|

市場調查報告書

商品編碼

1548194

用於 6G 通訊的介電材料、熱材料和透明材料:市場和技術 (2025-2045)6G Communications Dielectric, Thermal and Transparent Materials: Markets, Technology 2025-2045 |

|||||||

每一代無線通訊都透過提高傳輸頻率來提高效能。 6G 需要寬頻隙半導體,尤其是電介質。例如,傳輸訊號的繼電器將是用柔性電介質基板上的相變電介質調諧的超表面。 6G將演進為使用光電介電材料的無線遠紅外線傳輸。

隨著每一代新產品都採用產生更多熱量的基礎設施,冷卻變得更加重要,尤其是基於電介質的新型固態冷卻。此外,使用寬頻隙和介電材料的熱電和光伏發電將用於自供電基礎設施和客戶端設備。硬體正變得更加透明、更容易被接受、能力也更強。電介質、超寬頻 UWBG 半導體、熱材料和透明度等主題存在重大機會。

| 章節組成: | 8章 |

| SWOT評估: | 第16項 |

| 預測線: | 30線 |

| 信息克: | 67個 |

| 企業數: | 107公司 |

| 頁數: | 432頁 |

本報告提供6G通訊用電介質、導熱材料和透明材料的技術和市場調查,彙整6G的電介質·熱材料·透明材料的重要性,主要材料的R&D趨勢,技術藍圖,主要材料的市場規模的轉變·預測,6G的附加價值材料和設備製造技術從事的中小企業等資料。

