|

市場調查報告書

商品編碼

1581328

RCS 商務訊息全球市場:2024-2029Global RCS Business Messaging Market: 2024-2029 |

||||||

RCS 商務訊息流量預計到 2025 年將成長 50%

| 關鍵統計 | |

|---|---|

這份研究報告調查了RCS(豐富通訊服務)商業消息市場,重點關注蘋果進入該市場將如何影響未來兩年的成長,從而引領成長市場。的分析。該報告使網路營運商和訊息供應商利害關係人能夠瞭解影響市場成長的關鍵因素以及來年的關鍵投資機會。

該報告包括對 RCS 商業訊息採用和未來成長的市場預測、針對最新市場趨勢和機會的深入研究,以及對主要 RCS 訊息傳遞參與者和競爭領導者(包括董事會)的分析。

主要功能

- 市場動態:提供有關 RCS 商務訊息市場前景的詳細見解,並評估未來市場成長的主要推動因素,例如 Apple 進入市場的影響。我們重點介紹了明年影響 RCS Business Messaging 成長的關鍵因素,包括營運商使用 Google Jibe、品牌驗證流程以及來自第三方 OTT 訊息平台的競爭。我們還探索不同的訊息傳遞類型,包括身份驗證、交易、促銷和對話,並檢查每種類型的關鍵機會。此外,它還包括國家準備指數,該指數評估 60 個國家的市場機會,並確定訊息供應商明年重點關注的國家。

- 主要要點和策略建議深入分析 RCS 商務訊息傳遞市場的主要發展機會、產業趨勢和見解,並為利害關係人提供重要策略建議。

- 基準產業預測:RCS 商務訊息市場規模和預測包括年度總發送量和收入的五年預測。我們也按計費模式劃分收入,包括按訊息、基於會話、基於存取和基於號召性用語的計費模式。此預測將 RCS 業務訊息流量分為四個主要用例:

- 身份驗證

- 對話

- 促銷

- 交易

市場數據/預測

我們的研究套件包括存取一整套市場預測數據,其中包含 54 個表格和超過 24,000 個數據點。調查套件指標包括:

- RCS 業務訊息總數:

- 身份驗證

- 交易

- 促銷

- 對話

- RCS 業務消息總收入:按計費模式

- 按訊息計費(單一 RCS/基本 RCS)

- 基於會話

- 訪問基地

- 號召性用語基礎

Juniper Research 互動式預測 Excel 有以下功能:

- 統計分析:功能是可以搜尋資料期間所有地區和國家顯示的具體指標。可以輕鬆修改圖表並將其匯出到剪貼簿。

- 國家/地區資料工具:此工具可讓您查看預測期間內所有主要地區和國家的指標。您可以縮小搜尋列中顯示的指標範圍。

- 國家比較工具:使用者可以選擇國家/地區並針對特定國家/地區進行比較。該工具包括匯出圖表的功能。

- 假設分析:五個互動式場景讓使用者比較預測假設。

目錄

市場趨勢/策略

第 1 章主要趨勢與策略建議

- 主要趨勢

- 策略建議

第2章未來市場展望

- RCS 商務訊息傳遞:簡介

- 未來市場展望

- 市場推動因素

- 市場課題

- RCS 使用範例

- 身份驗證/驗證

- 提醒/通知

- 促銷訊息

- 基於對話的使用範例

- RCS 貨幣化

- 每個訊息收費

- 基於會話

- 號召性用語基礎

- 訪問基地

第 3 章 RCS 業務訊息詐欺的未來

- RCS 商業訊息傳遞中的詐欺:未來影響

第 4 章國家儲備指數

- RCS 商業訊息傳遞:國家/地區準備指數

- 優先市場

- 不斷成長的市場

- 市場飽和

- 新興市場

競賽排行榜

第 1 章瞻博網路研究:競爭排行榜

第 2 章供應商簡介

- RCS 商務訊息傳遞:公司簡介

- 思科 Webex

- CM.com

- 康維瓦

- Esendex

- GMS(全球訊息服務)

