|

市場調查報告書

商品編碼

1477282

二手車市場、依車輛類型、依燃料類型、依配銷通路、依最終用途、依地理位置Used Car Market, By Vehicle Type, By Fuel Type, By Distribution Channel, By End-Use, By Geography |

||||||

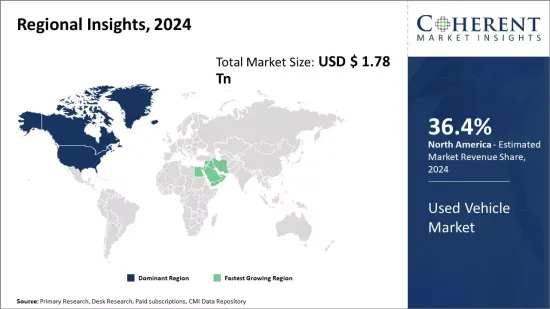

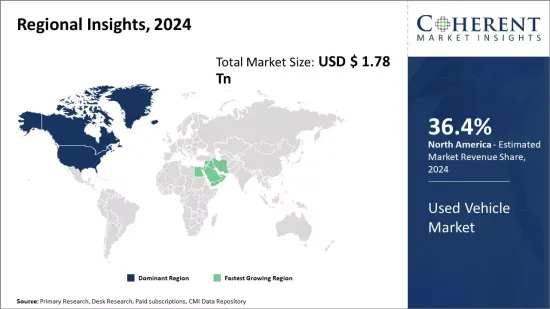

預計 2024 年二手車市值為 1.78 兆美元,預計到 2031 年將達到 2.73 兆美元,2024 年至 2031 年年複合成長率(CAGR) 為 6.3%。

| 報告範圍 | 報告詳情 | ||

|---|---|---|---|

| 基準年: | 2023年 | 2024 年市場規模: | 1.78 美元 |

| 歷史數據: | 2019年至2023年 | 預測期: | 2024年至2031年 |

| 預測 2024 年至 2031 年複合年成長率: | 6.30% | 2031 年價值預測: | $2.73 田納西 |

北美的二手車市場在整個汽車產業中佔有重要佔有率。每年有數百萬輛二手車易手,這是一個價值數十億美元的經濟部門。道路上車輛平均車齡增加、更換週期縮短以及負擔得起的融資選擇等因素推動了這一領域的需求。目前美國汽車的平均車齡超過11年,凸顯消費者更願意延長車輛保有時間,而不是承擔高昂的新車成本。此外,隨著越來越多的人選擇以具有競爭力的價格提供保固的經過認證的二手豪華車,預計二手豪華車銷售將強勁成長。儘管網際網路提高了二手車交易的透明度,但買家在確保車輛狀況和品質方面仍然存在課題。總體而言,二手車市場在為不同收入群體提供無障礙車輛所有權方面發揮著重要作用。

市場動態:

二手車市場。受到多種促進因素、限制因素和機會的影響。隨著車輛平均車齡的增加,駕駛者的強勁需求是刺激銷售的關鍵因素。此外,銀行提供的廉價貸款計劃和靈活的融資選擇使購車更加實惠。這進一步刺激了市場成長。然而,市場潛力受到一些州不明確的里程認證和所有權轉讓問題等監管課題的阻礙。嚴格的檢驗標準和排放法規也起到了約束作用。此外,線上市場的激增在一定程度上威脅了線下經銷商的獲利能力。在機會方面,對經過認證的二手豪華車和混合動力汽車和電動車(EV)等綠色二手車的需求不斷成長,為未來的擴張鋪平了道路。同樣,實施區塊鏈技術可以幫助解決所有權和里程表問題,從而增強消費者購買二手車的信心。

研究的主要特點:

- 該報告對全球二手車市場進行了深入分析,並提供了預測期(2024-2031年,以2023年為基準年)的市場規模和年複合成長率(CAGR%)。

- 它闡明了不同區隔市場的潛在收入成長機會,並解釋了該市場有吸引力的投資主張矩陣。

- 這項研究還提供了有關市場促進因素、限制因素、機會、新產品發布或批准、市場趨勢、區域前景以及主要參與者採取的競爭策略的重要見解。

- 它根據以下參數描述了全球二手車市場的主要參與者——公司亮點、產品組合、主要亮點、財務表現和策略。

- 該報告的見解將使行銷人員和公司管理當局能夠就未來的產品發布、類型升級、市場擴張和行銷策略做出明智的決策。

- 全球二手車市場報告迎合了該行業的各個利益相關者,包括投資者、供應商、產品製造商、分銷商、新進業者和金融分析師。

- 利害關係人可以透過用於分析全球二手車市場的各種策略矩陣輕鬆做出決策。

目錄

第1章:研究目標與假設

- 研究目標

- 假設

- 縮寫

第 2 章:市場範圍

- 報告說明

- 市場定義和範圍

- 執行摘要

- Coherent Opportunity Map (COM)

