|

市場調查報告書

商品編碼

1698520

碳化矽市場機會、成長動力、產業趨勢分析及2025-2034年預測Silicon Carbide Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

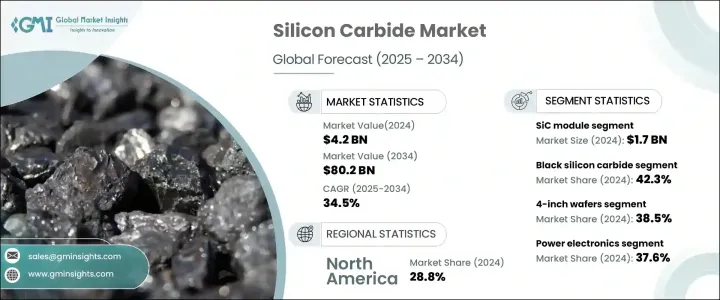

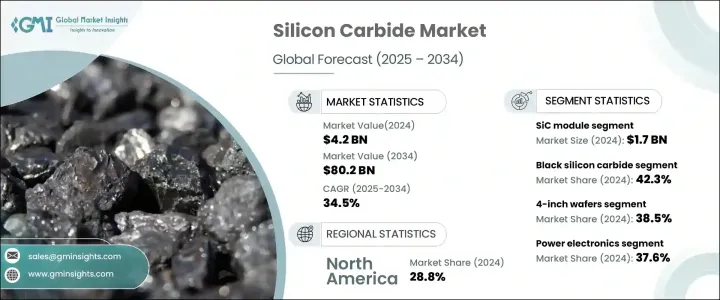

2024 年全球碳化矽市場價值為 42 億美元,預計 2025 年至 2034 年期間的複合年成長率將達到 34.5%,這得益於電動汽車 (EV) 的普及、可再生能源應用的擴大以及對高效電力電子產品的需求不斷成長。隨著各行各業轉向先進的能源解決方案,碳化矽憑藉其卓越的效率、耐用性和熱性能,已成為各種應用中的關鍵材料。

這一成長的主要驅動力之一是全球對電動車的需求激增。汽車製造商擴大將碳化矽元件整合到電力電子設備中,以提高車輛性能、提高充電效率並延長電池續航里程。碳化矽基功率半導體可實現更高的能量轉換效率,減少電力傳動系統中的功率損耗和熱產生。隨著各國政府推出嚴格的排放法規並鼓勵電動車的普及,碳化矽的需求持續加速成長。除了電動車之外,碳化矽在再生能源應用中也發揮著至關重要的作用,尤其是在太陽能和風能系統中。其高導熱性和耐極端條件性提高了能源效率和系統壽命,使其成為下一代電源解決方案的重要組成部分。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 42億美元 |

| 預測值 | 802億美元 |

| 複合年成長率 | 34.5% |

市場按設備類型細分,其中 SiC 模組在 2024 年創造 17 億美元的收入。這些模組由二極體和 MOSFET 等元件組成,廣泛應用於電動車、工業電源和再生能源基礎設施。它們能夠承受高電壓和高溫,因此非常適合電源轉換應用,尤其是電動車逆變器和充電站。隨著汽車產業繼續向電動車轉型,對 SiC 模組的需求預計將大幅上升,從而推動整體市場成長。

碳化矽也按產品類型分類,其中黑碳化矽在 2024 年佔據 42.3% 的主導市場。黑碳化矽因其出色的硬度和強度而廣泛應用於汽車、航太和金屬製造等行業的磨料應用。它在研磨、切割、拋光和耐磨塗層中的應用使其成為高性能製造中不可或缺的一部分。對耐用、高效磨料的需求不斷成長是該行業擴張的關鍵因素。

受電動車技術、工業自動化和再生能源專案進步的推動,北美在 2024 年將佔據全球碳化矽市場佔有率的 28.8%。該地區對能源效率的關注和高性能電子產品的廣泛採用推動了市場擴張。隨著各行各業繼續投資下一代技術,碳化矽將在塑造電力電子和永續能源解決方案的未來方面發揮至關重要的作用。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 對節能電力電子產品的需求不斷增加

- 電動車(EV)的普及率不斷提高

- 再生能源系統的成長

- 5G和電信基礎設施的擴展

- 擴大航太和國防領域的應用

- 產業陷阱與挑戰

- 製造成本高

- 技術複雜性和整合問題

- 成長動力

- 成長潛力分析

- 監管格局

- 技術格局

- 未來市場趨勢

- 差距分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:依產品類型,2021 年至 2034 年

- 主要趨勢

- 黑碳化矽

- 綠碳化矽

- 其他碳化矽類型

第6章:市場估計與預測:按設備類型,2021 年至 2034 年

- 主要趨勢

- SiC分立元件

- 二極體

- 場效電晶體

- BJT(雙極接面電晶體)

