|

市場調查報告書

商品編碼

1665224

公用事業規模微電網市場機會、成長動力、產業趨勢分析與 2025 - 2034 年預測Utility Scale Microgrid Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

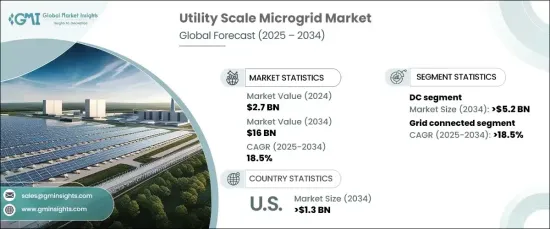

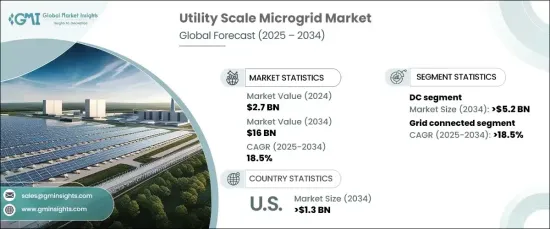

2024 年全球公用事業規模微電網市場價值為 27 億美元,預計將經歷強勁成長,2025 年至 2034 年的複合年成長率為 18.5%。公用事業規模微電網是一種能夠獨立運作或與主電網協同運行的本地化能源格局,正在徹底改變能源格局。透過整合太陽能板、風力渦輪機和儲能技術等分散式能源資源,這些系統可確保在特定區域內可靠地發電、儲存和分配電力。它們能夠增強電網彈性、最佳化能源使用並促進再生能源整合,成為現代能源基礎設施的基石。

能源獨立的需求是微電網應用的主要驅動力,特別是在偏遠和農村地區,因為這些地區擴展集中式電網成本過高且效率低。世界各國政府和監管機構正在透過支持政策、財政激勵和資助計畫來加速微電網的部署,為市場擴張創造了肥沃的土壤。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 27億美元 |

| 預測值 | 160億美元 |

| 複合年成長率 | 18.5% |

根據電網類型細分,市場包括交流、直流和混合系統,其中直流部分預計將實現顯著成長,到 2034 年將達到 52 億美元。這些系統還降低了營運成本、提高了效率並簡化了設計和維護,使其成為現代微電網安裝越來越受歡迎的選擇。

根據連接性,市場分為併網系統和離網系統,預計併網部分在預測期間的複合年成長率為 18.5%。這些系統滿足了停電和電網中斷期間對可靠備用電源的迫切需求。此外,它們在高峰需求期間平衡負載和補充電力的能力減輕了集中式電網的壓力,從而推動了它們的廣泛應用。

受導致電力供應中斷的自然災害日益頻繁的影響,美國公用事業規模微電網市場預計到 2034 年將創收 13 億美元。這些事件凸顯了具有彈性的能源系統的必要性,以便在緊急情況下維持運作並支持快速的復原工作。聯邦和州級舉措,包括財政激勵、補助和稅收抵免,進一步刺激對微電網技術的投資。

目錄

第 1 章:方法論與範圍

- 市場定義

- 基礎估算與計算

- 預測計算

- 初步研究與驗證

- 主要來源

- 資料探勘來源

- 市場定義

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統

- 監管格局

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- PESTEL 分析

第4章:競爭格局

- 介紹

- 戰略儀表板

- 創新與永續發展格局

第5章:市場規模及預測:依連結性,2021 – 2034 年

- 主要趨勢

- 已接取電網

- 離網

第 6 章:市場規模及預測:依電源分類,2021 年至 2034 年

- 主要趨勢

- 柴油發電機

- 天然氣

- 太陽能光電

- 熱電聯產

- 其他

第 7 章:市場規模及預測:按儲存設備,2021 – 2034 年

- 主要趨勢

- 鋰離子

- 鉛酸

- 液流電池

- 飛輪

- 其他

第 8 章:市場規模及預測:依電網類型,2021 – 2034 年

- 主要趨勢

- 交流

- 直流

- 混合

第 9 章:市場規模與預測:按地區,2021 – 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 法國

