|

市場調查報告書

商品編碼

1635507

中東風機和鼓風機:市場佔有率分析、產業趨勢和成長預測(2025-2030)Middle-East Fans and Blowers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

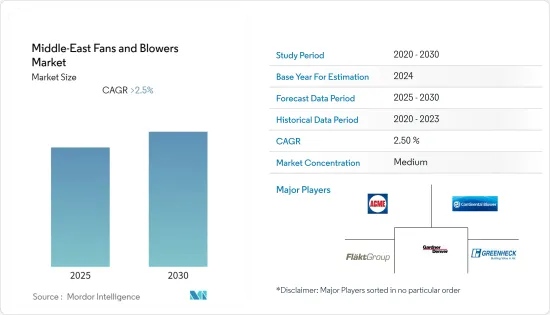

預計中東風機和鼓風機市場在預測期內的複合年成長率將超過 2.5%。

2020 年市場受到 COVID-19 的負面影響。目前,市場已達到疫情前水準。

主要亮點

- 從長遠來看,資料中心對冷卻系統的需求不斷成長(因為風扇和鼓風機是冷卻系統的重要組成部分)將是推動市場的關鍵因素。

- 另一方面,可再生能源發電發電廠需要最少的風扇和鼓風機基礎設施。由於該地區許多主要國家願意向可再生能源發電過渡,預計未來幾年可再生能源發電發電廠在發電結構中的佔有率將會增加,導致對風機和鼓風機的需求預計將受到抑制。

- 隨著都市化進程的加速和人口的成長,建築物的平均高度和擁擠程度不斷增加。預計這一趨勢將在預測期內持續下去,導致對通風設備的需求增加,以彌補通風不足的情況,並預計將代表市場的成長機會。

- 在預測期內,阿拉伯聯合大公國的中東風扇和鼓風機市場可能會顯著成長。

中東風機和鼓風機市場趨勢

石油和天然氣產業顯著成長

- 在強勁的基礎設施成長的推動下,中東地區的石油和天然氣產業預計未來幾年對風機和鼓風機的需求將大幅增加。中東地區石油和天然氣探勘和生產等行業正在經歷健康成長,而且這種成長可能會持續下去。

- 該地區的風機和鼓風機主要從中國、印度、義大利、德國和美國等國家進口。該地區供應風機和鼓風機的主要企業包括 Howden、Gardner Denver 和 Jeddah Filters。

- 該地區各國政府,特別是沙烏地阿拉伯和阿拉伯聯合大公國,正計劃實現工業部門多元化,以減少經濟對上游石油和天然氣部門的依賴,從而產生工業計劃開發的潛力。增加。

- 2021年,沙烏地阿拉伯國營公司沙烏地阿美公司計劃在未來10年內投資超過1,000億美元用於開發新的精製和化工計劃。預計這將顯著增加沙烏地阿拉伯的精製和石化基礎設施,增加對風機和鼓風機的需求。

- 近年來,中東地區石油和天然氣產量大幅增加。然而,由於歐佩克協議,石油和天然氣正在人為生產,產量正在減少。根據BP《2022年世界能源統計年鑑》顯示,2021年中東地區原油產量為2815.6萬桶/日,較上年(2,760.9萬桶/日)下降約2%。

- 因此,基於上述因素,石油和天然氣產業預計在預測期內中東風機和鼓風機市場將顯著成長。

阿拉伯聯合大公國經歷了顯著的成長

- 阿拉伯聯合大公國持有全球第七大石油和天然氣探明蘊藏量,預計將成為重要的天然氣生產國,截至2021年總產量排名世界第十。

- 截至2021年,阿拉伯聯合大公國是石油輸出國組織(OPEC)第六大原油生產國和第四大液體石油生產國。石油和天然氣產業對阿拉伯聯合大公國經濟很重要,並為該國的收入做出了重大貢獻。根據OPEC 2022年度統計快報,該國2021年原油產量約為2,718,000桶/日,比上年(2,779,000桶/日)下降i.2%。

- 隨著發電用天然氣需求的增加,該國透過國家石油公司 ADNOC 制定了 2030 年整合策略,旨在以具有成本效益的方式增加出口。由於ADNOC的出口擴大策略,天然氣氣體純化的需求預計將增加,這可能會推動市場成長。

