|

市場調查報告書

商品編碼

1699420

印表機市場機會、成長動力、產業趨勢分析及 2025-2034 年預測Printer Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

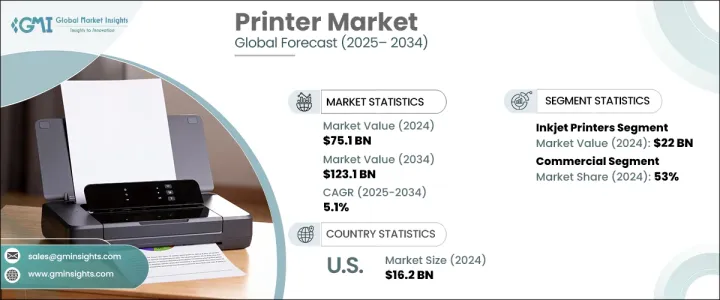

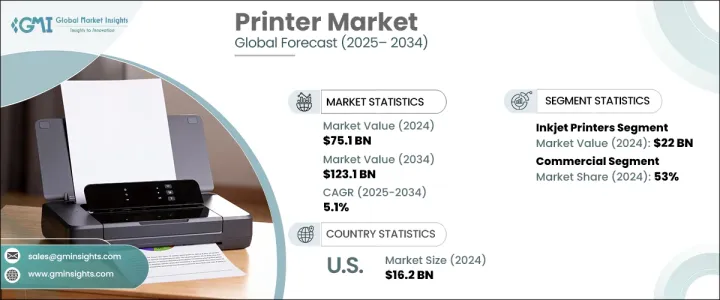

2024 年全球印表機市場價值為 751 億美元,預計 2025 年至 2034 年期間的複合年成長率為 5.1%。這一成長主要得益於數位印刷技術的日益普及,數位印刷技術正迅速取代傳統方法。隨著企業和消費者對更個人化和高品質的印刷解決方案的需求,數位印表機已被證明是各行業必不可少的工具。向效率和永續性的持續轉變進一步加速了商業和工業領域對先進印刷解決方案的需求。

數位印刷格局的不斷發展正在改變整個產業,其中噴墨和 3D 列印技術處於領先地位。高速噴墨印表機對於大量生產來說已變得不可或缺,它能提供卓越的列印品質、更快的周轉時間和更大的靈活性。這些進步迎合了尋求經濟高效、環保和客製化印刷選項的企業的需求。此外,按需印刷的興起趨勢正在透過減少浪費和提高供應鏈效率來重塑市場。工業應用、包裝和紡織品印刷的需求也在激增,各大品牌優先考慮採用數位解決方案來實現鮮豔耐用的印刷效果。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 751億美元 |

| 預測值 | 1231億美元 |

| 複合年成長率 | 5.1% |

印表機市場按類型細分,包括噴墨印表機、雷射印表機、點陣印表機、3D印表機等。預計 2024 年 3D 列印領域將在預測期內實現 5.9% 的強勁成長率。 3D 列印在醫療保健、航太和製造業中的應用日益廣泛,這正在徹底改變生產流程,實現快速成型並減少材料浪費。隨著印刷技術的不斷創新,企業正在利用自動化解決方案來提高生產力和精確度。

根據最終用途,市場分為工業、住宅和商業部分。 2024 年,商業領域將佔據市場主導地位,佔有 53% 的佔有率,這得益於醫療保健、教育和酒店等行業廣泛部署先進的列印解決方案。企業擴大採用網路印刷服務,這種服務可以提供無縫客製化、更短的印刷週期和更高的效率。商業領域也正在轉向永續的印刷方法,利用環保油墨和節能印表機來滿足監管和環境標準。

2024 年,北美佔據印表機市場的 72% 佔有率,估值達 162 億美元。由於技術的快速進步以及商業和工業應用對混合印表機的日益青睞,美國市場持續擴大。企業正在用現代數位解決方案取代傳統的膠印機,以提供更快的輸出速度、更低的營運成本和更少的環境影響。這種轉變正在重塑商業印刷產業,使公司能夠以更高的效率和創新來滿足不斷變化的消費者偏好。

目錄

第1章:方法論與範圍

- 市場範圍和定義

- 基礎估算與計算

- 預測計算

- 資料來源

- 基本的

- 次要

- 付費來源

- 公共資源

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 影響價值鏈的因素

- 利潤率分析

- 中斷

- 未來展望

- 製造商

- 經銷商

- 供應商格局

- 技術格局

- 重要新聞和舉措

- 監管格局

- 衝擊力

- 成長動力

- 家庭和辦公室列印需求增加

- 商業和工業印刷行業的成長

- 產業陷阱與挑戰

- 採用無紙化技術

- 不受控制的印刷成本

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:依類型,2021-2034

- 主要趨勢

- 噴墨印表機

- 雷射印表機

- 點陣印表機

- 3D印表機

- 膠印機

- 柔版印刷

- 其他(Grauvre等)

第6章:市場估計與預測:依功能,2021-2034

- 主要趨勢

- 單功能印表機

- 多功能印表機

第7章:市場估計與預測:依連結性,2021-2034

- 主要趨勢

- 繩索

- 無線

第8章:市場估計與預測:按價格,2021-2034 年

- 主要趨勢

- 低的

- 中等的

- 高的

第9章:市場估計與預測:依最終用途,2021-2034

- 主要趨勢

- 工業的

- 住宅

- 商業的

- 公司辦公室

- 衛生保健

- 教育

- 飯店業

- 其他(活動策劃者等)

