|

市場調查報告書

商品編碼

1683806

鋁回收-市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Aluminum Recycling - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

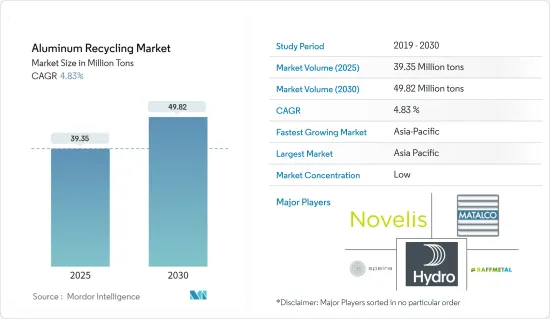

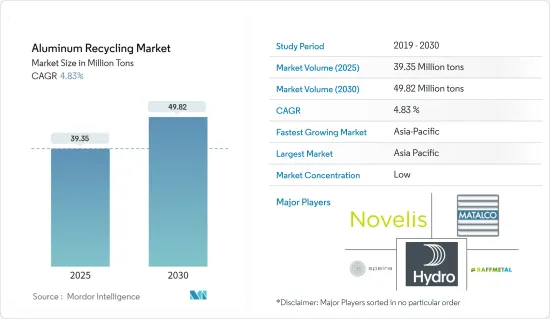

預計2025年鋁回收市場規模為3,935萬噸,預計2030年將達到4,982萬噸,預測期內(2025-2030年)的複合年成長率為4.83%。

新冠疫情對鋁回收市場產生了重大影響。建築業是鋁的主要消耗行業,因住宅房地產限制而受到的打擊尤其嚴重,導致住宅登記停止和房屋抵押貸款償還延遲。然而,自從限制解除以來,該行業已經恢復良好。由於各終端用戶產業消費增加,鋁市場在 2021-22 年顯著復甦。

主要亮點

- 短期內,汽車和建設產業對再生鋁的使用不斷成長預計將推動市場需求。

- 相反,鐵等不良雜質的存在可能會阻礙市場成長。

- 電動車產業的成長和對減少碳足跡的日益關注可能為市場提供新的成長機會。

- 預計亞太地區將主導市場,並在預測期內以最高的複合年成長率成長。

鋁回收市場趨勢

建築和建設產業的需求不斷增加

- 鋁是建設產業中第二大廣泛使用的金屬。建築中使用的鋁約60%是由回收材料製成的。

- 回收的鋁鑄造合金、擠壓材和其他產品可用於浮動天花板、窗戶、門、樓梯、牆板、屋頂瓦片和各種其他應用。

- 使用再生鋁還能帶來顯著的能源效益。重新熔化廢鋁所需的能量僅為生產原生金屬所需能量的 5%。因此,鋁不但不會加劇社會日益嚴重的廢棄物問題,反而可以透過重新熔化和重新加工來生產新一代建築零件。

- 再生鋁產品/再生鋁產品廣泛用於建築建築幕牆、帷幕牆、屋頂、覆層、遮陽棚、太陽能板、扶手、樓梯、架子和其他臨時結構。它也用於高層建築、高層建築和橋樑的建設。

- 根據牛津經濟研究院的報告,到2030年,全球建築業產出預計將在亞太地區成長最快,約40%,其次是北美,約16%。

- 全球建設活動的活性化是推動近期研究的市場發展的關鍵因素之一。尤其是亞太地區、北美和中東地區的建設產業呈現正成長率。因此,預測期內鋁回收市場的需求可能會增加。

- 在亞太地區,中國正在經歷建築熱潮。從全球來看,中國是最重要的建築市場,佔全球建築投資的20%左右。預計到 2030 年,光是中國在建設上就將投入約 13 兆美元。

- 建築業是印度第二大行業。 2022年的成長率為10.7%。到預測期結束時,印度建築業很可能成為世界第三大市場,規模約 1 兆美元。

- 根據加拿大建築協會的資料,建築業是加拿大最大的雇主之一,也是加拿大經濟成功的主要貢獻者。該行業對該國內生產總值(GDP) 貢獻了 7%。

- 作為「投資加拿大」計畫的一部分,加拿大政府宣布計畫在2028年在該國關鍵基礎建設上投資約1,400億美元。 2019-2020年,政府預計將核准在全國新的基礎設施計劃中投資56億美元。