- 此外,ADNOC 計劃投資其下游產業,作為其 2030 年整合策略的一部分。 ADNOC 開始持續努力(450 億美元)升級其下游業務,利用現有資產和新的下游投資來增強市場佔有率並提高企業永續性。

- ADNOC計劃發展與北歐化工和阿布達比聚合物有限公司(博祿)的合資企業。這三家公司的合資企業將在博祿的聚烯綜合工廠建造世界上最大的混合進料裂解裝置之一,2016年產能為450萬噸/年,預計2025年產能為1440萬噸/年。 2020年將擴大。

- 阿拉伯聯合大公國的採礦業僅限於探勘岩石和沙子以生產建築岩石和水泥。阿拉伯聯合大公國的採礦業因其豐富的礦產資源而具有吸引投資者的潛力,從銅礦和石膏到金屬和寶石的開採。然而,這些潛在的投資預計將為預測期內參與企業帶來巨大的機會。

中東風機和鼓風機產業概況

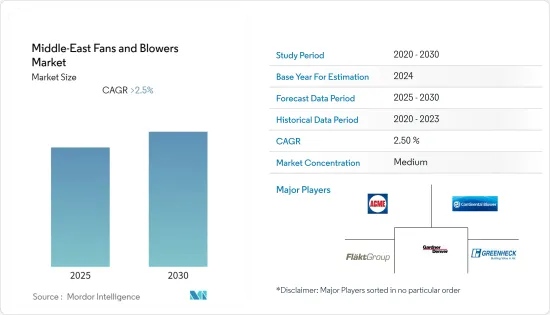

中東風機和鼓風機市場具有綜合性。市場主要企業包括(排名不分先後)Acme Engineering &Manufacturing Corp.、Continental Blower LLC、Flakt Woods Group SA、Gardner Denver Inc. 和 Greenheck Fan Corp.。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第 2 章執行摘要

第3章調查方法

第4章市場概況

- 介紹

- 2027年之前的市場規模與需求預測(單位:十億美元)

- 最新趨勢和發展

- 政府法規和措施

- 市場動態

- 促進因素

- 抑制因素

- 供應鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代產品/服務的威脅

- 競爭公司之間的敵對關係

第5章市場區隔

- 技術部分

- 離心式

- 軸流式

- 部署

- 工業的

- 發電

- 石油和天然氣

- 建造

- 其他

- 商業的

- 工業的

- 地區

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 卡達

- 其他中東地區

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 主要企業策略

- 公司簡介

- Acme Engineering & Manufacturing Corp.

- Continental Blower LLC

- Flakt Woods Group SA

- Gardner Denver Inc.

- Greenheck Fan Corp.

- Howden Group Ltd

第7章 市場機會及未來趨勢

The Middle-East Fans and Blowers Market is expected to register a CAGR of greater than 2.5% during the forecast period.

The market was negatively impacted by COVID-19 in 2020. Presently, the market reached pre-pandemic levels.

Key Highlights

- Over the long term, the major driving factor of the market is the increasing demand for cooling systems (as fans and blowers are the integral parts of cooling systems) from data centers.

- On the flip side, renewable power plants require minimal infrastructure for fans and blowers. With many major countries in the region looking forward to shifting toward renewable energy sources, the share of renewable power plants in the power generation mix is expected to increase over the coming years, which, in turn, is expected to restrain the demand for fans and blowers during the forecast period.

- Nevertheless, with the increasing urbanization and growing population, buildings' average height and congestion have increased. Since this trend is expected to continue during the forecast period, the demand for ventilating equipment to make up for the unavailability of proper ventilation is expected to increase, providing an opportunity for the market's growth.

- The United Arab Emirates is likely to witness significant growth in the Middle East fans and blowers market during the forecast period.

Middle-East Fans & Blowers Market Trends

Oil and Gas Industry to Witness Significant Growth

- The Middle East region's oil and gas industry is anticipated to witness a significant increase in demand for fans and blowers in the coming years on account of robust growth in infrastructure. The industries in the oil and gas sector, such as exploration and production, are growing healthy in the Middle Eastern region, and the growth is likely to continue in the coming years.

- The fans and blowers in the region are imported majorly from countries, such as China, India, Italy, Germany, and the United States. The significant companies supplying fans and blowers in the region include Howden, Gardner Denver, and Jeddah Filters.

