|

市場調查報告書

商品編碼

1685120

非極化電容器市場機會、成長動力、產業趨勢分析與預測 2025 - 2034Non-Polarized Electric Capacitor Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

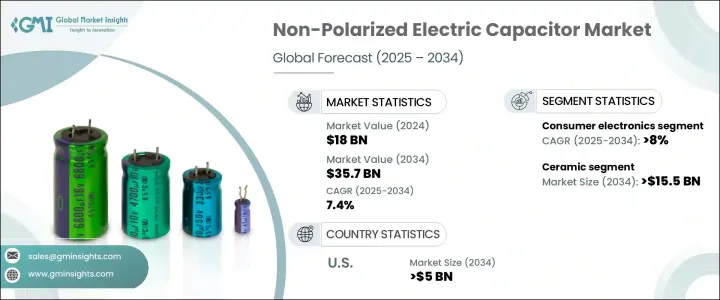

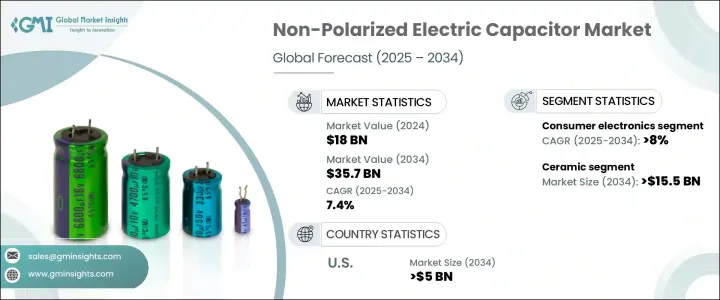

2024 年全球非極化電力電容器市場價值為 180 億美元,預計 2025 年至 2034 年期間的複合年成長率為 7.4%。隨著電容器技術的進步不斷改變儲能解決方案,這些組件在廣泛的電子和電氣應用中仍然不可或缺。高容量電容器的需求不斷增加,特別是在發展中地區,凸顯了它們在現代技術中的重要性。智慧型設備、電動車和再生能源系統的普及加劇了對高效能、可靠和耐用電容器的需求。

電容器是許多應用中不可或缺的一部分,從電源穩定到雜訊過濾和訊號去耦。微處理器和小型化電路的技術突破正在加速採用能夠承受高頻和高溫環境的電容器。隨著產業注重永續性和能源效率,製造商正在投資性能更好、壽命更長、可靠性更高的下一代電容器。消費性電子產品、自動化系統和高速資料傳輸網路的需求激增進一步推動了市場擴張,使得非極化電容器成為商業和工業領域的重要組成部分。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 180億美元 |

| 預測值 | 357億美元 |

| 複合年成長率 | 7.4% |

陶瓷非極化電容器市場預計將在 2034 年創造 155 億美元的市場規模,這得益於其卓越的穩定性、低電感和成本效益。這些電容器提供廣泛的電容範圍,通常在 1nF 和 30µF 之間,非常適合高頻和高溫應用。由於其使用壽命長、可靠性高,在汽車、電信和工業應用中廣泛使用。隨著業界對更高效、更緊湊的電子元件的需求,陶瓷電容器繼續成為工程師和製造商的首選,確保市場穩步擴大。

就終端使用產業而言,到 2034 年,消費性電子產業預計將以 8% 的複合年成長率成長,這反映了智慧型手機、可攜式運算設備和汽車電子產品對電容器的需求不斷成長。 5G網路、人工智慧和先進駕駛輔助系統(ADAS)的興起提升了電容器在高速資料處理和能源管理中的作用。隨著製造商優先考慮創新以提高電容器的效率、耐用性和減小尺寸,消費性電子領域仍然是市場成長的主要驅動力。對於具有更高熱穩定性和更大電容的緊湊、輕型電容器的需求正在塑造這個快節奏產業中電子元件的未來。

受消費性電子、汽車和再生能源領域的強勁需求推動,美國非極化電容器市場預計到 2034 年將創收 50 億美元。向電動車和智慧型設備的轉變加劇了在極端條件下高效運行的電容器的需求。產業領導者正在大力投資產品小型化、更高電容和增強熱阻,以滿足下一代應用不斷變化的需求。隨著技術的進步,專為提高效率和耐用性而設計的電容器將在推動未來的電子和儲能解決方案方面發揮關鍵作用,確保未來十年的市場持續成長。

目錄

第 1 章:方法論與範圍

- 市場範圍和定義

- 市場估計和預測參數

- 預測計算

- 資料來源

- 基本的

- 次要

- 有薪資的

- 民眾

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 監管格局

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 戰略展望

- 創新與永續發展格局

第 5 章:市場規模及預測:依資料,2021 – 2034 年

- 主要趨勢

- 薄膜電容器

- 陶瓷電容器

- 電解電容器

- 其他

第 6 章:市場規模與預測:依最終用途,2021 – 2034 年

- 主要趨勢

- 消費性電子產品

- 汽車

- 通訊與科技

- 輸配電

- 其他

第 7 章:市場規模及預測:按地區,2021 – 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 奧地利

