|

市場調查報告書

商品編碼

1637901

安全測試:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Security Testing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

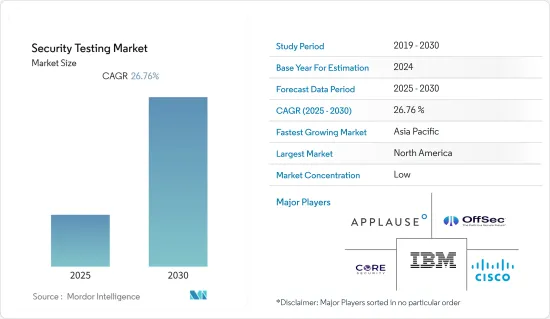

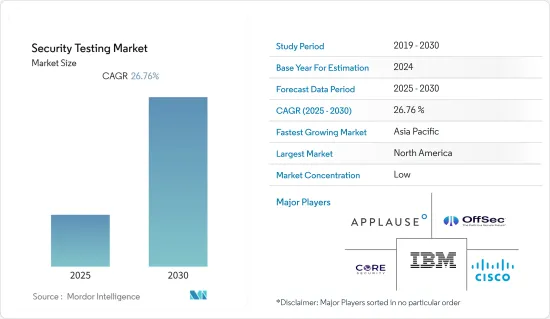

預計預測期內安全測試市場將以 26.76% 的複合年成長率成長。

物聯網設備和自帶設備(BYOD)的日益普及正在推動市場成長。隨著物聯網連接設備在我們的日常生活中變得越來越重要,它們需要經過測試並具有最低限度的安全等級。

主要亮點

- 越來越明顯的是,反惡意軟體等傳統方法已不足以保護敏感資訊。為了應對這項挑戰,各家公司正在透過網路安全策略加強敏感資訊,透過使用安全測試工具來更有效地保護敏感資訊。這些安全測試 (ST) 工具用於尋找和修復系統中的漏洞。

- 由於網路攻擊的複雜性,全球安全測試市場不斷成長,推動了網路和行動企業關鍵應用的成長,這些應用需要更先進、更安全的端點保護,並減少財務損失。 。

- 雖然雲端處理提高了組織的靈活性和功能性,但它也允許數位對手利用這種彈性。網路犯罪分子利用雲端處理平台發動 DNS 拒絕服務等攻擊。

- 此外,當今的許多系統和應用程式都可以透過多種瀏覽器、行動電話平台和裝置存取。因此,由於網路安全專業知識的缺乏和安全測試的高成本,智慧型設備和平板電腦等平台上出現了新的網路犯罪熱點。

安全測試市場趨勢

預測期內,雲端運算領域將變得越來越重要

- 網路威脅日益複雜,迫使公司尋找替代的安全測試方法來滿足其安全需求,許多公司轉向雲端部署。軟體開發生命週期中任何必須透過雲端服務進行協作的階段都必須採取強而有力的安全措施。

- 然而,預計在預測期內,雲端基礎的安全測試的日益普及以及 DevOps、DevSecs 和 AgileOps 等新技術的引入將為市場擴張提供有利可圖的機會。

- 此外,許多公司正在推行一種稱為雲端基礎的安全測試的新技術,該技術提供集中的安全保護、成本效益、降低的管理成本以及對更高等級安全的信心。此外,您還可以執行整合的雲端安全測試工具,例如 SOASTA CloudTests、StormMeter、Blaze、Loadus、Jenkins DevCLOUD、Xamarin Test Cloud、TestLink 和 Watir。預計這將對整個預測期內的安全測試市場產生積極影響。

- 大型企業必須遵守許多合規和內部法規。作為應用程式和解決方案設計過程的一部分,安全測試團隊應該使用內部和外部的自動化安全工具。

北美占主要佔有率

- 該地區大力採用先進技術、網路犯罪不斷增加以及互聯機器數量的增加是有利於該領域安全測試市場的一些主要因素。

- 去年9月,NIST發布了美國物聯網設備安全指南草案。由於物聯網經常存在駭客攻擊和資料外洩等網路安全風險,NIST 核心基準概述了製造商應在物聯網設備中建構的建議安全功能,以及消費者在購買設備時應在設備包裝盒或其他設備上尋找的安全措施類型。

- 此外,該地區佔資料產生的很大佔有率,因此對資料安全和保護的需求很高。此外,由於製造業、醫療保健、運輸和物流等各個工業領域較早採用了物聯網、人工智慧和自動化等技術,該地區的安全測試市場正在成長。

- 北美是一個技術中心。這就是為什麼聯邦政府對安全測試服務制定非常嚴格的規定。此外,BFSI 等行業也需要接受合規性測試。

- 此外,網路安全是美國國家和州兩級的一個重大議題,主要針對金融服務公司。該地區也是微軟和亞馬遜等主要雲端服務供應商的所在地。這一因素對於雲端基礎的安全測試市場的成長至關重要。

安全測試產業概況

安全測試市場競爭激烈,由幾家大公司組成。從市場佔有率來看,目前市場主要被少數幾家大公司佔據。這些佔據了壓倒性市場佔有率的大公司正致力於擴大海外基本客群。這些公司正在利用策略創新和合作措施來增加市場佔有率和盈利。

