 2035: Conservative Scenario

- Table 25.83 Pre-Sterilized / Ready to Use Pharmaceutical Packaging Market for Vials: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- Table 25.84 Pre-Sterilized / Ready to Use Pharmaceutical Packaging Market for Syringes: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- Table 25.85 Pre-Sterilized / Ready to Use Pharmaceutical Packaging Market for Cartridges: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- Table 25.86 Pre-Sterilized / Ready to Use Pharmaceutical Packaging Market for Caps: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- Table 25.87 Pre-Sterilized / Ready to Use Pharmaceutical Packaging Market for Plungers: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- Table 25.88 Pre-Sterilized / Ready to Use Pharmaceutical Packaging Market for Seals: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- Table 25.89 Pre-Sterilized / Ready to Use Pharmaceutical Packaging Market for Stoppers: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- Table 25.90 Pre-Sterilized / Ready to Use Pharmaceutical Packaging Market for Tip Caps / Needle Shields: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- Table 25.91 Pre-Sterilized / Ready to Use Pharmaceutical Packaging Market for Aluminum Containers and Closures: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- Table 25.92 Pre-Sterilized / Ready to Use Pharmaceutical Packaging Market for Glass Containers and Closures: Historical Trends (since 2018) and Forecasted Estimates (20232035)

- Table 25.93 Pre-Sterilized / Ready to Use Pharmaceutical Packaging Market for Plastic Containers and Closures: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- Table 25.94 Pre-Sterilized / Ready to Use Pharmaceutical Packaging Market for Rubber Containers and Closures: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- Table 25.95 Pre-Sterilized / Ready to Use Pharmaceutical Packaging Market in North America: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- Table 25.96 Pre-Sterilized / Ready to Use Pharmaceutical Packaging Market for Containers in North America: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- Table 25.97 Pre-Sterilized / Ready to Use Pharmaceutical Packaging Market for Closures in North America: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- Table 25.98 Pre-Sterilized / Ready to Use Pharmaceutical Packaging Market in Europe: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- Table 25.99 Pre-Sterilized / Ready to Use Pharmaceutical Packaging Market for Containers in Europe: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- Table 25.100 Pre-Sterilized / Ready to Use Pharmaceutical Packaging Market for Closures in Europe: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- Table 25.101 Pre-Sterilized / Ready to Use Pharmaceutical Packaging Market in Asia: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- Table 25.102 Pre-Sterilized / Ready to Use Pharmaceutical Packaging Market for Containers in Asia: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- Table 25.103 Pre-Sterilized / Ready to Use Pharmaceutical Packaging Market for Closures in Asia: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- Table 25.104 Pre-Sterilized / Ready to Use Pharmaceutical Packaging Market in Latin America: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- Table 25.105 Pre-Sterilized / Ready to Use Pharmaceutical Packaging Market for Containers in Latin America: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- Table 25.106 Pre-Sterilized / Ready to Use Pharmaceutical Packaging Market for Closures in Latin America: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- Table 25.107 Pre-Sterilized / Ready to Use Pharmaceutical Packaging Market in Middle East and North Africa: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- Table 25.108 Pre-Sterilized / Ready to Use Pharmaceutical PackagingMarket for Containers in Middle East and North Africa: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- Table 25.109 Pre-Sterilized / Ready to Use Pharmaceutical Packaging Market for Closures in Middle East and North Africa: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- Table 25.110 Pre-Sterilized / Ready to Use Pharmaceutical Packaging Market in Rest of the World: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- Table 25.111 Pre-Sterilized / Ready to Use Pharmaceutical Packaging Market for Containers in Rest of the World: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- Table 25.112 Pre-Sterilized / Ready to Use Pharmaceutical Packaging Market for Closures in Rest of the World: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