目錄

第1章 摘要整理·總論:2025~2045年的藍圖·預測線

第2章 簡介

- 概述、重點與狀況資訊圖

- 6G第一階段將分階段實施

- 6G第二階段將是混亂且極為困難的

- 6G 材料需求和工具包顯示了許多光學功能的重要性

- 補充6G頻率選擇

- 6G可重構智慧表面RIS的演進

- 6G RIS的SWOT評估

- 6G基地台的演進

- 6G材料/設備製造商範例

第3章 6G溫度控管材料與用途

- 概述、溫度控制挑戰與未來技術工具包

- 6G 通訊熱材料機會的 SWOT 評估

- 6G 對導熱材料的需求不斷增長,需要進一步創新:市場差距

- 解決熱挑戰時需要考慮的要點

- 新型導熱聚合物與複合材料:2024 年取得進展

- 2025 年至 2045 年出現的熱材料選擇:超材料、水凝膠、氣凝膠、離子凝膠、熱解石墨

- 熱管理結構

第4章 電介質,熱傳導木材,面向使用了透明材料的6G固體冷卻

- 摘要

- 11個主要結論

- 固態冷卻的定義與必要性

- 211 項最新研究出版物揭示了未來固態冷卻最需要的化合物

- 透過 10 項功能對 12 種固態冷卻工作原理進行比較

- 依主題和技術成熟度劃分的固態冷卻研究管線

- 新興固態冷卻的核心

- 固體冷卻和加熱預防的功能和形式

- 導熱材料和其他冷卻技術的未來

- 有機矽導熱材料的SWOT評估

- 對固態冷卻的整體 SWOT 評估以及將在 2024 年報告重大進展的 7 個新版本

- 2024年用於6G晶片、雷射和基地台建築多功能應用的熱電溫控材料

- 冷卻技術關注度和成熟度的三個曲線:2025 年、2035 年和 2045 年

第5章 隱形解決驗收與效能問題:透明被動反射陣列與全能 STAR RIS

- 2024 年概述與範例

- 2024 年 5 月 6G 傳輸處理的透明度狀況

- 可選6G光束處理表面,視覺上可以透明或不透明

- 透明的 IRS 和 RIS 幾乎可以覆蓋任何地方

- 透明被動智慧反光錶面IRS:Meta Nanoweb-R Sekisui

- 光學透明和透明毫米波和太赫茲 RIS

- 同時透射/反射型STAR RIS

- STAR RIS SWOT 評估

- 其他研究論文:2024 年

- 其他研究論文:2023

第6章 6G通訊的超材料的基礎,變速箱,能源回收等

- 概述與潛在應用與 2024 年的進展

- 資訊圖:超材料在 5G 和 6G 的地位

- 考慮用於 6G 的電磁超材料類別

- 用於 5G 和 6G 通訊的超材料反射陣列和 RIS

- 超材料模式和材料,包括 2024 年的關鍵進展

- 包含雙功能超表面的超表面,包含 6G RIS 窗口

- 超表面 6G 能量收集:2024 年取得顯著研究進展

- 2024 年 6G 可調諧超材料將取得 7 項進展

- GHz、THz、紅外線和可見光超材料的許多新應用可降低投資風險

- 超材料和超表面的 SWOT 評估

- 超材料整體的長期前景

第7章 6G 0.3THz 至可見光 6G 傳輸的電介質、光學材料和半導體

- 電介質的定義、6G的實用性、風險規避、2024年後的研究進展範例

- 高介電常數和低介電常數6G低損耗材料的探索

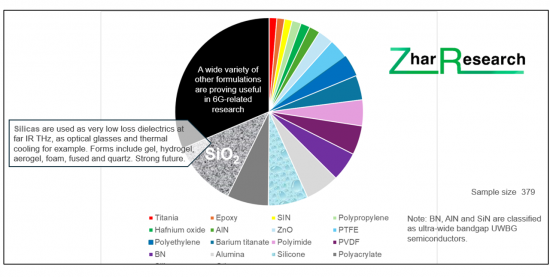

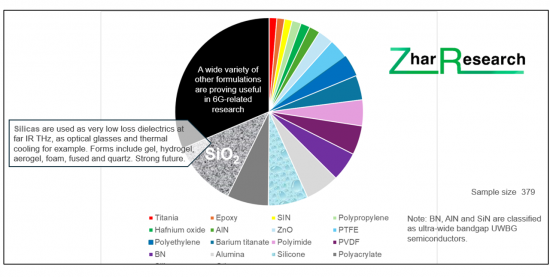

- 6G 重要介電配方的出現

- 相變電介質、液晶與 6G 光電替代品

- 太赫茲波導電纜和小型單元

- 6G近紅外線光纖的未來

第8章 涉及6G加值材料及裝置製造技術的中小企業

- AALTO HAPS (英國·德國·法國)

- Echodyne (美國)

- Evolv Technology (美國)

- Fractal Antenna Systems (美國)

- Greenerwave (法國)

- iQLP (美國)

- Kymeta Corp. (美國)

- LATYS Intelligence (加拿大)

- Meta Materials (加拿大)

- Metacept Systems (美國)

- Metawave (美國)

- Pivotal Commware (美國)

- SensorMetrix (美國)

- Teraview (美國)

Summary

Time for a report on 6G dielectrics, thermal and transparent materials. Why? Each generation of wireless communication increases performance by increasing transmission frequency. With 6G, that demands wide bandgap WBG semiconductors and particularly dielectrics. For example, the relay passing on the signal becomes a metasurface tuned with phase change dielectric on a flexible dielectric substrate as one option. 6G will evolve to add wireless far infrared transmission using optical dielectrics.

Every new generation employs more infrastructure generating more heat so cooling comes center stage, notably the new solid-state cooling based on dielectrics, and self-powering of infrastructure and client devices employs thermoelectrics and photovoltaics using WBG and dielectrics. Hardware increasingly becomes transparent to be acceptable (invisible facade overlayers, smart windows) and better performing (360-degree reconfigurable intelligent surfaces). Your big opportunity pivots to the overlapping topics of dielectrics, ultra-wide bandgap UWBG semiconductors, thermal materials and transparency and only this report covers them all. Vitally, it analyses the flood of advances in 2024, forecasting 2025-2045 because so much has changed recently.

Commercially oriented, the report has:

| Chapters: | 8 |

| SWOT appraisals: | 16 |

| Forecast lines: | 30 |

| Infograms: | 67 |

| Companies: | 107 |

| Pages: | 432 |

"6G Communications Dielectric, Thermal and Transparent Materials : Markets, Technology 2025-2045" starts with an Executive Summary and Conclusions clearly pulling everything together for those with limited time. Those 26 pages are mainly lucid new infograms, the 13 key conclusions and 2025-2045 roadmaps. The 30 forecast lines then add pages as both tables and graphs. The 41-page Introduction gives a thorough background to 6G hardware with SWOT appraisals and introduces some 2024 research.

