|

市場調查報告書

商品編碼

1686664

非洲農業機械:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Africa Agricultural Machinery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

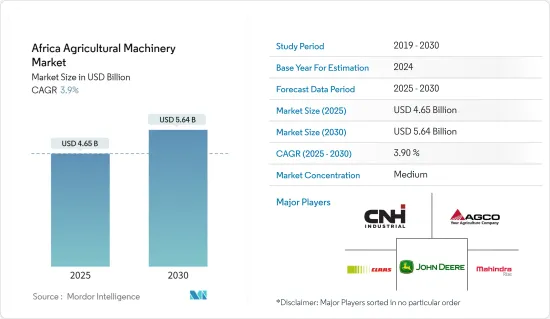

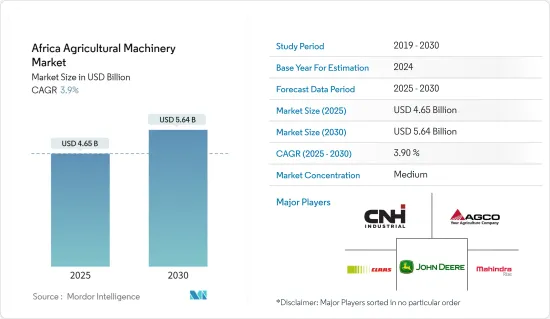

預計 2025 年非洲農業機械市場規模為 46.5 億美元,到 2030 年將達到 56.4 億美元,預測期內(2025-2030 年)的複合年成長率為 3.9%。

主要亮點

- 受非洲大陸農業方法現代化推動,非洲農業機械市場正穩步擴大。此次現代化旨在提高生產力和應對緊迫的糧食安全挑戰。例如,根據聯合國非洲經濟委員會的數據,非洲人口預計將成長五倍以上,從 1960 年的 2.83 億增加到 2023 年的 15 億以上,然後再成長 9.5 億,到 2050 年達到 25 億。這種成長增加了對糧食的需求,而現代機械是提高作物產量和滿足日益成長的需求的重要解決方案。

- 在南非,商業農民在農業領域發揮關鍵作用。根據威斯康辛州經濟發展公司最近的一份報告,約有 32,000 個商業農場生產了該州 80% 的農業產值。這些農民將機械化視為增加利潤和確保經營永續性的基石。這種觀點著市場的成長軌跡徵兆一片光明。南非農業機械協會 (SAAMA) 預計 2022 年曳引機銷量約為 9,181 台,聯合收割機銷量約為 373 台,這表明該國在農業機械化方面正在穩步前進。

- 在衣索比亞,大多數農民耕種小塊土地,大規模機械化仍然很少見,但政府正在積極推動農業和機械產業的成長。埃塞俄比亞的旗艦計畫之一「成長與轉型計畫 II」(GTP II)旨在振興這些產業。該計畫的一項關鍵策略是將大片可耕地租給國際公司,為大規模商業化農業鋪路。此舉不僅加強了設備的銷售,也有助於擴大衣索比亞農業機械市場。在政府支持和大公司不斷增加的投資下,該地區的農業機械化正在強勁成長。

非洲農業機械市場趨勢

按產品類型分類,曳引機是主要細分市場

農業對非洲經濟發展至關重要。非洲儘管擁有世界上最多的未開墾耕地,但其農業生產力卻落後於其他開發中地區。目前非洲農作物產量僅為世界平均的56%。為了滿足人口成長和快速都市化帶來的日益成長的糧食需求,非洲必須在未來幾十年提高作物產量。機械化,特別是基於曳引機的機械化,為縮小產量差距提供了可行的解決方案。

在非洲,曳引機是農活中不可或缺的工具,幫助人們完成從耕作到播種到收割的一切工作。農業進化聯盟的研究強調了非洲農業機械的巨大潛力,其中曳引機佔據主導地位。預計政府的支持將促進該行業的發展。例如,加納政府向經營89家曳引機租賃和維護中心的企業家提供曳引機補貼。

近年來,曳引機的流行趨勢不斷上升。根據南非農業機械協會(SAAMA)的報告,南非曳引機銷量從 2021 年的 7,680 台增加到 2022 年的 9,181 台。在小規模農戶佔多數的非洲,100匹馬力以下的小型曳引機是常態。製造商正在客製化適合非洲需求的車型,優先考慮經濟性、耐用性和易於維護性。在非洲分散的土地上,中小型曳引機比更大、更昂貴的機器更受歡迎。

