|

市場調查報告書

商品編碼

1685937

歐洲農業機械:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Europe Agricultural Machinery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

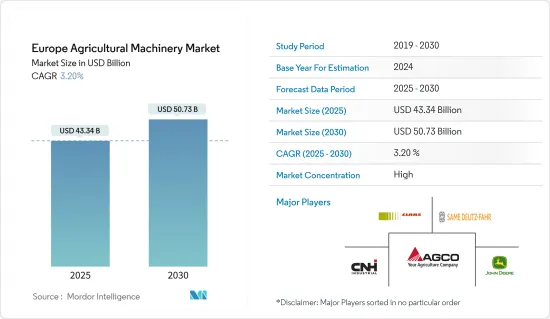

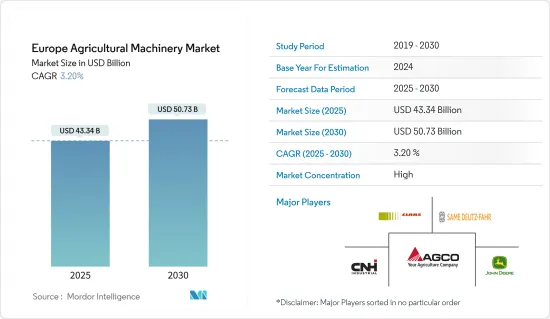

預計 2025 年歐洲農業機械市場規模為 433.4 億美元,到 2030 年將達到 507.3 億美元,預測期內(2025-2030 年)的複合年成長率為 3.20%。

歐盟農業正在經歷重大轉型,從傳統的密集型密集模式,嚴重依賴季節性移工在成員國的農場工作。技術純熟勞工的短缺日益嚴重,推動了歐洲國家的機械化進程,從而導致該地區農業機械銷售增加。根據世界銀行的資料,歐盟農業就業率將從2020年的4.32%下降到2022年的3.99%。可耕地面積的減少和淡水供應的減少也加劇了這一趨勢,進一步增加了歐洲國家對農業機械化的需求。

曳引機銷售是歐洲農業機械市場成長的主要動力。根據歐洲國家主管機關的數據,2023年歐洲各地將註冊211,700台曳引機,其中158,100台為專用農業曳引機。業界領導者正在引進配備先進技術的新機械,以提高該地區的農業效率和營運可行性。例如,2022年,約翰迪爾公司推出了一款無人操作員田間耕作曳引機,以應對該地區勞動力短缺的挑戰。

歐洲農業機械市場趨勢

技術純熟勞工短缺

歐洲農業傳統上依賴季節性移工作為各成員國的農業勞動力。然而,更好的就業機會、更高的薪資和更高的生活水準正吸引越來越多的農村人口遷移到都市區,導致都市區遷移現象激增。例如,西班牙的農村人口預計將從 2019 年的 19.4% 下降到 2023 年的 18.4%,突顯了這項人口結構變化。此外,農業工作要求高,工作時間長,需要體力勞動,並且經常暴露在風雨中,因此人們對農業的興趣正在下降,尤其是年輕一代。這一趨勢加劇了該地區農業勞動力短缺的問題,並對農業生產力構成了挑戰。

世界銀行預測,歐盟農業就業率將從2020年的4.32%下降到2022年的3.99%,凸顯農業勞動力持續下降。持續的勞動力短缺正在推動歐洲農業向機械化和自動化轉變,因為農民正在尋求其他方法來保持生產力。曳引機作為農業機械的關鍵部件,由於機械化需求的不斷成長,其市場成長潛力巨大。曳引機作為重要的農業機械之一,市場具有巨大的成長潛力。為了提高作物產量和提高農業經營效率,該地區的農民越來越傾向於購買高階曳引機來耕種更大的田地。

