|

市場調查報告書

商品編碼

1578352

氧化還原液流電池:市場預測線(23 條線)、路線圖、技術、製造商(59 家公司)、最新研究管線(2025-2045)Redox Flow Batteries: 23 Market Forecast Lines, Roadmaps, Technologies, 59 Manufacturers, Latest Research Pipeline 2025-2045 |

|||||||

氧化還原液流電池(RFB)幾十年來一直未開發,但現在是一個非常活躍的領域。其主要原因包括適當的市場需求的出現和重要的改進。

本報告預測,到2045年,RFB製造商的業務將超過200億美元,預計顯示兩倍的規模。關鍵是在克服初始成本和 LCOS 等RFB限制方面取得快速進展。例如,美國能源部的一份新報告指出,RFB是能夠實現長期電網儲存所需的每兆瓦時 50 美元成本的三種選擇之一。此外,其他兩種技術需要大量的土木工程工作,而RFB則不需要。

太陽能微電網復興

同樣重要的是,可持續 10 小時、安全堆疊的RFB已廣泛購買用於快速成長的太陽能微電網市場。事實上,使用RFB可以輕鬆解決陽光的間歇性問題。RFB提供規模經濟,因為功率和容量可以根據需要獨立調整。RFB可以在一台設備中執行短期和長期儲存。

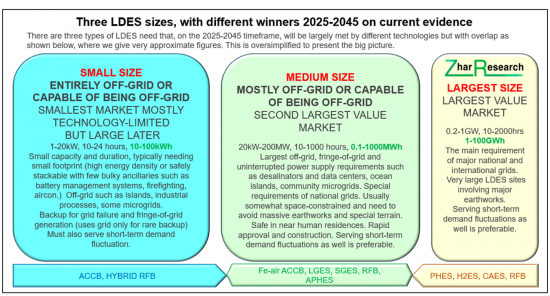

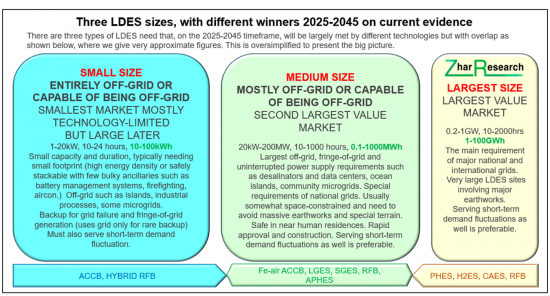

說明:三種 LDES 規模(2025-2045)的不同獲勝根據現有證據

本報告考察了全球氧化還原液流電池(RFB)市場,提供長期儲能(LDES)技術概要、RFB硬體和系統設計、研究管道、技術路線圖、及併網和離網技術的RFB前景、主要公司的概況等。

目錄

第1章 執行摘要/概述

第2章 簡介

- 能源基礎與 LCOS

- 透過快速降低成本加快進入再生能源領域

- 太陽能的勝利與間歇性挑戰

- LDES 迴避路線

- LDES 定義與選項比較

- 併網與離網 LDES 的不同需求

- 2025年重大專案與主要技術子集

- LDES 障礙、替代方案與投資環境

- LDES 工具包

- 最新的技術性能獨立評估

- 其他方面

第3章RFB設計原則、研究管線、毒素替代品、SWOT 評估

- 概述、成本分析、減少佔地面積、下一步設計挑戰

- 透過化學和反應評估RFB類型和參數

- 基本RFB硬體和系統設計

- 釩RFB設計

- 全鐵RFB設計

- 鐵鉻金屬配體設計

- 其他金屬配體RFB設計

- 氫溴RFB設計

- 有機RFB設計

- RFB薄膜設計

- RFB研究管道

- 需要解決的毒素問題以及各公司目前的成果

- SWOT評估:正常RFB

- SWOT評估:固定儲存中的RFB

- SWOT評估:混合RFB

- SWOT評估:釩RFB與替代品的比較

第4章 59家RFB企業、製造商、主要材料供應商比較介紹

- 透過8個因素進行比較:名稱、品牌、技術、技術準備、離網焦點、LDES 焦點、評論

- 58家RFB公司簡介(48家製造商,10種主要材料/服務)離網LDES的可能性

- Agora Energy Technologies

- Allegro Energy

- Beijing Herui Energy Storage

- Bryte Batteries Norway

- CellCube (Enerox)

- CERQ

- China CEC

- CMBlu

- Cougar Creek Technologies

- EDF bought Pivot Power

- Elestor

- ESS

- Green Energy Storage

- H2

- HBIS

- Hubei Lvdong

- Hunan Huifeng High Tech Energy

- HydraRedox

- Invinity Energy Systems

- Jolt Energy Storage Solutions

- Kemiwatt

- Korid Energy/AVESS

- Largo Inc

- LE System

- Lockheed Martin

- nanoFlowcell

- Noon Energy

- Pinflow

- Primus Power

- Prolux

- Quino Energy

- Redflow

- Redox One

- RFC Power

- Rongke Power

- Salgenx

- Shanghai Electric Energy Storage

- Shmid

- State Power Investment Corp.