Flood of 2024 research analysed

Then come two large chapters on your thermal materials and device opportunities in the light of breakthroughs in 2024 with a large amount of 2024 research analysed. Chapter 3 "6G thermal management materials and applications" (94 pages) presents the overall thermal picture, with the latest view of needs matched to the latest toolkit. That includes new thermally conductive polymers and composites, thermal metamaterial, hydrogel, aerogel, ionogel, pyrolytic graphite and graphene for both 6G infrastructure and client devices. There is even deep coverage of thermal systems you may wish to supply.

6G cooling becomes a large opportunity

Cooling emerges as the major thermal requirement due to 6G infrastructure making more heat and requiring client devices to manage heat in smaller formats. Indeed, emerging markets are in hotter places such as India and global warming also contributes to the 6G cooling problem. Conventional vapor compression cooling heats cities by up to several degrees and is not fit-and-forget so attention turns to solid state cooling for 6G merging with its hosts such as high-rise buildings and loitering stratospheric drones.

Consequently, a dedicated Chapter 4, "Solid state cooling for 6G using dielectric, thermal and transparent materials" (35 pages) analyses this favourite for infrastructure and client devices on the 20-year view. See eleven primary conclusions, most needed compounds for future solid-state cooling in 211 recent research announcements and twelve solid-state cooling operating principles compared by 10 capabilities. The research pipeline of solid-state cooling by topic vs technology readiness level is presented in three new maturity curves 2025, 2035, 2045. Thermal interface materials, thermoelectric, caloric, passive daytime radiative and other cooling principles are covered. Interestingly, your ultra-WBG materials such as SiN, AlN, BN and dielectrics such as silicas and aluminas are here need for cooling but later identified for many other 6G uses as well. It is found that solid state cooling suitable for 6G mainly needs inorganics whereas the other needs addressed in the report mainly need identified polymers.

Invisibility

Invisible 6G infrastructure will be more acceptable and functional from solar drones at 20km to satellites and transparent materials and devices, two major types being covered in Chapter 5, "Invisibility solves acceptance and performance problems: Transparent passive reflect-arrays and all-round STAR RIS", its 32 pages including two SWOT appraisals and a large amount of research progress in 2024.

Dielectric multifunctional metamaterials

Chapter 6, "Metamaterial basics, transmission, energy harvesting and more for 6G communications" takes 20 pages the assess a large amount of 2024 advance and give a SWOT appraisal. Understand why 6G demands progress from metal patterning on epoxy laminate to flexible, transparent, self-cleaning - even all dielectric - metamaterials for making 6G photovoltaics follow the sun and keep cool and for handling THz, near IR and visible light. See the remarkable research progress in 2024 achieving just that and also making electricity from movement, useful in 6G client devices.

Optical transmission materials and devices emerging

Then comes a large Chapter 7, "Dielectrics, optical materials, semiconductors for 6G 0.3THz to visible light 6G transmission" at 109 pages. Mostly dielectrics, it also includes ultra-wide gap semiconductors coming in and the flood of new research progress on all these topics. Overall, the important performance parameters are identified and, for dielectrics, a very detailed look at permittivities and dissipation factors DF for 20 dielectric families at the higher 6G frequencies. Matched against needs, it reveals that the emerging market for dielectrics with intermediate DF, low permittivity such as polyimides will be large, that for low DF, low permittivity such as porous silicas will be significant but there will also be a market for high permittivity, low DF such as hafnium oxide. What about Fluoropolymers (PBVE, PTFE, PVDF), epsilon near zero materials, THz and optical tuning materials? It is all here with a host of 2024 research advances and latest views.

Partners and acquisitions

To save time, you will need partners and acquisitions, mostly small companies, so the final Chapter 8, "Some small companies involved in 6G added value material and device manufacturing technologies" in 40 pages, profiles 14 for you to consider.

An important takeaway from, "6G Communications Dielectric, Thermal and Transparent Materials : Markets, Technology 2025-2045" is that the most successful materials in research for 6G thermal, dielectric and transparent applications have exceptionally varied morphologies, formats and applications in the preferred solid-state phase and are useful in many new composites. Overall, they are fairly-evenly divided between inorganics and organics with a trend to multifunctional smart materials using both.

