|

市場調查報告書

商品編碼

1478709

高密度封裝(MCM、MCP、SIP、3D-TSV):市場分析與技術趨勢High-Density Packaging (MCM, MCP, SIP, 3D-TSV): Market Analysis and Technology Trends |

||||||

在快速發展的半導體產業中,先進封裝處於創新的前沿,推動著從高效能運算到消費性電子產品等廣泛應用的下一波效能改進和整合能力。隨著設備變得越來越小、越來越複雜,傳統封裝技術正在達到其物理和功能極限。

人工智慧(AI)、5G 通訊、汽車電子和物聯網(IoT) 等技術的出現正在迅速推動對晶片的需求,這些晶片需要在日益緊湊的封裝中提供更高的性能、更低的功耗和更強大的功能。為了解決這個問題,3D 整合、小晶片、扇出晶圓級封裝 (FOWLP) 和矽通孔 (TSV) 等先進封裝技術已成為關鍵推動因素,使前所未有的整合度和系統複雜性成為可能。這些創新不僅克服了傳統縮放的限制,而且在電路設計、系統架構和材料科學方面開闢了新途徑,預示著半導體能力的新時代。

在快速發展的半導體製造領域,先進封裝技術在開發高性能、緊湊型和節能電子設備方面發揮著至關重要的作用。Forboros 擁有多種先進封裝技術,其中包括扇出晶圓級封裝 (FOWLP)、矽通孔 (TSV)、高頻寬記憶體 (HBM)、晶圓基板上晶片 (CoWoS)。

本報告深入探討了半導體先進封裝的現狀,深入瞭解最新的技術進步、材料創新和製程改進。我們審視競爭格局,專注於關鍵參與者及其策略舉措,以獲取市場佔有率並推動行業標準。此外,它還評估了全球供應鏈動態、監管環境和地緣政治因素對先進封裝市場的影響,使利害關係人能夠全面瞭解即將到來的課題和機會。

目錄

第一章簡介

第二章執行摘要

第三章技術問題與趨勢

- HDP技術概述

- 2D封裝

- 2.5D 和 3D 包

第4章 應用

- 半導體產業終端市場

- 記憶

- 鑄造部

第五章競爭環境

- 高密度聚乙烯製造商

第6章 3D-TSV技術

- 3D-TSV 驅動因素

- 3D 封裝類型

- 矽通孔工藝

- 重要加工技術

- 用法

- 3D封裝技術的局限性

- 公司簡介

第七章 市場預測

- 先進封裝概述

- 促進因素

- 系統級封裝 (SiP)

- 倒裝晶片/晶圓級封裝

- 全球IC市場預測

- 全球包裝市場預測

- 全球先進封裝預測

Introduction

In the rapidly evolving semiconductor industry, advanced packaging stands at the forefront of innovation, driving the next wave of performance enhancements and integration capabilities across a broad spectrum of applications, from high-performance computing to consumer electronics. As devices shrink in size yet grow in complexity, traditional packaging techniques are reaching their physical and functional limits, prompting the industry to adopt more sophisticated, efficient, and cost-effective solutions. This comprehensive report delves into the intricate world of semiconductor advanced packaging, exploring the latest trends, technologies, and market dynamics shaping the future of this critical sector.

The advent of technologies such as artificial intelligence (AI), 5G communications, automotive electronics, and the Internet of Things (IoT) has precipitated a surge in demand for chips that offer higher performance, lower power consumption, and greater functionality, all within increasingly compact footprints. In response, advanced packaging technologies such as 3D integration, chiplets, fan-out wafer-level packaging (FOWLP), and through-silicon vias (TSVs) have emerged as key enablers, allowing for unprecedented levels of integration and system complexity. These innovations not only overcome the limitations of traditional scaling but also open new avenues for circuit design, system architecture, and material science, heralding a new era of semiconductor functionality.

This report provides a deep dive into the state of the art in semiconductor advanced packaging, offering insights into the latest technological advancements, material innovations, and process improvements. It examines the competitive landscape, highlighting the key players and their strategic initiatives to capture market share and drive industry standards. Moreover, the report assesses the impact of global supply chain dynamics, regulatory environments, and geopolitical factors on the advanced packaging market, providing stakeholders with a comprehensive understanding of the challenges and opportunities ahead.

About This Report

In the rapidly evolving landscape of semiconductor manufacturing, advanced packaging technologies play a pivotal role in enabling the development of high-performance, compact, and energy-efficient electronic devices. Among the myriad of advanced packaging techniques, fan-out wafer-level packaging (FOWLP), through-silicon vias (TSVs), High Bandwidth Memory (HBM), Chip-on-Wafer-on-Substrate (CoWoS), and Foveros have emerged as key innovations revolutionizing the industry. This essay delves into these advanced packaging technologies, exploring their principles, applications, benefits, and impact on the semiconductor ecosystem.

