|

市場調查報告書

商品編碼

1687278

雙電層電容器 (EDLC):市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Electric Double-layer Capacitor (EDLC) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

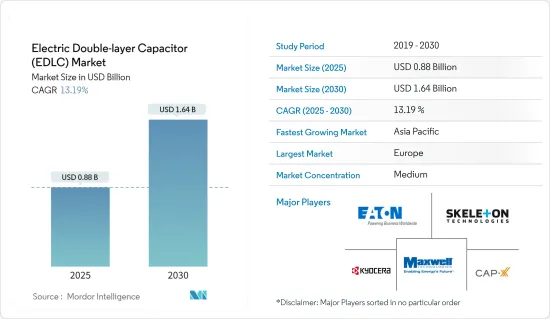

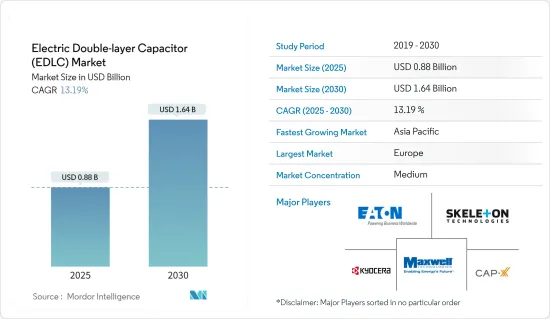

預計 2025 年電雙層電容器市場規模為 8.8 億美元,預計到 2030 年將達到 16.4 億美元,預測期內(2025-2030 年)的複合年成長率為 13.19%。

市場成長的動力來自於各種應用對電雙層電容器 (EDLC) 的需求不斷成長,包括行動裝置中的電池負載平衡、電子設備中的記憶體備份、能量再生和汽車中的能源採集。石墨烯和奈米碳管EDLC 的需求激增以及政府減少二氧化碳排放的法規預計將促進市場成長。

主要亮點

- EDLC 正在取代各種汽車、電網和 IT 應用中的電池,提供安全性、快速充電和小尺寸,同時消除複雜的電池管理系統。改良的EDLC及其衍生將有利於微型電網、火車、路面電車、卡車、大型越野車、用於能源採集物聯網節點的小型不斷電系統、資料中心等。隨著汽車製造商強調減少對石油產業的依賴以及政府機構實施嚴格的環境法規,電動車的成長前景看好。這促使EDLC製造商在快速發展的汽車產業中探索盈利的機會。

- 由於智慧電錶需要大量能量來傳輸無線資料,因此配備了儲能裝置來補充尖峰時段電源。然而,當伺服器、停電、事故或其他緊急情況需要保護資料,或者行車記錄器需要緊急備用電源時,電源儲存設備是必要的。智慧電錶和行車記錄器等經常在戶外使用,因此希望儲能設備的特性在低溫環境下也能維持下去。

- 目前正在進行廣泛研究,以開發基於當前 EDLC 技術的經濟實惠的創新解決方案。這些解決方案為現有模型提供了更經濟、更環保的替代方案,凸顯了降低製造成本和對碳電極作為關鍵零件的依賴的必要性。

- 一個大問題是 EDLC 和普通電池之間的價差。 EDLC 具有附加功能,但價格比電池稍貴。預計這將阻礙市場成長。

- COVID-19 疫情爆發和全球停工影響了製造業活動,尤其是亞太地區,該地區是全球相當一部分 EDLC 和電極材料的生產地。亞洲新冠肺炎病例激增,導致中國、日本和馬來西亞主要陶瓷電容器工廠關閉。不過,業界對後疫情時代的發展抱持著重大進展的希望。他們的主要任務包括推進材料的商業測試、推進與潛在合作夥伴的商業談判以及探索客製化 EDLC 應用的新市場途徑。

雙電層電容器市場趨勢

對可再生能源解決方案的需求不斷成長將推動市場成長

- EDLC 在可再生能源應用中的使用正在逐年增加。因此,對再生能源來源的日益關注對於 EDLC 製造商來說意味著巨大的機會。目前,亞太地區可再生能源及其變體和其他潛在能源的消費量顯著成長,這推動了EDLC市場的成長。 EDLC是一種新型能源儲存設備,其功率密度比電池高,能量密度比普通電容器高。

- 由於其效率極高、充電/放電能力強以及溫度範圍廣等優點,EDLC 的應用範圍越來越廣,包括可再生能源發電、運輸和電力系統。在本研究中,我們提案一種由電池和EDLC(SC)組成的混合儲能系統來實現風力發電廠的配電能力。設計的方案控制電池的充電和放電,同時將更快的風電瞬變轉移到EDLC。這可以延長電池壽命。