- StorEn Technologies

- StorTera

- Stryten Energy

- Sumitomo Electric

- Suntien Green Energy

- Swanbarton

- VFlowTech

- Vionx Energy

- VizBlue

- VLiquid

- Voith

- Volterion

- VoltStorage

- VRB Energy

- Wattjoule Corporation

- WeView

- Wuhan NARI

- XL Batteries

- Yinfeng New Energy

- Zhiguang

LDES(長期儲能)第5章RFB

- 摘要

- RFB研究:關注 LDES

- RFBLDES 專案和到2025年的計算:時間、容量和當前獲勝技術

- RFBLDES 結果與目標

- 獲獎的LDES氧化還原液流電池技術

- 44 家RFB公司可能會遷移到 LDES 功能:8 欄比較

- 超越網格和 LDESRFB趨勢的領導者

- 八個參數圖闡明了RFB在 LDES 中的競爭地位

第6章 離網LDES氧化還原液流電池

- 摘要

- 離網:建築物、工業流程、迷你電網、微電網等。

- 離網發電與管理

- 傾向於需要更長的儲存時間

- 減少 LDES 需求並限制 LDES 擴展的策略

- 適用於併網與離網的LDES 工具包

- LDES 作為離網發電的市場驅動力

- 離網儲存的多功能性

- LDES 成本問題

- LDES 技術在併網和離網方面的潛力概述

- 為什麼離網LDES將成為2025年至2045年RFB數量最多、價值最大的市場

- 支援2024年至2045年銷售數量最多的LDES 的技術

Summary

Redox flow batteries are now a very active area after decades in the wilderness. That is largely because the appropriate market needs have arrived but it is increasingly reinforced by important improvements.

Essential new report

The new commercially-oriented 327-page report, "Redox Flow Batteries: 23 Market Forecast Lines, Roadmaps, Technologies, 59 Manufacturers, Latest Research Pipeline 2025-2045" predicts that these manufacturers will share over $20 billion of business in 2045, possibly double. Key is the now rapid progress in overcoming RFB limitations such as up-front cost and Levelised Cost of Storage LCOS. For example, a new US Department of Energy report finds that RFB are one of only three options able to drop to the $50/MWh it sees as necessary for long duration storage for grids. The other two technologies identified need massive earthworks: RFB does not.

Solar microgrids resurgent

Equally important, safely stackable RFB with ten hours duration (MWh divided by MW) are already widely purchased for solar microgrids, a rapidly-growing market. Indeed, coping with longer solar intermittency is easily achievable with RFB and most competition cannot keep up with that trend mainly driven by solar power taking over but also wind and their attendant intermittency. RFB has economy of scale due to separate adjustment of power and capacity as needed. RFB can perform short-and long-duration storage in one unit.

Traditional vanadium gaining business

The traditional vanadium RFB is gaining business. That is mostly for systems capable of being off-grid but some grid giants are being erected in China. An even bigger one is now planned in Europe.

Iron and other approaches slash cost and hybrids go small

Much of the effort is directed at using iron and, later, other options, to save cost. For different applications, the industry is perfecting small hybrids of RFB with one side having conventional battery structure instead of a tank of liquid. These may offer long duration in our solar buildings, where space is very tight. Eliminate the expensive ion exchange membrane? Offer 50-year life? Switch it off to store power in its liquids for a year with no leak or fade? Only the new Zhar Research report has the analysis, latest research, roadmaps and forecasts.

What the report offers

The Executive Summary and Conclusions is sufficient in itself with the new infograms, three SWOT appraisals, roadmaps and 23 forecast lines, graphs with explanations. The Introduction (30 pages) explains the context of renewable energy, Long Duration Energy Storage (most of the future RFB opportunity), its best technologies compared with many diagrams and comparison tables. Here are escape routes from needing LDES, because this report is balanced, real-world appraisal of your opportunity, not the maximised dream of a trade association. The conclusion is that LDES will not be as large a market as enthusiasts portray, but huge, nonetheless.

