|

市場調查報告書

商品編碼

1699347

鋁市場機會、成長動力、產業趨勢分析及2025-2034年預測Aluminum Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

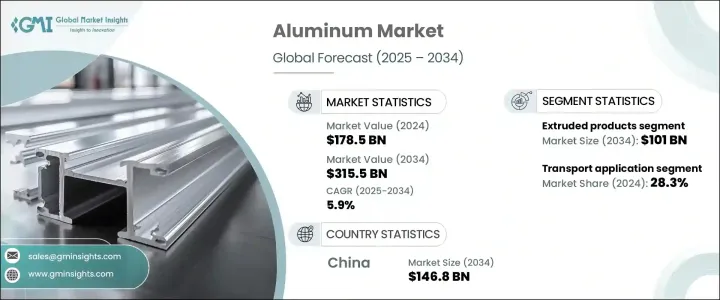

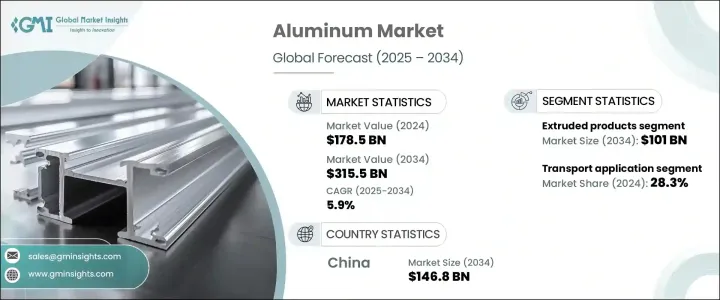

2024 年全球鋁市場價值為 1,785 億美元,預計 2025 年至 2034 年期間的複合年成長率為 5.9%。作為最主要的商品之一,鋁的需求強勁,尤其是在工業應用領域。 2023年全球原鋁產量達7,230萬噸,呈現穩定擴張態勢。市場受益於各行業消費的增加,輕質材料、可回收性和製造程序的效率推動了顯著的成長。

依產品類型,鋁市場分為扁平產品、鍛造產品、擠壓產品、長材產品、鑄造產品等。擠壓產品領域成長最快,到 2024 年將達到 564 億美元。扁平產品緊隨其後,由於其在汽車和包裝行業的重要作用,到 2024 年將達到 491 億美元。這些產品佔據了市場主導地位,貢獻了總銷售額的40%以上。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 1785億美元 |

| 預測值 | 3155億美元 |

| 複合年成長率 | 5.9% |

擠壓產品的需求仍然很高,尤其是在建築和運輸領域。同時,由於汽車輕量化趨勢的推動,扁平材產品在汽車產業中得到了廣泛的應用,因而備受關注。光是汽車業就佔鋁總消費量的約30%。此外,航太、建築施工和電氣行業成為市場擴張的主要貢獻者。鋁在電網、輸電線路和大型基礎設施項目中發揮著至關重要的作用。

市場根據加工方法進一步細分,包括軋製、擠壓、拉伸、鑄造和鍛造。預計拉絲製程將在未來幾年佔據主導地位,主要是因為它在高強度線材製造和航太零件中的應用。鋁鑄件佔加工鋁的20%,尤其是在汽車和工業機械領域。先進的加工技術專注於減少排放和提高能源效率,進一步加強產業的永續發展措施。

新技術有助於降低生產成本和環境影響。儘管競爭激烈,但高額的資本投入仍對新參與者構成了進入障礙。儘管原物料價格波動帶來了挑戰,尤其是在疫情後成本大幅飆升的情況下,輕質鋁合金的需求也創造了新的機會。

市場按應用細分為運輸、建築、電氣和電子、包裝、設備和機械、耐用消費品、箔庫存等。運輸業在 2024 年佔據 28.3% 的市場佔有率,預計到 2034 年將以 4.5% 的複合年成長率成長。電氣和電子領域佔有相當大的佔有率,鋁廣泛用於電力傳輸、電路板和熱交換器。包裝佔了 15.2% 的市場佔有率,因為鋁的可回收性使其成為食品和飲料容器的首選材料。包括工業自動化部件在內的設備和機械也實現了顯著成長。