德國佔據市場主導地位

德國是歐洲重要的農業機械設備市場。該國以精密工程和創新而聞名,是世界領先的農業機械出口國之一。此外,德國是歐洲最大的農業機械製造國和消費國。

在德國,曳引機是農業機械的主要動力來源。在曳引機市場,愛科集團憑藉 Massey Ferguson 和 Valtra Inc. 等品牌佔據重要地位。市場參與企業正在推出創新設備以提高農業機械化水準。 2022年,凱斯推出大型方形打包機LB 424 XLD。此型號可生產尺寸為 120 公分 x 70 公分的超高密度捆包,密度提高 10%,進而提高捆包品質、處理和轉子切割效率。

德國農民每年都會獲得歐盟的補貼,幫助他們投資昂貴的現代化機械。這項補貼將使農場管理更有效率。然而,隨著工人擴大轉向非農業部門,對執行勞動密集型任務的農業機械的需求日益成長。

歐洲農機產業概況

歐洲農業機械市場主要受眾多跨國公司的影響與推動。同樣,Deutz-Fahr、John Deere、CNH Industrial、CLAAS KGaA mbH 和 AGCO Corporation 是歐洲農業機械市場中佔有主要佔有率的一些知名公司。在這個市場營運的公司旨在透過產品特色、價格、品質、規模和技術創新來提高其影響力。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場概況

- 市場促進因素

- 技術純熟勞工短缺

- 政府支持加強農業機械化

- 市場限制

- 初期採購成本高、維護成本高

- 波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章 市場區隔

- 類型

- 聯結機

- 小於50馬力

- 50至100馬力

- 100~150 HP

- 超過150馬力

- 犁地機械

- 犁

- 光環

- 耕作和耕耘機

- 其他設備

- 灌溉機械

- 噴水灌溉

- 滴灌

- 其他灌溉機械

- 收割機

- 聯合收割機

- 青貯收割機

- 其他收割機械

- 牧草和飼料機械

- 草坪修剪機

- 打包機

- 其他牧草及飼料機械

- 其他類型

- 聯結機

- 地區

- 德國

- 法國

- 英國

- 西班牙

- 義大利

- 俄羅斯

- 其他歐洲國家

第6章 競爭格局

- 最受歡迎的策略

- 市場佔有率分析

- 公司簡介

- CLAAS KGaA mbH

- Deere & Company

- Lely France

- CNH Industrial NV

- Kubota Corporation

- AGCO Corporation

- Same Deutz-Fahr

- Yanmar Co. Ltd

- Kuhn Group

第7章 市場機會與未來趨勢

The Europe Agricultural Machinery Market size is estimated at USD 43.34 billion in 2025, and is expected to reach USD 50.73 billion by 2030, at a CAGR of 3.20% during the forecast period (2025-2030).

Agriculture in the European Union has undergone a significant transformation from its traditionally labor-intensive model, which relied heavily on seasonal immigrant workers in member states' farm fields. The increasing shortage of skilled labor has driven a rise in mechanization across European countries, leading to increased sales of agricultural machinery in the region. World Bank data indicates that employment in agriculture in the European Union decreased from 4.32% in 2020 to 3.99% in 2022. Additional factors contributing to this trend include the reduction in arable land area and declining freshwater availability, further intensifying the demand for farm mechanization in European countries.

Tractor sales are a primary driver of growth in the European agricultural machinery market. According to National Authorities of Europe, 211,700 tractors were registered across Europe in 2023, with 158,100 of these being specifically agricultural tractors. Industry leaders are introducing new machinery equipped with advanced technologies to enhance farming efficiency and ease of operations in the region. For example, in 2022, John Deere & Co. launched an operator-less tractor for field tilling, addressing the challenge of labor shortages in the region.

Europe Agricultural Machinery Market Trends

Shortage of Skilled Labor

European agriculture has traditionally depended on seasonal immigrant workers for farm labor across various member states. However, rural populations are increasingly drawn to urban areas due to better job prospects, higher salaries, and improved living standards, resulting in a rapid increase in rural-to-urban migration. For example, Spain's rural population decreased from 19.4% in 2019 to 18.4% in 2023, highlighting this demographic shift. Furthermore, the demanding nature of farm work, which often involves long hours, physical labor, and exposure to weather conditions, has led to a decline in interest in agricultural careers, particularly among younger generations. This trend has exacerbated the farm labor shortage in the region, creating challenges for agricultural productivity.

