|

市場調查報告書

商品編碼

1698590

半導體代工市場機會、成長動力、產業趨勢分析及2025-2034年預測Semiconductor Foundry Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

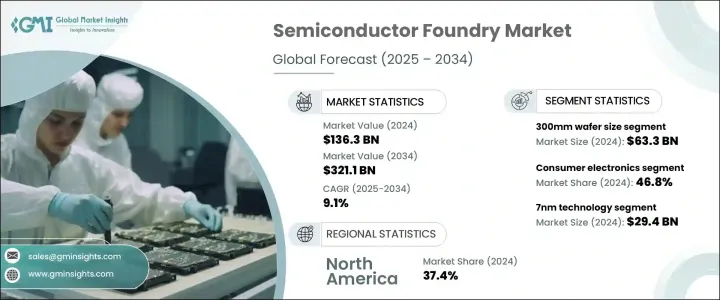

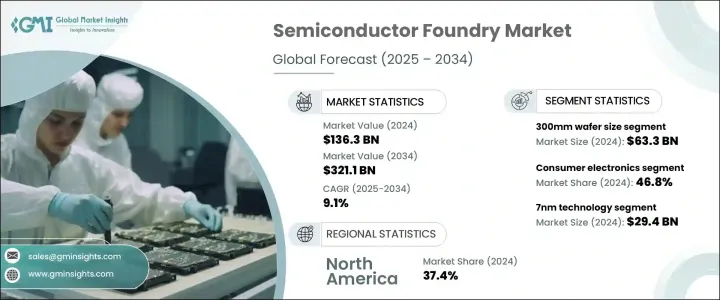

2024 年全球半導體代工市場價值為 1,363 億美元,預計到 2034 年將以 9.1% 的複合年成長率成長。市場擴張的動力來自於對人工智慧應用不斷成長的需求以及封裝技術的進步。基於人工智慧的應用需要高運算能力,從而推動了對 GPU、TPU 和人工智慧加速器等專用晶片的需求。雲端運算、自主系統、醫療保健和金融技術中人工智慧的應用日益廣泛,加劇了對先進半導體解決方案的需求。隨著深度學習、自然語言處理和電腦視覺中的工作負載變得越來越複雜,半導體代工廠正在投資尖端製程節點,包括 5nm 及以下製程節點。隨著企業尋求提高處理能力並最佳化能源使用,擴大高效能、節能晶片的製造能力仍是當務之急。

先進封裝解決方案的創新正在進一步塑造產業成長。現代半導體設計面臨著功率效率和性能方面的挑戰,因為傳統的單晶片結構難以滿足不斷發展的人工智慧和高效能運算需求。先進的封裝方法,包括 2.5D/3D 整合和小晶片,可以實現更好的互連、更高的能源效率和卓越的運算能力。在國家計劃和私營部門資金的支持下,對這些技術的投資增加正在推動對高性能半導體解決方案的需求。隨著技術的發展,代工廠正專注於複雜的封裝技術以維持產業競爭力。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 1363億美元 |

| 預測值 | 3211億美元 |

| 複合年成長率 | 9.1% |

汽車產業對半導體代工業務的成長做出了重大貢獻。隨著 ADAS、EV 技術和物聯網車輛系統的融合,對高性能半導體元件的需求激增。現代汽車晶片確保無縫即時資料處理和連接,這對於增強車輛的安全性和自動化至關重要。汽車電子產品日益複雜,需要對 ADAS、電動傳動系統和資訊娛樂系統的半導體製造進行投資,從而擴大該領域的代工機會。

按晶圓尺寸進行市場細分顯示 450 毫米類別將快速擴張,預計複合年成長率為 10.5%。隨著半導體裝置變得越來越先進,公司正在轉向更大的晶圓來提高生產效率和可擴展性。 300 毫米晶圓市場價值 633 億美元,由於異構整合和 3D 堆疊等晶片架構的進步,該市場正在實現成長。同時,對於 5G 網路和智慧型手機中的 MEMS 和 RF 組件至關重要的 200 毫米晶圓,預計到 2034 年將超過 813 億美元。

市場也按應用進行分類,消費性電子產品將在 2024 年佔據 46.8% 的市場。物聯網設備的採用率和人工智慧的整合不斷提高,將繼續推動這一領域的需求。在資料中心擴張和 5G 部署的推動下,通訊業預計將以 10.9% 的複合年成長率成長。汽車產業將在 2024 年佔據 13.6% 的市場佔有率,繼續推動對電動車和配備 ADAS 的汽車的半導體解決方案的需求。工業應用也在興起,人工智慧驅動的自動化解決方案推動了對高階半導體元件的需求。

