|

市場調查報告書

商品編碼

1665284

公用事業規模直流微電網市場機會、成長動力、產業趨勢分析與 2025 - 2034 年預測Utility Scale DC Microgrid Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

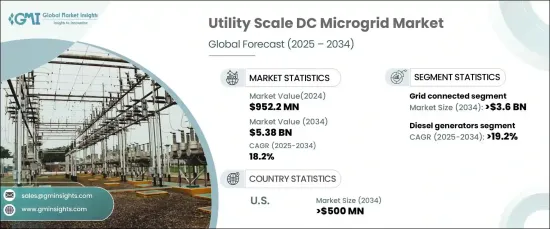

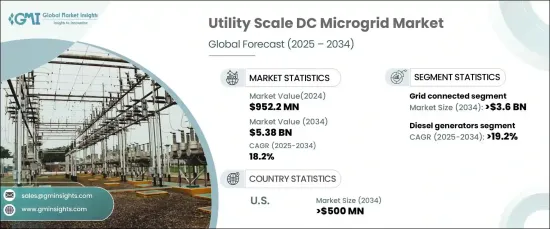

全球公用事業規模直流微電網市場預計將在 2024 年達到 9.522 億美元,並在 2025 年至 2034 年期間以 18.2% 的驚人複合年成長率成長。它們為整合分散式能源資源(DER)提供了靈活的解決方案,既可以在電網連接模式下運行以實現無縫分配,也可以在停電期間以孤島模式運行,確保為關鍵操作和偏遠地區持續供電。

對於能夠輕鬆整合太陽能光伏 (PV) 和風能等再生能源的高效能能源系統的需求不斷成長,推動了直流微電網的廣泛應用。隨著公用事業公司致力於最佳化再生能源整合,直流微電網正成為管理分散能源系統的重要工具。它們支援本地發電、儲存和消費的能力使其成為現代能源網路的理想選擇。向分散式系統的快速轉變進一步加速了直流微電網的採用,使公用事業公司能夠更有效地管理分散式能源,同時提高整體能源靈活性和效率。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 9.522億美元 |

| 預測值 | 53.8億美元 |

| 複合年成長率 | 18.2% |

到 2034 年,電網連接部分預計將產生 360 萬美元的收入,這得益於其在電網連接和孤島模式之間平穩過渡的能力。此功能增強了系統可靠性並最大限度地減少了電源中斷,因此非常有吸引力。隨著對可擴展且經濟高效的解決方案的需求不斷成長,這些微電網因其無需進行大規模基礎設施升級即可逐步擴大容量的能力而越來越受到關注。能源效率的提高和營運成本的降低進一步鞏固了它們在支持未來能源格局中的作用。

在電源方面,到 2034 年,柴油發電機部分將以 19.2% 的強勁複合年成長率成長。它們能夠靈活地滿足不同的能源需求,而無需對基礎設施進行重大改變,從而推動其更廣泛的採用。這些發電機在電網連接不可靠或不存在的偏遠地區也發揮著重要作用,進一步鞏固了它們在市場上的地位。

在美國,公用事業規模的直流微電網市場預計到 2034 年將產生 5 億美元的收入。自然災害和電網故障發生頻率日益增加,凸顯了對彈性能源解決方案的需求,而直流微電網則成為確保可靠電力供應的關鍵因素。隨著再生技術和電網現代化建設的不斷進步,美國市場持續成長的前景仍然強勁。

目錄

第 1 章:方法論與範圍

- 研究設計

- 基礎估算與計算

- 預測模型

- 初步研究與驗證

- 主要來源

- 資料探勘來源

- 市場定義

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統

- 監管格局

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- PESTEL 分析

第4章:競爭格局

- 介紹

- 戰略儀表板

- 創新與永續發展格局

第5章:市場規模及預測:依連結性,2021 – 2034 年

- 主要趨勢

- 已接取電網

- 離網

第 6 章:市場規模及預測:依電源分類,2021 年至 2034 年

- 主要趨勢

- 柴油發電機

- 天然氣

- 太陽能光電

- 熱電聯產

- 其他

第 7 章:市場規模及預測:按儲存設備,2021 – 2034 年

- 主要趨勢

- 鋰離子

- 鉛酸

- 液流電池

- 飛輪

- 其他

第 8 章:市場規模與預測:按地區,2021 – 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 法國

