|

市場調查報告書

商品編碼

1357957

電池租賃市場:依電池化學、依用途、依商業模式、依地區Battery Leasing Market, By Battery Chemistry, By Application, By Business Model, By Region |

||||||

電池租賃市場規模預計將從 2023 年的 150.3 億美元增至 2030 年的 317.9 億美元,預測期內年複合成長率為 11.3%。

| 報告範圍 | 報告詳情 | ||

|---|---|---|---|

| 基準年 | 2022年 | 2023年市場規模 | 150.3億美元 |

| 實績資料 | 2018-2021 | 預測期 | 2023-2030 |

| 預測期年複合成長率 | 11.30% | 2030年市場規模預測 | 317.9億美元 |

電池租賃是能源產業的一個不斷成長的趨勢,為希望過渡到清潔能源的企業和個人提供了永續的解決方案。電池租賃是租用或租賃電池而不是購買電池,為能源儲存提供了更實惠、更靈活的選擇。

對可靠且經濟實惠的儲能解決方案的需求不斷成長,推動了電池租賃的需求。隨著太陽能光伏發電和風能等再生能源來源的增加,人們越來越需要儲存多餘的能源以備後用。電池租賃允許用戶獲取儲存的能量,而無需承擔與購買電池相關的高昂初期成本。

市場動態:

電池租賃市場是由幾個關鍵要素推動的。首先,隨著企業和個人尋求減少對石化燃料的依賴並轉向更清潔的能源,對儲能解決方案的需求正在迅速增加。電池租賃提供了一種經濟有效的獲取能源儲存的方式,並允許更多的人採用可再生能源技術。

其次,電池技術的進步使其更有效率且價格實惠。這降低了電池租賃的總成本,使其成為對消費者和企業有吸引力的選擇。此外,電動車需求的不斷成長也促進了電池租賃市場的成長。隨著電動車變得越來越普及,對方便且價格實惠的充電基礎設施的需求不斷成長,而電池租賃可以滿足這一需求。

儘管存在這些機遇,但電池租賃市場也存在課題和抑制因素。主要課題之一是法規和政策不標準化。有關電池租賃的法規可能因地區或國家而異,這可能會成為市場成長的障礙。

本研究的主要特點

- 本報告對全球電池租賃市場進行了詳細分析,包括以2022年為基準年的預測期(2023-2030)的市場規模和年複合成長率。

- 它揭示了各個部門市場的潛在商機,並為該市場說明了一系列有吸引力的投資提案。

- 它還提供了有關市場促進因素、抑制因素、機會、新產品發布和核准、市場趨勢、區域前景、主要企業採取的競爭策略等的重要考察。

- 根據公司亮點、產品系列、主要亮點、財務實績和策略等參數對全球電池租賃市場的主要企業進行了介紹。

- 研究中的主要企業包括Nextera Energy、Onewatt、EDF Energy、Engie、EON Energy Solutions、Alpiq、Leclanche、Sonnen、Enel X、殼牌、Total Solar Distributed Generation USA、Sunrun、LG Chem、三星SDI、比亞迪、松下、寧德時代、特斯拉、Fluence、Powin Energy 等。

- 該報告的見解使行銷人員和負責人能夠就未來的產品發布、技術升級、市場擴張和行銷策略做出明智的資訊。

- 本研究報告針對投資者、供應商、產品製造商、經銷商、新進業者和財務分析師等相關人員。

- 相關人員可以從用於分析全球電池租賃市場的各種策略矩陣中受益,以促進決策。

目錄

第1章 調查目的和假設

- 這項研究的目的

- 假設

- 簡稱

第2章 市場展望

- 報告說明

- 市場定義和範圍

- 執行摘要

- Coherent Opportunity Map(COM)

