|

市場調查報告書

商品編碼

1682707

醫療保健的數位雙胞胎市場:各治療領域,數位雙胞胎類別,各應用領域,各終端用戶,各主要地區:2035年前的產業趨勢與全球預測Digital Twins in Healthcare Market by Therapeutic Area, Type of Digital Twin, Areas of Application, End Users and Key Geographical Regions : Industry Trends and Global Forecasts, Till 2035 |

||||||

預計到 2035 年,全球醫療保健數位孿生市場規模將從目前的 19 億美元增長至 334 億美元,預測期內複合年增長率為 30%。

近年來,人工智慧、深度學習、機器學習、大數據等技術取得了令人矚目的進步。這些項目目前正吸引醫療保健領域公司的極大興趣。因此,行業利益相關者正在致力於推動創新並利用上述技術來提高現有流程的效能。在這些技術中,數位孿生已成為醫療保健領域一項很有前景的技術。在此背景下,值得一提的是,數位孿生本質上是一種虛擬模型,它使用真實世界的數據來創建可以預測系統或流程表現的模擬。具體來說,在醫療保健領域,數位孿生可用於預測風險、降低勞動成本、改善病患照護並實現決策過程自動化。此外,醫療保健領域的公司越來越有可能採用數位孿生概念來降低研發成本。在個人化醫療、虛擬模擬和自動化技術日益增長的需求的推動下,醫療保健領域的數位孿生預計將實現顯著成長。

目前,已有 90 多個數位孿生應用於商業或正在開發中,用於各種醫療相關的應用,包括診斷、健康監測和手術規劃。

產業提供的數位孿生中超過 42% 是流程孿生,其中大部分主要用於資產/流程管理、個人化護理和手術規劃。值得注意的是,過去三年來,該行業的合作活動以超過20%的速度成長,其中超過45%的合作是在過去兩年內達成的。許多私人和公共投資者正在提供大量資本投資來支持正在進行的創新。數位孿生市場中的新創公司正在逐步採用人工智慧和區塊鏈等先進創新技術,以與競爭對手區分開來。隨著人們對遠距病人監控、預測分析、個人化治療和物聯網整合的興趣日益濃厚,醫療保健領域的數位孿生市場預計將在短期內穩步增長。由於數位孿生技術在醫療保健和製藥行業的應用日益廣泛,預計到 2035 年,醫療保健領域的全球數位孿生市場將以每年 30% 的速度成長。

本報告提供全球醫療保健的數位雙胞胎市場相關調查,提供市場概要,以及各治療領域,數位雙胞胎類別,各應用領域,各終端用戶,各主要地區的趨勢,及加入此市場的主要企業簡介等資訊。

目錄

第1章 序文

第2章 調查手法

第3章 經濟以及其他的計劃特有的考慮事項

第4章 摘要整理

第5章 簡介

第6章 市場形勢

第7章 重要的洞察

第8章 企業競爭力分析

第9章 詳細的企業簡介

- 章概要

- BigBear.ai

- Certara

- Dassault Systemes

- NavvTrack

- Unlearn.ai

第10章 企業簡介一覽

第11章 夥伴關係和合作

第12章 資金籌措和投資的分析

第13章 BERKUSStart-Ups的評估分析

第14章 對市場的影響分析:促進因素,阻礙因素,機會,課題

第15章 全球醫療保健的數位雙胞胎市場

第16章 醫療保健的數位雙胞胎市場,各治療領域

第17章 醫療保健的數位雙胞胎市場,數位雙胞胎各類型

第18章 醫療保健的數位雙胞胎市場,各應用領域

第19章 醫療保健的數位雙胞胎市場,各終端用戶

第20章 醫療保健的數位雙胞胎市場,各主要地區

第21章 結論

第22章 執行洞察

第23章 附錄I:表格形式資料

第24章 附錄II:企業及團體一覽

DIGITAL TWINS IN HEALTHCARE MARKET: OVERVIEW

As per Roots Analysis, the global digital twins in healthcare market is estimated to grow from USD 1.9 billion in the current year to USD 33.4 billion by 2035, at a CAGR of 30% during the forecast period, till 2035.

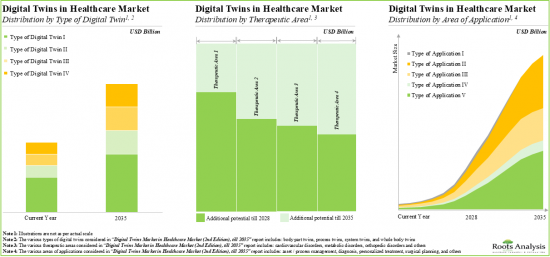

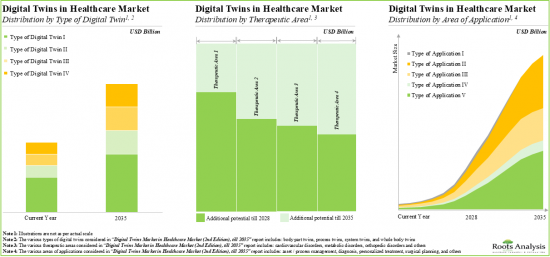

The market opportunity for cell and gene therapy supply chain software has been distributed across the following segments:

Therapeutic Area

- Cardiovascular Disorders

- Metabolic Disorders

- Orthopedic Disorders

- Other Disorders

Type of Digital Twin

- Process Twins

- System Twins

- Whole Body Twins

- Body Part Twins

Area of Application

- Asset / Process Management

- Personalized Treatment

- Surgical Planning

- Diagnosis

- Other Applications

End Users

- Pharmaceutical Companies

- Medical Device Manufacturers

- Healthcare Providers

- Patients

- Other End Users

Key Geographical Regions

- North America

- Europe

- Asia

- Latin America

- Middle East and North Africa

- Rest of the World

DIGITAL TWINS IN HEALTHCARE MARKET: GROWTH AND TRENDS

In recent years, there have been significant advancements related to technologies, such as artificial intelligence, deep learning and machine learning and big data. These programs have now garnered significant interest of players engaged in the healthcare domain. Consequently, the industry stakeholders are undertaking efforts to drive innovation and improve the performance of the existing processes, using the aforementioned technologies. Amidst these technologies, digital twins have emerged as a promising technique for use in the healthcare sector. In this context, it is worth mentioning that a digital twin, in its essence, is a virtual model that employs real-world data to create simulations, which are capable of predicting the performance of a system or process. Specifically, in the healthcare domain, digital twins can be applied for risk prediction, lowering labor costs, providing improved patient care and automated decision-making process. Further, players engaged in the healthcare domain may increasingly adopt the digital twin concept to cut down their research and development costs. Driven by the growing demand for personalized medicine, virtual simulation and automated technologies, the digital twin in healthcare is poised to witness substantial growth.

