|

市場調查報告書

商品編碼

1699261

能源即服務 (EaaS) 市場機會、成長動力、產業趨勢分析及 2025-2034 年預測Energy as a Service (EaaS) Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

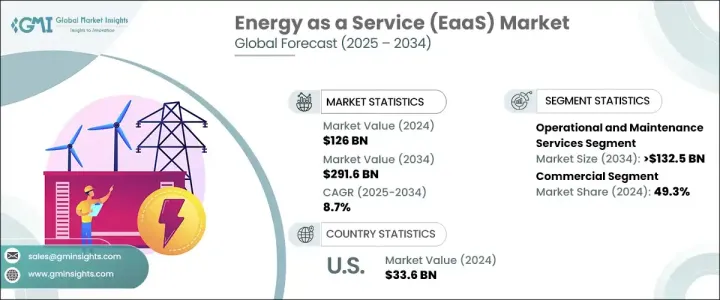

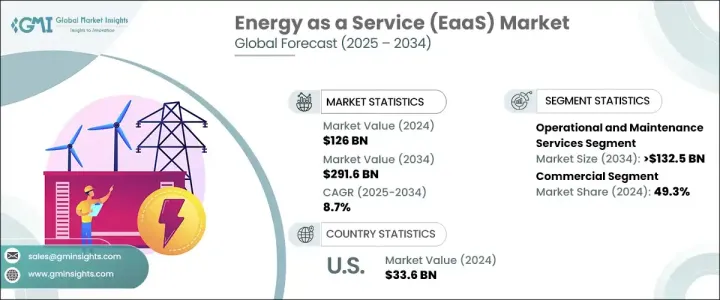

2024 年全球能源即服務 (EaaS) 市場估值達到 1,260 億美元,預計 2025 年至 2034 年的複合年成長率為 8.7%。這一成長是由日益向永續發展轉變所推動的,並得到政府支持性激勵措施和各行各業能源需求激增的推動。企業和機構正在積極尋求具有成本效益、有彈性且分散的能源解決方案,以最佳化消耗並提高效率。基於訂閱的能源服務模式因其能夠提供長期成本節約和營運優勢而越來越受到關注。市場動態受到該產業對能源效率、電網現代化和數位轉型日益重視的影響。物聯網感測器、預測性維護工具和即時分析等先進技術的日益整合正在改善能源管理,使 EaaS 解決方案對企業來說更加可行。世界各國政府也正在實施嚴格的能源法規和資助計劃,以促進永續能源計劃,進一步推動其採用。隨著人們越來越關注減少碳足跡和提高能源彈性,對靈活和可擴展的 EaaS 模型的需求正在上升,為未來十年持續的市場擴張奠定了基礎。

該行業分為能源供應服務、營運和維護服務以及能源效率和最佳化服務。營運和維護服務在確保能源系統的可靠性和性能方面發揮著至關重要的作用。隨著企業優先考慮提高效率和永續性的解決方案,這些服務預計到 2034 年將產生 1,325 億美元的收入。透過提供持續的能源供應、最佳化的營運和最小化的停機時間,這些服務可協助組織實現更好的能源管理,同時保持成本效益。對無縫基礎設施維護和營運支援日益成長的需求正在推動其廣泛採用,從而使企業能夠降低風險並提高長期能源效能。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 1260億美元 |

| 預測值 | 2916億美元 |

| 複合年成長率 | 8.7% |

就最終用途而言,市場分為住宅、商業、工業和公用事業部門。 2024 年,商業部門佔據了 49.3% 的市場佔有率,反映出企業對節能解決方案的需求日益成長。不斷上漲的營運費用和更嚴格的監管要求迫使商業機構採用 EaaS 模型,以確保節省成本、最佳化能源並遵守永續發展要求。這些服務還提供可擴展的能源解決方案,以滿足商業設施的特定需求,提高效率並降低費用。

策略合作夥伴關係正在成為在這個市場營運的公司的關鍵成長策略,幫助他們擴大影響力並開發創新服務產品。 2024年美國市場估值為336億美元,北美佔全球市場佔有率的30.8%以上。由於能源成本上升和對現代化能源基礎設施的需求,預計到 2034 年,這一區域主導地位將進一步增強。電網老化導致效率下降和停電風險增加,促使企業投資於資本投入更低、可靠性更高的 EaaS 解決方案。