第3章 市場動態、法規及趨勢分析

- 市場動態

- 促進因素

- 對可靠且經濟實惠的儲能解決方案的需求不斷成長

- 抑制因素

- 缺乏規範的法規和政策

- 機會

- 電動車需求增加

- 影響分析

- 主要亮點

- 法規場景

- 產品發布/核准

- PEST分析

- 波特的分析

- 併購場景

第4章 電池租賃市場-冠狀病毒(COVID-19)大流行的影響

- 新型冠狀病毒感染疾病(COVID-19)的流行病學

- 供需面分析

- 經濟影響

第5章 電池租賃市場:依電池化學分類,2023-2030 年

- 鉛

- 鋰離子

- 液流電池

- 硫磺鈉

- 其他

第6章 電池租賃市場:依用途,2023-2030

- 住宅

- 商業的

- 工業的

- 網格存儲

- 電動車充電

- 其他

第7章 電池租賃市場:依商業模式分類,2023-2030

- BaaS

- Energy-as-a-Service

- 電力租賃

- 其他

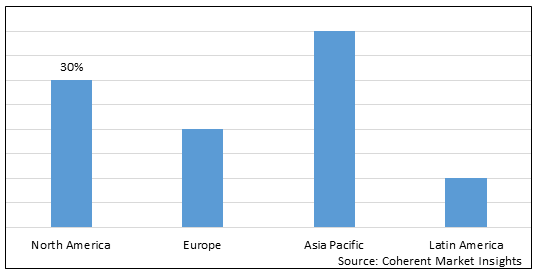

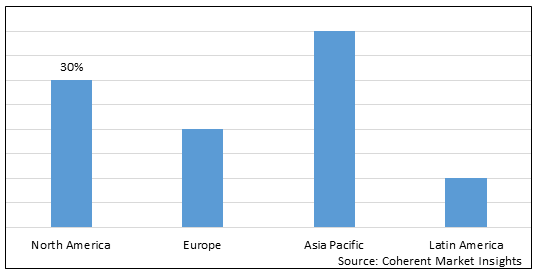

第8章 電池租賃市場:依地區分類,2023-2030

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

第9章 競爭形勢

- Nextera Energy

- Onewatt

- EDF Energy

- Engie

- EON Energy Solutions

- Alpiq

- Leclanche

- Sonnen

- Enel X

- Shell

- Total Solar Distributed Generation USA

- Sunrun

- Samsung SDI

- BYD

- LG Chem

- Panasonic

- CATL

- Tesla

- Fluence

- Powin Energy

第10章 章

- 調查方法

- 關於出版商

The Battery Leasing Market size is expected to reach US$ 31.79 billion by 2030, from US$ 15.03 billion in 2023, at a CAGR of 11.3% during the forecast period.

| Report Coverage | Report Details | ||

|---|---|---|---|

| Base Year: | 2022 | Market Size in 2023: | US$ 15.03 Bn |

| Historical Data for: | 2018 to 2021 | Forecast Period: | 2023 - 2030 |

| Forecast Period 2023 to 2030 CAGR: | 11.30% | 2030 Value Projection: | US$ 31.79 Bn |

Battery leasing is a growing trend in the energy industry, offering a sustainable solution for businesses and individuals looking to transition to clean energy sources. It involves renting or leasing batteries instead of purchasing them outright, providing a more affordable and flexible option for energy storage.

The demand for battery leasing has been driven by the increasing need for reliable and affordable energy storage solutions. With the rise of renewable energy sources, such as solar and wind power, there is a growing need to store excess energy for later use. Battery leasing allows users to access this stored energy without the high upfront costs associated with purchasing batteries.

Market Dynamics:

The battery leasing market is driven by several key factors. Firstly, the need for energy storage solutions is increasing rapidly, as businesses and individuals seek to reduce their reliance on fossil fuels and transition to cleaner energy sources. Battery leasing provides a cost-effective way to access energy storage, enabling more people to adopt renewable energy technologies.

Secondly, technological advancements in battery technology have made it more efficient and affordable. This has led to a decrease in the overall cost of battery leasing, making it an attractive option for consumers and businesses. Additionally, the increasing demand for electric vehicles has also contributed to the growth of the battery leasing market. As the adoption of electric vehicles continues to rise, there is a growing need for accessible and affordable charging infrastructure, which battery leasing can provide.

Despite the opportunities, there are also some challenges and restraints in the battery leasing market. One of the main challenges is the lack of standardized regulations and policies. Each region and country may have different regulations regarding battery leasing, which can create barriers to market growth.

Key Features of the Study:

- This report provides in-depth analysis of the global battery leasing market, including market size (US$ Billion) and compound annual growth rate (CAGR%) for the forecast period (2023-2030), with 2022 as the base year.

