|

市場調查報告書

商品編碼

1684663

乾草和飼料設備市場機會、成長動力、產業趨勢分析和 2025 - 2034 年預測Haying and Forage Equipment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

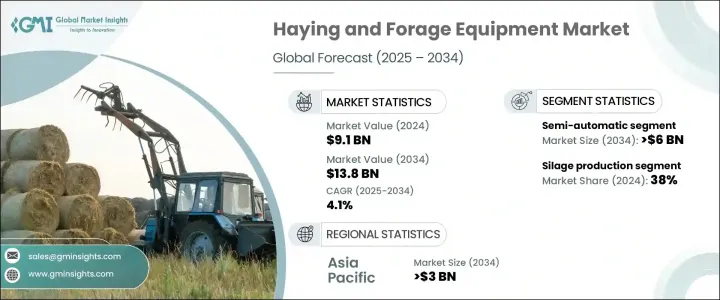

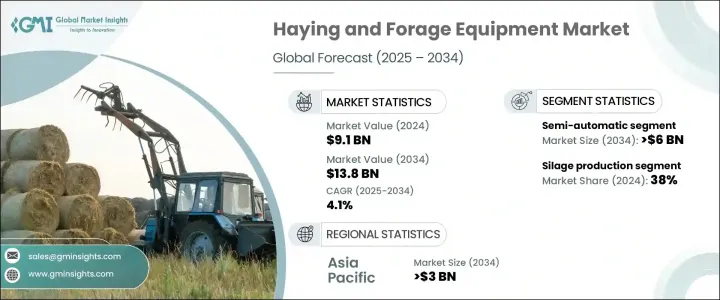

2024 年全球乾草和飼料設備市場價值為 91 億美元,將經歷顯著成長,預計 2025 年至 2034 年期間的複合年成長率為 4.1%。隨著全球人口穩步成長,農業部門面臨越來越大的提高生產力的壓力,特別是乳製品和肉類行業。為了滿足這種需求,農民擴大採用機械化牧草收割來確保穩定供應高品質的飼料。採用先進的乾草和飼料機械有助於降低勞動成本,提高營運效率,並提高乾草和青貯飼料的品質。因此,市場可望繼續擴張。

除了對牲畜飼料的需求不斷成長之外,乾草和飼料機械的技術進步在產業轉型中發揮著至關重要的作用。智慧農業解決方案和精準農業與乾草和飼料設備相結合,提高了整體生產力。這些創新不僅使營運更加高效,而且還允許農民收集資料以改善決策。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 91億美元 |

| 預測值 | 138億美元 |

| 複合年成長率 | 4.1% |

市場按操作類型分類,包括手動、半自動和全自動系統。 2024 年,半自動部分佔據市場最大佔有率,達到 40%。預計該領域將大幅成長,到 2034 年將達到 60 億美元。與手動方法相比,這些機器可節省大量時間和勞力,同時比全自動替代方案更實惠。這使得半自動設備對農民特別有吸引力,特別是在新興市場,因為經濟性和易用性是主要考慮因素。

在應用方面,乾草和飼料設備市場分為青貯飼料生產、水果乾草製作和作物殘留物處理。青貯飼料生產佔有最大的佔有率,到 2024 年將佔 38% 的市場佔有率。青貯飼料生產可以長期儲存飼料,這對於維持牲畜生產力至關重要,特別是在生長季節不可預測或放牧面積有限的地區。全球對乳製品和肉類產品的需求不斷成長,進一步推動了青貯飼料作為飼料保存的主要方法的應用。

中國將在 2024 年佔據全球乾草和牧草設備市場的 60% 佔有率,佔據主導地位,預計到 2034 年將達到 30 億美元。此外,中國致力於透過政府激勵措施和機械化項目實現農業部門現代化,這一舉措在先進乾草和飼料機械的快速普及中發揮了關鍵作用,刺激了該地區的顯著成長。

目錄

第 1 章:方法論與範圍

- 研究設計

- 研究方法

- 資料收集方法

- 基礎估計和計算

- 基準年計算

- 市場估計的主要趨勢

- 預測模型

- 初步研究與驗證

- 主要來源

- 資料探勘來源

- 市場定義

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 供應商概況

- 零件供應商

- 技術供應商

- 乾草和飼料設備製造商

- 經銷商

- 最終用戶

- 利潤率分析

- 定價分析

- 專利格局

- 成本明細

- 技術與創新格局

- 重要新聞及舉措

- 監管格局

- 衝擊力

- 成長動力

- 對高效率、優質牲畜飼料生產的需求不斷成長

- 提高農業機械化和自動化程度

- 乾草和飼料機械的技術進步

- 政府對農業現代化的補貼與支持

- 產業陷阱與挑戰

- 先進的乾草和飼料設備初始成本較高

- 發展中地區對機械化解決方案的認知與採用有限

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第 5 章:市場估計與預測:按設備,2021 - 2034 年

