|

市場調查報告書

商品編碼

1567378

濺鍍靶材市場:2024年~2025年(Critical Materials Report)Sputter Targets Market Report 2024-2025 (Critical Materials Report) |

||||||

價格

本報告考察了濺射靶材市場,重點關注半導體裝置製造中使用的 PVD 技術中的濺射,特別關注該領域靶材的市場和供應鏈。

資訊圖表

目錄

第1章 摘要整理

第2章 調查範圍,目的,手法

第3章 半導體產業市場現況與展望

- 世界經濟與展望

- 以電子產品細分市場劃分的晶片銷售額

- 半導體製造業的成長與擴張

- 政策和貿易趨勢及影響

- 半導體材料概述

第4章 濺鍍用靶材市場趨勢

- 濺鍍用靶材市場趨勢-概要

- 與濺鍍用靶材製造地投資- 各地區

- 價格趨勢

- 濺鍍用靶材技術概要

- 地區性的考慮

- EHS和貿易/物流的問題

- 濺鍍用靶材市場趨勢的評估

第5章 供應端市場形勢

- 濺鍍用靶材市場佔有率

- M&A活動和夥伴關係

- 工廠封閉

- 新加入企業

- 有已停產的可能的供應商或零件/產品線

- 材料供應商的評估

第6章 次級供應鏈,金屬

- 次級供應鏈:供應商和市場概要

- 次級供應鏈:混亂

- 次級供應鏈的M&A或夥伴關係活動

- 次級供應鏈的EHS和物流的問題

- 次級供應鏈的 "新" 進入者

- 次級供應鏈工廠的最新資訊

- 次級供應鏈的工廠封閉

- 次級供應鏈的評估

第7章 供應商簡介

- ADVANCED TARGETS MATERIALS CO., LTD.

- AMERICAN ELEMENTS

- FURUYA METAL CO

- GO ELEMENT

- GRIKIN

- 其他20公司以上

第8章 附錄

- 採用PVD技術的先進製程、新結構、特殊薄膜

This report addresses sputtering, the dominant PVD technique used in semiconductor device fabrication, and specifically covers the market and supply-chain for targets within that segment. The report contains data and analysis from TECHCET's data base and Sr. Analyst experience, as well as that developed from primary and secondary market research.