從技術節點來看,7nm製程技術在高效能運算領域扮演著至關重要的角色,預計2024年價值將達到294億美元。 10nm 節點的複合年成長率為 9.7%,以滿足高階行動處理器和計算設備的需求。在汽車和工業自動化應用的推動下,14nm 節點正在顯著成長,預計到 2034 年收入將超過 480 億美元。廣泛應用於無線通訊基礎設施的 22nm 製程節點預計將以 7.8% 的複合年成長率成長,而 OLED 顯示器和網路解決方案對 28nm 節點的需求仍然很大。

從地區來看,北美引領全球市場,2024 年佔 37.4% 的市佔率。該地區的主導地位歸功於強大的半導體製造能力、對先進晶片設計的投資以及對尖端半導體技術的早期採用。

目錄

第1章:方法論與範圍

- 市場範圍和定義

- 基礎估算與計算

- 預測計算

- 資料來源

- 基本的

- 次要

- 付費來源

- 公共資源

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商矩陣

- 利潤率分析

- 技術與創新格局

- 專利分析

- 重要新聞和舉措

- 監管格局

- 衝擊力

- 成長動力

- 人工智慧應用需求激增

- 汽車產業的轉型

- 先進封裝技術

- 超大規模資料中心擴建

- 採用5G技術

- 產業陷阱與挑戰

- 供應鏈中斷

- 高昂的研發和資本成本

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:按技術節點,2021 - 2032 年

- 主要趨勢

- 7奈米

- 10奈米

- 14奈米

- 22奈米

- 28奈米

- 40奈米

- 65奈米

- 90奈米

- 其他

第6章:市場估計與預測:按應用,2021 - 2032 年

- 主要趨勢

- 消費性電子產品

- 溝通

- 汽車

- 工業的

- 其他

第7章:市場預估與預測:依晶圓尺寸,2021 - 2032

- 主要趨勢

- 200毫米

- 300毫米

- 450毫米

第8章:市場估計與預測:按地區,2021 - 2032 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳新銀行

- 亞太其他地區

- 拉丁美洲

- 巴西

- 墨西哥

- 拉丁美洲其他地區

- MEA

- 阿拉伯聯合大公國

- 南非

- 沙烏地阿拉伯

- MEA 其餘地區

第9章:公司簡介

- Dongbu Hitek Co. Ltd

- Globalfoundries Inc.

- Hua Hong Semiconductor Limited

- Intel Corporation

- Microchip Technologies Inc.

- NXP Semiconductors NV

- ON Semiconductor Corporation

- Powerchip Technology Corporation

- Renesas Electronics Corporation

- Samsung Electronics Co. Ltd (Samsung Foundry)

- Semiconductor Manufacturing International Corporation (SMIC)

9.12 意法半導體

- 德州儀器公司

- 塔爾半導體有限公司

- 台積電有限公司

- 聯華電子(UMC)

- 萬兆國際半導體公司

- X-FAB矽晶圓代工廠

The Global Semiconductor Foundry Market, valued at USD 136.3 billion in 2024, is expected to grow at a 9.1% CAGR through 2034. Market expansion is driven by rising demand for AI applications and advancements in packaging technologies. AI-based applications require high-computing capabilities, fueling the demand for specialized chips like GPUs, TPUs, and AI accelerators. Increased adoption of AI in cloud computing, autonomous systems, healthcare, and financial technology has intensified the need for advanced semiconductor solutions. As workloads in deep learning, natural language processing, and computer vision become more complex, semiconductor foundries are investing in cutting-edge process nodes, including 5nm and below. Expanding manufacturing capacity for high-performance, energy-efficient chips remains a priority as companies seek to enhance processing power while optimizing energy use.

Innovations in advanced packaging solutions are further shaping industry growth. Modern semiconductor designs face challenges in power efficiency and performance as traditional monolithic structures struggle to meet evolving AI and HPC demands. Advanced packaging methods, including 2.5D/3D integration and chiplets, enable better interconnects, improved energy efficiency, and superior computing power. Increased investment in these technologies, backed by national programs and private sector funding, is driving demand for high-performance semiconductor solutions. As technology evolves, foundries are focusing on sophisticated packaging techniques to stay competitive in the industry.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $136.3 Billion |

| Forecast Value | $321.1 Billion |

| CAGR | 9.1% |

The automotive sector is significantly contributing to semiconductor foundry growth. With the integration of ADAS, EV technologies, and IoT-enabled vehicle systems, the need for high-performance semiconductor components has surged. Modern automotive chips ensure seamless real-time data processing and connectivity, which are essential for enhanced safety and automation in vehicles. The increasing complexity of automotive electronics necessitates investments in semiconductor manufacturing for ADAS, electric drivetrains, and infotainment systems, expanding foundry opportunities in this sector.