- 古普舒普

- Infobip

- 互通技術

- LINK 移動性

- 訊息

- 移動路線

- 辛奇

- 女高音設計

- Syniverse

- 塔塔通訊公司

- Twilio

- 沃納奇

- 瞻博網路研究排行榜評估方法

- 限制和解釋

資料/預測:目錄

第1章要點/市場預測

- RCS 商務訊息傳遞市場概況與未來前景

- 預測方法

- 相容 RCS 的訂閱者

- RCS 活躍訂閱者

- 發送的 RCS 業務訊息數

- RCS 商務訊息收入

第 2 章獲利模型:每則訊息收費

- 獲利:每則訊息收費

- 預測方法

- 透過每個訊息收費獲利的 RCS 業務訊息數量

- RCS 業務訊息收入透過以訊息計費貨幣化

第 3 章貨幣化模型:基於會話

- 獲利:基於會話

- 預測方法

- 基於會話獲利的 RCS 業務訊息數量

- 基於會話貨幣化的 RCS 業務訊息收入

第 4 章其他獲利模式

- 獲利:其他

- 預測方法

- 透過其他方式獲利的 RCS 業務訊息數量

- 透過其他方式獲利的 RCS 業務訊息收入

'RCS Business Messaging Traffic to Grow 50% in 2025'

| KEY STATISTICS | |

|---|---|

| Total revenue in 2024: | 1.8bn |

| Total revenue in 2029: | $8.7bn |

| Market growth 2024-2029: | 370% |

| Forecast period: | 2024-2029 |

Overview

Our latest "RCS (Rich Communication Services) Business Messaging" research suite comprises comprehensive and insightful analysis of key factors driving this advancing market, with focus on how Apple's entrance into the market will impact growth over the next two years. The report enables stakeholders from network operators and messaging vendors to understand the major factors influencing growth in the market, and where the key investment opportunities are for RCS business messaging next year.

The RCS business messaging market report includes several different options that can be purchased separately, including access to a market forecast of the adoption and future growth of the RCS business messaging market; a detailed study highlighting the latest market trends and opportunities, and a Competitor Leaderboard document containing an analysis of the major players in the RCS messaging space. The coverage can also be purchased as a full research suite, containing all of these elements, and including a substantial discount.

The study provides a critical tool for stakeholders in the telecoms industry for navigating this rapidly growing market; allowing vendors to shape their future strategy with RCS business messaging monetisation, and capitalise on emerging opportunities as RCS takes off in markets where Apple has a high market share. Its extensive coverage makes this RCS business messaging market analysis research suite an incredibly valuable resource for examining the future of this market as it reaches an inflection point.

Key Features

- Market Dynamics: Provides detailed insight into the outlook of the RCS business messaging market; assessing the key drivers to future market growth, including the impact of Apple's entrance into the market. It addresses the key factors that will impact the growth of RCS business messaging next year, including operator onboarding with Google Jibe, the brand verification process, and competition from third-party OTT (over-the-top) messaging platforms. The research also explores the different messaging types, including authentication, transactional, promotional, and conversational, and examines the key opportunities for each. Moreover, it includes a Country Readiness Index, which assesses the market opportunities across 60 countries, identifying the countries which must be of focus for messaging vendors next year.

- Key Takeaways & Strategic Recommendations: In-depth analysis of key development opportunities, industry trends and findings within the RCS business messaging market; accompanied by key strategic recommendations for stakeholders.

- Benchmark Industry Forecasts: The market size and forecasts for RCS business messaging include 5-year forecasts for total number of RCS business messages sent per annum, and total revenue from RCS business messaging. It also splits RCS business messaging revenue by billing model, including the pay-per-message, session-based, access-based and call-to-action-based billing model. The forecast breaks down RCS business messaging traffic into four key use cases:

- Authentication

- Conversational

- Promotional

- Transactional

- Juniper Research Competitor Leaderboard: Key industry player capability and capacity assessment for 17 RCS Business Messaging vendors, via the Juniper Research Competitor Leaderboard.

SAMPLE VIEW

Market Data & Forecasts PDF Report:

A comprehensive analysis of the current market landscape, alongside strategic recommendations and a walk-through of the forecasts.

Market Trends & Strategies Report:

A comprehensive analysis of the current market landscape, alongside strategic recommendations.