DIGITAL TWINS IN HEALTHCARE MARKET: KEY INSIGHTS

The report delves into the current state of the digital twins in healthcare market and identifies potential growth opportunities within the industry. Some key findings from the report include:

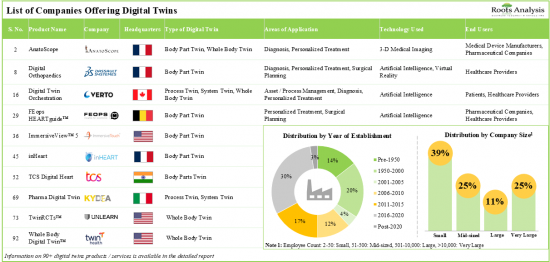

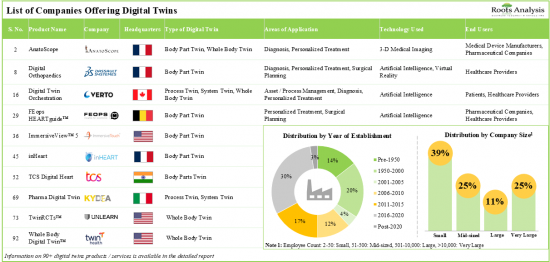

- Currently, over 90 digital twins are either commercially available in the market or are under development for various healthcare related applications including diagnosis, health monitoring and surgical planning.

- Over 42% of the digital twins offered by industry players are process twins; majority of the twins are primarily intended for asset / process management, personalized treatment and surgical planning.

- The partnership activity in this industry has grown at a rate of over 20% in the past three years; it is worth noting that over 45% of the deals have been signed in the last two years.

- To support the ongoing innovations, several private and public investors have made substantial capital investments; notably, most of the funding rounds took place in the past few years.

- Start-ups in the digital twin market are gradually adopting advanced and innovative technologies, such as artificial intelligence and blockchain, in order to differentiate themselves from their competitors.

- Owing to the growing interest towards remote patient monitoring, predictive analytics, personalized treatment, and IoT integration, the market for digital twins in healthcare will increase steadily in the foreseeable future.

- Driven by increasing adoption of digital twin technologies in healthcare and pharmaceutical industries, it is anticipated that the global digital twins market in healthcare domain is likely to grow at an annualized rate of 30%, till 2035.

DIGITAL TWINS IN HEALTHCARE MARKET: KEY SEGMENTS

Cardiovascular Disorders are Likely to Dominate the Digital Twins in Healthcare Market

Based on the therapeutic areas, the market is segmented into cardiovascular disorders, metabolic disorders, orthopedic disorders and other disorders. At present, cardiovascular disorders hold the maximum share of the digital twins in healthcare market. This trend is unlikely to change in the near future.

Asset / Process Management Segment Occupies the Largest Share of the Digital Twins in Healthcare Market

Based on the areas of application, the market is segmented into asset / process management, personalized treatment, surgical planning, diagnosis and other applications. Currently, asset / process management captures the highest portion of the digital twins in healthcare market. However, this trend is expected to gradually shift towards personalized treatment in the future. This can be attributed to the fact that personalized biochemical modeling has experienced an emerging trend in this domain and has demonstrated several promising results, including administrating soft tissue behavior in orthopedic surgical interventions.

Pharmaceutical Companies are Likely to Dominate the Digital Twins in Healthcare Market

Based on the end users, the market is segmented into healthcare providers, medical device manufacturers, patients, pharmaceutical companies and other end users. At present, the pharmaceutical companies hold the maximum share of the digital twins in healthcare market. This trend is likely to remain the same in the forthcoming years.

North America Accounts for the Largest Share of the Market

Based on key geographical regions, the market is segmented into North America, Europe, Asia, Latin America, Middle East and North Africa, and Rest of the World. The majority share is expected to be captured by players based in North America. It is worth highlighting that, over the years, the market in Middle East and North Africa is expected to grow at a higher CAGR.

Example Players in the Digital Twins in Healthcare Market

- BigBear.ai

- Certara

- Dassault Systemes

- DEO

- Mesh Bio

- NavvTrack

- OnScale

- Phesi

- PrediSurge

- SingHealth

- Twin Health

- Unlearn

- Verto

- VictoryXR

- Virtonomy

Primary Research Overview

The opinions and insights presented in this study were influenced by discussions conducted with multiple stakeholders. The research report features detailed transcripts of interviews held with the following industry stakeholders:

- Co-Founder and Chief Scientific Officer, Australia

- Managing Director and Chief Executive Officer, Germany

- Chief Commercial Officer, Germany

- Chief Solutions Officer, Canada

- Co-founder and Chief Technology Officer, US

- Business Consultant, France

- Business Development Executive, US

DIGITAL TWINS IN HEALTHCARE MARKET: RESEARCH COVERAGE

- Market Sizing and Opportunity Analysis: The report features an in-depth analysis of the digital twins in healthcare market, focusing on key market segments, including [A] therapeutic area, [B] type of digital twin, [C] area of application, [D] end users and [E] key geographical regions.

- Market Landscape: A comprehensive evaluation of companies involved in the development of digital twins, considering various parameters, such as [A] year of establishment, [B] company size, [C] location of headquarters, [D] status of development, [E] therapeutic area, [F] areas of application, [G] type of technology used, [H] type of digital twin and [I] end users.

- Key Insights: An in-depth digital twins in healthcare market analysis, highlighting the contemporary market trends, using five schematic representations, based on [A] areas of application and status of development, [B] type of technology used and type of digital twin, [C] type of end user and type of digital twin, [D] area of application and location of headquarters, and [E] company size and location of headquarters.

- Company Competitiveness Analysis: A comprehensive competitive analysis of digital twins developers, examining factors, such as [A] years of experience, [B] portfolio strength, [C] partnership strength and [D] funding strength.

- Company Profiles: In-depth profiles of key industry players offering digital twins, focusing on [A] company overviews, [B] financial information (if available), [C] recent developments and [D] an informed future outlook.

- Partnerships and Collaborations: An analysis of partnerships established in this sector, since 2018, covering acquisitions, mergers, commercialization agreements, licensing agreements, product development agreements, research agreements, service agreements, service alliances, technology development agreements, technology integration agreements, technology utilization agreements and others.

- Funding and Investment Analysis: A detailed evaluation of the investments made in the digital twins market, encompassing grants, seed funding, venture capital investments, initial public offering, secondary offerings, private placements, debt financing and other equity.

- Berkus Start-Up Valuation Analysis: A proprietary analysis designed to assess start-ups in this market, by assigning monetary values to various competition differentiators possessed by a player. This evaluation is based on the Berkus start-up valuation criteria, which include factors such as sound idea, prototype, management experience and strategic relationships undertaken by market players.

- Market Impact Analysis: The report analyzes various factors such as drivers, restraints, opportunities, and challenges affecting the market growth.

KEY QUESTIONS ANSWERED IN THIS REPORT

- How many companies are currently engaged in this market?

- Which are the leading companies in this market?

- What factors are likely to influence the evolution of this market?

- What is the current and future market size?

- What is the CAGR of this market?

- How is the current and future market opportunity likely to be distributed across key market segments?

REASONS TO BUY THIS REPORT

- The report provides a comprehensive market analysis, offering detailed revenue projections of the overall market and its specific sub-segments. This information is valuable to both established market leaders and emerging entrants.

- Stakeholders can leverage the report to gain a deeper understanding of the competitive dynamics within the market. By analyzing the competitive landscape, businesses can make informed decisions to optimize their market positioning and develop effective go-to-market strategies.