- 義大利

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

- 拉丁美洲

- 巴西

- 阿根廷

- 智利

第8章:公司簡介

- ABB

- Cornell Dubilier

- Elna

- Havells India

- Kemet

- Kyocera AVX Components

- Murata Manufacturing

- Panasonic

- Samsung Electro-Mechanics

- Schneider Electric

- Siemens

- Taiyo Yuden

- TDK

- Vishay Intertechnology

- Wima

- Xuansn Capacitor

The Global Non-Polarized Electric Capacitor Market, valued at USD 18 billion in 2024, is set to experience a CAGR of 7.4% between 2025 and 2034. As advances in capacitor technology continue to transform energy storage solutions, these components remain indispensable across a wide array of electronic and electrical applications. The increasing demand for high-capacitance capacitors, particularly in developing regions, underscores their importance in modern technology. The proliferation of smart devices, electric vehicles, and renewable energy systems has intensified the need for efficient, reliable, and durable capacitors.

Capacitors are integral to numerous applications, from power supply stabilization to noise filtering and signal decoupling. Technological breakthroughs in microprocessors and miniaturized circuits are accelerating the adoption of capacitors that can withstand high-frequency and high-temperature environments. As industries focus on sustainability and energy efficiency, manufacturers are investing in next-generation capacitors with improved performance, longer lifespans, and enhanced reliability. The surge in demand for consumer electronics, automation systems, and high-speed data transmission networks further fuels market expansion, making non-polarized electric capacitors an essential component in both commercial and industrial sectors.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $18 Billion |

| Forecast Value | $35.7 Billion |

| CAGR | 7.4% |

The ceramic non-polarized electric capacitor segment is poised to generate USD 15.5 billion by 2034, driven by its superior stability, low inductance, and cost-effectiveness. These capacitors offer a broad capacitance range, typically between 1nF and 30µF, making them ideal for high-frequency and high-temperature applications. Their long lifespan and exceptional reliability have led to widespread adoption in automotive, telecommunications, and industrial applications. As industries demand more efficient and compact electronic components, ceramic capacitors continue to be a preferred choice for engineers and manufacturers, ensuring steady market expansion.

In terms of end-use industries, the consumer electronics sector is expected to grow at a CAGR of 8% through 2034, reflecting the ever-increasing need for capacitors in smartphones, portable computing devices, and automotive electronics. The rise of 5G networks, artificial intelligence, and advanced driver assistance systems (ADAS) has elevated the role of capacitors in high-speed data processing and energy management. With manufacturers prioritizing innovations to enhance capacitor efficiency, durability, and size reduction, the consumer electronics segment remains a major driver of market growth. The demand for compact, lightweight capacitors with improved thermal stability and higher capacitance is shaping the future of electronic components in this fast-paced industry.

The U.S. non-polarized electric capacitor market is projected to generate USD 5 billion by 2034, fueled by strong demand across consumer electronics, automotive, and renewable energy sectors. The transition toward electric vehicles and smart devices has heightened the need for capacitors that operate efficiently under extreme conditions. Industry leaders are investing heavily in product miniaturization, higher capacitance, and enhanced thermal resistance to meet the evolving demands of next-generation applications. As technology advances, capacitors designed for improved efficiency and durability will play a crucial role in powering the future of electronic and energy storage solutions, ensuring sustained market growth over the coming decade.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Strategic outlook

- 4.3 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Material, 2021 – 2034 ('000 Units, USD Billion)

- 5.1 Key trends

- 5.2 Film capacitors

- 5.3 Ceramic capacitors

- 5.4 Electrolytic capacitors

- 5.5 Others

Chapter 6 Market Size and Forecast, By End Use, 2021 – 2034 ('000 Units, USD Billion)

- 6.1 Key trends

- 6.2 Consumer electronics

- 6.3 Automotive

- 6.4 Communications & technology

- 6.5 Transmission & distribution

- 6.6 Others

Chapter 7 Market Size and Forecast, By Region, 2021 – 2034 ('000 Units, USD Billion)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.2.3 Mexico

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Austria

- 7.3.5 Italy

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 South Korea

- 7.4.5 Australia

- 7.5 Middle East & Africa

- 7.5.1 Saudi Arabia

- 7.5.2 UAE

- 7.5.3 South Africa

- 7.6 Latin America

- 7.6.1 Brazil

- 7.6.2 Argentina

- 7.6.3 Chile

Chapter 8 Company Profiles

- 8.1 ABB

- 8.2 Cornell Dubilier

- 8.3 Elna

- 8.4 Havells India

- 8.5 Kemet

- 8.6 Kyocera AVX Components

- 8.7 Murata Manufacturing

- 8.8 Panasonic

- 8.9 Samsung Electro-Mechanics

- 8.10 Schneider Electric

- 8.11 Siemens

- 8.12 Taiyo Yuden

- 8.13 TDK

- 8.14 Vishay Intertechnology

- 8.15 Wima

- 8.16 Xuansn Capacitor