- 預計多項政府措施將推動EDLC市場的發展。例如,中國政府最近宣布,計劃在2025年增加30千兆瓦以上的儲存容量,以穩定電網並促進可再生能源的使用。使用電化學、壓縮空氣、飛輪和 EDLC 系統的儲能技術被稱為新能源儲存,與抽水蓄能不同,抽水蓄能利用大壩後面儲存的水在需要時發電。

- 根據國際可再生能源機構(IENA)的數據,到2022年,中國可再生能源裝置容量將達到1,161吉瓦(GW),居世界首位,其次是美國(352GW)、巴西(175GW)和印度(163GW)。預計這些數字還將進一步成長,可再生能源產業預計將繼續推動對 EDLC 的需求。

- 此外,能源儲存是阻礙風能、太陽能等可再生能源廣泛應用的最大障礙之一。美國能源電網系統用於分配能源,在短時間內儲存剩餘能源的彈性有限。傳統的 EDLC 具有高功率,即使經過 100 萬次充電/放電循環後,效能也不會劣化。

- 為了緩解自然資源的快速枯竭,人們擴大轉向使用可再生能源發電,預計這將在未來幾年推動 EDLC 市場的發展。歐洲、亞洲和美國各國對可再生能源發電的需求不斷增加,預計將進一步推動市場成長。

歐洲佔有較大市場佔有率

- 汽車產業對 EDLC 的日益廣泛應用正在推動該地區市場的成長。德國汽車工業透過智慧技術的融合,引領全球汽車工業的創新。混合動力汽車汽車和電動車預計將引領該國汽車產業的成長,主要企業將專注於電動車技術。預計這將對 EDLC 市場的成長產生積極影響。

- 歐盟委員會的石墨烯旗艦舉措旨在十年內讓石墨烯走出實驗室,走進社會。該舉措在能源領域面臨的挑戰包括生產石墨烯(這需要大量高品質的材料)、將其整合到能源設備中同時保持其特性,以及以適合商業化的可擴展方式提高設備性能。由於石墨烯基材料被廣泛用作EDLC中的電極,這些趨勢有利於市場的成長。

- 此外,義大利豪華跑車製造商蘭博基尼等歐洲汽車製造商過去也曾與麻省理工學院等研究機構合作生產蘭博基尼 Terzo Millennio。這款電動車使用嵌入在車身的EDLC作為能源來源。蘭博基尼首款量產混合動力汽車將採用先進的電動技術,這家超級跑車製造商將專注於輕型雙電層電容器 (EDLC) 和在碳纖維車身中儲存電能的能力。預計這些努力的成功將激勵更多汽車製造商採用類似的策略,從而增加所研究市場的機會。

- 由於歐盟部分地區的快速投資和政府措施推動,歐洲可再生能源投資激增,EDLC 市場很可能存在。 2022年12月,為因應俄羅斯對烏克蘭的侵略,並解決歐盟對俄羅斯石化燃料的依賴,歐洲議會同意採取進一步措施,在2030年之前提高歐盟再生能源的佔有率。

- 因此,超級電容在大型風力發電機的俯仰控制應用方面逐漸受到關注,預計在預測期內,該市場將繼續受益於歐洲可再生風力發電的使用日益增加。例如,據 Windflix Europe 稱,歐盟預計將在 2022 年至 2026 年期間安裝 116 吉瓦新風電,以實現其 2030 年氣候和能源目標。利用歐盟五大海洋盆地的巨大潛力,歐盟離岸風力發電裝置容量預計將從 2021 年的 14.6 吉瓦成長至少 25 倍,到 2030 年。

雙電層電容器產業概況

雙電層電容器(EDLC)市場較為分散,預測期內仍將維持此狀態。市場參與者正在採取聯盟、合併、產品創新、投資、夥伴關係和收購等策略來獲得永續的競爭優勢。主要市場參與者包括伊頓公司、麥克斯韋科技、Skeleton Technologies、京瓷公司等。

- 2023 年 4 月—印度科學研究所 (IISc) 的研究人員設計了一種可儲存大量電荷的超小型超級電容。根據研究人員介紹,新開發的電容器體積更小,比現有的超級電容小得多,可廣泛應用於從家用電器到路燈、醫療設備、電動車和醫療設備。

