|

市場調查報告書

商品編碼

1636168

能源物流 -市場佔有率分析、產業趨勢/統計、成長預測(2025-2030)Energy Logistics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

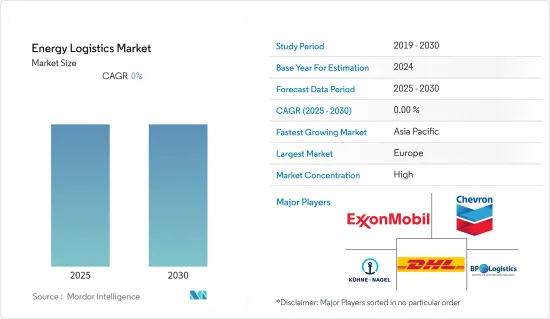

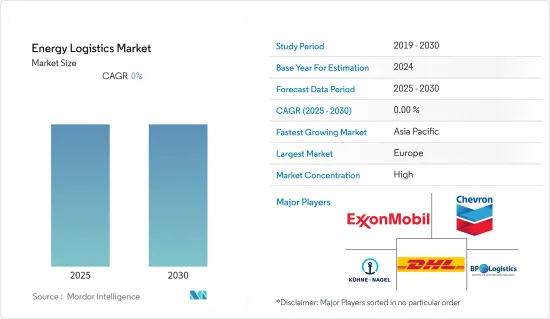

能源物流市場預計在預測期內複合年成長率為 0%

主要亮點

- 國際能源總署 (IEA) 表示,能源價格上漲、對能源安全的擔憂以及更強力的氣候政策結束了天然氣十年的快速成長,導致 2021 年經濟前景比預期更差。

- 到 2030 年,石油需求預計將以每年 0.8% 的速度成長,達到每天 1.03 億桶左右的尖峰時段,但電動車和效率的提高將減少需求。隨著天然氣價格上漲,預計部分地區能源和工業部門對煤炭的需求將暫時增加,但排放努力很快將導致煤炭需求下降,預計10年內需求將下降。

- 可再生能源,特別是太陽能和風能,到 2023 年將佔全球發電量的 28%,但到 2030 年將佔 43%。能源危機正在改變長期的需求趨勢。

- 受到全球價格飆升嚴重打擊的行業現在面臨生產配置的真正風險。消費者正在重新評估他們的能源消費模式,以應對價格上漲以及在某些情況下採取的緊急需求減少舉措。

- 政策反應各不相同,但許多都著重於加速清潔能源投資。這意味著能源領域更加重視可再生能源,並加速工業流程、車輛和暖氣領域的電氣化。

- 能源危機是促進能源安全和減少排放的決定性時刻,因為許多應對危機的措施可能與實現全球氣候目標所需的措施一致。

能源物流市場趨勢

石油和天然氣領域蓬勃發展

石油和天然氣產業是能源物流市場的重要組成部分,因為石油和天然氣仍然是全球重要的能源來源。該部門包括原油、精煉石油產品和天然氣的運輸、儲存和分銷。

根據國際能源總署(IEA)預測,在石化和航空業強勁需求的推動下,2022年至2028年石油需求預計將成長6%,達到1.057億毫米/日。然而,這種累積成長意味著年需求成長將從 2023 年的約 2.4 Mb/d 放緩至 2028 年的約 0.4 Mb/d,這表明需求高峰即將到來。

非OPEC+石油生產國計畫在中期增加全球供給能力,其中美國、巴西和圭亞那共和國處於領先地位,預計2028年石油產量將增加510萬桶/日。 OPEC+內部的產能計畫以沙烏地阿拉伯、阿拉伯聯合大公國和伊拉克為主導,非洲和亞洲成員國的產量持續下降,俄羅斯產量預計因制裁也將下降。這意味著23個OPEC+國家的產能在預測期內將增加80萬桶/天。

能源物流的石油和天然氣部分受到多種因素的影響。市場需求、地緣政治因素和法律規範在塑造產業方面發揮著重要作用。石油價格波動、全球能源政策變化以及地緣政治緊張局勢都會影響油氣資源的運輸和分配。

全球能源需求增加

- 預計2050年全球電力需求將達到660兆BTU,比2023年成長18%。由於能源效率的提高減少了人口成長帶來的能源需求,預計到 2050 年,住宅和商業初級能源需求將下降約 15%。