第 10 章:市場估計與預測:按配銷通路,2021-2034 年

- 主要趨勢

- 線上

- 電子商務

- 公司網站

- 離線

- 電子產品商店

- 品牌店

- 其他(百貨公司等)

第 11 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

第12章:公司簡介

- Brother

- Canon

- Dell

- Epson

- Fujifilm

- HP

- Konica Minolta

- Kyocera

- Lexmark

- Oki

- Ricoh

- Roland

- Sharp

- Toshiba

- Xerox

The Global Printer Market was valued at USD 75.1 billion in 2024 and is projected to grow at a CAGR of 5.1% between 2025 and 2034. This growth is largely driven by the increasing adoption of digital printing technologies, which are rapidly replacing traditional methods. As businesses and consumers demand more personalized and high-quality printing solutions, digital printers are proving to be essential tools across various industries. The ongoing shift toward efficiency and sustainability is further accelerating the demand for advanced printing solutions in commercial and industrial sectors.

The evolving landscape of digital printing is transforming the industry, with inkjet and 3D printing technologies leading the way. High-speed inkjet printers are becoming indispensable for high-volume production, offering superior print quality, faster turnaround times, and greater flexibility. These advancements cater to businesses seeking cost-effective, eco-friendly, and customized printing options. Additionally, the rising trend of on-demand printing is reshaping the market by minimizing waste and enhancing supply chain efficiency. Industrial applications, packaging, and textile printing are also experiencing a surge in demand, with brands prioritizing digital solutions for vibrant and durable prints.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $75.1 Billion |

| Forecast Value | $123.1 Billion |

| CAGR | 5.1% |

The printer market is segmented by type, including inkjet, laser, dot matrix, 3D printers, and others. In 2024, the 3D printing segment is anticipated to witness a robust growth rate of 5.9% during the forecast period. The increasing adoption of 3D printing in healthcare, aerospace, and manufacturing is revolutionizing production processes, enabling rapid prototyping and reducing material wastage. With continuous innovations in printing technologies, businesses are leveraging automated solutions to enhance productivity and precision.

By end-use, the market is categorized into industrial, residential, and commercial segments. In 2024, the commercial segment dominated the market with a 53% share, driven by the widespread deployment of advanced printing solutions in industries such as healthcare, education, and hospitality. Businesses are increasingly adopting web-to-print services, which provide seamless customization, shorter print runs, and improved efficiency. The commercial sector is also shifting toward sustainable printing methods, utilizing eco-friendly inks and energy-efficient printers to meet regulatory and environmental standards.

North America held a commanding 72% share of the printer market in 2024, with a valuation of USD 16.2 billion. The U.S. market continues to expand due to rapid technological advancements and the growing preference for hybrid printers across commercial and industrial applications. Businesses are replacing traditional offset printing presses with modern digital solutions that offer faster output, lower operational costs, and reduced environmental impact. This transition is reshaping the commercial printing industry, enabling companies to meet evolving consumer preferences with greater efficiency and innovation.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Technological landscape

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Increased demand for home and office printing

- 3.6.1.2 Growth in the commercial and industrial printing sector

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Adoption of paperless technology

- 3.6.2.2 Uncontrolled printing costs

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Type, 2021-2034 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Inkjet printers

- 5.3 Laser printers

- 5.4 Dot matrix printers

- 5.5 3D printers

- 5.6 Offset printers

- 5.7 Flexographic

- 5.8 Others (Grauvre, etc.)

Chapter 6 Market Estimates & Forecast, By Functionality, 2021-2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Single function printers

- 6.3 Multifunction printers

Chapter 7 Market Estimates & Forecast, By Connectivity, 2021-2034 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Cord

- 7.3 Cordless

Chapter 8 Market Estimates & Forecast, By Price, 2021-2034 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Low

- 8.3 Medium

- 8.4 High

Chapter 9 Market Estimates & Forecast, By End Use, 2021-2034 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Industrial

- 9.3 Residential

- 9.4 Commercial

- 9.4.1 Corporate offices

- 9.4.2 Healthcare

- 9.4.3 Educational

- 9.4.4 Hospitality

- 9.4.5 others (events planners etc.)

Chapter 10 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 Online

- 10.2.1 E-commerce

- 10.2.2 Company websites

- 10.3 Offline

- 10.3.1 Electronics stores

- 10.3.2 Brand stores

- 10.3.3 Others (department stores etc.)

Chapter 11 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Thousand Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 UK

- 11.3.2 Germany

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Russia

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 South Korea

- 11.4.5 Australia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.6 MEA

- 11.6.1 UAE

- 11.6.2 Saudi Arabia

- 11.6.3 South Africa

Chapter 12 Company Profiles

- 12.1 Brother

- 12.2 Canon

- 12.3 Dell

- 12.4 Epson

- 12.5 Fujifilm

- 12.6 HP

- 12.7 Konica Minolta

- 12.8 Kyocera

- 12.9 Lexmark

- 12.10 Oki

- 12.11 Ricoh

- 12.12 Roland

- 12.13 Sharp

- 12.14 Toshiba

- 12.15 Xerox