- 2023年1月-Skeleton Technology宣布計劃在德國薩克森州建造全球最大的超級電容工廠。據該公司介紹,全球首家萊比錫超級工廠將擁有一條全自動超級電容器生產線,將使公司產能提高40倍。該公司預計將於 2024 年開始生產。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 競爭對手之間的競爭

- 替代品的威脅

- 宏觀趨勢如何影響市場

第5章 市場動態

- 市場促進因素

- 對可再生能源解決方案的需求不斷增加

- 出於環保考慮,使用 EDLC 的汽車產量增加

- 市場挑戰

- 產品成本上升

第6章 技術簡介

- EDLC 與傳統電介質的比較分析

第7章 市場區隔

- 按最終用戶

- 消費性電子產品

- 能源和公共產業

- 電網應用

- 風及其他

- 產業

- 汽車/運輸

- 巴士和卡車

- 鐵路和路面電車

- 48V輕度混合動力汽車

- 微混合動力汽車及其他車輛

- 大型車輛

- 按地區

- 美國

- 歐洲

- 中國

- 日本

- 韓國等亞洲國家

- 世界其他地區

第8章 競爭格局

- 公司簡介

- Eaton Corporation PLC

- Maxwell Technologies Inc.(Tesla Inc.)

- Skeleton Technologies Inc.

- Cap-XX Limited

- Kyocera Corporation

- Supreme Power Solutions

- LS Mtron Ltd

- Tokin Corporation

- Shanghai Aowei Technology Development Co. Ltd

- Loxus Inc.

- Panasonic Corporation

- Nantong Jianghai Capacitor Co. Ltd

- Beijing HCC Energy Tech. Co. Ltd

- Jinzhou Kaimei Power Co. Ltd(KAM)

- Shanghai Green Tech Co. Ltd(GTCAP)

- Shenzhen Topmay Electronic Co. Ltd

- Liaoning Brother Electronics Technology Co. Ltd

- SEMG(Seattle Electronics Manufacturing Group(HK)Co. Ltd)

- Chengdu Ztech Polymer Material Co. Ltd

- Shanghai Pluspark Electronics Co. Ltd

- Nippon Chemi-Con Corporation

- Yunasko

- Tavrima Canada Inc.

- Seiko Instruments Inc.

- TDK Corporation

- Taiyo Yuden Co. Ltd

- Vishay Intertechnology Inc.

- Cornell Dubilier Electronics Inc.

- Wurth Elektronik Group

- Lelon Electronics Corp.

第9章投資分析

第 10 章:市場的未來

The Electric Double-layer Capacitor Market size is estimated at USD 0.88 billion in 2025, and is expected to reach USD 1.64 billion by 2030, at a CAGR of 13.19% during the forecast period (2025-2030).

The market's growth is attributed to the increased demand for electric double-layer capacitors (EDLCs) across various applications, including battery load leveling in mobile devices, memory backup in electronic devices, energy regeneration, energy harvesting in automobiles, and more. The surging demand for graphene and carbon nanotube EDLCs and government regulations regarding reducing carbon emissions are expected to contribute to the market's growth.

Key Highlights

- EDLCs are substituting batteries in various automotive, grid, and IT applications, offering safety, faster charging, and smaller size while eliminating complicated battery management systems. Improved EDLCs and derivatives are beneficial to mini-grids, trains, trams, trucks, heavy off-road vehicles, small uninterruptible power supplies for IoT nodes using energy harvesting, and data centers. With automotive manufacturers emphasizing reducing dependency on the oil sector and governing bodies imposing stringent environmental regulations, growth prospects for electric vehicles are promising. This has led EDLC manufacturers to explore profitable opportunities in the rapidly evolving automotive industry.

- Smart meters are equipped with a power storage device to supplement their power supply for peak assistance because they need a lot of energy to transmit wireless data. However, to protect data in the case of an emergency, such as a server, power outage, or accident, or when drive recorders need an emergency backup power supply. Smart meters and drive recorders are frequently utilized outdoors, and in other low-temperature situations, power storage devices are expected to maintain their properties at low temperatures.

- Various research is underway to develop affordable and innovative solutions built on current EDLC technology. These solutions will provide a more affordable and eco-friendly alternative to existing models and stress the need to reduce the cost of carbon electrode production and the dependency on critical components.

- A major concern is the price difference between an EDLC and a regular battery. EDLCs are slightly more expensive than batteries, although they perform additional functions. This is expected to hinder the growth of the market.