- 最大且成長最快的能源部門是發電,其推動力是開發中國家擴大獲得可靠的能源。已開發國家能源效率的提高將部分抵消電氣化的成長。

- 新建築和基礎設施的建設以及滿足人類需求的產品的生產支持了工業部門的成長。

- 隨著經濟的擴張和貨物運輸需求的增加,對商業運輸的需求也不斷增加。然而,個人流動性的增加被效率的提高和電動車的增加所抵消。

- 隨著新興經濟體的人口和經濟成長,全球能源消費的佔有率將持續成長,到2050年將達到70%左右。

- 新興國家推動了全球100%以上的能源需求成長。已開發經濟體能源效率的提高速度超過了經濟成長速度,有助於抵消傳統上伴隨經濟成長而來的能源需求的成長。 2023 年美國和歐洲的總能源消耗總合預計將從 35% 下降到 2050 年的約 20%。

能源物流產業概況

能源物流市場的競爭格局高度多元化且充滿活力,眾多參與企業爭奪市場佔有率。

埃克森美孚、雪佛龍和英國石油等主要綜合石油公司在能源物流市場佔有很大佔有率。這些公司擁有自己的運輸和物流部門,可以控制從生產到分銷的整個供應鏈。這些公司通常擁有廣泛的基礎設施,如管道、儲存碼頭和油輪船隊,這使它們在效率和成本效益方面具有競爭優勢。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

- 分析方法

- 調查階段

第3章執行摘要

第4章市場洞察

- 市場概況

- 目前的市場狀況

- 工業技術趨勢

- 政府措施和法規

- 電子商務洞察

- 價值鏈/供應鏈分析

- 供需分析

- COVID-19 對市場的影響

第5章市場動態

- 促進因素

- 支持市場的產業成長

- 全球貿易驅動市場

- 抑制因素

- 影響市場的合規挑戰

- 有限的基礎設施阻礙了市場

- 機會

- 市場驅動的技術進步

- 推動市場的永續實踐

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者/買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第6章 市場細分

- 按用途

- 石油和天然氣

- 可再生能源

- 發電

- 能源開採

- 按最終用戶

- 政府部門

- 私部門

- 透過交通工具

- 鐵路

- 航空

- 路

- 水路

第7章 競爭格局

- 公司簡介

- ExxonMobil

- Chevron

- BP

- DHL

- Kuehne+Nagel

- CH Robinson

- Maersk

- Mediterranean Shipping Company(MSC)

- COSCO Shipping Lines

- TransCanada*

- 其他公司

第8章市場的未來

第9章 附錄

The Energy Logistics Market is expected to register a CAGR of 0% during the forecast period.

Key Highlights

- According to the International Energy Agency (IEA), the economic outlook is less optimistic than 2021's outlook, with high energy prices, energy security concerns, and reinforced climate policies ending a decade of rapid growth for natural gas; it is projected to grow at a rate of 0.4% annually between now and 2030 compared to 2.3% between 2010 and 2019.

- Oil demand is projected to grow by 0.8% annually to 2030, reaching a peak of around 103 million barrels per day, with EVs and efficiency improvements reducing its demand. Coal is expected to witness a temporary increase in demand from some regions from the energy and industry sectors as natural gas prices rise, but efforts to cut emissions will soon put coal back into decline, ending the decade 9% lower than it is now.

- Renewables, particularly solar photovoltaic and wind, will account for 43% of global electricity generation in 2030 compared to 28% in 2023. The energy crisis is changing the demand trends that have long been in place.

- Industries that were hit hard by global prices are now facing real risks of production rationing. Consumers are re-evaluating their energy consumption patterns in response to higher prices and, in some cases, to emergency demand reduction initiatives.

- While policy responses vary, many are focused on accelerating clean energy investments. This implies an even greater emphasis on renewables in the energy sector and accelerating electrification in industrial processes, cars, and heating.

- As many of the responses to the crisis align with those required to achieve global climate objectives, the energy crisis may turn out to be a defining moment in terms of driving energy security and reducing emissions.

Energy Logistics Market Trends

The Oil & Gas Segment is booming

The oil & gas segment is a significant component of the energy logistics market, as oil and gas remain crucial sources of energy globally. This segment involves the transportation, storage, and distribution of crude oil, refined petroleum products, and natural gas.

According to the International Energy Agency (IEA), from 2022 to 2028, the oil demand is projected to grow by 6% to 105.7 Mmb/d, driven by strong demand from the petrochemical and aviation industries. However, this cumulated increase implies that annual demand growth will slow from around 2.4 Mb/d in 2023 to around 0.4 Mb/d in 2028, indicating that the peak demand is just around the corner.