Market Data & Forecasts

The market-leading research suite for the RCS Business Messaging market includes access to the full set of market forecast data of 54 tables and over 24,000 datapoints. Metrics in the research suite include:

- Total Number of RCS Business Messages, split into:

- Authentication

- Transactional

- Promotional

- Conversational

- Total Revenue from RCS Business Messages, split by billing model:

- Pay-per-message (Single RCS/ Basic RCS)

- Session-based

- Access-based

- Call-to-action-based

Juniper Research Interactive Forecast Excel contains the following functionality:

- Statistics Analysis: Users benefit from the ability to search for specific metrics, displayed for all regions and countries across the data period. Graphs are easily modified and can be exported to the clipboard.

- Country Data Tool: This tool lets users look at metrics for all key regions and countries in the forecast period. Users can refine the metrics displayed via a search bar.

- Country Comparison Tool: Users can select countries and compare each of them for specific countries. The ability to export graphs is included in this tool.

- What-if Analysis: Here, users can compare forecast metrics against their own assumptions, via five interactive scenarios.

Market Trends & Strategies Report

This market study examines the "RCS Business Messaging" landscape in detail, assessing the impact of Apple supporting RCS on the growth of RCS business messaging in 2025. The report delivers an in-depth analysis of the strategic opportunities for vendors; addressing key challenges impacting future growth, and how stakeholders must navigate these to maximise growth of the RCS business messaging market next year.

It also evaluates country level opportunities for RCS business messaging growth via Juniper Research's Country Readiness Index, identifying the key markets that messaging vendors should focus on next year.

Competitor Leaderboard Report

This RCS business messaging market study includes a Competitor Leaderboard report, which provides detailed evaluation and market positioning of 17 RCS business messaging vendors. The vendors are positioned as established leaders, leading challengers or disruptors and challengers based on product and capability assessments.

Juniper Research Competitor Leaderboard for RCS Business Messaging, including key players:

|

|

Interop Technologies:

|

|

This document is centred around the Juniper Research Competitor Leaderboard; a vendor positioning tool that provides an at-a-glance view of the competitive landscape in a market, backed by a robust methodology.

Table of Contents

Market Trends & Strategies

1. Key Trends & Strategic Recommendations

- 1.1. Key Trends

- 1.2. Strategic Recommendations

2. Future Market Outlook

- 2.1. Introduction to RCS Business Messaging

- Figure 2.1: SMS vs RCS: Key Features & Capabilities

- 2.2. Future Market Outlook

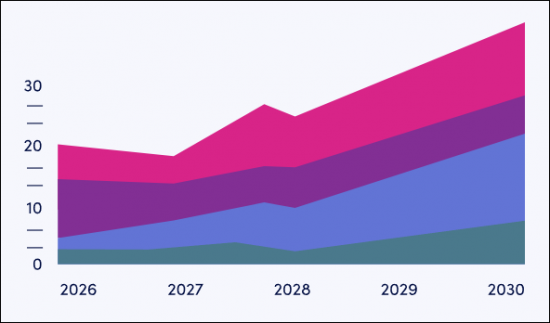

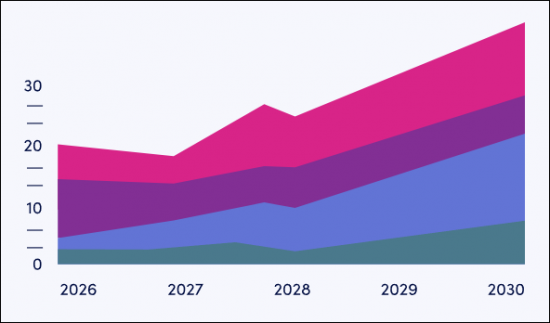

- Figure 2.2: Total Revenue from RCS Business Messaging ($m), 2024-2029, Split by 8 Key Regions

- 2.2.1. Market Drivers

- i. Apple's Launch of RCS in iOS 18 Update

- Figure 2.3: Proportion of Mobile Subscribers Which Were RCS-capable in 2023 Key Markets (%)

- Figure 2.4: Total Number of RCS-Capable Subscribers in the US (m), 2023 vs 2024