- 沙烏地阿拉伯「2030願景」和國家轉型計畫(NTP)的公佈,帶動了教育、醫療等各個領域的投資增加,以支持該國的經濟成長。沙烏地阿拉伯政府對該國社會基礎設施的發展有廣泛的規劃。政府和私人對該國各個領域的投資可能會導致商業建築建設活動的增加。

- 因此,由於上述因素,預測期內再生鋁的需求將受到正面影響。

亞太地區佔市場主導地位

- 預計預測期內亞太地區將成為再生鋁最大的成長市場。中國、印度和日本等國家在電子、汽車、建築、航太和國防等產業正在經歷成長。

- 中國自 1970 年代起就開始在國內進行鋁回收。此外,近年來我們也著重在鋁的二次利用。為此,中國計劃在2030年將原生鋁冶煉產能限制在4,500萬噸左右。

- 根據國際貿易管理局(ITA)的資料,中國無論按年銷售量或產量來看,仍是全球最大的汽車市場。預計2025年國內產量將達近3,500萬輛。為因應新冠疫情,中國政府正在刺激汽車消費。中國佔全球新電動車銷量的一半以上(58%)。根據國際能源總署(IEA)預測,2022年全國新電動車銷量將達590萬輛,較2021年成長80%以上。

- 根據國際貿易組織的報告,中國是全球最大的建築市場,都市化居世界最高。根據美國建築師協會(AIA)上海分會的資料,到2025年,中國自1990年代以來將建造一座相當於10個紐約規模的城市。

- 據印度品牌股權基金會(IBEF)稱,民航業是近年來印度成長最快的產業之一。印度航空業預計將受到冠狀病毒的影響,因為2023年(2022年4月至12月)的空中交通量預計為2.3671億,而去年同期為1.3161億。此外,2023 年 6 月,印度航空與空中巴士和波音簽署協議,購買 470 架飛機,價值約 700 億美元。

- 日本的家電產業是世界領先的產業之一。日本在電腦、遊戲機、行動電話和其他關鍵零件的生產方面處於世界領先地位。此外,家用電器約佔日本經濟產出的三分之一。由於來自印度、中國和韓國等國家的激烈競爭,日本的整體電子產品產量正在下降。

- 根據日本電子情報技術產業協會(JEITA)統計,2023年1月日本消費性電子產品產值為234.25億日圓(約1.65億美元),較去年同期大幅成長79.8%。同時,2023年1月電子設備產值達到2,903.09億日圓(20.42億美元),年增89.6%。

- 因此,上述因素可能會在預測期內影響所研究市場的需求。

鋁回收業概況

鋁回收市場比較分散。主要參與者包括 Novelis Inc.、Speira GmbH、Norsk Hydro ASA、Matalco Inc. 和 Raffmetal(不分先後順序)。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 擴大再生鋁在建設產業的使用

- 汽車產業對再生鋁的需求不斷增加

- 限制因素

- 存在鐵等不良雜質

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章 市場區隔

- 產品類型

- 鑄造合金

- 擠壓

- 床單

- 其他產品類型

- 最終用戶產業

- 車

- 航太和國防

- 建築和施工

- 電氣和電子

- 包裝

- 其他最終用戶產業

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 馬來西亞

- 泰國

- 印尼

- 越南

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 北歐國家

- 土耳其

- 俄羅斯

- 歐洲其他地區

- 南美洲

- 巴西

- 阿根廷

- 哥倫比亞

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 卡達

- 阿拉伯聯合大公國

- 奈及利亞

- 埃及

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭格局

- 併購、合資、合作與協議

- 市場佔有率排名分析

- 主要企業策略

- 公司簡介

- Alcoa Corporation

- Amag Austria Metall AG

- Constellium

- Kuusakoski OY

- Matalco Inc.