惠普企業宣布,它將透過 HPE GreenLake 平台創新、新的雲端服務以及不斷擴展的私有雲端產品組合和合作夥伴生態系統來提升混合雲端領導地位。 HPE於今年6月完成對OpsRamp的收購,並將其作為HPE GreenLake平台上的SaaS服務提供,為客戶提供針對多供應商、多重雲端IT環境的AI主導營運。

麥克菲有限責任公司 (McAfee LLC) 與戴爾科技集團合作,宣布推出 McAfee Business Protection,這是一款針對中小型企業主的全新全面安全解決方案。 McAfee Business Protection 透過屢獲殊榮的安全性、身分識別和暗網資料監控、VPN 和網路保護來幫助戴爾 SMB 客戶避免網路威脅和漏洞,從而實現安全瀏覽。 McAfee Business Protection 旨在滿足企業日益成長的需求,透過為員工的個人電腦和線上連線提供更高的安全性,幫助企業主保護自己免受駭客、惡意軟體和病毒的侵害。變得更容易。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 購買者/消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- COVID-19 市場影響

- 產業價值鏈分析

- 技術簡介

第5章 市場動態

- 市場促進因素

- 安全威脅日益增加

- 政府法規推動安全需求

- 市場限制

- 缺乏安全測試意識

第6章 市場細分

- 按部署

- 本地

- 雲

- 混合

- 按類型

- 網路安全測試

- VPN 測試

- 防火牆測試

- 其他服務類型

- 應用程式安全測試

- 應用程式類型

- 行動應用程式安全測試

- Web應用程式安全性測試

- 雲端應用程式安全測試

- 企業應用安全測試

- 測試類型

- SAST

- DAST

- IAST

- RASP

- 網路安全測試

- 透過測試工具

- Web 應用程式測試工具

- 程式碼審查工具

- 滲透測試工具

- 軟體測試工具

- 其他測試工具

- 按最終用戶產業

- 政府

- BFSI

- 衛生保健

- 製造業

- 資訊科技/通訊

- 零售

- 其他最終用戶產業

- 按地區

- 北美洲

- 歐洲

- 亞洲

- 拉丁美洲

- 中東和非洲

第7章 競爭格局

- 公司簡介

- Core Security Technologies Inc

- Offensive Security LLC

- Applause App Quality Inc

- IBM Corporation

- Cisco Systems Inc.

- iViZ Security Inc.

- Hewlett Packard Enterprise Company

- Accenture PLC

- McAfee LLC

- Veracode Inc.

- ControlCase LLC

- Paladion Networks Pvt Ltd.

- Maveric Systems Ltd.

- Checkmarx Ltd.

第8章投資分析

第9章 市場機會與未來趨勢

The Security Testing Market is expected to register a CAGR of 26.76% during the forecast period.

The increasing adoption of IoT devices and BYOD (bring your own device) stimulates the market's growth. IoT-connected devices must be tested and set a minimum level of security as their importance to our daily lives increases.

Key Highlights

- It's becoming increasingly clear that traditional methods like antimalware software are no longer enough to protect sensitive information. To deal with this challenge, individual enterprises are strengthening their sensitive information through a cybersecurity strategy by using security testing tools to protect it more effectively. These tools for security testing (ST) are used to find and fix holes in the system.

- An increase in worldwide security testing market growth, owing to the complexity of cyberattacks, leads to a surge in web and mobile enterprises' critical applications that require a greater degree of secure endpoint protection and businesses that implement safety measures designed to mitigate financial loss.

- While cloud computing has increased the flexibility and functionality of organizations, it also allows digital adversaries to leverage its elasticity similarly. Cybercriminals use cloud computing platforms to carry out attacks such as DNS denial of service.

- In addition, many systems and applications available today can be accessed from multiple browsers, cellular platforms, and devices. Therefore, it is anticipated that market growth will be hindered by the emergence of a new cybercrime hot spot on smart devices and platforms like tablet computers, with factors including a lack of expertise in cybersecurity and greater costs associated with security testing.

Security Testing Market Trends

Cloud Segment to Gain Significant Importance over the Forecast Period

- The complexity of the cyber threat, forcing companies to seek alternative security testing methods than they usually do to respond to their security needs, means that many enterprises are looking for easy security solutions through a Cloud deployment. In every stage of the software development lifecycle, where collaboration must take place through cloud services, there is a need to implement robust security practices.

- However, the market will offer profitable opportunities to expand during the forecast period as the adoption of cloud-based security testing is expected to increase and new technology like DevOps, DevSecs, or AgileOps are introduced in Software Security Testing.

- Many companies are also pursuing a new technology called Cloud Based Security Testing, offering centralized security protection, cost efficiency, reduced administration costs, and credibility to the more sophisticated class of security. Moreover, the ability to run integrated cloud security testing tools such as SOASTA CloudTests, StormMeter, Blaze, Loadus, Jenkins DevCLOUD, Xamarin test clouds, TestLink, and Watir is available. It is expected to impact the security testing market throughout the forecast period positively.