- ii. Basic RCS Messages

- iii. Increased Demand for Conversational Use Cases

- i. Apple's Launch of RCS in iOS 18 Update

- 2.2.2. Market Challenges

- i. Brand Verification Process

- ii. Competition from OTT Messaging Platforms

- iii. Fraud

- iv. Unity Amongst Operators

- 2.3. RCS Use Cases

- 2.3.1. Authentication & Verification

- Figure 2.5: Example of a Verification Message

- i. Strengths

- ii. Weaknesses

- iii. Opportunities

- iv. Threats

- 2.3.2. Reminders & Notifications

- Figure 2.6: Example of a Transactional Message

- i. Strengths

- ii. Weaknesses

- iii. Opportunities

- iv. Threats

- Figure 2.6: Example of a Transactional Message

- 2.3.3. Promotional Messages

- Figure 2.7: Example Promotional RCS Business Message

- i. Strengths

- ii. Weaknesses

- iii. Opportunities

- iv. Threats

- Figure 2.7: Example Promotional RCS Business Message

- 2.3.4. Conversational-based Use Cases

- Figure 2.8: Example RCS Conversation

- i. Strengths

- ii. Weaknesses

- iii. Opportunities

- iv. Threats

- Figure 2.8: Example RCS Conversation

- 2.3.1. Authentication & Verification

- 2.4. RCS Monetisation

- 2.4.1. Pay-per-message

- 2.4.2. Session-based

- 2.4.3. Call-to-action

- 2.4.4. Access-based

3. Future of RCS Business Messaging Fraud

- 3.1. Future Impact of Fraud on RCS Business Messaging

- Table 3.1: The Role of RCS in Preventing Types of Fraud Observed Over SMS

- 3.1.1. Emerging Types of Messaging Fraud

4. Country Readiness Index

- 4.1. RCS Business Messaging Country Readiness Index

- Figure 4.1: Countries in Each Region

- Table 4.2: Juniper Research RCS Business Messaging Country Readiness Index: Scoring Criteria

- Table 4.4: RCS Business Messaging Country Readiness Index: Market Segments37

- 4.2. Focus Markets

- 4.2.1. High Acceptance of A2P SMS Will Increase Transition Rate to RCS Business Messaging

- Figure 4.5: Average A2P SMS Message per Mobile Subscriber per Month in 2024 for Key Markets: US, Canada & France

- 4.2.2. Lack of Competition from OTT Messaging Players Will Create Demand for an Alternative Rich Media Messaging Channel

- Figure 4.6: Penetration of OTT Messaging vs RCS Messaging in France in 2024 (%)

- 4.2.3. ROI for RCS Business Messaging to Enterprises

- Figure 4.7: Average Revenue per RCS business message in Key Markets in 2024 ($)

- 4.2.4. Support for Chatbots Will Create Demand for Conversational Use Cases

- 4.2.1. High Acceptance of A2P SMS Will Increase Transition Rate to RCS Business Messaging

- 4.3. Growth Markets

- 4.3.1. A High Smartphone Penetration Will Create High Opportunity for Future Growth

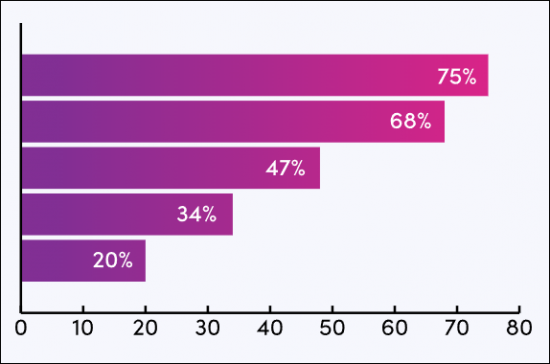

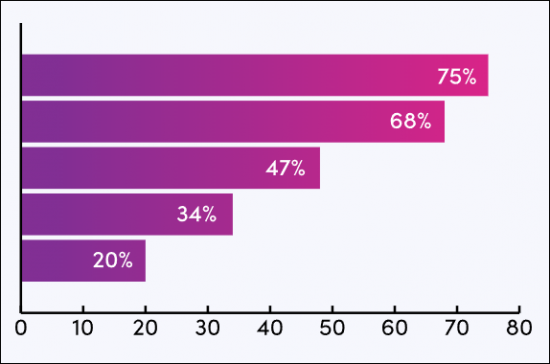

- Figure 4.8: Smartphone Penetration in Key Growth Markets (%)

- 4.3.2. Successful Implementation of RCS to Date Will Encourage Adoption by Other Brands

- 4.3.1. A High Smartphone Penetration Will Create High Opportunity for Future Growth