- JFET(結型場效電晶體)

- SiC 模組

- 其他SiC裝置

第7章:市場預估與預測:依晶圓尺寸,2021 – 2034

- 主要趨勢

- 2英吋

- 4吋

- 6吋以上

第 8 章:市場估計與預測:按應用,2021 年至 2034 年

- 主要趨勢

- 電力電子

- 電源和逆變器

- 無線充電

- 電網設備

- 工業馬達驅動器

- 電動車充電基礎設施

- 再生能源系統

- 光學設備

- LED照明

- 光子學

- 雷射應用

- 紫外線探測器

- 感測

- 壓力感測器

- 溫度感測器

- 氣體感測器

- 輻射探測器

- 其他應用

第9章:市場估計與預測:依生產方式,2021 年至 2034 年

- 主要趨勢

- 艾奇遜過程

- 物理氣相傳輸(PVT)

- 化學氣相沉積 (CVD)

- 其他生產方法

第 10 章:市場估計與預測:按最終用途產業,2021 年至 2034 年

- 主要趨勢

- 汽車

- 航太與國防

- 電信

- 能源與電力

- 衛生保健

- 電子和半導體

- 工業製造

- 石油和天然氣

- 礦業

- 化學加工

- 消費性電子產品

- 研究與開發

第 11 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第12章:公司簡介

- ROHM Co., Ltd.

- Central Semiconductor Corp.

- Cree, Inc.

- Danfoss A/S

- Fuji Electric Co., Ltd.

- General Electric Company (GE Aviation)

- GeneSiC Semiconductor Inc.

- Global Power Technologies Group

- Hitachi Power Semiconductor Device, Ltd.

- II-VI Incorporated

- Infineon Technologies AG

- Littelfuse, Inc.

- Microsemi Corporation

- Mitsubishi Electric Corporation

- NXP Semiconductors NV

- ON Semiconductor Corporation

- Power Integrations, Inc.

- Renesas Electronics Corporation

- STMicroelectronics NV

- Taiyo Yuden Co., Ltd.

- Toshiba Corporation

- United Silicon Carbide, Inc. (USCi)

The Global Silicon Carbide Market was valued at USD 4.2 billion in 2024 and is projected to expand at a CAGR of 34.5% from 2025 to 2034, driven by the rising adoption of electric vehicles (EVs), expanding renewable energy applications, and increasing demand for high-efficiency power electronics. As industries shift toward advanced energy solutions, silicon carbide has emerged as a crucial material in various applications due to its superior efficiency, durability, and thermal performance.

One of the primary drivers of this growth is the surging demand for EVs worldwide. Automakers are increasingly integrating silicon carbide components into power electronics to enhance vehicle performance, improve charging efficiency, and extend battery range. SiC-based power semiconductors enable higher energy conversion efficiency, reducing power losses and heat generation in electric drivetrains. As governments introduce stringent emissions regulations and incentivize EV adoption, the demand for silicon carbide continues to accelerate. In addition to EVs, silicon carbide plays a critical role in renewable energy applications, particularly in solar and wind power systems. Its high thermal conductivity and resistance to extreme conditions enhance energy efficiency and system longevity, making it an essential component in next-generation power solutions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.2 Billion |

| Forecast Value | $80.2 Billion |

| CAGR | 34.5% |

The market is segmented by device type, with SiC modules generating USD 1.7 billion in revenue in 2024. These modules, which consist of components such as diodes and MOSFETs, are extensively used in electric vehicles, industrial power supplies, and renewable energy infrastructure. Their ability to handle high voltages and temperatures makes them ideal for power conversion applications, particularly in EV inverters and charging stations. As the automotive industry continues transitioning toward electric mobility, the demand for SiC modules is expected to rise significantly, fueling overall market growth.

Silicon carbide is also categorized by product type, with black silicon carbide holding a dominant market share of 42.3% in 2024. Recognized for its exceptional hardness and strength, black SiC is widely utilized in abrasive applications across industries such as automotive, aerospace, and metal fabrication. Its use in grinding, cutting, polishing, and wear-resistant coatings makes it indispensable in high-performance manufacturing. The increasing demand for durable and efficient abrasive materials has been a key factor in the segment's expansion.

