|

市場調查報告書

商品編碼

1627192

中東和非洲壓力感測器:市場佔有率分析、行業趨勢和成長預測(2025-2030)MEA Pressure Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

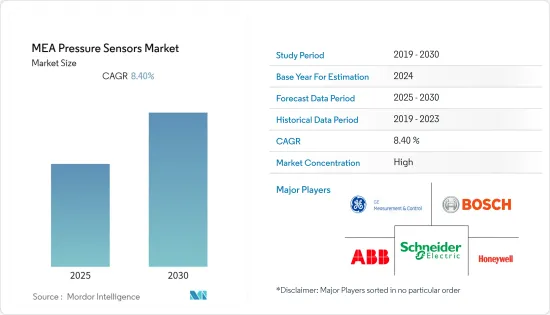

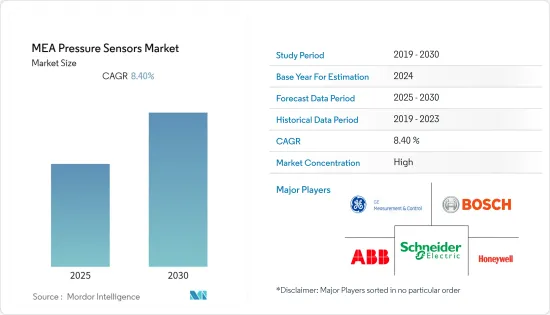

中東和非洲壓力感測器市場預計在預測期內複合年成長率為 8.4%

主要亮點

- 中東在全球石油和天然氣工業中佔有很大佔有率。數位化正在推動該地區石油和天然氣行業自動化的採用,從而推動壓力感測器市場的發展。

- 私立醫院的增加以及外國公司對醫療保健領域投資的增加正在推動非洲IT醫療保健產業的發展。不斷變化的經濟狀況正在推動對低成本醫療設備的需求,並為該地區的壓力感測器供應商創造了巨大的機會。

- 此外,奈及利亞案例發展計畫等政府主導正在興起,增加了整個非洲的汽車製造活動。這也打開了該地區的壓力感測器市場。

- 疫情對中東國家油氣市場產生了深遠影響。在此期間,由於原油需求大幅下降,許多精製被關閉,一些現代化活動也被擱置。

中東和非洲壓力感測器市場趨勢

石油和天然氣成長顯著

- 中東一些國家生產和出口世界上大部分原油。因此,該地區對廣泛應用的壓力感測器有很高的需求。例如,根據貝克休斯統計,截至2021年10月,中東地區石油和天然氣鑽井平台數量為275個,包括海上和陸上,位居全球第二。

- 該地區新的油氣天然氣田不斷被發現,老舊未利用的油氣天然氣田也不斷更新。例如,政府所有的阿布達比國家石油公司最近宣布了一項大型鑽井平台擴張計劃,到 2025 年將增加數十台鑽機。

- 根據石油輸出國組織統計,沙烏地阿拉伯持有世界已探明石油蘊藏量的約17%。石油和天然氣工業約佔國內生產總值的50%和出口收益的70%。該國石油和天然氣行業的強大影響力促進了該地區的市場成長。

阿拉伯聯合大公國擁有最高的市場佔有率

- 沿岸地區擴大部署太陽能來滿足其部分能源需求。包括阿拉伯聯合大公國在內的該地區正在進行各種計劃,以進一步推進壓力感測器在能源和電力領域的應用。此外,阿拉伯聯合大公國計劃新增發電量約21GW,其中太陽能發電量預計將佔新增發電總量的26.1%。

- 阿拉伯聯合大公國等國家正在為後石油時代的未來做準備,並增加對建立技術型經濟的投資。例如,根據通訊的數據,儘管該地區受到疫情影響,但阿拉伯聯合大公國2020年的網路普及率仍達99%,位居全球第一。這進一步補充了壓力感測器在基於物聯網的設備中的應用。

- 壓力感測器也很容易用於食品和飲料製造廠。例如,2020 年 11 月,阿拉伯聯合大公國領先的乳製品果汁公司 Al Rawabi Dairy Company 與 VEGA 合作安裝了 VEGABAR 38 壓力感測器,在 5 公尺高的奶罐中進行液位測量。

中東和非洲壓力感測器產業概況

中東和非洲壓力感測器市場高度集中,由幾個主要企業組成。從市場佔有率來看,目前該市場由少數大公司主導。然而,憑藉創新和永續的包裝,許多公司正在透過贏得新契約和開拓新市場來擴大其市場佔有率。

- 2021 年 7 月 - 博世力士樂公司推出 Hydac 壓力感測器,以提高工業液壓領域的功能、可靠性和整體性能,無論是在製造系統、機械、移動或實驗室應用中。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 評估 COVID-19 對產業的影響

- 市場促進因素

- 汽車、醫療等終端用戶產業的成長

- MEMS 和 NEMS 系統在工業中的採用率不斷提高

- 市場限制因素

- 與感測產品相關的高成本

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家/消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第5章市場區隔

- 按用途

- 汽車(輪胎壓力、煞車油壓力、燃料箱內蒸氣壓力、燃油噴射和CDRi、歧管絕對壓力等)

- 醫療(CPAP、人工呼吸器、吸入器、血壓監測等)

- 消費性電子產品

- 工業的

- 航太/國防

- 飲食

- 空調

- 按國家/地區

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

- 其他中東/非洲

第6章 競爭狀況

- 公司簡介

- ABB Ltd

- All Sensors Corporation

- Bosch Sensortec GmbH

- Endress+Hauser AG

- GMS Instruments BV

- Honeywell International Inc.

