|

市場調查報告書

商品編碼

1611486

碳化矽(SiC)的專利形勢的分析(2024年)Silicon Carbide (SiC) Patent Landscape Analysis 2024 |

||||||

了解 SiC 產業的最新 IP 演變和趨勢。

調查整個 SiC 供應鏈的專利活動。

SiC 技術:複雜且快速發展的前景

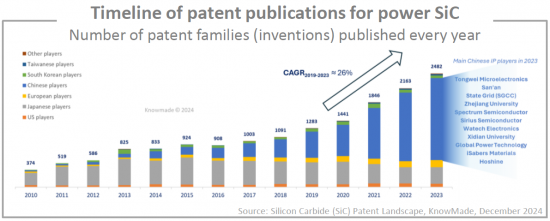

在 2022 年碳化矽 (SiC) 專利格局中,KnowMade 透露,SiC 裝置的智慧財產權 (IP) 活動正在增加。許多歷史悠久的智慧財產權公司在此期間尋求擴大其碳化矽發明的保護範圍。隨著電動車 (EV) 推動功率 SiC 市場的崛起,SiC 公司在歐洲和中國等行業戰略地區申請了更多專利。同時,電動車的繁榮促使許多新進業者加速了 SiC 技術的開發,因此年輕 SiC 市場的早期領導者可能會維持甚至加速其智慧財產權活動,為未來幾年的激烈競爭做好準備。你做。在這種情況下,主要的 SiC 公司可能會利用專利來保護市場佔有率並獲得進入 SiC 行業所需的大量投資。市場競爭的加劇在知識產權領域已經很明顯。

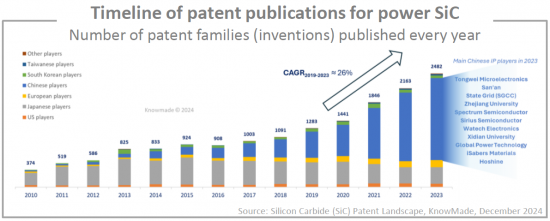

中美之間的地緣政治緊張局勢也促使專利申請量增加,並加速全球(尤其是中國)本土半導體生態系統的形成。 2023年,中國企業將佔整個SiC供應鏈專利公開量的70%以上,新進市場的企業數量也可圈可點,其中包括許多涉足SiC晶圓產業的企業。隨著許多公司參與SiC晶圓的開發,中國已經成功遏制了供應短缺的局面,但激烈的價格競爭讓許多供應商迎來了經濟不穩定的時代。這種新情況可能有利於碳化矽晶圓供應商之間的專利訴訟。