INFOGRAPHICS

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY

- 1.1 SPUTTERING TARGETS BUSINESS - MARKET OVERVIEW

- 1.2 MARKET TRENDS IMPACTING 2024 OUTLOOK

- 1.3 SPUTTER TARGETS 5-YEAR UNIT SHIPMENT FORECAST BY SEGMENT

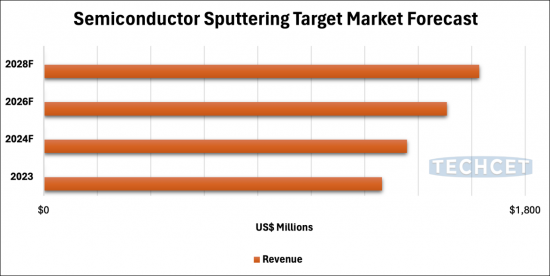

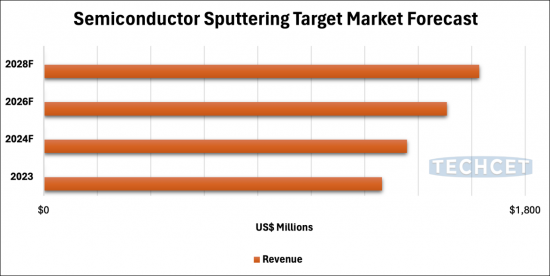

- 1.4 SPUTTERING TARGETS 5-YEAR REVENUE FORECAST BY SEGMENT

- 1.5 SPUTTERING TARGETS SEGMENT TRENDS

- 1.6 TECHNOLOGY TRENDS

- 1.7 COMPETITIVE LANDSCAPE

- 1.8 MOST RECENTLY REPORTED QUARTERLY FINANCIALS OF TOP-5 SUPPLIERS

- 1.9 EHS, TRADE, AND/OR LOGISTICS ISSUES/CONCERNS

- 1.10 ANALYST ASSESSMENT OF SPUTTERING TARGETS

2 SCOPE, PURPOSE AND METHODOLOGY

- 2.1 SCOPE

- 2.2 PURPOSE & METHODOLOGY

- 2.3 OVERVIEW OF OTHER TECHCET CMRTM OFFERINGS

3 SEMICONDUCTOR INDUSTRY MARKET STATUS & OUTLOOK

- 3.1 WORLDWIDE ECONOMY AND OUTLOOK

- 3.1.1 SEMICONDUCTOR INDUSTRIES TIES TO THE GLOBAL ECONOMY

- 3.1.2 SEMICONDUCTOR SALES GROWTH

- 3.1.3 TAIWAN OUTSOURCE MANUFACTURER MONTHLY SALES TRENDS

- 3.2 CHIPS SALES BY ELECTRONIC GOODS SEGMENT

- 3.2.1 ELECTRONICS OUTLOOK

- 3.2.2 AUTOMOTIVE INDUSTRY OUTLOOK

- 3.2.2.1 ELECTRIC VEHICLE (EV) MARKET TRENDS

- 3.2.2.2 INCREASE IN SEMICONDUCTOR CONTENT FOR AUTOS

- 3.2.3 SMARTPHONE OUTLOOK

- 3.2.4 PC OUTLOOK

- 3.2.5 SERVERS / IT MARKET

- 3.3 SEMICONDUCTOR FABRICATION GROWTH & EXPANSION

- 3.3.1 IN THE MIDST OF HUGE INVESTMENT IN CHIP EXPANSIONS

- 3.3.2 NEW FABS IN THE US

- 3.3.3 WW FAB EXPANSION DRIVING GROWTH

- 3.3.4 EQUIPMENT SPENDING TRENDS

- 3.3.5 TECHNOLOGY ROADMAPS

- 3.3.6 FAB INVESTMENT ASSESSMENT

- 3.4 POLICY & TRADE TRENDS AND IMPACT

- 3.5 SEMICONDUCTOR MATERIALS OVERVIEW

- 3.5.1 TECHCET WAFER STARTS FORECAST THROUGH 2028

- 3.5.2 TECHCET MATERIALS MARKET FORECAST THROUGH 2028

4 SPUTTERING TARGETS MARKET TRENDS

- 4.1 SPUTTERING TARGETS MARKET TRENDS - OUTLINE

- 4.1.1 2023 SPUTTERING TARGETS MARKET LEADING INTO 2024

- 4.1.2 SPUTTERING TARGETS MARKET OUTLOOK

- 4.1.3 SPUTTERING TARGETS 5-YEAR UNIT SHIPMENT FORECAST BY SEGMENT

- 4.1.4 SPUTTERING TARGETS 5-YEAR REVENUE FORECAST BY SEGMENT

- 4.2 SPUTTERING TARGETS MANUFACTURING LOCATIONS AND INVESTMENTS - BY REGION

- 4.2.1 SPUTTERING TARGETS MANUFACTURING LOCATIONS AND INVESTMENTS - CAPACITY EXPANSIONS

- 4.3 PRICING TRENDS

- 4.4 SPUTTERING TARGET TECHNOLOGY OVERVIEW

- 4.4.1 SPUTTERING TARGET TECHNOLOGY- Trends

- 4.4.2 SPUTTERING TARGET technology- DRIVERS BY DIAMETER

- 4.4.3 SPUTTERING TARGET technology- SPECIALTY/ EMERGING MATERIALS APPLICATIONS

- 4.5 REGIONAL CONSIDERATIONS

- 4.5.1 REGIONAL ASPECTS AND DRIVERS

- 4.6 EHS AND TRADE/LOGISTICS ISSUES