- The report offers stakeholders a comprehensive overview of the market, including key drivers, barriers, opportunities, and challenges. This information empowers stakeholders to stay abreast of market trends and make data-driven decisions to capitalize on growth prospects.

ADDITIONAL BENEFITS

- Complimentary PPT Insights Packs

- Complimentary Excel Data Packs for all Analytical Modules in the Report

- 10% Free Content Customization

- Detailed Report Walkthrough Session with Research Team

- Free Updated report if the report is 6-12 months old or older

TABLE OF CONTENTS

1. PREFACE

- 1.1. Introduction

- 1.2. Market Share Insights

- 1.3. Key Market Insights

- 1.4. Report Coverage

- 1.5. Frequently Asked Questions

- 1.6. Chapter Outlines

2. RESEARCH METHODOLOGY

- 2.1. Chapter Overview

- 2.2. Research Assumptions

- 2.3. Project Methodology

- 2.4. Forecast Methodology

- 2.5. Robust Quality Control

- 2.6. Key Market Segmentations

- 2.7. Key Considerations

- 2.7.1. Demographics

- 2.7.2. Economic Factors

- 2.7.3. Government Regulations

- 2.7.4. Supply Chain

- 2.7.5. COVID Impact

- 2.7.6. Market Access

- 2.7.7. Healthcare Policies

- 2.7.8. Industry Consolidation

3. ECONOMIC AND OTHER PROJECT SPECIFIC CONSIDERATIONS

- 3.1. Chapter Overview

- 3.2. Market Dynamics

- 3.2.1. Time Period

- 3.2.1.1. Historical Trends

- 3.2.1.2. Current and Forecasted Estimates

- 3.2.2. Currency Coverage and Foreign Exchange Rate

- 3.2.2.1. Major Currencies Affecting the Market

- 3.2.2.2. Factors Affecting Currency Fluctuations and Foreign Exchange Rates

- 3.2.2.3. Impact of Foreign Exchange Rate Volatility on the Market

- 3.2.2.4. Strategies for Mitigating Foreign Exchange Risk

- 3.2.3. Trade Policies

- 3.2.3.1. Impact of Trade Barriers on the Market

- 3.2.3.2. Strategies for Mitigating the Risks Associated with Trade Barriers

- 3.2.4. Recession

- 3.2.4.1. Historical Analysis of Past Recessions and Lessons Learnt

- 3.2.4.2. Assessment of Current Economic Conditions and Potential Impact on the Market

- 3.2.5. Inflation

- 3.2.5.1. Measurement and Analysis of Inflationary Pressures in the Economy

- 3.2.5.2. Potential Impact of Inflation on the Market Evolution

- 3.2.1. Time Period

4. EXECUTIVE SUMMARY

5. INTRODUCTION

- 5.1. Chapter Overview

- 5.2. Overview of Digital Twins in Healthcare

- 5.3. Types of Digital Twins Used in Healthcare

- 5.3.1. System Twin

- 5.3.2. Process Twin

- 5.3.3. Human Digital Twin

- 5.4. Applications of Digital Twins in the Healthcare Domain

- 5.4.1. Asset / Process Management

- 5.4.2. Clinical Trial Evaluation

- 5.4.3. Personalized Medicine

- 5.4.4. Surgical Planning

- 5.5. Challenges Associated with the Adoption of Digital Twins

- 5.6. Future Perspectives

6. MARKET LANDSCAPE

- 6.1. Chapter Overview

- 6.2. Digital Twins in Healthcare: Overall Market Landscape

- 6.2.1. Analysis by Development Status

- 6.2.2. Analysis by Therapeutic Area

- 6.2.3. Analysis by Area of Application

- 6.2.4. Analysis by Type of Technology Used

- 6.2.5. Analysis by End Users

- 6.2.6. Analysis by Type of Digital Twin

- 6.3. Digital Twins in Healthcare: Developer Landscape

- 6.3.1. Analysis by Year of Establishment

- 6.3.2. Analysis by Company Size

- 6.3.3. Analysis by Location of Headquarters

7. KEY INSIGHTS

- 7.1. Chapter Overview

- 7.2. Analysis by Area of Application and Development Status

- 7.3. Analysis by Type of Technology Used and Type of Digital Twin

- 7.4. Analysis by Type of End User and Type of Digital Twin

- 7.5. Analysis by Location of Headquarters and Area of Application

- 7.6. Analysis by Company Size and Location of Headquarters

8. COMPANY COMPETITIVENESS ANALYSIS

- 8.1. Chapter Overview

- 8.2. Assumptions and Key Parameters

- 8.3. Methodology

- 8.4. Digital Twins in Healthcare: Company Competitiveness Analysis

- 8.4.1. Company Competitiveness Analysis: Benchmarking of Portfolio Strength

- 8.4.2. Company Competitiveness Analysis: Benchmarking of Partnership Activity

- 8.4.3. Company Competitiveness Analysis: Benchmarking of Funding Activity

- 8.4.4. Company Competitiveness Analysis: Players Based in North America

- 8.4.5. Company Competitiveness Analysis: Players Based in Europe

- 8.4.6. Company Competitiveness Analysis: Players Based in Asia and Rest of the World

9. DETAILED COMPANY PROFILES

- 9.1. Chapter Overview

- 9.2. BigBear.ai

- 9.2.1. Company Overview

- 9.2.2. Financial Information

- 9.2.3. Recent Developments and Future Outlook

- 9.3. Certara

- 9.3.1. Company Overview

- 9.3.2. Financial Information

- 9.3.3. Recent Developments and Future Outlook

- 9.4. Dassault Systemes

- 9.4.1. Company Overview

- 9.4.2. Financial Information

- 9.4.3. Recent Developments and Future Outlook

- 9.5. NavvTrack

- 9.5.1. Company Overview

- 9.5.2. Recent Developments and Future Outlook

- 9.6. Unlearn.ai

- 9.6.1. Company Overview

- 9.6.2. Recent Developments and Future Outlook

10. TABULATED COMPANY PROFILES

- 10.1. Chapter Overview

- 10.2. Players Based in North America

- 10.2.1. OnScale

- 10.2.2. Phesi

- 10.2.3. Twin Health

- 10.2.4. Verto

- 10.2.5. VictoryXR

- 10.3. Players Based in Europe

- 10.3.1. DEO

- 10.3.2. PrediSurge

- 10.3.3. Virtonomy

- 10.4. Players Based in Asia

- 10.4.1. Mesh Bio

- 10.4.2. SingHealth

11. PARTNERSHIPS AND COLLABORATIONS

- 11.1. Chapter Overview

- 11.2. Digital Twins in Healthcare: Partnerships and Collaborations

- 11.2.1. Partnership Models

- 11.2.2. List of Partnerships and Collaborations

- 11.2.3. Analysis by Year of Partnership

- 11.2.4. Analysis by Type of Partnership

- 11.2.5. Analysis by Year and Type of Partnership

- 11.2.6. Analysis by Type of Partnership and Company Size

- 11.2.7. Most Active Players: Analysis by Number of Partnerships

- 11.2.8. Local and International Agreements

- 11.2.9. Intercontinental and Intracontinental Agreements

12. FUNDING AND INVESTMENTS ANALYSIS

- 12.1. Chapter Overview

- 12.2. Types of Funding

- 12.3. Digital Twins in Healthcare: List of Funding and Investments

- 12.3.1. Analysis by Number of Funding Instances

- 12.3.2. Analysis by Amount Invested

- 12.3.3. Analysis by Type of Funding

- 12.3.4. Analysis by Geography

- 12.3.5. Most Active Players: Analysis by Number of Funding Instances

- 12.3.6. Most Active Players: Analysis by Amount of Funding

- 12.4. Concluding Remarks

13. BERKUS START-UP VALUATION ANALYSIS

- 13.1. Chapter Overview

- 13.2. Assumptions and Key Parameters

- 13.3. Methodology

- 13.4. Berkus Start-Up Valuation: Total Valuation of Players

- 13.5. Digital Twins in Healthcare: Benchmarking of Berkus Start-Up Valuation Parameters

