|

市場調查報告書

商品編碼

1576904

床墊產業電商E-commerce in the Mattress Industry |

|||||||

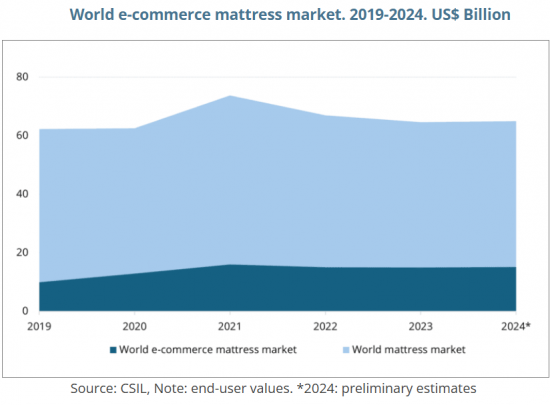

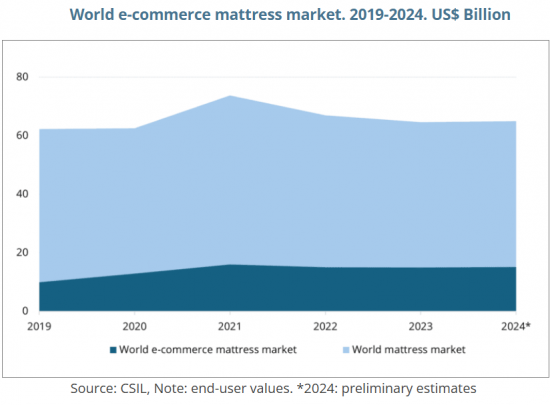

電子商務是近年來床墊行業最大的變化之一。線上銷售的成長得益於幾個關鍵因素,包括技術進步、不斷發展的零售策略以及消費者線上購物偏好的重大變化。該電子商務通路價值約150億美元,目前佔全球床墊市場總量的23%。

北美仍然是線上床墊銷售的最大市場,其次是亞太地區。在亞洲,中國領先市場,韓國線上滲透率最高,印度是線上床墊成長最快的市場之一。歐洲排名第三,英國和德國是該地區最大的市場。

亮點

資訊圖表

本報告調查了全球線上床墊銷售市場,提供全球和主要區域床墊市場概述,電子商務床墊銷售的商業模式,電子商務床墊銷售趨勢,依地區和國家的詳細分析、競爭格局、主要公司簡介等。

主題

- 電子商務與地理位置

- 電子商務對床墊銷售的影響

- 床墊交付和類型

- 床墊電子商務銷售:依銷售通路

- 電子商務床墊銷售市場前景廣闊

- 電子商務床墊銷售中提供的最重要的服務

- 退回床墊的比例

- 2023年和2024年銷售額波動預測:線上銷售額和總銷售額

主要公司

Amazon、bett1、Casper、Emma、IKEA、JD.com、Kurlon、Mattress Firm、Mlily、Nectar Sleep-Resident、Otto、Pepperfry、Purple、Simba、Saatva、Serta Simmons、Simba Sleep、Suning、Taobao、Tempur Sealy、Tmall、Tuft&Needle、Wayfair、Zinus。

目錄(摘要)

簡介

執行摘要

- 2024年上半年床墊產業的電子商務表現與市場特徵/公司洞察

第1章 床墊市場電商

- 全球床墊市場概覽

- 全球床墊市場概覽:床墊消費、依國家/地區劃分的消費以及國際貿易

- 床墊市場的電子商務:床墊銷售佔有率、電子商務床墊銷售以及依國家劃分的電子商務床墊銷售

- 電子商務商業模式

第2章 線上床墊業務特色

- 業務發展與組織

- 運送選項

- 服務與退貨策略

- Bed-in-a-box

- 產業供應商的作用

- 均碼床墊和相關寢具

- 付款方式

第3章 美國、加拿大電商床墊市場

- 零售與電子商務銷售:概覽/需求驅動因素

- 美國和加拿大的電子商務床墊銷售狀況

- 競爭:依通路的線上床墊銷售情況/美國和加拿大主要零售商的線上床墊銷售情況

- 電子商務零售商(純電子零售商、線上銷售零售商)

- 線上床墊公司(直接對消費者):領先線上床墊公司的供應特徵比較以及線上床墊公司樣本中單人床墊的價格

- 網路上銷售的床墊製造商

第4章 歐洲電商床墊市場:法國、德國、義大利、西班牙、英國

- 零售與電子商務銷售:概覽/需求驅動因素

- 歐洲的電子商務床墊銷售狀況

- 競爭:依通路的線上床墊銷售情況/歐洲主要零售商的線上床墊銷售情況

- 電子商務零售商(純電子零售商、線上銷售零售商)