市場前景凸顯了不斷發展的促進鋁永續使用的法規,特別是在包裝和運輸領域。供應鏈中斷帶來了挑戰,而鋁箔庫存和耐用消費品需求的增加增強了鋁的市場地位。

2024 年,中國鋁市場規模達 809 億美元,預計到 2034 年將達到 1,468 億美元。亞太地區憑藉其產業多樣性和強大的製造能力佔據主導地位。預計2024年中國將佔全球鋁產量的55%,佔全球消費量的近50%,生產4,200萬噸原鋁,超過其2023年的產量。政府政策、豐富的鋁土礦儲量以及能源補貼促成了這種主導地位。城市化和基礎設施擴張進一步刺激了該地區的鋁需求。

目錄

第1章:方法論與範圍

- 市場範圍和定義

- 基礎估算與計算

- 預測計算

- 資料來源

- 基本的

- 次要

- 付費來源

- 公共資源

- 初步研究和驗證

- 主要來源

- 資料探勘來源

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 影響價值鏈的因素

- 利潤率分析

- 中斷

- 未來展望

- 製造商

- 經銷商

- 供應商格局

- 利潤率分析

- 重要新聞和舉措

- 監管格局

- 衝擊力

- 成長動力

- 汽車輕量化材料需求不斷成長

- 擴大低碳鋁生產計劃

- 加大對鋁回收和循環經濟的關注

- 建築和基礎設施項目的成長

- 包裝產業需求強勁

- 鋁加工技術的進步

- 政府政策支持永續金屬生產

- 產業陷阱與挑戰

- 能源限制和環境法規

- 原物料價格波動

- 貿易緊張局勢影響全球供應鏈

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:按產品,2021 年至 2034 年

- 主要趨勢

- 扁平材

- 擠壓產品

- 鍛造產品

- 長材

- 鑄件產品

- 其他

第6章:市場估計與預測:按加工方法,2021 年至 2034 年

- 主要趨勢

- 捲動

- 擠壓

- 繪製

- 鑄件

- 鍛造

第7章:市場估計與預測:按應用,2021 年至 2034 年

- 主要趨勢

- 運輸

- 建造

- 電氣和電子產品

- 包裝

- 設備和機械

- 耐久性消費品

- 鋁箔庫存

- 其他

第8章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第9章:公司簡介

- Alcoa

- Aleris Rolled Products

- Arconic

- Emirates Global Aluminum

- Hangzhou Century Aluminium

- Hindalco

- Hongqiao Group

- JW Aluminium

- Logan Aluminium

- Norsk Hydro

- Novelis

- Rio Tinto

- Rusal

- Shandong Xinfa Aluminium Group

- South32

- SPIC

- Vedanta Limited

The Global Aluminum Market was valued at USD 178.5 billion in 2024 and is projected to grow at a 5.9% CAGR from 2025 to 2034. As one of the most prominent commodities, aluminum has seen strong demand, particularly in industrial applications. The global production of primary aluminum reached 72.3 million tons in 2023, demonstrating steady expansion. The market benefits from increasing consumption in various industries, with significant growth driven by lightweight materials, recyclability, and efficiency in manufacturing processes.

Based on product type, the aluminum market is categorized into flat products, forged products, extruded products, long products, cast products, and others. The extruded products segment recorded the highest growth, reaching USD 56.4 billion in 2024. Flat products followed closely, reaching USD 49.1 billion in 2024 due to their significant role in the automotive and packaging industries. These products dominated the market, contributing to over 40% of total sales.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $178.5 Billion |

| Forecast Value | $315.5 Billion |

| CAGR | 5.9% |

Extruded products remained in high demand, especially within the construction and transportation sectors. Meanwhile, flat products gained prominence due to their widespread use in the automotive industry, driven by the push for lightweight vehicles. The automotive sector alone accounted for approximately 30% of total aluminum consumption. Additionally, aerospace, building & construction, and the electrical industry emerged as key contributors to market expansion. Aluminum played a crucial role in power grids, transmission lines, and large-scale infrastructure projects.