List of Figures

- Figure 2.1 Research Methodology: Research Methodology

- Figure 2.2 Research Methodology: Forecast Methodology

- Figure 2.3 Research Methodology: Robust Quality Control

- Figure 2.4 Research Methodology: Key Market Segmentation

- Figure 4.1 Executive Summary: Pre-Sterilized / Ready to Use Containers Market Landscape

- Figure 4.2 Executive Summary: Pre-Sterilized / Ready to Use Closures Market Landscape

- Figure 4.3 Executive Summary: Partnerships and Collaborations

- Figure 4.4 Executive Summary: Market Entry Decision Making Framework

- Figure 4.5 Executive Summary: Demand Analysis

- Figure 4.6 Executive Summary: Market Sizing and Opportunity Analysis

- Figure 5.1 Advantages of Pharmaceutical Packaging

- Figure 5.2 Type of Pharmaceutical Packaging

- Figure 5.3 Innovation in Pharmaceutical Packaging and Value Chain

- Figure 5.4 Ready to Use Enables Flexible, Flexible Aseptic Processing

- Figure 5.5 Advantages of Ready to Use Platform

- Figure 5.6 Drivers of Ready to Use Platform

- Figure 6.1 Pre-Sterilized / Ready to Use Containers: Distribution by Type of Container

- Figure 6.2 Pre-Sterilized / Ready to Use Containers: Distribution by Material(s) of Fabrication

- Figure 6.3 Pre-Sterilized / Ready to Use Containers: Distribution by Container Color

- Figure 6.4 Pre-Sterilized / Ready to Use Containers: Distribution by Type of Compatible Drug(s)

- Figure 6.5 Pre-Sterilized / Ready to Use Containers: Distribution by Scale of Operation

- Figure 6.6 Pre-Sterilized / Ready to Use Containers: Distribution by Packaging Format(s)

- Figure 6.7 Pre-Sterilized / Ready to Use Containers: Distribution by Sterilization Technique(s) Used

- Figure 6.8 Pre-Sterilized / Ready to Use Containers: Distribution by Quality Certification(s) Obtained

- Figure 6.9 Pre-Sterilized / Ready to Use Containers: Distribution by Target Market

- Figure 6.10 Pre-Sterilized / Ready to Use Containers: Distribution by Availability of Additional Coating

- Figure 6.11 Pre-Sterilized / Ready to Use Containers: Distribution by Availability of RTU Kits

- Figure 6.12 Pre-Sterilized / Ready to Use Container Manufacturers: Distribution by Year of Establishment

- Figure 6.13 Pre-Sterilized / Ready to Use Container Manufacturers: Distribution by Company Size

- Figure 6.14 Pre-Sterilized / Ready to Use Container Manufacturers: Distribution by Location of Headquarters (Region-wise)

- Figure 6.15 Pre-Sterilized / Ready to Use Container Manufacturers: Distribution by Location of Headquarters (Country-wise)

- Figure 6.16 Leading Manufacturers: Distribution by Number of Products

- Figure 7.1 Pre-Sterilized / Ready to Use Closures: Distribution by Type of Closure

- Figure 7.2 Pre-Sterilized / Ready to Use Closures: Distribution by Material(s) of Fabrication

- Figure 7.3 Pre-Sterilized / Ready to Use Closures: Distribution by Type of Compatible Container(s)

- Figure 7.4 Pre-Sterilized / Ready to Use Closures: Distribution by Type of Compatible Drug(s)

- Figure 7.5 Pre-Sterilized / Ready to Use Closures: Distribution by Sterilization Technique(s) Used

- Figure 7.6 Pre-Sterilized / Ready to Use Closures: Distribution by Available Finish Format(s)

- Figure 7.7 Pre-Sterilized / Ready to Use Closures: Distribution by Quality Certification(s) Obtained

- Figure 7.8 Pre-Sterilized / Ready to Use Closures: Distribution by Target Market

- Figure 7.9 Pre-Sterilized / Ready to Use Closures: Distribution by Availability of Additional Coating

- Figure 7.10 Pre-Sterilized / Ready to Use Closure Manufacturers: Distribution by Year of Establishment

