|

市場調查報告書

商品編碼

1687727

越南鋁:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Vietnam Aluminum - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

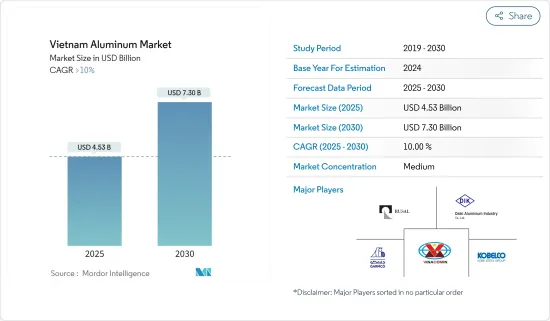

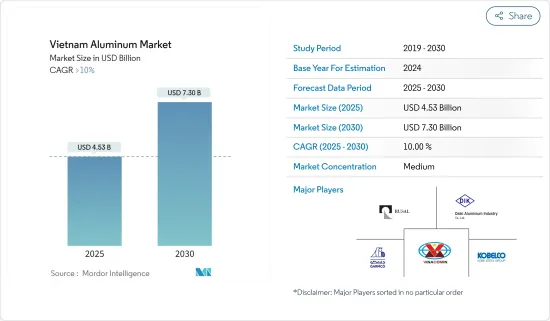

越南鋁市場規模預計在 2025 年為 45.3 億美元,預計在 2030 年將達到 73 億美元,在市場估計和預測期(2025-2030 年)內以超過 10% 的複合年成長率成長。

由於政府採取多起關閉和限制措施,COVID-19 疫情對越南鋁市場的需求產生了負面影響。然而,隨著限制的解除,市場正在經歷逐步成長,預計在預測期內將繼續保持這一成長軌跡。

主要亮點

- 建設產業需求增加和汽車行業擴張等因素正在推動市場成長。

- 嚴格的法規以及替代品的不斷增加正在抑制市場的成長。

- 在整個預測期內,人們對再生鋁使用的認知不斷提高可能會成為一個機會。

越南鋁市場趨勢

建築和建設產業的需求不斷成長,推動著市場

- 鋁是建設產業中第二大廣泛使用的金屬。由於其重量輕、耐腐蝕,被廣泛應用於窗戶、帷幕牆、屋頂、覆層、遮陽簾、太陽能板、扶手、貨架和其他臨時結構。

- 根據越南統計總局統計,近年來建築業一直是該國GDP的主要貢獻者。

- 根據越南統計總局發布的資料,2023 年第四季度,該國建築業 GDP 增至 388.199 兆越南盾(150 億美元),而 2023 年第三季為 263.97 兆越南盾(100 億美元)。

- 越南建設部最近也宣布,廣寧省下龍市人民委員會已於2022年11月初開始興建社會住宅計劃,將在下龍市紅海區和高清區興建約1,000套公寓。

- 計劃總投資約 1.3 兆越南盾(5,230 萬美元),預計於 2026 年第一季完工。竣工後,該設施預計將居住3,880 多名員工和低收入居民。

- 2023年,道達爾能源ENEOS與世界知名運動服裝品牌的主要供應商、最大的鞋類和鞋類製造商之一Golden Victory Vietnam簽署了一項長期協議,在其位於越南南定省的工廠開發4.6兆瓦峰值(MWp)的太陽能光伏(PV)系統。

- 預計所有這些因素都將推動該國建設產業對鋁的需求,從而促進預測期內的市場成長。

汽車產業預計將主導市場

- 隨著汽車產業越來越重視燃油效率、減少二氧化碳排放和設計靈活性,鋁在現代汽車中發揮越來越重要的作用。各處均使用了鋁,使汽車整體重量減輕了幾公斤。

- 許多汽車零件都是由鋁製成的,包括散熱器、車輪、懸吊部件、保險桿、變速箱體、引擎汽缸體以及車身部件,例如引擎蓋、車門和車架。

- 根據越南工業協會透露,2022年1月至2023年越南汽車產量將達到17,314輛,其中最常見的是乘用車(14,036輛),其次是商用車(3,174輛)和專用車(104輛)。