- Invensys Ltd

- Kistler Group

- Rockwell Automation Inc.

- Rosemount Inc.(Emerson Electric Company)

- Sensata Technologies Inc.

- Siemens AG

- Yokogawa Corporation

第7章 投資分析

第8章市場的未來

簡介目錄

Product Code: 50638

The MEA Pressure Sensors Market is expected to register a CAGR of 8.4% during the forecast period.

Key Highlights

- The Middle East accounts for a significant share in the global oil and gas industry. Digitization has fueled the adoption of automation in the oil and gas industry in the region, thus driving the market for the pressure sensor.

- The growing number of private hospitals and increasing investments in the healthcare sector by foreign players are helping in boosting the African IT healthcare industry. Fluctuating economic condition has driven the demand for low-cost medical equipment, thus creating a huge opportunity for pressure sensor vendors in the region.

- Moreover, increasing instances of government initiatives, like the Nigerian Automotive Industry Development Plan, is augmenting the automotive manufacturing activity across Africa. This is developing the market for pressure sensors in the region too.

- The pandemic had a deep impact on the oil and gas market of the Middle Eastern countries. Many of the oil refineries were shut down during the period as the demand for crude oil drastically decreased, and several modernization activities were put on hold.

MEA Pressure Sensors Market Trends

Oil and Gas to Show Significant Growth

- The Middle Eastern region is home to countries that produce and export a prominent share of crude oil globally. Owing to this, the region commands significant demand for pressure sensors which are used for a wide range of applications. For instance, as of October 2021, the number of oil and gas rigs in the Middle East stood at 275, including offshore and land, which is the second-highest in the world, according to Baker Hughes.

- The region is witnessing the discovery of new oil and gas wells continuously while old and underutilized ones are being rejuvenated. For instance, recently, the government-owned Abu Dhabi National Oil Co. announced a major rig fleet expansion program that is expected to add dozens of rigs by 2025.

- According to the Organization of the Petroleum Exporting Countries, Saudi Arabia possesses around 17% of the world's proven petroleum reserves. The oil and gas industry accounted for about 50% of gross domestic product and about 70% of export earnings. The significant presence of the oil and gas industry in the country has contributed to the growth of the market in the region.

United Arab Emirates to Hold the Highest Market Share

- The Gulf region has been adopting solar power to meet some of its energy needs. Various projects are underway across the region, including the United Arab Emirates, which further increase the application of pressure sensors in the energy and power sector. Moreover, The United Arab Emirates plans to increase its power-generation capacity by around 21 GW, and its solar capacity is anticipated to constitute 26.1% of the total additional generation capacity.

- Countries like the United Arab Emirates are increasingly investing in building a technology-based economy to prepare for a post-oil future. For instance, in 2020, the United Arab Emirates held the highest network penetration in the world, which stood at 99% amid the impact of the pandemic in the region, according to the International Telecommunication Union. This would further complement the application of pressure sensors in IoT-based devices.

- Pressure sensors are also being readily used in food and beverage manufacturing plants. For instance, in November 2020, Al Rawabi Dairy Company is a leading dairy and juice company in the United Arab Emirates (UAE), partnered with VEGA to install a VEGABAR 38 pressure sensor to carry out the level measurements of its 5-meter high milk tanks.

MEA Pressure Sensors Industry Overview

The Middle East and Africa Pressure Sensor market is highly concentrated and consists of a few major players. In terms of market share, few of the major players currently dominate the market. However, with innovative and sustainable packaging, many of the companies are increasing their market presence by securing new contracts and by tapping new markets.

- July 2021 - The Bosch Rexroth SA launched Hydac pressure transducers to provide improved functionality, reliability, and overall performance throughout the industrial hydraulics sector - in manufacturing systems, machinery, mobile or laboratory applications.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Assessment of Impact of COVID-19 on the Industry

- 4.3 Market Drivers

- 4.3.1 Growth Of End-user Verticals, such as Automotive and Healthcare

- 4.3.2 Increasing Adoption of MEMS and NEMS Systems in the Industry

- 4.4 Market Restraints

- 4.4.1 High Costs Associated with Sensing Products

- 4.5 Industry Value Chain Analysis

- 4.6 Industry Attractiveness - Porter's Five Force Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Application

- 5.1.1 Automotive (Tire Pressure, Break Fluid Pressure, Vapor Pressure in Fuel Tank, Fuel Injection and CDRi, and Manifold Absolute Pressure among others)

- 5.1.2 Medical (Continuous Positive Airway Pressure (CPAP), Ventilators and Inhalers, and Blood Pressure Monitoring, Among Others)

- 5.1.3 Consumer Electronics

- 5.1.4 Industrial

- 5.1.5 Aerospace and Defence

- 5.1.6 Food and Beverage

- 5.1.7 HVAC

- 5.2 By Country

- 5.2.1 United Arab Emirates

- 5.2.2 Saudi Arabia

- 5.2.3 South Africa

- 5.2.4 Rest of Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 ABB Ltd

- 6.1.2 All Sensors Corporation

- 6.1.3 Bosch Sensortec GmbH

- 6.1.4 Endress+Hauser AG

- 6.1.5 GMS Instruments BV

- 6.1.6 Honeywell International Inc.

- 6.1.7 Invensys Ltd

- 6.1.8 Kistler Group

- 6.1.9 Rockwell Automation Inc.

- 6.1.10 Rosemount Inc. (Emerson Electric Company)

- 6.1.11 Sensata Technologies Inc.

- 6.1.12 Siemens AG

- 6.1.13 Yokogawa Corporation

7 INVESTMENT ANALYSIS

8 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219