- The COVID-19 outbreak and lockdown worldwide have impacted manufacturing activities, especially in Asia-Pacific, where a significant portion of the global EDLCs and electrode materials are manufactured. The surge in COVID-19 cases in Asia caused the closure of major producers of ceramic capacitor factories in China, Japan, and Malaysia. However, industries look forward to significant progress in the post-COVID-19 scenario. Some of their main priorities are advancing commercial testing of materials, progressing commercial negotiations with possible partners, and discovering new paths to market for customized EDLC applications.

Electric Double-layer Capacitor Market Trends

Rising Demand for Renewable Energy Solutions Drives the Market's Growth

- The use of EDLCs for renewable energy applications has grown over the years. Hence, increasing the focus on renewable energy sources is a huge opportunity for EDLC manufacturers. Currently, Asia-Pacific is growing significantly in renewable energy consumption, its variants, and other potential materials, which is driving the EDLC market growth. EDLC is a new energy storage device that can provide more power density than batteries and more energy density than ordinary capacitors.

- Due to their advantages, such as very high efficiency, high charge/current discharge capability, and wide temperature range, EDLCs are being employed in an expanding variety of applications, including renewable energy power production, transportation, power systems, and many more. A hybrid energy storage system consisting of a battery and EDLC (SC) is proposed for use in wind farms to achieve power dispatch ability. The designed scheme controls the battery's charging/discharging powers while the faster wind power transients are diverted to the EDLC. This prolongs the battery's life.

- Several government initiatives will likely drive EDLCs in the market. For instance, the Chinese authorities have recently announced a plan to add more than 30 gigawatts of energy storage capacity by 2025 to enhance renewable energy usage while stabilizing the electric grid. Electricity storage techniques that use electrochemical, compressed air, flywheel, and EDLC systems are referred to as new energy storage, as opposed to pumped hydro, which uses water held behind dams to create electricity as needed.

- According to International Renewable Energy Agency (IENA), in 2022, China was the leading country in terms of installed renewable energy capacity (1,161 gigawatts(GW), followed by the United States (352 GW), Brazil (175 GW), and India (163 GW). With these numbers anticipated to grow further, the renewable energy sector is anticipated to continue to drive the demand for EDLCs.

- Furthermore, energy storage is one of the biggest obstacles preventing the widespread use of renewable energy sources, like wind and solar power. The US energy grid system is used for distributing energy and allows for limited flexibility for the storage of excess on short notice. Conventional EDLCs have a high-power output with minimal performance degradation for as many as 1,000,000 charge-discharge cycles.

- There are upgrades to power generation from renewable resources to reduce the rapid depletion of natural resources, which is expected to drive the market for EDLCs in the coming years. There is an increasing demand for renewable energy generation, observed in countries across Europe, Asia, and the United States, which would further fuel the growth of the market studied.

Europe to Hold Significant Market Share

- The growing adoption of EDLCs in the automotive industries has positively boosted the market's growth in the region, as Europe is among the fastest-growing EV markets. The German automotive industry has been leading technological innovations in the global automotive industry with the integration of smart technologies. Hybrid and electric vehicles are expected to lead the growth of the automotive industry in the country, with the companies focusing on electric vehicle technologies. This is anticipated to impact the growth of the EDLCs market positively.

- The European Commission's Graphene Flagship initiative aims to take graphene from the lab to society within a decade. The initiative's issues in the energy field include the production of graphene to address the requirement of high-quality materials in large quantities, its integration into energy devices while preserving its properties, and device performance improvements using scalable methods suitable for commercialization. As graphene-based materials are widely used as electrodes of EDLCs, such trends favor the studied market's growth.

- Furthermore, European automotive players, such as Lamborghini, the Italian manufacturer of luxury sports cars, have worked in the past with research institutes such as Massachusetts Institute of Technology to build the Lamborghini Terzo Millennio. This electric vehicle uses EDLCs embedded into the car's chassis as a source of energy. Lamborghini's first series-production hybrid cars included advanced electric technology, with the supercar manufacturer focused on lightweight EDLCs and the capacity to store electrical energy in carbon fiber bodywork. The success of such efforts are anticipated to drive more auto manufacturers adopt similar strategy which in turn will drive opportunities in the studied market.

- Due to the rapid investments and government initiatives in several EU regions, there is likely to be a market for EDLC as a result of the surge in renewable energy investments across Europe. The EU Parliament agreed on additional measures in December 2022 to increase the percentage of renewables in the EU considerably ahead of 2030 in response to Russia's aggressiveness in Ukraine and to address the EU's reliance on Russian fossil fuels.