- 4.6.1 EHS ISSUES

- 4.6.2 TRADE/LOGISTICS ISSUES

- 4.7 TECHCET ANALYST ASSESSMENT OF SPUTTERING TARGETS MARKET TRENDS

5 SUPPLY-SIDE MARKET LANDSCAPE

- 5.1 SPUTTERING TARGETS MARKET SHARE

- 5.2.1 CURRENT QUARTER - SUPPLIERS' ACTIVITIES & REPORTED EVENUES

- 5.2.2 CURRENT QUARTER REPORTING - JX ADVANCED METALS

- 5.2.3 CURRENT QUARTER REPORTING - HONEYWELL

- 5.2.4 CURRENT QUARTER REPORTING - KFMI

- 5.2.5 CURRENT QUARTER REPORTING - LINDE

- 5.2.6 CURRENT QUARTER REPORTING - TOSOH

- 5.3 M&A ACTIVITY AND PARTNERSHIPS

- 5.4 PLANT CLOSURES

- 5.5 NEW ENTRANTS

- 5.5.1 NEW ENTRANTS- BARRIERS TO ENTRY

- 5.5.2 NEW ENTRANTS- COMPANIES

- 5.6 SUPPLIERS OR PARTS/PRODUCT LINES THAT ARE AT RISK OF DISCONTINUATIONS

- 5.7 TECHCET ANALYST ASSESSMENT OF MATERIAL SUPPLIERS

6 SUB-TIER SUPPLY-CHAIN, METALS

- 6.1 SUB-TIER SUPPLY-CHAIN: SOURCES & MARKETS OVERVIEW

- 6.1.1 SUB-TIER Metals MARKET BACKGROUND

- 6.1.2 SUB-TIER Metals MARKET TRENDS

- 6.1.3 SUB-TIER METALS MARKET STATISTICS

- 6.1.4 SUB-TIER METALS SUPPLY CHAIN MANAGEMENT CONSIDERATIONS

- 6.1.5 SUB-TIER METALS SUPPLY CHAIN SUPPLY SIDE OVERVIEW

- 6.1.6 SUB-TIER METALS SUPPLIER NEWS

- 6.2 SUB-TIER SUPPLY-CHAIN: DISRUPTIONS

- 6.3 SUB-TIER SUPPLY-CHAIN M&A OR PARTNERSHIP ACTIVITY

- 6.4 SUB-TIER SUPPLY-CHAIN EHS AND LOGISTICS ISSUES

- 6.5 SUB-TIER SUPPLY-CHAIN "NEW" ENTRANTS

- 6.6 SUB-TIER SUPPLY-CHAIN PLANT UPDATES

- 6.7 SUB-TIER SUPPLY-CHAIN PLANT CLOSURES

- 6.9 SUB-TIER SUPPLY-CHAIN TECHCET ANALYST ASSESSMENT

7 SUPPLIER PROFILES

- ADVANCED TARGETS MATERIALS CO., LTD.

- AMERICAN ELEMENTS

- FURUYA METAL CO

- GO ELEMENT

- GRIKIN

- ...AND 20+ MORE

8 APPENDIX

- 8.1 ADVANCED PROCESSES, EMERGING STRUCTURES, AND SPECIALTY FILMS USING PVD

- 8.1.1 LOGIC, 10 NM & BELOW

- 8.1.2 DRAM - PVD VERSUS OTHER DEPOSITIONS

- 8.1.3 3D NAND - PVD VERSUS OTHER DEPOSITIONS

- 8.1.4 NEW DEVELOPMENTS IN THE TECHNOLOGY OR MARKETS: UNIVERSITY AND SUPPLIER R&D IN 5-7 YEARS

- 8.1.5 BPR ARCHITECTURE

- 8.1.6 SPECIALTY (STT MRAM, FE RAM, OTHER) MEMORY PVD MATERIALS

LIST OF FIGURES

- FIGURE 1.1: SPUTTERING TARGET SHIPMENT FORECAST BY SEGMENT

- FIGURE 1.2: SPUTTERING TARGET REVENUE FORECAST BY SEGMENT

- FIGURE 1.3: 2023 SPUTTERING TARGET SUPPLIER MARKET SHARE ESTIMATES BY REVENUE

- FIGURE 3.1: GLOBAL ECONOMY AND THE ELECTRONICS SUPPLY CHAIN (2023)

- FIGURE 3.2: WORLDWIDE SEMICONDUCTOR SALES

- FIGURE 3.3: TECHCET'S TAIWAN SEMICONDUCTOR INDUSTRY INDEX (TTSII) IN 000'S OF NTD

- FIGURE 3.4: 2023 SEMICONDUCTOR CHIP APPLICATIONS

- FIGURE 3.5: GLOBAL LIGHT VEHICLE UNIT SALES (IN MILLIONS OF UNITS)