North America accounted for 28.8% of the global silicon carbide market share in 2024, driven by advancements in electric vehicle technology, industrial automation, and renewable energy projects. The region's focus on energy efficiency and the widespread adoption of high-performance electronics have propelled market expansion. As industries continue investing in next-generation technologies, silicon carbide is set to play a vital role in shaping the future of power electronics and sustainable energy solutions.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing demand for energy efficient power electronics

- 3.2.1.2 Growing adoption of electric vehicles (EVs)

- 3.2.1.3 Growth in renewable energy systems

- 3.2.1.4 Expansion of 5G and telecommunications infrastructure

- 3.2.1.5 Expanding applications in aerospace and defense

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High manufacturing costs

- 3.2.2.2 Technical complexity and integration issues

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 – 2034 (USD Bn)

- 5.1 Key trends

- 5.2 Black silicon carbide

- 5.3 Green silicon carbide

- 5.4 Other silicon carbide types

Chapter 6 Market Estimates and Forecast, By Device Type, 2021 – 2034 (USD Bn)

- 6.1 Key trends

- 6.2 SiC discrete devices

- 6.2.1 Diodes

- 6.2.2 MOSFETs

- 6.2.3 BJTs (Bipolar Junction Transistors)

- 6.2.4 JFETs (Junction Field Effect Transistors)

- 6.3 SiC modules

- 6.4 Other SiC devices

Chapter 7 Market Estimates and Forecast, By Wafer Size, 2021 – 2034 (USD Bn)

- 7.1 Key trends

- 7.2 2-inch

- 7.3 4-inch

- 7.4 6-inch and above

Chapter 8 Market Estimates and Forecast, By Application, 2021 – 2034 (USD Bn)

- 8.1 Key trends

- 8.2 Power electronics

- 8.2.1 Power supply and inverter

- 8.2.2 Wireless charging

- 8.2.3 Power grid devices

- 8.2.4 Industrial motor drives

- 8.2.5 Electric vehicle charging infrastructure

- 8.2.6 Renewable energy systems

- 8.3 Optical Devices

- 8.3.1 LED lighting

- 8.3.2 Photonics

- 8.3.3 Laser applications

- 8.3.4 UV detectors

- 8.4 Sensing

- 8.4.1 Pressure sensors

- 8.4.2 Temperature sensors

- 8.4.3 Gas sensors

- 8.4.4 Radiation detectors

- 8.4.5 Other applications

Chapter 9 Market Estimates and Forecast, By Production Method, 2021 – 2034 (USD Bn)

- 9.1 Key trends

- 9.2 Acheson process

- 9.3 Physical Vapor Transport (PVT)

- 9.4 Chemical Vapor Deposition (CVD)

- 9.5 Other production methods

Chapter 10 Market Estimates and Forecast, By End Use industry, 2021 – 2034 (USD Bn)

- 10.1 Key trends

- 10.2 Automotive

- 10.3 Aerospace & defense

- 10.4 Telecommunications

- 10.5 Energy & power

- 10.6 Healthcare

- 10.7 Electronics & semiconductors

- 10.8 Industrial manufacturing

- 10.9 Oil & gas

- 10.10 Mining

- 10.11 Chemical processing

- 10.12 Consumer electronics

- 10.13 Research & development

Chapter 11 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Bn & Kilo Tons)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Spain

- 11.3.5 Italy

- 11.3.6 Netherlands

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 Middle East and Africa

- 11.6.1 Saudi Arabia

- 11.6.2 South Africa

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 ROHM Co., Ltd.

- 12.2 Central Semiconductor Corp.

- 12.3 Cree, Inc.

- 12.4 Danfoss A/S

- 12.5 Fuji Electric Co., Ltd.

- 12.6 General Electric Company (GE Aviation)

- 12.7 GeneSiC Semiconductor Inc.

- 12.8 Global Power Technologies Group

- 12.9 Hitachi Power Semiconductor Device, Ltd.

- 12.10 II-VI Incorporated

- 12.11 Infineon Technologies AG

- 12.12 Littelfuse, Inc.

- 12.13 Microsemi Corporation

- 12.14 Mitsubishi Electric Corporation

- 12.15 NXP Semiconductors N.V.

- 12.16 ON Semiconductor Corporation

- 12.17 Power Integrations, Inc.

- 12.18 Renesas Electronics Corporation

- 12.19 STMicroelectronics N.V.

- 12.20 Taiyo Yuden Co., Ltd.

- 12.21 Toshiba Corporation

- 12.22 United Silicon Carbide, Inc. (USCi)