- 網到床墊公司(直接面對消費者):各大網路床墊公司供貨能力比較/網下床墊公司雙人床床墊價格

- 網路上銷售的床墊製造商

第5章 亞太電商床墊市場:中國、印度、韓國

- 零售與電子商務銷售:概覽/需求驅動因素

- 亞太地區電子商務床墊銷售額

- 電子商務零售商(純電子零售商、線上銷售零售商)

- 線上床墊公司(直接面對消費者)

- 網路上銷售的床墊製造商

第6章 附錄:CSIL全球電商床墊市場研究結果

- 調查結果:全球電商床墊市場

- 電子商務活動

- 地點

- 電子商務銷售對床墊銷售的影響

- 運送的床墊數量和類型

- 電子商務床墊銷售:依銷售通路

- 電子商務床墊銷售最有前景的5個市場

- 為電子商務床墊銷售提供服務

- 退回床墊的百分比

- 2023年和2024年銷售額波動預測:線上銷售額和總銷售額

第7章 上市公司

- 線上床墊銷售公司:國家、零售形態、活動、網站

CSIL's Report "E-commerce in the mattress industry" offers a detailed analysis of the online mattress market with a focus on three world areas (North America, Europe, and Asia Pacific), and the most up-to-date data and statistics of the sector.

This report aims at responding to the following questions:

- What is the current state of the e-commerce mattress market globally?

- How has the online mattress industry evolved between 2019 and 2024?

- What are the key trends in online mattress sales in North America, Europe, and Asia Pacific?

- What are the top companies selling mattresses online?

- How are the largest mattress companies adapting to the e-commerce trend?

The study analyses the largest retail mattress markets, estimating the current incidence of online mattress sales in key countries (the USA, Canada, China, India, South Korea, Germany, the UK, France, Italy, and Spain), the e-commerce mattress sales of the leading retailers (e-tailers, brick-and-mortar retailers, online mattress companies and mattress manufacturers) and providing company profiles highlighting their activity and performance in this sector.

Mattress sales and e-commerce mattress sales are provided for the time series 2019-2024 by country/region.

E-COMMERCE BUSINESS MODELS. The report identifies the leading online retailers involved in mattress sales by business model:

- E-tailers (pure e-commerce companies)

- Brick and Click companies (dealers with physical stores and web-store)

- Non-furniture specialists' chains (large multichannel dealers selling furniture, homewares, accessories, home improvement, lighting fixtures, and electronics).

- Online mattress companies (direct-to-consumer and start-ups selling online via their own web platform or through e-tailers)

- Mattress manufacturers selling online via own website

FEATURES OF THE ONLINE MATTRESS BUSINESS AND ORGANIZATION: The most important peculiarities of the e-commerce business in the mattress industry, including services (delivery and logistic issues, payment methods, return strategies), product features (bed-in-a-box, one-size-fits-all mattresses) and the role of industry suppliers.

ECOMMERCE IN THE MATTRESS INDUSTRY. THE LARGEST MARKETS: The report focuses on three world areas, North America (the United States and Canada), Europe (the United Kingdom, Germany, France, Italy, and Spain), and Asia Pacific (China, South Korea, and India).

For each considered geographical area and country, the report provides: Retail and e-commerce sales (sector overview of economic and e-commerce indicators enriching the analysis) and E-commerce mattress sales (mattress sales and e-commerce mattress sales by country) up to 2024.

COMPETITION AND PROFILES OF THE LEADING COMPANIES IN THE ONLINE MATTRESS MARKET: online mattress sales by distribution channels and by leading retailers in Europe, the US, Canada, and the Asia Pacific.

The study also profiles the leading retailers and manufacturers operating in the online mattress market, highlighting their e-commerce activity and financial performance.

For selected online mattress companies, the report also describes supply features (like number of trial nights, years of warranty, price of a twin mattress, in-home-delivery, and setup) and distribution strategy.

As regards mattress manufacturers selling online, leading players for each considered country are provided, together with information about their online activity.

SURVEY RESULTS: GLOBAL E-COMMERCE MATTRESS MARKET

The Report "E-commerce in the mattress industry" was also carried out through direct interviews with leading mattress manufacturers and retailers operating in the e-commerce mattress business and an online survey carried on by CSIL in September-October 2024, addressed to global retailers and manufacturers involved in the mattress industry.

Topics:

- E-commerce activity and Location

- Incidence of e-commerce sales on mattress sales

- Delivery and type of mattresses

- E-commerce mattress sales by sales channels

- The top promising markets for e-commerce mattress sales

- The most important services offered for e-commerce mattress sales

- Share of mattresses returned back

- Expected sales variation in 2024 over 2023 for online and total sales

Selected companies:

Amazon, bett1, Casper, Emma, IKEA, JD.com, Kurlon, Mattress Firm, Mlily, Nectar Sleep-Resident, Otto, Pepperfry, Purple, Simba, Saatva, Serta Simmons, Simba Sleep, Suning, Taobao, Tempur Sealy, Tmall, Tuft&Needle, Wayfair, Zinus.

