|

市場調查報告書

商品編碼

1522208

全球床墊產業The World Mattress Industry |

|||||||

本報告全面提供了全球床墊產業的最新趨勢和資料。涵蓋2014年至2023年床墊市場指標、生產、消費和國際貿易流向,2024年和2025年床墊市場預測,全球主要床墊製造商的詳細概況和競爭格局及其策略。

全球床墊產業主要製造商

全球 35 家領先床墊製造商的詳細資料:公司資訊(公司名稱、總部、一般聯絡方式)、財務亮點和銷售業績、製造活動(工廠和生產策略)

本報告涵蓋約 600 家公司。

目標公司

Adova、Aquinos、Ashley Furniture、Auping、BRN Sleep Products、Corplet、De Rucci、Emma-The Sleep Company、Eurocomfort、Flex、Healthcare(Mlily)、Herval Moveis e Colches、Hilding Anders、Ikano Industry、Jason Furniture- Kuka、Kurlon、Leggett & Platt、Magniflex、Perdormire、Pikolin、Serta Simmons、Sheela Foam(Sleepwell)、Silentnight、Sinomax、Sleep Number、Tempur Sealy、Xilinmen、Yatas Yatak、Zinus

inus。亮點

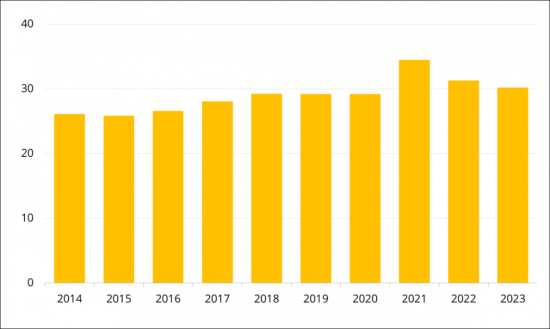

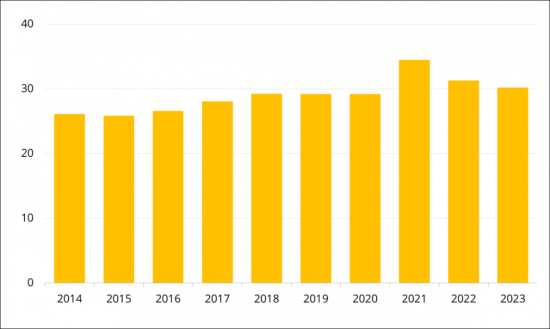

全球床墊消耗量:2014-2023

10 億美元

來源:CSIL

過去十年,全球床墊市場呈現穩定成長。由於疫情恢復和價格大幅上漲,2021年需求顯著成長,但隨後2022年和2023年需求下降,市場恢復到2019年的水準。根據CSIL估計,全球床墊消費預計將在2024年陷入停滯,並在2025年恢復成長(以實際價值計算),其中北美和歐洲的成長放緩(低於全球平均值),而亞洲的成長預計將會上升。

全球市場驅動力:床墊產業的一個關鍵驅動力是消費者越來越意識到更好的睡眠對健康的好處。受通膨影響較小的高端產業存在顯著的成長機會。同樣重要的是,無論是在線上還是透過傳統銷售管道,對捲裝和壓縮床墊的需求不斷成長。疫情期間陷入停滯的合約產業的復甦也為企業提供了成長潛力。近年來,電子商務的蓬勃發展也對床墊市場產生了重大影響。

目錄(摘要)

研究方法/簡介/執行摘要

第一部分:床墊消費、生產與國際貿易

- 床墊消費與進口:2014-2023

- 50個主要市場的床墊消費狀況

- 主要市場的進口滲透與開發

- 床墊生產與出口:2014-2023

- 50個主要國家的床墊生產

- 主要出口國家、來源和目的地

- 床墊國際貿易

- 床墊國際貿易:60個國家

- 床墊消費場景

- 世界 GDP 趨勢

- 床墊消費:依地區/國家劃分

第二部分:床墊市場指標

- 全球床墊產業概況(50個主要國家)

- 60個國家的床墊進出口狀況:2014-2023年

- 世界床墊貿易:出口目的地和進口來源地

- 2024-2025年床墊消費:預計將發生重大變化

第三部分:床墊產業排名前20的國家

- 澳洲、比利時、巴西、加拿大、中國、法國、德國、印度、義大利、日本、墨西哥、波蘭、葡萄牙、韓國、西班牙、瑞典、土耳其、英國、美國、越南

關於每個國家:

- 2014年至2023年產量、表觀消費量、出口、進口、2024年及2025年消費量年度變動預測

- 2018年至2023年的產量:比利時、巴西、加拿大、中國、法國、德國、印度、義大利、日本、墨西哥、波蘭、葡萄牙、西班牙、瑞典、土耳其、英國、美國、越南)

- 依材料劃分的生產明細資訊:內置彈簧、乳膠、泡棉等(用於澳洲、比利時、巴西、中國、法國、德國、印度、義大利、墨西哥、波蘭、葡萄牙、西班牙、土耳其、英國、越南)可能的

- 主要貿易夥伴:進口國和出口國

- 社會經濟指標:人口預測、主要城市常住人口、成長預測等。

- 主要床墊製造商的銷售簡介

第四部分:主要床墊製造商簡介

第五部分:依國家劃分的床墊市場指標

關於每個國家:

- 2014年至2023年產量、表觀消費量、出口、進口、2024年及2025年消費量年度變動預測

- 主要貿易夥伴(進口來源國和出口目的地國)

附錄

CSIL's Market Research Report 'The world mattress industry' provides a comprehensive picture of the global mattress sector with the latest trends and data: mattress market indicators from 2014 to 2023, covering production, consumption, and international trade flows, mattress market forecasts for 2024 and 2025, competitive landscape analysis with detailed profiles of the leading world mattress manufacturers and their strategies.

The purpose of this study is to provide an in-depth analysis of the mattress market across regions, countries, and key players, with outlook and market potential approached through a thorough analysis of the main sector's statistics.

THE WORLD MATTRESS INDUSTRY: BASIC DATA AND MATTRESS MARKET INDICATORS

The first part reviews the main drivers and challenges of the global mattress industry, such as supply chain issues, trade tensions, nearshoring, globalization and uncertainties, e-commerce channels, sustainability, and circularity. It also presents updated figures for the world mattress market and its competitive landscape.

This part also presents insights from the CSIL's survey addressed to a sample of global manufacturers involved in the mattress industry (April - June 2024) on Mattress manufacturers' strategies.

KEY MARKETS AND THE MOST IMPORTANT COUNTRIES IN THE GLOBAL MATTRESS SECTOR. 50 COUNTRIES ANALYSIS

The first part of this chapter provides a detailed analysis of the Top 20 world mattress markets (Australia, Belgium, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Poland, Portugal, South Korea, Spain, Sweden, Turkiye, United Kingdom, United States, Vietnam), that includes for each country:

- Mattress production, apparent consumption, exports, imports for the years 2014-2023, and forecasts of yearly changes in mattress consumption in 2024 and 2025.

- Mattress production in quantity (available for Belgium, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Poland, Portugal, Spain, Sweden, Turkiye, United Kingdom, United States, Vietnam)

- Information on breakdown of production by material (innerspring, latex, foam, other) available for Australia, Belgium, Brazil, China, France, Germany, India, Italy, Mexico, Poland, Portugal, Spain, Turkiye, United Kingdom, Vietnam

- Major trading partners (countries of origin of imports and destination of exports of mattresses)

- Socio-economic indicators, including population forecasts and resident population in main cities and projected growth

- Major mattress manufacturers by turnover, and short profiles of selected leading mattress manufacturers (Company name, Headquarters/Main Location, Email, Website, Activity, Product Portfolio, Online Sales, Total Turnover range, Employees range, Manufacturing plants)

Moreover, for further 30 countries (Argentina, Austria, Bulgaria, Chile, Croatia, Czech Republic, Denmark, Estonia, Finland, Greece, Hungary, Indonesia, Ireland, Kuwait, Latvia, Lithuania, Malaysia, Netherlands, Norway, Philippines, Romania, Russia, Saudi Arabia, Serbia, Slovakia, South Africa, Switzerland, Taiwan (China), Thailand, United Arab Emirates), the study provides Mattress production, apparent consumption, exports, imports for the years 2014-2023 and forecasts of yearly changes in mattress consumption in 2024 and 2025; Major trading partners (countries of origin of imports and destination of exports of mattresses).

Data on the international trade of mattresses (in addition to the 50 countries) are provided for a further 10 other countries, for a total of 60 countries covered by the report.

LEADING MANUFACTURERS IN THE WORLD MATTRESS INDUSTRY

Detailed profiles of the 35 world leading mattress manufacturers: company information (company name, headquarter, general contact info), financial highlights and sales performance, manufacturing activity (plants and production strategies).