Fan-Out Wafer-Level Packaging (FOWLP):

Fan-out wafer-level packaging (FOWLP) is a cutting-edge packaging technique that offers superior performance, increased functionality, and enhanced miniaturization compared to traditional packaging methods. In FOWLP, the semiconductor die is embedded within a polymer matrix, and redistribution layers (RDLs) are used to redistribute the I/Os to the package perimeter.

Through-Silicon Vias (TSVs):

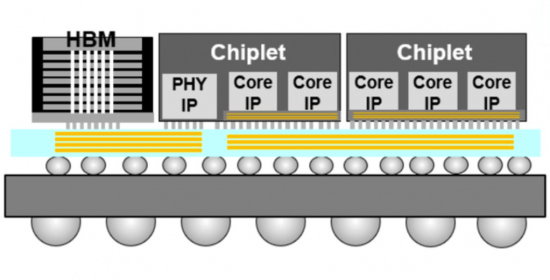

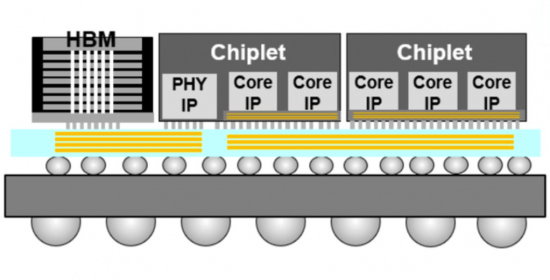

Through-silicon vias (TSVs) are vertical electrical interconnects that traverse through the silicon substrate, enabling multi-die stacking and 3D integration. TSVs facilitate the vertical integration of heterogeneous devices, such as logic, memory, and sensors, on a single silicon substrate, thereby reducing interconnect length, improving performance, and conserving space. TSVs are instrumental in advanced packaging technologies like 3D stacked memory, system-on-chip (SoC) integration, and interposer-based packaging, driving innovations in high-performance computing, artificial intelligence, and networking applications.

High Bandwidth Memory (HBM):

High Bandwidth Memory (HBM) is an advanced memory technology that leverages vertical stacking and TSVs to achieve unprecedented levels of memory bandwidth and energy efficiency. HBM utilizes multiple DRAM dies vertically stacked on top of each other and interconnected through TSVs, allowing for significantly higher memory bandwidth compared to traditional memory architectures. HBM is widely used in graphics cards, data centers, and highperformance computing systems, where memory bandwidth and power efficiency are critical for handling large datasets and complex workloads.

Chip-on-Wafer-on-Substrate (CoWoS):

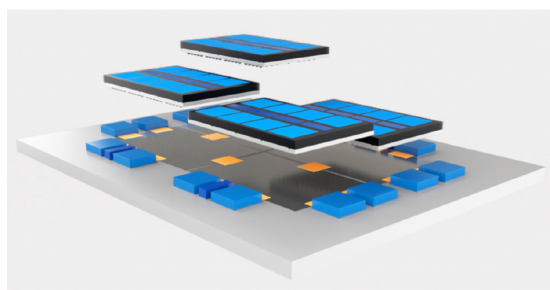

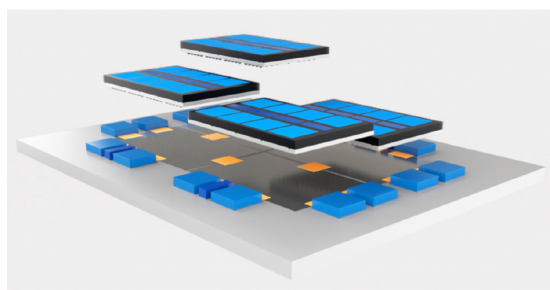

Chip-on-Wafer-on-Substrate (CoWoS) is a packaging technology developed by TSMC that enables the integration of multiple silicon dies on a single substrate, or interposer. In CoWoS, individual chips are fabricated on separate wafers and then bonded onto a silicon interposer using microbumps and TSVs. This allows for heterogeneous integration of different functional blocks, such as logic, memory, and analog, on a single package, enabling higher levels of performance, power efficiency, and system-level integration. CoWoS is widely used in highperformance computing, networking, and AI accelerators, where heterogeneous integration is essential for achieving optimal performance and functionality.