- Figure 7.11 Pre-Sterilized / Ready to Use Closure Manufacturers: Distribution by Company Size

- Figure 7.12 Pre-Sterilized / Ready to Use Closure Manufacturers: Distribution by Location of Headquarters (Region-wise)

- Figure 7.13 Pre-Sterilized / Ready to Use Closure Manufacturers: Distribution by Location of Headquarters (Country-wise)

- Figure 7.14 Leading Manufacturers: Distribution by Number of Products

- Figure 8.1 Key Insights: Distribution by Type of Container and Scale of Operation

- Figure 8.2 Key Insights: Distribution by Type of Container and Packaging Format(s)

- Figure 8.3 Key Insights: Distribution by Type of Container and Material(s) of Fabrication

- Figure 8.4 Key Insights: Distribution by Type of Container and Container Color

- Figure 8.5 Key Insights: Distribution by Type of Container and Sterilization Technique(s) Used

- Figure 8.6 Key Insights: Distribution by Type of Container and Type of Compatible Drug(s)

- Figure 8.7 Key Insights: Distribution by Material(s) of Fabrication and Sterilization Technique(s) Used

- Figure 8.8 Key Insights: Distribution by Type of Closure and Material(s) of Fabrication

- Figure 8.9 Key Insights: Distribution by Type of Closure and Sterilization Technique(s) Used

- Figure 8.10 Key Insights: Distribution by Type of Closure and Available Finish Format(s)

- Figure 8.11 Key Insights: Distribution by Type of Closure and Type of Compatible Drug(s)

- Figure 9.1 Product Competitiveness Analysis: Vials

- Figure 9.2 Product Competitiveness Analysis: Syringes

- Figure 9.3 Product Competitiveness Analysis: Bags

- Figure 9.4 Product Competitiveness Analysis: Cartridges

- Figure 10.1 Product Competitiveness Analysis: Stoppers

- Figure 10.2 Product Competitiveness Analysis: Plungers

- Figure 10.3 Product Competitiveness Analysis: Caps

- Figure 10.4 Product Competitiveness Analysis: Tip Caps / Needle Shields

- Figure 10.5 Product Competitiveness Analysis: Seals

- Figure 11.1 Aptar: Annual Revenues, FY 2016 Onwards (USD Billion)

- Figure 11.2 Datwyler: Annual Revenues, FY 2016 Onwards (CHF Billion)

- Figure 11.3 SCHOTT: Annual Revenues, FY 2019 Onwards (EUR Billion)

- Figure 11.4 West Pharmaceutical Services: Annual Revenues (USD Billion)

- Figure 12.1 Partnerships and Collaborations: Cumulative Year-wise Trend, since 2015

- Figure 12.2 Partnerships and Collaborations: Distribution by Type of Partnership

- Figure 12.3 Partnerships and Collaborations: Distribution by Year and Type of Partnership

- Figure 12.4 Partnerships and Collaborations: Distribution by Type of Partner

- Figure 12.5 Partnerships and Collaborations: Distribution by Year of Partnership and Type of Partner, since 2015

- Figure 12.6 Partnerships and Collaborations: Distribution by Type of Partnership and Type of Partner

- Figure 12.7 Partnerships and Collaborations: Distribution by Purpose of Partnership

- Figure 12.8 Partnerships and Collaborations: Distribution by Type of Packaging System

- Figure 12.9 Partnerships and Collaborations: Distribution by Type of Packaging Material

- Figure 12.10 Most Active Players: Distribution by Number of Partnerships

- Figure 12.11 Partnerships and Collaborations: Local and International Agreements

- Figure 12.12 Partnerships and Collaborations: Intercontinental and Intracontinental Agreements