- 2023年9月,捷克汽車品牌Skoda與TC Motor合資進入越南市場。其中包括德國的寶馬、賓士、福斯和標緻,儘管大眾目前還沒有在越南設立工廠。

- 越南汽車工業(VAMA) 也建議,國家汽車發展策略(2021-2050 年)可以促進製造業發展並鼓勵使用電動車。因此,預計 2030 年至 2040 年間電動車的數量將大幅成長,到 2040 年產能將達到 350 萬輛。

- 此外,鋁也用於摩托車製造中的各種零件,例如引擎零件和車架。

- 2024年7月,越南貿易部報告稱,奇瑞推出與當地企業成立了價值8億美元的合資企業,以建造一家工廠。奇瑞將成為第一家在越南建廠的中國電動車製造商。該廠將由奇瑞汽車部門Omoda&Jaecoo與越南公司Geoleximco共同建造。

- 因此,由於上述因素,越南汽車產業的發展及其快速成長可能會在預測期內促進鋁市場的擴張。

越南鋁業概況

越南的鋁市場已部分整合。主要參與者(不分先後順序)包括越南煤炭礦產工業集團、大基鋁業越南公司(DAVCO)、神戶製鋼所有限公司、GARMCO 和 RusAL。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查結果

- 調查前提

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 汽車公司用鋁取代不銹鋼

- 國內建築和基礎設施活動成長

- 其他促進因素

- 限制因素

- 替代產品的可用性

- 成本高且環境法規嚴格

- 其他限制因素

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章 市場區隔

- 加工類型

- 鑄件

- 擠壓

- 鍛件

- 平板壓延鋼材

- 顏料和粉末

- 最終用戶產業

- 車

- 航太和國防

- 建築和施工

- 電氣和電子

- 包裝

- 工業

- 其他最終用戶產業(海洋、電力等)

第6章 競爭格局

- 併購、合資、合作、協議

- 市場佔有率排名分析

- 主要企業策略

- 公司簡介

- Alcoa Corporation

- Daiki Aluminium Industry Co. Ltd

- Emirates Global Aluminium PJSC

- GARMCO

- KOBE Steel Ltd

- Norsk Hydro ASA

- Rusal

- Vietnam Coal and Mineral Industries Group

第7章 市場機會與未來趨勢

- 回收鋁以便進一步利用

- 其他機會

The Vietnam Aluminum Market size is estimated at USD 4.53 billion in 2025, and is expected to reach USD 7.30 billion by 2030, at a CAGR of greater than 10% during the forecast period (2025-2030).

The COVID-19 pandemic had a negative impact on the demand for the aluminum market in Vietnam due to various lockdowns and restrictions imposed by the government. The market, however, has been growing gradually with the restrictions being lifted, and this growth trajectory is likely to continue over the forecast period.

Key Highlights

- Factors such as the rising demand for the construction industry and the expansion of the automotive industry are driving market growth.

- The growing availability of substitutes, along with stringent regulations, are acting as restraints to market growth.

- The increasing awareness of the usage of recycled aluminum is likely to act as an opportunity through the forecast period.

Vietnam Aluminum Market Trends

Growth in Demand from the Building and Construction Industry is Driving the Market

- Aluminum is the second most widely utilized metal in the building and construction industry. Due to its lightweight and corrosion resistance abilities, it is widely used in building windows, curtain walls, roofing and cladding, solar shades, solar panels, railings, shelves, and other temporary structures.

- According to the General Statistics Office of Vietnam, the construction industry has significantly contributed to the country's GDP in recent years.

- According to data released by the Statistics Office of Vietnam, the country's GDP from the construction industry increased to VND 388.199 trillion (USD 15 billion) in the fourth quarter of 2023 compared to VND 263.97 trillion (USD 10 billion) in the third quarter of 2023.

- In its recent publication, the Vietnamese Ministry of Construction also stated that the People's Committee of Ha Long City in Quang Ninh Province had commenced construction of a social housing project for nearly 1,000 apartments in Ha Long City's Hong Hai Ward and Cao Thang Ward in the early November of 2022.

- The overall investment in the project is projected to be around VND 1.3 trillion (USD 52.3 million), with completion scheduled for the first quarter of 2026. After completion, the project aims to house more than 3,880 employees and low-income residents.