Foveros:

Foveros is an advanced packaging technology developed by Intel that enables 3D stacking of logic dies, memory dies, and other components to create highly integrated and compact semiconductor packages. In Foveros, individual dies are fabricated separately and then stacked vertically using microbumps and TSVs, allowing for dense integration of heterogeneous components with minimal footprint. Foveros enables innovative form factors, such as chiplets and system-in-package (SiP), and facilitates the development of power-efficient, highperformance devices for a wide range of applications, including mobile computing, IoT, and edge computing.

The Need for This Report

Investing in a semiconductor advanced packaging report offers several compelling reasons, each of which contributes to enhancing your understanding of the industry and making informed decisions. Here's why you should consider purchasing such a report:

Industry Insights: A semiconductor advanced packaging report provides comprehensive insights into the latest trends, developments, and innovations shaping the semiconductor packaging landscape. It offers valuable information on emerging technologies, market dynamics, and competitive landscape, helping you stay updated with the latest industry advancements.

Market Analysis: The report offers in-depth analysis of the semiconductor packaging market, including market size, growth potential, and key drivers and challenges. It provides detailed segmentation by packaging type, application, and region, for FOWLP, through-silicon vias (TSVs), and 3D integration, as well as AI-based technologies including HBM3, CoWoS, and Foveros.

Competitive Intelligence: By examining the strategies, product portfolios, and market positioning of key players in the semiconductor packaging industry, the report offers valuable competitive intelligence. It helps you benchmark your company's performance against industry leaders, identify potential collaborators or acquisition targets, and develop effective market entry or expansion strategies.

Technology Trends: Semiconductor advanced packaging reports delve into the latest technological advancements and innovations in packaging techniques such as fan-out waferlevel packaging (FOWLP), through-silicon vias (TSVs), and 3D integration, as well as AI-based technologies including HBM3, CoWoS, and Foveros. By understanding the evolving technological landscape, you can anticipate future trends, align your R&D efforts with market demands, and gain a competitive edge in the industry.

Investment Opportunities: Armed with comprehensive market insights and competitive analysis, a semiconductor advanced packaging report enables you to identify attractive investment opportunities across different segments of the semiconductor packaging market. Whether you're a semiconductor manufacturer, equipment supplier, or investor, the report provides valuable guidance for making strategic investment decisions and maximizing returns on investment.

Table of Contents

Chapter 1. Introduction

Chapter 2. Executive Summary

- 2.1. Summary of Technology Issues

- 2.2. Summary of Market Forecasts

Chapter 3. Technology Issues and Trends

- 3.1. Overview of HDP Technology

- 3.1.1. Need for Multiple IC Integration

- 3.1.2. Challenges of Multiple IC Integration

- 3.1.3. Technical Constraints of Integration

- 3.1.4. Economic Benefits of HDP

- 3.1.5. Technology Issues

- 3.2 2D Packages

- 3.2.1. MCMs

- 3.2.1.1. Substrates

- 3.2.1.2. Thermal Management

- 3.2.1.3. Design

- 3.2.1.4. Known Good Die

- 3.2.2. System In Package (SiP)

- 3.2.2.1. SiP Challenges

- 3.2.2.2. Cost

- 3.2.2.3. SiP Design

- 3.2.2.4. SoC Versus SiP

- 3.2.3. Multichip Package (MCP)

- 3.2.4. Package-On-Package (PoP)

- 3.2.1. MCMs

- 3.3 2.5D and 3D Packages

- 3.3.1. Conventional Wafer Fan-Out Technologies

- 3.3.2. Silicon Interposers

- 3.3.3. 3D-IC Stacks

Chapter 4. Applications

- 4.1. Semiconductor Industry by End Market

- 4.2. Memory

- 4.2.1. DRAM

- 4.2.2. NAND

- 4.2.3. China Memory

- 4.2.4. HDD vs SSD

- 4.3. Foundry Sector

Chapter 5. Competitive Environment

- 5.1. HDP Manufacturers

Chapter 6 3-D-TSV Technology

- 6.1. Driving Forces In 3D-TSV

- 6.2 3-D Package Varieties

- 6.3. TSV Processes

- 6.4. Critical Processing Technologies

- 6.4.1. Plasma Etch Technology

- 6.4.2. Cu Plating

- 6.4.3. Thin Wafer Bonding

- 6.4.4. Wafer Thinning/CMP

- 6.4.5. Lithography

- 6.5. Applications

- 6.6. Limitations Of 3-D Packaging Technology

- 6.6.1. Thermal Management

- 6.6.2. Cost

- 6.6.3. Design Complexity

- 6.6.4. Time To Delivery

- 6.7. Company Profiles

Chapter 7. Market Forecast

- 7.1. Overview of Advanced Packages

- 7.2. Driving Forces

- 7.3. System-in-Package (SiP)