According to the World Bank, agricultural employment in the European Union decreased from 4.32% in 2020 to 3.99% in 2022, underscoring the ongoing decline in the agricultural workforce. This persistent labor shortage has prompted a significant shift towards mechanization and automation in European agriculture, as farmers seek alternative solutions to maintain productivity. Tractors, a crucial component of agricultural machinery, have experienced substantial growth potential in the market due to this increased demand for mechanization. Tractors, one of the essential agricultural machinery, have witnessed enormous growth potential in the market. Farmers in the region increasingly prefer purchasing high-end tractors to work on larger fields as part of their effort to improve crop yields and boost farm efficiencies.

Germany Dominates the Market

Germany stands as a significant market for agricultural machinery and implements in Europe. The country's reputation for precision engineering and innovation has positioned it as one of the world's leading exporters of agricultural machinery. Additionally, Germany ranks among the largest manufacturers and consumers of agricultural machinery within Europe.

Tractors serve as the primary power source for agricultural machinery in Germany. AGCO Corporation holds a prominent position in the tractor market, offering brands such as Massey Ferguson and Valtra Inc. Market participants are introducing innovative equipment to promote farm mechanization. In 2022, Case IH launched the LB 424 XLD large square baler model, which produces extra-dense 120 cm x 70 cm bales with a 10% increase in density, enhancing bale quality, handling, and rotor cutting efficiency.

German farmers receive annual subsidies from the European Union for investing in modern machinery, which can be costly. These subsidies enable more efficient farm operations. However, as workers increasingly prefer non-farming sectors, the demand for agricultural machinery to perform labor-intensive tasks is rising.

Europe Agricultural Machinery Industry Overview

The agricultural machinery market in Europe is consolidated and driven primarily by the presence of many global players. Same Deutz-Fahr, John Deere, CNH Industrial, CLAAS KGaA mbH, and AGCO Corporation are some prominent players holding a major share in the agricultural machinery market in Europe. The companies operating in the market aim to strengthen their presence through product features, pricing, quality, scale of operations, and technological innovations.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Shortage of Skilled Labor

- 4.2.2 Government Support to Enhance Farm Mechanization

- 4.3 Market Restraints

- 4.3.1 Heavy Initial Procurement Cost and High Expenditure on Maintenance

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Tractors

- 5.1.1.1 Less than 50 HP

- 5.1.1.2 50 to 100 HP

- 5.1.1.3 100 to 150 HP

- 5.1.1.4 Above 150 HP

- 5.1.2 Plowing and Cultivating Machinery

- 5.1.2.1 Plows

- 5.1.2.2 Harrows

- 5.1.2.3 Cultivators and Tillers

- 5.1.2.4 Other Equipment

- 5.1.3 Irrigation Machinery

- 5.1.3.1 Sprinkler Irrigation

- 5.1.3.2 Drip Irrigation

- 5.1.3.3 Other Irrigation Machinery

- 5.1.4 Harvesting Machinery

- 5.1.4.1 Combine Harvesters

- 5.1.4.2 Forage Harvesters

- 5.1.4.3 Other Harvesting Machinery

- 5.1.5 Haying and Forage Machinery

- 5.1.5.1 Mowers

- 5.1.5.2 Balers

- 5.1.5.3 Other Haying and Forage Machinery

- 5.1.6 Other Types

- 5.1.1 Tractors

- 5.2 Geography

- 5.2.1 Germany

- 5.2.2 France

- 5.2.3 United Kingdom

- 5.2.4 Spain

- 5.2.5 Italy

- 5.2.6 Russia

- 5.2.7 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 CLAAS KGaA mbH

- 6.3.2 Deere & Company

- 6.3.3 Lely France

- 6.3.4 CNH Industrial NV

- 6.3.5 Kubota Corporation

- 6.3.6 AGCO Corporation

- 6.3.7 Same Deutz-Fahr

- 6.3.8 Yanmar Co. Ltd

- 6.3.9 Kuhn Group