- It elucidates potential revenue opportunities across different segments and explains attractive investment proposition matrices for this market.

- This study also provides key insights about market drivers, restraints, opportunities, new product launches or approvals, market trends, regional outlook, and competitive strategies adopted by key players.

- Key players in the global battery leasing market are profiled based on parameters such as company highlights, product portfolio, key highlights, financial performance, and strategies.

- Key companies covered in this study include Nextera Energy, Onewatt, EDF Energy, Engie, EON Energy Solutions, Alpiq, Leclanche, Sonnen, Enel X, Shell, Total Solar Distributed Generation USA, Sunrun, LG Chem, Samsung SDI, BYD, Panasonic, CATL, Tesla, Fluence, and Powin Energy.

- Insights from this report would enable marketers and management authorities to make informed decisions regarding future product launches, technology upgrades, market expansion, and marketing tactics.

- The global battery leasing market report caters to stakeholders including investors, suppliers, product manufacturers, distributors, new entrants, and financial analysts.

- Stakeholders would benefit from various strategy matrices used in analyzing the global battery leasing market, which provides ease in decision-making.

Battery Leasing Market Segmentation

- By Battery Chemistry

- Lead Acid

- Li-ion

- Flow Battery

- Sodium Sulfur

- Others

- By Application

- Residential

- Commercial

- Industrial

- Grid Storage

- EV Charging

- Others

- By Business Model

- BaaS

- Energy-as-a-Service

- Power Rental

- Others

- By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

- Top companies in Battery Leasing Market

- Nextera Energy

- Onewatt

- EDF Energy

- Engie

- EON Energy Solutions

- Alpiq

- Leclanche

- Sonnen

- Enel X

- Shell

- Total Solar Distributed Generation USA

- Sunrun

- LG Chem

- Samsung SDI

- BYD

- Panasonic

- CATL

- Tesla

- Fluence

- Powin Energy

Table of Contents

1. Research Objectives and Assumptions

- Research Objectives

- Assumptions

- Abbreviations

2. Market Purview

- Report Description

- Market Definition and Scope

- Executive Summary

- Market Snapshot, By Battery Chemistry

- Market Snapshot, By Application

- Market Snapshot, By Business Model

- Market Snapshot, By Region

- Coherent Opportunity Map (COM)

3. Market Dynamics, Regulations, and Trends Analysis

- Market Dynamics

- Drivers

- Increasing need for reliable and affordable energy storage solutions

- Restraints

- Lack of standardized regulations and policies

- Opportunities

- Increasing demand for electric vehicles

- Impact Analysis

- Key Highlights

- Regulatory Scenario

- Product launch/Approvals

- PEST Analysis

- PORTER's Analysis

- Merger and Acquisition Scenario

4. Battery Leasing Market - Impact of Coronavirus (COVID-19) Pandemic

- COVID-19 Epidemiology

- Supply Side and Demand Side Analysis

- Economic Impact

5. Battery Leasing Market , By Battery Chemistry, 2023-2030, (US$ Bn)

- Introduction

- Market Share Analysis, 2023 and 2030 (%)

- Y-o-Y Growth Analysis, 2018 - 2030

- Segment Trends

- Lead Acid

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2023-2030,(US$ Bn)

- Li-ion

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2023-2030,(US$ Bn)

- Flow Battery

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2023-2030,(US$ Bn)

- Sodium Sulfur

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2023-2030,(US$ Bn)

- Others

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2023-2030,(US$ Bn)

6. Battery Leasing Market , By Application, 2023-2030, (US$ Bn)

- Introduction

- Market Share Analysis, 2023and 2030 (%)

- Y-o-Y Growth Analysis, 2018- 2030

- Segment Trends

- Residential

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2023-2030,(US$ Billion)

- Commercial

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2023-2030,(US$ Billion)

- Industrial

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2023-2030,(US$ Billion)

- Grid Storage

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2023-2030,(US$ Billion)

- EV Charging

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2023-2030,(US$ Billion)

- Others

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2023-2030,(US$ Billion)

7. Battery Leasing Market , By Business Model, 2023-2030, (US$ Bn)

- Introduction

- Market Share Analysis, 2023and 2030 (%)

- Y-o-Y Growth Analysis, 2018- 2030

- Segment Trends

- BaaS

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2023-2030,(US$ Billion)