- 7.4. Flip Chip/Wafer Level Packaging

- 7.5. Worldwide IC Market Forecast

- 7.6. Worldwide Packaging Market Forecast

- 7.7. Worldwide Advanced Package Forecast

- 7.7.1. Worldwide 3-D Through Silicon Via (TSV) Market

- 7.7.1.1. TSMC CoWoS

- 7.7.1.2. Intel Foveros

- 7.7.1.3. HBM (High Bandwidth Memory) Packages

- 7.7.1.4. Chiplets

- 7.7.1. Worldwide 3-D Through Silicon Via (TSV) Market

List of Tables

- 3.1. Multichip Modules Vs. Circuit Board Assemblies

- 3.2. MCM Cost Comparison

- 3.3. Materials Challenge For Packaging

- 3.4. Substrate Technology Features

- 3.5. Comparison of SoC and SiP Architectures

- 3.6. Comparison of CSP and PoP Architectures

- 4.1. Global Semiconductor Forecast By End Market

- 4.2. Global Semiconductor Revenue Forecast By Device Type

- 4.3. Global Semiconductor Unit Forecast By Device Type

- 4.4. DRAM Supply

- 4.5. DRAM Demand

- 4.6. DRAM Revenues

- 4.7. NAND Supply

- 4.8. NAND Supply-Demand

- 4.9. NAND Unit Demand By Application

- 4.10. NAND Revenues

- 4.11. Comparison Of HDD and SSD For Storage

- 4.12. Foundry Market Forecast

- 4.13. Comparison Of Foundry Capacities

- 5.1. MCM Manufacturers

- 6.1. 3-D Mass Memory Volume Comparison Between Other Technologies and TI's 3D Technology In Cm3/Gbit

- 6.2. 3-D Mass Memory Weight Comparison Between Other Technologies and TI's 3D Technology In Grams3/Gbit

- 7.1. Semiconductor Forecast by Revenues

- 7.2. Worldwide IC Package Market Forecast

- 7.3. Worldwide Advanced Package Market

- 7.4. TSMC'S CoWoS Revenue Analysis

- 7.5. HBM TAM Demand 2023-2026

List of Figures

- 1.1. Schematic Cross-Section View Of An MCM-D

- 1.2. Cross-Section Of The RF And Microwave MCM-D Structure

- 1.3. Thin Film Layers On The Planarized Core Layer Of MCM-SL/D Technology

- 1.4. Flip Chip MCP

- 1.5. SIP Cross Section

- 3.1. IC Packaging Trends

- 3.2. Technology Tree For HDP Types

- 3.3. Form Factor Decrease By Package Type

- 3.4. Wafer Level Packaging Processing Line

- 3.5. TSMC's InFO

- 3.6. SLIM and SWIFT Package Definition

- 4.1. Global Semiconductor Forecast By End Market

- 4.2. DRAM Roadmap By Die Shrink

- 4.3. 3D NAND Roadmap By Die Layers

- 4.4. HDD and SSD Shipments Forecast

- 4.5. HDD and SSD ASP

- 4.6. HDD and SSD Zetabytes

- 4.7. Pure-Play Foundry Market Shares

- 6.1. 3-D Technology On DRAM Density

- 6.2. 3-D Through-Silicon Via (TSV)

- 6.3. Graphical Illustration Of The Silicon Efficiency Between MCMs And 3D Technology

- 6.4. Silicon Efficiency Comparison Between 3D Packaging Technology And Other Conventional Packaging Technologies

- 6.5. 3D Packages

- 6.6. Via First, Middle, And Last Process Flows

- 6.7. Via First TSV Process Flow

- 6.8. New Applications Driving TSV Growth

- 6.9. Projection Of TSV Applications And Process Requirements

- 6.10. 3-D Technology For DRAM

- 6.11. Moore's Law For Active Element Density

- 7.1. Various System-In-Package (SiP) Applications

- 7.2. SiP Structures

- 7.3. Wire Bond Versus Flip Chip

- 7.4. Flip Chip And Wire Bond Equipment Forecast

- 7.5. Growth In Copper Wire Bonding

- 7.6. UNIT SHIPMENTS OF SEMICONDUCTORS

- 7.7. WLP Demand By Devices

- 7.8. Device Shipment Forecast FIWLP vs FOWLP

- 7.9. WLP Demand By Wafers

- 7.10. Projection of 3-D TSV Applications And Process Requirement

- 7.11. Market Forecast of 3-D TSV Units

- 7.12. Market Forecast of 3-D TSV Wafers

- 7.13. TSMC's CoWoS Advanced Package

- 7.14. TSMC's CoWoS Advanced Package Revenues

- 7.15. SK hynix HBM3 Package