The report covers overall around 600 companies

Selected companies

Among the considered companies: Adova, Aquinos, Ashley Furniture, Auping, BRN Sleep Products, Correct, De Rucci, Emma-The Sleep Company, Eurocomfort, Flex, Healthcare (Mlily), Herval Moveis e Colches, Hilding Anders, Ikano Industry, Jason Furniture - Kuka, Kurlon, Leggett & Platt, Magniflex, Perdormire, Pikolin, Serta Simmons, Sheela Foam (Sleepwell), Silentnight, Sinomax, Sleep Number, Tempur Sealy, Xilinmen, Yatas Yatak, Zinus.

Highlights:

World Mattress Consumption, 2014-2023.

US$ billion

Source: CSIL

The world mattress market has witnessed stable growth over the past decade, except for a remarkable surge in 2021, due to the recovery from the pandemic combined with considerable price increases. However, in 2022 and 2023, the market experienced a decline in demand, bringing the market back to its 2019 figures. According to CSIL estimates, world consumption of mattresses is expected to stagnate in 2024 and to return to growth in 2025 (in real terms), with slow growth in North America and Europe (below the world average), and a substantial consumption increase in Asia.

Regional and country analysis: Asia Pacific and North America are the leading markets for mattresses, accounting for over 70% of the total. In terms of single countries, the US and China are the largest mattress-consuming countries.

Global market drivers: A significant driver for the mattress industry is growing consumer awareness about the health benefits of better sleep. This trend is evident in both traditional and emerging markets. The high-end segment, less affected by inflation, presents notable growth opportunities. Additionally, the increasing demand for roll-packed and compressed mattresses in both online and traditional sales channels is pivotal. The revival of the contract segment, which was stalled during the pandemic, also offers potential growth for companies. The e-commerce boom has significantly impacted the mattress market in the last few years.

TABLE OF CONTENTS(ABSTRACT)

METHODOLOGY, INTRODUCTION AND EXECUTIVE SUMMARY

- Structure of the report, Basic data, Competitive system and Product trends

- E-commerce and sustainability: major topics of the world mattress market

- Mattress manufacturers' strategies. Insights from the CSIL's survey

PART I. CONSUMPTION, PRODUCTION AND INTERNATIONAL TRADE OF MATTRESSES

- Consumption and imports of mattresses 2014-2023

- Mattress consumption in the 50 major markets

- Import penetration and opening of major markets

- Production and exports of mattresses 2014-2023

- Mattress production in the 50 major countries

- Major exporting countries. Origin and destination of mattresses

- International trade of mattresses

- International trade of mattresses, 60 countries

- Mattress consumption. Scenario

- Evolution of world GDP

- Mattress consumption. Countries grouped by geographical region, 2025.

PART II. MATTRESS MARKET INDICATORS

- Overview of the world mattress industry (50 major countries)

- Mattress exports and imports, 60 countries, 2014-2023

- World mattress trade. Destination of exports and origin of imports

- Mattress consumption 2024-2025. Change forecasts in real terms

PART III. TOP 20 COUNTRIES FOR MATTRESS INDUSTRY (Australia, Belgium, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Poland, Portugal, South Korea, Spain, Sweden, Turkey, United Kingdom, United States, Vietnam)

FOR EACH COUNTRY:

- Mattress production, apparent consumption, exports, imports for the years 2014-2023 and forecasts of yearly changes in mattress consumption in 2024 and 2025.

- Mattress production in quantity 2018-2023 (available for Belgium, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Poland, Portugal, Spain, Sweden, Turkiye, United Kingdom, United States, Vietnam)

- Information on breakdown of production by material (innerspring, latex, foam, other) (available for Australia, Belgium, Brazil, China, France, Germany, India, Italy, Mexico, Poland, Portugal, Spain, Turkiye, United Kingdom, Vietnam)

- Major trading partners (countries of origin of imports and destination of exports of mattresses)

- Socio-economic indicators, including population forecasts and resident population in main cities and projected growth

- Major mattress manufacturers by turnover with short profiles

PART IV. SELECTED PROFILES OF MAJOR MATTRESS MANUFACTURERS

PART V. COUNTRY TABLES: MATTRESS MARKET INDICATORS BY COUNTRY

FOR EACH COUNTRY:

- Mattress production, apparent consumption, exports, imports for the years 2014-2023, and forecasts of yearly changes in mattress consumption in 2024 and 2025.

- Major trading partners (countries of origin of imports and destination of exports of mattresses).