- FIGURE 3.6: ELECTRIFICATION TREND BY WORLD REGION

- FIGURE 3.7: AUTOMOTIVE SEMICONDUCTOR PRODUCTION

- FIGURE 3.8: MOBILE PHONE SHIPMENTS, WW ESTIMATES

- FIGURE 3.9: WORLDWIDE PC AND TABLET FORECAST

- FIGURE 3.10: TSMC PHOENIX CAMPUS WITH THE 2ND FAB VISIBLE IN THE BACKGROUND

- FIGURE 3.11: ESTIMATED GLOBAL FAB SPENDING 2023-2028

- FIGURE 3.12: FAB EXPANSIONS WITHIN THE US

- FIGURE 3.13: SEMICONDUCTOR CHIP MANUFACTURING REGIONS OF THE WORLD

- FIGURE 3.14: GLOBAL TOTAL EQUIPMENT SPENDING (US$ M) AND Y-O-Y CHANGE

- FIGURE 3.15: ADVANCED LOGIC DEVICE TECHNOLOGY ROADMAP OVERVIEW

- FIGURE 3.16: DRAM TECHNOLOGY ROADMAP OVERVIEW

- FIGURE 3.17: 3D NAND TECHNOLOGY ROADMAP OVERVIEW

- FIGURE 3.18: INTEL OHIO PLANT SITE AS OF FEB. 2024

- FIGURE 3.19: TECHCET WAFER START FORECAST BY NODE SEGMENTS

- FIGURE 3.20: TECHCET WORLDWIDE MATERIALS FORECAST ($M USD)

- FIGURE 4.1: SPUTTER TARGET SHIPMENT FORECAST BY SEGMENT

- FIGURE 4.2: SPUTTERING TARGET REVENUE FORECAST BY SEGMENT

- FIGURE 4.3: US CHIPS ACT DIRECT FUNDING OVERVIEW

- FIGURE 4.4: JX ADVANCED METALS' PLANNED EXPANSIONS

- FIGURE 4.5: MARKET METAL PRICE TRENDS (2019 = 100)

- FIGURE 4.6: HIGH MAGNIFICATION IMAGES OF AL SPUTTERING TARGET SURFACES

- FIGURE 4.7: 2023 SPUTTERING TARGET REVENUE SHARE BY REGION

- FIGURE 4.8: AN EXAMPLE OF CIRCULARITY OF MATERIALS IN METALLURGY

- FIGURE 5.1: 2023 SPUTTERING TARGET SUPPLIER MARKET SHARE ESTIMATES BY REVENUE

- FIGURE 5.2: ENEOS HOLDINGS METALS SEGMENT QUARTER ENDING 06/30/2024 FINANCIALS

- FIGURE 5.3: HONEYWELL ADVANCED MATERIALS QUARTER ENDING 06/30/2024 FINANCIALS

- FIGURE 5.4: KFMI SALES BY REGION (M CNY)