Non-OPEC+ oil-producing countries have plans to increase global supply capacity over the medium term, projected to increase by 5.1 million barrels per day (mb/d) by 2028, led by the United States, Brazil, and the Republic of Guyana. Plans to build capacity within OPEC+ are led by Saudi Arabia, the United Arab Emirates, and Iraq, with African and Asian members expected to continue declining and Russian production declining due to sanctions. This implies a net capacity increase of 0.8 million Mb/d among the 23 members of OPEC+ over the forecast period.

The oil & gas segment of energy logistics is influenced by various factors. Market demand, geopolitical factors, and regulatory frameworks play a significant role in shaping the industry. Fluctuations in oil prices, changes in global energy policies, and geopolitical tensions can impact the transportation and distribution of oil and gas resources.

Increasing Global Demand for Energy

- The global electricity demand is projected to reach 660 quadrillion BTUs in 2050, an increase of 18% compared to 2023, driven by population growth and rising prosperity. The demand for residential and commercial primary energy is projected to decline by around 15% by 2050 as improvements in energy efficiency reduce the need for energy from a rising population.

- The largest and fastest-growing energy sector is electricity generation, driven by increasing access to reliable energy in developing countries. The growth of electrification is partly offset by improved energy efficiency in developed countries.

- The construction of new buildings and infrastructure and the production of products that meet human needs support the growth in the industrial sector.

- The demand for commercial transportation is growing as economies expand and the need to transport goods increases. However, the increase in personal mobility is offset by efficiency improvements and an increase in the number of electric vehicles.

- The share of global energy consumption continues to grow proportionally to the population and economic growth in developing economies, reaching approximately 70% in 2050.

- More than 100% of global energy demand growth is driven by developing countries. Energy efficiency improvements are outpacing economic growth in developed economies, helping to offset energy demand growth that has traditionally been associated with economic growth. The combined percentage of energy consumed in the United States and Europe in 2023 is expected to drop from 35% to around 20% by 2050.

Energy Logistics Industry Overview

The competitive landscape of the energy logistics market is quite diverse and dynamic, with numerous players vying for market shares.

Major integrated oil companies like ExxonMobil, Chevron, and BP have a significant presence in the energy logistics market. These companies have their own transportation and logistics divisions, allowing them to control the entire supply chain from production to distribution. They often have extensive infrastructure, including pipelines, storage terminals, and tanker fleets, giving them a competitive advantage in terms of efficiency and cost-effectiveness.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definitions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Analysis Methodology

- 2.2 Research Phases

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Current Market Scenario

- 4.3 Technological Trends in the Industry

- 4.4 Government Initiatives and Regulations

- 4.5 Insights into the Ecommerce

- 4.6 Value Chain / Supply Chain Analysis

- 4.7 Demand and Supply Analysis

- 4.8 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Drivers

- 5.1.1 Industrial Growth Supporting the Market

- 5.1.2 Global Trade Driving the Market

- 5.2 Restraints

- 5.2.1 Compliance Challenges Affecting the Market

- 5.2.2 Limited Infrastructure Inhibiting the Market

- 5.3 Opportunitites

- 5.3.1 Technological Advancements Driving the Market

- 5.3.2 Sustainable Practices Driving the Market

- 5.4 Industry Attractiveness - Porter's Five Forces Analysis

- 5.4.1 Bargaining Power of Suppliers

- 5.4.2 Bargaining Power of Consumers / Buyers

- 5.4.3 Threat of New Entrants

- 5.4.4 Threat of Substitute Products

- 5.4.5 Intensity of Competitive Rivalry

6 MARKET SEGMENTATION

- 6.1 By Application

- 6.1.1 Oil & Gas

- 6.1.2 Renewable Energy

- 6.1.3 Power Generation

- 6.1.4 Energy Mining

- 6.2 By End-User

- 6.2.1 Government Sector

- 6.2.2 Private Sector

- 6.3 By Mode of Transport

- 6.3.1 Railways

- 6.3.2 Airways

- 6.3.3 Roadways

- 6.3.4 Waterways

7 COMPETITIVE LANDSCAPE

- 7.1 Overview (Market Concentration and Major Players)

- 7.2 Company Profiles

- 7.2.1 ExxonMobil

- 7.2.2 Chevron

- 7.2.3 BP

- 7.2.4 DHL

- 7.2.5 Kuehne + Nagel

- 7.2.6 C.H. Robinson

- 7.2.7 Maersk

- 7.2.8 Mediterranean Shipping Company (MSC)

- 7.2.9 COSCO Shipping Lines

- 7.2.10 TransCanada*

- 7.3 Other Companies