|

市場調查報告書

商品編碼

1708158

汽車燃油供給幫浦市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Automotive Fuel Feed Pumps Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

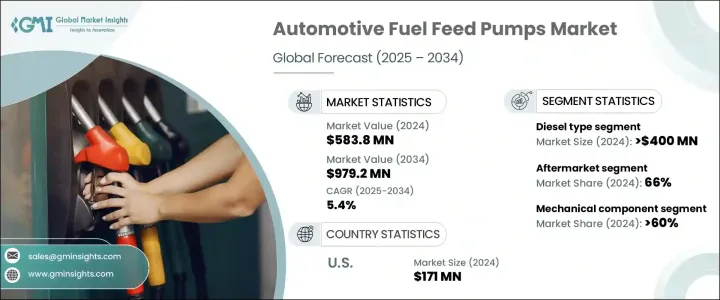

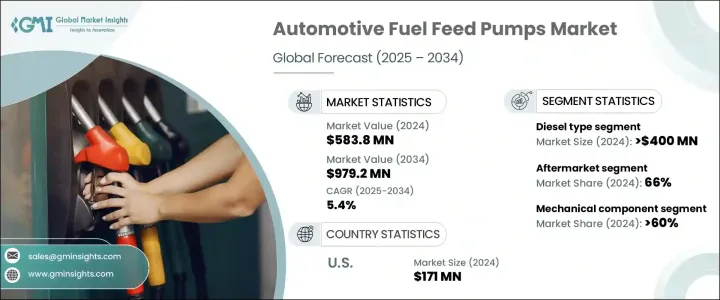

2024 年全球汽車燃油供給幫浦市場價值為 5.838 億美元,預計 2025 年至 2034 年期間的複合年成長率為 5.4%。在已開發經濟體和新興經濟體汽車產量和銷售量激增的推動下,該市場正在穩步擴張。隨著中國、印度、巴西等快速成長市場的都市化進程加快、可支配所得增加,對乘用車和商用車的需求也急劇上升。隨著道路上車輛數量的增加,對高效燃油供給幫浦系統的需求也日益成長,因為這些零件在確保無縫燃油輸送和維持引擎性能方面發揮著至關重要的作用。

此外,汽車工程技術的進步,包括提高燃油效率和控制排放的推動,正在推動先進燃油供給幫浦的採用。由於汽車製造商優先考慮引擎耐用性和最佳化燃料使用,全球汽車產業向混合動力和先進內燃機的轉變也刺激了對高性能燃油供給幫浦系統的需求。此外,由於車隊老化導致對替換零件的需求不斷增加,加上政府對汽車排放和性能的監管更加嚴格,正在影響市場動態,並為全球OEM和售後市場供應商創造持續的成長機會。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 5.838億美元 |

| 預測值 | 9.792億美元 |

| 複合年成長率 | 5.4% |

汽車燃油供給幫浦市場依引擎類型分為汽油和柴油兩類。其中,柴油引擎燃油供給幫浦在2024年的收入為4億美元。柴油引擎廣泛應用於商用和工業車輛,包括卡車、巴士和建築機械,所有這些車輛都需要高效耐用的燃油輸送系統。柴油供給幫浦對於支援高壓燃油噴射系統至關重要,該系統可最佳化引擎功率、提高燃油效率並確保引擎的長期可靠性。隨著全球對重型車輛的需求不斷成長,特別是在建築、物流和公共交通領域,對堅固的柴油供應泵的需求也不斷增加。這些泵浦因其能夠應對極端操作條件而受到青睞,使其成為各行各業高性能車輛不可或缺的零件。

汽車燃油供給幫浦的銷售分為OEM (原廠設備製造商)和售後市場通路。到 2024 年,售後市場將佔據主導地位,佔有 66% 的佔有率,這主要是由於隨著車輛老化,對更換泵浦的需求不斷增加。隨著時間的推移,燃油供給幫浦會磨損,需要更換以保持車輛的性能和安全。消費者和車隊營運商都在尋求經濟高效、可靠的售後解決方案,這些解決方案必須隨時可用並且與各種車型相容。售後市場廣泛的產品可用性和可負擔性繼續吸引多樣化的客戶群,使其成為市場格局的重要組成部分。

