|

市場調查報告書

商品編碼

1684591

繪圖儀印表機市場機會、成長動力、產業趨勢分析和 2025 - 2034 年預測Plotter Printer Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

2024 年全球繪圖儀印表機市場規模達到 116 億美元,預計 2025 年至 2034 年期間將以 5.5% 的強勁複合年成長率成長。這些領域的行業嚴重依賴廣告看板、海報和小冊子等材料的高品質、大幅面列印,因此精確、高解析度的繪圖儀至關重要。此外,印刷技術的進步使企業能夠更快、更有效率地生產印刷品,進一步推動市場擴張。

除廣告和出版外,工程、建築和建築行業也因快速城市化和基礎設施發展而見證了顯著成長。這些行業越來越需要複雜的繪圖儀印表機來製作詳細的建築設計、施工計劃和工程圖。隨著城市專案變得越來越複雜,對具有精度和可靠性的高性能繪圖儀印表機的需求不斷增加,進一步支持了市場的全球擴張。此外,各行業的企業都在轉向數位印刷解決方案,這可以提高生產力並降低營運成本,使繪圖儀印表機成為現代化營運不可或缺的工具。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 116億美元 |

| 預測值 | 197億美元 |

| 複合年成長率 | 5.5% |

市場按印表機類型細分,包括雷射繪圖儀、噴墨繪圖儀、靜電繪圖儀、熱感式繪圖儀、筆式繪圖儀和其他繪圖儀,包括 LED 繪圖儀。其中,噴墨繪圖儀預計將成長最快,預計 2024 年市場價值將達到 41 億美元,成長率為 6%。它們之所以受歡迎,是因為它們能夠處理大幅面列印,技術進步提高了速度、色彩準確度和成本效率。這些繪圖儀特別適合大型項目,例如摩天大樓設計和工程藍圖,因為精度和高速輸出至關重要。

繪圖儀印表機的通路分為直接和間接部分。間接通路預計將佔據市場主導地位,到 2024 年預計將佔據總市場佔有率的 58.5%。他們還提供保固、技術支援和客戶協助等增值服務,從而成為買家的有吸引力的選擇。間接通路提供的可及性和便利性對其市場佔有率的成長貢獻巨大。

在北美,繪圖儀印表機市場的價值在 2024 年將達到 28 億美元。噴墨和 3D 列印等先進數位印刷技術的採用進一步推動了對高性能繪圖儀印表機的需求。該地區的企業擴大將這些尖端解決方案應用於各種應用,確保未來幾年市場穩定成長。

目錄

第 1 章:方法論與範圍

- 市場範圍和定義

- 基礎估算與計算

- 預測參數

- 資料來源

- 基本的

- 次要

- 付費來源

- 公共資源

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 影響價值鏈的因素

- 利潤率分析

- 中斷

- 未來展望

- 製造商

- 經銷商

- 零售商

- 衝擊力

- 成長動力

- 印刷和出版需求增加

- 擴大在建築和工程領域的應用

- 3D 列印的普及度不斷提高

- 產業陷阱與挑戰

- 初期投資成本高

- 維護和營運成本

- 成長動力

- 技術與創新格局

- 消費者購買行為分析

- 人口趨勢

- 影響購買決策的因素

- 消費者產品採用

- 首選配銷通路

- 成長潛力分析

- 監管格局

- 定價分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第 5 章:市場估計與預測:按印表機類型,2021 年至 2034 年

- 主要趨勢

- 噴墨繪圖儀

- 雷射繪圖儀

- 靜電繪圖儀

- 熱敏繪圖儀

- 筆式繪圖儀

- 其他(繪圖儀、LED 繪圖儀)

第 6 章:市場估計與預測:按類型,2021 年至 2034 年

- 主要趨勢

- 大幅面繪圖儀

- 小幅面繪圖儀

第 7 章:市場估計與預測:依印刷資料,2021 年至 2034 年

- 主要趨勢

- 紙

- 乙烯基塑膠

- 織物

- 塑膠

- 金屬

- 玻璃

- 其他(薄膜、畫布等)