本報告提供全球碳化矽(SiC)產業調查分析,超過1萬9,000件的專利的Excel資料庫之外又加上,全球專利趨勢的說明,及主要企業的IP簡介等資訊。

目錄

簡介

- 報告背景

- 報告的目的

- 研究策略和範圍

- 閱讀指南:在報告中找到正確的訊息

- 專利檢索、選擇與分析技術

- 專利分析術語

Excel資料庫

- Excel 文件,包含本研究所選取的所有專利以及權利人透過統計分析得出的完整數據。

摘要整理

- 亮點

- 關於SiC基板、SiC功率元件、SiC封裝模組和SiC電路的供應鏈細分領域

- 主要知識產權公司的時間表

- 活躍的智慧財產權公司、不活躍的智慧財產權公司、新進入的智慧財產權公司

- 主要專利申請人:依細分市場劃分

- 主要知識產權公司:依國家劃分

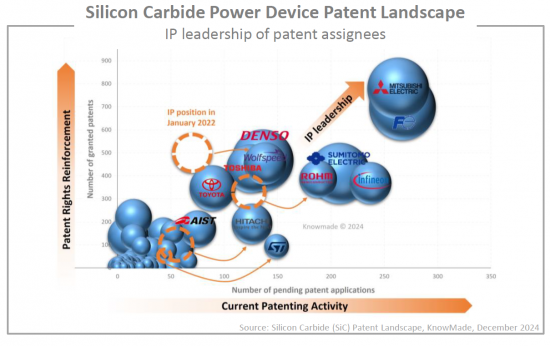

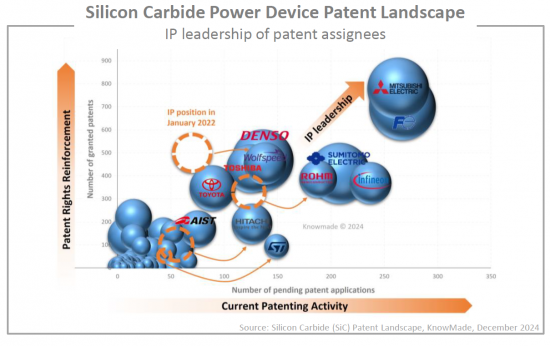

- 專利權人的智慧財產權領導力

專利形勢的分析

專利狀況概覽

- 主要趨勢

- 主要專利持有者

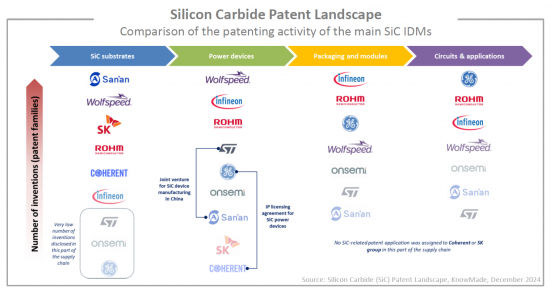

- 主要知識產權公司在整個供應鏈中的定位

- 知識產權新進入者公司

- 近期智慧財產權聯盟及專利交易

- 聚焦中國知識產權企業

- SiC專利領域的中國主要企業

- 中國知識產權新進者

- 中國近期的智慧財產權聯盟與專利交易

- 中國企業進行全球智慧財產權活動

SiC襯底專利狀況

- (包括與散裝、外延片、生長設備、精加工/切片相關的專利)

- 專利公佈的時間序列變化:按子細分

- 主要專利持有者排名

- 主要專利持有者:按細分領域

- 現存專利的地理範圍

- 主要專利持有人和專利申請人:按國家劃分

- 專利權人的智慧財產權領導力

- 專注於體 SiC 和裸 SiC 晶圓

- 聚焦SiC外延片

SiC功率元件專利狀況

- (包括與二極體、MOSFET 和其他裝置及技術方面相關的專利)

- 專利公佈的時間序列變化:按子細分

- 主要專利持有者排名

- 主要專利持有者:按細分領域

- 現存專利的地理範圍

- 主要專利持有人和專利申請人:按國家劃分

- 專利權人的智慧財產權領導力

- 聚焦碳化矽二極體

- 聚焦SiC MOSFET(平面、溝槽MOSFET)

SiC功率模組專利狀況

- (包括與封裝、模組、封裝、晶片連接、寄生效應、熱問題等相關的專利)

- 主要專利持有者排名

- 現存專利的地理範圍

- 主要專利持有人和專利申請人:按國家劃分

- 專利權人的智慧財產權領導力

SiC電路的專利狀況

- 主要專利持有者排名

- 現存專利的地理範圍

- 主要專利持有人和專利申請人:按國家劃分

- 專利權人的智慧財產權領導力

主要的SiC IDM的IP簡介

- 主要的SiC IDM的比較

- 專利公佈的時間序列變化

- 整個 SiC 供應鏈的專利活動水準和智慧財產權組合的可執行性

- 專利持有者在整個 SiC 供應鏈中的智慧財產權領導地位

- SiC MOSFET專利持有者的智慧財產權領先地位

- 有效專利組合的地理範圍

- 全球智慧財產權領導地位

- IP簡介

- 關於每家公司:SiC 專利組合概覽(專利活動、專利法律地位、地理範圍、技術範圍)、最新智慧財產權動態。

- Wolfspeed

- Infineon

- ROHM

- STMicroelectronics

- onsemi

- SK group

- Coherent

- General Electric

- San'an

- 關於每家公司:SiC 專利組合概覽(專利活動、專利法律地位、地理範圍、技術範圍)、最新智慧財產權動態。

KnowMade的簡報

Figure out the latest IP evolutions and trends in the SiC industry.