第 3 章:市場動態、法規與趨勢分析

- 市場動態

- 促進要素

- 限制

- 機會

- 監管場景

- 產業動態

- 併購

- 新系統啟動/批准

- COVID-19 大流行的影響

第 4 章:2019-2031 年全球二手車市場(依車輛類型)

- 介紹

- 掀背車

- 轎車

- 運動型多用途車

- 其他

第 5 章:2019-2031 年全球二手車市場(依燃料類型)

- 介紹

- 汽油

- 柴油引擎

- 混合動力/電動

- 其他

第 6 章:全球二手車市場(依配銷通路),2019-2031

- 介紹

- 特約經銷商

- 獨立經銷商

- 其他

第 7 章:2019-2031 年全球二手車市場(依最終用途)

- 介紹

- 個人的

- 商業的

第 8 章:2019-2031 年全球二手車市場(依地區)

- 介紹

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 義大利

- 法國

- 俄羅斯

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 東協

- 澳洲

- 韓國

- 日本

- 亞太地區其他地區

- 拉丁美洲

- 巴西

- 阿根廷

- 墨西哥

- 拉丁美洲其他地區

- 中東和非洲

- 海灣合作理事會國家

- 南非

- 中東和非洲其他地區

第 9 章:競爭格局

- 公司簡介

- Arnold Clark Automobiles Ltd.

- Asbury Automotive Group Inc.

- AutoNation Inc.

- Autotrader

- AutoScout24

- Universal Motor Agencies

- CarMax Inc.

- Carvana

- Cox Automotive Inc. (Autotrader)

- Emil Frey AG

- Group 1 Automotive Inc.

- Inchcape Group

- Lithia Motors Inc. CarMax Business Service LLC

- Asbury Automotive Group

- AutoNation Inc.

- eBay Inc.

- Big Boy toyz

- VROOM

第10章:命運之輪

- 命運之輪

- 分析師觀點

- 連貫的機會圖

第 11 章:部分

- 參考

- 研究方法論

The used car market is estimated to be valued at US$ 1.78 Trillion in 2024 and is expected to reach US$ 2.73 Trillion by 2031, growing at a compound annual growth rate (CAGR) of 6.3% from 2024 to 2031.

| Report Coverage | Report Details | ||

|---|---|---|---|

| Base Year: | 2023 | Market Size in 2024: | US$ 1.78 Tn |

| Historical Data for: | 2019 To 2023 | Forecast Period: | 2024 To 2031 |

| Forecast Period 2024 to 2031 CAGR: | 6.30% | 2031 Value Projection: | US$ 2.73 Tn |

The used car market in the North America holds a significant share of the overall automotive industry. With millions of used cars changing hands every year, it is a multi-billion dollar sector of the economy. Factors, such as increasing average age of vehicles on the road, shorter replacement cycles, and availability of affordable financing options, drive demand in this space. The average age of vehicles in the U.S. is over 11 years currently, highlighting consumers' preference to retain vehicles longer instead of bearing high costs of new vehicles. Furthermore, robust growth is expected in used luxury car sales as more people opt for certified pre-owned luxury vehicles that come with warranty at competitive prices. While the internet has enabled greater transparency in used car transactions, challenges around ensuring vehicle condition and quality still exist for buyers. Overall, the used car market plays an important role in providing accessible vehicle ownership across different income segments.

Market Dynamics:

The used car market. is influenced by several drivers, restraints, and opportunities. Strong driver demand amid the rising average age of vehicles acts as a key factor spurring sales. Additionally, the availability of inexpensive loan schemes and flexible financing options from banks has made vehicle purchase more affordable. This has further stimulated market growth. However, market potential is hindered by regulatory challenges involving unclear mileage certification and title transfer issues in some states. Stringent inspection standards and emission regulations also act as a restraint. Moreover, the proliferation of online marketplaces has threatened offline dealer profitability to some extent. On the opportunity side, the burgeoning demand for certified pre-owned luxury cars and green used vehicles like hybrids and Electric Vehicles (EVs) is paving the way for future expansion. Similarly, implementing Blockchain technology can help address title and odometer problems, thereby boosting consumer confidence in used car buying.