Caption: Thermal, dielectric, UWBG materials of interest for 6G: latest research priorities. Source: Simplified image from Zhar Research report, "6G Communications Dielectric, Thermal and Transparent Materials : Markets, Technology 2025-2045".

Table of Contents

1. Executive Summary and Conclusions with roadmaps and forecast lines 2025-2045

- 1.1. Purpose of this report

- 1.2. Methodology of this analysis

- 1.3. Key conclusions: What will drive 6G success, landscape infogram

- 1.4. 6G hardware vanishing acceptable, affordable: implications, opportunities

- 1.5. Key conclusions: 6G materials generally

- 1.6. Key conclusions: thermal materials for 6G with four infograms

- 1.7. Key conclusions: dielectrics for 6G with five infograms

- 1.8. Organisations developing 6G hardware and likely purchasers of 6G added value materials

- 1.9. Technology roadmaps 2025-2045 and market forecast lines 2025-2045

- 1.9.1. Assumptions

- 1.9.2. Roadmaps of 6G materials and hardware 2025-2045

- 1.10. Market forecasts for 6G dielectric and thermal materials 2025-2045: tables with graphs

- 1.10.1. Dielectric materials market for 6G $ billion 2024-2045

- 1.10.2. Low loss materials for 6G area million square meters 2024-2045

- 1.10.3. Low loss materials for 6G value market % by frequency in two categories 2029-2045

- 1.10.4. Dielectric and thermal materials for 6G value market % by location 2029-2045

- 1.10.5. Thermal management material and structure for 6G Communications infrastructure and client devices $ billion 2025-2045

- 1.10.6. 5G vs 6G thermal interface material market $ billion 2024-2045

- 1.11. Background forecasts 2025-2045: tables with graphs

- 1.11.1. Market for 6G vs 5G base stations units millions yearly 2024-2045

- 1.11.2. Market for 6G base stations market value $bn if successful 2025-2045

- 1.11.3. 6G RIS value market $ billion: active and three semi-passive categories 2029-2045

- 1.11.4. 6G fully passive transparent metamaterial reflect-array market $ billion 2029-2045

- 1.11.5. 6G infrastructure/ client device market for materials manipulating IR and visible light: four categories $ billion 2029-2045

- 1.11.6. 6G infrastructure and device market for materials manipulating IR and visible light $ billion 2029-2045

- 1.11.7. Smartphone billion units sold globally 2023-2045 if 6G is successful

2. Introduction

- 2.1. Overview, reason for focus of this report and landscape infograms

- 2.1.1. Overview

- 2.1.2. Importance of dielectric, thermal and transparent materials and devices for 6G

- 2.1.3. Infograms: Planned 6G hardware deployment by land, water, air

- 2.2. 6G Phase One will be incremental

- 2.2.1. Overview

- 2.2.2. New needs, 5G inadequacies, massive overlap 4G, 5G, 6G

- 2.3. 6G Phase Two will be disruptive and extremely difficult

- 2.3.1. Overview

- 2.3.2. Some objectives of 6G mostly not achievable at start

- 2.3.3. View of a Japanese MNO heavily involved in hardware

- 2.3.4. ITU proposals and 3GPP initiatives also go far beyond what is achievable at start

- 2.3.5. Ultimate objectives and perceptions of those most heavily investing in 6G

- 2.4. Some 6G material needs and toolkit showing importance of many optical functions

- 2.5. Choosing complementary 6G frequencies

- 2.5.1. Overview

- 2.5.2. How attenuation in air by frequency and type 0.1THz to visible is complementary

- 2.5.3. Infogram: The Terahertz Gap and optics demands 6G RIS tuning materials and devices different from 5G

- 2.5.4. Spectrum for 6G Phase One and Two in context of current general use of spectrum

- 2.5.5. Essential frequencies for 6G success and some hardware resulting

- 2.6. Evolution of 6G reconfigurable intelligent surfaces RIS

- 2.6.1. Multifunctional and using many optical technologies

- 2.6.2. Infogram: RIS specificity, tuning criteria, physical principles, activation options

- 2.6.3. 6G RIS tuning material benefits and challenges compared

- 2.6.4. RIS will become zero energy devices and they will enable ZED client devices