美國汽車燃油供給幫浦市場在 2024 年創造了 1.71 億美元的產值,預計 2025 年至 2034 年的複合年成長率為 5.5%。這一成長主要得益於該國龐大的汽車保有量和強大的汽車製造生態系統。美國車輛平均使用年限的增加擴大了售後市場對燃油供給幫浦的需求,因為更換燃油供給幫浦對於維持車輛的運作和效率至關重要。美國強勁的替代市場凸顯了對高品質、耐用的燃油供給幫浦的需求,以滿足消費者對性能和壽命的期望。

目錄

第1章:方法論與範圍

- 研究設計

- 研究方法

- 資料收集方法

- 基礎估算與計算

- 基準年計算

- 市場評估的主要趨勢

- 預測模型

- 初步研究和驗證

- 主要來源

- 資料探勘來源

- 市場範圍和定義

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 原物料供應商

- 組件提供者

- 製造商

- 技術提供者

- 配銷通路分析

- 最終用途

- 利潤率分析

- 供應商格局

- 技術與創新格局

- 專利分析

- 監管格局

- 成本細分分析

- 重要新聞和舉措

- 衝擊力

- 成長動力

- 增加汽車產量和銷售

- 嚴格的排放法規

- 對節能汽車的需求不斷成長

- 汽車技術的進步

- 產業陷阱與挑戰

- 創新研發成本高

- 更嚴格的車輛安全和性能標準

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:按引擎,2021 - 2034 年

- 主要趨勢

- 汽油

- 柴油引擎

第6章:市場估計與預測:按組件,2021 - 2034 年

- 主要趨勢

- 機械的

- 電的

- 渦輪泵

第7章:市場估計與預測:依車型,2021 - 2034 年

- 主要趨勢

- 搭乘用車

- 商用車

- 輕型商用車(LCV)

- 中型商用車(MCV)

- 重型商用車(HCV)

- 二輪車

第8章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 直接噴射系統

- 多點噴射系統

- 燃油噴射系統

- 化油器引擎

- 高性能車輛

第9章:市場估計與預測:依銷售管道,2021 - 2034 年

- 主要趨勢

- OEM

- 售後市場

第10章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 法國

- 英國

- 西班牙

- 義大利

- 俄羅斯

- 北歐人

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳新銀行

- 東南亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿拉伯聯合大公國

- 南非

- 沙烏地阿拉伯

第 11 章:公司簡介

- Aisin Seiki

- AST Otomotiv

- Carter Fuel

- Continental

- Daimler

- Delphi Automotive

- DENSO

- DEUTZ

- Devendra

- HELLA

- Hitachi Astemo

- Johnson Electric

- Perkins Engines

- Rheinmetall

- Robert Bosch

- Scania

- Schaeffler

- SHW

- Valeo

- ZF Friedrichshafen

The Global Automotive Fuel Feed Pumps Market was valued at USD 583.8 million in 2024 and is projected to grow at a CAGR of 5.4% between 2025 and 2034. The market is witnessing steady expansion driven by surging vehicle production and sales across both developed and emerging economies. As urbanization accelerates and disposable incomes rise in fast-growing markets like China, India, and Brazil, the demand for passenger and commercial vehicles is also rising sharply. With more vehicles on the road, the need for efficient fuel feed pump systems is growing, as these components play a crucial role in ensuring seamless fuel delivery and maintaining engine performance.

Additionally, technological advancements in automotive engineering, including the push toward better fuel efficiency and emission control, are fueling the adoption of advanced fuel feed pumps. The global automotive sector's shift toward hybrid and advanced internal combustion engines is also stimulating the demand for high-performance fuel feed pump systems as automakers prioritize engine durability and optimized fuel usage. Furthermore, the increasing need for replacement parts due to aging vehicle fleets, combined with stricter government regulations for vehicle emissions and performance, is influencing market dynamics and creating consistent growth opportunities for both OEM and aftermarket suppliers worldwide.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $583.8 Million |

| Forecast Value | $979.2 Million |

| CAGR | 5.4% |

The automotive fuel feed pump market is segmented based on engine type into gasoline and diesel categories. Among these, diesel engine fuel feed pumps accounted for USD 400 million in revenue in 2024. Diesel-powered engines are widely used in commercial and industrial vehicles, including trucks, buses, and construction machinery, all of which require highly efficient and durable fuel delivery systems. Diesel fuel feed pumps are essential in supporting high-pressure fuel injection systems that optimize engine power, improve fuel efficiency, and ensure long-term engine reliability. As global demand for heavy-duty vehicles grows, particularly in the construction, logistics, and public transportation sectors, the need for robust diesel fuel feed pumps is rising. These pumps are favored for their ability to handle extreme operating conditions, making them indispensable components in high-performance vehicles across a range of industries.