- In 2023, TotalEnergies ENEOS signed a long-term agreement with Golden Victory Vietnam Co. Ltd, one of the largest manufacturers of shoes and footwear and a key supplier to globally renowned sportswear brands, for developing a 4.6-megawatt peak (MWp) solar photovoltaic (PV) system at its facility in Nam Dinh Province, Vietnam.

- All these factors are expected to drive the demand for aluminum in the country's construction industry and boost market growth over the forecast period.

Automotive Industry is Projected to Dominate the Market

- As the automobile industry increasingly focuses on fuel efficiency, lowering CO2 emissions, and design flexibility, aluminum plays an increasingly significant role in modern vehicles. The use of aluminum reduces the overall weight of an automobile by several kilograms in various areas.

- Many automobile components, including radiators, wheels, suspension components, bumpers, transmission bodies, engine cylinder blocks, and body components like hoods, doors, and even frames, are constructed of aluminum.

- According to the Vietnam Automobile Manufacturers Association, a total number of 17,314 units of automobiles were produced in the country between January 2022 and 2023, the prominent share being of passenger cars (14,036 units), followed by commercial vehicles (3,174 units) and special purpose vehicles (104 units).

- In September 2023, Czech automobile brand Skoda entered the Vietnamese market as part of its joint venture with TC Motor, while other European manufacturers entered Vietnam very soon after. These included German manufacturers BMW, Mercedes, Volkswagen, and Peugeot, of which Volkswagen still has no factory in the country.

- The Vietnam Automobile Manufacturers Association (VAMA) also suggested that the National Automobile Development Strategy (2021-2050) could promote manufacturing and boost the use of e-vehicles. The number of electric vehicles will, thus, considerably expand between 2030 and 2040, reaching a production capacity of 3.5 million vehicles by that year.

- In addition, aluminum is used in various components, such as engine parts and frames, in two-wheeler manufacturing.

- In Apil 2024, Vietnam's trade ministry reported that Chery had entered a USD 800 million joint venture with a local firm to build a plant. Chery will be the first Chinese EV manufacturer to establish a plant in Vietnam. The plant will be built in partnership between Chery's automotive unit, Omoda & Jaecoo, and Vietnamese firm Geoleximco.

- Therefore, owing to all the factors mentioned above, the development of the automotive industry and its fast-paced growth in Vietnam is likely to help the aluminum market expand during the forecast period.

Vietnam Aluminum Industry Overview

The aluminum market in Vietnam is partially consolidated in nature. Some major players (in no particular order) include Vietnam Coal and Mineral Industries Group, Daiki Aluminium Vietnam (DAVCO), Kobe Steel Ltd, GARMCO, and RusAL.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS (Market Size in Value and Volume)

- 4.1 Driver

- 4.1.1 Substitution of Stainless Steel with Aluminum by Automotive Companies

- 4.1.2 Growing Construction and Infrastructure Activities in the Country

- 4.1.3 Other Drivers

- 4.2 Restraint

- 4.2.1 Availability of Substitute Products

- 4.2.2 High Costs and Stringent Environmental Regulations

- 4.2.3 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value and Volume)

- 5.1 Processing Type

- 5.1.1 Castings

- 5.1.2 Extrusions

- 5.1.3 Forgings

- 5.1.4 Flat-rolled Products

- 5.1.5 Pigments and Powders

- 5.2 End-user Industry

- 5.2.1 Automotive

- 5.2.2 Aerospace and Defense

- 5.2.3 Building and Construction

- 5.2.4 Electrical and Electronics

- 5.2.5 Packaging

- 5.2.6 Industrial

- 5.2.7 Other End-user Industries (Marine, Power, and Others)

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Alcoa Corporation

- 6.4.2 Daiki Aluminium Industry Co. Ltd

- 6.4.3 Emirates Global Aluminium PJSC

- 6.4.4 GARMCO

- 6.4.5 KOBE Steel Ltd

- 6.4.6 Norsk Hydro ASA

- 6.4.7 Rusal

- 6.4.8 Vietnam Coal and Mineral Industries Group

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Recycling of Aluminum for Further Usage

- 7.2 Other Opportunities