|

市場調查報告書

商品編碼

1666646

壓力感測器市場機會、成長動力、產業趨勢分析與 2025 - 2034 年預測Pressure Sensor Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

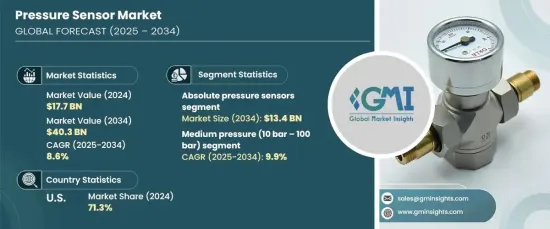

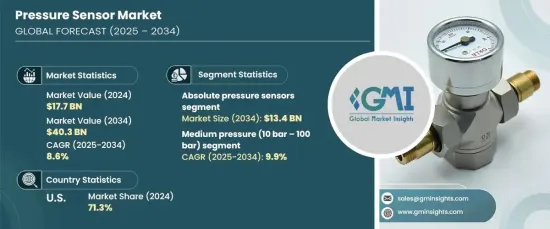

2024 年全球壓力感測器市場規模達到 177 億美元,預計 2025 年至 2034 年期間的複合年成長率為 8.6%。這一成長主要得益於感測器技術的不斷進步,包括小型化、更高的光譜解析度以及適用於各行各業的經濟高效的系統的開發。

隨著汽車、醫療保健、工業自動化和航太等領域對更智慧、更可靠的感測解決方案的需求不斷增加,壓力感測器已成為許多關鍵應用的重要組成部分。它們的多功能性和準確性使其成為從引擎管理到環境監控等眾多系統平穩運行不可或缺的一部分。對自動化的日益依賴,加上對高性能機械精度的不斷成長的需求,正在推動市場成長。隨著對智慧技術和基礎設施開發的大量投資,未來幾年對先進壓力感測器的需求將會不斷增加。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 177億美元 |

| 預測值 | 403億美元 |

| 複合年成長率 | 8.6% |

壓力感測器按產品類型分類,其中最常用的是差壓感測器、絕對壓力感測器、真空感測器、密封壓力感測器、多量程感測器和表壓感測器。航太,絕對壓力感測器佔據最大的市場佔有率,預計到 2034 年將達到 134 億美元。儘管氣壓有波動,它們仍能持續運轉,因此在對準確性要求嚴格的環境中,它們是不可或缺的。

市場還根據壓力範圍進行細分,包括低壓(高達 10 bar)、中壓(10 bar 至 100 bar)和高壓(100 bar 以上)感測器。中壓部分在 10 bar 至 100 bar 範圍內運行,是成長最快的類別,預計 2025 年至 2034 年的複合年成長率為 9.9%。它們對於液壓和氣動系統的監控和控制至關重要,可確保各種機械和流程的穩定性和效率。

2024年,美國在全球壓力感測器市場佔據主導地位,佔有71.3%的佔有率。該國的領先地位歸功於其先進的技術基礎設施、強大的汽車行業以及在工業自動化和醫療保健方面的大量投資。隨著這些行業不斷創新,對壓力感測器的需求預計將持續上升。隨著技術和基礎設施的不斷進步,特別是在需要高精度和高可靠性的領域,美國仍然是全球市場的重要參與者。

目錄

第 1 章:方法論與範圍

- 市場範圍和定義

- 基礎估算與計算

- 預測計算

- 資料來源

- 基本的

- 次要

- 付費來源

- 公共資源

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 影響價值鏈的因素

- 利潤率分析

- 中斷

- 未來展望

- 製造商

- 經銷商

- 供應商概況

- 利潤率分析

- 重要新聞及舉措

- 監管格局

- 衝擊力

- 成長動力

- 汽車技術的進步

- 工業自動化的成長

- 消費性電子產品的擴張

- 更加重視醫療監測

- 產業陷阱與挑戰

- 製造成本高

- 整合和校準的複雜性

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第 5 章:市場估計與預測:按產品類型,2021-2034 年

- 主要趨勢

- 絕對壓力感測器

- 表壓感測器

- 差壓感知器

- 真空壓力感知器

- 密封壓力感測器

- 多量程壓力感測器

- 其他

第 6 章:市場估計與預測:按技術,2021 年至 2034 年

- 主要趨勢

- 壓阻式

- 電容式

- 電磁

- 諧振固態

- 光學的

- 其他

第 7 章:市場估計與預測:按輸出類型,2021-2034 年

- 主要趨勢

- 類比輸出

- 數位輸出

第 8 章:市場估計與預測:按壓力範圍,2021 年至 2034 年

- 主要趨勢

- 低壓(最高 10 巴)

- 中壓(10 bar – 100 bar)

- 高壓(100 bar 以上)

第 9 章:市場估計與預測:按垂直產業,2021 年至 2034 年

- 主要趨勢

- 汽車

- 衛生保健

- 工業製造

- 能源和電力

- 消費性電子產品

- 航太和國防

- 石油和天然氣

- 其他

第 10 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中東及非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第 11 章:公司簡介

- Analog Devices Inc. (ADI)

- APG (American Pressure Gauge)

- Bosch Sensortec

- Delphi Technologies

- Emerson Electric Co.

- First Sensor AG

- FUTEK Advanced Sensor Technology

- Hitec Products

- Honeywell International Inc.