Key Features of the Study:

- This report provides an in-depth analysis of the global used car market., and provides market size (US$ Trillion) and compound annual growth rate (CAGR %) for the forecast period (2024-2031, considering 2023 as the base year.

- It elucidates potential revenue growth opportunities across different segments and explains attractive investment proposition matrices for this market.

- This study also provides key insights about market drivers, restraints, opportunities, new product launches or approvals, market trends, regional outlook, and competitive strategies adopted by key players.

- It profiles key players in the global used car market based on the following parameters - company highlights, products portfolio, key highlights, financial performance, and strategies.

- Key companies covered as a part of this study include Arnold Clark Automobiles Ltd., Asbury Automotive Group Inc., AutoNation Inc., Autotrader, AutoScout24, Universal Motor Agencies, CarMax Inc., Carvana, Cox Automotive Inc. (Autotrader), Emil Frey AG, Group 1 Automotive Inc., Inchcape Group, Lithia Motors Inc.

- Insights from this report would allow marketers and the management authorities of the companies to make informed decisions regarding their future product launches, type up-gradation, market expansion, and marketing tactics.

- The global used car market report caters to various stakeholders in this industry including investors, suppliers, product manufacturers, distributors, new entrants, and financial analysts.

- Stakeholders would have ease in decision-making through various strategy matrices used in analyzing the global used car market.

Market Segmentation

- Vehicle Type

- Hatchbacks

- Sedan

- Sports Utility Vehicle

- Others

- Fuel Type

- Petrol

- Diesel

- Hybrid/Electric

- Others

- Distribution Channel

- Franchised dealer

- Independent dealer

- Others

- End-use

- Personal

- Commercial

- Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

- Key Players Insights

- Arnold Clark Automobiles Ltd.

- Asbury Automotive Group Inc.

- AutoNation Inc.

- Autotrader

- AutoScout24

- Universal Motor Agencies

- CarMax Inc.

- Carvana

- Cox Automotive Inc. (Autotrader)

- Emil Frey AG

- Group 1 Automotive Inc.

- Inchcape Group

- Lithia Motors Inc.

- CarMax Business Service LLC

- Asbury Automotive Group

- AutoNation Inc.

- eBay Inc.

- Big Boy toyz

- VROOM

- Others

Table of Contents

1. Research Objectives and Assumptions

- Research Objectives

- Assumptions

- Abbreviations

2. Market Purview

- Report Description

- Market Definition and Scope

- Executive Summary

- Market Snippet, By Vehicle Type

- Market Snippet, By Fuel Type

- Market Snippet, By Distribution Channel

- Market Snippet, By End-use

- Market Snippet, By Region

- Coherent Opportunity Map (COM)

3. Market Dynamics, Regulations, and Trends Analysis

- Market Dynamics

- Drivers

- Restraints

- Opportunities

- Regulatory Scenario

- Industry Trend

- Merger and Acquisitions

- New system Launch/Approvals

- Impact of the COVID-19 Pandemic

4. Global Used Car Market, By Vehicle Type, 2019-2031 (US$ Trillion)

- Introduction

- Market Share Analysis, 2024 and 2031 (%)

- Segment Trends

- Hatchbacks

- Introduction

- Market Size and Forecast, 2019-2031, (US$ Trillion)

- Sedan

- Introduction

- Market Size and Forecast, 2019-2031, (US$ Trillion)

- Sports Utility Vehicle

- Introduction

- Market Size and Forecast, 2019-2031, (US$ Trillion)

- Others

- Introduction

- Market Size and Forecast, 2019-2031, (US$ Trillion)

5. Global Used Car Market, By Fuel Type, 2019-2031 (US$ Trillion)

- Introduction

- Market Share Analysis, 2024 and 2031 (%)

- Segment Trends

- Petrol

- Introduction

- Market Size and Forecast, 2019-2031, (US$ Trillion)

- Diesel

- Introduction

- Market Size and Forecast, 2019-2031, (US$ Trillion)

- Hybrid/Electric

- Introduction

- Market Size and Forecast, 2019-2031, (US$ Trillion)

- Others

- Introduction

- Market Size and Forecast, 2019-2031, (US$ Trillion)