2021年,歐洲農業機械工業協會(CEMA)與聯合國糧食及農業組織(FAO)將《永續農業機械化合作備忘錄》延長至2025年。新協議強調了自動化和智慧化農業機械、精密農業、數位資料管理和農業機械利用率的準確資料的重要性,特別是在非洲國家。這些努力可能會刺激包括曳引機在內的農業機械市場的成長。

南非佔市場主導地位

在非洲國家中,南非是最大的市場。從歷史上看,南非的農業經濟已從依賴糧食援助轉變為注重國內生產。南非目前農業和農機市場具有巨大的成長潛力。

此外,南非是撒哈拉以南非洲最大的穀物生產國。產量以玉米為主,其次是小麥、大豆和葵花籽。根據糧農組織統計資料庫,2022年南非穀物總產量將達1,870萬噸,其中玉米約佔1,610萬噸。強勁的生產水準正在刺激機械化程度的提高和對最先進農業設備的投資。此外,南非的機械化率超過非洲大陸的其他國家,曳引機普及率顯著,收割機、播種機和灌溉系統的使用也十分廣泛。高度的機械化使南非農民變得更有效率和更有生產力。人事費用,特別是大規模作物種植的成本,超過許多其他非洲國家。

由於有約翰迪爾、馬恆達、愛科集團等多家跨國公司的存在,其產品很容易進入南非市場。 2022 年,約翰迪爾在 2022 年南浦收穫日推出了 X9 系列聯合收割機。從那時起,這款全新 11 級聯合收割機抵達南非海岸,其驚人的工作能力和性能引起了廣泛關注。

非洲農機產業概況

非洲農機市場相對集中。市場的主要企業包括 Deere &Company、AGCO Corporation、CNH Industrial NV、Mahindra &Mahindra Ltd、Claas KGaA mbH 等。為了保持其在市場中的地位,主要企業正在擴大產品系列併擴大其業務範圍。透過向市場推出創新的新產品來擴大產品系列是這些公司最常採用的策略。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場概況

- 市場促進因素

- 農業勞動力減少

- 不斷提高的技術進步

- 加大政府對加強農業機械化的支持

- 市場限制

- 農業支出增加

- 現代農業機械的安全問題

- 波特五力分析

- 新進入者的威脅

- 購買者/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章 市場區隔

- 產品類型

- 聯結機

- 耕作及栽培機械

- 播種施肥機

- 收割機

- 牧草和飼料機械

- 灌溉機械

- 其他產品類型

- 地區

- 南非

- 其他非洲地區

第6章 競爭格局

- 最受歡迎的策略

- 市場佔有率分析

- 公司簡介

- Tractors and Farm Equipment Limited(TAFE)

- Claas KGaA mbH

- AGCO Corporation

- Mahindra & Mahindra Ltd

- Deere & Company

- CNH Industrial NV

第7章 市場機會與未來趨勢

The Africa Agricultural Machinery Market size is estimated at USD 4.65 billion in 2025, and is expected to reach USD 5.64 billion by 2030, at a CAGR of 3.9% during the forecast period (2025-2030).

Key Highlights

- Africa's agriculture machinery market is steadily expanding, fueled by the continent's push to modernize farming practices. This modernization aims to enhance productivity and tackle pressing food security challenges. For instance, according to the United Nations Economic Commission for Africa, its population expanded from 283 million in 1960 to more than 1.5 billion in 2023 - a more than five-fold increase-and is projected to increase by 950 million and touch 2.5 billion by 2050. Such growth amplifies the demand for food, and modern machinery stands as a pivotal solution to boost crop yields and meet this escalating demand.

- In South Africa, commercial farmers play a crucial role in the agricultural sector. Recently, according to the Wisconsin Economic Development Corporation, approximately 32,000 commercial farmers produce 80% of the country's agricultural value. These farmers view mechanization as a cornerstone for enhancing profits and ensuring the sustainability of their operations. This perspective bodes well for the market's growth trajectory. The South African Agricultural Machinery Association (SAAMA) has sales of about 9,181 tractors and 373 combined harvesters for 2022, underscoring the nation's steady march towards agricultural mechanization.

- In Ethiopia, while most farmers operate on small landholdings and large-scale mechanization remains rare, the government is actively promoting growth in both agriculture and the machinery sector. One of its flagship initiatives, the Growth and Transformation Plan (GTP II), aims to invigorate these sectors. A key strategy under this plan involves leasing vast arable lands to international entities, paving the way for large-scale commercial farming. This move is not only bolstering equipment sales but also propelling the agricultural machinery market's expansion in Ethiopia. With government backing and heightened investments from major players, the region witnesses robust growth in agricultural mechanization.