- 4.4. Saturated Markets

- 4.4.1. Several Factors Create a Low Demand for RCS Business Messaging

- 4.5. Developing Markets

- 4.5.1. Low Smartphone Penetration Resulting in Low Reach of RCS

- Figure 4.9: Average Smartphone Penetration in Focus and Developing Markets

- 4.5.2. Low Mobile Messaging Acceptance

- Figure 4.10: Average A2P SMS Sent per Mobile Subscriber in Key Developing Markets in 2024

- Table 4.11: Juniper Research Country Readiness Index Heatmap: North America

- Table 4.12: Juniper Research Country Readiness Index Heatmap: Latin America

- Table 4.13: Juniper Research Country Readiness Index Heatmap: West Europe

- Table 4.14: Juniper Research Country Readiness Index Heatmap: Central & East Europe

- Table 4.15: Juniper Research Country Readiness Index Heatmap: Far East & China

- Table 4.16: Juniper Research Country Readiness Index Heatmap: Indian Subcontinent

- Table 4.17: Juniper Research Country Readiness Index Heatmap: Rest of Asia Pacific

- Table 4.18: Juniper Research Country Readiness Index Heatmap: Africa & Middle East

- 4.5.1. Low Smartphone Penetration Resulting in Low Reach of RCS

Competitor Leaderboard

1. Juniper Research Competitor Leaderboard

- 1.1. Why Read This Report

- Table 1.1: Juniper Research Leaderboard: RCS Business Messaging Vendors Included & Product Portfolio

- Figure 1.2: Juniper Research Competitor Leaderboard: RCS Business Messaging Vendors

- Table 1.3: Juniper Research Leaderboard: RCS Business Messaging Vendors & Positioning

2. Vendor Profiles

- 2.1. RCS Business Messaging: Company Profiles

- 2.1.1. Cisco Webex

- i. Corporate Information

- Table 2.1: Cisco's Key Acquisitions, 2023 - Present

- Table 2.2: Cisco's Selected Financial Information ($bn), 2021-2023

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Recommendations

- i. Corporate Information

- 2.1.2. CM.com

- i. Corporate Information

- Table 2.3: Acquisitions Made by CM.com, 2021-Present

- Table 2.4: CM.com's Select Financial Information (Euro-m), 2022-2023

- ii. Geographical Spread

- iii. Key Clients & Strategic Partners

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Opportunities

- i. Corporate Information

- 2.1.3. Comviva

- i. Corporate Information

- ii. Geographical Spread

- iii. Key Clients & Strategic Recommendations

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Opportunities

- 2.1.4. Esendex

- i. Corporate Information

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Opportunities

- 2.1.5. GMS (Global Message Services)

- i. Corporate Information

- ii. Geographical Spread

- iii. Key Clients & Strategic Partners

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Opportunities

- 2.1.6. Gupshup

- i. Corporate Information

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Opportunities

- 2.1.7. Infobip

- i. Corporate Information

- Table 2.5: Infobip's Acquisitions - April 2021 to Present

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Opportunities

- i. Corporate Information

- 2.1.8. Interop Technologies

- i. Corporate Information

- ii. Geographical Spread

- iii. Key Clients & Strategic Partners

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Opportunities

- 2.1.9. LINK Mobility

- i. Corporate Information

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Opportunities

- 2.1.10. Messaggio

- i. Corporate Information

- ii. Geographical Spread

- iii. Key Clients & Strategic Partners

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths and Strategic Opportunities

- 2.1.11. Route Mobile

- i. Corporate

- Table 2.6: Route Mobile's Financial Information (Indian Rupee Cr), FY 2021-22 - FY 2023-

- ii. Geographical Spread

- iii. Key Clients & Strategic Partners

- iv. High-level View of Offerings

- Figure 2.8: Route Mobile RBM Managed Services Overview

- i. Corporate

- v. Juniper Research's View: Key Strengths & Strategic Opportunities

- 2.1.12. Sinch

- i. Corporate

- Table 2.9: Sinch's Most Recent Acquisitions, 2020-2021

- Table 2.10: Sinch's Select Financial Information (SEKm), 2022-2023

- Table 2.9: Sinch's Most Recent Acquisitions, 2020-2021

- ii. Geographical Spread

- iii. Key Clients & Strategic Partners

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Opportunities

- i. Corporate

- 2.1.13. Soprano Design

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients & Strategic Partners

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Opportunities

- 2.1.14. Syniverse

- i. Corporate

- ii. Geographical Spread

- iii. Key Customers & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Opportunities