- Energy-as-a-Service

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2023-2030,(US$ Billion)

- Power Rental

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2023-2030,(US$ Billion)

- Others

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2023-2030,(US$ Billion)

8. Battery Leasing Market , By Region, 2023-2030, (US$ Bn)

- Introduction

- Market Share Analysis, By Country, 2023and 2030 (%)

- Y-o-Y Growth Analysis, For Country 2018-2030

- Country Trends

- North America

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, By Battery Chemistry, 2023-2030,(US$ Bn)

- Market Size and Forecast, and Y-o-Y Growth, By Application, 2023-2030,(US$ Bn)

- Market Size and Forecast, and Y-o-Y Growth, By Business Model, 2023-2030,(US$ Bn)

- Europe

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, By Battery Chemistry, 2023-2030,(US$ Bn)

- Market Size and Forecast, and Y-o-Y Growth, By Application, 2023-2030,(US$ Bn)

- Market Size and Forecast, and Y-o-Y Growth, By Business Model, 2023-2030,(US$ Bn)

- Asia Pacific

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, By Battery Chemistry, 2023-2030,(US$ Bn)

- Market Size and Forecast, and Y-o-Y Growth, By Application, 2023-2030,(US$ Bn)

- Market Size and Forecast, and Y-o-Y Growth, By Business Model, 2023-2030,(US$ Bn)

- Latin America

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, By Battery Chemistry, 2023-2030,(US$ Bn)

- Market Size and Forecast, and Y-o-Y Growth, By Application, 2023-2030,(US$ Bn)

- Market Size and Forecast, and Y-o-Y Growth, By Business Model, 2023-2030,(US$ Bn)

- Middle East & Africa

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, By Battery Chemistry, 2023-2030,(US$ Bn)

- Market Size and Forecast, and Y-o-Y Growth, By Application, 2023-2030,(US$ Bn)

- Market Size and Forecast, and Y-o-Y Growth, By Business Model, 2023-2030,(US$ Bn)

9. Competitive Landscape

- Nextera Energy

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- Onewatt

- Company Highlights

- Product Portfolio

- Key Highlights

- Financial Performance

- Strategies

- EDF Energy

- Company Highlights

- Product Portfolio

- Key Highlights

- Financial Performance

- Strategies

- Engie

- Company Highlights

- Product Portfolio

- Key Highlights

- Financial Performance

- Strategies

- EON Energy Solutions

- Company Highlights

- Product Portfolio

- Key Highlights

- Financial Performance

- Strategies

- Alpiq

- Company Highlights

- Product Portfolio

- Key Highlights

- Financial Performance

- Strategies

- Leclanche

- Company Highlights

- Product Portfolio

- Key Highlights

- Financial Performance

- Strategies

- Sonnen

- Company Highlights

- Product Portfolio

- Key Highlights

- Financial Performance

- Strategies

- Enel X

- Company Highlights

- Product Portfolio

- Key Highlights

- Financial Performance

- Strategies

- Shell

- Company Highlights

- Product Portfolio

- Key Highlights

- Financial Performance

- Strategies

- Total Solar Distributed Generation USA

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- Sunrun

- Company Highlights

- Product Portfolio

- Key Highlights

- Financial Performance

- Strategies

- Samsung SDI

- Company Highlights

- Product Portfolio

- Key Highlights

- Financial Performance

- Strategies

- BYD

- Company Highlights

- Product Portfolio

- Key Highlights

- Financial Performance

- Strategies

- LG Chem

- Company Highlights

- Product Portfolio

- Key Highlights

- Financial Performance

- Strategies

- Panasonic

- Company Highlights

- Product Portfolio

- Key Highlights

- Financial Performance

- Strategies

- CATL

- Company Highlights

- Product Portfolio

- Key Highlights

- Financial Performance

- Strategies

- Tesla

- Company Highlights

- Product Portfolio

- Key Highlights

- Financial Performance

- Strategies

- Fluence

- Company Highlights

- Product Portfolio

- Key Highlights

- Financial Performance

- Strategies

- Powin Energy

- Company Highlights

- Product Portfolio

- Key Highlights

- Financial Performance

- Strategies

- Analyst Views

10. Section

- Research Methodology

- About us