- As a result, the market is expected to continue to profit from the growing use of renewable wind energy in Europe over the forecast period as supercapacitors gain prominence in big wind turbine pitch control applications. For instance, in order to achieve its 2030 climate and energy goals, the EU is predicted to deploy 116 GW of new wind farms between 2022 and 2026, according to Windflix Europe. Using the enormous potential of the five EU sea basins, the installed offshore wind capacity in the EU, which was 14.6 GW in 2021, is expected to expand by at least 25 times by 2030.

Electric Double-layer Capacitor Industry Overview

The electric double-layer capacitor (EDLC) market is fragmented and remains the same over the forecast period. Players in the market are adopting strategies such as partnerships, mergers, product innovations, investments, partnerships, and acquisitions to gain sustainable competitive advantage. Some key market players include Eaton Corporation PLC, Maxwell Technologies, Skeleton Technologies, Kyocera Corporation, etc.

- April 2023 - Researchers at the Indian Institute of Science (IISc) designed an ultra-micro supercapacitor capable of storing an enormous amount of electric charge. According to the researchers, the newly developed capacitor is more compact and much smaller than existing supercapacitors, with potential applications in many devices ranging from consumer electronics to streetlights, medical devices, and electric cars and medical devices.

- January 2023 - Skeleton Technology announced its plans to build the world's largest supercapacitor factory in Saxony, Germany. According to the company, this first-of-its-kind Leipzig Superfactory will include a fully automated supercapacitor production line that will increase the company's production capacity 40-fold. The company expects the start of the production by 2024.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitutes

- 4.3 Impact of Macro Trends on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Demand for Renewable Energy Solutions

- 5.1.2 Increasing Production of EDLC-based Vehicles Owing to Environmental Concerns

- 5.2 Market Challenges

- 5.2.1 Higher Costs of Products

6 TECHNOLOGY SNAPSHOT

- 6.1 Comparative Analysis of EDLCs and Conventional Dielectric

7 MARKET SEGMENTATION

- 7.1 By End User

- 7.1.1 Consumer Electronics

- 7.1.2 Energy and Utilities

- 7.1.2.1 Grid Applications

- 7.1.2.2 Wind and Others

- 7.1.3 Industrial

- 7.1.4 Automotive/Transportation

- 7.1.4.1 Bus and Truck

- 7.1.4.2 Rail and Tram

- 7.1.4.3 48V Mild Hybrid Car

- 7.1.4.4 Micro Hybrids and Other Cars

- 7.1.4.5 Heavy Vehicles

- 7.2 By Geography

- 7.2.1 United States

- 7.2.2 Europe

- 7.2.3 China

- 7.2.4 Japan

- 7.2.5 Korea and Rest of Asia

- 7.2.6 Rest of the World

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Eaton Corporation PLC

- 8.1.2 Maxwell Technologies Inc. (Tesla Inc.)

- 8.1.3 Skeleton Technologies Inc.

- 8.1.4 Cap-XX Limited

- 8.1.5 Kyocera Corporation

- 8.1.6 Supreme Power Solutions

- 8.1.7 LS Mtron Ltd

- 8.1.8 Tokin Corporation

- 8.1.9 Shanghai Aowei Technology Development Co. Ltd

- 8.1.10 Loxus Inc.

- 8.1.11 Panasonic Corporation

- 8.1.12 Nantong Jianghai Capacitor Co. Ltd

- 8.1.13 Beijing HCC Energy Tech. Co. Ltd

- 8.1.14 Jinzhou Kaimei Power Co. Ltd (KAM)

- 8.1.15 Shanghai Green Tech Co. Ltd (GTCAP)

- 8.1.16 Shenzhen Topmay Electronic Co. Ltd

- 8.1.17 Liaoning Brother Electronics Technology Co. Ltd

- 8.1.18 SEMG (Seattle Electronics Manufacturing Group (HK) Co. Ltd)

- 8.1.19 Chengdu Ztech Polymer Material Co. Ltd

- 8.1.20 Shanghai Pluspark Electronics Co. Ltd

- 8.1.21 Nippon Chemi-Con Corporation

- 8.1.22 Yunasko

- 8.1.23 Tavrima Canada Inc.

- 8.1.24 Seiko Instruments Inc.

- 8.1.25 TDK Corporation

- 8.1.26 Taiyo Yuden Co. Ltd

- 8.1.27 Vishay Intertechnology Inc.

- 8.1.28 Cornell Dubilier Electronics Inc.

- 8.1.29 Wurth Elektronik Group

- 8.1.30 Lelon Electronics Corp.