Chapter 3. RFB design principles, research pipeline, toxigen alternatives and SWOT appraisals (63 pages) looks closely at the different chemistries, electrolytes, membranes and so on, with infograms and tables. Understand the implications of the latest research pipeline and how to deal with matters of concern to industry such as toxicity issues. Which objectives are far off, even unrealistic?

Chapter 4. compares in eight columns then profiles 59 RFB companies, mostly manufacturers, but also some key materials providers in its 132 pages. Which four are already serious about 100 day LDES RFB, embarrassing the competition facing this very real emerging need? Chapter 5. Long Duration Energy Storage LDES RFB (28 pages) is equally detailed. It closely examines 13 relevant research advances in 2024. Parameters required, achieved and likely are revealed and explained because LDES is where the main potential of RFB now lies - from compact hybrid RFB in a building to very large RFB in a grid. Chapter 6. Redox flow batteries for LDES beyond grids (15 pages) then takes another look at this aspect because it will probably dominate value sales 2025-2045.

CAPTION: Three LDES sizes, with different winners 2025-2045

on current evidence

Table of Contents

1. Executive summary and conclusions

- 1.1. Purpose of this report

- 1.2. Methodology of this analysis

- 1.2. The different characteristics of grid utility and beyond-grid LDES 2025-2045

- 1.3. Eight primary conclusions: RFB markets and industry with ten infograms

- 1.4. 19 primary conclusions concerning RFB technologies

- 1.4.1. The 19 conclusions

- 1.4.2. Research pipeline analysis: 108 papers from 2022-2024

- 1.4.3. Seven RFB parameters in volume sales, vanadium vs other 2025-2045

- 1.5. 48 RFB manufacturers compared in 8 columns: name, brand, technology, tech. readiness, beyond grid focus, LDES focus, comment

- 1.6. Pie charts of active material and country of RFB manufacturers

- 1.7. SWOT appraisal of regular RFB

- 1.8. SWOT appraisal of hybrid RFB

- 1.9. SWOT appraisal of vanadium RFB against alternatives

- 1.10. RFB roadmap by market and by technology 2025-2045

- 1.11. Long Duration Energy Storage LDES roadmap 2025-2045

- 1.12. Market forecasts in 23 lines

- 1.12.1. RFB global value market grid vs beyond-grid 2025-2045 table, graph, explanation

- 1.12.2. RFB global value market short term and LDES 2025-2045 table, graph, explanation

- 1.12.3. Vanadium vs iron vs other RFB value market % 2025-2045 table, graph, explanation

- 1.12.4. Vanadium loses RFB share but rises elsewhere

- 1.12.5. Regional share of RFB value market in four regions 2025-2045

- 1.12.6. LDES value market $ billion in 9 technology categories with explanation 2025-2045