- 13.5.1. AI Body: Benchmarking of Berkus Start-Up Valuation Parameters

- 13.5.2. AnatoScope: Benchmarking of Berkus Start-Up Valuation Parameters

- 13.5.3. Antleron: Benchmarking of Berkus Start-Up Valuation Parameters

- 13.5.4. EmbodyBio: Benchmarking of Berkus Start-Up Valuation Parameters

- 13.5.5. Klinik Sankt Moritz: Benchmarking of Berkus Start-Up Valuation Parameters

- 13.5.6. MAI: Benchmarking of Berkus Start-Up Valuation Parameters

- 13.5.7. Mindbank AI: Benchmarking of Berkus Start-Up Valuation Parameters

- 13.5.8. Neo PLM: Benchmarking of Berkus Start-Up Valuation Parameters

- 13.5.9. Twinsight: Benchmarking of Berkus Start-Up Valuation Parameters

- 13.6. Digital Twins in Healthcare: Benchmarking of Players

- 13.6.1. Sound Idea: Benchmarking of Players

- 13.6.2. Prototype: Benchmarking of Players

- 13.6.3. Management Experience: Benchmarking of Players

- 13.6.4. Strategic Relationships: Benchmarking of Players

- 13.6.5. Total Valuation: Benchmarking of Players

14. MARKET IMPACT ANALYSIS: DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES

- 14.1. Chapter Overview

- 14.2. Market Drivers

- 14.3. Market Restraints

- 14.4. Market Opportunities

- 14.5. Market Challenges

- 14.6. Conclusion

15. GLOBAL DIGITAL TWIN IN HEALTHCARE MARKET

- 15.1. Chapter Overview

- 15.2. Assumptions and Methodology

- 15.3. Global Digital Twin in Healthcare Market, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 15.3.1. Scenario Analysis

- 15.3.1.1. Conservative Scenario

- 15.3.1.2. Optimistic Scenario

- 15.3.2. Key Market Segmentations

- 15.3.1. Scenario Analysis

16. DIGITAL TWIN IN HEALTHCARE MARKET, BY THERAPEUTIC AREA

- 16.1. Chapter Overview

- 16.2. Assumptions and Methodology

- 16.3. Digital Twin in Healthcare Market: Distribution by Therapeutic Area, 2018, 2024 and 2035

- 16.3.1. Cardiovascular Disorders: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 16.3.2. Metabolic Disorders: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 16.3.3. Orthopedic Disorders: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 16.3.4. Other Disorders: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 16.3.5. Data Triangulation and Validation

17. DIGITAL TWIN IN HEALTHCARE MARKET, BY TYPE OF DIGITAL TWINS

- 17.1. Chapter Overview

- 17.2. Assumptions and Methodology

- 17.3. Digital Twin in Healthcare Market: Distribution by Type of Digital Twins, 2018, 2024 and 2035

- 17.3.1. Process Twins: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 17.3.2. System Twins: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 17.3.3. Whole Body Twins: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 17.3.4. Body Part Twins: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 17.3.5. Data Triangulation and Validation

18. DIGITAL TWIN IN HEALTHCARE MARKET, BY AREA OF APPLICATION

- 18.1. Chapter Overview

- 18.2. Assumptions and Methodology

- 18.3. Digital Twin in Healthcare Market: Distribution by Area of Application, 2018, 2024 And 2035

- 18.3.1. Asset / Process Management: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 18.3.2. Personalized Treatment: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 18.3.3. Surgical Planning: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 18.3.4. Diagnosis: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 18.3.5. Other Applications: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 18.3.6. Data Triangulation and Validation

19. DIGITAL TWIN IN HEALTHCARE MARKET, BY END USERS

- 19.1. Chapter Overview

- 19.2. Assumptions and Methodology

- 19.3. Digital Twin in Healthcare Market: Distribution by End Users, 2018, 2024 and 2035

- 19.3.1. Pharmaceutical Companies: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 19.3.2. Medical Device Manufacturers: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 19.3.3. Healthcare Providers: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 19.3.4. Patients: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 19.3.5. Other End Users: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 19.3.6. Data Triangulation and Validation

20. DIGITAL TWIN IN HEALTHCARE MARKET, BY GEOGRAPHY

- 20.1. Chapter Overview

- 20.2. Assumptions and Methodology

- 20.3. Digital Twins in Healthcare Market: Distribution by Key Geographies, 2018, 2024 And 2035

- 20.3.1. North America: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 20.3.1.1. US: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 20.3.1.2. Canada: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 20.3.2. Europe: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 20.3.2.1. France: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 20.3.2.2. Germany: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 20.3.2.3. Italy: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 20.3.2.4. Spain: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 20.3.2.5. UK: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 20.3.2.6. Rest of Europe: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 20.3.3. Asia: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 20.3.3.1. China: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 20.3.3.2. India: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 20.3.3.3. Japan: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 20.3.3.4. Singapore: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 20.3.3.5. South Korea: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 20.3.3.6. Rest of Asia: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 20.3.4. Latin America: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 20.3.5. Middle East and North Africa: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 20.3.6. Rest of the World: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 20.3.6.1. Australia: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 20.3.6.2. New Zealand: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 20.3.7. Data Triangulation and Validation

- 20.3.1. North America: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

21. CONCLUSION

22. EXECUTIVE INSIGHTS

- 22.1. Chapter Overview

- 22.2. Company A

- 22.2.1. Company Snapshot

- 22.2.2. Interview Transcript: Chief Commercial Officer

- 22.3. Company B

- 22.3.1. Company Snapshot

- 22.3.2. Interview Transcript: Chief Solutions Officer

- 22.4. Company C

- 22.4.1. Company Snapshot

- 22.4.2. Interview Transcript: Co-founder and Chief Technology Officer

- 22.5. Company D

- 22.5.1. Company Snapshot

- 22.5.2. Interview Transcript: Data Scientist

- 22.6. Company E

- 22.6.1. Company Snapshot

- 22.6.2. Interview Transcript: Business Consultant

- 22.7. Company F

- 22.7.1. Company Snapshot

- 22.7.2. Interview Transcript: Co-Founder and Chief Scientific Officer

- 22.8. Company G

- 22.8.1. Company Snapshot

- 22.8.2. Interview Transcript: Head of Business Development

- 22.9. Company H

- 22.9.1. Company Snapshot

- 22.9.2. Interview Transcript: Managing Director and Chief Executive Officer

23. APPENDIX I: TABULATED DATA

24. APPENDIX II: LIST OF COMPANIES AND ORGANIZATIONS

List of Tables

- Table 6.1 Digital Twins in Healthcare: Information on Development Status

- Table 6.2 Digital Twins in Healthcare: Information on Therapeutic Area

- Table 6.3 Digital Twins in Healthcare: Information on Areas of Application

- Table 6.4 Digital Twins in Healthcare: Information on Type of Technology Used

- Table 6.5 Digital Twins in Healthcare: Information on End Users

- Table 6.6 Digital Twins in Healthcare: Information on Type of Digital Twin

- Table 6.7 Digital Twins Developers: Information on Year of Establishment, Company Size, Location of Headquarters, Region of Headquarters and Number of Products