- Many compliance and internal regulations apply to large enterprises. As part of the application and solution design process, security testing teams must use automated security tools internally and externally.

North America to Hold Major Share

- The strong adoption of advanced technologies, increased cybercrime, and the increasing number of interconnected machines in the region are some of the main factors that will benefit the market for security tests in this area.

- The NIST published its draft guidelines on the security of Internet of Things devices in the United States last September 2022. Because IoT regularly poses a cybersecurity risk through hacks and data breaches, the NIST's Core Baseline highlights recommended security features for manufacturers to incorporate into their IoT devices and guidelines for consumers to look for on a device's box or online description while shopping.

- Furthermore, it contributes a significant share to data generation; therefore, this region has a high demand for data security and protection. Moreover, the market for security testing in this region is growing due to an early adoption of technology like the Internet of Things, Artificial Intelligence, and automation across different industry sectors: manufacturing, health care, transport, and logistics.

- The North American region is a technology hub. Therefore, the federal government has made very stringent rules regarding security testing services. Moreover, it is made compulsory for industries like BFSI to adhere to compliance testing.

- In addition, cybersecurity at both domestic and state levels is becoming an important issue for the United States, mainly regarding financial services companies. The region also has major cloud service providers, like Microsoft and Amazon. This factor is essential in the growth of cloud-based security testing markets.

Security Testing Industry Overview

The security testing market is highly competitive and consists of several major players. In terms of market share, few of the major players currently dominate the market. These major players with a prominent market share focus on expanding their customer base across foreign countries. These companies leverage strategic innovations and collaborative initiatives to increase their market shares and profitability.

Hewlett Packard Enterprise has announced advances in hybrid cloud leadership with HPE GreenLake platform innovation, new cloud services, and expanded private cloud portfolio and partner ecosystem; HPE closes OpsRamp acquisition in June this year, which is available as Saas offering on the HPE GreenLake platform, providing customers with AI-driven operations for multi-vendor, multi-cloud IT environments.

McAfee LLC has announced McAfee Business Protection, a new comprehensive security solution for small business owners in collaboration with Dell Technologies. McAfee Business Protection helps Dell small business customers avoid cyber threats and vulnerabilities with award-winning security, identity and dark web data monitoring, VPN, web protection for safe browsing, and more. McAfee Business Protection, designed to meet the growing needs of businesses, provides more secure security for employees' personal computers and online connections to make it easier for business owners to defend themselves against hackers, malware, or viruses.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 COVID-19 Impact on the Market

- 4.4 Industry Value Chain Analysis

- 4.5 Technology Snapshot

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Security Threats

- 5.1.2 Government Regulations Driving Security Needs

- 5.2 Market Restraints

- 5.2.1 Lack of Awareness About Security Testing

6 MARKET SEGMENTATION

- 6.1 By Deployment

- 6.1.1 On Premise

- 6.1.2 Cloud

- 6.1.3 Hybrid

- 6.2 By Type

- 6.2.1 Network Security Testing

- 6.2.1.1 VPN Testing

- 6.2.1.2 Firewall Testing

- 6.2.1.3 Other Service Types

- 6.2.2 Application Security Testing

- 6.2.2.1 Application Type

- 6.2.2.1.1 Mobile Application Security Testing

- 6.2.2.1.2 Web Application Security Testing

- 6.2.2.1.3 Cloud Application Security Testing

- 6.2.2.1.4 Enterprise Application Security Testing

- 6.2.2.2 Testing Type

- 6.2.2.2.1 SAST

- 6.2.2.2.2 DAST

- 6.2.2.2.3 IAST

- 6.2.2.2.4 RASP

- 6.2.1 Network Security Testing

- 6.3 By Testing Tool

- 6.3.1 Web Application Testing Tool

- 6.3.2 Code Review Tool

- 6.3.3 Penetration Testing Tool

- 6.3.4 Software Testing Tool

- 6.3.5 Other Testing Tools

- 6.4 By End user Industry

- 6.4.1 Government

- 6.4.2 BFSI

- 6.4.3 Healthcare

- 6.4.4 Manufacturing

- 6.4.5 IT and Telecom

- 6.4.6 Retail

- 6.4.7 Other End user Industries

- 6.5 By Geography

- 6.5.1 North America

- 6.5.2 Europe

- 6.5.3 Asia

- 6.5.4 Latin America

- 6.5.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Core Security Technologies Inc

- 7.1.2 Offensive Security LLC

- 7.1.3 Applause App Quality Inc

- 7.1.4 IBM Corporation

- 7.1.5 Cisco Systems Inc.

- 7.1.6 iViZ Security Inc.

- 7.1.7 Hewlett Packard Enterprise Company

- 7.1.8 Accenture PLC

- 7.1.9 McAfee LLC

- 7.1.10 Veracode Inc.

- 7.1.11 ControlCase LLC

- 7.1.12 Paladion Networks Pvt Ltd.

- 7.1.13 Maveric Systems Ltd.

- 7.1.14 Checkmarx Ltd.