|

市場調查報告書

商品編碼

1637804

風扇和鼓風機:市場佔有率分析、行業趨勢和統計、成長預測(2025-2030)Fans And Blowers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

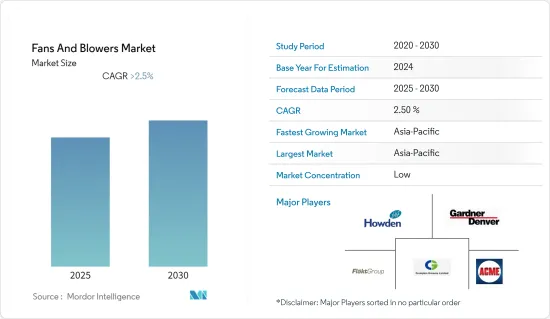

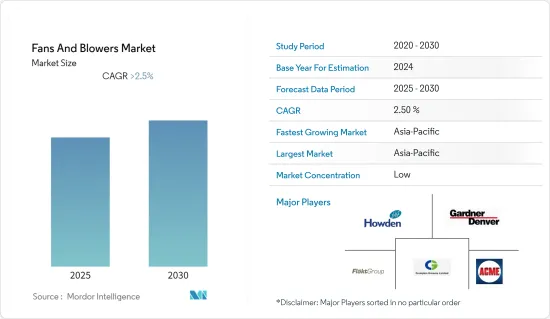

預計風扇和鼓風機市場在預測期內的複合年成長率將超過 2.5%。

由於封鎖措施,各製造業暫時關閉,且 2020 年沒有新的製造業或建築計劃,因此 COVID-19 大流行影響了所研究的市場。目前市場已恢復至疫情前的水準。

主要亮點

- 在預測期內,資料中心和公司辦公室等商業設施的增加以及許多新興國家工業化的不斷發展預計將推動風扇和鼓風機市場的成長。

- 可再生發電廠需要最少的風扇和鼓風機基礎設施。隨著許多主要國家轉向可再生能源發電,預計未來幾年可再生能源發電在發電結構中的佔有率將會增加,這預計將限制對風機和鼓風機的需求。

- 都市化的加速和人口成長為市場創造了機會。建築物的平均高度和擁擠度持續增加。預計這一趨勢將在預測期內持續下去,導致對通風設備的需求增加,以彌補通風不足的情況,並預計將代表市場的成長機會。

風機和鼓風機市場趨勢

工業領域預計將主導市場

- 風扇和鼓風機用於多種行業,包括化學、石油和天然氣、鋼鐵廠和食品製造,以維持室內空氣品質並提供無塵的工作環境。隨著許多國家工廠和發電廠等新型製造業的建立,工業化趨勢的增強預計將推動市場成長。

- 消耗空氣設備最多的產業包括鋼廠、化工廠和燃油發電廠,這些產業近年來成長較快。例如,2022年8月,印度政府計劃在奧裡薩邦興建6座鋼鐵廠。該計劃的投資者包括塔塔鋼鐵公司、安賽樂米塔爾公司、新日鐵和阿達尼集團。在目前的情況下,化學工業特別是在開發中國家很發達。

- 例如,2022年4月,INEOS Nitriles計劃在德國科隆建立一家生產乙腈的化學工廠。法國化工公司啟動了在該國建立新化工園區和叢集的新計畫。

- 市場主要企業也在投資擴建,以滿足工業風扇和鼓風機的需求。例如,豪頓於 2023 年 4 月宣布將在巴西開設分店,擴大在拉丁美洲的業務。客戶可以 24 小時訪問我們的服務中心,其中包括硬體採購、售後支援以及針對我們的工業風扇和鼓風機產品線的專業硬體支援。

- 由於這些發展,預計工業領域在預測期內將優於其他部署領域。

亞太地區主導市場

- 由於中國、印度和日本等國家的高需求,預計亞太地區在不久的將來將佔據最大的市場佔有率。都市化的提高和工業單位的激增是高需求背後的一個主要因素。

- 近年來,中國和印度等國家的石油和天然氣、石化計劃、鋼廠計劃和發電工程都有成長。預計即將推出的工業計劃將繼續這種趨勢。

- 例如,中國等國家正在發展燃料發電產業。 2022年第一季,中國許多省份地方政府核准了新增約830萬千瓦燃煤電廠的新計畫。其中包括湖南、陝西、甘肅、安徽、浙江和福建。

- 印度計劃開展多個煉油廠計劃。例如,2022年7月,拉賈斯坦邦政府與HPCL簽署協議,在拉賈斯坦邦巴爾默區建立煉油石化聯合體。該計劃包括13台機械裝置,總合為900萬噸/年。計劃於 2024 年投入運作。

- 預計此類計劃將在預測期內推動亞太地區對風扇和鼓風機的需求。

風機和鼓風機產業概述

風扇和鼓風機市場分散。市場上的主要企業包括(排名不分先後)Acme Engineering & Manufacturing Corp.、Airmaster Fan Company Inc. 和 Continental Blower LLC。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第2章調查方法

第3章執行摘要

第4章市場概況

- 介紹

- 至2028年市場規模及需求預測(單位:十億美元)

- 最新趨勢和發展

- 市場動態

- 促進因素

- 抑制因素

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第5章市場區隔

- 依技術

- 離心式

- 軸流式

- 按發展

- 工業的

- 發電

- 石油和天然氣

- 建造

- 鋼

- 化學

- 礦業

- 其他行業

- 商業的

- 工業的

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 南美洲

- 中東/非洲

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 主要企業策略

- 公司簡介

- Acme Engineering & Manufacturing Corp.