The market is further segmented based on processing methods, including rolling, extruding, drawing, casting, and forging. The drawing process is expected to dominate in the coming years, mainly due to its application in high-strength wire manufacturing and aerospace components. Aluminum casting accounted for 20% of processed aluminum, particularly within automotive and industrial machinery. Advanced processing technologies focused on reducing emissions and enhancing energy efficiency, further strengthening the industry's sustainability initiatives.

New technologies helped lower production costs and environmental impact. Despite moderate competitive rivalry, high capital investments acted as entry barriers for new players. The demand for lightweight aluminum alloys created new opportunities, although raw material price fluctuations presented challenges, especially as costs surged significantly post-pandemic.

The market is segmented by application into transport, construction, electrical & electronics, packaging, equipment & machinery, consumer durables, foil stock, and others. The transportation sector led with a 28.3% market share in 2024 and is anticipated to grow at a 4.5% CAGR through 2034. The electrical & electronics segment held a substantial share, with aluminum widely used in power transmission, circuit boards, and heat exchangers. Packaging contributed 15.2% of the market, as aluminum's recyclability made it a preferred material for food and beverage containers. Equipment & machinery, including industrial automation components, also saw significant growth.

The market outlook highlighted evolving regulations promoting sustainable aluminum usage, particularly in packaging and transportation. Supply chain disruptions posed challenges, while the rise in foil stock and consumer durables demand reinforced aluminum's market presence.

The aluminum market in China generated USD 80.9 billion in 2024 and is projected to reach USD 146.8 billion by 2034. The Asia Pacific region dominated due to industrial diversity and strong manufacturing capabilities. China accounted for 55% of aluminum production and nearly 50% of global consumption in 2024, producing 42 million tons of primary aluminum, surpassing its 2023 output. Government policies, abundant bauxite reserves, and energy subsidies contributed to this dominance. Urbanization and infrastructure expansion further fueled aluminum demand in the region.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Rising demand for lightweight materials in automotive

- 3.6.1.2 Expanding low-carbon aluminium production initiatives

- 3.6.1.3 Increasing aluminium recycling and circular economy focus

- 3.6.1.4 Growth in construction and infrastructure projects

- 3.6.1.5 Strong demand from the packaging industry

- 3.6.1.6 Advancements in aluminium processing technologies

- 3.6.1.7 Government policies supporting sustainable metal production

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Energy restrictions and environmental regulations

- 3.6.2.2 Volatility in raw material prices

- 3.6.2.3 Trade tensions affecting global supply chains

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates and Forecast, By Product, 2021 – 2034 (USD Billion) (Carats)

- 5.1 Key trends

- 5.2 Flat products

- 5.3 Extruded products

- 5.4 Forged products

- 5.5 Long products

- 5.6 Cast products

- 5.7 Others

Chapter 6 Market Estimates and Forecast, By Processing Method, 2021 – 2034 (USD Billion) (Carats)

- 6.1 Key trends

- 6.2 Rolling

- 6.3 Extruding

- 6.4 Drawn

- 6.5 Casting

- 6.6 Forging

Chapter 7 Market Estimates and Forecast, By Application, 2021 – 2034 (USD Billion) (Carats)

- 7.1 Key trends

- 7.2 Transport

- 7.3 Construction

- 7.4 Electrical & electronics

- 7.5 Packaging

- 7.6 Equipment & machinery

- 7.7 Consumer durables

- 7.8 Foil stock

- 7.9 Others

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Billion) (Carats)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Alcoa

- 9.2 Aleris Rolled Products

- 9.3 Arconic

- 9.4 Emirates Global Aluminum

- 9.5 Hangzhou Century Aluminium

- 9.6 Hindalco

- 9.7 Hongqiao Group

- 9.8 JW Aluminium

- 9.9 Logan Aluminium

- 9.10 Norsk Hydro

- 9.11 Novelis

- 9.12 Rio Tinto

- 9.13 Rusal

- 9.14 Shandong Xinfa Aluminium Group

- 9.15 South32

- 9.16 SPIC

- 9.17 Vedanta Limited