Africa Agricultural Machinery Market Trends

Tractors is the Significant Segment by Product Type

Agriculture is pivotal to Africa's economic development. Despite boasting the world's largest expanse of uncultivated arable land, Africa's agricultural productivity lags behind other developing regions. Current crop yields in Africa stand at just 56% of the global average. To meet the rising food demand spurred by population growth and swift urbanization, Africa must boost its crop yields in the coming decades. Mechanization, particularly through tractors, presents a viable solution to bridge this yield gap.

In Africa, tractors are indispensable, facilitating everything from plowing and tilling to planting and harvesting. Research by Agri Evolution Alliance underscores the vast potential for agricultural machinery in Africa, with tractors leading the charge. Government support is anticipated to drive sector development. For instance, the Ghanaian government provides subsidized tractors to entrepreneurs operating 89 centers for tractor rental and servicing.

Tractor sales have shown an upward trend in recent years. The South African Agricultural Machinery Association (SAAMA) reports that tractor sales in South Africa increased from 7,680 units in 2021 to 9,181 units in 2022. Given Africa's predominant smallholder farms, compact tractors, typically under 100 HP, reign supreme. Manufacturers are tailoring models to suit African needs-prioritizing affordability, durability, and ease of maintenance. In Africa's fragmented land holdings, small and medium-sized tractors shine, as opposed to larger, costlier machinery.

In 2021, the European Agricultural Machinery Industry Association (CEMA) and the Food and Agriculture Organization of the United Nations (FAO) extended their memorandum of understanding (MoU) on sustainable agricultural mechanization until 2025. This renewed agreement emphasizes the importance of automated and intelligent agricultural machinery, precision agriculture, digital data management, and accurate statistical data on agricultural machinery use, particularly in African countries. These initiatives are likely to stimulate growth in the agricultural machinery including tractor market.

South Africa Dominates the Market

Among African nations, South Africa stands out as the largest market. Historically, the South African agricultural economy transitioned from relying on food aid to emphasizing domestic production, a shift initiated by the Green Revolution, championed by the World Food Program of the United Nations. South Africa now has major potential for the growth of the agriculture and agriculture machinery market.

Moreover, South Africa holds the title of the leading cereal producer in Sub-Saharan Africa. Maize dominates its production, trailed by wheat, soybeans, and sunflower seeds. According to the FAOSTAT, the total cereal production in South Africa reached 18.7 million metric tons in 2022, with maize accounting for approximately 16.1 million metric tons. Such robust production levels have spurred a push towards mechanization and investments in cutting-edge agricultural equipment. Additionally, South Africa outpaces its continental counterparts in mechanization rates, showcasing notable tractor penetration and the prevalent use of harvesters, planters, and irrigation systems. This advanced mechanization empowers South African farmers to boost efficiency and productivity, particularly in large-scale crop farming, where labor costs surpass those in many other African nations.

The presence of several global companies, like John Deere, Mahindra, and AGCO Corporation, may enable the easy introduction of products in the South African market. In 2022, John Deere launched X9 Series combine harvesters at NAMPO Harvest Day 2022. It has since created a massive buzz around the incredible operational capacity and performance of the all-new class 11 Combine to arrive on South African shores.

Africa Agricultural Machinery Industry Overview

The African agricultural machinery market is relatively consolidated. The major players in the market include Deere & Company, AGCO Corporation, CNH Industrial NV, Mahindra & Mahindra Ltd, and Claas KGaA mbH. Major players in the market have extended their product portfolio and broadened their businesses to maintain their positions in the market. Expanding the product portfolio by introducing new and innovative products into the market is the most adopted strategy by these companies.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Declining Agricultural Labor

- 4.2.2 Rising Technological Advancements

- 4.2.3 Growing Government Support to Enhance Farm Mechanization

- 4.3 Market Restraints

- 4.3.1 Increasing Farm Expenditure

- 4.3.2 Security Concerns in Modern farming Machinery

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Product Type

- 5.1.1 Tractors

- 5.1.2 Plowing and Cultivating Machinery

- 5.1.3 Planting and Fertilizing Machinery

- 5.1.4 Harvesting Machinery

- 5.1.5 Haying and Forage Machinery

- 5.1.6 Irrigation Machineries

- 5.1.7 Other Product Types

- 5.2 Geography

- 5.2.1 South Africa

- 5.2.2 Rest of Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Tractors and Farm Equipment Limited (TAFE)

- 6.3.2 Claas KGaA mbH

- 6.3.3 AGCO Corporation

- 6.3.4 Mahindra & Mahindra Ltd

- 6.3.5 Deere & Company

- 6.3.6 CNH Industrial NV