Market segmentation by wafer size indicates rapid expansion in the 450mm category, expected to grow at a 10.5% CAGR. As semiconductor devices become more advanced, companies are turning to larger wafers to increase production efficiency and scalability. The 300mm wafer segment, valued at USD 63.3 billion in 2024, is witnessing growth due to advancements in chip architectures like heterogeneous integration and 3D stacking. Meanwhile, 200mm wafers, essential for MEMS and RF components in 5G networks and smartphones, are projected to surpass USD 81.3 billion by 2034.

The market is also categorized by application, with consumer electronics dominating at 46.8% market share in 2024. Rising IoT device adoption and AI integration continue to drive demand in this segment. Communications is expected to grow at a 10.9% CAGR, propelled by data center expansions and 5G rollouts. The automotive sector, accounting for 13.6% of the market in 2024, continues to drive demand for semiconductor solutions in EVs and ADAS-equipped vehicles. Industrial applications are also on the rise, with AI-driven automation solutions fueling demand for high-grade semiconductor components.

In terms of technology nodes, 7nm process technology, valued at USD 29.4 billion in 2024, plays a crucial role in high-performance computing. The 10nm node is expanding at a 9.7% CAGR, catering to premium mobile processors and computing devices. The 14nm node is growing significantly, driven by applications in automotive and industrial automation, with projected revenues surpassing USD 48 billion by 2034. The 22nm process node, widely used in wireless communication infrastructure, is expected to grow at a 7.8% CAGR, while the 28nm node remains in demand for OLED displays and networking solutions.

Regionally, North America leads the global market, holding 37.4% market share in 2024. The region's dominance is attributed to strong semiconductor manufacturing capabilities, investments in advanced chip design, and early adoption of cutting-edge semiconductor technologies.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2032

- 2.2 Business trends

- 2.2.1 Total addressable market (TAM), 2024-2032

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Vendor matrix

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Key news and initiatives

- 3.7 Regulatory landscape

- 3.8 Impact forces

- 3.8.1 Growth drivers

- 3.8.1.1 Surging demand for AI Applications

- 3.8.1.2 Transformation in Automotive industry

- 3.8.1.3 Advanced Packaging Technologies

- 3.8.1.4 Expansion of Hyperscale Data Centre

- 3.8.1.5 Adoption of 5G technologies

- 3.8.2 Industry pitfalls & challenges

- 3.8.2.1 Supply Chain Disruptions

- 3.8.2.2 High R&D and Capital Costs

- 3.8.1 Growth drivers

- 3.9 Growth potential analysis

- 3.10 Porter's analysis

- 3.10.1 Supplier power

- 3.10.2 Buyer power

- 3.10.3 Threat of new entrants

- 3.10.4 Threat of substitutes

- 3.10.5 Industry rivalry

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2023

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Technology Node, 2021 - 2032 (USD Billion)

- 5.1 Key trends

- 5.2 7nm

- 5.3 10nm

- 5.4 14nm

- 5.5 22nm

- 5.6 28nm

- 5.7 40nm

- 5.8 65nm

- 5.9 90nm

- 5.10 Others

Chapter 6 Market Estimates & Forecast, By Application, 2021 - 2032 (USD Billion)

- 6.1 Key trends

- 6.2 Consumer electronics

- 6.3 Communication

- 6.4 Automotive

- 6.5 Industrial

- 6.6 Others

Chapter 7 Market Estimates & Forecast, By Wafer Size, 2021 - 2032 (USD Billion)

- 7.1 Key trends

- 7.2 200mm

- 7.3 300mm

- 7.4 450mm

Chapter 8 Market Estimates & Forecast, By Region, 2021 - 2032 (USD Billion)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 ANZ

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Rest of Latin America

- 8.6 MEA

- 8.6.1 UAE

- 8.6.2 South Africa

- 8.6.3 Saudi Arabia

- 8.6.4 Rest of MEA

Chapter 9 Company Profiles

- 9.1 Dongbu Hitek Co. Ltd

- 9.2 Globalfoundries Inc.

- 9.3 Hua Hong Semiconductor Limited

- 9.4 Intel Corporation

- 9.5 Microchip Technologies Inc.

- 9.6 NXP Semiconductors NV

- 9.7 ON Semiconductor Corporation

- 9.8 Powerchip Technology Corporation

- 9.9 Renesas Electronics Corporation

- 9.10 Samsung Electronics Co. Ltd (Samsung Foundry)

- 9.11 Semiconductor Manufacturing International Corporation (SMIC)

9.12 STMicroelectronics NV

- 9.13 Texas Instruments Inc.

- 9.14 Tower Semiconductor Ltd.

- 9.15 TSMC Limited

- 9.16 United Microelectronics Corporation (UMC)

- 9.17 Vanguard International Semiconductor Corporation

- 9.18 X-FAB Silicon Foundries