- Table 9.1 List of Companies Profiled

- Table 9.2 BigBear.ai: Company Overview

- Table 9.3 BigBear.ai: Recent Developments and Future Outlook

- Table 9.4 Certara: Company Overview

- Table 9.5 Certara: Recent Developments and Future Outlook

- Table 9.6 Dassault Systemes: Company Overview

- Table 9.7 Dassault Systemes: Recent Developments and Future Outlook

- Table 9.8 NavvTrack: Company Overview

- Table 9.9 NavvTrack: Recent Developments and Future Outlook

- Table 9.10 Unlearn.ai: Company Overview

- Table 9.11 Unlearn.ai: Recent Developments and Future Outlook

- Table 10.1 List of Companies Profiled

- Table 10.2 OnScale: Company Overview

- Table 10.3 Phesi: Company Overview

- Table 10.5 Twin Health: Company Overview

- Table 10.6 Verto: Company Overview

- Table 10.7 VictoryXR: Recent Developments and Future Outlook

- Table 10.8 DEO: Company Overview

- Table 10.9 PrediSurge: Company Overview

- Table 10.10 Virtonomy: Company Overview

- Table 10.11 Mesh Bio: Company Overview

- Table 10.12 SingHealth: Company Overview

- Table 11.1 Digital Twins in Healthcare: List of Partnerships and Collaborations, since 2018

- Table 11.2 Partnerships and Collaborations: Information on Type of Agreement (Country-wise and Continent-wise), since 2018

- Table 12.1 Funding and Investments: Information on Year of Investment, Type of Funding, Amount and Investor, since 2018

- Table 12.2 Funding and Investment Analysis: Regional Distribution by Total Amount Invested, since 2018

- Table 13.1 Berkus Start-Up Valuation: Total Valuation of Players

- Table 22.1 Virtonomy: Company Snapshot

- Table 22.2 Decision Lab: Company Snapshot

- Table 22.3 DIGIOTAI Solutions: Company Snapshot

- Table 22.4 TwInsight: Company Snapshot

- Table 22.5 Dassault Systemes: Company Snapshot

- Table 22.6 TwInsight: Company Snapshot

- Table 22.7 Unlearn.AI: Company Snapshot

- Table 22.8 Yokogawa Insilico Biotechnology: Company Snapshot

- Table 23.1 Digital Twins: Distribution by Development Status

- Table 23.2 Digital Twins: Distribution by Therapeutic Area

- Table 23.3 Digital Twins: Distribution by Areas of Application

- Table 23.4 Digital Twins: Distribution by Type of Technology Used

- Table 23.5 Digital Twins: Distribution by End Users

- Table 23.6 Digital Twins in Healthcare: Distribution by Type of Digital Twin

- Table 23.7 Digital Twin Developers: Distribution by Year of Establishment

- Table 23.8 Digital Twin Developers: Distribution by Company Size

- Table 23.9 Digital Twin Developers: Distribution by Location of Headquarters

- Table 23.10 BigBear.ai: Annual Revenues, FY 2021 Onwards (USD Million)

- Table 23.11 Certara: Annual Revenues, FY 2020 Onwards (USD Million)

- Table 23.12 Dassault Systemes: Annual Revenues, FY 2019 Onwards (EUR Billion)

- Table 23.13 Partnerships and Collaborations: Cumulative Year-wise Trend, since 2018

- Table 23.14 Partnerships and Collaborations: Distribution by Type of Partnership

- Table 23.15 Partnerships and Collaborations: Distribution by Year and Type of Partnership

- Table 23.16 Partnerships and Collaborations: Distribution by Type of Partnership and Company Size

- Table 23.17 Most Active Players: Distribution by Number of Partnerships

- Table 23.18 Partnerships and Collaborations: Local and International Agreements

- Table 23.19 Partnerships and Collaborations: Intercontinental and Intracontinental Agreements

- Table 23.20 Funding and Investment Analysis: Cumulative Year-wise Trend, since 2018

- Table 23.21 Funding and Investment Analysis: Cumulative Amount Invested (USD Million), since 2018

- Table 23.22 Funding and Investment Analysis: Distribution of Instances by Type of Funding, since 2018

- Table 23.23 Funding and Investment Analysis: Year-Wise Distribution by Type of Funding, since 2018

- Table 23.24 Funding and Investment Analysis: Distribution of Total Amount Invested (USD Million) by Type of Funding, since 2018

- Table 23.25 Funding and Investment Analysis: Distribution by Geography

- Table 23.26 Most Active Players: Distribution by Number of Funding Instances

- Table 23.27 Most Active Players: Distribution by Amount Raised (USD Million)

- Table 23.28 Global Digital Twins in Healthcare Market, Historical Trends, since 2018 (USD Billion)

- Table 23.29 Global Digital Twins in Healthcare Market, Forecasted Estimates, till 2035, Conservative, Base and Optimistic Scenario (USD Billion)

- Table 23.30 Global Digital Twins in Healthcare Market: Distribution by Therapeutic Area, 2018, 2024 and 2035

- Table 23.31 Digital Twins in Healthcare Market for Cardiovascular Disorders, Historical Trends, since 2018 (USD Billion)

- Table 23.32 Digital Twins in Healthcare Market for Cardiovascular Disorders, Conservative, Base and Optimistic Scenarios, till 2035 (USD Billion)

- Table 23.33 Digital Twins in Healthcare Market for Metabolic Disorders, Historical Trends, since 2018 (USD Billion)

- Table 23.34 Digital Twins in Healthcare Market for Metabolic Disorders, Conservative, Base and Optimistic Scenarios, till 2035 (USD Billion)

- Table 23.35 Digital Twins in Healthcare Market for Orthopedic Disorders, Historical Trends, since 2018 (USD Billion)

- Table 23.36 Digital Twins in Healthcare Market for Orthopedic Disorders, Conservative, Base and Optimistic Scenarios, till 2035 (USD Billion)

- Table 23.37 Digital Twins in Healthcare Market for Other Disorders, Historical Trends, since 2018 (USD Billion)

- Table 23.38 Digital Twins in Healthcare Market for Other Disorders, Conservative, Base and Optimistic Scenarios, till 2035 (USD Billion)

- Table 23.39 Global Digital Twins in Healthcare Market: Distribution by Type of Digital Twin, 2018, 2024 and 2035

- Table 23.40 Digital Twins in Healthcare Market for Process Twins, Historical Trends, since 2018 (USD Billion)