- 英國

- 俄羅斯

- 亞太地區

- 中國

- 日本

- 韓國

- 印度

- 澳洲

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

- 拉丁美洲

- 巴西

- 阿根廷

- 智利

第9章:公司簡介

- ARDA Power

- AEG International

- Bosch Global

- Eaton

- G&W Electric

- PowerSecure

- Sumitomo Electric Industries

- Schneider Electric

- SolarWorX

- Schaltbau Group

The Global Utility Scale DC Microgrid Market is projected to reach USD 952.2 million in 2024 and grow at an impressive CAGR of 18.2% from 2025 to 2034. These advanced microgrids are localized energy systems designed to generate, distribute, and utilize direct current (DC) electricity, enhancing grid reliability and promoting decarbonization. They offer flexible solutions for integrating distributed energy resources (DERs), operating in either grid-connected mode for seamless distribution or islanded mode during outages, ensuring continuous power supply to critical operations and remote areas.

The rising demand for efficient energy systems that can easily integrate renewable sources like solar photovoltaic (PV) and wind energy is driving the growing adoption of DC microgrids. As utilities work to optimize renewable energy integration, DC microgrids are becoming essential tools for managing decentralized energy systems. Their capacity to support localized generation, storage, and consumption makes them ideal for modern energy networks. The rapid shift towards decentralized systems is further accelerating the adoption of DC microgrids, allowing utilities to manage DERs more effectively while enhancing overall energy flexibility and efficiency.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $952.2 Million |

| Forecast Value | $5.38 Billion |

| CAGR | 18.2% |

The grid-connected segment is expected to generate USD 3.6 million by 2034, driven by its ability to transition smoothly between grid-connected and islanded modes. This feature enhances system reliability and minimizes power disruptions, making it highly appealing. As the demand for scalable and cost-effective solutions grows, these microgrids are gaining traction for their ability to expand capacity incrementally without the need for extensive infrastructure upgrades. The improved energy efficiency and lower operating costs further solidify their role in supporting the future energy landscape.

Regarding power sources, the diesel generator segment is set to grow at a robust CAGR of 19.2% through 2034. Diesel generators are crucial for providing rapid, reliable energy, especially in maintaining essential utility functions. Their flexibility to meet varying energy demands without significant infrastructure changes is driving increased adoption. These generators are also proving invaluable in remote areas with unreliable or nonexistent grid connections, further strengthening their position in the market.

In the U.S., the utility-scale DC microgrid market is expected to generate USD 500 million by 2034. The country's increasing focus on renewable energy integration and decarbonization goals is spurring demand, particularly as utilities address the challenges posed by the variability of renewable energy sources. The growing frequency of natural disasters and grid failures is highlighting the need for resilient energy solutions, positioning DC microgrids as a key player in ensuring a reliable power supply. With ongoing advancements in renewable technologies and grid modernization efforts, the prospects for continued growth in the U.S. market remain strong.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Base estimates & calculations

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 – 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Strategic dashboard

- 4.3 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Connectivity, 2021 – 2034 (USD Million & MW)

- 5.1 Key trends

- 5.2 Grid connected

- 5.3 Off grid

Chapter 6 Market Size and Forecast, By Power Source, 2021 – 2034 (USD Million & MW)

- 6.1 Key trends

- 6.2 Diesel generators

- 6.3 Natural gas

- 6.4 Solar PV

- 6.5 CHP

- 6.6 Others

Chapter 7 Market Size and Forecast, By Storage Device, 2021 – 2034 (USD Million & MW)

- 7.1 Key trends

- 7.2 Lithium-ion

- 7.3 Lead acid

- 7.4 Flow battery

- 7.5 Flywheels

- 7.6 Others

Chapter 8 Market Size and Forecast, By Region, 2021 – 2034 (USD Million & MW)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.2.3 Mexico

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 France

- 8.3.3 UK

- 8.3.4 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 South Korea

- 8.4.4 India

- 8.4.5 Australia

- 8.5 Middle East and Africa

- 8.5.1 Saudi Arabia

- 8.5.2 UAE

- 8.5.3 South Africa

- 8.6 Latin America

- 8.6.1 Brazil

- 8.6.2 Argentina

- 8.6.3 Chile

Chapter 9 Company Profiles

- 9.1 ARDA Power

- 9.2 AEG International

- 9.3 Bosch Global

- 9.4 Eaton

- 9.5 G&W Electric

- 9.6 PowerSecure

- 9.7 Sumitomo Electric Industries

- 9.8 Schneider Electric

- 9.9 SolarWorX

- 9.10 Schaltbau Group