|

市場調查報告書

商品編碼

1626340

亞太地區壓力感測器 -市場佔有率分析、產業趨勢/統計、成長預測(2025-2030)APAC Pressure Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

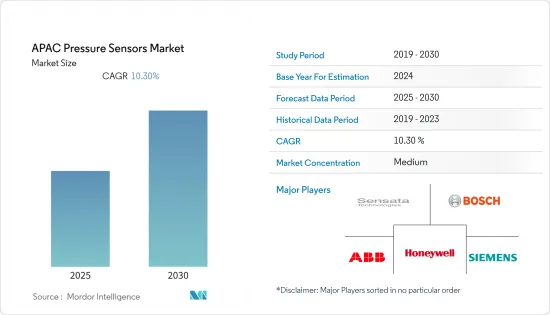

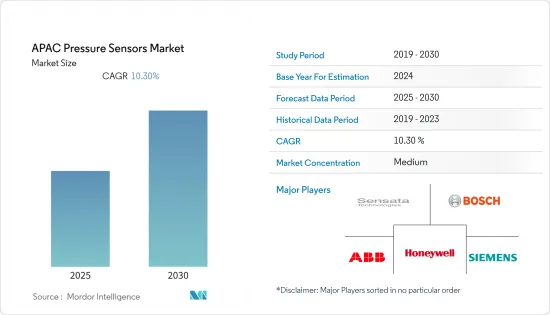

亞太地區壓力感測器市場預計在預測期內複合年成長率為 10.3%

主要亮點

- 亞太地區是電子電氣設備製造市場最大的地區,佔全球市場佔有率的50%以上。該地區也是 MEMS 技術的重要供應商,特別是在中國大陸和台灣。

- 另一方面,中國是全球最大的汽車市場和全球最大的汽車生產基地,其中包括電動車,成長潛力巨大。馬來西亞有27家汽車製造和組裝廠。

- 這些行業佔壓力感測器市場的很大一部分,因此該地區在預測期內存在巨大的機會。聯網汽車概念的不斷發展以及中國有關車輛安全的法規也預計將推動 MEMS 壓力感測器的採用。

- 疫情對市場產生了負面影響,智慧型手機需求下降,汽車產業產量下降。大多數工廠停止營運,許多工廠自動化計劃被擱置。這些案例對市場產生了負面影響。

亞太地區壓力感測器市場趨勢

汽車工業呈現顯著成長

- 汽車產業目前正在經歷技術轉型,主要目標是提高安全性、舒適性和娛樂性,這為壓力感測器提供了各種機會。這些感測器(例如 MEMS)的小型化正在影響其在汽車產業設計方案中的需求,也是大規模採用的關鍵因素。

- 技術的發展正在推動自動駕駛和自動駕駛汽車的發展,而汽車中感測器的採用預計將標誌著後續的成長。在汽車領域,政府機構執行的安全法規在整合壓力感測器方面也發揮著重要作用。例如,在美國,NHTSA 自 2002 年起強制使用 TPMS(胎壓監測系統)。因此,由於存在強勁的汽車產業,美國汽車產業一直領先於所研究的市場。

- 如上所述,預計由於世界各國的環境和安全法規,未來對汽車壓力感測器的精度、品質和價格的要求將變得更加嚴格。

醫療領域佔據最高市場佔有率

- 醫療產業因其在連續氣道正壓通氣、人工呼吸器、吸入器、血壓監測、藥物輸送系統、內視鏡手術和腹腔鏡設備等設備和監測設備方面的大量應用而佔據最高的市場佔有率。

- Honeywell 等公司生產和銷售 TruStability RSC 系列壓阻矽壓力感測器,可提供數位輸出,用於在指定的滿量程壓力跨度和溫度範圍內讀取壓力。具有整合 EEPROM 的 24 位元類比數位轉換器用於校準和溫度補償感測器的偏移、靈敏度、溫度影響和非線性。廣泛用於睡眠呼吸中止症裝置。

- 此外,該公司還提供26PC SMT(表面黏著技術)系列壓力感測器。這種小型、低成本、高價值的壓力感測解決方案取代了醫療保健專業人員將聽診器放在袖帶下並聆聽血液上升的聲音的需要。此感測器比手動設備更快速、更準確地測量血壓,並且直接在印刷電路基板(PCB) 上使用。

亞太地區壓力感測器產業概況

亞太地區壓力感測器市場適度細分,由幾家主要公司組成。從市場佔有率來看,目前該市場由少數大公司主導。然而,創新和永續技術使許多公司能夠透過贏得新契約和開拓新市場來提高其市場佔有率。

- 2021 年 8 月 - MS Motorservice International GmbH 擴大了壓力感測器的產品系列。壓力感測器是備件專家提供的廢氣感測器領域的第三個創新產品系列,具有久經考驗的皮爾博格品質。目前產品共有19種,相容全球約9000萬輛汽車。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 評估 COVID-19 對產業的影響

- 市場促進因素

- 汽車、醫療等終端用戶產業的成長

- MEMS 和 NEMS 系統在工業中的採用率不斷提高

- 市場限制因素

- 與感測產品相關的高成本

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第5章市場區隔

- 按用途

- 汽車(輪胎壓力、煞車油壓力、燃料箱蒸氣壓、燃油噴射和CDRi、歧管絕對壓力等)

- 醫療(CPAP、人工呼吸器、吸入器、血壓監測等)

- 消費性電子產品

- 工業的

- 航太/國防

- 飲食

- 空調

- 按國家/地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

第6章 競爭狀況

- 公司簡介

- ABB Ltd

- All Sensors Corporation

- Bosch Sensortec GmbH

- Endress+Hauser AG

- GMS Instruments BV

- Honeywell International Inc.