- Table 23.41 Digital Twins in Healthcare Market for Process Twins, Conservative, Base and Optimistic Scenarios, till 2035 (USD Billion)

- Table 23.42 Digital Twins in Healthcare Market for System Twins, Historical Trends, since 2018 (USD Billion)

- Table 23.43 Digital Twins in Healthcare Market for System Twins, Conservative, Base and Optimistic Scenarios, till 2035 (USD Billion)

- Table 23.44 Digital Twins in Healthcare Market for Whole Body Twins, Historical Trends, since 2018 (USD Billion)

- Table 23.45 Digital Twins in Healthcare Market for Whole Body Twins, Conservative, Base and Optimistic Scenarios, till 2035 (USD Billion)

- Table 23.46 Digital Twins in Healthcare Market for Body Part Twins, Historical Trends, since 2018 (USD Billion)

- Table 23.47 Digital Twins in Healthcare Market for Body Part Twins, Conservative, Base and Optimistic Scenarios, till 2035 (USD Billion)

- Table 23.48 Global Digital Twins in Healthcare Market: Distribution by Area of Application, 2018, 2024 and 2035

- Table 23.49 Digital Twins in Healthcare Market for Asset / Process Management, Historical Trends, since 2018 (USD Billion)

- Table 23.50 Digital Twins in Healthcare Market for Asset / Process Management, Conservative, Base and Optimistic Scenarios, till 2035 (USD Billion)

- Table 23.51 Digital Twins in Healthcare Market for Personalized Treatment, Historical Trends, since 2018 (USD Billion)

- Table 23.52 Digital Twins in Healthcare Market for Personalized Treatment, Conservative, Base and Optimistic Scenarios, till 2035 (USD Billion)

- Table 23.53 Digital Twins in Healthcare Market for Surgical Planning, Historical Trends, since 2018 (USD Billion)

- Table 23.54 Digital Twins in Healthcare Market for Surgical Planning, Conservative, Base and Optimistic Scenarios, till 2035 (USD Billion)

- Table 23.55 Digital Twins in Healthcare Market for Diagnosis, Historical Trends, since 2018 (USD Billion)

- Table 23.56 Digital Twins in Healthcare Market for Diagnosis, Conservative, Base and Optimistic Scenarios, till 2035 (USD Billion)

- Table 23.57 Digital Twins in Healthcare Market for Other Application Areas, Historical Trends, since 2018 (USD Billion)

- Table 23.58 Digital Twins in Healthcare Market for Other Application Areas, Conservative, Base and Optimistic Scenarios, till 2035 (USD Billion)

- Table 23.59 Global Digital Twins in Healthcare Market: Distribution by End Users, 2018, 2024 and 2035

- Table 23.60 Digital Twins in Healthcare Market for Pharmaceutical Companies, Historical Trends, since 2018 (USD Billion)

- Table 23.61 Digital Twins in Healthcare Market for Pharmaceutical Companies, Conservative, Base and Optimistic Scenarios, till 2035 (USD Billion)

- Table 23.62 Digital Twins in Healthcare Market for Medical Device Manufacturers, Historical Trends, since 2018 (USD Billion)

- Table 23.63 Digital Twins in Healthcare Market for Medical Device Manufacturers, Conservative, Base and Optimistic Scenarios, till 2035 (USD Billion)

- Table 23.64 Digital Twins in Healthcare Market for Healthcare Providers, Historical Trends, since 2018 (USD Billion)

- Table 23.65 Digital Twins in Healthcare Market for Healthcare Providers, Conservative, Base and Optimistic Scenarios, till 2035 (USD Billion)

- Table 23.66 Digital Twins in Healthcare Market for Patients, Historical Trends, since 2018 (USD Billion)

- Table 23.67 Digital Twins in Healthcare Market for Patients, Conservative, Base and Optimistic Scenarios, till 2035 (USD Billion)

- Table 23.68 Digital Twins in Healthcare Market for Other End Users, Historical Trends, since 2018 (USD Billion)

- Table 23.69 Digital Twins in Healthcare Market for Other End Users, Conservative, Base and Optimistic Scenarios, till 2035 (USD Billion)

- Table 23.70 Global Digital Twins in Healthcare Market: Distribution by Key Geographies, 2018, 2024 and 2035

- Table 23.71 Digital Twins in Healthcare Market in North America, Historical Trends, since 2018 (USD Billion)

- Table 23.72 Digital Twins in Healthcare Market in North America, Conservative, Base and Optimistic Scenarios, till 2035 (USD Billion)

- Table 23.73 Digital Twins in Healthcare Market in the US, Historical Trends, since 2018 (USD Billion)

- Table 23.74 Digital Twins in Healthcare Market in the US, Conservative, Base and Optimistic Scenarios, till 2035 (USD Billion)

- Table 23.75 Digital Twins in Healthcare Market in Canada, Historical Trends, since 2018 (USD Billion)

- Table 23.76 Digital Twins in Healthcare Market in Canada, Conservative, Base and Optimistic Scenarios, till 2035 (USD Billion)

- Table 23.77 Digital Twins in Healthcare Market in Europe, Historical Trends, since 2018 (USD Billion)

- Table 23.78 Digital Twins in Healthcare Market in Europe, Conservative, Base and Optimistic Scenarios, till 2035 (USD Billion)

- Table 23.79 Digital Twins in Healthcare Market in France, Historical Trends, since 2018 (USD Billion)

- Table 23.80 Digital Twins in Healthcare Market in France, Conservative, Base and Optimistic Scenarios, till 2035 (USD Billion)

- Table 23.81 Digital Twins in Healthcare Market in Germany, Historical Trends, since 2018 (USD Billion)

- Table 23.82 Digital Twins in Healthcare Market in Germany, Conservative, Base and Optimistic Scenarios, till 2035 (USD Billion)

- Table 23.83 Digital Twins in Healthcare Market in Italy, Historical Trends, since 2018 (USD Billion)

- Table 23.84 Digital Twins in Healthcare Market in Italy, Conservative, Base and Optimistic Scenarios, till 2035 (USD Billion)

- Table 23.85 Digital Twins in Healthcare Market in Spain, Historical Trends, since 2018 (USD Billion)

- Table 23.86 Digital Twins in Healthcare Market in Spain, Conservative, Base and Optimistic Scenarios, till 2035 (USD Billion)

- Table 23.87 Digital Twins in Healthcare Market in the UK, Historical Trends, since 2018 (USD Billion)

- Table 23.88 Digital Twins in Healthcare Market in the UK, Conservative, Base and Optimistic Scenarios, till 2035 (USD Billion)

- Table 23.89 Digital Twins in Healthcare Market in Rest of the Europe, Historical Trends, since 2018 (USD Billion)

- Table 23.90 Digital Twins in Healthcare Market in Rest of the Europe, Conservative, Base and Optimistic Scenarios, till 2035 (USD Billion)

- Table 23.91 Digital Twins in Healthcare Market in Asia, Historical Trends, since 2018 (USD Billion)

- Table 23.92 Digital Twins in Healthcare Market in Asia, Conservative, Base and Optimistic Scenarios, till 2035 (USD Billion)

- Table 23.93 Digital Twins in Healthcare Market in China, Historical Trends, since 2018 (USD Billion)