第 8 章:市場估計與預測:按連結性,2021 年至 2034 年

- 主要趨勢

- 有線

- 無線的

第 9 章:市場估計與預測:按最終用途產業,2021 年至 2034 年

- 主要趨勢

- 建築、工程和施工 (AEC)

- 製造業

- 媒體與娛樂

- 政府和公共部門

- 衛生保健

- 教育

- 其他(紡織服裝等)

第 10 章:市場估計與預測:按配銷通路,2021 年至 2034 年

- 主要趨勢

- 直接的

- 間接

第 11 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 馬來西亞

- 印尼

- 拉丁美洲

- 巴西

- 墨西哥

- 中東及非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

第 12 章:公司簡介

- Canon

- Epson

- Roland DG

- Mimaki

- Ricoh

- Xerox

- Kyocera

- Seiko Instruments

- Mutoh

- Oki Data

- Summa

- Graphtec

- AGFA

- Colortrac

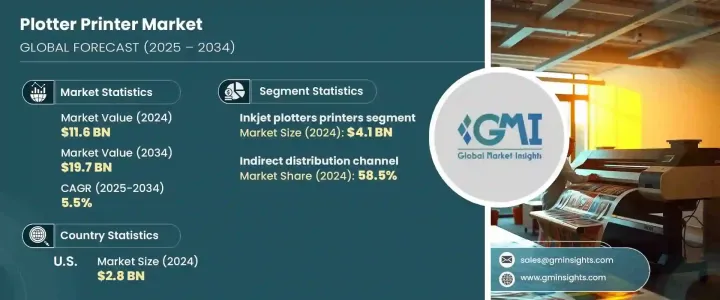

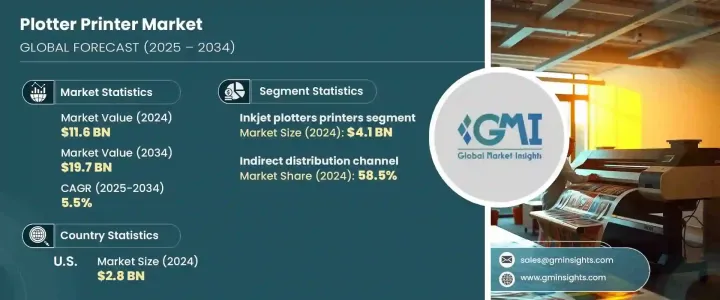

The Global Plotter Printer Market reached USD 11.6 billion in 2024 and is forecasted to grow at a robust CAGR of 5.5% from 2025 to 2034. The surge in demand for advanced printing equipment across various sectors, such as advertising, graphics, and publishing, is a key factor driving this growth. Industries in these fields rely heavily on high-quality, large-scale prints for materials like billboards, posters, and brochures, making precise and high-resolution plotters essential. Additionally, advancements in printing technology are enabling businesses to produce prints faster and with greater efficiency, further fueling market expansion.

Beyond advertising and publishing, the engineering, construction, and architectural sectors are also witnessing significant growth fueled by rapid urbanization and infrastructure development. These industries increasingly require sophisticated plotter printers to produce detailed architectural designs, construction plans, and engineering diagrams. With urban projects becoming more complex, the need for high-performance plotter printers that deliver precision and reliability continues to rise, further supporting the market's global expansion. Moreover, businesses across various sectors are transitioning to digital printing solutions, which enhance productivity and reduce operational costs, making plotter printers indispensable tools for modern operations.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $11.6 Billion |

| Forecast Value | $19.7 Billion |

| CAGR | 5.5% |

The market is segmented by printer type, encompassing laser plotters, inkjet plotters, electrostatic plotters, thermal plotters, pen plotters, and others, including LED plotters. Among these, inkjet plotters are anticipated to exhibit the highest growth, reaching a projected market value of USD 4.1 billion in 2024 with a growth rate of 6%. Their popularity stems from their ability to handle large prints and advancements in technology that enhance speed, color accuracy, and cost-efficiency. These plotters are particularly favored for large-scale projects, such as skyscraper designs and engineering blueprints, where precision and high-speed output are critical.