- 主要趨勢

- 割草機

- 打包機

- 攤草機

- 耙子

- 青貯收割機

- 護髮素

- 包裝器

- 其他

第 6 章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 乾草收割

- 青貯飼料生產

- 農作物殘渣處理

第7章:市場估計與預測:按營運,2021 - 2032 年

- 主要趨勢

- 手動的

- 半自動

- 全自動

第 8 章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 西班牙

- 義大利

- 俄羅斯

- 北歐

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳新銀行

- 東南亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東及非洲

- 阿拉伯聯合大公國

- 南非

- 沙烏地阿拉伯

第9章:公司簡介

- AGCO

- Challenge Implements

- Claas KGaA

- CNH Industrial

- Deere & Company

- Farm King

- Kongskilde Industries

- Krone

- Kubota

- Kuhn Group

- Lely Industries

- Maschinenfabrik Bernard Krone

- McHale Engineering

- Morra Group

- Pottinger Landtechnik

- Rostselmash

- Sitrex

- Tonutti-Wolagri

- Vermeer

- Vicon

The Global Haying And Forage Equipment Market, valued at USD 9.1 billion in 2024, is set to experience significant growth, projected to expand at a CAGR of 4.1% from 2025 to 2034. This growth is primarily driven by the increasing need for efficient livestock feed production. With the global population steadily rising, there is growing pressure on the agricultural sector to enhance productivity, particularly in the dairy and meat industries. To meet this demand, farmers are increasingly turning to mechanized forage harvesting to secure a consistent supply of high-quality feed. The adoption of advanced haying and forage machinery is helping reduce labor costs, boost operational efficiency, and elevate the quality of hay and silage. As a result, the market is positioned for continued expansion.

In addition to the growing demand for livestock feed, technological advancements in haying and forage machinery are playing a crucial role in transforming the industry. The integration of smart farming solutions and precision agriculture into haying and forage equipment is enhancing overall productivity. These innovations not only enable more efficient operations but also allow farmers to gather data for improved decision-making.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $9.1 Billion |

| Forecast Value | $13.8 Billion |

| CAGR | 4.1% |

The market is categorized by operation type, which includes manual, semi-automatic, and fully automatic systems. In 2024, the semi-automatic segment captured the largest share of the market, accounting for 40%. This segment is anticipated to grow significantly, reaching USD 6 billion by 2034. Semi-automatic equipment stands out because it strikes an optimal balance between cost and performance. These machines provide substantial time and labor savings compared to manual methods, while being more affordable than fully automated alternatives. This makes semi-automatic equipment particularly attractive to farmers, especially in emerging markets where affordability and ease of use are key considerations.

When it comes to application, the haying and forage equipment market is segmented into silage production, fruit haymaking, and crop residue processing. Silage production holds the largest share, representing 38% of the market in 2024. This dominance is driven by the vital role silage plays in preserving nutrient-rich feed for livestock. Silage production allows for long-term storage of forage, which is crucial for maintaining livestock productivity, especially in regions with unpredictable growing seasons or limited grazing areas. The increasing global demand for dairy and meat products further fuels the adoption of silage as a key method of feed preservation.

China leads the global haying and forage equipment market with a commanding 60% share in 2024, and it is projected to reach USD 3 billion by 2034. The country's prominence in the market is largely attributed to its vast agricultural industry and large livestock population, both of which drive the demand for efficient forage harvesting equipment. Additionally, China's commitment to modernizing its agricultural sector through government incentives and mechanization programs has played a pivotal role in the rapid adoption of advanced haying and forage machinery, spurring significant growth in the region.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Component supplier

- 3.2.2 Technology supplier

- 3.2.3 Haying and forage equipment manufacturers

- 3.2.4 Distributors

- 3.2.5 End users

- 3.3 Profit margin analysis

- 3.4 Pricing analysis

- 3.5 Patent Landscape

- 3.6 Cost Breakdown

- 3.7 Technology & innovation landscape

- 3.8 Key news & initiatives

- 3.9 Regulatory landscape

- 3.10 Impact forces

- 3.10.1 Growth drivers

- 3.10.1.1 Growing demand for efficient and high-quality livestock feed production

- 3.10.1.2 Increasing mechanization and automation in agriculture

- 3.10.1.3 Technological advancements in haying and forage machinery

- 3.10.1.4 Government subsidies and support for modernizing agricultural practices

- 3.10.2 Industry pitfalls & challenges

- 3.10.2.1 High initial costs of advanced haying and forage equipment

- 3.10.2.2 Limited awareness and adoption of mechanized solutions in developing regions

- 3.10.1 Growth drivers

- 3.11 Growth potential analysis

- 3.12 Porter's analysis

- 3.13 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Equipment, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Mowers

- 5.3 Balers

- 5.4 Tedders

- 5.5 Rakes

- 5.6 Forage Harvesters

- 5.7 Conditioners

- 5.8 Wrappers

- 5.9 Others

Chapter 6 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Haymaking

- 6.3 Silage production

- 6.4 Crop residue processing

Chapter 7 Market Estimates & Forecast, By Operation, 2021 - 2032 ($Bn, Units)

- 7.1 Key trends

- 7.2 Manual

- 7.3 Semi-Automatic

- 7.4 Fully Automatic

Chapter 8 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Russia

- 8.3.7 Nordics

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 ANZ

- 8.4.6 Southeast Asia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 MEA

- 8.6.1 UAE

- 8.6.2 South Africa

- 8.6.3 Saudi Arabia

Chapter 9 Company Profiles

- 9.1 AGCO

- 9.2 Challenge Implements

- 9.3 Claas KGaA

- 9.4 CNH Industrial

- 9.5 Deere & Company

- 9.6 Farm King

- 9.7 Kongskilde Industries

- 9.8 Krone

- 9.9 Kubota

- 9.10 Kuhn Group

- 9.11 Lely Industries

- 9.12 Maschinenfabrik Bernard Krone

- 9.13 McHale Engineering

- 9.14 Morra Group

- 9.15 Pottinger Landtechnik

- 9.16 Rostselmash

- 9.17 Sitrex

- 9.18 Tonutti-Wolagri

- 9.19 Vermeer

- 9.20 Vicon