- 2.6.5. Examples of 2024 research advances with far infrared THz RIS

- 2.6.6 6G RIS SWOT appraisal

- 2.7. Evolution of 6G base stations

- 2.7.1. Trend to use more optical technology

- 2.7.2. 6G Self-powered ultra-massive UM-MIMO base station design

- 2.8. Examples of manufacturers of 6G materials and equipment

- 2.8.1. Across the landscape infogram

- 2.8.2. Mapped across the globe

3. 6G thermal management materials and applications

- 3.1. Overview, temperature control challenges, future technology toolkit

- 3.2. SWOT appraisal of 6G Communications thermal material opportunities

- 3.3. Greater need for thermal materials in 6G demands more innovation: Gaps in the market

- 3.4. Important considerations when solving thermal challenges

- 3.5. New thermally conductive polymers and composites: 2024 progress

- 3.6. Thermal material options emerging 2025-2045: metamaterial, hydrogel, aerogel, ionogel, pyrolytic graphite

- 3.6.1. Thermal metamaterial with 11 advances in 2024

- 3.6.2. Thermal hydrogels including many advances in 2024

- 3.6.3. Ionogels for 6G applications: advances in 2024

- 3.6.5. Graphene-based thermal materials and structures including 2024 progress

- 3.7. Heat management structures

4. Solid state cooling for 6G using dielectric, thermal and transparent materials

- 4.1. Overview

- 4.2. Eleven primary conclusions

- 4.3. Definition and need for solid-state cooling

- 4.4. The most needed compounds for future solid-state cooling in 211 recent research announcements

- 4.5. Twelve solid-state cooling operating principles compared by 10 capabilities

- 4.6. Research pipeline of solid-state cooling by topic vs technology readiness level

- 4.7. Heart of emerging solid-state cooling

- 4.8. Function and format of solid-state cooling and prevention of heating

- 4.9. The future of thermal interface materials and other cooling by thermal conduction

- 4.10. SWOT appraisal for silicone thermal conduction materials

- 4.11. SWOT appraisals of solid-state cooling in general and seven emerging versions with radical advances reported in 2024

- 4.12. Thermoelectric temperature control materials for 6G chips, lasers, multifunctional use in base station buildings in 2024

- 4.13. Attention vs maturity of cooling technologies 3 curves 2025, 2035, 2045

- 4.14. Further reading

5. Invisibility solves acceptance and performance problems: Transparent passive reflect-arrays and all-round STAR RIS

- 5.1. Overview and examples in 2024

- 5.2. Situation with transparent 6G transmission-handling surfaces in 2024-5

- 5.3. Options for 6G beam-handling surfaces that can be visually transparent or opaque

- 5.4. Transparent IRS and RIS can go almost anywhere

- 5.5. Transparent passive intelligent reflecting surface IRS: Meta Nanoweb-R Sekisui

- 5.6. Optically transparent and transmissive mmWave and THz RIS

- 5.6.1. Overview

- 5.6.2. NTT DOCOMO transparent RIS

- 5.6.3. Cornell University RIS prototype and later work elsewhere

- 5.7. Simultaneous transmissive and reflective STAR RIS

- 5.7.1. Overview

- 5.7.2. STAR-RIS optimisation

- 5.7.3. STAR-RIS-ISAC integrated sensing and communication system

- 5.7.4. TAIS Transparent Amplifying Intelligent Surface and SWIPT active STAR-RIS

- 5.7.5. STAR-RIS with energy harvesting and adaptive power

- 5.7.6. Potential STAR-RIS applications including MIMO and security

- 5.8. STAR RIS SWOT appraisal

- 5.9. Other research papers analysed from 2024

- 5.10. Other research papers analysed from 2023

6. Metamaterial basics, transmission, energy harvesting and more for 6G communications

- 6.1. Overview and potential uses and some advances in 2024

- 6.2. Infogram: The place of metamaterials in 5G and 6G

- 6.3. Classes of electromagnetic metamaterial considered for 6G

- 6.4. Metamaterial reflect-arrays and RIS for 5G and 6G Communications

- 6.5. Metamaterial patterns and materials including major advances in 2024

- 6.6. Hypersurfaces including bifunctional metasurfaces including 6G RIS windows that cool

