|

市場調查報告書

商品編碼

1231840

東南亞的冷凍食品產業(2023年~2032年)Research Report on Southeast Asia Frozen Food Industry 2023-2032 |

||||||

隨著東南亞的經濟發展都市化進行,居民的日常生活步調加速,工作女性的人口慢慢增加,東南亞的冷凍食品需求每日擴大。

本報告提供東南亞的冷凍食品產業調查分析,主要的促進因素,課題與機會,COVID-19影響等資訊。

樣本圖

目錄

第1章 新加坡的冷凍食品產業的分析

- 新加坡的冷凍食品產業的開發環境

- 地區

- 人口

- 經濟

- 新加坡的最低工資

- 新加坡的冷凍食品產業的經營(2023年~2032年)

- 供給

- 需求

- 進出口情形

- 新加坡的主要的冷凍食品廠商和公司的分析

第2章 泰國的冷凍食品產業的分析

- 泰國的冷凍食品產業的開發環境

- 地區

- 人口

- 經濟

- 泰國的最低工資

- 泰國的冷凍食品產業的經營(2023年~2032年)

- 供給

- 需求

- 進出口情形

- 泰國的主要的冷凍食品廠商和公司的分析

第3章 菲律賓的冷凍食品產業的分析

- 菲律賓的冷凍食品產業的開發環境

- 地區

- 人口

- 經濟

- 菲律賓的最低工資

- 菲律賓的冷凍食品產業的經營(2023年~2032年)

- 供給

- 需求

- 進出口情形

- 菲律賓的主要的冷凍食品廠商和公司的分析

第4章 馬來西亞的冷凍食品產業的分析

- 馬來西亞的冷凍食品產業的開發環境

- 地區

- 人口

- 經濟

- 馬來西亞的最低工資

- 馬來西亞的冷凍食品產業的經營(2023年~2032年)

- 供給

- 需求

- 進出口情形

- 馬來西亞的主要的冷凍食品廠商和公司的分析

第5章 印尼的冷凍食品產業的分析

- 印尼的冷凍食品產業的開發環境

- 地區

- 人口

- 經濟

- 印尼的最低工資

- 印尼的冷凍食品產業的經營(2023年~2032年)

- 供給

- 需求

- 進出口情形

- 印尼的主要的冷凍食品廠商和公司的分析

第6章 越南的冷凍食品產業的分析

- 越南的冷凍食品產業的開發環境

- 地區

- 人口

- 經濟

- 越南的最低工資

- 越南的冷凍食品產業的經營(2023年~2032年)

- 供給

- 需求

- 進出口情形

- 越南的主要的冷凍食品廠商和公司的分析

第7章 緬甸的冷凍食品產業的分析

- 緬甸的冷凍食品產業的開發環境

- 地區

- 人口

- 經濟

- 緬甸的最低工資

- 緬甸的冷凍食品產業的經營(2023年~2032年)

- 供給

- 需求

- 進出口情形

- 緬甸的主要的冷凍食品廠商和公司的分析

第8章 汶萊的冷凍食品產業的分析

- 汶萊的冷凍食品產業的開發環境

- 地區

- 人口

- 經濟

- 汶萊的最低工資

- 汶萊的冷凍食品產業的經營(2023年~2032年)

- 供給

- 需求

- 進出口情形

- 汶萊的主要的冷凍食品廠商和公司的分析

第9章 寮國的冷凍食品產業的分析

- 寮國的冷凍食品產業的開發環境

- 地區

- 人口

- 經濟

- 寮國的最低工資

- 寮國的冷凍食品產業的經營(2023年~2032年)

- 供給

- 需求

- 進出口情形

- 寮國的主要的冷凍食品廠商和公司的分析

第10章 柬埔寨的冷凍食品產業的分析

- 柬埔寨的冷凍食品產業的開發環境

- 地區

- 人口

- 經濟

- 柬埔寨的最低工資

- 柬埔寨的冷凍食品產業的經營(2023年~2032年)

- 供給

- 需求

- 進出口情形

- 柬埔寨的主要的冷凍食品廠商和公司的分析

第11章 東南亞的冷凍食品產業預測(2023年~2032年)

- 東南亞的冷凍食品產業發展的影響要素的分析

- 有利的要素

- 不利的要素

- 東南亞的冷凍食品產業的供給的分析(2023年~2032年)

- 東南亞的冷凍食品產業的需求的分析(2023年~2032年)

- 東南亞的冷凍食品產業的進出口情形的分析(2023年~2032年)

- COVID-19流行對冷凍食品產業的影響

As Southeast Asia's economy develops, urbanization continues, the pace of daily life of residents accelerates, and the population of working women gradually increases, the demand for frozen foods in Southeast Asia is expanding day by day. At the same time, the increased penetration of mobile Internet has also driven the booming development of e-commerce, providing consumers with more channels to purchase quality frozen foods.