- Infineon Technologies AG

- Kistler Instrumente AG

- Murata Manufacturing Co., Ltd.

- NXP Semiconductors

- Panasonic Corporation

- Sensata Technologies

- STMicroelectronics

- TE Connectivity

- Texas Instruments (TI)

The Global Pressure Sensor Market reached USD 17.7 billion in 2024 and is projected to expand at a CAGR of 8.6% between 2025 and 2034. This surge is primarily fueled by continuous advancements in sensor technology, including miniaturization, improved spectral resolution, and the development of cost-effective systems that are accessible to a wide range of industries.

As the demand for smarter and more reliable sensing solutions increases across sectors such as automotive, healthcare, industrial automation, and aerospace, pressure sensors have become essential components for many critical applications. Their versatility and accuracy make them integral to the smooth operation of numerous systems, from engine management to environmental monitoring. The growing reliance on automation, coupled with the rising need for precision in high-performance machinery, is driving market growth. With significant investments in smart technologies and infrastructure development, the demand for advanced pressure sensors is set to escalate in the coming years.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $17.7 billion |

| Forecast Value | $40.3 billion |

| CAGR | 8.6% |

Pressure sensors are categorized by product type, with differential, absolute, vacuum, sealed, multi-range, and gauge pressure sensors being the most commonly used. Among these, the absolute pressure sensor segment holds the largest share of the market and is projected to reach USD 13.4 billion by 2034. These sensors are designed to measure pressure in relation to a perfect vacuum, making them crucial for applications requiring high levels of precision, such as in aerospace, automotive, and environmental monitoring. With their ability to function consistently despite fluctuations in atmospheric pressure, they are indispensable in environments where accuracy is non-negotiable.

The market is also segmented by pressure range, including low (up to 10 bar), medium (10 bar to 100 bar), and high-pressure (above 100 bar) sensors. The medium-pressure segment, operating within the 10 bar to 100 bar range, is the fastest-growing category, with a projected CAGR of 9.9% from 2025 to 2034. These sensors play a vital role in industries such as manufacturing, automotive, and industrial automation. They are essential for the monitoring and control of hydraulic and pneumatic systems, which ensure the stability and efficiency of various machinery and processes.

In 2024, the U.S. dominated the global pressure sensor market, holding a commanding 71.3% share. The country's leading position is attributed to its advanced technological infrastructure, strong automotive sector, and significant investments in industrial automation and healthcare. As these industries continue to innovate, the demand for pressure sensors is expected to keep rising. With ongoing advancements in technology and infrastructure, particularly in areas requiring high precision and reliability, the U.S. remains a key player in the global market.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Advancements in automotive technologies

- 3.6.1.2 Growth in industrial automation

- 3.6.1.3 Expansion of consumer electronics

- 3.6.1.4 Increased focus on healthcare monitoring

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 High manufacturing costs

- 3.6.2.2 Integration and calibration complexities

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product Type, 2021-2034 (USD Million & Volume Units)

- 5.1 Key trends

- 5.2 Absolute pressure sensors

- 5.3 Gauge pressure sensors

- 5.4 Differential pressure sensors

- 5.5 Vacuum pressure sensors

- 5.6 Sealed pressure sensors

- 5.7 Multi-range pressure sensors

- 5.8 Others

Chapter 6 Market Estimates & Forecast, By Technology, 2021-2034 (USD Million & Units)

- 6.1 Key trends

- 6.2 Piezoresistive

- 6.3 Capacitive

- 6.4 Electromagnetic

- 6.5 Resonant solid-state

- 6.6 Optical

- 6.7 Others

Chapter 7 Market Estimates & Forecast, By Output Type, 2021-2034 (USD Million & Units)

- 7.1 Key trends

- 7.2 Analog output

- 7.3 Digital output

Chapter 8 Market Estimates & Forecast, By Pressure Range, 2021-2034 (USD Million & Units)

- 8.1 Key trends

- 8.2 Low pressure (Up to 10 bar)

- 8.3 Medium pressure (10 bar – 100 bar)

- 8.4 High pressure (Above 100 bar)

Chapter 9 Market Estimates & Forecast, By Industry Vertical, 2021-2034 (USD Million & Units)

- 9.1 Key trends

- 9.2 Automotive

- 9.3 Healthcare

- 9.4 Industrial manufacturing

- 9.5 Energy and power

- 9.6 Consumer electronics

- 9.7 Aerospace & defense

- 9.8 Oil & gas

- 9.9 Others

Chapter 10 Market Estimates & Forecast, By Region, 2021-2034 (USD Million & Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Analog Devices Inc. (ADI)

- 11.2 APG (American Pressure Gauge)

- 11.3 Bosch Sensortec

- 11.4 Delphi Technologies

- 11.5 Emerson Electric Co.

- 11.6 First Sensor AG

- 11.7 FUTEK Advanced Sensor Technology

- 11.8 Hitec Products

- 11.9 Honeywell International Inc.

- 11.10 Infineon Technologies AG

- 11.11 Kistler Instrumente AG

- 11.12 Murata Manufacturing Co., Ltd.

- 11.13 NXP Semiconductors

- 11.14 Panasonic Corporation

- 11.15 Sensata Technologies

- 11.16 STMicroelectronics

- 11.17 TE Connectivity

- 11.18 Texas Instruments (TI)