- Figure 13.1 Spider Web Analysis: Product Reach

- Figure 13.2 Spider Web Analysis: Product Differentiation

- Figure 13.3 Spider Web Analysis: Market Activity

- Figure 13.4 Spider Web Analysis: Product Competitiveness

- Figure 13.5 Spider Web Analysis: Manufacturing Complexity

- Figure 13.6 Market Entry Decision Making Framework: Concluding Remarks

- Figure 14.1 Demand for Pre-Sterilized / Ready to Use Vials, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- Figure 14.2 Demand for Pre-Sterilized / Ready to Use Syringes, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- Figure 14.3 Demand for Pre-Sterilized / Ready to Use Cartridges, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- Figure 14.4 Demand for Pre-Sterilized / Ready to Use Caps, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- Figure 14.5 Demand for Pre-Sterilized / Ready to Use Plungers, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- Figure 14.6 Demand for Pre-Sterilized / Ready to Use Seals, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- Figure 14.7 Demand for Pre-Sterilized / Ready to Use Stoppers, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- Figure 14.8 Demand for Pre-Sterilized / Ready to Use Tip Caps / Needle Shields, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- Figure 14.9 Demand for Pre-Sterilized / Ready to Use Aluminum Containers and Closures, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- Figure 14.10 Demand for Pre-Sterilized / Ready to Use Glass Containers and Closures, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- Figure 14.11 Demand for Pre-Sterilized / Ready to Use Plastic Containers and Closures, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- Figure 14.12 Demand for Pre-Sterilized / Ready to Use Rubber Containers and Closures, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- Figure 14.13 Demand for Pre-Sterilized / Ready to Use Pharmaceutical Packaging in North America, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- Figure 14.14 Demand for Pre-Sterilized / Ready to Use Pharmaceutical Packaging in Europe, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- Figure 14.15 Demand for Pre-Sterilized / Ready to Use Pharmaceutical Packaging in Asia, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- Figure 14.16 Demand for Pre-Sterilized / Ready to Use Pharmaceutical Packaging in Latin America, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- Figure 14.17 Demand for Pre-Sterilized / Ready to Use Pharmaceutical Packaging in Middle East and North Africa, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- Figure 14.18 Demand for Pre-Sterilized / Ready to Use Pharmaceutical Packaging in Rest of the World, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- Figure 16.1 Percentage Distribution of Production and Processing Costs for Primary Packaging Components

- Figure 16.2 Global Pre-Sterilized / Ready to Use Pharmaceutical Packaging Market, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- Figure 16.3 Global Pre-Sterilized / Ready to Use Pharmaceutical Packaging Market, till 2035: Conservative Scenario

- Figure 16.4 Global Pre-Sterilized / Ready to Use Pharmaceutical Packaging Market, till 2035: Optimistic Scenario

- Figure 16.5 Dynamic Dashboard

- Figure 17.1 Pre-Sterilized / Ready to Use Pharmaceutical Packaging Market: Distribution by Type of Container, 2018, Current Year and 2035 (USD Billion)

- Figure 17.2 Pre-Sterilized / Ready to Use Pharmaceutical Packaging Market for Vials: Historical Trends (since 2018) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 17.3 Pre-Sterilized / Ready to Use Pharmaceutical Packaging Market for Syringes: Historical Trends (since 2018) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 17.4 Pre-Sterilized / Ready to Use Pharmaceutical Packaging Market for Cartridges: Historical Trends (since 2018) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 18.1 Pre-Sterilized / Ready to Use Pharmaceutical Packaging Market: Distribution by Type of Closure, 2018, Current Year and 2035 (USD Billion)