- Norsk Hydro Asa

- Novelis

- Raffmetal Spa

- Real Alloy

- Speira Gmbh

- Stena Metall AB

- Ye Chiu Group

第7章 市場機會與未來趨勢

- 電動車領域的成長

- 越來越重視減少碳足跡

The Aluminum Recycling Market size is estimated at 39.35 million tons in 2025, and is expected to reach 49.82 million tons by 2030, at a CAGR of 4.83% during the forecast period (2025-2030).

The COVID-19 pandemic had a substantial impact on the aluminum recycling market. Building and construction, a major sink for aluminum, was badly hit, especially due to curtailment in residential real estate resulting in the suspension of home registrations and slow home loan disbursements. However, the sector has been recovering well since restrictions were lifted. The aluminum market recovered significantly in the 2021-22 period, owing to rising consumption from various end-user industries.

Key Highlights

- Over the short term, the growing utilization of recycled aluminum in the automotive and construction industry is expected to drive demand for the market.

- On the contrary, the presence of undesirable impurities like iron is likely to hamper the market's growth.

- Growth in the electric vehicles segment and growing focus on the reduction of carbon footprint are likely to provide new growth opportunities for the market.

- The Asia-Pacific region is expected to dominate the market and is also likely to witness the highest CAGR during the forecast period.

Aluminum Recycling Market Trends

Increasing Demand from the Building and Construction Industry

- Aluminum is the second most widely used metal in the building and construction industry. Around 60% of the aluminum used in the buildings consists of recycled material.

- Recycled aluminum casting alloys, extruded sheets, and other products were used in floating ceilings, windows, doors, stairs, wall panels, roof sheets, and a variety of other applications.

- The use of recycled aluminum also offers substantial energy benefits. Remelting used aluminum requires only 5 percent of the energy needed to produce primary metal. Thus, rather than contributing to society's growing waste problem, aluminum can be remelted and reformed to produce a new generation of building parts.

- Secondary aluminum/recycled aluminum products are extensively used in building facades, curtain walls, roofing and cladding, solar shading, solar panels, railings, staircases, shelves, and other temporary structures. They are also used in the construction of high-rise buildings, skyscrapers, and bridges.

- According to the Oxford Economics report, global construction output is expected to grow the most in the Asia-Pacific region by around 40% by 2030, followed by the North American region by nearly 16%.

- Increasing construction activity worldwide is one of the key factors driving the market studied in recent times. Asia-Pacific, North America, and the Middle East, among others, are witnessing a positive growth rate in the building and construction industry. Hence, the demand for the recycling aluminum market is likely to increase over the forecast period.

- In Asia-Pacific, China is amid a construction mega-boom. Globally, China has the most significant building market, making up around 20% of all construction investments across the world. The country alone is likely to spend about USD 13 trillion on buildings by 2030.

- The construction industry is the second-largest in India. It grew at 10.7% in 2022. By the end of the forecast period, India's construction industry may emerge as the third-largest market across the world, with a size of around USD 1 trillion.

- As per the Canadian Construction Association data, the construction sector is one of largest employers in Canada and a significant contributor to the country's economic success. The industry contributes to 7% of the country's GDP.

- As part of the 'Investing in Canada Plan,' the Canadian government has announced plans to invest around USD 140 billion for significant infrastructure developments in the country by 2028. In 2019-20, the government plans to approve investments valuing USD 5.6 billion for new infrastructure projects in the country.

- The announcement of Vision 2030 and the National Transformation Plan (NTP) in Saudi Arabia have increased investments in different sectors, such as education and healthcare, to support the economic growth of the country. The government has expansive plans for the development of social infrastructure in the country. Government and private investments in various sectors of the country are likely to lead to a rise in commercial building construction activities.

- Therefore, owing to the factors mentioned above, the demand for recycled aluminum will be positively impacted during the forecasted period.

Asia-Pacific Region to Dominate the Market

- The Asia-Pacific region is expected to be the largest growing market for recycled aluminum during the forecast period. Industries such as electronics, automotive, building and construction, aerospace and defense, etc., are growing in countries such as China, India, and Japan, among others.

- China has been recycling aluminum domestically since the 1970s. Additionally, It has increased its focus on secondary Aluminum in recent years. In this regard, It is planning to cap the primary aluminum smelting capacity at around 45 million tons by 2030.