- Invensys Ltd

- Kistler Group

- Rockwell Automation Inc.

- Rosemount Inc.(Emerson Electric Company)

- Sensata Technologies Inc.

- Siemens AG

- Yokogawa Corporation

第7章 投資分析

第8章市場的未來

簡介目錄

Product Code: 47912

The APAC Pressure Sensors Market is expected to register a CAGR of 10.3% during the forecast period.

Key Highlights

- Asia-Pacific is the largest region in the electrical and electronics manufacturing market, accounting for more than 50% of the global market share. The region is also a significant vendor of MEMS technologies, especially in China and Taiwan.

- On the other hand, China is the world's largest car market and the world's largest production site for cars, including electric cars, with much growth potential. There are 27 automotive manufacturing and assembly plants in Malaysia.

- As these industries account for a significant portion of the pressure sensor market, hence the region offers an excellent opportunity over the forecast period. The growing concept of connected cars and China's regulations regarding automotive safety are also expected to drive the adoption of MEMS pressure sensors.

- The pandemic had a negative impact on the market as the market witnessed a decrease in demand for smartphones and less production of vehicles in the automotive industry. Most of the factories were discontinued, and many factory automation projects were put on hold. Such instances had a negative impact on the market.

APAC Pressure Sensors Market Trends

Automotive Industry to Show Significant Growth

- The automotive industry, which is currently undergoing a technology transformation, with a major objective of increasing safety, comfort, and entertainment, provides various opportunities for pressure sensors. The miniature size of these sensors, such as MEMS, is influencing their demand in the design scheme of the automotive industry, making them a crucial factor for massive adoption.

- With technological developments driving the development of autonomous and self-driving cars, the adoption of sensors in cars is expected to witness subsequent growth. In the automotive sector, safety regulations enforced by governmental organizations also play a crucial role in incorporating pressure sensors. For instance, in the United States, the NHTSA has mandated the use of TPMS (tire pressure monitoring system) since 2002. Hence, the US automotive sector has been leading the market studied, owing to the presence of a robust automotive sector.

- Thus, environmental and safety regulations of various countries throughout the world are expected to lead to an increasingly stringent requirement for accuracy, quality, and price of automotive pressure sensors, in the future.

Medical sector to hold the highest market share

- The Medical industry is expected to hold the highest market share with its large set of applications in devices and monitoring equipment such as Continuous Positive Air Pressure, Ventilators, Inhalers, Blood Pressure Monitoring, Drug Delivery Systems, Endoscopic Procedures, Laparoscopic Devices.

- Companies such as Honeywell manufactures and market their TruStability RSC Series, a piezoresistive silicon pressure sensor that offers a digital output for reading pressure over the specified full-scale pressure span and temperature range. It is calibrated and temperature compensated for sensor offset, sensitivity, temperature effects, and non-linearity, using a 24-bit analog-to-digital converter with integrated EEPROM. It is widely used in sleep apnea machines.

- Moreover, the company also offers the 26PC SMT (Surface Mount Technology) Series pressure sensor. This small, low-cost, high-value pressure sensing solution replaces the need of the healthcare professional having to place a stethoscope under the pressure cuff to hear the noise of the rushing blood. The sensor measures blood pressure faster and more accurately than manual devices and is used directly with printed circuit boards (PCBs).

APAC Pressure Sensors Industry Overview

The Asia Pacific Pressure Sensor market is moderately fragmented and consists of several major players. In terms of market share, few of the major players currently dominate the market. However, with innovative and sustainable technologies, many companies are increasing their market presence by securing new contracts and tapping new markets.

- August 2021 - MS Motorservice International GmbH has expanded its product portfolio with differential pressure sensors. Differential pressure sensors make up the third innovative product group in the area of exhaust gas sensors that the spare parts specialist offers in proven Pierburg quality. Currently boasting an impressive 19 different products, the company can cater for almost 90 million vehicles globally, with the range being continually expanded.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Assessment of Impact of COVID-19 on the Industry

- 4.3 Market Drivers

- 4.3.1 Growth Of End-user Verticals, such as Automotive and Healthcare

- 4.3.2 Increasing Adoption of MEMS and NEMS Systems in the Industry

- 4.4 Market Restraints

- 4.4.1 High Costs Associated with Sensing Products

- 4.5 Industry Value Chain Analysis

- 4.6 Industry Attractiveness - Porter's Five Force Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Application

- 5.1.1 Automotive (Tire Pressure, Break Fluid Pressure, Vapor Pressure in Fuel Tank, Fuel Injection and CDRi, and Manifold Absolute Pressure among others)

- 5.1.2 Medical (Continuous Positive Airway Pressure (CPAP), Ventilators and Inhalers, and Blood Pressure Monitoring, Among Others)

- 5.1.3 Consumer Electronics

- 5.1.4 Industrial

- 5.1.5 Aerospace and Defence

- 5.1.6 Food and Beverage

- 5.1.7 HVAC

- 5.2 By Country

- 5.2.1 China

- 5.2.2 India

- 5.2.3 Japan

- 5.2.4 South Korea

- 5.2.5 Rest of Asia Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 ABB Ltd

- 6.1.2 All Sensors Corporation

- 6.1.3 Bosch Sensortec GmbH

- 6.1.4 Endress+Hauser AG

- 6.1.5 GMS Instruments BV

- 6.1.6 Honeywell International Inc.

- 6.1.7 Invensys Ltd

- 6.1.8 Kistler Group

- 6.1.9 Rockwell Automation Inc.

- 6.1.10 Rosemount Inc. (Emerson Electric Company)

- 6.1.11 Sensata Technologies Inc.

- 6.1.12 Siemens AG

- 6.1.13 Yokogawa Corporation

7 INVESTMENT ANALYSIS

8 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219