Highlights:

INFOGRAPHICS

In recent years, e-commerce has represented one of the most significant shifts in the mattress industry. Online sales have grown due to several key factors such as technological advancements, evolving retail strategies, and a marked orientation in consumer preferences towards online shopping. Valued at approximately US$15 billion, the e-commerce channel now represents 23% of the total global mattress market.

North America remains the largest market for mattresses sold online, followed by Asia Pacific. In Asia, China dominates the market, while South Korea has one of the highest online penetration shares and India is one of the fastest-growing markets for online mattresses. Europe ranks third, with the United Kingdom and Germany being the largest markets in the region.

Table of Contents (Abstract)

INTRODUCTION

- Data gathering, terminology, processing methodology and sample of companies

EXECUTIVE SUMMARY

- E-commerce in the mattress industry performances and market peculiarities, companies insights for the first half of 2024

1. E-COMMERCE IN THE MATTRESS MARKET

- An overview of the world mattress market

- 1.1. An overview of the world mattress market: mattress consumption and consumption by country. International trade of mattresses

- 1.2. E-commerce in the mattress market: Mattress sales and e-commerce mattress sales by country/region; Share of e-commerce mattress sales

- 1.3. Models of e-commerce business

- E-tailers (pure e-commerce retailers)

- Brick-and-Click companies (dealers with physical stores and webstore)

- Non-furniture specialist chains

- Online mattress companies (direct-to-consumer)

- Mattress manufactures selling online via their own website

2. FEATURES OF THE ONLINE MATTRESS BUSINESS

- 2.1. The business evolution and organisation

- Delivery options

- Services and return strategies

- Bed-in-a-box

- The role of industry suppliers

- One-size-fits-all mattresses and related bedding products

- Payment methods

3. E-COMMERCE MATTRESS MARKET IN THE UNITED STATES AND CANADA

- 3.1. Retail and e-commerce sales: overview and demand drivers

- United States. E-commerce as a percentage of total retail sales

- United States and Canada: Macroeconomic and e-commerce indicators

- 3.2. E-commerce mattress sales in the USA and Canada

- 3.3. Competition: online mattress sales by distribution channel in a sample of companies and online mattress sales by leading retailers in the USA and Canada

- 3.4. E-commerce retailers (pure e-tailers, retailers selling online)

- 3.5. Online mattress companies (direct-to-consumer): Supply features comparison of the Leading online mattress companies and Price for a twin mattress in a sample of online mattress companies

- 3.6. Mattress manufacturers selling online

4. E-COMMERCE MATTRESS MARKET IN EUROPE: France, Germany, Italy, Spain and the UK

- 4.1. Retail and e-commerce sales: overview and demand drivers

- Europe. Economic and E-commerce Indicators

- France, Germany, Italy, Spain and the United Kingdom: e-commerce indicators

- 4.2. E-commerce mattress sales in Europe

- Mattress sales and e-commerce mattress sales in France, Germany, Italy, Spain and the United Kingdom

- 4.3. Competition: online mattress sales by distribution channel in a sample of companies and online mattress sales by leading retailers in Europe

- 4.4. E-commerce retailers (pure e-tailers, retailers selling online)

- 4.5. Online mattress companies (direct-to-consumer): Supply features comparison of the Leading online mattress companies and Price for a twin mattress in a sample of online mattress companies

- 4.6. Mattress manufacturers selling online

5. E-COMMERCE MATTRESS MARKET IN ASIA PACIFIC: China, India and South Korea

- 5.1. Retail and e-commerce sales: overview and demand drivers

- Asia Pacific: China, India and South Korea. Economic and E-commerce Indicators

- 5.2. E-commerce mattress sales in Asia Pacific

- Mattress sales and e-commerce mattress sales in China, India, South Korea

- 5.3. E-commerce retailers (pure e-tailers, retailers selling online)

- E-commerce retailers selling mattresses in Asia Pacific: China, India, South Korea

- 5.4. Online mattress companies (direct-to-consumer)

- 5.5. Mattress manufacturers selling online

6. ANNEX: Results of the CSIL survey on the Global e-commerce mattress market

- 6.1. Survey results: Global e-commerce mattress market

- E-commerce activity

- Location

- Incidence of e-commerce sales on mattress sales

- Shipments and types of mattresses

- E-commerce mattress sales by sales channels

- Top 5 promising markets for e-commerce mattress sales

- Services offered for e-commerce mattress sales

- Share of mattresses returned back

- Expected sales variation in 2024 over 2023 for online and total sales

7. MENTIONED COMPANIES

- List of mentioned companies selling mattresses online: country, retailing format, activity, website