SAMPLE VIEW

Frozen food in Southeast Asia has a large gap between different countries, which is reflected in the different production, transportation and storage capacities of frozen food, different penetration rates of refrigerators, and differences in the scale of the frozen food industry in Southeast Asia. For example, Thailand's frozen food industry is growing rapidly and is rated as one of the "most promising industries in 2023" by the Ministry of Commerce of Thailand. In 2022, 99 new companies were registered in Thailand's frozen food industry, an 87% increase year-on-year, bringing the total number of frozen food companies to 838, of which about 90% are small enterprises. To promote the development of Thailand's frozen food industry, the government has also developed policies and safety standards to enhance international and local consumer confidence in the safety and quality of Thai frozen food products.

Southeast Asia in this report includes 10 countries: Singapore, Thailand, Philippines, Malaysia, Indonesia, Vietnam, Myanmar, Brunei, Laos and Cambodia.

According to CRI's analysis, the economic levels of the 10 Southeast Asian countries vary greatly, with Singapore being the only developed country with a per capita GDP of about US$73,000 in 2021. While Myanmar and Cambodia will have a GDP per capita of less than US$2,000 in 2021. The population and minimum wage levels of each country also vary greatly. Brunei, which has the smallest population, will have a total population of less than 500,000 people in 2021, while Indonesia, which has the largest population, will have a population of about 275 million people in 2021. The most economically advanced countries in Southeast Asia do not have a set minimum wage, with the actual minimum wage exceeding US$400/month (for foreign maids), while the lowest minimum wage level in Myanmar is only about US$93/month.

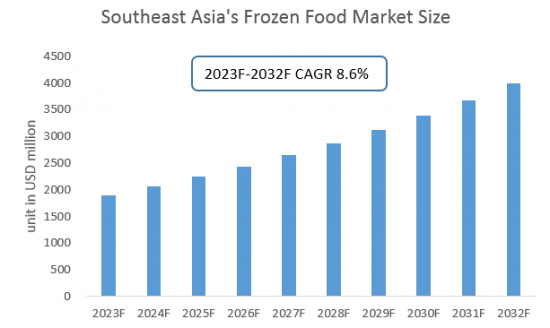

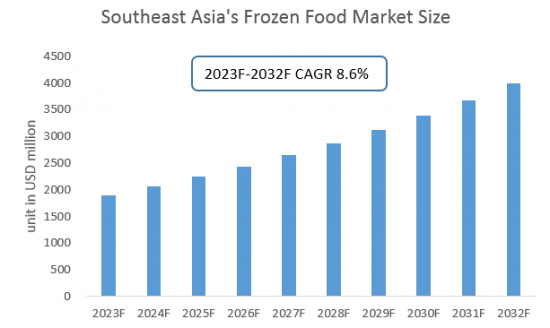

CRI expects the market size of the frozen food industry in Southeast Asia to continue to grow from 2023-2032, fueled by export demand and driven by local consumption.

Topics covered:

- Southeast Asia Frozen Food Industry Status and Major Sources in 2018-2022

- What is the Impact of COVID-19 on Southeast Asia Frozen Food Industry?

- Which Companies are the Major Players in Southeast Asia Frozen Food Industry Market and What are their Competitive Benchmarks?

- Key Drivers and Market Opportunities in Southeast Asia Frozen Food Industry

- What are the Key Drivers, Challenges, and Opportunities for Southeast Asia Frozen Food Industry during 2023-2032?

- What is the Expected Revenue of Southeast Asia Frozen Food Industry during 2023-2032?

- What are the Strategies Adopted by the Key Players in the Market to Increase Their Market Share in the Industry?

- What are the Competitive Advantages of the Major Players in Southeast Asia Frozen Food Industry Market?

- Which Segment of Southeast Asia Frozen Food Industry is Expected to Dominate the Market in 2032?

- What are the Major Adverse Factors Facing Southeast Asia Frozen Food Industry?

Table of Contents

1 Singapore Frozen Food Industry Analysis

- 1.1 Singapore Frozen Food Industry Development Environment

- 1.1.1 Geography

- 1.1.2 Population

- 1.1.3 Economy

- 1.1.4 Minimum Wage in Singapore

- 1.2 Singapore Frozen Food Industry Operation 2023-2032

- 1.2.1 Supply

- 1.2.2 Demand

- 1.2.3 Import and Export Situation

- 1.3 Analysis of Major Frozen Food Manufacturers and Traders in Singapore

2 Analysis of the Frozen Food Industry in Thailand

- 2.1 Development Environment of Thailand Frozen Food Industry

- 2.1.1 Geography

- 2.1.2 Population

- 2.1.3 Economy

- 2.1.4 Thailand Minimum Wage

- 2.2 Thailand Frozen Food Industry Operation 2023-2032

- 2.2.1 Supply

- 2.2.2 Demand

- 2.2.3 Import and Export Situation

- 2.3 Analysis of Major Frozen Food Production and Trading Companies in Thailand

3 Analysis of the Philippine Frozen Food Industry

- 3.1 Philippine Frozen Food Industry Development Environment

- 3.1.1 Geography

- 3.1.2 Population

- 3.1.3 Economy

- 3.1.4 Minimum Wage in the Philippines

- 3.2 Philippine Frozen Food Industry Operation 2023-2032

- 3.2.1 Supply

- 3.2.2 Demand

- 3.2.3 Import and Export Situation

- 3.3 Analysis of Major Frozen Food Production and Trading Companies in the Philippines