- 1.12.7. LDES total value market showing beyond-grid gaining share 2025-2045

2. Introduction

- 2.1. Energy fundamentals and LCOS

- 2.2. Racing into renewables with rapid cost reduction

- 2.3. Solar winning and the intermittency challenge

- 2.4. Escape routes from LDES

- 2.4.1. General situation

- 2.4.2. Reduction of LDES need by unrelated actions

- 2.4.3. Many options to deliberately reduce the need for LDES

- 2.5. LDES definitions and choices compared

- 2.6. The very different needs for grid vs beyond-grid LDES 2025-2045

- 2.7. Leading projects in 2025 showing leading technology subsets

- 2.8. LDES impediments, alternatives and investment climate

- 2.9. LDES toolkit

- 2.9.1. Overview

- 2.9.2. LDES choices compared

- 2.10. Latest independent assessments of performance by technology

- 2.12. Other aspects

3. RFB design principles, research pipeline, toxigen alternatives and SWOT appraisals

- 3.1. Overview, cost analysis, footprint reduction and next design challenges

- 3.1.1. General

- 3.1.2. Cost issues, cost breakdown and potential improvement

- 3.1.3. Footprint reduction

- 3.2. Types of RFB by chemistry and reaction with parameter appraisal

- 3.3. Basic RFB hardware and system design

- 3.4. Vanadium RFB design

- 3.5. All-iron RFB design

- 3.6. Iron Chromium metal ligand design

- 3.7. Other metal ligand RFB design

- 3.8. Hydrogen-bromine RFB design

- 3.9. Organic RFB design

- 3.10. RFB membrane design

- 3.10.1. Issues

- 3.10.2. Membrane difficulty levels and materials used and proposed

- 3.10.3. Recent RFB membrane research

- 3.11. RFB research pipeline

- 3.11.1. Overview

- 3.11.2. Extreme promises

- 3.11.3. Research pipeline analysis: 108 papers from 2022 to 2024

- 3.11.4. Iron-based electrolyte RFB research 2024

- 3.11.5. Vanadium electrolyte RFB research

- 3.11.6. Organic electrolyte RFB research

- 3.11.7. Zinc electrolyte RFB research

- 3.11.8. General and other metals RFB research

- 3.11.9. Manganese-based RFB research

- 3.12. Toxigen issues to tackle and current achievements by company

- 3.13. SWOT appraisal of regular RFB

- 3.14. SWOT appraisal of RFB for stationary storage

- 3.15. SWOT appraisal of hybrid RFB

- 3.16. SWOT appraisal of vanadium RFB against alternatives

4. 59 RFB companies, manufacturers, key materials providers compared and profiled in 132 pages

- 4.1. 58 RFB companies compared in 8 columns: name, brand, technology, tech. readiness, beyond grid focus, LDES focus, comment

- 4.2. Profiles of 58 RFB companies (48 manufacturers, 10 in key materials/ services) in 130 pages with appraisal for beyond-grid LDES potential

- Agora Energy Technologies

- Allegro Energy

- Beijing Herui Energy Storage

- Bryte Batteries Norway

- CellCube (Enerox)

- CERQ

- China CEC

- CMBlu

- Cougar Creek Technologies

- EDF bought Pivot Power

- Elestor

- ESS

- Green Energy Storage

- H2

- HBIS

- Hubei Lvdong

- Hunan Huifeng High Tech Energy

- HydraRedox

- Invinity Energy Systems

- Jolt Energy Storage Solutions

- Kemiwatt

- Korid Energy / AVESS

- Largo Inc

- LE System

- Lockheed Martin

- nanoFlowcell

- Noon Energy

- Pinflow

- Primus Power

- Prolux

- Quino Energy

- Redflow

- Redox One

- RFC Power

- Rongke Power

- Salgenx

- Shanghai Electric Energy Storage

- Shmid

- State Power Investment Corp.

- StorEn Technologies

- StorTera

- Stryten Energy

- Sumitomo Electric

- Suntien Green Energy

- Swanbarton

- VFlowTech

- Vionx Energy

- VizBlue

- VLiquid

- Voith

- Volterion

- VoltStorage

- VRB Energy

- Wattjoule Corporation

- WeView

- Wuhan NARI

- XL Batteries

- Yinfeng New Energy

- Zhiguang

5. Long Duration Energy Storage LDES RFB

- 5.1. Overview

- 5.1.1. Definition

- 5.1.2. Very different LDES needs for grid vs beyond-grid

- 5.1.3. RFB capability in the LDES world

- 5.1.4. Duration vs power of LDES technologies not needing major earthworks compared with others in 2025

- 5.2. RFB research pivoting to LDES

- 5.2.1. Overview of research

- 5.2.2. 13 important RFB research advances in 2024 relevant to LDES

- 5.3. RFB LDES projects and calculations to 2025: hours, capacity, currently winning technology

- 5.4. RFB LDES achievements and aspirations 2025-2045

- 5.5. Winning LDES redox flow battery technologies 2025-2045

- 5.7 44 RFB companies likely to move to LDES capability compared in 8 columns

- 5.8. Leaders in the trends to beyond-grid and LDES RFB

- 5.9. Eight parameter maps revealing RFB competitive position in LDES

6. Redox flow batteries for LDES beyond grids

- 6.1. Overview

- 6.2. Beyond-grid: buildings, industrial processes, minigrids, microgrids, other

- 6.3. Beyond-grid electricity production and management

- 6.4. The trend to needing longer duration storage

- 6.5. Strategies for reducing LDES need can limit escalation of LDES

- 6.6. LDES toolkit for grid and beyond-grid

- 6.7. Market drivers of beyond-grid electricity generation notably providing LDES

- 6.8. Multifunctional nature of beyond-grid storage

- 6.9. LDES cost challenge

- 6.10. Big picture of LDES technology potential for grid and beyond-grid

- 6.11. Why beyond-grid LDES will become the largest number and value market for RFB 2025-2045

- 6.12. Technologies for largest number of LDES sold 2024-2045