|

市場調查報告書

商品編碼

1684621

工業風扇和鼓風機市場機會、成長動力、產業趨勢分析和 2025 - 2034 年預測Industrial Fans and Blowers Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

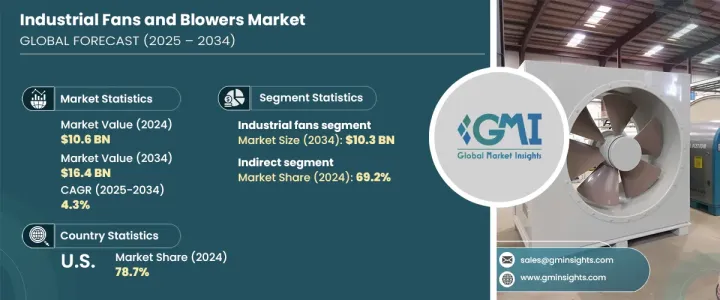

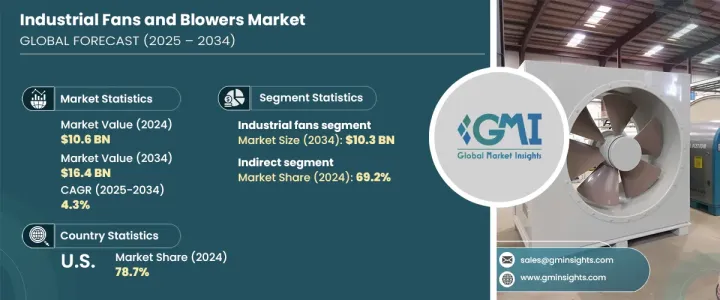

2024 年全球工業風扇和鼓風機市場價值為 106 億美元,預計將實現強勁成長,預計 2025 年至 2034 年的複合年成長率為 4.3%。隨著產業的發展和生產設施變得越來越大、越來越複雜,確保最佳的空氣流通對於維持安全和健康的工作條件至關重要。工業風扇和鼓風機在這些系統中發揮著不可或缺的作用,可以循環空氣、去除有害氣體、調節溫度和控制濕度水平。

日益嚴格的環境法規和日益受到重視的永續性進一步推動了對節能通風解決方案的需求。各行各業都在尋求高性能風扇和鼓風機,以提供卓越的氣流並降低能耗,幫助企業遵守嚴格的環境標準。變速風扇和無葉片設計等技術進步正在徹底改變市場,提高能源效率和整體系統效率。工業流程日益複雜以及對自動化的追求促使企業尋求根據其獨特營運需求量身定做的專業通風解決方案。通風系統中先進技術的整合持續推動工業風扇和鼓風機市場的創新,使其成為一個充滿活力且不斷擴張的行業,擁有巨大的成長機會。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 106億美元 |

| 預測值 | 164億美元 |

| 複合年成長率 | 4.3% |

工業風扇市場價值在 2024 年為 66 億美元,預計到 2034 年將達到 103 億美元。這些風扇對於空氣循環、冷卻、排氣通風和除塵等任務至關重要,可確保操作安全、調節溫度並維持各種環境中的空氣品質。它們對不同工業應用的適應性使其對於最佳化從製造工廠到資料中心等各個領域的系統性能至關重要。

在分銷方面,間接通路佔據了相當大的市場佔有率,到 2024 年將達到 69.2%。這些中介機構還提供安裝、技術支援和維護等基本服務,有助於維持風扇和鼓風機的最佳性能,進一步鞏固其在市場成長中的作用。

在美國,工業風扇和鼓風機市場在 2024 年佔據 78.7% 的主導佔有率,預計在預測期內將繼續以 5.2% 的速度成長。堅實的工業基礎,加上持續的技術進步和不斷擴大的基礎設施,使美國成為全球市場的重要參與者。製造業、化學加工和能源等行業的需求繼續加強美國在該領域的領導地位,為持續成長提供了穩定的基礎。

目錄

第 1 章:方法論與範圍

- 市場範圍和定義

- 基礎估算與計算

- 預測計算

- 資料來源

- 基本的

- 次要

- 付費來源

- 公共資源

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 影響價值鏈的因素

- 利潤率分析

- 中斷

- 未來展望

- 製造商

- 經銷商

- 供應商概況

- 定價分析

- 重要新聞及舉措

- 監管格局

- 衝擊力

- 成長動力

- 工業通風需求不斷成長

- 擴大工業應用

- 都市化和基礎設施發展

- 產業陷阱與挑戰

- 維護和營運成本

- 競爭定價壓力

- 成長動力

- 成長潛力分析

- 技術進步

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第 5 章:工業風扇和鼓風機市場估計與預測:按產品,2021-2034 年

- 主要趨勢

- 工業風扇

- 離心風機

- 前彎

- 向後彎曲

- 軸流風扇

- 混流風扇

- 橫流風扇

- 其他(通風機等)

- 離心風機

- 工業鼓風機

- 正排量鼓風機

- 離心式鼓風機

- 高速渦輪鼓風機

- 多段離心鼓風機

- 其他(再生鼓風機等)

第 6 章:工業風扇與鼓風機市場估計與預測:按動力源,2021-2034 年

- 主要趨勢

- 繩索

- 無線

第 7 章:工業風扇與鼓風機市場估計與預測:按容量 2021-2034

- 主要趨勢

- 高的

- 中等的

- 低的

第 8 章:工業風扇與鼓風機市場估計與預測:依最終用途 2021-2034

- 主要趨勢

- 食品和飲料

- 廢水處理

- 水泥廠

- 鋼鐵廠

- 礦業

- 發電廠

- 化學

- 石油和天然氣

- 航太和國防

- 食品加工

- 紙漿和造紙

- 水處理廠

- 其他

第 9 章:工業風扇與鼓風機市場估計與預測:按配銷通路2021-2034

- 主要趨勢

- 直接的

- 間接

第 10 章:工業風扇與鼓風機市場估計與預測:按地區,2021-2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第 11 章:公司簡介