- Table 23.94 Digital Twins in Healthcare Market in China, Conservative, Base and Optimistic Scenarios, till 2035 (USD Billion)

- Table 23.95 Digital Twins in Healthcare Market in India, Historical Trends, since 2018 (USD Billion)

- Table 23.96 Digital Twins in Healthcare Market in India, Conservative, Base and Optimistic Scenarios, till 2035 (USD Billion)

- Table 23.97 Digital Twins in Healthcare Market in Japan, Historical Trends, since 2018 (USD Billion)

- Table 23.98 Digital Twins in Healthcare Market in Japan, Conservative, Base and Optimistic Scenarios, till 2035 (USD Billion)

- Table 23.99 Digital Twins in Healthcare Market in Singapore, Historical Trends, since 2018 (USD Billion)

- Table 23.100 Digital Twins in Healthcare Market in Singapore, Conservative, Base and Optimistic Scenarios, till 2035 (USD Billion)

- Table 23.101 Digital Twins in Healthcare Market in South Korea, Historical Trends, since 2018 (USD Billion)

- Table 23.102 Digital Twins in Healthcare Market in South Korea, Conservative, Base and Optimistic Scenarios, till 2035 (USD Billion)

- Table 23.103 Digital Twins in Healthcare Market in Rest of the Asia, Historical Trends, since 2018 (USD Billion)

- Table 23.104 Digital Twins in Healthcare Market in Rest of the Asia, Conservative, Base and Optimistic Scenarios, till 2035 (USD Billion)

- Table 23.105 Digital Twins in Healthcare Market in Latin America, Historical Trends, since 2018 (USD Billion)

- Table 23.106 Digital Twins in Healthcare Market in Latin America, Conservative, Base and Optimistic Scenarios, till 2035 (USD Billion)

- Table 23.107 Digital Twins in Healthcare Market in Middle East and North Africa, Historical Trends, since 2018 (USD Billion)

- Table 23.108 Digital Twins in Healthcare Market in Middle East and North Africa, Conservative, Base and Optimistic Scenarios, till 2035 (USD Billion)

- Table 23.109 Digital Twins in Healthcare Market in Rest of the World, Historical Trends, since 2018 (USD Billion)

- Table 23.110 Digital Twins in Healthcare Market in Rest of the World, Conservative, Base and Optimistic Scenarios, till 2035 (USD Billion)

- Table 23.111 Digital Twins in Healthcare Market in Australia, Historical Trends, since 2018 (USD Billion)

- Table 23.112 Digital Twins in Healthcare Market in Australia, Conservative, Base and Optimistic Scenarios, till 2035 (USD Billion)

- Table 23.113 Digital Twins in Healthcare Market in New Zealand, Historical Trends, since 2018 (USD Billion)

- Table 23.114 Digital Twins in Healthcare Market in New Zealand, Conservative, Base and Optimistic Scenarios, till 2035 (USD Billion)

List of Figures

- Figure 2.1 Research Methodology: Project Methodology

- Figure 2.2 Research Methodology: Forecast Methodology

- Figure 2.3 Research Methodology: Robust Quality Control

- Figure 2.4 Research Methodology: Key Market Segmentations

- Figure 3.1 Lessons Learnt from Past Recessions

- Figure 4.1 Executive Summary: Market Landscape

- Figure 4.2 Executive Summary: Partnerships and Collaborations

- Figure 4.3 Executive Summary: Funding and Investment Analysis

- Figure 4.4 Executive Summary: Market Forecast (I / II)

- Figure 4.5 Executive Summary: Market Forecast (II / II)

- Figure 5.1 Overview of Digital Twin Technology

- Figure 5.2 Human Digital Twin

- Figure 5.3 Challenges Associated with the Adoption of Digital Twins

- Figure 6.1 Digital Twins: Distribution by Development Status

- Figure 6.2 Digital Twins: Distribution by Therapeutic Area

- Figure 6.3 Digital Twins: Distribution by Areas of Application

- Figure 6.4 Digital Twins: Distribution by Type of Technology Used

- Figure 6.5 Digital Twins: Distribution by End Users

- Figure 6.6 Digital Twins: Distribution by Type of Digital Twin

- Figure 6.7 Digital Twin Developers: Distribution by Year of Establishment

- Figure 6.8 Digital Twin Developers: Distribution by Company Size

- Figure 6.9 Digital Twin Developers: Distribution by Location of Headquarters

- Figure 7.1 Key Insights: Distribution by Area of Application and Development Status

- Figure 7.2 Key Insights: Distribution by Type of Technology Used and Type of Digital Twin

- Figure 7.3 Key Insights: Distribution by Type of End User and Type of Digital Twin

- Figure 7.4 Key Insights: Distribution by Location of Headquarters and Area of Application

- Figure 7.5 Key Insights: Distribution by Company Size and Location of Headquarters

- Figure 8.1 Company Competitiveness Analysis: Benchmarking of Portfolio Strength

- Figure 8.2 Company Competitiveness Analysis: Benchmarking of Partnership Activity

- Figure 8.3 Company Competitiveness Analysis: Benchmarking of Funding Activity

- Figure 8.4 Company Competitiveness Analysis: Dot-plot Analysis of Players Based in North America

- Figure 8.5 Company Competitiveness Analysis: 3-D Bubble Chart Analysis of Players Based in North America

- Figure 8.6 Company Competitiveness Analysis: Dot-plot Analysis of Players Based in Europe

- Figure 8.7 Company Competitiveness Analysis: 3-D Bubble Chart Analysis of Players Based in Europe

- Figure 8.8 Company Competitiveness Analysis: 3-D Bubble Chart Analysis of Players Based in Asia and Rest of the World

- Figure 9.1 BigBear.ai: Annual Revenues, FY 2021 Onwards (USD Million)

- Figure 9.2 Certara: Annual Revenues, FY 2020 Onwards (USD Million)

- Figure 9.3 Dassault Systemes: Annual Revenues, FY 2019 Onwards (EUR Billion)

- Figure 11.1 Partnerships and Collaborations: Cumulative Year-wise Trend, since 2018

- Figure 11.2 Partnerships and Collaborations: Distribution by Type of Partnership

- Figure 11.3 Partnerships and Collaborations: Distribution by Year and Type of Partnership

- Figure 11.4 Partnerships and Collaborations: Distribution by Type of Partnership and Company Size

- Figure 11.5 Most Active Players: Distribution by Number of Partnerships

- Figure 11.6 Partnerships and Collaborations: Local and International Agreements

- Figure 11.7 Partnerships and Collaborations: Intercontinental and Intracontinental Agreements

- Figure 12.1 Funding and Investment Analysis: Cumulative Year-wise Trend, since 2018

- Figure 12.2 Funding and Investment Analysis: Cumulative Amount Invested (USD Million), since 2018

- Figure 12.3 Funding and Investment Analysis: Distribution of Instances by Type of Funding, since 2018

- Figure 12.4 Funding and Investment Analysis: Year-Wise Distribution by Type of Funding, since 2018

- Figure 12.5 Funding and Investment Analysis: Distribution of Total Amount Invested (USD Million) by Type of Funding, since 2018

