|

市場調查報告書

商品編碼

1667046

低壓電力電容器市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Low Voltage Electric Capacitor Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

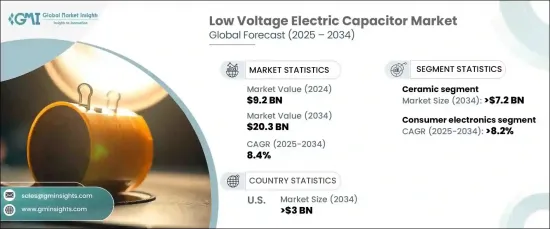

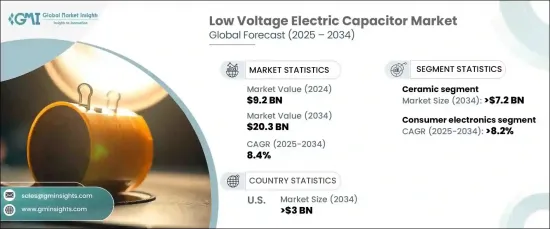

2024 年全球低壓電力電容器市場價值為 92 億美元,將實現強勁成長,預計 2025 年至 2034 年的複合年成長率為 8.4%。隨著全球各行各業採用智慧電網技術和自動化,對減少能量損失和增強功率因數校正的低壓電容器的需求正在激增。這些電容器對於最佳化能源分配、確保效率和支援向更永續能源解決方案的轉變至關重要。

全球對再生能源專案的重視,特別是太陽能和風能領域,進一步加速了市場成長。低壓電容器對於維持電網穩定性至關重要,尤其是在電源波動的系統中。此外,新興經濟體中住宅、商業和工業基礎設施的快速擴張推動了電容器在暖通空調系統、馬達驅動器和先進照明解決方案等領域的應用。對電容器的日益依賴凸顯了它們在現代能源和自動化框架中的作用,因為它們有助於滿足不斷成長的能源需求,同時遵守效率標準。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 92億美元 |

| 預測值 | 203億美元 |

| 複合年成長率 | 8.4% |

陶瓷低壓電容器市場預計將實現顯著成長,預計到 2034 年將創下 72 億美元的市場規模。電子設備小型化趨勢日益成長,增加了對多層陶瓷電容器 (MLCC) 的需求,因為這些元件支援高密度電路。介電材料和精細生產技術的創新繼續塑造陶瓷電容器的未來,以滿足現代電子和高性能設備不斷變化的需求。

就終端應用而言,到 2034 年,消費性電子領域預計將以 8.2% 的複合年成長率成長。隨著電子設備變得越來越複雜,電容器在能量儲存、雜訊濾波和訊號去耦方面發揮著至關重要的作用。領先的製造商正在積極擴大其產品組合,推出先進的電容器解決方案,以滿足消費性電子和其他行業的多樣化需求。

預計到 2034 年,美國低壓電容器市場規模將達到 30 億美元。智慧電網技術的廣泛採用和電動車(EV)充電網路的擴展是主要推動因素。電容器對於功率因數校正和穩定的能量分配仍然是不可或缺的,使其成為製造業、暖通空調系統和消費性電子產品等各個領域不可或缺的一部分。更嚴格的能源效率法規和不斷成長的行業需求進一步促進了市場的擴張,鞏固了其在不斷變化的能源格局中的地位。

目錄

第 1 章:方法論與範圍

- 市場範圍和定義

- 市場估計和預測參數

- 預測計算

- 資料來源

- 基本的

- 次要

- 有薪資的

- 民眾

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 監管格局

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- PESTEL 分析

第4章:競爭格局

- 介紹

- 戰略展望

- 創新與永續發展格局

第 5 章:市場規模及預測:依資料,2021 – 2034 年

- 主要趨勢

- 薄膜電容器

- 陶瓷電容器

- 電解電容器

- 其他

第 6 章:市場規模與預測:依最終用途,2021 – 2034 年

- 主要趨勢

- 消費性電子產品

- 汽車

- 通訊與科技

- 輸配電

- 其他

第 7 章:市場規模及預測:按地區,2021 – 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 奧地利

- 義大利

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

- 拉丁美洲

- 巴西

- 阿根廷

- 智利

第8章:公司簡介

- ABB

- Cornell Dubilier

- Elna

- Havells India

- Kemet

- Kyocera AVX Components

- Murata Manufacturing

- Panasonic

- Samsung Electro-Mechanics

- Schneider Electric

- Siemens

- Taiyo Yuden

- TDK

- Vishay Intertechnology

- Wima

- Xuansn Capacitor

The Global Low Voltage Electric Capacitor Market, valued at USD 9.2 billion in 2024, is set to witness robust growth, projected to expand at a CAGR of 8.4% from 2025 to 2034. This upward trajectory is driven by advancements in industrial automation, the increasing integration of renewable energy sources, and the growing demand for energy-efficient electrical systems. As industries worldwide adopt smart grid technologies and automation, the need for low voltage capacitors to reduce energy losses and enhance power factor correction is surging. These capacitors are critical in optimizing energy distribution, ensuring efficiency, and supporting the shift toward more sustainable energy solutions.