4 Analysis of Frozen Food Industry in Malaysia

- 4.1 Malaysia Frozen Food Industry Development Environment

- 4.1.1 Geography

- 4.1.2 Population

- 4.1.3 Economy

- 4.1.4 Minimum Wage in Malaysia

- 4.2 Malaysia Frozen Food Industry Operation 2023-2032

- 4.2.1 Supply

- 4.2.2 Demand

- 4.2.3 Import and Export Situation

- 4.3 Analysis of Major Frozen Food Production and Trading Companies in Malaysia

5 Indonesia Frozen Food Industry Analysis

- 5.1 Indonesia Frozen Food Industry Development Environment

- 5.1.1 Geography

- 5.1.2 Population

- 5.1.3 Economy

- 5.1.4 Minimum Wage in Indonesia

- 5.2 Indonesia Frozen Food Industry Operation 2023-2032

- 5.2.1 Supply

- 5.2.2 Demand

- 5.2.3 Import and Export Situation

- 5.3 Analysis of Major Frozen Food Production and Trading Companies in Indonesia

6 Analysis of Vietnam Frozen Food Industry

- 6.1 Development Environment of Frozen Food Industry in Vietnam

- 6.1.1 Geography

- 6.1.2 Population

- 6.1.3 Economy

- 6.1.4 Minimum Wage in Vietnam

- 6.2 Vietnam Frozen Food Industry Operation 2023-2032

- 6.2.1 Supply

- 6.2.2 Demand

- 6.2.3 Import and Export Situation

- 6.3 Analysis of Major Frozen Food Production and Trading Enterprises in Vietnam

7 Analysis of Frozen Food Industry in Myanmar

- 7.1 Development Environment of Myanmar Frozen Food Industry

- 7.1.1 Geography

- 7.1.2 Population

- 7.1.3 Economy

- 7.1.4 Myanmar Minimum Wage

- 7.2 Myanmar Frozen Food Industry Operation 2023-2032

- 7.2.1 Supply

- 7.2.2 Demand

- 7.2.3 Import and Export Situation

- 7.3 Analysis of Myanmar's Major Frozen Food Production and Trading Companies

8 Analysis of Brunei Frozen Food Industry

- 8.1 Brunei Frozen Food Industry Development Environment

- 8.1.1 Geography

- 8.1.2 Population

- 8.1.3 Economy

- 8.1.4 Brunei Minimum Wage

- 8.2 Brunei Frozen Food Industry Operation 2023-2032

- 8.2.1 Supply

- 8.2.2 Demand

- 8.2.3 Import and Export Status

- 8.3 Analysis of Brunei's Major Frozen Food Production and Trading Companies

9 Analysis of the Frozen Food Industry in Laos

- 9.1 Development Environment of Frozen Food Industry in Laos

- 9.1.1 Geography

- 9.1.2 Population

- 9.1.3 Economy

- 9.1.4 Minimum Wage in Laos

- 9.2 Laos Frozen Food Industry Operation 2023-2032

- 9.2.1 Supply

- 9.2.2 Demand

- 9.2.3 Import and Export Situation

- 9.3 Analysis of Major Frozen Food Production and Trading Companies in Laos

10 Analysis of Frozen Food Industry in Cambodia

- 10.1 Development Environment of Cambodia Frozen Food Industry

- 10.1.1 Geography

- 10.1.2 Population

- 10.1.3 Economy

- 10.1.4 Minimum Wage in Cambodia

- 10.2 Cambodia Frozen Food Industry Operation in 2023-2032

- 10.2.1 Supply

- 10.2.2 Demand

- 10.2.3 Import and Export Situation

- 10.3 Analysis of Major Frozen Food Production and Trading Companies in Cambodia

11 Southeast Asia Frozen Food Industry Outlook 2023-2032

- 11.1 Southeast Asia Frozen Food Industry Development Influencing Factors Analysis

- 11.1.1 Favorable Factors

- 11.1.2 Unfavorable Factors

- 11.2 Southeast Asia Frozen Food Industry Supply Analysis 2023-2032

- 11.3 Southeast Asia Frozen Food Industry Demand Analysis 2023-2032

- 11.4 Southeast Asia Frozen Food Industry Import and Export Status Analysis 2023-2032

- 11.5 Impact of COVID -19 Epidemic on Frozen Food Industry