- 2.1.15. Tata Communications

- v. Juniper Research's View: Key Strengths & Strategic Opportunities

- 2.1.16. Twilio

- i. Corporate Information

- Table 2.13: Twilio's Acquisitions Nov 2019-Dec 2023

- Table 2.14: Twilio's Revenue Information 2021-Present

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Opportunities

- i. Corporate Information

- 2.1.17. Vonage

- i. Corporate Information

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Opportunities

- 2.1.1. Cisco Webex

- 2.2. Juniper Research Leaderboard Assessment Methodology

- 2.3. Limitations & Interpretations

Data & Forecasting Table of Contents

1. Key Takeaways & Market Forecasts

- 1.1. RCS Business Messaging Market Summary & Future Outlook

- 1.1.1. RCS Business Messaging Market Summary Forecast Methodology

- Figure 1.1: Forecast Methodology: RCS Business Messaging Market Summary

- 1.1.2. RCS-Capable Subscribers

- Figure & Table 1.2: Total Number of RCS-capable Subscribers (m), Split by 8 Key Regions, 2023-2029

- 1.1.3. RCS Active Subscribers

- Figure & Table 1.3: Total Number of RCS Active Subscribers (m), Split by 8 Key Regions, 2023-2029

- 1.1.4. Number of RCS Business Messages Sent

- Figure & Table 1.4: Total Number of RCS Business Messages (m), Split by Type Message, 2023-2029

- 1.1.5. RCS Business Messaging Revenue

- Figure & Table 1.5: Total Revenue from RCS Business Messaging Traffic ($m), Split by 8 Key Regions, 2023-2029

- 1.1.1. RCS Business Messaging Market Summary Forecast Methodology

2. Price-Per-Message Monetisation

- 2.1. Price-per-message Monetisation

- 2.1.1. Price-per-message Forecast Methodology

- Figure 2.1: 2.1.1. Price-per-Message Forecast Methodology

- 2.1.2. Number of RCS Business Messages Monetised by Pay-per-message

- Figure & Table 2.2: Total Number of RCS Business Messages Monetised by the Pay-per-message Model (m), Split by Basic and Single RCS Message, 2024-2029

- 2.1.3. Revenue from RCS Business Messages Monetised by the Pay-per-message Model

- Figure & Table 2.3: Total Revenue from RCS Business Messaging Monetised via the Pay-per-message Model ($m), Split by 8 Key Regions, 2023-2029

- 2.1.1. Price-per-message Forecast Methodology

3. Session-based Monetisation Model

- 3.1. Session-based Monetisation Model

- 3.1.1. Session-based Monetisation Forecast Methodology

- Figure 3.1: Session-based Monetisation Model Forecast Methodology

- 3.1.2. Number of RCS Business Messages Monetised by the Session-based Model

- Figure & Table 3.2: Total Number of RCS Business Messages that are Monetised via the Session-based Model (m), Split by 8 Key Regions, 2023-2029

- 3.1.3. Revenue from Session-based Monetisation

- Figure & Table 3.3: Total Revenue from RCS Business Messaging Sessions ($m), Split by 8 Key Regions, 2023-2029

- 3.1.1. Session-based Monetisation Forecast Methodology

4. Other Monetisation Models

- 4.1. Other RCS Business Messaging Monetisation Models

- 4.1.1. Other RCS Business Messaging Monetisation Models Forecast Methodology

- Figure 4.1: Access-based Monetisation Model Forecast Methodology

- Figure 4.2: CTA Monetisation Model Forecast Methodology

- 4.1.2. Number of RCS Business Messages Monetised by Other Models

- Figure & Table 4.3: Total Number of RCS Business Messages Delivered via Other Monetisation Models (m), Split by the Access-based & CTA Models, 2023-2029

- 4.1.3. Revenue from Other Monetisation Models

- Figure & Table 4.4: Total Revenue from Other RCS Business Messaging Monetisation Models ($m), Split out by the Access-based and CTA Models, 2023-2029

- 4.1.1. Other RCS Business Messaging Monetisation Models Forecast Methodology