- The governments in the region, especially in Saudi Arabia and the United Arab Emirates planned to diversify the industrial sector to reduce the dependency of the economy on the upstream oil and gas sector, which is likely to result in the development of industrial projects, thereby leading to surge in demand for fans and blowers.

- In 2021, the state-owned firm in Saudi Arabia, Saudi Aramco, planned to invest more than USD 100 billion in the development of new refining and chemicals projects over the next decade, as the company envisages balancing its business between upstream and downstream operations. This is expected to result in massive augmentation in refinery and petrochemical infrastructure in Saudi Arabia, thus, bolstering the demand for fans and blowers.

- The oil and gas production in the Middle Eastern region has been growing considerably over the years. However, the OPEC agreements artificially produced oil and gas, which has decreased production. According to BP Statistical Review of World Energy 2022, the crude oil production n in the Middle Eastern region accounted for 28,156 thousand barrels per day in 2021, i.e. decrease of about 2% when compared to the previous year's value (27,609 thousand barrels per day).

- Therefore, based on the factors mentioned above factors, the oil and gas industry is expected to witness significant growth in the Middle East fans and blowers market during the forecast period.

United Arab Emirates to Witness Significant Growth

- The United Arab Emirates is estimated to hold the 7th largest proven oil and natural gas reserves globally and a significant producer of natural gas, ranking 10th in the world in overall production as of 2021.

- As of 2021, the United Arab Emirates was the sixth-largest crude oil producer and the fourth-largest petroleum liquids producer in the Organization of the Petroleum Exporting Countries (OPEC). The oil and gas sector is critical to the United Arab Emirates economy, contributing significantly to the country's revenue. According to OPEC Annual Statistical Bulletin 2022, the crude oil production in the country accounted for about 2,718 thousand barrels per day in 2021, i.e., a decrease of about 2.2% compared to the previous year's value (2,779 thousand barrels per day).

- With the growing demand for natural gas for power generation, the country, through its national oil company, ADNOC, developed a 2030 Integrated Strategy, which aims at providing a cost-effective method for increasing exports. With the company strategizing to increase the export, the demand for natural gas refining plants is expected to increase, thereby, likely propelling the market growth.

- Furthermore, ADNOC plans to invest in the downstream sector as part of the 2030 Integrated Strategy. It has embarked on an ongoing effort (USD 45 billion) to upgrade its downstream operations, leveraging its pre-existing assets and new downstream investments to strengthen its market share and enhance corporate sustainability.

- ADNOC plans to grow its joint venture with Borealis and the Abu Dhabi Polymers Company Ltd (Borouge). The joint venture of these three companies is expected to construct one of the world's largest mixed-feed crackers at Borouge's integrated polyolefins facility, which is projected to expand the production capacity from 4.5 million t/y in 2016 to an estimated 14.4 million t/y by 2025.

- The UAE mining industry is very much confined to the exploration of rocks and sand for manufacturing building rocks and cement for construction purposes. The mining sector in the United Arab Emirates has the potential to attract investors for its long list of minerals, ranging from copper mines and gypsum to the extraction of metals and valuable stones.However, these potential investments are expected to present an excellent opportunity for the fans and blowers market players during the forecast period.

Middle-East Fans & Blowers Industry Overview

The Middle East fans and blowers market is consolidated in nature. Some of the major players in the market (in no particular order) include Acme Engineering & Manufacturing Corp., Continental Blower LLC, Flakt Woods Group SA, Gardner Denver Inc., and Greenheck Fan Corp.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast, in USD billion, till 2027

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Technology

- 5.1.1 Centrifugal

- 5.1.2 Axial

- 5.2 Deployment

- 5.2.1 Industrial

- 5.2.1.1 Power Generation

- 5.2.1.2 Oil and Gas

- 5.2.1.3 Construction

- 5.2.1.4 Other Industries

- 5.2.2 Commercial

- 5.2.1 Industrial

- 5.3 Geography

- 5.3.1 United Arab Emirates

- 5.3.2 Saudi Arabia

- 5.3.3 Qatar

- 5.3.4 Rest of Middle-East

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Acme Engineering & Manufacturing Corp.

- 6.3.2 Continental Blower LLC

- 6.3.3 Flakt Woods Group SA

- 6.3.4 Gardner Denver Inc.

- 6.3.5 Greenheck Fan Corp.

- 6.3.6 Howden Group Ltd