Sales of automotive fuel feed pumps are classified into OEM (original equipment manufacturer) and aftermarket channels. The aftermarket segment dominated with a 66% share in 2024, largely due to the rising need for replacement pumps as vehicles age. Over time, fuel feed pumps experience wear and require replacement to maintain vehicle performance and safety. Consumers and fleet operators alike seek cost-effective and reliable aftermarket solutions that are readily available and compatible with a variety of vehicle models. The aftermarket's broad product availability and affordability continue to attract a diverse customer base, making it a critical part of the market landscape.

The U.S. automotive fuel feed pumps market generated USD 171 million in 2024, with expectations to grow at a CAGR of 5.5% from 2025 to 2034. This growth is primarily driven by the country's substantial vehicle fleet and a strong automotive manufacturing ecosystem. The rising average age of vehicles in the U.S. amplifies the demand for aftermarket fuel feed pumps as replacements become essential to keep vehicles operational and efficient. The robust replacement market in the U.S. highlights the need for high-quality, durable fuel feed pumps that align with consumer expectations for performance and longevity.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.1.1 Raw material providers

- 3.1.1.2 Component providers

- 3.1.1.3 Manufacturers

- 3.1.1.4 Technology providers

- 3.1.1.5 Distribution channel analysis

- 3.1.1.6 End use

- 3.1.2 Profit margin analysis

- 3.1.1 Supplier landscape

- 3.2 Technology & innovation landscape

- 3.3 Patent analysis

- 3.4 Regulatory landscape

- 3.5 Cost breakdown analysis

- 3.6 Key news & initiatives

- 3.7 Impact forces

- 3.7.1 Growth drivers

- 3.7.1.1 Increasing vehicle production & sales

- 3.7.1.2 Stringent emission regulations

- 3.7.1.3 Growing demand for fuel-efficient vehicles

- 3.7.1.4 Advancements in automotive technology

- 3.7.2 Industry pitfalls & challenges

- 3.7.2.1 High R&D costs for innovation

- 3.7.2.2 Stricter vehicle safety & performance standards

- 3.7.1 Growth drivers

- 3.8 Growth potential analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Engine, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Gasoline

- 5.3 Diesel

Chapter 6 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Mechanical

- 6.3 Electric

- 6.4 Turbopump

Chapter 7 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Passenger Vehicle

- 7.3 Commercial Vehicles

- 7.3.1 Light Commercial Vehicles (LCV)

- 7.3.2 Medium Commercial Vehicles (MCV)

- 7.3.3 Heavy Commercial Vehicles (HCV)

- 7.4 Two wheelers

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Direct injection system

- 8.3 Multipoint injection system

- 8.4 Fuel injection system

- 8.5 Carbureted engines

- 8.6 High-performance vehicles

Chapter 9 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 OEM

- 9.3 Aftermarket

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 France

- 10.3.3 UK

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 ANZ

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 South Africa

- 10.6.3 Saudi Arabia

Chapter 11 Company Profiles

- 11.1 Aisin Seiki

- 11.2 AST Otomotiv

- 11.3 Carter Fuel

- 11.4 Continental

- 11.5 Daimler

- 11.6 Delphi Automotive

- 11.7 DENSO

- 11.8 DEUTZ

- 11.9 Devendra

- 11.10 HELLA

- 11.11 Hitachi Astemo

- 11.12 Johnson Electric

- 11.13 Perkins Engines

- 11.14 Rheinmetall

- 11.15 Robert Bosch

- 11.16 Scania

- 11.17 Schaeffler

- 11.18 SHW

- 11.19 Valeo

- 11.20 ZF Friedrichshafen