- Airmaster Fan Company Inc.

- Continental Blower LLC

- CG Power and Industrial Solutions Limited

- DongKun Industrial Co. Ltd.

- Flakt Woods Group SA

- Gardner Denver Inc.

- Greenheck Fan Corp.

- Howden Group Ltd

- Loren Cook Company

- Pollrich GmbH

第7章 市場機會及未來趨勢

The Fans And Blowers Market is expected to register a CAGR of greater than 2.5% during the forecast period.

The COVID-19 pandemic affected the market studied, as lockdown measures temporarily shut down various manufacturing industries, and there were no new manufacturing or construction projects in 2020. Currently, the market has rebounded to pre-pandemic levels.

Key Highlights

- The growing multitude of commercial places, like data centers, corporate offices, etc., and the increasing industrialization in many developing countries are expected to drive the fans and blowers market's growth during the forecast period.

- Renewable power plants require minimal infrastructure for fans and blowers. With many major countries shifting toward renewable energy sources, the share of renewable power plants in the power generation mix is expected to increase over the coming years, which, in turn, is expected to restrain the demand for fans and blowers.

- The increasing urbanization and growing population present an opportunity for the market. The average height of buildings and congestion have been increasing. Since this trend is expected to continue during the forecast period, the demand for ventilating equipment to make up for the unavailability of proper ventilation is expected to increase, providing an opportunity for the market's growth.

Fans and Blowers Market Trends

Industrial Segment Expected to Dominate the Market

- Fans and blowers are used in various industries, like chemicals, oil and gas, steel plants, food manufacturing, etc., to maintain indoor air quality and a dust-free environment for people to work in. The growing trend of industrialization in many countries, with new factories, power plants, and other manufacturing sectors, is expected to drive the market's growth

- The most air-equipment-consuming industries are iron and steel plants, chemical plants, fuel-based power plants, etc., which have seen a proliferation in recent years. For example, in August 2022, the government of India planned to build six steel plants in Odisha. The investors for the project include Tata Steel, ArcelorMittal, Nippon Steel, and the Adani Group. The chemical industry is advancing in the current scenario, particularly in developing countries.

- For example, in April 2022, INEOS Nitriles planned to establish a chemical plant in Koln, Germany, to produce acetonitrile. The French chemical companies tabled new plans for setting up new chemical parks and clusters in the country.

- Major player in the market is also investing in the expansion of operations to cater the needs of industrial fans and blowers. For instance, in April 2023, Howden announced that they plas to set up a branch in Brazil to expand its Latin American presence. Customers have 24-hour access to the service center, which provides hardware procurement, aftermarket service support, and hardware specialized assistance for product range of industrial fans and blowers.

- Due to such developments, the industrial sector is anticipated to overshadow other deployment segments during the forecast period.

Asia-Pacific to Dominate the Market

- Asia-Pacific is expected to have the largest market share in the near future due to the high demand for such products from countries like China, India, Japan, etc. The growing rate of urbanization with the proliferation of industrial and commercial units is the key factor responsible for the high demand.

- In countries like China and India, oil and gas and petrochemical projects, iron and steel plant projects, and power generation projects have witnessed growth in recent years. The trend is expected to continue in the unfolding scene due to the upcoming industrial projects.

- For example, countries like China are still developing the fuel-based power generation sector. In the first quarter of 2022, the provincial governments of many states in China approved new plans to add around 8.3 GW of coal-based power generation plants. The states include Hunan, Shaanxi, Gansu, Anhui, Zhejiang, and Fujian.

- Several refinery projects have been planned in India. For example, in July 2022, the Rajasthan government entered into an agreement with HPCL to set up a refinery and petrochemical complex in the Barmer district of Rajasthan. The project includes 13 mechanical units with a combined capacity of 9 million metric tons per year. It is expected to be operational by 2024.

- Such projects are expected to bolster the demand for fans and blowers in Asia-Pacific during the forecast period.

Fans and Blowers Industry Overview

The fans and blowers market is fragmented. Some of the major players in the market (in no particular order) include Acme Engineering & Manufacturing Corp., Airmaster Fan Company Inc., and Continental Blower LLC.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Market Dynamics

- 4.4.1 Drivers

- 4.4.2 Restraints

- 4.5 Supply Chain Analysis

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Consumers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitute Products and Services

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Technology

- 5.1.1 Centrifugal

- 5.1.2 Axial

- 5.2 By Deployment

- 5.2.1 Industrial

- 5.2.1.1 Power Generation

- 5.2.1.2 Oil and Gas

- 5.2.1.3 Construction

- 5.2.1.4 Iron and Steel

- 5.2.1.5 Chemicals

- 5.2.1.6 Mining

- 5.2.1.7 Other Industries

- 5.2.2 Commercial

- 5.2.1 Industrial

- 5.3 By Geography

- 5.3.1 North America

- 5.3.2 Europe

- 5.3.3 Asia-Pacific

- 5.3.4 South America

- 5.3.5 Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Acme Engineering & Manufacturing Corp.

- 6.3.2 Airmaster Fan Company Inc.

- 6.3.3 Continental Blower LLC

- 6.3.4 CG Power and Industrial Solutions Limited

- 6.3.5 DongKun Industrial Co. Ltd.

- 6.3.6 Flakt Woods Group SA

- 6.3.7 Gardner Denver Inc.

- 6.3.8 Greenheck Fan Corp.

- 6.3.9 Howden Group Ltd

- 6.3.10 Loren Cook Company

- 6.3.11 Pollrich GmbH