目錄

第1章:方法論與範圍

- 市場定義

- 基礎估算與計算

- 預測計算

- 初步研究與驗證

- 主要來源

- 資料探勘來源

- 市場定義

第2章:執行摘要

第3章:行業洞察

- 產業生態系統

- 監管格局

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 戰略儀表板

- 創新與技術格局

第5章:市場規模與預測:依類型,2021 年至 2034 年

- 主要趨勢

- 能源供應服務

- 營運和維護服務

- 能源效率和最佳化服務

第6章:市場規模及預測:依最終用途,2021 年至 2034 年

- 主要趨勢

- 住宅

- 商業的

- 工業的

- 公用事業

第7章:市場規模及預測:依地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 義大利

- 英國

- 法國

- 丹麥

- 亞太地區

- 中國

- 韓國

- 印度

- 日本

- 世界其他地區

第8章:公司簡介

- Alpiq

- Ameresco

- Bernhard Energy Solutions

- Capstone Green Energy Corporation

- Centrica

- Contemporary Energy Solutions

- Edison Energy

- Enel X

- EDF Energy

- Honeywell International

- IonicBlue

- Schneider Electric

- Siemens

- WGL Energy

The Global Energy As A Service (EaaS) Market reached a valuation of USD 126 billion in 2024 and is projected to grow at a CAGR of 8.7% from 2025 to 2034. This growth is driven by the increasing shift toward sustainability, reinforced by supportive government incentives and surging energy demand across industries. Businesses and institutions are actively seeking cost-effective, resilient, and decentralized energy solutions to optimize consumption and enhance efficiency. Subscription-based energy service models are gaining traction as they provide long-term cost savings and operational advantages. Market dynamics are further influenced by the rising emphasis on energy efficiency, grid modernization, and digital transformation in the sector. The growing integration of advanced technologies, such as IoT sensors, predictive maintenance tools, and real-time analytics, is improving energy management, making EaaS solutions more viable for businesses. Governments worldwide are also implementing stringent energy regulations and funding programs to promote sustainable energy initiatives, further driving adoption. With an increasing focus on reducing carbon footprints and improving energy resilience, the demand for flexible and scalable EaaS models is rising, setting the stage for sustained market expansion over the next decade.

The industry is categorized into energy supply services, operational and maintenance services, and energy efficiency and optimization services. Operational and maintenance services play a crucial role in ensuring the reliability and performance of energy systems. These services are projected to generate USD 132.5 billion by 2034 as businesses prioritize solutions that enhance efficiency and sustainability. By providing continuous energy supply, optimized operations, and minimized downtime, these services help organizations achieve better energy management while maintaining cost-effectiveness. The rising need for seamless infrastructure maintenance and operational support is driving widespread adoption, allowing businesses to reduce risks and improve long-term energy performance.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $126 Billion |

| Forecast Value | $291.6 Billion |

| CAGR | 8.7% |

In terms of end use, the market is segmented into residential, commercial, industrial, and utility sectors. The commercial sector accounted for 49.3% of the market share in 2024, reflecting the growing demand for energy-efficient solutions among businesses. Rising operational expenses and stricter regulatory requirements are compelling commercial establishments to adopt EaaS models that ensure cost savings, energy optimization, and compliance with sustainability mandates. These services also offer scalable energy solutions tailored to the specific needs of commercial facilities, boosting efficiency and lowering expenses.

Strategic partnerships are emerging as a key growth strategy for companies operating in this market, helping them expand their reach and develop innovative service offerings. The U.S. market held a valuation of USD 33.6 billion in 2024, with North America accounting for more than 30.8% of the global market share. This regional dominance is expected to grow further by 2034, fueled by increasing energy costs and the need for modernized energy infrastructure. Aging power grids are leading to efficiency declines and higher risks of outages, prompting businesses to invest in EaaS solutions that offer lower capital investment and greater reliability.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market Definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 – 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Strategic dashboard

- 4.3 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Type, 2021 – 2034 (USD Billion)

- 5.1 Key trends

- 5.2 Energy supply service

- 5.3 Operational and Maintenance services

- 5.4 Energy Efficiency and Optimization services

Chapter 6 Market Size and Forecast, By End Use, 2021 – 2034 (USD Billion)

- 6.1 Key trends

- 6.2 Residential

- 6.3 Commercial

- 6.4 Industrial

- 6.5 Utility

Chapter 7 Market Size and Forecast, By Region, 2021 – 2034 (USD Billion)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.2.3 Mexico

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 Italy

- 7.3.3 UK

- 7.3.4 France

- 7.3.5 Denmark

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 South Korea

- 7.4.3 India

- 7.4.4 Japan

- 7.5 Rest of World

Chapter 8 Company Profiles

- 8.1 Alpiq

- 8.2 Ameresco

- 8.3 Bernhard Energy Solutions

- 8.4 Capstone Green Energy Corporation

- 8.5 Centrica

- 8.6 Contemporary Energy Solutions

- 8.7 Edison Energy

- 8.8 Enel X

- 8.9 EDF Energy

- 8.10 Honeywell International

- 8.11 IonicBlue

- 8.12 Schneider Electric

- 8.13 Siemens

- 8.14 WGL Energy