6. Global Used Car Market, By Distribution Channel, 2019-2031 (US$ Trillion)

- Introduction

- Market Share Analysis, 2024 and 2031 (%)

- Segment Trends

- Franchised dealer

- Introduction

- Market Size and Forecast, 2019-2031, (US$ Trillion)

- Independent dealer

- Introduction

- Market Size and Forecast, 2019-2031, (US$ Trillion)

- Others

- Introduction

- Market Size and Forecast, 2019-2031, (US$ Trillion)

7. Global Used Car Market, By End-use, 2019-2031 (US$ Trillion)

- Introduction

- Market Share Analysis, 2024 and 2031 (%)

- Segment Trends

- Personal

- Introduction

- Market Size and Forecast, 2019-2031, (US$ Trillion)

- Commercial

- Introduction

- Market Size and Forecast, 2019-2031, (US$ Trillion)

8. Global Used Car Market, By Region, 2019-2031 (US$ Trillion)

- Introduction

- Market Share Analysis, By Region, 2024 and 2031 (%)

- North America

- Regional Trends

- Market Size and Forecast, By Vehicle Type, 2019-2031 (US$ Trillion)

- Market Size and Forecast, By Fuel Type, 2019-2031 (US$ Trillion)

- Market Size and Forecast, By Distribution Channel, 2019-2031 (US$ Trillion)

- Market Size and Forecast, By End-use, 2019-2031 (US$ Trillion)

- Market Share Analysis, By Country, 2019 and 2031 (%)

- U.S.

- Canada

- Europe

- Regional Trends

- Market Size and Forecast, By Vehicle Type, 2019-2031 (US$ Trillion)

- Market Size and Forecast, By Fuel Type, 2019-2031 (US$ Trillion)

- Market Size and Forecast, By Distribution Channel, 2019-2031 (US$ Trillion)

- Market Size and Forecast, By End-use, 2019-2031 (US$ Trillion)

- Market Share Analysis, By Country, 2019 and 2031 (%)

- U.K.

- Germany

- Italy

- France

- Russia

- Rest of Europe

- Asia Pacific

- Regional Trends

- Market Size and Forecast, By Vehicle Type, 2019-2031 (US$ Trillion)

- Market Size and Forecast, By Fuel Type, 2019-2031 (US$ Trillion)

- Market Size and Forecast, By Distribution Channel, 2019-2031 (US$ Trillion)

- Market Size and Forecast, By End-use, 2019-2031 (US$ Trillion)

- Market Share Analysis, By Country, 2019 and 2031 (%)

- China

- India

- ASEAN

- Australia

- South Korea

- Japan

- Rest of Asia Pacific

- Latin America

- Regional Trends

- Market Size and Forecast, By Vehicle Type, 2019-2031 (US$ Trillion)

- Market Size and Forecast, By Fuel Type, 2019-2031 (US$ Trillion)

- Market Size and Forecast, By Distribution Channel, 2019-2031 (US$ Trillion)

- Market Size and Forecast, By End-use, 2019-2031 (US$ Trillion)

- Market Share Analysis, By Country, 2019 and 2031 (%)

- Brazil

- Argentina

- Mexico

- Rest of Latin America

- Middle East and Africa

- Regional Trends

- Market Size and Forecast, By Vehicle Type, 2019-2031 (US$ Trillion)

- Market Size and Forecast, By Fuel Type, 2019-2031 (US$ Trillion)

- Market Size and Forecast, By Distribution Channel, 2019-2031 (US$ Trillion)

- Market Size and Forecast, By End-use, 2019-2031 (US$ Trillion)

- Market Share Analysis, By Country, 2019 and 2031 (%)

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

9. Competitive Landscape

- Company Profiles

- Arnold Clark Automobiles Ltd.

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- Asbury Automotive Group Inc.

- AutoNation Inc.

- Autotrader

- AutoScout24

- Universal Motor Agencies

- CarMax Inc.

- Carvana

- Cox Automotive Inc. (Autotrader)

- Emil Frey AG

- Group 1 Automotive Inc.

- Inchcape Group

- Lithia Motors Inc. CarMax Business Service LLC

- Asbury Automotive Group

- AutoNation Inc.

- eBay Inc.

- Big Boy toyz

- VROOM

10. Wheel of Fortune

- Wheel of Fortune

- Analyst View

- Coherent Opportunity Map

11. Section

- References

- Research Methodology

- About us and Sales Contact