- Figure 18.2 Pre-Sterilized / Ready to Use Pharmaceutical Packaging Market for Caps: Historical Trends (since 2018) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 18.3 Pre-Sterilized / Ready to Use Pharmaceutical Packaging Market for Plungers: Historical Trends (since 2018) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 18.4 Pre-Sterilized / Ready to Use Pharmaceutical Packaging Market for Seals: Historical Trends (since 2018) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 18.5 Pre-Sterilized / Ready to Use Pharmaceutical Packaging Market for Stoppers: Historical Trends (since 2018) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 18.6 Pre-Sterilized / Ready to Use Pharmaceutical Packaging Market for Tip Caps / Needle Shields: Historical Trends (since 2018) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 19.1 Pre-Sterilized / Ready to Use Pharmaceutical Packaging Market for Aluminum Containers and Closures: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- Figure 19.2 Pre-Sterilized / Ready to Use Pharmaceutical Packaging Market for Glass Containers and Closures: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- Figure 19.3 Pre-Sterilized / Ready to Use Pharmaceutical Packaging Market for Plastic Containers and Closures: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- Figure 19.4 Pre-Sterilized / Ready to Use Pharmaceutical Packaging Market for Rubber Containers and Closures: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- Figure 20.1 Pre-Sterilized / Ready to Use Pharmaceutical Packaging Market in North America: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- Figure 20.2 Pre-Sterilized / Ready to Use Pharmaceutical Packaging Market for Containers in North America: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- Figure 20.3 Pre-Sterilized / Ready to Use Pharmaceutical Packaging Market for Closures in North America: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- Figure 20.4 Pre-Sterilized / Ready to Use Pharmaceutical Packaging Market in Europe: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- Figure 20.5 Pre-Sterilized / Ready to Use Pharmaceutical Packaging Market for Containers in Europe: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- Figure 20.6 Pre-Sterilized / Ready to Use Pharmaceutical Packaging Market for Closures in Europe: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- Figure 20.7 Pre-Sterilized / Ready to Use Pharmaceutical Packaging Market in Asia: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- Figure 20.8 Pre-Sterilized / Ready to Use Pharmaceutical Packaging Market for Containers in Asia: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- Figure 20.9 Pre-Sterilized / Ready to Use Pharmaceutical Packaging Market for Closures in Asia: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- Figure 20.10 Pre-Sterilized / Ready to Use Pharmaceutical Packaging Market in Latin America: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- Figure 20.11 Pre-Sterilized / Ready to Use Pharmaceutical Packaging Market for Containers in Latin America: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- Figure 20.12 Pre-Sterilized / Ready to Use Pharmaceutical Packaging Market for Closures in Latin America: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- Figure 20.13 Pre-Sterilized / Ready to Use Pharmaceutical Packaging Market in Middle East and North Africa: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- Figure 20.14 Pre-Sterilized / Ready to Use Pharmaceutical Packaging Market for Containers in Middle East and North Africa: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- Figure 20.15 Pre-Sterilized / Ready to Use Pharmaceutical Packaging Market for Closures in Middle East and North Africa: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- Figure 20.6 Pre-Sterilized / Ready to Use Pharmaceutical Packaging Market in Rest of the World: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- Figure 20.17 Pre-Sterilized / Ready to Use Pharmaceutical Packaging Market for Containers in Rest of the World: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- Figure 20.18 Pre-Sterilized / Ready to Use Pharmaceutical Packaging Market for Closures in Rest of the World: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- Figure 21.1 Emerging Trends in Pharmaceutical Packaging

- Figure 21.2 Future Growth Opportunities for Ready to Use Containers and Closures Based on Recent Trends

- Figure 22.1 Key Considerations for Selecting a Robotic System

- Figure 22.2 Pharmaceutical Manufacturing: Advantages of Robotic Systems

- Figure 22.3 Pharmaceutical Manufacturing: Disadvantages of Robotic Systems

- Figure 23.1 Concluding Remarks: Pre-Sterilized / Ready to Use Containers Market Landscape

- Figure 23.2 Concluding Remarks: Pre-Sterilized / Ready to Use Closures Market Landscape

- Figure 23.3 Concluding Remarks: Partnerships and Collaborations

- Figure 23.4 Concluding Remarks: Market Entry Decision Making Framework

- Figure 23.5 Concluding Remarks: Demand Analysis

- Figure 23.6 Concluding Remarks: Market Forecast