- 英國

- 俄羅斯

- 西班牙

- 義大利

- 丹麥

- 亞太地區

- 中國

- 日本

- 韓國

- 印度

- 澳洲

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

- 拉丁美洲

- 巴西

- 阿根廷

- 智利

第10章:公司簡介

- Ameresco

- Bloom Energy

- Caterpillar

- Eaton

- General Electric

- PG&E

- Piller Power Systems

- S&C Electric Company

- Stellar Energy

- Schneider Electric

The Global Utility Scale Microgrid Market, valued at USD 2.7 billion in 2024, is set to experience robust growth with a projected CAGR of 18.5% from 2025 to 2034. Utility-scale microgrids, localized energy systems capable of operating independently or in conjunction with the main power grid, are revolutionizing the energy landscape. By integrating distributed energy resources such as solar panels, wind turbines, and energy storage technologies, these systems ensure reliable electricity generation, storage, and distribution within defined areas. Their ability to enhance grid resilience, optimize energy usage, and facilitate renewable energy integration positions them as a cornerstone of modern energy infrastructure.

The demand for energy independence is a major driver of microgrid adoption, particularly in remote and rural regions where extending centralized grids is cost-prohibitive and inefficient. Governments and regulatory authorities worldwide are accelerating the deployment of microgrids through supportive policies, financial incentives, and funding programs, creating fertile ground for market expansion.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.7 Billion |

| Forecast Value | $16 Billion |

| CAGR | 18.5% |

Segmented by grid type, the market includes AC, DC, and hybrid systems, with the DC segment expected to achieve remarkable growth, reaching USD 5.2 billion by 2034. DC systems are gaining popularity due to their seamless compatibility with renewable energy sources, eliminating energy losses from DC-to-AC conversions. These systems also offer reduced operational costs, improved efficiency, and simplified design and maintenance, making them an increasingly preferred choice for modern microgrid installations.

By connectivity, the market is categorized into grid-connected and off-grid systems, with the grid-connected segment projected to grow at a CAGR of 18.5% over the forecast period. These systems address the critical need for reliable backup power during outages and grid disruptions. Additionally, their ability to balance loads and supplement power during peak demand periods alleviates stress on centralized grids, driving their widespread adoption.

The U.S. utility-scale microgrid market is anticipated to generate USD 1.3 billion by 2034, fueled by the growing frequency of natural disasters that disrupt power supplies. These events highlight the necessity of resilient energy systems capable of sustaining operations during emergencies and supporting swift recovery efforts. Federal and state-level initiatives, including financial incentives, grants, and tax credits, are further spurring investments in microgrid technologies.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definition

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 – 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Strategic dashboard

- 4.3 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Connectivity, 2021 – 2034 (USD Billion & MW)

- 5.1 Key trends

- 5.2 Grid connected

- 5.3 Off grid

Chapter 6 Market Size and Forecast, By Power Source, 2021 – 2034 (USD Billion & MW)

- 6.1 Key trends

- 6.2 Diesel generators

- 6.3 Natural gas

- 6.4 Solar PV

- 6.5 CHP

- 6.6 Others

Chapter 7 Market Size and Forecast, By Storage Device, 2021 – 2034 (USD Billion & MW)

- 7.1 Key trends

- 7.2 Lithium-ion

- 7.3 Lead Acid

- 7.4 Flow battery

- 7.5 Flywheels

- 7.6 Others

Chapter 8 Market Size and Forecast, By Grid Type, 2021 – 2034 (USD Billion & MW)

- 8.1 Key trends

- 8.2 AC

- 8.3 DC

- 8.4 Hybrid

Chapter 9 Market Size and Forecast, By Region, 2021 – 2034 (USD Billion & MW)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.2.3 Mexico

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 France

- 9.3.3 UK

- 9.3.4 Russia

- 9.3.5 Spain

- 9.3.6 Italy

- 9.3.7 Denmark

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 South Korea

- 9.4.4 India

- 9.4.5 Australia

- 9.5 Middle East and Africa

- 9.5.1 Saudi Arabia

- 9.5.2 UAE

- 9.5.3 South Africa

- 9.6 Latin America

- 9.6.1 Brazil

- 9.6.2 Argentina

- 9.6.3 Chile

Chapter 10 Company Profiles

- 10.1 Ameresco

- 10.2 Bloom Energy

- 10.3 Caterpillar

- 10.4 Eaton

- 10.5 General Electric

- 10.6 PG&E

- 10.7 Piller Power Systems

- 10.8 S&C Electric Company

- 10.9 Stellar Energy

- 10.10 Schneider Electric