The distribution channels for plotter printers are divided into direct and indirect segments. Indirect channels are expected to dominate the market, accounting for an estimated 58.5% of the total market share by 2024. These channels, which include retail outlets and e-commerce platforms, play a crucial role in expanding customer reach. They also offer value-added services such as warranties, technical support, and customer assistance, making them an attractive choice for buyers. The accessibility and convenience provided by indirect channels are significantly contributing to their growing market share.

In North America, the plotter printer market was valued at USD 2.8 billion in 2024. The region's demand is driven by a growing reliance on reliable printing solutions for technical drawings, blueprints, and marketing materials. The adoption of advanced digital printing technologies, including inkjet and 3D printing, is further boosting the demand for high-performance plotter printers. Businesses in the region are increasingly turning to these cutting-edge solutions for a variety of applications, ensuring steady growth for the market in the coming years.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast parameters

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factors affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.1.7 Retailers

- 3.2 Impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increased demand in printing and publishing

- 3.2.1.2 Expanding use in architecture and engineering

- 3.2.1.3 Rising adoption of 3D printing

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High initial investment costs

- 3.2.2.2 Maintenance and operating costs

- 3.2.1 Growth drivers

- 3.3 Technology & innovation landscape

- 3.4 Consumer buying behavior analysis

- 3.4.1 Demographic trends

- 3.4.2 Factors affecting buying decision

- 3.4.3 Consumer product adoption

- 3.4.4 Preferred distribution channel

- 3.5 Growth potential analysis

- 3.6 Regulatory landscape

- 3.7 Pricing analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Printer type, 2021 – 2034, (USD Billion)

- 5.1 Key trends

- 5.2 Inkjet plotters

- 5.3 Laser plotters

- 5.4 Electrostatic plotters

- 5.5 Thermal plotters

- 5.6 Pen plotters

- 5.7 Others (Plotters, LED Plotters)

Chapter 6 Market Estimates & Forecast, By Type, 2021 – 2034, (USD Billion)

- 6.1 Key trends

- 6.2 Large format plotters

- 6.3 Small format plotters

Chapter 7 Market Estimates & Forecast, By Printing Material, 2021 – 2034, (USD Billion)

- 7.1 Key trends

- 7.2 Paper

- 7.3 Vinyl

- 7.4 Fabric

- 7.5 Plastic

- 7.6 Metal

- 7.7 Glass

- 7.8 Others (Film, Canvas, etc.)

Chapter 8 Market Estimates & Forecast, By Connectivity, 2021 – 2034, (USD Billion)

- 8.1 Key trends

- 8.2 Wired

- 8.3 Wireless

Chapter 9 Market Estimates & Forecast, By End Use Industry, 2021 – 2034, (USD Billion)

- 9.1 Key trends

- 9.2 Architecture, engineering & construction (AEC)

- 9.3 Manufacturing

- 9.4 Media & entertainment

- 9.5 Government and public sector

- 9.6 Healthcare

- 9.7 Education

- 9.8 Others (textile and apparel, etc.)

Chapter 10 Market Estimates & Forecast, By Distribution Channel, 2021 – 2034, (USD Billion)

- 10.1 Key trends

- 10.2 Direct

- 10.3 Indirect

Chapter 11 Market Estimates & Forecast, By Region, 2021 – 2034, (USD Billion)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 South Korea

- 11.4.5 Australia

- 11.4.6 Malaysia

- 11.4.7 Indonesia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.6 MEA

- 11.6.1 Saudi Arabia

- 11.6.2 UAE

- 11.6.3 South Africa

Chapter 12 Company Profiles (Business Overview, Financial Data, Product Landscape, Strategic Outlook, SWOT Analysis)

- 12.1 Canon

- 12.2 Epson

- 12.3 Roland DG

- 12.4 Mimaki

- 12.5 Ricoh

- 12.6 Xerox

- 12.7 Kyocera

- 12.8 Seiko Instruments

- 12.9 Mutoh

- 12.10 Oki Data

- 12.11 Summa

- 12.12 Graphtec

- 12.13 AGFA

- 12.14 Colortrac