- Figure 12.6 Funding and Investment Analysis: Distribution by Geography

- Figure 12.7 Most Active Players: Distribution by Number of Funding Instances, since 2018

- Figure 12.8 Most Active Players: Distribution by Amount Raised (USD Million), since 2018

- Figure 12.9 Funding and Investment Summary, since 2018 (USD Million)

- Figure 13.1 Berkus Start-Up Valuation: Total Valuation of Players (USD Million)

- Figure 13.2 AI Body: Benchmarking of Berkus Start-Up Valuation Parameters

- Figure 13.3 AnatoScope: Benchmarking of Berkus Start-Up Valuation Parameters

- Figure 13.4 Antleron: Benchmarking of Berkus Start-Up Valuation Parameters

- Figure 13.5 EmbodyBio: Benchmarking of Berkus Start-Up Valuation Parameters

- Figure 13.6 Klinik Sankt Moritz: Benchmarking of Berkus Start-Up Valuation Parameters

- Figure 13.7 MAI: Benchmarking of Berkus Start-Up Valuation Parameters

- Figure 13.8 Mindbank AI: Benchmarking of Berkus Start-Up Valuation Parameters

- Figure 13.9 Neo PLM: Benchmarking of Berkus Start-Up Valuation Parameters

- Figure 13.10 TwInsight: Benchmarking of Berkus Start-Up Valuation Parameters

- Figure 13.11 Sound Idea: Benchmarking of Players

- Figure 13.12 Prototype: Benchmarking of Players

- Figure 13.13 Management Experience: Benchmarking of Players

- Figure 13.14 Strategic Relationships: Benchmarking of Players

- Figure 13.15 Total Valuation: Benchmarking of Players

- Figure 14.1 Digital Twins in Healthcare: Market Drivers

- Figure 14.2 Digital Twins in Healthcare: Market Restraints

- Figure 14.3 Digital Twins in Healthcare: Market Opportunities

- Figure 14.4 Digital Twins in Healthcare: Market Challenges

- Figure 15.1 Global Digital Twins in Healthcare Market, Historical Trends (since 2018) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 15.2 Global Digital Twins in Healthcare Market, Forecasted Estimates (till 2035): Conservative Scenario (USD Billion)

- Figure 15.3 Global Digital Twins in Healthcare Market, Forecasted Estimates (till 2035): Optimistic Scenario (USD Billion)

- Figure 16.1 Digital Twins in Healthcare Market: Distribution by Therapeutic Area, 2018, 2024 And 2035

- Figure 16.2 Digital Twins in Healthcare Market for Cardiovascular Disorders, Historical Trends (since 2018) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 16.3 Digital Twins in Healthcare Market for Metabolic Disorders, Historical Trends (since 2018) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 16.4 Digital Twins in Healthcare Market for Orthopedic Disorders, Historical Trends (since 2018) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 16.5 Digital Twins in Healthcare Market for Other Disorders, Historical Trends (since 2018) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 17.1 Digital Twins in Healthcare Market: Distribution by Type of Digital Twin, 2018, 2024 And 2035

- Figure 17.2 Digital Twins in Healthcare Market for Process Twins, Historical Trends (since 2018) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 17.3 Digital Twins in Healthcare Market for System Twins, Historical Trends (since 2018) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 17.4 Digital Twins in Healthcare Market for Whole Body Twins, Historical Trends (since 2018) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 17.5 Digital Twins in Healthcare Market for Body Part Twins, Historical Trends (since 2018) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 18.1 Digital Twins in Healthcare Market: Distribution by Area of Application, 2018, 2024 And 2035

- Figure 18.2 Digital Twins in Healthcare Market for Asset / Process Management, Historical Trends (since 2018) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 18.3 Digital Twins in Healthcare Market for Personalized Treatment, Historical Trends (since 2018) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 18.4 Digital Twins in Healthcare Market for Surgical Planning, Historical Trends (since 2018) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 18.5 Digital Twins in Healthcare Market for Diagnosis, Historical Trends (since 2018) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 18.6 Digital Twins in Healthcare Market for Other Application Areas, Historical Trends (since 2018) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 19.1 Digital Twins in Healthcare Market: Distribution by End Users, 2018, 2024 And 2035

- Figure 19.2 Digital Twins in Healthcare Market for Pharmaceutical Companies, Historical Trends (since 2018) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 19.3 Digital Twins in Healthcare Market for Medical Device Manufacturers, Historical Trends (since 2018) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 19.4 Digital Twins in Healthcare Market for Healthcare Providers, Historical Trends (since 2018) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 19.5 Digital Twins in Healthcare Market for Patients, Historical Trends (since 2018) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 19.6 Digital Twins in Healthcare Market for Other End Users, Historical Trends (since 2018) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 20.1 Digital Twins in Healthcare Market: Distribution by Key Geographies, 2018, 2024 And 2035

- Figure 20.2 Digital Twins in Healthcare Market in North America, Historical Trends (since 2018) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 20.3 Digital Twins in Healthcare Market in the US, Historical Trends (since 2018) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 20.4 Digital Twins in Healthcare Market in Canada, Historical Trends (since 2018) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 20.5 Digital Twins in Healthcare Market in Europe, Historical Trends (since 2018) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 20.6 Digital Twins in Healthcare Market in France, Historical Trends (since 2018) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 20.7 Digital Twins in Healthcare Market in Germany, Historical Trends (since 2018) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 20.8 Digital Twins in Healthcare Market in Italy, Historical Trends (since 2018) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 20.9 Digital Twins in Healthcare Market in Spain, Historical Trends (since 2018) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 20.10 Digital Twins in Healthcare Market in the UK, Historical Trends (since 2018) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 20.11 Digital Twins in Healthcare Market in Rest of the Europe, Historical Trends (since 2018) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 20.12 Digital Twins in Healthcare Market in Asia, Historical Trends (since 2018) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 20.13 Digital Twins in Healthcare Market in China, Historical Trends (since 2018) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 20.14 Digital Twins in Healthcare Market in India, Historical Trends (since 2018) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 20.15 Digital Twins in Healthcare Market in Japan, Historical Trends (since 2018) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 20.16 Digital Twins in Healthcare Market in Singapore, Historical Trends (since 2018) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 20.17 Digital Twins in Healthcare Market in South Korea, Historical Trends (since 2018) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 20.18 Digital Twins in Healthcare Market in Rest of the Asia, Historical Trends (since 2018) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 20.19 Digital Twins in Healthcare Market in Latin America, Historical Trends (since 2018) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 20.20 Digital Twins in Healthcare Market in Middle East and North Africa, Historical Trends (since 2018) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 20.21 Digital Twins in Healthcare Market in Rest of the World, Historical Trends (since 2018) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 20.22 Digital Twins in Healthcare Market in Australia, Historical Trends (since 2018) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 20.23 Digital Twins in Healthcare Market in New Zealand, Historical Trends (since 2018) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 21.1 Conclusion: Market Landscape

- Figure 21.2 Conclusion: Partnerships and Collaborations

- Figure 21.3 Conclusion: Funding and Investments

- Figure 21.4 Conclusion: Berkus Start-up Valuation Analysis

- Figure 21.5 Conclusion: Market Forecast (I / II)

- Figure 21.6 Conclusion: Market Forecast (II / II)