Explore the patenting activities across the SiC supply chain.

Key features:

- PDF>170 slides

- Excel database containing all patents analyzed in the report (>19,000 patent families), including segmentations + hyperlink to updated online database (legal status, documents etc.)

- Describing the global patenting trends, including time evolution of patent publications, countries of patent filings, etc.

- Identifying the main patent assignees and the IP newcomers in the different segments of the supply chain.

- Determining the status of their patenting activity (active/inactive) and their IP dynamics (ramping up, slowing down, steady).

- Identifying the IP collaborations (patent co-filings) and IP transfers (changes of patent ownership).

- Providing a detailed picture of the Chinese SiC ecosystem focusing on the patenting activity of Chinese entities.

- Patents categorized in 5 main supply chain segments and 10 main sub-segments: bulk SiC & bare SiC wafers, epitaxial SiC substrates (incl. growth apparatus, finishing), SiC devices (diodes, planar MOSFETs, trench MOSFETs), SiC modules (thermal issues, parasitics, die-attach, encapsulation), circuits.

- IP profile of main players: Patent portfolio overview (IP dynamics, segmentation, legal status, geographic coverage, etc.)

SiC technology: A complex and fast-evolving landscape

In the Silicon Carbide (SiC) patent landscape 2022, KnowMade found out that the intellectual property (IP) activities were ramping up for SiC devices. Many historical IP players aimed to increase the perimeter of protection for their SiC inventions at this time. Electric vehicles (EV) had been driving the emergence of the power SiC market, prompting SiC companies to file more patents in strategic regions for this industry, such as Europe and China. In parallel, early leaders in the young SiC market have maintained or even accelerated their IP activities to prepare for a stronger competition in the next few years, since the EV boom led many new players to speed up the development of SiC technology. In this context, patents may be leveraged by leading SiC companies to protect their market share and thereby secure the large investments that have been required to enter the SiC industry. The growing competition in the market is already conspicuous in the IP landscape.

Geopolitical tensions between US and China have also triggered an increase in patent filings, accelerating the formation of local semiconductor ecosystems across the world, especially in China. In 2023, Chinese players were responsible for more than 70% of patent publications across the whole SiC supply chain, with an impressive number of newcomers, of which many companies involved in the SiC wafer industry. With such a high number of companies involved in SiC wafer developments, China has already succeeded in stopping the shortage situation but opened a period of economic instability for many suppliers due to a fierce price competition. This new context may favor patent litigations between SiC wafer suppliers.

Patent landscape overview

The first section of the Silicon Carbide (SiC) Patent Landscape report 2024 describes the global patent competition across the SiC supply chain by identifying the main IP players and newcomers and positioning their patent portfolios in each part of the SiC supply chain. The SiC patent portfolios are also analyzed geographically to highlight important markets in the IP strategy of SiC companies.

For SiC power devices, the patent analysis has been split into diodes, MOSFET and other SiC devices. What's more, for SiC MOSFET, the IP competitive analysis is available for planar MOSFET and trench MOSFET separately. It highlights the fact that most companies in the SiC patent landscape have integrated trench MOSFET in their technological roadmap, leading to an acceleration in patent filings in this area. As a result, trench MOSFET has become an increasingly competitive IP space in recent years.

Furthermore, a special focus is made on China which stands out by the explosion of the number of patent assignees in recent years, and an IP activity that is strongly dominated by domestic patent filings. Few players stand out by filing patent applications outside China. Interestingly, due to the very high patenting activity in China, patent analysis has become very relevant to describe such a dense ecosystem and make it less opaque to global competitors.