The global emphasis on renewable energy projects, particularly in solar and wind sectors, is further accelerating market growth. Low voltage capacitors are instrumental in maintaining grid stability, especially in systems experiencing power supply fluctuations. Moreover, the rapid expansion of residential, commercial, and industrial infrastructure in emerging economies fuels the adoption of capacitors in applications like HVAC systems, motor drives, and advanced lighting solutions. This increasing reliance on capacitors underscores their role in modern energy and automation frameworks, as they help meet rising energy demands while adhering to efficiency standards.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $9.2 Billion |

| Forecast Value | $20.3 Billion |

| CAGR | 8.4% |

The ceramic low voltage electric capacitor segment is poised for remarkable growth, with forecasts suggesting it will generate USD 7.2 billion by 2034. Renowned for their reliability, compactness, and cost-effectiveness, ceramic capacitors have become a staple in high-frequency and high-temperature applications. The growing trend of miniaturizing electronic devices has amplified the demand for multilayer ceramic capacitors (MLCCs), as these components support high-density circuitry. Innovations in dielectric materials and refined production techniques continue to shape the future of ceramic capacitors, aligning with the evolving needs of modern electronics and high-performance devices.

In terms of end-use applications, the consumer electronics segment is projected to grow at a CAGR of 8.2% through 2034. The increasing use of capacitors in smartphones, portable computing devices, and automotive applications is a significant growth driver. As electronic devices become more complex, capacitors play an essential role in energy storage, noise filtering, and signal decoupling. Leading manufacturers are actively expanding their product portfolios, introducing advanced capacitor solutions to cater to the diverse requirements of consumer electronics and other industries.

The United States low voltage electric capacitor market is anticipated to reach USD 3 billion by 2034. This growth is attributed to rising investments in renewable energy projects, energy-efficient infrastructure, and industrial automation. The widespread adoption of smart grid technologies and the expansion of electric vehicle (EV) charging networks are key contributors. Capacitors remain indispensable for power factor correction and stable energy distribution, making them integral to various sectors, including manufacturing, HVAC systems, and consumer electronics. Stricter energy efficiency regulations and growing industry demand further bolster the market's expansion, solidifying its position in the evolving energy landscape.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Strategic outlook

- 4.3 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Material, 2021 – 2034 ('000 Units, USD Billion)

- 5.1 Key trends

- 5.2 Film capacitors

- 5.3 Ceramic capacitors

- 5.4 Electrolytic capacitors

- 5.5 Others

Chapter 6 Market Size and Forecast, By End Use, 2021 – 2034 ('000 Units, USD Billion)

- 6.1 Key trends

- 6.2 Consumer electronics

- 6.3 Automotive

- 6.4 Communications & technology

- 6.5 Transmission & distribution

- 6.6 Others

Chapter 7 Market Size and Forecast, By Region, 2021 – 2034 ('000 Units, USD Billion)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.2.3 Mexico

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Austria

- 7.3.5 Italy

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 South Korea

- 7.4.5 Australia

- 7.5 Middle East & Africa

- 7.5.1 Saudi Arabia

- 7.5.2 UAE

- 7.5.3 South Africa

- 7.6 Latin America

- 7.6.1 Brazil

- 7.6.2 Argentina

- 7.6.3 Chile

Chapter 8 Company Profiles

- 8.1 ABB

- 8.2 Cornell Dubilier

- 8.3 Elna

- 8.4 Havells India

- 8.5 Kemet

- 8.6 Kyocera AVX Components

- 8.7 Murata Manufacturing

- 8.8 Panasonic

- 8.9 Samsung Electro-Mechanics

- 8.10 Schneider Electric

- 8.11 Siemens

- 8.12 Taiyo Yuden

- 8.13 TDK

- 8.14 Vishay Intertechnology

- 8.15 Wima

- 8.16 Xuansn Capacitor