- As per the International Trade Administration (ITA) data, China remains the largest auto market globally in annual sales and production. Domestic production is anticipated to reach nearly 35 million units by 2025. The Chinese government is boosting car consumption following the COVID-19 pandemic. China accounts for over half (58%) of all new electric vehicles sold worldwide. According to the International Energy Agency (IEA), 5.9 million new electric cars will be sold nationwide in 2022, an increase of more than 80% compared to 2021.

- According to the report of the International Trade Organization, China is the largest construction market across the world and has the highest rate of urbanization globally. According to data from the American Institute of Architects (AIA) Shanghai, by 2025, China will have built a city equivalent to 10 in New York since the 1990s.

- According to the Indian Brand Equity Foundation (IBEF), the civil aviation industry has become one of India's fastest-growing industries in recent years. The aviation industry in India is expected to be affected by the new coronavirus, as can be seen from the fact that the air traffic volume in 2023 (April to December 2022) was 236.71 million, compared to 131.61 million in the same period of the previous year. Furthermore, In June 2023, the Indian company Air India signed agreements with Airbus and Boeing to purchase 470 planes for an estimated cost of USD 70 billion.

- The consumer electronics industry in Japan is one of the world's leading industries. The country is a world leader in producing computers, gaming stations, cell phones, and other vital components. Further, consumer electronics account for around one-third of the Japanese economic output. Japan's overall electronics production has declined due to stiff competition from countries such as India, China, and South Korea.

- According to the Japanese Electronics and Information Technology Industries (JEITA), the production value of consumer electronic equipment in the country stood at JPY 23,425 million (USD 165 million) in January 2023, increasing by a significant 79.8% during the same period last year. Meanwhile, the production value of electronic devices stood at JPY 290,309 million (USD 2,042 million) in January 2023, increasing by 89.6% annually.

- Thus, the factors above will likely affect the market demand studied during the forecast period.

Aluminum Recycling Industry Overview

The aluminum recycling market is fragmented in nature. Some major players include Novelis Inc., Speira GmbH, Norsk Hydro ASA, Matalco Inc., and Raffmetal, among others (not in any particular order).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Utilization of Recycled Aluminum in the Construction Industry

- 4.1.2 Growing Demand for Recycled Aluminum from the Automotive Industry

- 4.2 Restraints

- 4.2.1 Presence of Undesirable Impurities Like Iron

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Product Type

- 5.1.1 Casting Alloys

- 5.1.2 Extrusion

- 5.1.3 Sheets

- 5.1.4 Other Product Types

- 5.2 End-user Industry

- 5.2.1 Automotive

- 5.2.2 Aerospace and Defense

- 5.2.3 Building and Construction

- 5.2.4 Electrical and Electronics

- 5.2.5 Packaging

- 5.2.6 Other End-user Industries

- 5.3 Geography

- 5.3.1 Asia Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Malaysia

- 5.3.1.6 Thailand

- 5.3.1.7 Indonesia

- 5.3.1.8 Vietnam

- 5.3.1.9 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Spain

- 5.3.3.6 Nordic Countries

- 5.3.3.7 Turkey

- 5.3.3.8 Russia

- 5.3.3.9 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 Qatar

- 5.3.5.3 United Arab Emirates

- 5.3.5.4 Nigeria

- 5.3.5.5 Egypt

- 5.3.5.6 South Africa

- 5.3.5.7 Rest of Middle-East and Africa

- 5.3.1 Asia Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Alcoa Corporation

- 6.4.2 Amag Austria Metall AG

- 6.4.3 Constellium

- 6.4.4 Kuusakoski OY

- 6.4.5 Matalco Inc.

- 6.4.6 Norsk Hydro Asa

- 6.4.7 Novelis

- 6.4.8 Raffmetal Spa

- 6.4.9 Real Alloy

- 6.4.10 Speira Gmbh

- 6.4.11 Stena Metall AB

- 6.4.12 Ye Chiu Group

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growth in the Electric Vehicles Segment

- 7.2 Growing Focus on Reduction of Carbon Footprint