Eventually, the patent analysis highlights the IP activities of main market players, which are facing strong competition from many players in this landscape. They are either future market competitors, future integrators of SiC devices such as automotive Tiers-1 and OEM, or even potential suppliers (SiC equipment, materials). Indeed, patents may also be instrumental in negotiations and partnerships across the future SiC supply chain.

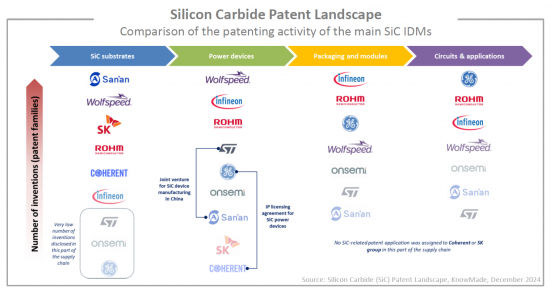

IP profiles of key players

The second section of the Silicon Carbide (SiC) Patent Landscape report 2024 focuses on the IP activities of main SiC device market players and/or companies investing significantly into building a vertically-integrated infrastructure for SiC. Such companies have adopted an IDM business model and look to integrate within the company every step of SiC manufacturing, from material growth, to device manufacturing and packaging. Interestingly, the comparison of their IP activities highlights quite differentiated IP strategies. While certain companies heavily rely on patents to assert their position in the market, other companies have not significantly developed their patent portfolio across the SiC supply chain. Regarding the geographic distribution of patent filings, there are also some discrepancies between players, showing the relative importance of the different markets for each company (US, Japan, Europe, China, South Korea and Taiwan).

This patent analysis provides a complete overview of the SiC patent portfolios held by Wolfspeed, Infineon, onsemi, Rohm, SK, STMicroelectronics, Coherent (and its licensor General Electric) and San'an. By focusing on the recent patenting activities of such players, it is possible to detect small signals, such as involvement in new technological areas (e.g., superjunction structures, trench MOSFET), or a strong IP activity in new regions. As such, it may provide some indications regarding the strategic plans of the company. Eventually, this review of the latest patent publications details the recent evolutions of SiC technology at every level of the supply chain.

Useful Excel patent database

This report includes an extensive Excel database with the 19,000+ patent families (inventions) analyzed in this study, including patent information (numbers, dates, assignees, title, abstract, etc.) and hyperlinks to an updated online database (original documents, legal status, etc.), and segments (bulk SiC, epitaxial SiC substrates, SiC diodes, planar SiC MOSFETs, trench SiC MOSFETs, SiC modules, circuits, etc.). Additionally, the Excel file comprises the complete data by assignee from the statistical analyses, including the number of patent families, timeline of patenting activity, number of granted patents and pending patent applications, and geographical coverage of patent portfolio.

Companies mentioned in the report (non-exhaustive)

Mitsubishi Electric, Sumitomo Electric, Denso, Fuji Electric, Toyota Group, Hitachi, Infineon, Toshiba, Rohm, Resonac, Panasonic , Wolfspeed, SICC, CETC, Nissan, State Grid (SGCC), General Electric, San'an, LG Corporation, CRRC, ABB, Hyundai, Siemens, Global Power Technology, Shindengen Electric Manufacturing, STMicroelectronics, CEC, FerroTec Holdings, Synlight Crystal, Onsemi, Bosch, Disco, Kansai Electric Power (KEPCO), TankeBlue, SK group, Tongwei Microelectronics, Midea, BASiC Semiconductor, TYSiC - Tianyu Semiconductor Technology, PN Junction Semiconductor, iSabers Materials, Spectrum Semiconductor, Shin-Etsu, KY Semiconductor, Sanken Electric, Gree Electric Appliances, Century Goldray (CENGOL), Sharp, Kyocera, Watech Electronics, Sirius Semiconductor, Huawei, Proterial (Hitachi Metals), Senic, Toyo Tanso, Shanghai Hestia Power, Coherent, YASC - Anhui Yangtze Advanced Semiconductor, GlobalWafers, BYD, Northrop Grumman, Microchip Technology, EpiWorld, Volkswagen Group, Sumitomo Metal Mining, JRC - Japan Radio, Semikron Danfoss, Chongqing Wattscience Electronic Technology, Hoshine, Power Integrations, Meidensha Electric Manufacturing, StarPower Semiconductor, United Nova Technology (UNT), Soitec, Delta Electronics, ZF, Guangzhou Summit Crystal Semiconductor (GZSC), Jiangsu Jixin Advanced Materials, Xiner, Huaxinwei Semiconductor Technology (Beijing) , Semisouth Lab, Beijing Microcore Technology, Hypersics Semiconductor, SiCentury, Macrocore Semiconductor, Daikin Industries, Nissin Electric, Raytheon Technologies, NCE Power, etc.