- FIGURE 5.5: LINDE QUARTER ENDING 06/30/2024 FINANCIALS

- FIGURE 5.6: TOSOH SPECIALTY QUARTER ENDING 06/30/2024 FINANCIALS

- FIGURE 6.1: METAL PURIFICATION SOURCING IN-HOUSE VERSUS OUTSOURCED TRADEOFFS

- FIGURE 6.2: PRICE COMPARISON OF VARIOUS METALS

- FIGURE 6.3: PRICE INDICES OF BASE VS. PRECIOUS METALS

- FIGURE 6.4: DIAMETER AND THICKNESS IMPACT ON VOLUME

- FIGURE 6.5: AL TARGET SAMPLE PRICING OFFERED BY A DISTRIBUTOR

- FIGURE 6.6: TARGET EROSION PROFILE

- FIGURE 6.7: CU PRODUCTION AND APPLICATION HIGHLIGHTS QUADRANT CHART

- FIGURE 6.8: CU 5-YEAR PRICE HISTORY

- FIGURE 6.9: AL PRODUCTION AND APPLICATION HIGHLIGHTS QUADRANT CHART

- FIGURE 6.10: AL 5-YEAR PRICE HISTORY

- FIGURE 6.11: TI PRODUCTION, APPLICATION HIGHLIGHTS, AND 5-YEAR PRICE HISTORY QUADRANT CHART

- FIGURE 6.12: TA PRODUCTION, APPLICATION HIGHLIGHTS, AND 5-YEAR PRICE HISTORY QUADRANT CHART

- FIGURE 6.13: W PRODUCTION, APPLICATION HIGHLIGHTS, AND 5-YEAR PRICE HISTORY QUADRANT CHART

- FIGURE 6.14: NI PRODUCTION, APPLICATION HIGHLIGHTS, AND 5-YEAR PRICE HISTORY QUADRANT CHART

- FIGURE 6.15: CO PRODUCTION, APPLICATION HIGHLIGHTS, AND 5-YEAR PRICE HISTORY QUADRANT CHART

- FIGURE 6.16: MO PRODUCTION, APPLICATION HIGHLIGHTS, AND 5-YEAR PRICE HISTORY QUADRANT CHART

- FIGURE 6.17: CR PRODUCTION, APPLICATION HIGHLIGHTS, AND 5-YEAR PRICE HISTORY QUADRANT CHART

- FIGURE 6.18: IN PRODUCTION, APPLICATION HIGHLIGHTS, AND 5-YEAR PRICE HISTORY QUADRANT CHART

- FIGURE 6.19: RU PRODUCTION, APPLICATION HIGHLIGHTS, AND 5-YEAR PRICE HISTORY QUADRANT CHART

- FIGURE 6.20: AU PRODUCTION, APPLICATION HIGHLIGHTS, AND 5-YEAR PRICE HISTORY QUADRANT CHART

- FIGURE 6.21: AG PRODUCTION, APPLICATION HIGHLIGHTS, AND 5-YEAR PRICE HISTORY QUADRANT CHART

- FIGURE 6.22: PT PRODUCTION, APPLICATION HIGHLIGHTS, AND 5-YEAR PRICE HISTORY QUADRANT CHART

- FIGURE 6.23: PD PRODUCTION, APPLICATION HIGHLIGHTS, AND 5-YEAR PRICE HISTORY QUADRANT CHART

- FIGURE 6.24: METALS MAKEUP IN CLEANTECH, BY MASS

- FIGURE 6.25: METAL USAGE INDICES IN CLEANTECH BY SCENARIO

- FIGURE 6.26: SUPPLY / DEMAND BALANCE AND CLEANTECH'S IMPACT

- FIGURE 6.27: RELATED CHINA MINING AND REFINING PRODUCTION

- FIGURE 6.28: RISK ASSESSMENT OF METALS

- FIGURE 6.29: KEY PLAYERS IN THE SPUTTERING TARGET SUPPLY CHAIN

- FIGURE 6.30: CAPITAL EXPENDITURE ($B) FROM EACH MINING GROUP

- FIGURE 6.31: CAPITAL SPENDING CONTRIBUTION FROM EACH MINING GROUP

- FIGURE 6.32: RECENT EXPLORATION SPENDING, IN $B

- FIGURE 6.33: VENTURE CAPITAL INVESTMENT IN CRITICAL MINERALS OPERATIONS

- FIGURE 6.34: A COMPARISON OF METAL TO MINING ETFS

- FIGURE 6.35: A GUIDE TO UNDERSTANDING THE TVPRA LIST

- FIGURE 6.36: PGM LCA FROM 2022 AND SELECTIVE COMPARISON VERSUS 2017

- FIGURE 8.1: ILLUSTRATION OF 3D NAND ARCHITECTURE

- FIGURE 8.2: ILLUSTRATION OF THE BPR ARCHITECTURE AND NOTABLE CHARACTERISTICS

- FIGURE 8.3: ILLUSTRATION OF MRAM DEVICE STRUCTURE

LIST OF TABLES

- TABLE 1.1: SPUTTERING TARGET GROWTH OVERVIEW

- TABLE 1.2: MOST RECENT QUARTERLY SUPPLIER SALES (IN LOCAL REPORTING CURRENCY)

- TABLE 3.1: GLOBAL GDP AND SEMICONDUCTOR REVENUES

- TABLE 3.2: BATTERY ELECTRIC VEHICLE (BEV) REGIONAL TRENDS

- TABLE 3.3: DATA CENTER SYSTEMS AND COMMUNICATION SERVICES MARKET SPENDING 2023

- TABLE 4.1: A SELECTED LIST OF SPUTTERING TARGET SUPPLIER MANUFACTURING LOCATIONS

- TABLE 4.2: PRINCIPAL PVD APPLICATIONS BY WAFER DIAMETER

- TABLE 4.3: REGIONAL SPUTTERING TARGET MARKETS

- TABLE 5.1: MOST RECENT QUARTERLY SUPPLIER SALES

- TABLE 5.2: ENTRY BARRIERS TO THE SPUTTERING TARGET MARKET AND MITIGATION APPROACHES

- TABLE 6.1: HEIGHTENED RISK SUMMARIZATION

- TABLE 6.2: KEY OPERATIONS OF SUB-TIER METALS SUPPLIERS AND THEIR COMPANY-WIDE INVESTMENTS

- TABLE 6.3: SUMMARY OF CAPEX GROWTH FROM EACH MINING GROUP

- TABLE 8.1: LOGIC PVD APPLICATIONS

- TABLE 8.2: DRAM PVD APPLICATIONS

- TABLE 8.3: 3D NAND PVD APPLICATIONS

02-2729-4219

+886-2-2729-4219