- 6.7. Metasurface 6G energy harvesting: Impressive research advances in 2024

- 6.8. Tunable metamaterials for 6G with seven advances in 2024

- 6.9. Many emerging applications of GHz, THz, infrared and visible light metamaterials derisking investment

- 6.10. SWOT appraisal of metamaterials and metasurfaces

- 6.11. The long-term picture of metamaterials overall

7. Dielectrics, optical materials, semiconductors for 6G 0.3THz to visible light 6G transmission

- 7.1. Dielectric definition, 6G usefulness, derisking, examples of research progress from 2024

- 7.1.1. Overview, important parameters, some latest examples and Zhar Research appraisal

- 7.1.2. Different dielectrics from 5G to 6G: better parameters, lower costs, larger areas

- 7.1.3. Important parameters for 6G dielectrics at device, board, package and RIS level: 5 infograms

- 7.1.4. Advances in 2024 and earlier with Zhar Research overall conclusions

- 7.1.5. SWOT appraisal of low-loss dielectrics for 6G infrastructure and client devices

- 7.1.6. Examples of new dielectrics being derisked by potential use both in 6G and other applications

- 7.2. The quest for high and low permittivity 6G low loss materials

- 7.2.1. Basic mechanisms affecting THz permittivity are challenging at 6G frequencies

- 7.2.2. Permittivity 0.1-1THz for 20 low loss compounds simplified

- 7.2.3. Dissipation factor optimisation across THz frequency for 20 material families

- 7.2.6. Special cases Epsilon Near Zero ENZ, silicon, phase change, electro-sensitive

- 7.2.4. THz dissipation factor variation for 20 material families: the detail

- 7.2.5. Compromises depending on format, physical properties and application

- 7.2.6. Special cases Epsilon Near Zero ENZ, silicon, phase change, electro-sensitive

- 7.3. Important dielectric formulations emerging for 6G including advances in 2024

- 7.3.1. Alumina including sapphire

- 7.3.2. Fluoropolymers PBVE, PTFE, PVDF

- 7.3.3. Polyimides

- 7.3.4. Polyphenylene ether and its polystyrene blends, polyphenylene oxide

- 7.3.5. Polypropylenes and their composites

- 7.3.6. Silica and its composites including quartz

- 7.4. Phase change dielectrics, liquid crystal and alternatives for 6G optronics

- 7.4.1. Overview

- 7.4.2. Status of 11 semiconductor and active layer candidates

- 7.4.3. Liquid crystal adopting many more 6G optronic roles: advantages, challenges

- 7.4.4. Vanadium dioxide adopting many more 6G optronic roles: advantages, challenges

- 7.5. Terahertz waveguide cables and small units

- 7.5.1. Need, and state of play

- 7.5.2. Advances in THz waveguides in 2025 (pre-publication), 2024 and 2023

- 7.5.3. Design and materials of 6G waveguide cables including fluoropolymers and polypropylenes

- 7.5.4 THz waveguides from InAs, GaP, sapphire etc. for boosting emitters, sensing etc.

- 7.5.5. Manufacturing polymer THz cable in long reels

- 7.5.6. THz waveguide gratings etched on metal-wires

- 7.5.7. SWOT appraisal of terahertz cable waveguides in 6G systems

- 7.6. Future near IR fiber optics for 6G

- 7.6.1. 5G experience

- 7.6.2. Fundamental types

- 7.6.3. Vulnerability of fiber optic cable: Serious attacks occurring

- 7.6.4. Limiting use of the fiber and its electronics to save cost

- 7.6.5. Fiber optic cable design and materials

- 7.6.6. SWOT appraisal of fiber optics in 6G system design

8. Some small companies involved in 6G added value material and device manufacturing technologies

- 8.1. AALTO HAPS UK, Germany, France

- 8.2. Echodyne USA

- 8.3. Evolv Technology USA

- 8.4. Fractal Antenna Systems USA

- 8.5. Greenerwave France

- 8.6. iQLP USA

- 8.7. Kymeta Corp. USA

- 8.8. LATYS Intelligence Canada

- 8.9. Meta Materials Canada

- 8.10. Metacept Systems USA

- 8.11. Metawave USA

- 8.12. Pivotal Commware USA

- 8.13. SensorMetrix USA

- 8.14. Teraview USA