TABLE OF CONTENTS

INTRODUCTION

- Context of the report

- Objectives of the report

- Research strategy and scope of the report

- Reading guide: find the right information in the report

- Methodology for patent search, selection and analysis

- Terminology for patent analysis

EXCEL DATABASE

- Excel file that includes all patent selected for this study, along with the complete data by assignee from the statistical analyses.

EXECUTIVE SUMMARY

- Highlights

- For each supply chain segment SiC substrates, SiC power devices, SiC packaging & modules, and SiC circuits:

- Timeline of main IP players

- IP players still active, IP players no longer active, IP newcomers

- Leading patent assignees by sub-segments

- Leading IP players by country

- IP leadership of patent assignees

PATENT LANDSCAPE ANALYSIS

Patent Landscape Overview

- Main trends

- Main patent owners

- Position of main IP players across the supply chain

- IP newcomers

- Recent IP collaborations & patent transactions

- Focus on Chinese IP players

- Main Chinese companies in the SiC patent landscape

- Chinese IP newcomers

- Recent Chinese IP collaborations & patent transactions

- Chinese entities with global IP activities

SiC Substrate Patent Landscape

- (Includes patents related to bulk, epiwafers, growth apparatus, and finishing & slicing)

- Time evolution of patent publications by sub-segments

- Ranking of main patent assignees

- Main patent assignees by sub-segments

- Geographic coverage of alive patents

- Main patent owners and patent applicants by countries

- IP leadership of patent assignees

- Focus on Bulk SiC and bare SiC wafers

- Focus on SiC epitaxial wafers

SiC Power Devices Patent Landscape

- (Includes patents related to diodes, MOSFETs, other devices and technological aspects)

- Time evolution of patent publications by sub-segments

- Ranking of main patent assignees

- Main patent assignees by sub-segments

- Geographic coverage of alive patents

- Main patent owners and patent applicants by countries

- IP leadership of patent assignees

- Focus on SiC diodes

- Focus on SiC MOSFETs (planar and trench MOSFETs)

SiC Power Modules Patent Landscape

- (Includes patents related to packaging, modules, encapsulation, die-attach, parasitics, thermal issues, etc.)

- Ranking of main patent assignees

- Geographic coverage of alive patents

- Main patent owners and patent applicants by countries

- IP leadership of patent assignees

SiC Circuits Patent Landscape

- Ranking of main patent assignees

- Geographic coverage of alive patents

- Main patent owners and patent applicants by countries

- IP leadership of patent assignees

IP PROFILES OF MAIN SiC IDM

- Comparison between main SiC IDM

- Time evolution of patent publications

- Level of patenting activity and IP portfolio enforceability across the SiC supply chain

- IP leadership of patent assignees across the SiC supply chain

- IP leadership of patent assignees for SiC MOSFET

- Geographical coverage of alive patent portfolio

- IP leadership across the world

- IP profiles

- For each player: SiC patent portfolio overview (patenting activity, patent legal status, geographical coverage, technology coverage), and latest IP developments.

- Wolfspeed

- Infineon

- ROHM

- STMicroelectronics

- onsemi

- SK group

- Coherent

- General Electric

- San'an

- For each player: SiC patent portfolio overview (patenting activity, patent legal status, geographical coverage, technology coverage), and latest IP developments.