- Aerzen

- Atlantic Blower

- Atlas Copco

- Busch

- Dicheng

- Everest

- Howden

- Ingersoll Rand

- Kaeser

- Kay International

- New York Blower

- Piller

- Savio

- Shandong Zhaggiu

- Sofaco

- Xylem

The Global Industrial Fans And Blowers Market, valued at USD 10.6 billion in 2024, is poised for robust growth with an expected CAGR of 4.3% from 2025 to 2034. A critical driver of this expansion is the increasing demand for effective ventilation in industrial settings. As industries evolve and production facilities grow larger and more intricate, ensuring optimal air circulation becomes crucial for maintaining safe and healthy working conditions. Industrial fans and blowers play an indispensable role in these systems, circulating air, removing harmful gases, regulating temperatures, and controlling humidity levels.

Rising environmental regulations, paired with an increased focus on sustainability, are further propelling the demand for energy-efficient ventilation solutions. Industries are seeking high-performance fans and blowers that deliver superior airflow with reduced energy consumption, helping businesses comply with stringent environmental standards. Technological advancements such as variable-speed fans and bladeless designs are revolutionizing the market, enhancing both energy efficiency and overall system effectiveness. The growing complexity of industrial processes and the push for automation are prompting companies to seek specialized ventilation solutions tailored to their unique operational needs. The integration of advanced technologies in ventilation systems continues to drive innovation in the industrial fans and blowers market, making it a dynamic and expanding industry with significant opportunities for growth.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $10.6 Billion |

| Forecast Value | $16.4 Billion |

| CAGR | 4.3% |

The industrial fan segment, valued at USD 6.6 billion in 2024, is expected to reach USD 10.3 billion by 2034. Industrial fans are essential across a variety of sectors, including manufacturing, HVAC, energy, and chemical processing. These fans are crucial for tasks like air circulation, cooling, exhaust ventilation, and dust control, ensuring operational safety, regulating temperatures, and maintaining air quality in various environments. Their adaptability to different industrial applications makes them vital for optimizing system performance in everything from manufacturing plants to data centers.

In terms of distribution, the indirect segment commands a substantial market share, accounting for 69.2% in 2024. By utilizing distributors, dealers, and retailers, this channel offers access to wider customer bases, including those in remote and specialized markets. These intermediaries also provide essential services such as installation, technical support, and maintenance, which help maintain the optimal performance of fans and blowers, further cementing their role in market growth.

In the United States, the industrial fans and blowers market held a dominant share of 78.7% in 2024, with continued growth expected at a rate of 5.2% over the forecast period. The solid industrial base, coupled with ongoing technological advancements and expanding infrastructure in the U.S., positions it as a key player in the global market. Demand from industries such as manufacturing, chemical processing, and energy continues to strengthen the U.S.'s leadership in the sector, providing a stable foundation for sustained growth.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Pricing analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Growing demand for industrial ventilation

- 3.6.1.2 Expanding industrial applications

- 3.6.1.3 Urbanization and infrastructure development

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Maintenance and operational costs

- 3.6.2.2 Competitive pricing pressure

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Technological advancement

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Industrial Fans and Blowers Market Estimates & Forecast, By Product, 2021-2034 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Industrial fans

- 5.2.1 Centrifugal fans

- 5.2.1.1 Forward curved

- 5.2.1.2 Backward curved

- 5.2.2 Axial fans

- 5.2.3 Mixed flow fans

- 5.2.4 Cross flow fans

- 5.2.5 Others (Plenum Fans, etc.)

- 5.2.1 Centrifugal fans

- 5.3 Industrial Blower

- 5.3.1 Positive displacement blowers

- 5.3.2 Centrifugal blowers

- 5.3.3 High speed turbo blowers

- 5.3.4 Multistage centrifugal blowers

- 5.3.5 Others (regenerative blowers etc.)

Chapter 6 Industrial Fans and Blowers Market Estimates & Forecast, By power source, 2021-2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Cord

- 6.3 Cordless

Chapter 7 Industrial Fans and Blowers Market Estimates & Forecast, By Capacity 2021-2034 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 High

- 7.3 Medium

- 7.4 Low

Chapter 8 Industrial Fans and Blowers Market Estimates & Forecast, By End Use 2021-2034 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Food & beverage

- 8.3 Wastewater treatment

- 8.4 Cement plant

- 8.5 Steel plant

- 8.6 Mining

- 8.7 Power plant

- 8.8 Chemical

- 8.9 Oil and gas

- 8.10 Aerospace and defence

- 8.11 Food processing

- 8.12 Pulp and paper

- 8.13 Water treatment plant

- 8.14 Others

Chapter 9 Industrial Fans and Blowers Market Estimates & Forecast, By Distribution Channel 2021-2034 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Direct

- 9.3 Indirect

Chapter 10 Industrial Fans and Blowers Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 United States

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 United Kingdom

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.6 Middle East & Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 United Arab Emirates

Chapter 11 Company Profiles

- 11.1 Aerzen

- 11.2 Atlantic Blower

- 11.3 Atlas Copco

- 11.4 Busch

- 11.5 Dicheng

- 11.6 Everest

- 11.7 Howden

- 11.8 Ingersoll Rand

- 11.9 Kaeser

- 11.10 Kay International

- 11.11 New York Blower

- 11.12 Piller

- 11.13 Savio

- 11.14 Shandong Zhaggiu

- 11.15 Sofaco

- 11.16 Xylem